Lot of strange things going on. Feels like a bit too much leverage out there.

Sports photos from the 1970s often have a blue haze caused by cigarette smoke inside the venue.

Lot of strange things going on. Feels like a bit too much leverage out there.

Sports photos from the 1970s often have a blue haze caused by cigarette smoke inside the venue.

Short EURUSD @ 1.0490

Stop loss 1.0616

Take profit 1.0306

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC 7:30 a.m.

Short EURSEK @ 11.52

Stop loss 11.7110

Cover 31DEC 7:30 a.m.

Today, let’s start with a short survey to get your views for 2025.

Please click here to take the 90-second survey. Or use the QR code. Results in am/FX on Monday. You can read last year’s results here. Surveys like this don’t always yield contrarian outcomes, but last year they most certainly did.

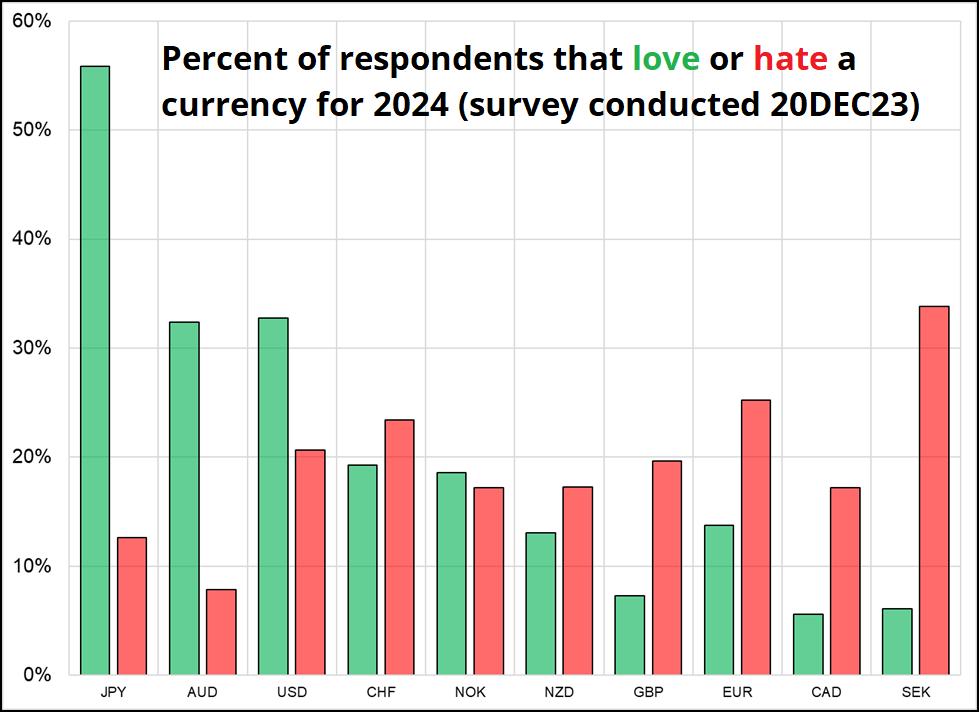

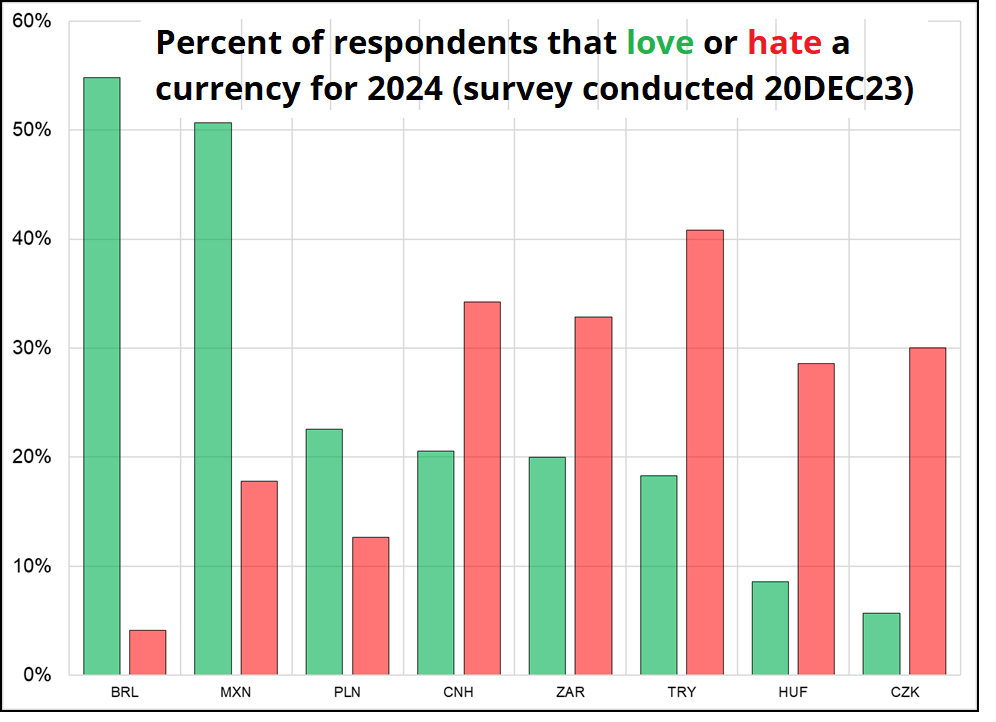

The most popular currency for 2024 was the JPY.

