Bonds are back!

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Bonds are back!

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

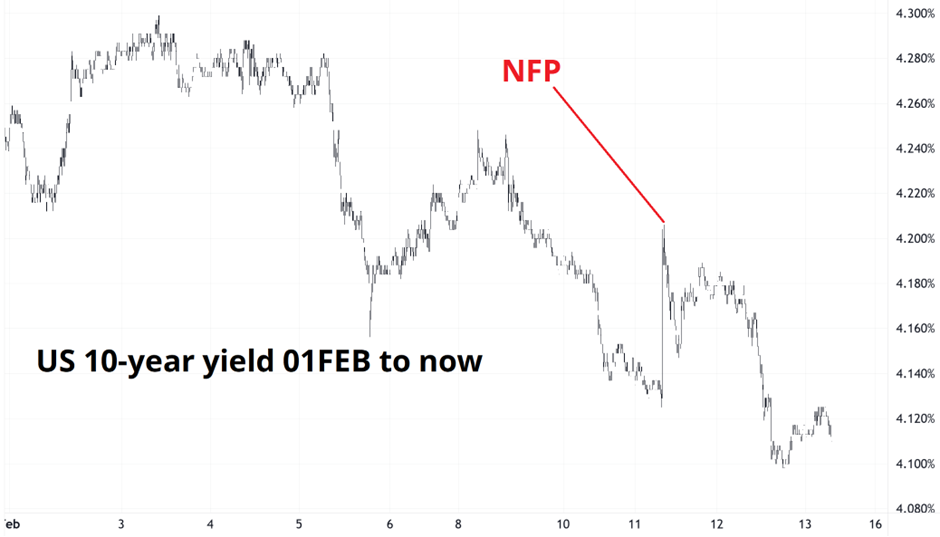

Despite a strong U.S. jobs report, bonds rallied hard this week, leaving many on Wall Street scratching their heads. Bigger picture macro players are now starting to place bets that AI will be a disinflationary force. Disinflation means lower interest rates and higher bond prices and that’s what we got here this week.

The continued flight out of technology stocks leaves investors even more desperate for safe havens… They tried putting money into gold and silver, but those both buckled too as the market hunts down and shoots every 2026 consensus trade. Maybe when you see lineups outside gold shops, you should start thinking about selling, not buying precious metals.

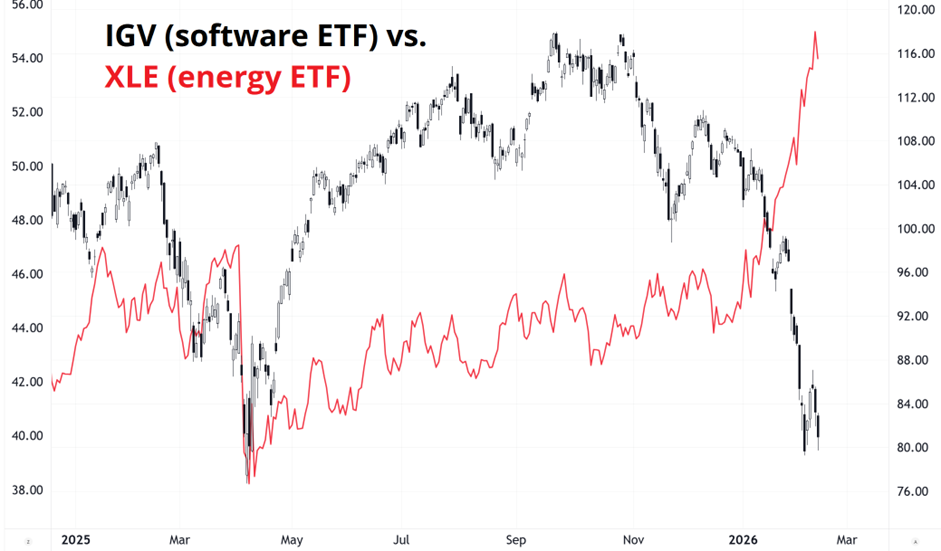

Energy stocks are ripping higher as value hunters rotate out of expensive technology stocks and look for companies that trade in atoms, not electrons. “Buy real stuff and sell digital stuff” has become an important theme after the apocalypse in software stocks. After last week’s collapse, the iShares Tech Software ETF tried to rally early in the week but is going out on the lows.

