Watershed trinary event in ~13 days

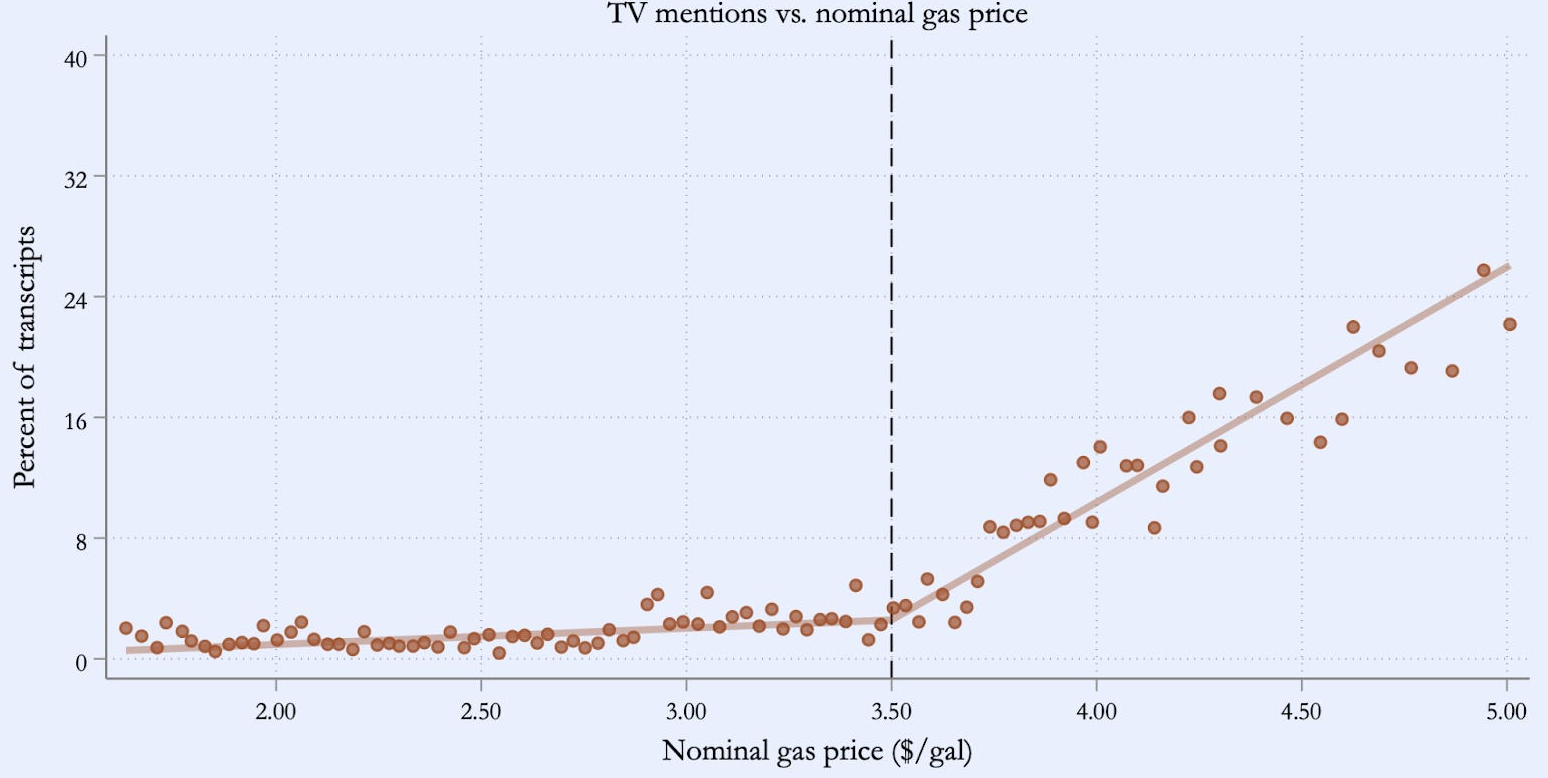

