A massive escalation is the only way this stays relevant for more than a few days

Some ticker symbols that when I see them, the first thought that pops into my head each time is super annoying (see bottom of page).

A massive escalation is the only way this stays relevant for more than a few days

Some ticker symbols that when I see them, the first thought that pops into my head each time is super annoying (see bottom of page).

Flat

Iran began construction of the Natanz facility in 2002, and the international community became aware of it in 2003. Since then, there have been quite a lot of conflagrations and such, and while it’s hard not to find all these headlines scary, it’s also hard to imagine how any of this will impact MAG7 earnings or the US economy.

As such, I tend to have a blasé outlook on these attacks, while keeping an open mind to the possibility that attacks on oil facilities in Iran would have a real inflationary and economic impact. Maybe I am just being lazy.

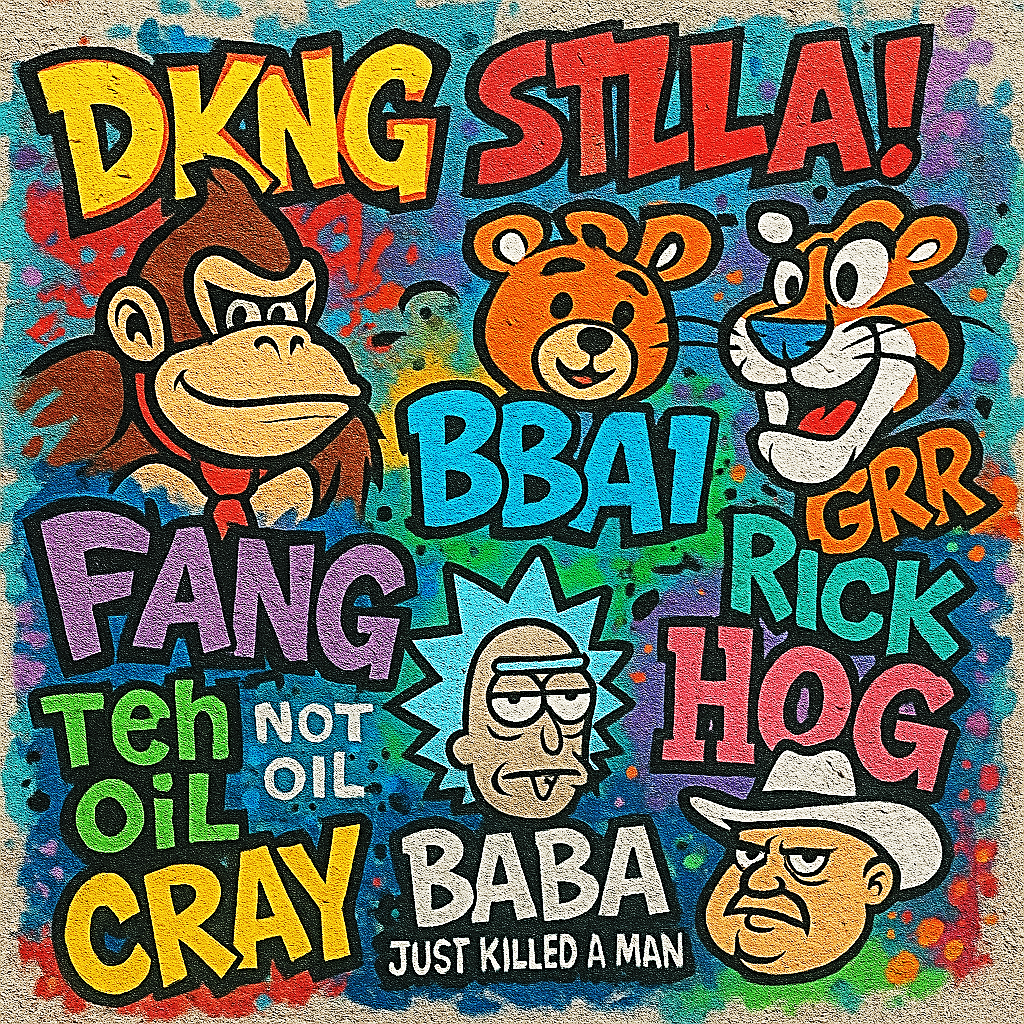

Below is NASDAQ the last time we went through this, about 8 months ago.

