Looking at the results from our 2024 outlook survey, which includes G10 FX, EMFX, yields, and other assets.

Degrossed

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Looking at the results from our 2024 outlook survey, which includes G10 FX, EMFX, yields, and other assets.

The big tree and skating rink in Rockefeller Center

December 20, 2023

Thank you to everyone that completed the survey yesterday; I know it was a bit more complicated than just ticking boxes, but I wanted to get a sense not just of people’s point estimates for the Fed but their distribution of forecasts.

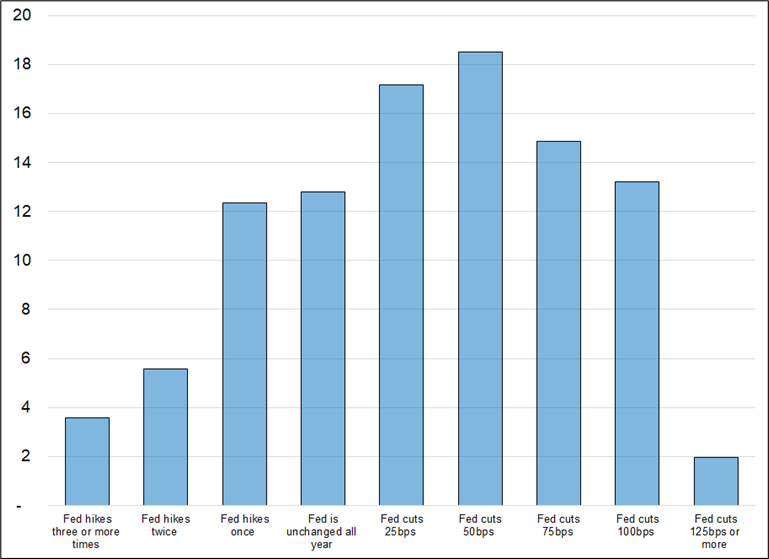

What percentage do you assign to the following Fed outcomes in 2024?

This survey result stands in stark contrast to the six cuts priced into the market. People on average think that 5 or more cuts totaling 125bps is almost a zero and yet the strip has six cuts. Some of this could be the possibility of even more cuts priced in probabilistically, but man… Six cuts seems like a lot and I hate to be the guy saying “too much is priced”. But I am.

The possibility of a reacceleration in Q1 2024, or even a soft landing where the Fed cautiously brings Fed Funds down to take the pressure off real rates, is almost everyone’s base case and yet the pricing shows something much, much more aggressive. Hmm. Even if you factor in the possibility of a recession and say 10 cuts (250bps) from the Fed, you need to assign a very high probability of that outcome in your EV grid before the expected value comes in at more than six cuts.

There is money to be made if you are a believer in higher-for-longer. Lots of money!