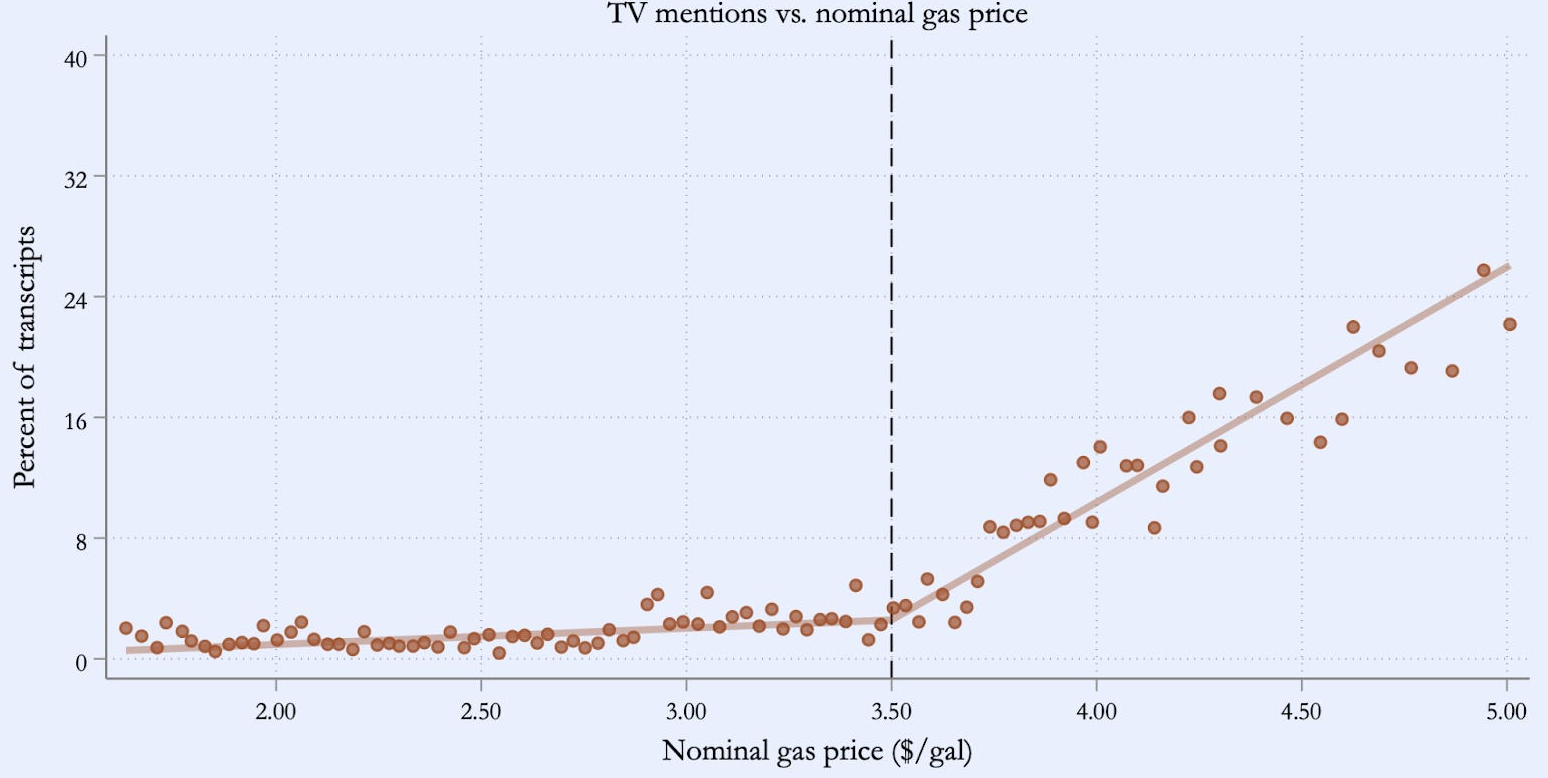

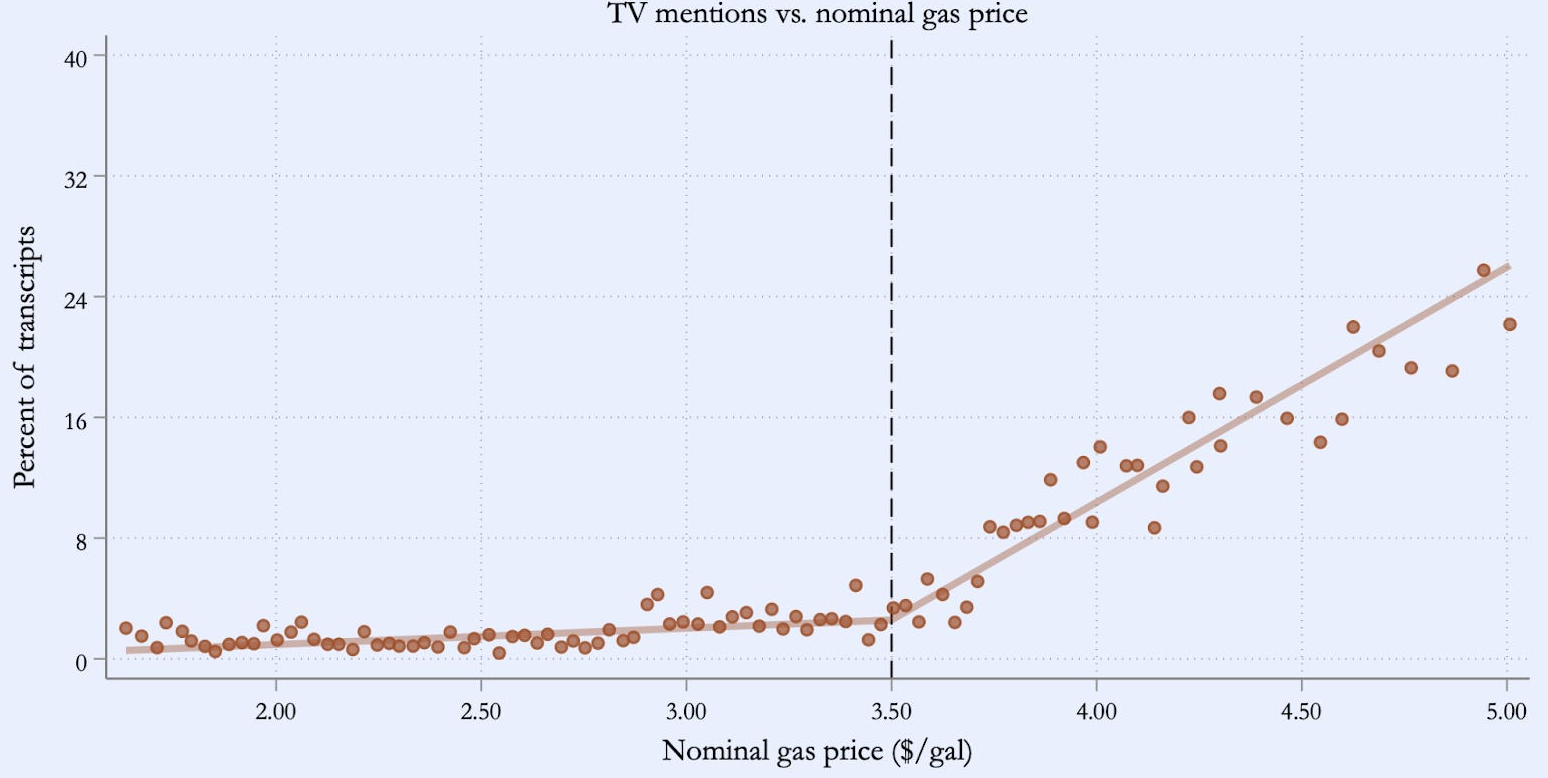

Negative media coverage of US gasoline prices ramps up as gas prices hit $3.50.

