Current Views

Long EURUSD @ 1.1346

Stop loss 1.1184

TP above 1.17

Small miracle

EURUSD and GBPUSD both held exactly where you might have hoped if you’re long. That is the first good news for USD bears in a while, even as USDJPY takes out the high and cleansed the final stop losses (including mine). We now eagerly await the results of the Bessent/China meetings in Geneva. Some sort of China tariff cut as a goodwill gesture has been floated in various media outlets and Trump tweeted “80% Tariff on China seems right! Up to Scott B.” this morning.

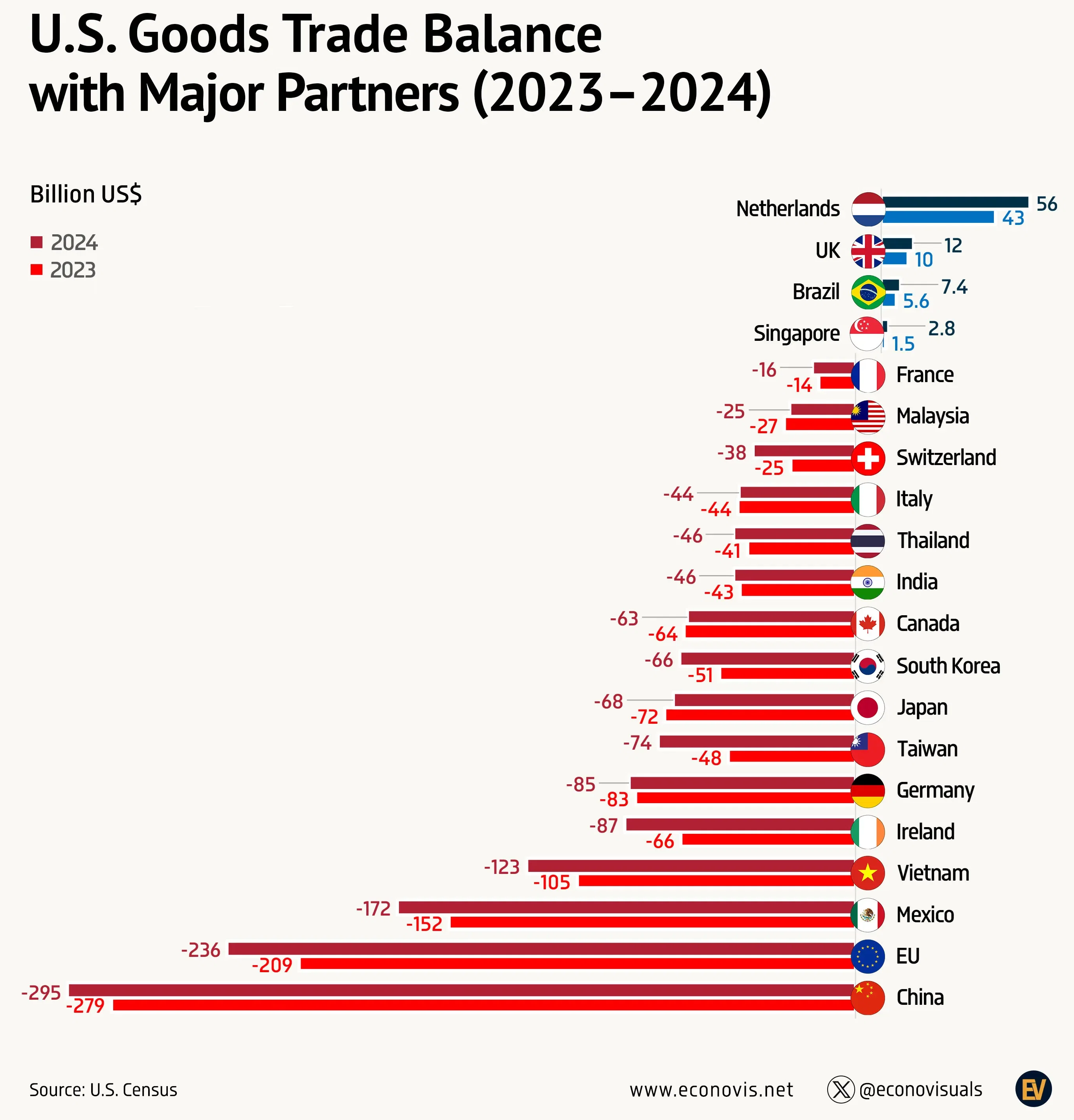

Hard to see why any of this matters, other than the obvious headline risk, as these deals are all leading to the same endgame. 10% global tariff, huge tariffs on China that fall short of an embargo (with plenty of outs possible if they drop Vietnam to zero, as they probably will), and some sector-specific tariffs. All these meetings and announcements feel more like noise than useful signal. The UK looked particularly keen to roll over yesterday as the amounts of money being discussed are tiny and the UK runs a trade deficit with the USA anyway, so it’s pure theatre. Maybe a deal with Brazil, next?