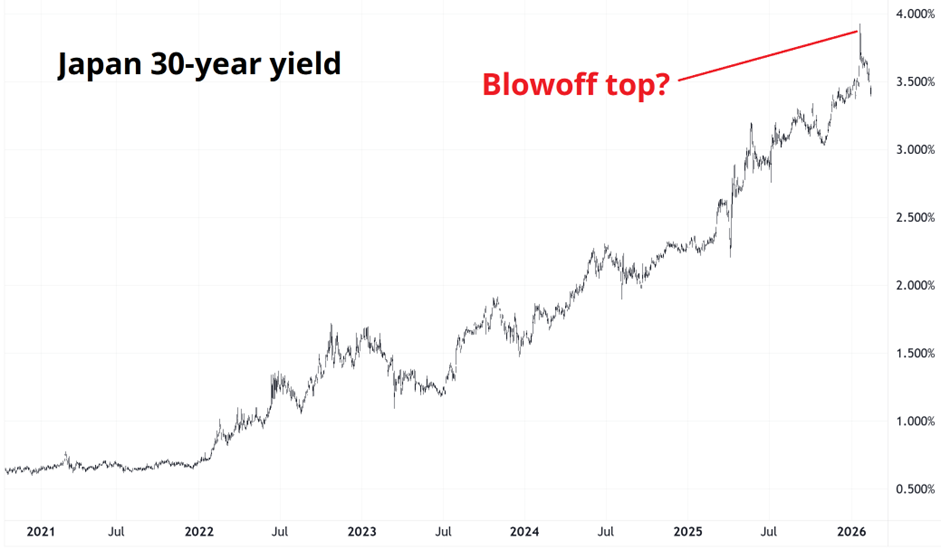

The global bond market also found support from Sanae Takaichi’s landslide election victory in Japan. While many thought a supermajority for her LDP party would be negative for Japanese bonds and the yen, the exact opposite happened. They both rallied. The removal of uncertainty has encouraged long-term investors to dip their toes back in the water. With a bit of stability, those juicier Japanese yields are attracting plenty of interest. So are the Nikkei and the yen… It’s called the “Buy Japan” trade. Stability in Japanese bonds flowed through to all global bond markets, including the U.S. of A.

The market is ignoring the strong U.S. data for now, perhaps because there is no credible scenario where the Fed hikes rates. This asymmetry should be supporting risky assets and the debasement trade, but it’s not. You have a continued soft landing and a guarantee that the Fed won’t hike, and yet stocks can’t take out the highs. Hmmm.

The double top in NASDAQ looks scary as does the deceleration in upward momentum in the SPX. We have been consolidating in the megatech-heavy NQ futures for five months and the NASDAQ is trading exactly where it was last September.

The S&P 500 has held in better and even made a marginal new high at 7002 this year, but fears that AI could hollow out various industries, and put downward pressure on prices in SaaS, legal, tax, trucking logistics, and other industries knocked us back again. There is a head and shoulders forming with a neckline at 6791 in cash SPX.

The massive sector rotations fly in the face of the fear that passive investors are simply a huge price-insensitive monolith that just buys the most expensive stocks willy nilly. In fact, the opposite is happening… Investors are actively rejecting many sectors. The largest market cap stocks are trading the worst while cheaper value plays like energy have exploded higher.

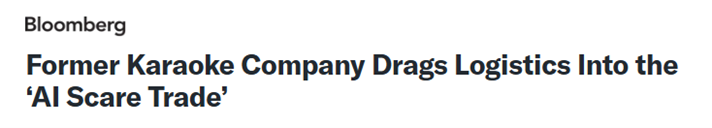

We are probably in the late stages of the “AI will eat the world” trade as yesterday we got a typical late-narrative event:

This reminds me of the late stages of the blockchain mania in 2018:

It’s impressive to me how little blockchain has accomplished relative to the hype 9 years ago. Blockchain is the Johnny Manziel of technologies.