Cable news is much worse than network news when it comes to this negativity bias.

Full source and more info at bottom of page.

Watershed trinary event in ~13 days

Negative media coverage of US gasoline prices ramps up as gas prices hit $3.50.

Cable news is much worse than network news when it comes to this negativity bias.

Full source and more info at bottom of page.

Flat

Not sure if my am/FX was good timing or bad timing yesterday. Earlier would have been better I guess, but at least I got it out before DJT confirmed the thesis.

I did post the main gist in my Bloomberg coverage chats and tweet at 7:33 a.m.; just in case you think I am being sus, I’m not. It just takes longer to produce am/FX than it takes to fire off a Bloomberg blast or a tweet.

If you trade FX and FX options, and are not covered by myself or someone else at Spectra, please ping me on Bloomberg. We can cover almost anyone at a hedge fund or bank with very little or no onboarding process. And in case you were wondering, we cannot do Bloomberg chats with non-clients, sorry.

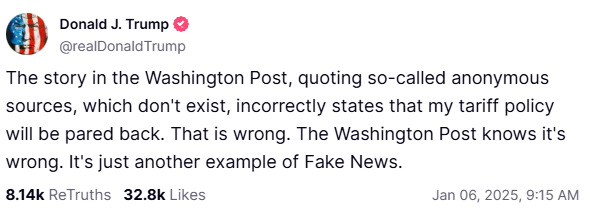

Anyway, we are very much in the 2016/2017 mode here with clickbait from WaPo, a strong USD in anticipation of Trump policies, France politics in the spotlight, and so on. EURUSD didn’t correct all the way back to pre-WaPo levels, indicating some nervousness from USD longs as German CPI rises, and tariff timing and composition remains an important question.