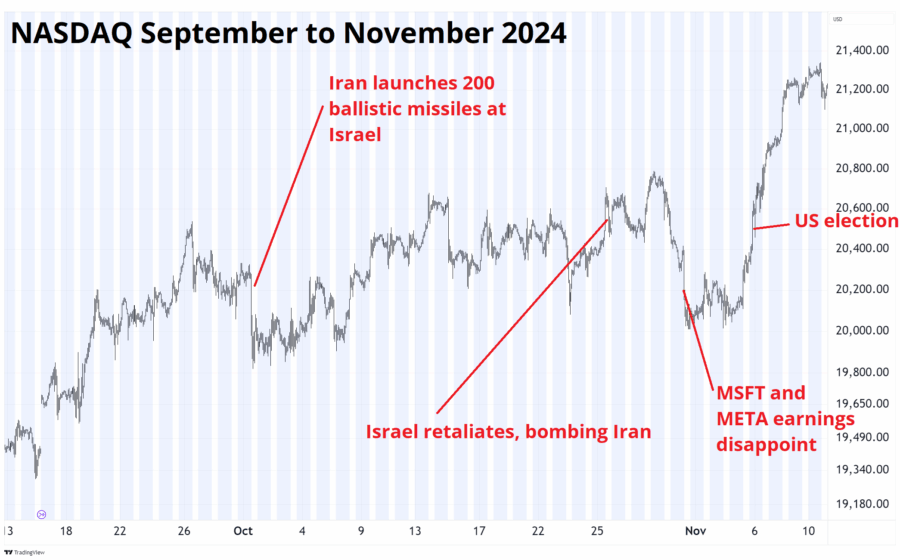

Interestingly, crude went from $66 to $78 that time, but it took a few weeks. This time, it covered the exact same ground in an hour.

I suppose the de-escalation was clear last time and that helped, whereas we don’t know how long this will drag on or whether there will be subsequent attacks on Iran. It’s also not clear what Iran’s retaliation capabilities are, or how the Sunday meeting might impact things.

US still wants talks with Iran on Sunday: US official

June 13 (AFP) — The United States still hopes to hold talks Sunday with Iran, even after Israel launched a massive attack on the Islamic republic, a US official said.

“We still intend to have talks Sunday,” the official told AFP on condition of anonymity.

With a potentially dovish Fed meeting next week, any kind of cooling in this conflict could unleash a speedy rally to the all-time highs in stocks.

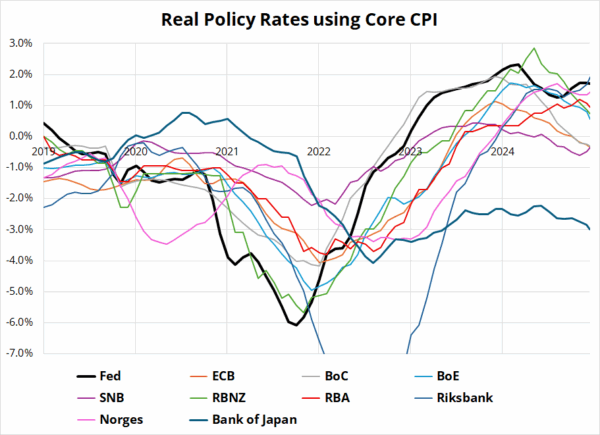

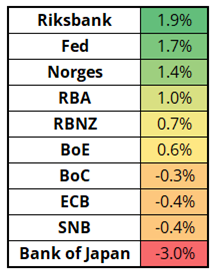

Next week’s calendar appears at the end of today’s note, and the highlight will be a flurry of central bank meetings. We get BOJ, Riksbank, FOMC, SNB, Norges, and Bank of England. I have been mentioning how Fed policy looks tight relative to peers and if you do the simplest calculation of real policy rates using core inflation, you can see that the Fed and Riksbank stand out. The scaling of the y-axis is wide because of the megaloose policy after COVID and subsequent recalibration, so after the chart I have included a table of the current readings.

That Bank of Japan number stands out, obviously, as they have been incredibly slow and reticent to adopt an orthodox policy stance, even with rice prices exploding, a weak currency, and inflation above 3%. There is essentially nothing priced in for BOJ, BoE, Norges, or the Fed while the SNB is priced for 25bps (with a 25% chance of 50bps) while the Riksbank is 80% priced for a cut. Short EURSEK and USDSEK have been popular expressions of the short USD and long Europe trades and there is some risk that an extremely dovish Riksbank could lead to a painful selloff in SEK. I continue to believe that next week’s FOMC meeting will sound dovish and set the table for a cut in July. The July meeting is currently only priced at 23% and I think that can go to 70% pretty quickly.