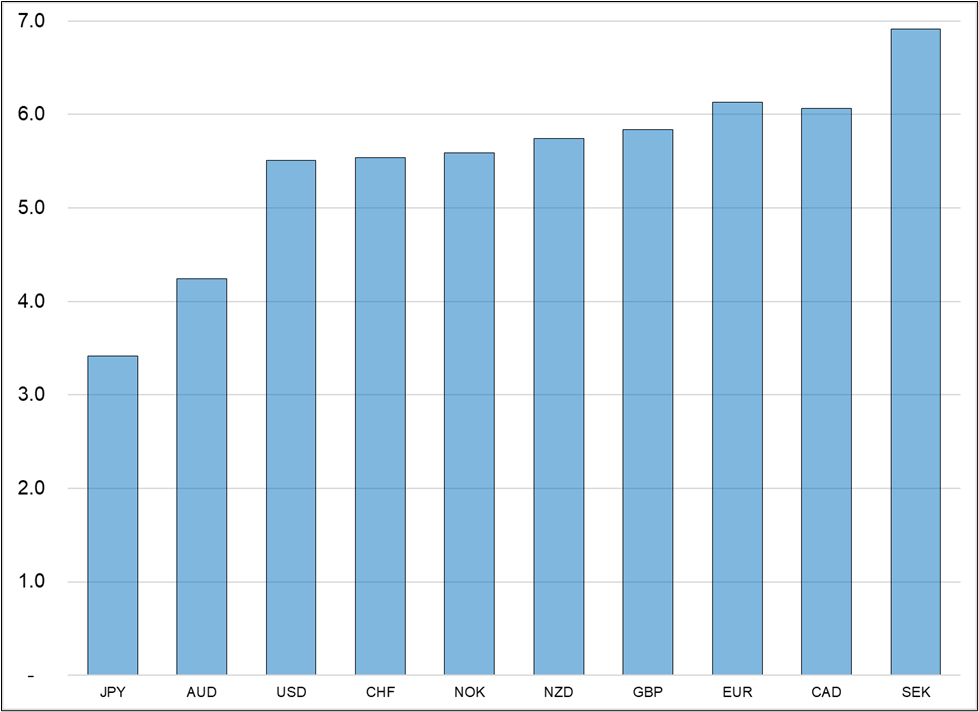

The currency polls were more informative than usual for me this year as usually the favorite currencies are fairly obvious to me, but this year they were not. Here’s how people ranked the currencies, on average (low number = high rank = I like it!)

Average ranking of expected currency performance in G10 (low number = high rank = favored)

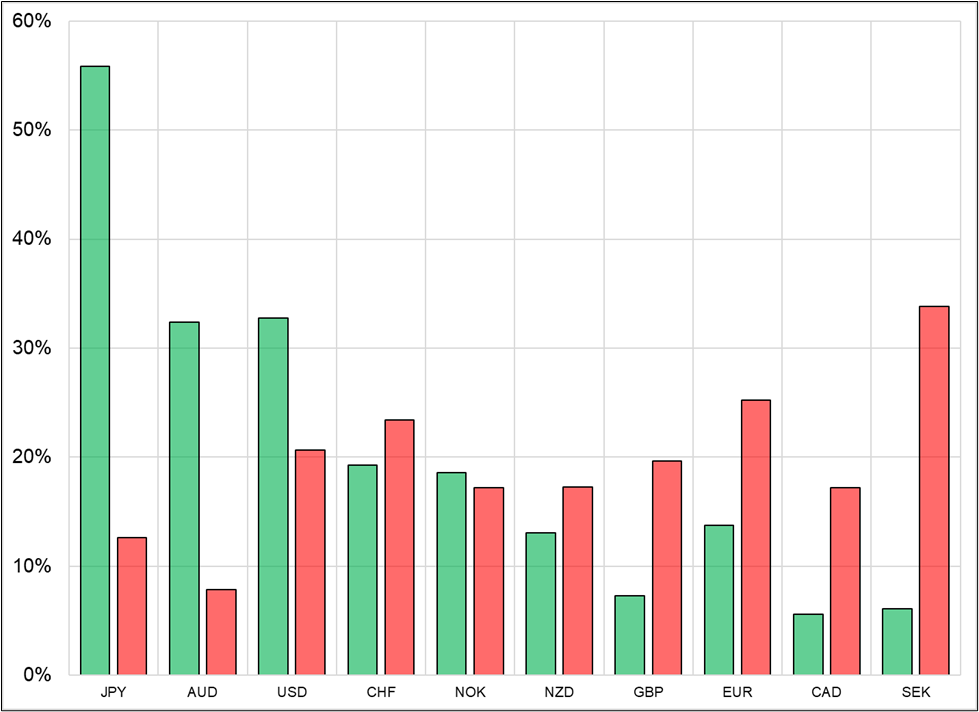

I wanted to isolate the love/hate factor as well by looking only at what percentage of people ranked a currency either 1 or 2 (love) or 9 or 10 (hate).