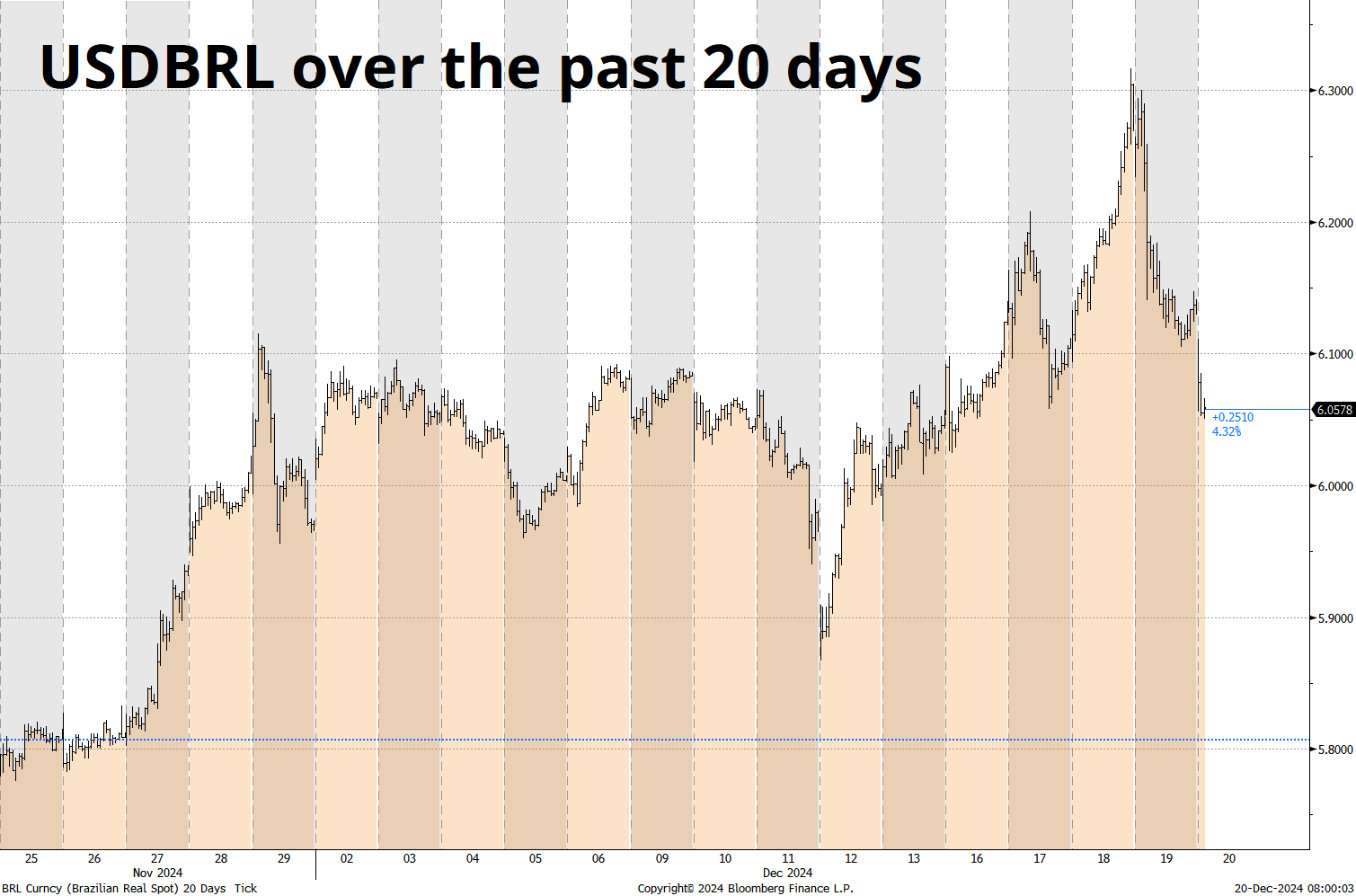

And EM, the most loved currency was, um… BRL.