A friend of mine runs a roll-up business where they buy mobile video games and improve the monetization. His last company was 30 people, mostly coders and data analytics people. They IPO’d that company and are now doing the exact same thing with fitness and self-improvement apps. The new company has 5 employees because most of the coding and data analytics and rewriting of code can be done by one or two people using ChatGPT. I thought of this anecdote because Phil Valori of Spectra FX posted this comment today:

Anecdotally on the UK, I have a friend who started, grew and run a Graduate recruitment firm. Organising milk rounds[1] and student/employer engagements bla bla bla. For 20 years.

Revenue in covid 2.6mm

Revenue this year 1.2mm

Revenue next year 400k.

“The main issue is that the grad recruitment market has fallen off a cliff – most of our employers are using AI to do what the grads would have done and what little recruitment they ARE doing, they are using AI for too.”

I am always skeptical of narratives suggesting that technology and automation will lead to massive job losses because this has been a fear for the past 100+ years and it never happens. New technologies create job market disruption but have never generated massive unemployment. Bare minimum AI is going to lead to some severe job market disruption in the next 24 months. Maybe worse. Good for productivity and bad for coders. Interesting because “learn to code” was the common knowledge advice just a few years ago, while truck drivers were at greatest risk of job losses due to self-driving trucks. That has not worked out so far.

—

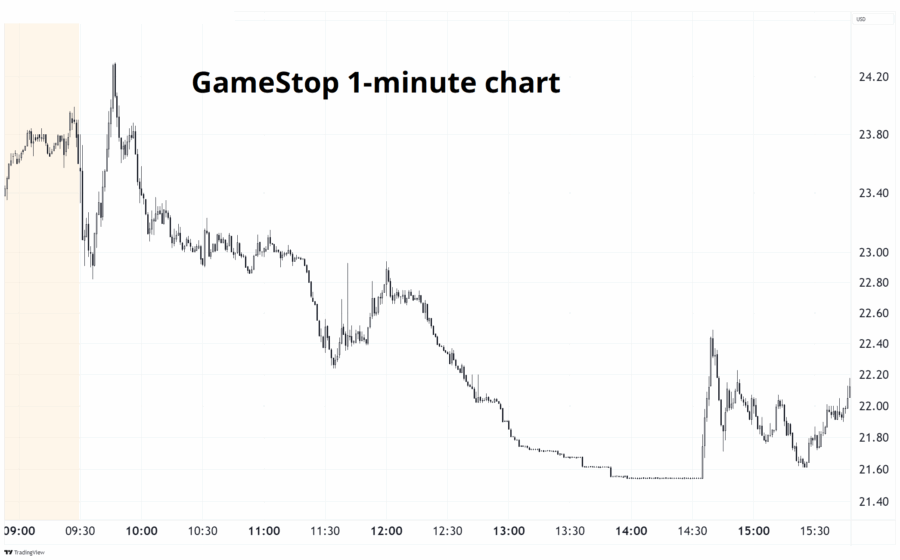

GME: One of the weirdest 1-minute charts I have seen in a while. Someone was on the bid for infinity at $21.54. Weird.

—

The heroine in the original Donkey Kong was named “Pauline” not Princess Peach.

Have a safe weekend.

—

[1] Milk round is UK slang for Job Fair or Career Fair, an event where employers gather at or near a university to recruit upcoming graduates.