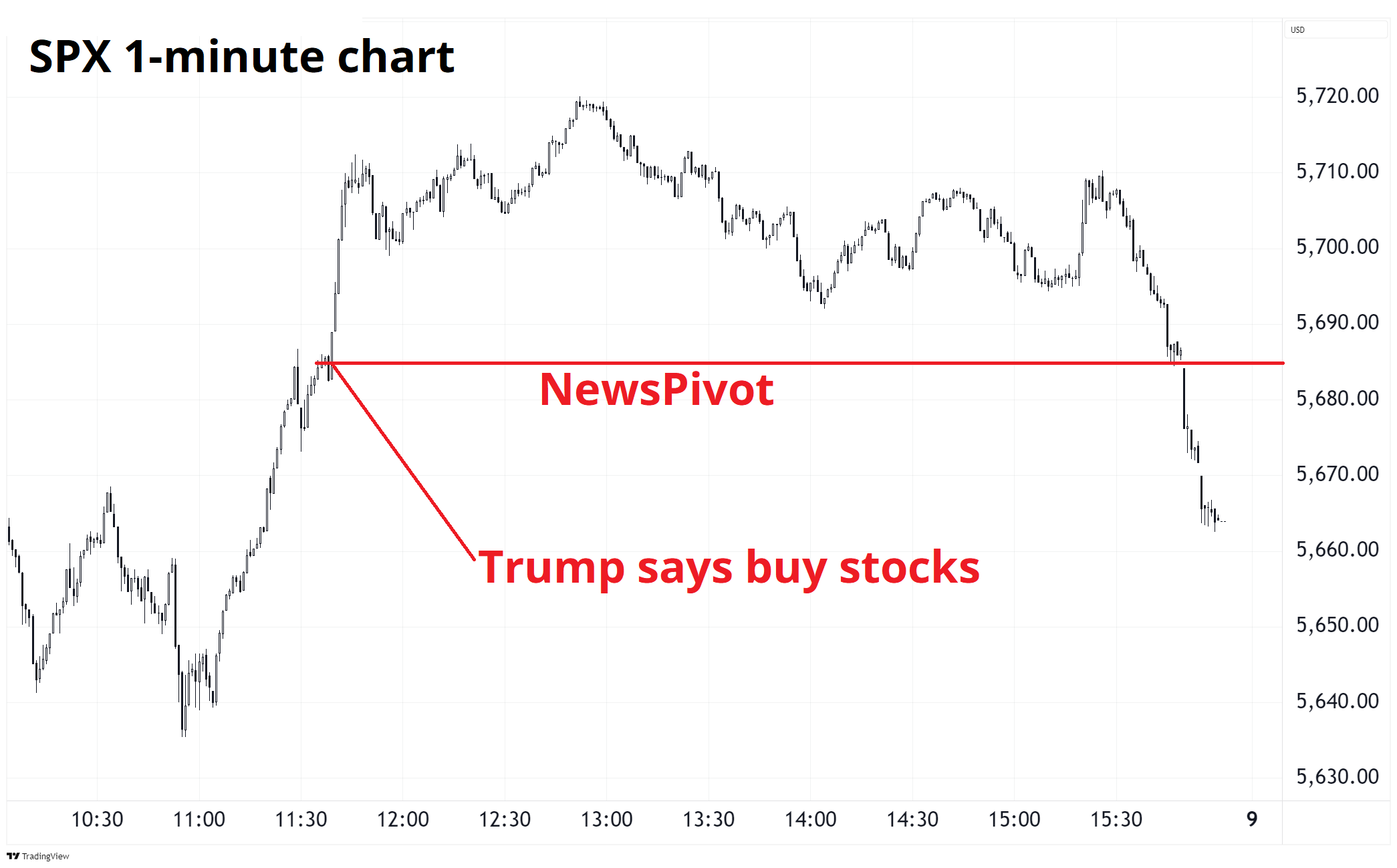

It’s easy to be glib about all this, but part of the challenge here is to separate the signal from the noise and in this case, I would argue peak glibness is warranted as the substance of the UK/US agreement is entirely without substance. And while on the topic of signal vs. noise… We are now in a world where the President and his administration tweets buy recommendations for various securities and indexes (ETH, TSLA, SPX) and as traders we have to decide what to do. He obviously has inside information, and so it’s nuts to ignore the tweets. Then again, how do you risk manage a trade that is so brazenly idiotic?

These pumps are only relevant to day traders, and the right strategy is to get in and out quickly, because otherwise you can sit there waiting for the news that might never come. Yesterday, it was obvious the market thought the Trump tweet (BUY STOCKS!) was a harbinger of news that would land before the market close, but it wasn’t. As such, as the close neared, and post-Tweet longs went underwater on the break of 5685, there was a micro capitulation. You can see the selloff accelerated as the longs went into the red.