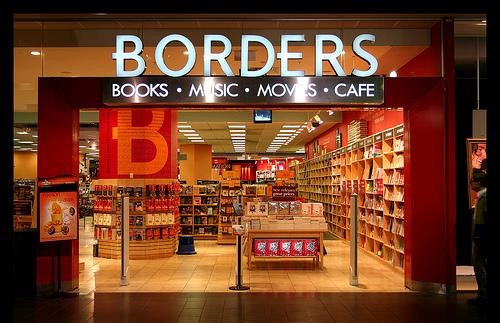

It is tempting to buy IGV (the software ETF) given the insane aggression of sellers, but I also remember how the legacy media companies and bricks and mortar stores got shellacked like this in the late 1990s due to the threat from the internet. Yes, some of them survived, but even the survivors were dead money for years because the market shoots first and asks questions later. Best to avoid the risk of investing in disruptees, no matter how cheap they look.

I get the angst around software, but in a degrossing event you are going to see a lot of healthy babies thrown out with the bathwater. There are probably opportunities to dumpster dive for companies that have been smashed but who are not in jeopardy from Claude’s Cowork plugins or the karaoke company’s big fancy breakthrough that totally isn’t just press release hype.

I am not a single name expert, but you can get some ideas from an excellent ex-Bridgewater fella right here. I am also contemplating TTWO as I want to be long at some point soonish ahead of the marketing blitz for GTA 6. That game will be the biggest selling video game of all time ($3 to $7B in first year, $15B in total sales) and there is enough worry about the launch date (November 2026) that it will be seen as bullish if and when the marketing starts. They won’t spend marketing dollars until launch is assured so I would expect a big runup in TTWO in late spring or early summer. This dip feels like an opportunity to get ahead of that. For perspective, the top grossing movie of all time (Avatar) took in around $3B. GTA 6 could take in double that in its first 60 days. And personally, I don’t think AI-generated video games are going to compete with human-generated games for years, if ever. TTWO beat and raised last week but the stock is in the toilet on last week’s degrossing event and the Gemini Genie scare. Here’s a good article on the topic:

https://www.bloomberg.com/news/newsletters/2026-02-06/why-the-gaming-stock-ai-panic-makes-no-sense

Something like TTWO December 18, 2026 $250 calls make sense to me. Not investment advice (I got bullish earlier in the week at $198 and it’s at $190 now—do your own research)!

My point here is not necessarily about TTWO specifically. My point is that after a degrossing / contagion event like the one we saw last week, you need to find the assets that sold off in sympathy for no reason and buy them.

The Big Beautiful Bill tax refunds start February 15 and so it’s showtime for stocks, especially the crappiest retail favorites like unprofitable tech. If stocks cannot rally with the big money drop over the next four weeks, that sends an extremely bearish signal for the rest of H1. I was bearish stocks into February but I will be extremely nimble now because there is some truth to the idea that mega tax refunds will be partially deployed into beaten down assets. This could benefit crypto, too. The reason I am not bullish is that I am wondering if retail has been beaten down so badly by this year’s selloffs, the wipeout in quantum, the destruction of most digital coins, etc. that they might just put the money in the bank this time. Let’s see.

Here is the 14-word stock market summary from January 30:

I am bearish for February. Retail is full to the gills. Sell the footballs.

Here is this week’s 14-word stock market summary:

Starting to look like major top. Tax refunds coming. Next four weeks are key.

https://www.spectramarkets.com/subscribe/

As mentioned at the top of the show, bonds are in demand. When you need a safe haven and you can’t trust gold, silver, or crypto… You buy bonds. So that’s what everyone did this week, despite solid U.S. data.

Based on historical data, the beat on NFP should have sent US 10-year yields higher by around 12 to 15 basis points. Instead, yields closed flat Thursday and proceeded to make new lows. Bonds are back, baby.

