The whisper still seems ambitious

Demetri Martin had an art show in LA. He is my favorite comedian.

The whisper still seems ambitious

Demetri Martin had an art show in LA. He is my favorite comedian.

Friday 1.1450 EUR call

Cost ~23bps off 1.1405 spot

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

The betting markets remain weirdly complacent with Kalshi still showing an 84% chance of NFP above 100k (and 38% chance of it coming above 150k), and Polymarket showing a 74% chance of NFP above 100k. The Under 50k bucket on Polymarket is trading 4.6%/5.0% in small, and that seems wildly underpriced. Similarly, I bought some “Will NFP be under 94k” for 15 cents on IBKR. There is not yet panic in the air. The Bloomberg whisper number is 115k.

Bonds are not waiting around to find out. We got a zippy move yesterday and the 4.26% range bottom in 10s is within reach. If we are anywhere near there before 8:30 a.m. tomorrow, I will cut my bond long as the risk reward gets worse near that level, but for now I am sticking with the trade. All the backtesting I have done with Conference Board, Initial Claims, Continuing Claims, and ADP points to a weaker than expected NFP and it’s rare to have so many very good indicators all saying the same thing.

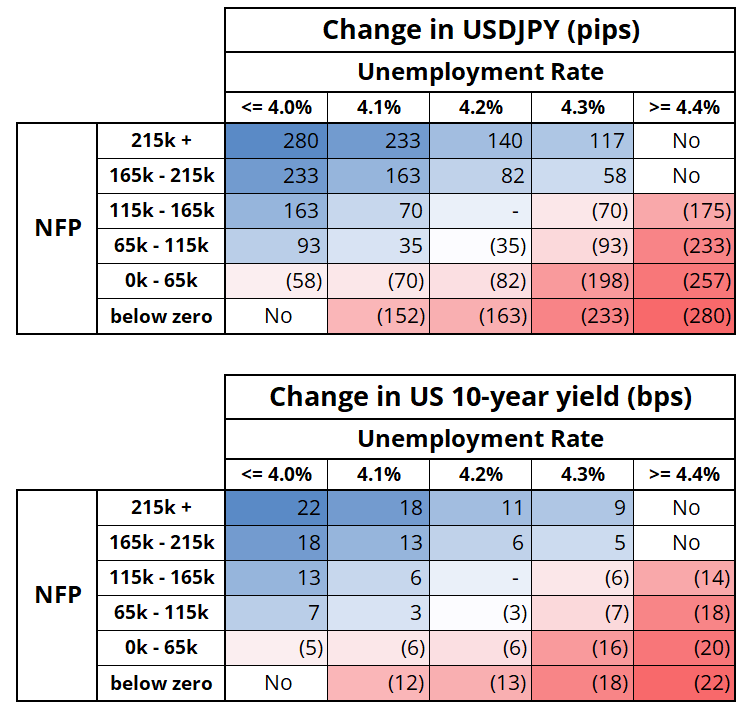

And there is logic to believing that a spike in policy uncertainty that started on April 2 would have an impact by the time the May 12 NFP survey period comes around. Economists tend to anchor on prior data and do a bad job at turning points (especially when there is a shock that cannot be modelled, like now). My base case is +77k jobs and a 4.3% Unemployment Rate. Given the variance in the series and the litany of negative signposts, a tiny negative print with a 4.4% UR is not out of the question.

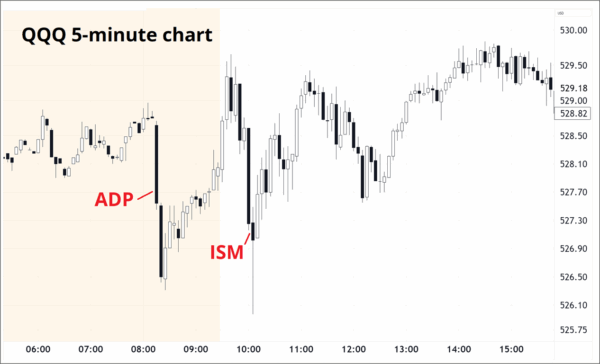

These things are never predetermined. The noise factor of the release is high and sometimes the signposts point you in the wrong direction. But this week has been one of the most ex-ante obvious times to expect a weakening jobs market and so far ADP and ISM have complied. As discussed a few times in here, JOLTS is meaningless. It was an April number

There are some interesting things going on here. First, we have a bit of an intellectual dishonesty problem with the USD views because it feels like higher rates are bad for the USD (bond vigilantes!) and lower rates are bad for the USD (recession!). I usually hate setups like that because trades are rarely all-weather like that. But in this case, the why is important. If bond yields are rising because growth is good in the US and inflation is perking up from low levels, that would be bullish USD. But yields were going up because of fiscal fears. Now, yields are going down because of slowdown/recession fears. Both are then logically bearish USD. If yields were going lower right now because Republicans decided to be fiscally responsible, that would be bullish USD. You know what I mean?

Second, I got many pings yesterday from clients (and a WSJ reporter) asking why stocks were not lower on the weak US data. Three points on this:

Compare bond yields and stocks yesterday after the two weak data points, and you can see why it’s no fun to trade stocks on economic data.

If you can trade stocks and bonds, why would you trade stocks on economic data? Just trade bonds.

Here are my best guesses for asset market reactions to various NFP / UR combos tomorrow.

Platinum is moving! See here for the original bull thesis. The new narrative and tech break higher are drawing more upside interest. The two stocks I picked are doing well. PLTM is up 7% and PLG is up 28% since May 21. Still a long way from the original target, but the fact that it’s moving feels like a small miracle. I haven’t traded many things that just sit there for a week and do nothing. Platinum is a patience tester.

https://stayathomemacro.substack.com/p/the-labor-market-wont-offer-the-same

For context on how insane PLTR is: They have 5B revenue forecast for 2026 and 303B market cap. CRWV has 12B revenue forecast for 2026 and 78B market cap. The PLTR reckoning will be swift when it happens.

Yep, my Dad reads am/FX. 😊

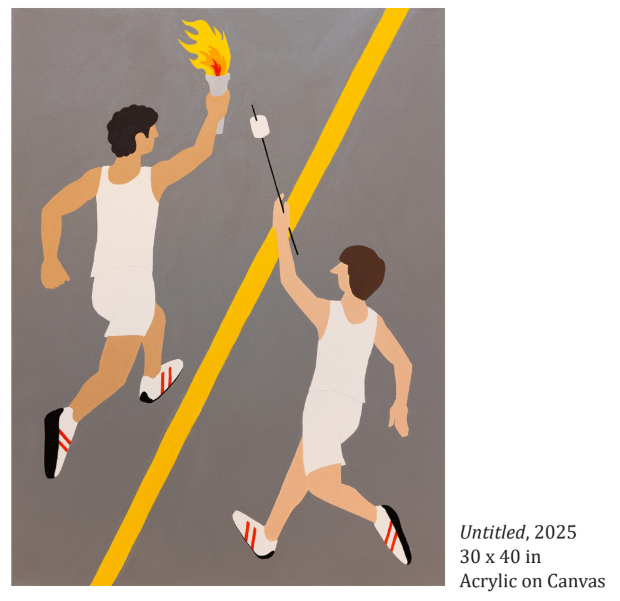

Demetri Martin had an art show in LA.