There is a significant policy premium in the USD and bonds. We await ratification.

2025 is 45 squared and it’s also the sum of the first nine cubes.

There is a significant policy premium in the USD and bonds. We await ratification.

2025 is 45 squared and it’s also the sum of the first nine cubes.

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC 7:30 a.m.

Short EURSEK @ 11.52

Stop loss 11.7110

Cover 31DEC 7:30 a.m.

This is day 364 of 365 for 2024. The Trump trades are well-subscribed and now he either has to deliver some shock and awe, or disappoint. The popular trades are:

The turn of the year is always tricky because P&L resets to zero and mark-to-market becomes more relevant and potentially painful. If you are long USD and up $18 million for the year in 2024 and the USD corrects a bit and you drop to up only $15 million, your psychology and behavior will be radically different from the situation where you banked $18 million in 2024 and then are down $3 million on January 5th of the new year. Small and medium red P&L numbers feel completely different from black P&L numbers getting slightly less big. The psychology of drawdowns from high water is different from the psychology of early year drawdowns.

For now, we are left to wonder how severe a positioning issue there is in the USD. Nobody is going to bail until either a) price movements force them to (EURUSD > 1.0625) or Trump headlines sound less aggressive than expected.

The other wildcard for 2025 would be a meaningful weakening in the US data. The recent rise in US 10-year yields is more about inflation and a stalled Fed cutting cycle and has nothing to do with US data. In fact, while the US data is fine, the second derivative has turned lower.

You can see in the chart that the market tried something similar in April 2024 (yields up despite weakening surprise score in the US) and it didn’t work out. Yields topped a week or two after the economic surprises dumped.

And commodities are not endorsing higher yields, either:

The recent rise in yields is some combination of:

As is the case with the USD… A lot needs to go right for the short bonds trade to work out in 2025. Bonds have priced in a significant risk of an inflationary fiscal / monetary policy mix and with China still struggling, Europe in the dumps, and US equities fully subscribed, there is quite a lot that could go wrong for USD longs, crypto bulls, equity longs, and bond shorts into 2025. The policy premium in the USD and in bonds is logical as inauguration approaches, but it’s also large and potentially excessive if newsflow doesn’t deliver forthwith.

Other than some recent dabbling short equities, I am not ready to take the other side of any of these trades yet. But any clarity on fiscal or tariff policy that isn’t fully shock and awe / hardcore bullish USD and bearish bonds will trigger a large and sudden reversal trade early in the year. People still remember what happened in Q1 2017 and will be quick to panic if Q1 2025 looks similar. If fiscal policy doesn’t look loose, tariff policy does not shock / awe, or the US economic data cools, the biggest reversals would be EURUSD, USDCAD, and US bonds. CPI on the 15th is particularly important given the big turn in the Fed’s balance of risks.

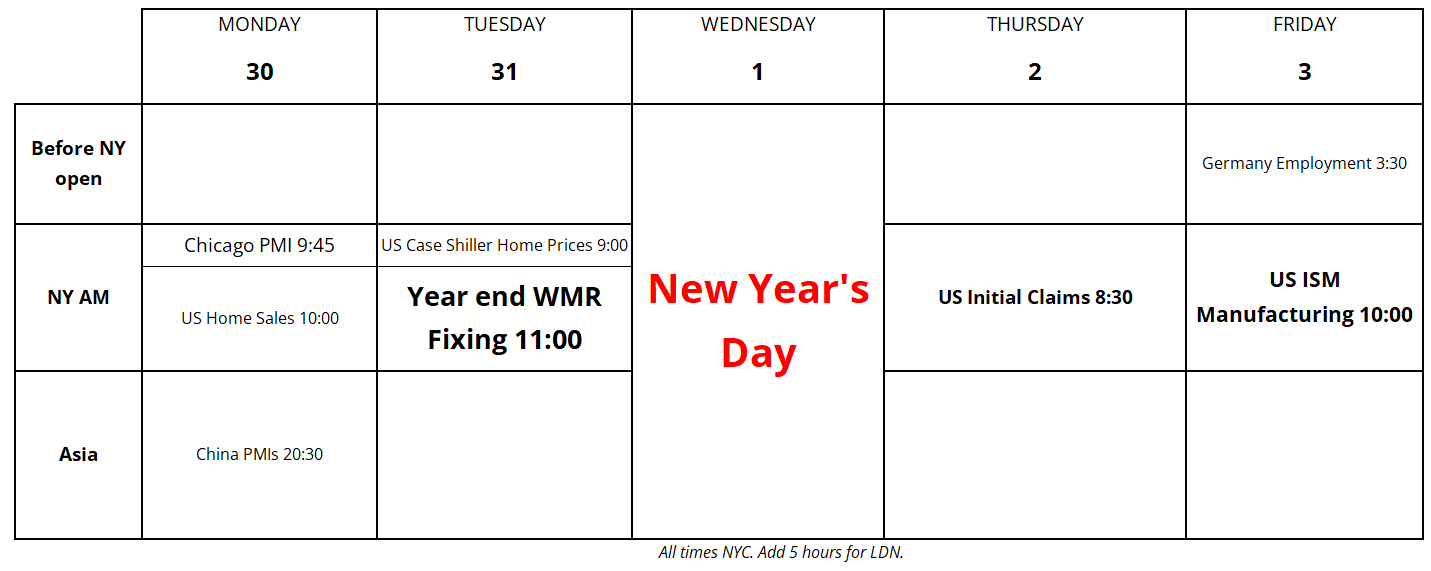

This week’s calendar is as light as they get. The year-end FX madness around 11:00 a.m. will be the highlight, with ISM on Friday also clocking in at high importance as we see how long the Trump Bump lasts. The starting point for the Trump trades is going to be a big issue when the calendar turns and everyone’s P&L resets to zero.

Some key dates in January:

07JAN JOLTS and ISM Services

09JAN Markets closed for Jimmy Carter’s funeral

10JAN NFP

14JAN PPI (will help forecast CPI)

15JAN CPI

16JAN Retail Sales

20JAN Inauguration and tariff announcements imminent

29JAN FOMC and Bank of Canada

30JAN ECB

Don’t forget to buy your Trader Handbook and Almanac now so you get it early in 2025!

The bitcoin chart is rather intriguing as we are on massive support and the neckline of a huge head and shoulders.

Through 92k looks dangerous as volumes are drying up and it seems like Mr. Saylor might have gone on vacation.

CHF bears are going to start panic selling if the year-end CHF buyers don’t show up soon!

Have a numerically-pleasing day.

2025 is the sum of the first nine cubes.

45 squared is 2025.

If you add 1 to each digit of 2025 you get 3136, which is 56 squared.