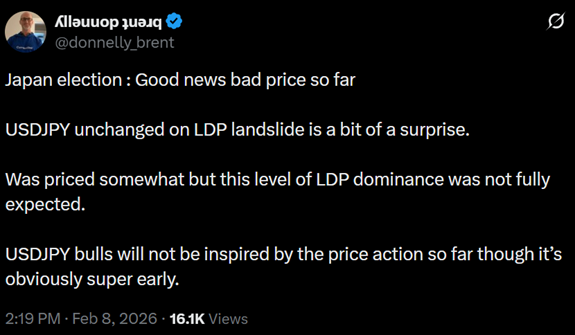

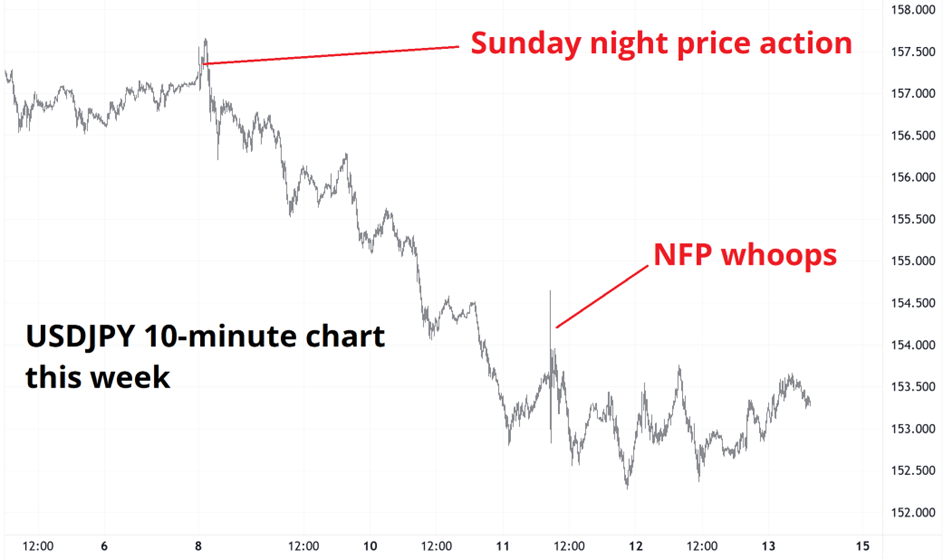

We had a textbook combo of buy the rumor/sell the fact and good news/bad price in USDJPY this week as Sanae Takaichi won a supermajority in Japan. The market initially made a very weak attempt to take USDJPY higher and then the pair quickly came back to earth as trading picked up. This is not purely hindsight; I tweeted about it during the Super Bowl when USDJPY was trading above 157.00.

You can see in the chart that the Sunday open was the high and then after the strong payrolls release, it looked like possible semi-official selling of USDJPY as massive volumes went through right in the face of the post-NFP USD buyers.

The bullish JPY narrative is:

The March BOJ meeting and all BOJ speeches are important.