Percent of respondents that love or hate a currency for 2024

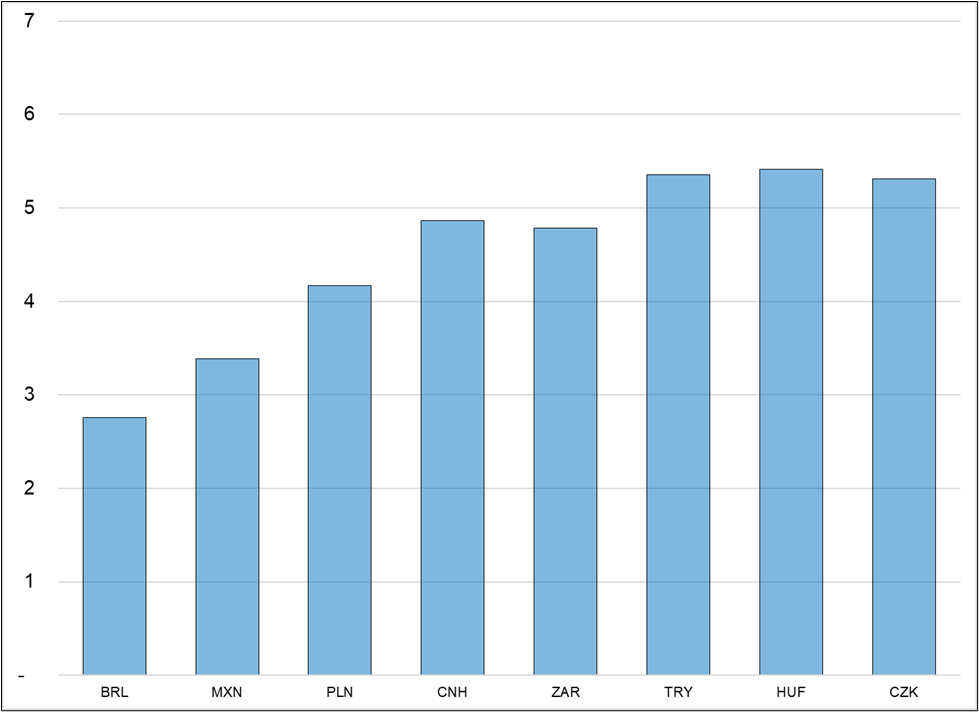

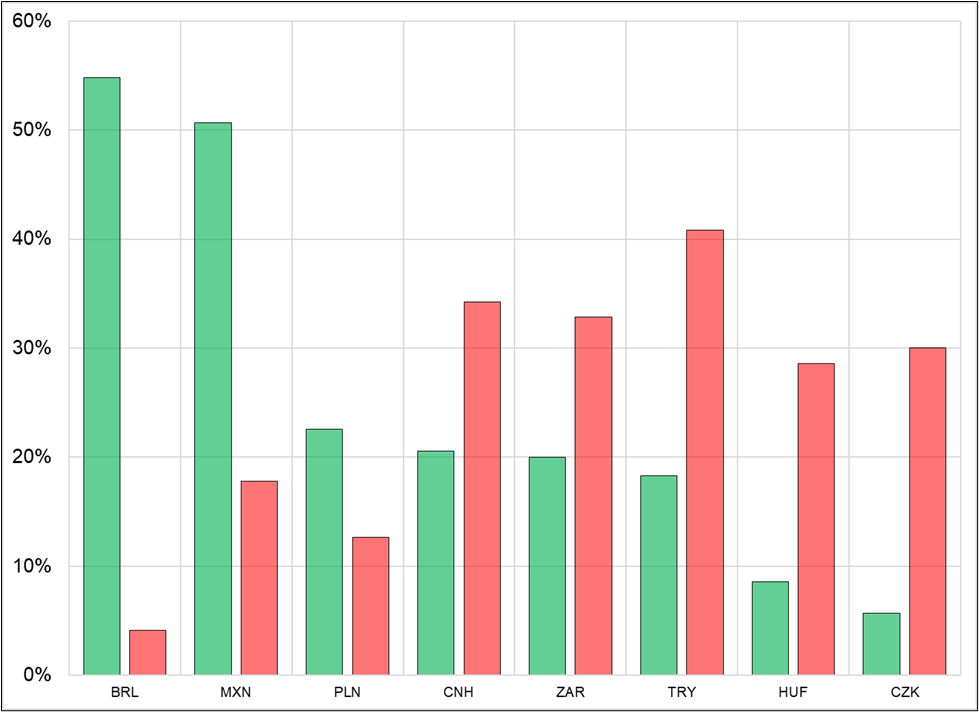

Out of 265 respondents, 75 answered the question on EMFX as I offered a “I don’t know” option there. Here are the same charts for EMFX.

Average ranking of expected currency performance in EMFX (low number = high rank = favored)

Again, here’s the love/hate factor—for EMFX this time.

Percent of respondents that love or hate a currency for 2024

Putting this all together, in G10 you get:

In EMFX you get:

Moving to the other asset classes, here are the results:

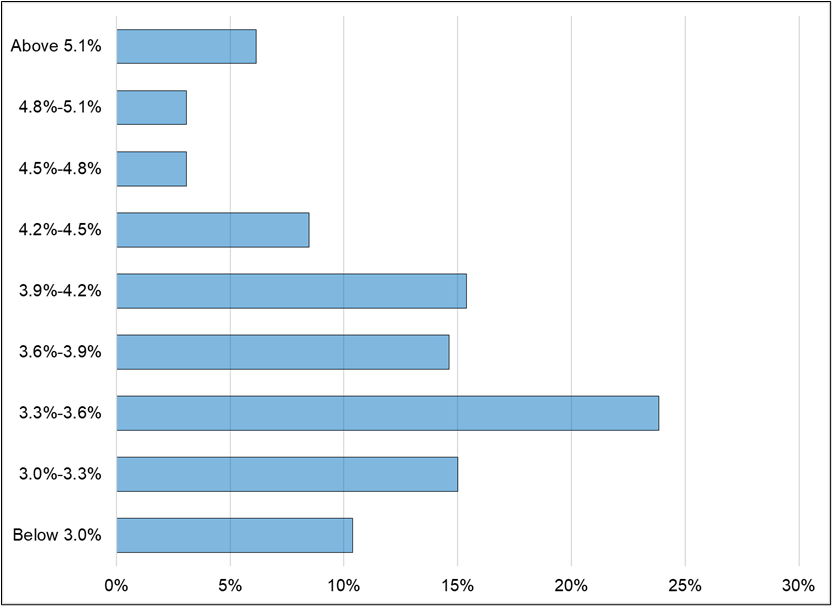

Where do you think US 10-year yields trade at the end of 2024?

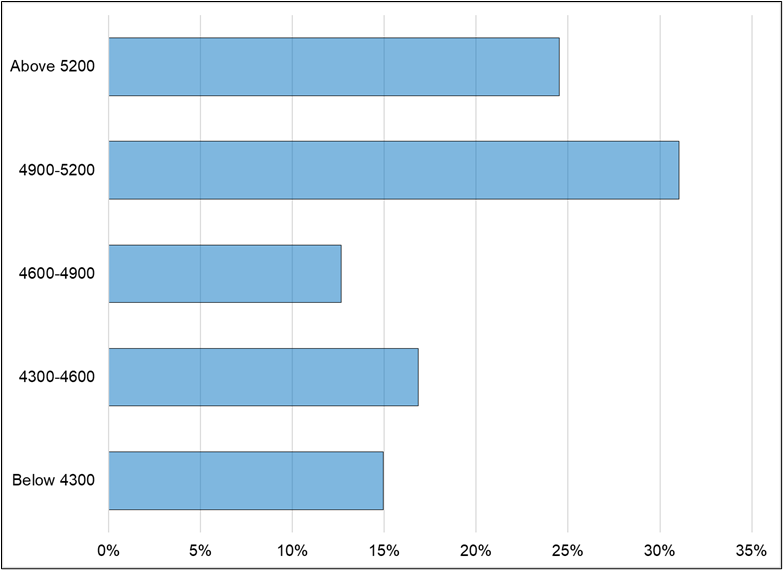

Where do you think the S&P 500 (cash index) will close the year (December 2024)?

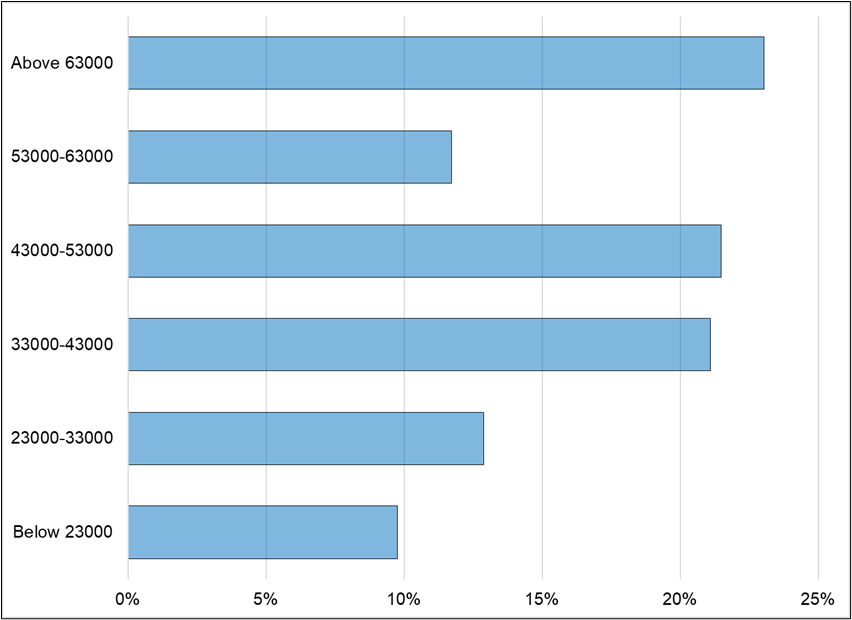

Where do you think bitcoin will close the year (December 2024)?