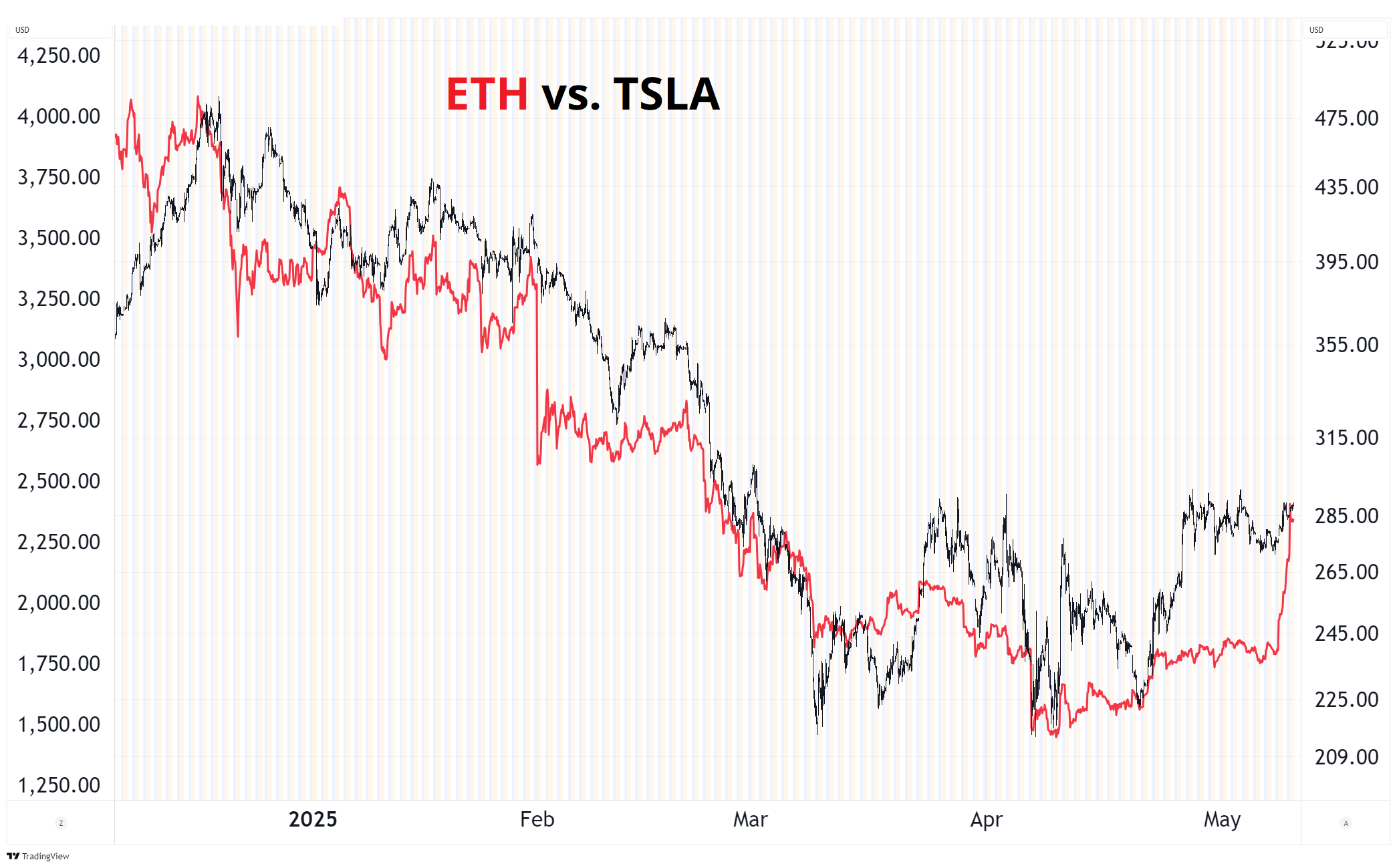

The strategy of following the government with a stop at breakeven, hoping for an insta-rip is correct and is a good way to trade headlines. Use the bullish announcement level as the NewsPivot and get out if we revert back below. Please see Alpha Trader for a discussion of how to use NewsPivots more generally. Yes, Trump’s April 10 tweet generated a 10% gain. But he pumped ETH at 2200, and it went straight to 1400. When Lutnick recommended buying TSLA, it ramped 20% in a straight line. But when Trump pumped ORCL and Stargate, ORCL collapsed soon after. These trades should work instantly and never go out of the money.

I will leave the myriad ethical and conflict interest issues aside because that ship sailed the night $TRUMPCOIN launched. There is no government oversight of government-led pump and dump schemes, by definition! So, I am going to concentrate on how to make money and/or avoid getting my head ripped off by these shenanigans. As repugnant as this all feels, if you are a day trader there is money to be made by simply going with the pumps and using an incredibly tight stop. I would rather try to make money on this stuff than get angry about it. Chaotic neutral, as they say.