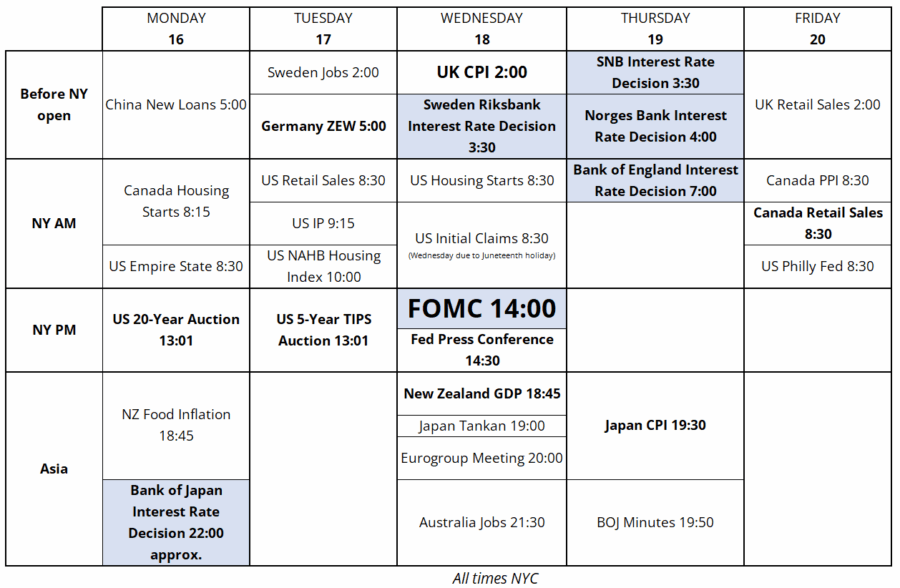

Trading Calendar for the week of June 16, 2025

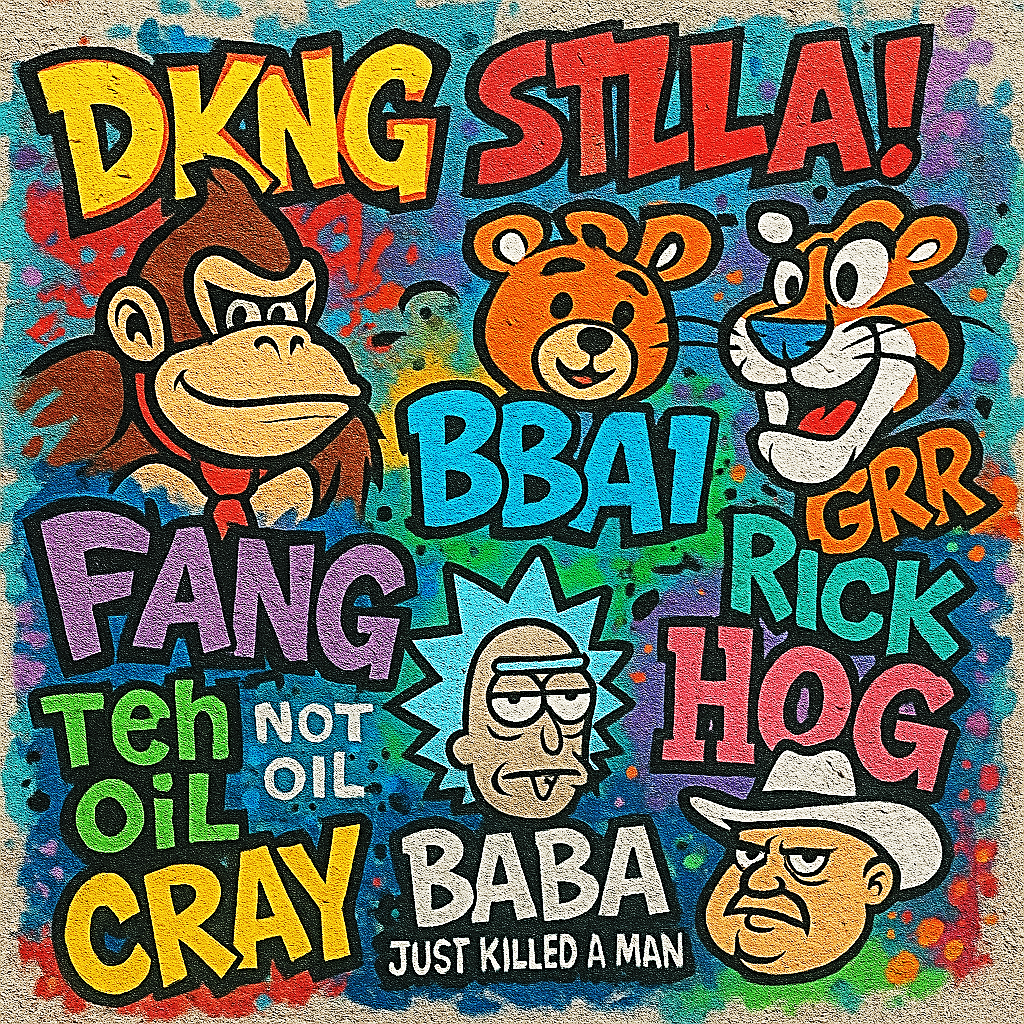

Some ticker symbols that when I see them, the first thought that pops into my head each time is super annoying:

| DKNG | Donkey Kong |

| STLA | Stelllaaaaa!!! |

| BBAI | Build-a-Bear |

| GRR | Tony the Tiger |

| POT | WEED |

| HOG | Boss Hog from Dukes of Hazzard |

| FANG | Tech not oil |

| RICK | And Morty |

| BABA | Just killed a man |

| CRAY | Cray cray |