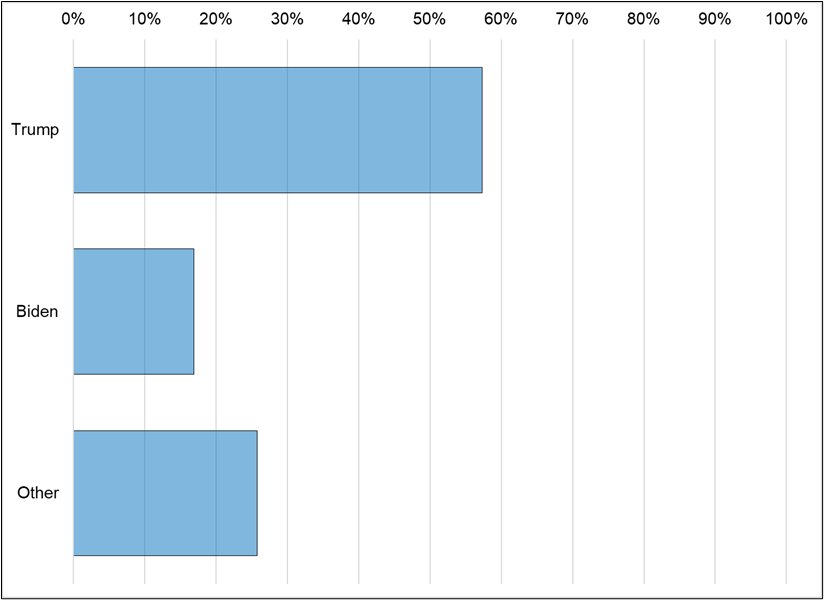

Who do you expect to win the 2024 US Presidential election?

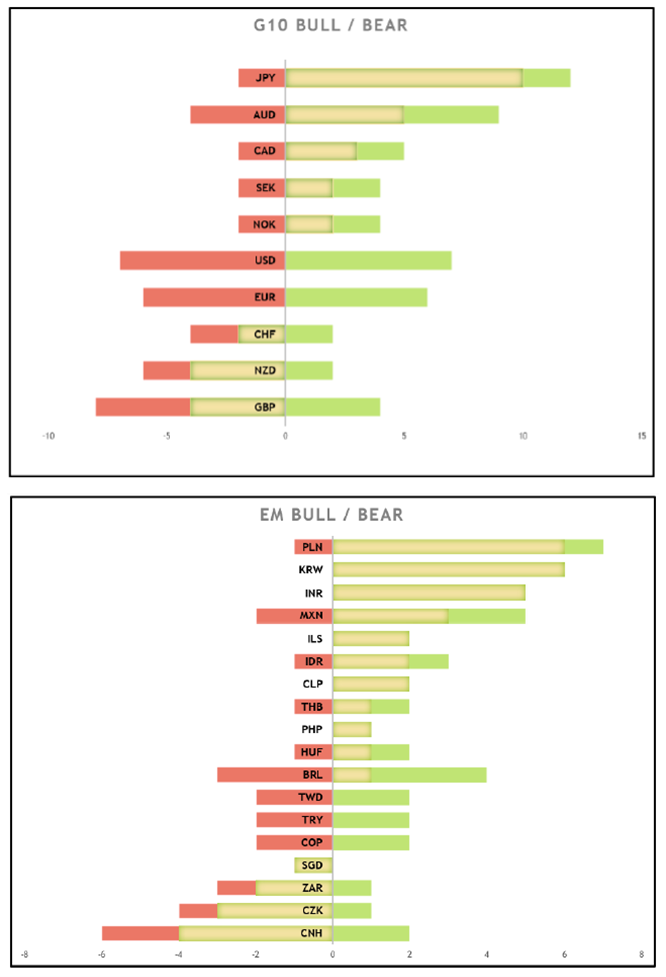

Finally, it’s worth noting that this is a survey of am/FX readers and could be biased for whatever reason. Adam, Dan, and Ben spent a considerable amount of time over here at Spectra compiling an aggregate view of the 2024 outlooks from bank strategists. The results are on the next page. Overall vibes are similar but there are some subtle differences here and there. Still, JPY and AUD are on top with GBP and EUR much hated. Strategists don’t hate SEK the way y’all do.

Aggregated 2024 outlook of global bank strategists

Don’t forget to order your Spectra Trader Handbook and Almanac so you get it before the new year!

The EURCHF was stopped out on broad euro weakness.

I’m off until next week. am/FX returns 27DEC. Merry Christmas to those that celebrate and happy holidays to everyone (including those that celebrate Christmas). :]

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Taking profit on the USDJPY and looking for a way to get short GBPUSD for corporate month end.