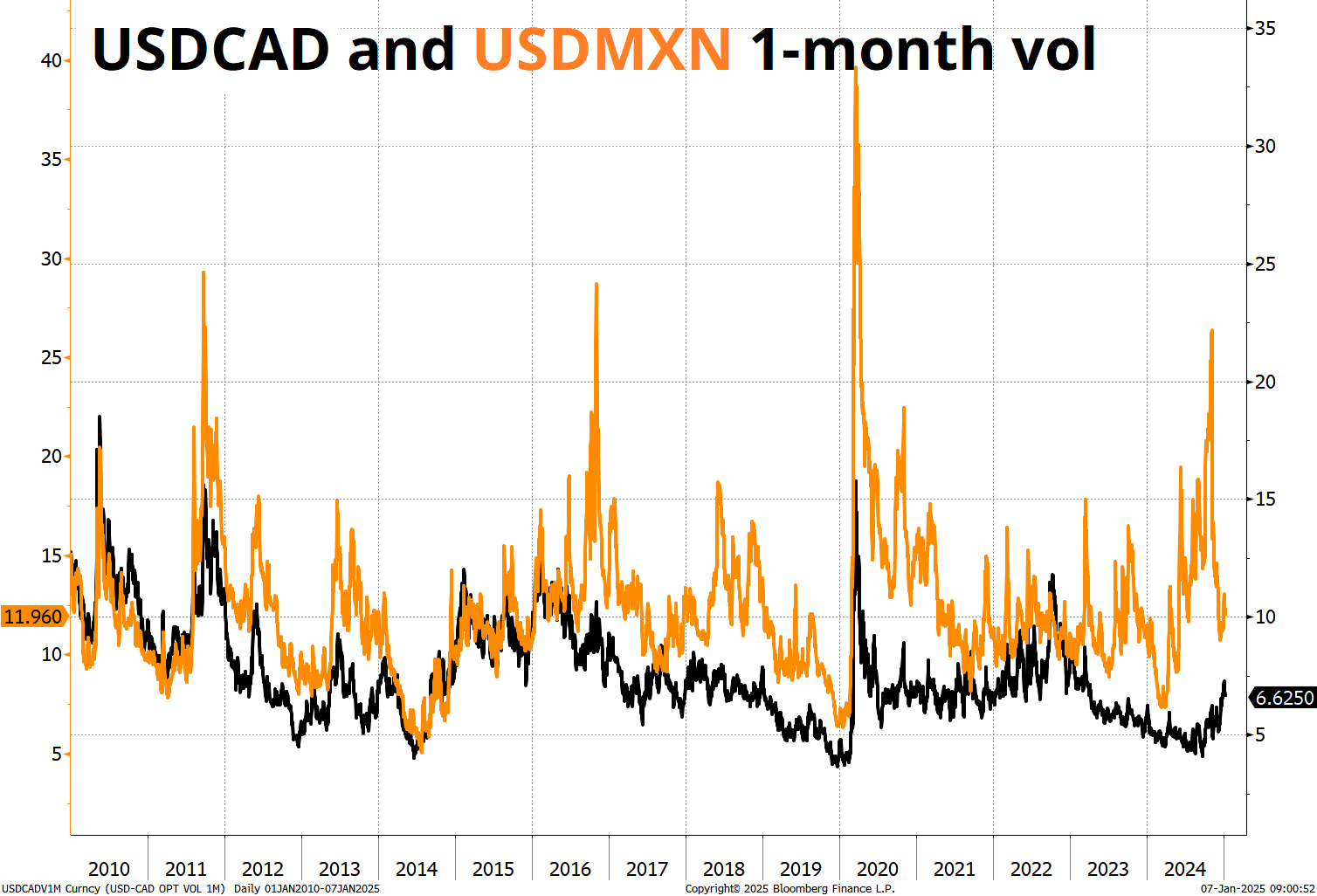

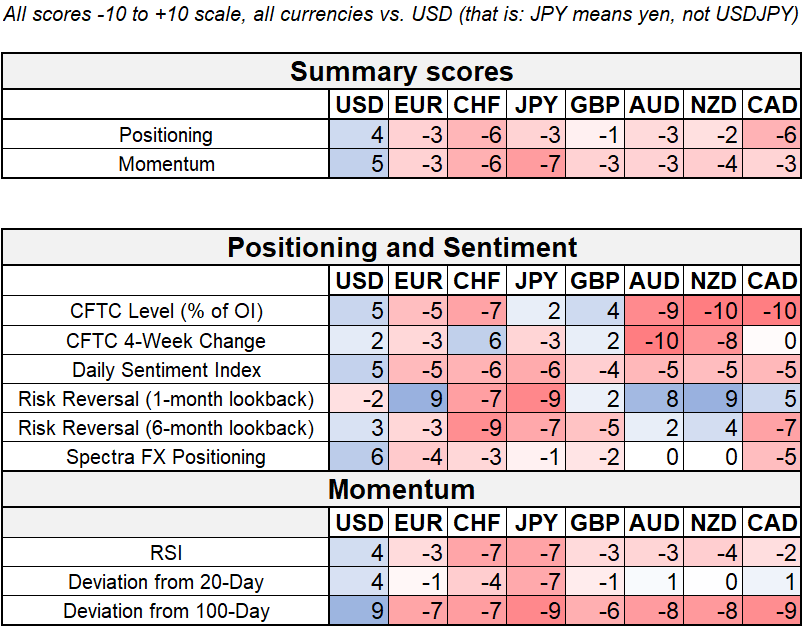

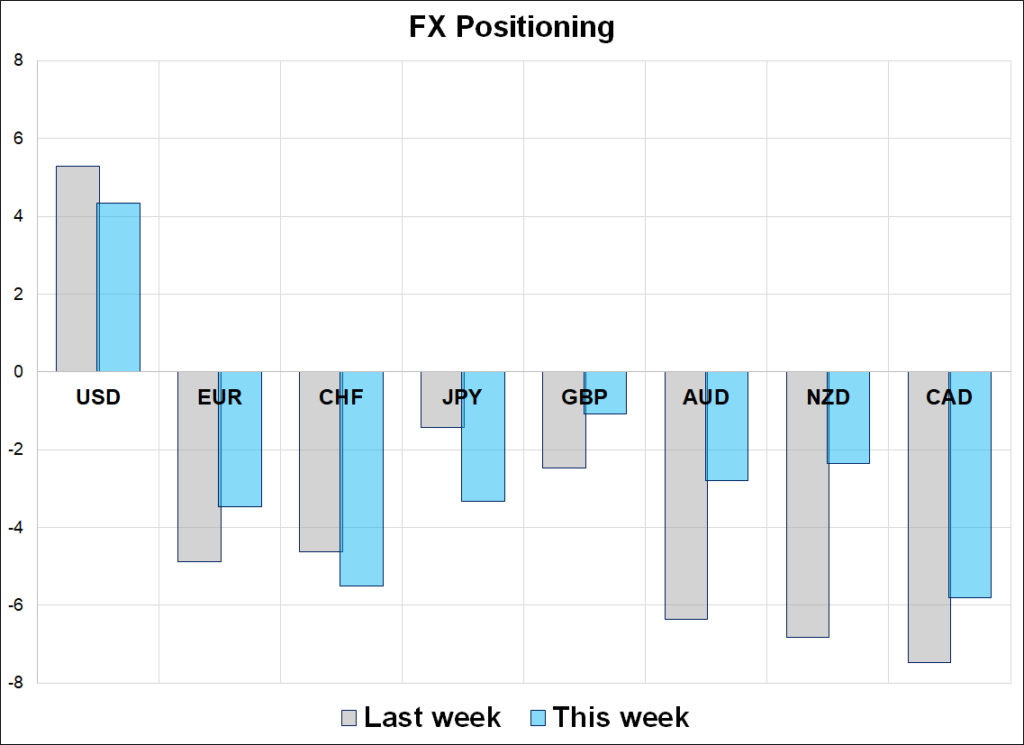

The rinse in USDCAD has shaken out the weakest USDCAD longs and the CAD position is a bit cleaner, but still somewhat extreme. The gigantic short positions in AUD, CAD, and other currencies on the CFTC remain a light yellow flag, but remember the CTAs that trade on the CFTC are slow moving trend followers and the down trend in those currencies is unchanged.

Many currencies are at important levels. AUDUSD held the 2022 lows perfectly as you can see here:

Note too, the RSI got to a three-year low there and has rebounded nicely. If all you had was this chart, it would probably argue for a constructive view on AUD, especially as copper made a nice double bottom at 4.00 and oil and LNG are rallying. But on the flipside, you have continued malaise in China and the looming risk of global tariffs.

At the same time, USDJPY and USDCNH are sneaking back towards important highs.

It all comes back to the three main outcomes:

Humming in the background are some other factors that are important but hard to care about when we’re just 13 days from Day One policy news. Most notably, the long end of global bond markets keeps selling off.

UK 30-year yield is highest since 1998. US 30-year yield highest since 2007. Japan 10-year yield highest since 2011, etc.

Is this normalization away from secular stagnation? Or something more nefarious related to ginormous deficits and sticky inflation?