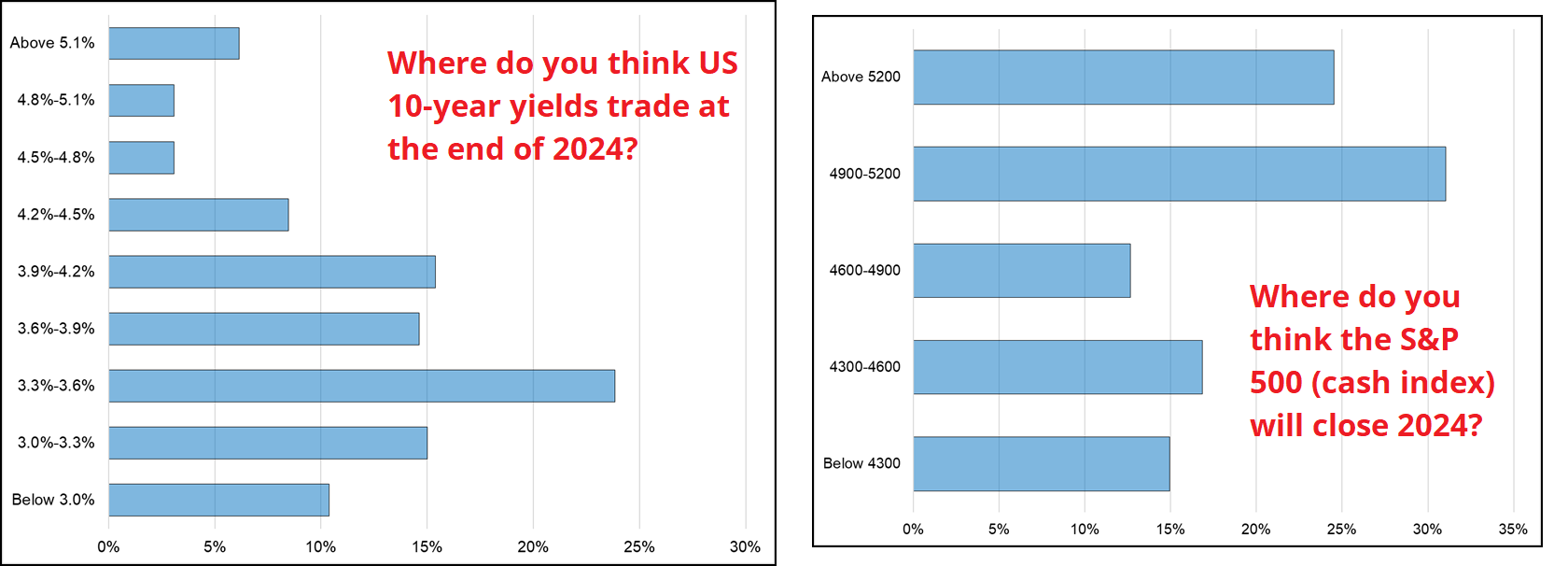

On stocks and bonds, the consensus was also miles off the mark.

The takeaways from this outcome, which is not particularly horrendous compared to other years are as follows:

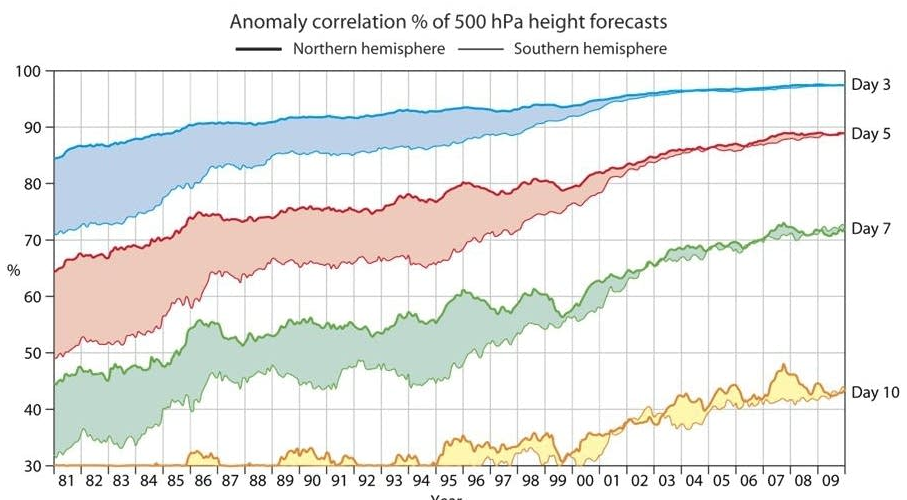

I can tell you with certainty what it’s going to be like tomorrow, and with mild uncertainty what it’s going to be like in 6 days, but we have no clue what the weather is going to be like on February 4th. I have no clue where USDCAD is going to be a year from now; I don’t even know what might be driving it. The chart shows the forecasting accuracy for weather since 1985. You can see forecasts getting more accurate, but you can also see that the further out you look in a complex system, the harder it is to forecast. Weather and financial markets are not perfectly analogous; I am stretching the comparison a bit to make a point.

I am not a rates guy, but I was able to hear some screams of pain and terror from the rates market yesterday as the curve is doing all kinds of weird stuff and it has disinverted via bear steepening. This is pretty weird. Past disinversions have been harbingers of recession because they came in a bond bull market, but as with everything this cycle, the old rules probably don’t make any sense. This steepening seems to be more a product of sticky inflation and fiscal concerns as Trump is now arguing for no more debt limit. Speaking of useless old rules that don’t apply anymore: Note too that the Sahm Rule has untriggered, as predicted by Claudia.

The debit limit is a joke, and everyone knows it’s a joke, but it does serve as some sort of psychological limiter on government deficits as the speed bumps it creates at least force politicians to have a bunch of unserious discussions before producing the 1600-page bills that nobody can possibly read.