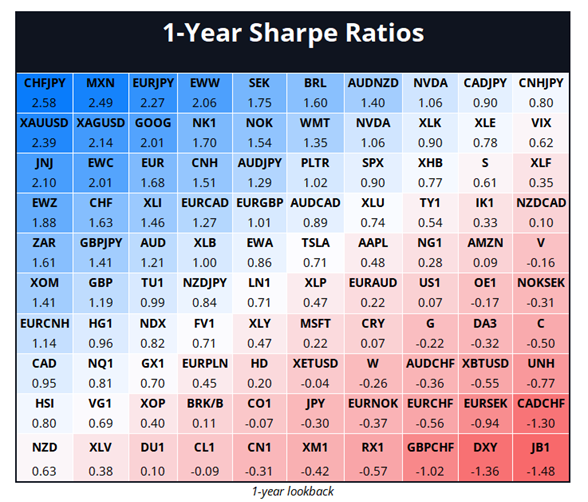

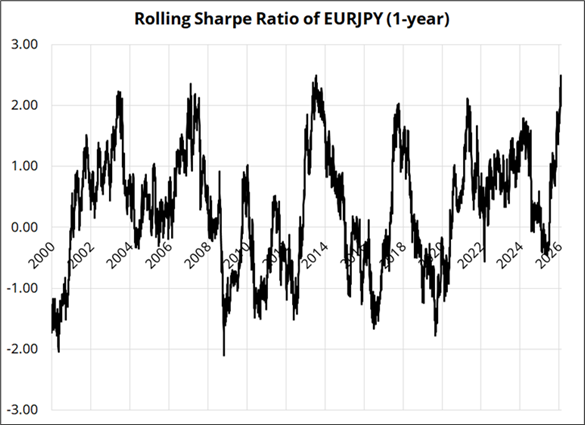

Long EURJPY and CHFJPY have been two of the highest Sharpe trades in macro (not just FX) for the past year. High Sharpes attract a ton of money from trend followers, momentum chasers, and humans. They often unwind faster than they built up.

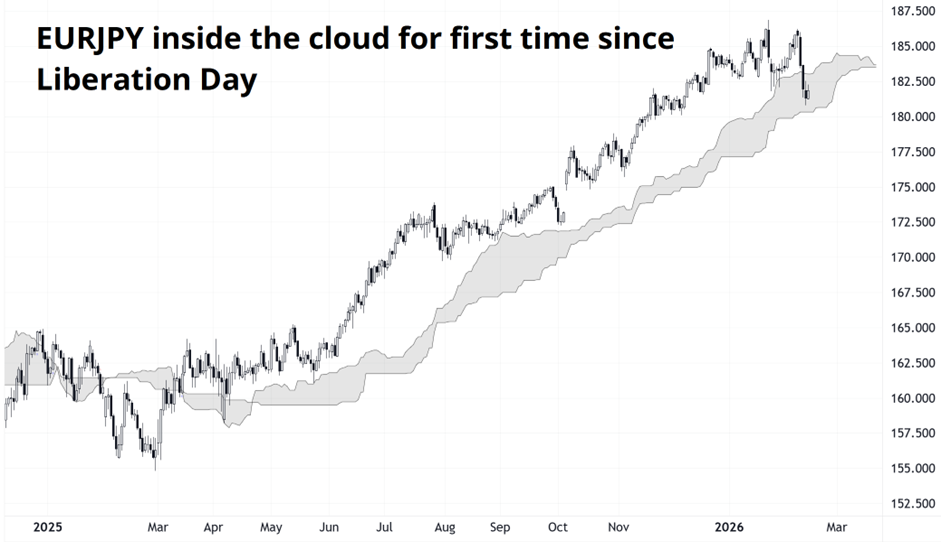

And the chart shows that EURJPY has been above the daily cloud for 6 months and 20 big figures and now we are back inside the cloud. Bearish.

Here’s the rolling Sharpe of EURJPY back to 2000.

So I am bearish EURJPY. I think we test 180.00 and probably just plunge right through it.

Elsewhere, the USD sellers are tired as the bearish USD trade became consensus after the Greenland brouhaha and EURUSD did a blowoff high on Trump’s comments that a lower USD is ok. AUDUSD, the favorite USD short, also held perfectly at the 2023 highs, major resistance at 0.7157.

Warsh is rather orthodox. The U.S. economy is fine. Precious metals stopped going up. The USD short trade is tired.

I wrote an 8-minute read about crypto yesterday and you can read it right here. The actionable takeaways are:

COIN and HOOD underperform massively. The stocks are already way down, but they could go way downer. Transaction volumes are going to be low when volatility is low and as the original generation of crypto bros ages out, I am not sure there will be fresh meat for a while.

Stay on high alert for the next bull narrative. Bitcoin has been down before, but it’s never out. Gotta be ready for the next wave, in case it comes. But don’t hold your breath.

Buy bitcoin 25-35k. If bitcoin gets to 35,000, it becomes a bit more of a lotto ticket again and it’s probably worth buying in anticipation of a rebound.

Wallstreet bets had their moment with SLV calls, but now the silver bubble has burst and I would think we consolidate. Energy is hot. Cocoa is not.

That’s it for this week.

Get rich or have fun trying.

Vonnegut 1

Advice from the legend

Vonnegut 2

Why you should do stuff, even if you suck at it

*************

A song that will make you sad for no reason

*************

Catholic Portuguese priest DJ FTW

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.