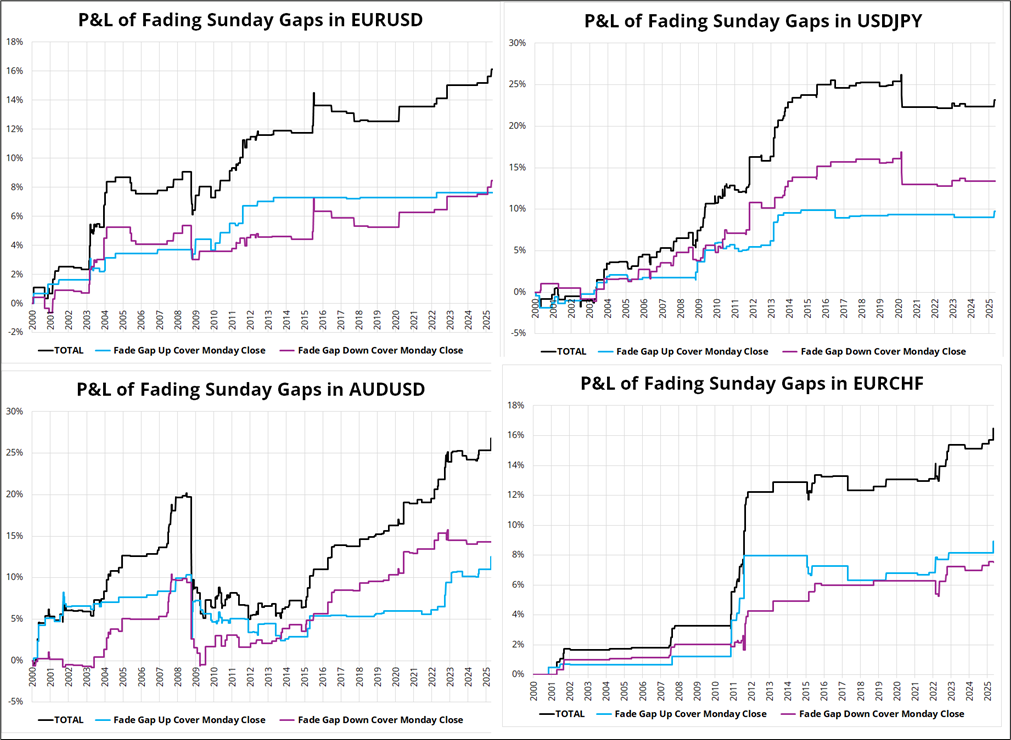

Gaps

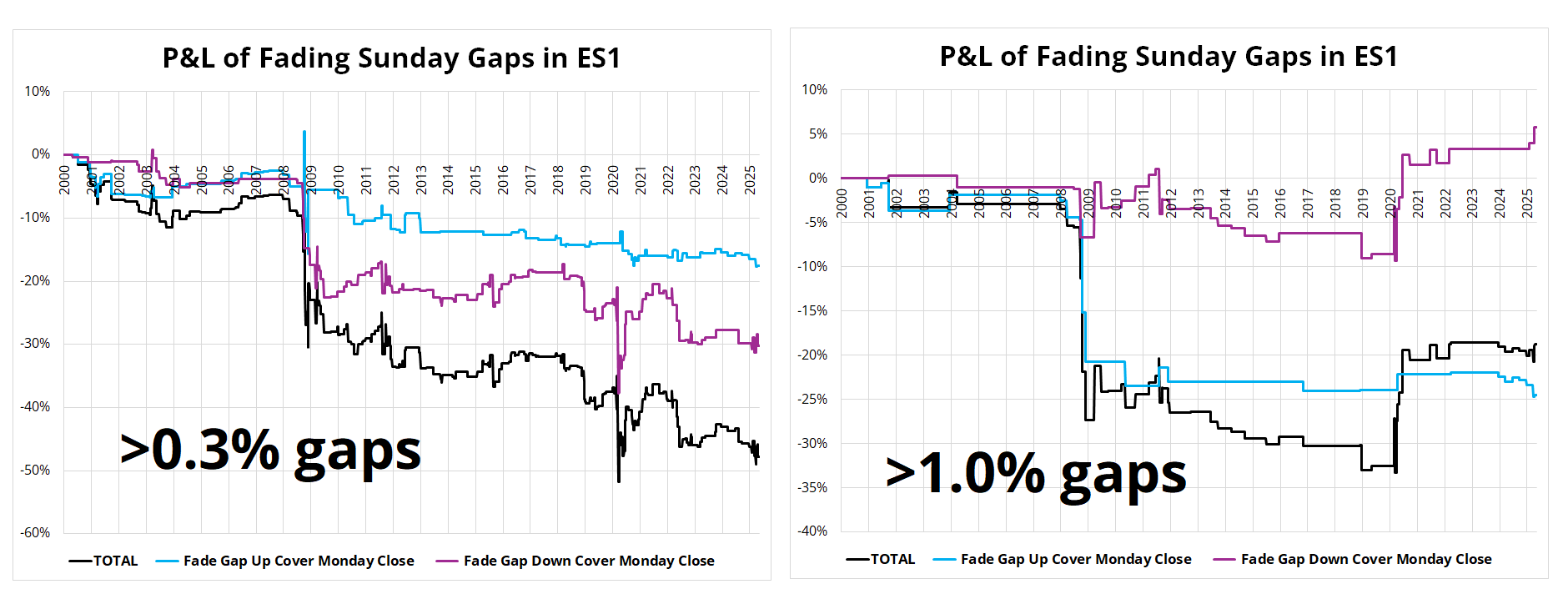

It is a well-known fact that Sunday gaps in FX markets tend to mean revert. I mention this because there could be a gap this Sunday as we will probably get conciliatory headlines, and I estimate there is a 10% chance of some kind of breakdown in talks. Big weekend news creates a situation where every participant in the world is the same way. So, if there’s terrible weekend news, the invisible hand has to keep moving lower and lower until it runs into an extremely motivated buyer who loves the new, lower price. By the time you get to a place where buyers and sellers can match, the price has more than fully discounted the news. This is super counterintuitive and frustrating for the litany of sellers who then buy back higher 12 hours later.