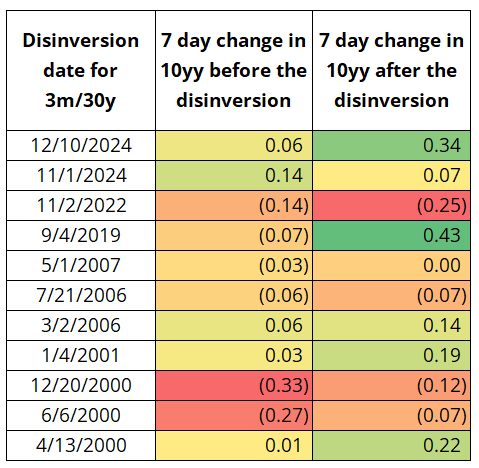

Here are past 3m/30y disinversions, along with what 10-year yields did in the seven days leading up and after the disinversion. You can see that only the bond market selloff leading into the repo crisis of 2019 is comparable to the present disinversion.

All this to say that I definitely do not see the current steepening as a recession indicator.

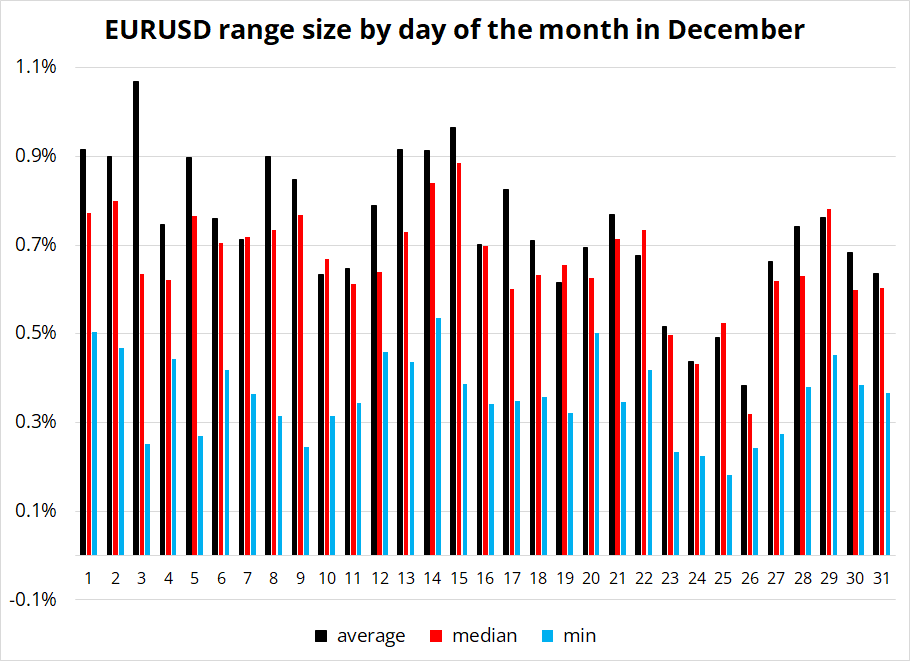

The calendar is naturally quite light next week. 1-week FX vol remains elevated and looks to me like a huge sell. Even with the stock market correction and pivot of the pivot of the pivot by the Fed… It’s Christmas week!

To take advantage of this with limited downside, I would sell 1-week put spreads on the commodity currencies. For example, off 0.6237 spot you can sell a 1-week AUDUSD 0.6225/0.6200 put spread and collect $80,000 for 100 AUD (ballpark!).

This is a boring way to make money because it’s negative leverage (risk 175 to make 75), but I think it’s super positive EV. Trades don’t always have to pay 3:1 to be positive EV! I know nobody will want to do this, but I am suggesting it anyway. Selling tight spreads is a good way to collect premium. People do it much more in equities, but nobody ever seems to want to do it in FX for whatever reason.

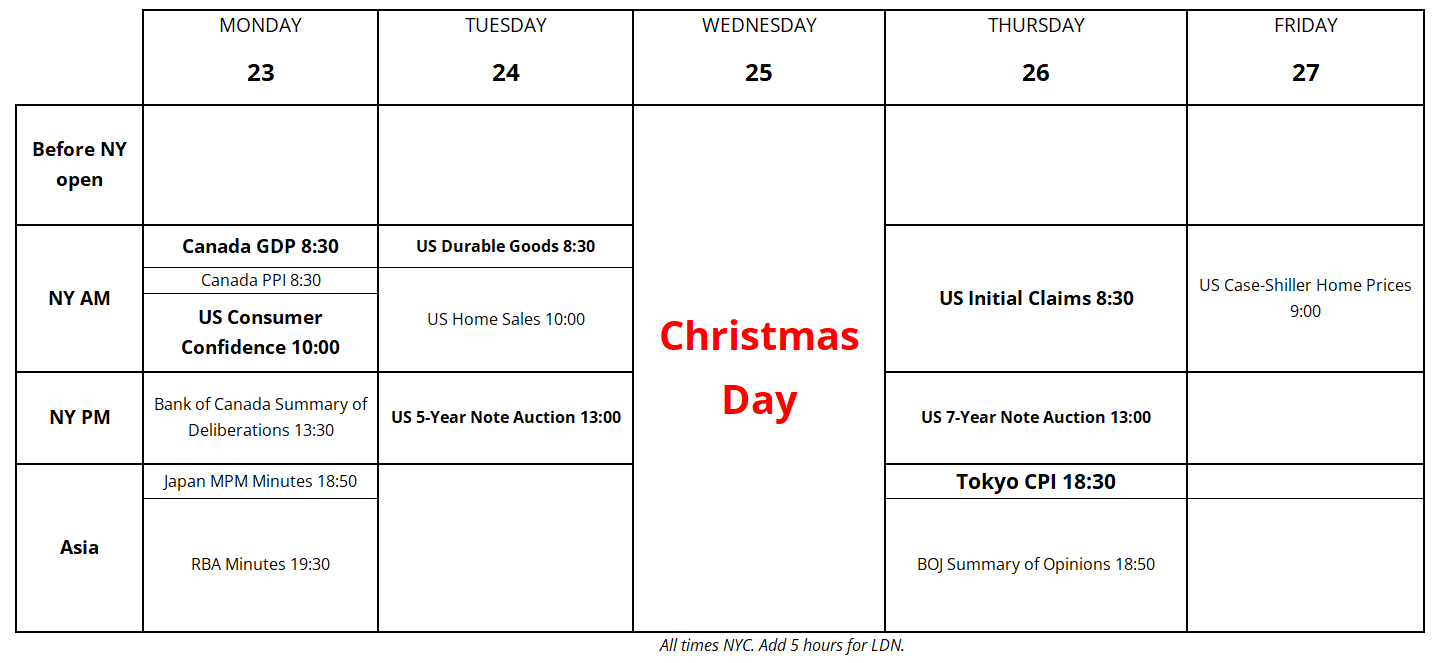

Anyhoo… Here’s the calendar.

In case you missed it, Brazil has been intervening aggressively in the currency. They have announced around $19B USD of interventions so far (selling USDBRL). I mention this because disorderly EM moves and disorderly bond market moves like we are seeing right now are indicators that liquidity is not quite as plentiful as we thought a few weeks ago. The tide is going out a bit and Brazil is naked. QUBT is naked. Who else is naked??

Despite the zippy drop, the NASDAQ is still flat on the month. The monthly candle looks a lot like a gravestone doji. The bitcoin chart, naturally, looks identical as it is a high-beta risky technology asset similar to NQ.

Have a smoky weekend.

Sports photos from the 1970s often have a blue haze caused by cigarette smoke inside the venue.

https://petapixel.com/2015/10/15/why-old-sports-photos-often-have-a-blue-haze/

HT DILLIAN via Tom Whitwell