These charts show the P&L of fading Sunday gaps of 0.25% or more vs. the Friday close. When the P&L flatlines for ages, that simply means there were no gaps in that period. Look at all the gaps in 2009-2012! The Eurozone crisis was a period where EURUSD was gapping up and down almost every weekend on Greek referenda, EU bailouts, and sovereign ratings changes. Craziness. Clearly there are times when fading the gap doesn’t work, but as a general strategy, it does.

I cannot explain why, but Sunday gaps in S&P futures are not a fade.

Final Thoughts

ETH finally caught back up to TSLA!

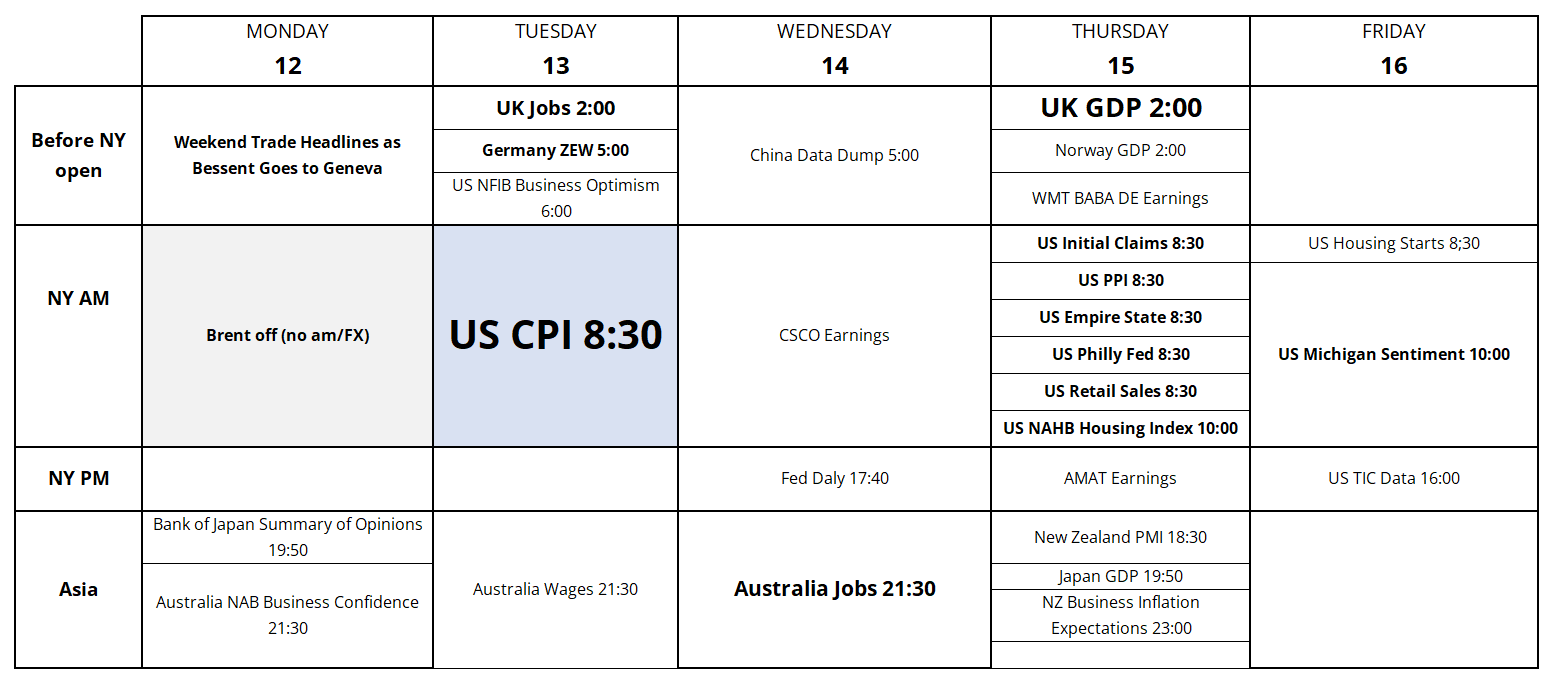

I am out on Monday for the celebration of my lovely wife’s birthday. Next week’s calendar below. Earnings season cools down considerably. See you Tuesday.

Next week’s calendar