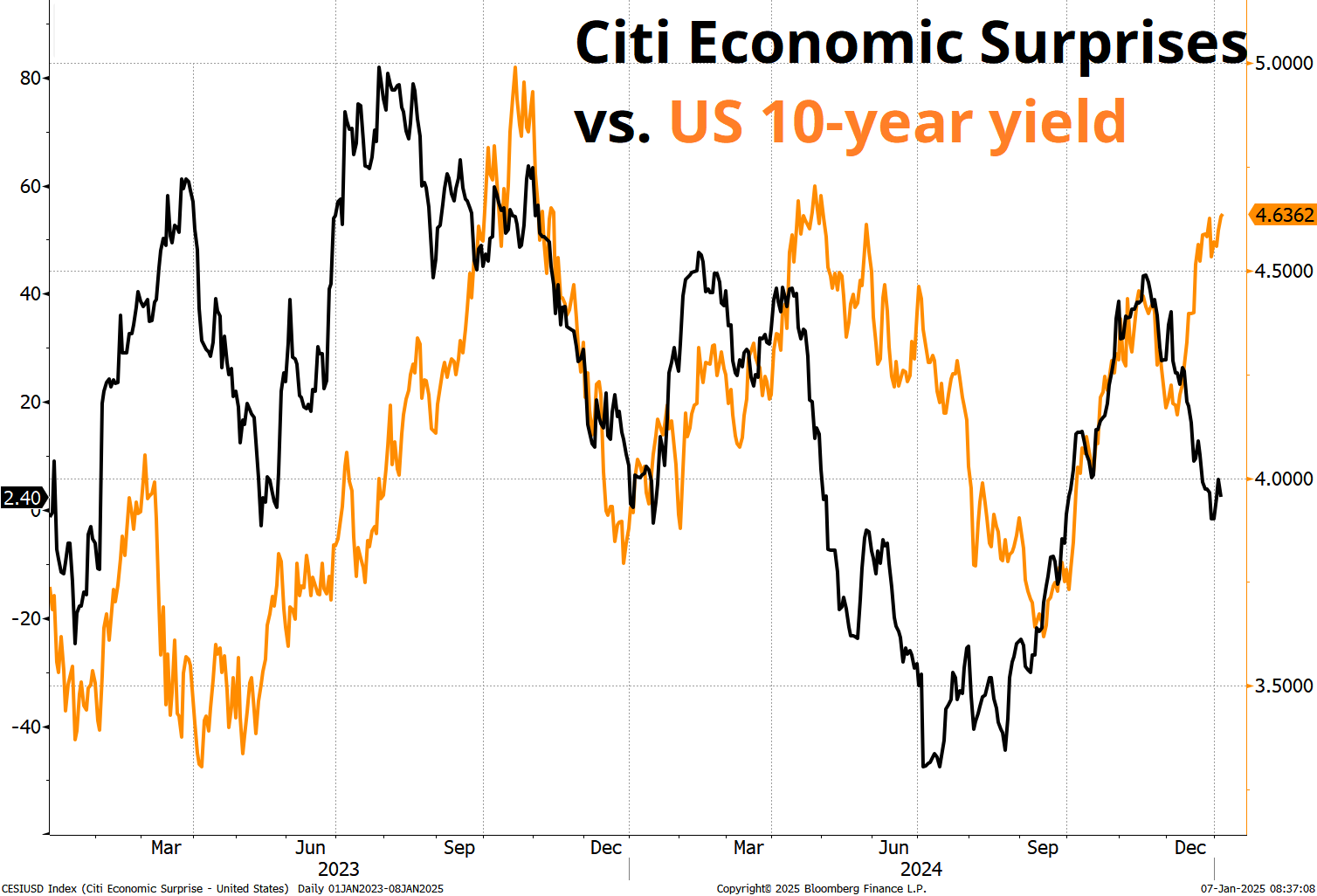

It certainly has nothing to do with recent economic data in the US, as Atlanta Fed GDPNow has been revised lower by almost a full percentage since November and the Economic Surprise Indices have fizzled in tandem as US yields continue to slink back towards the monster 5% level.

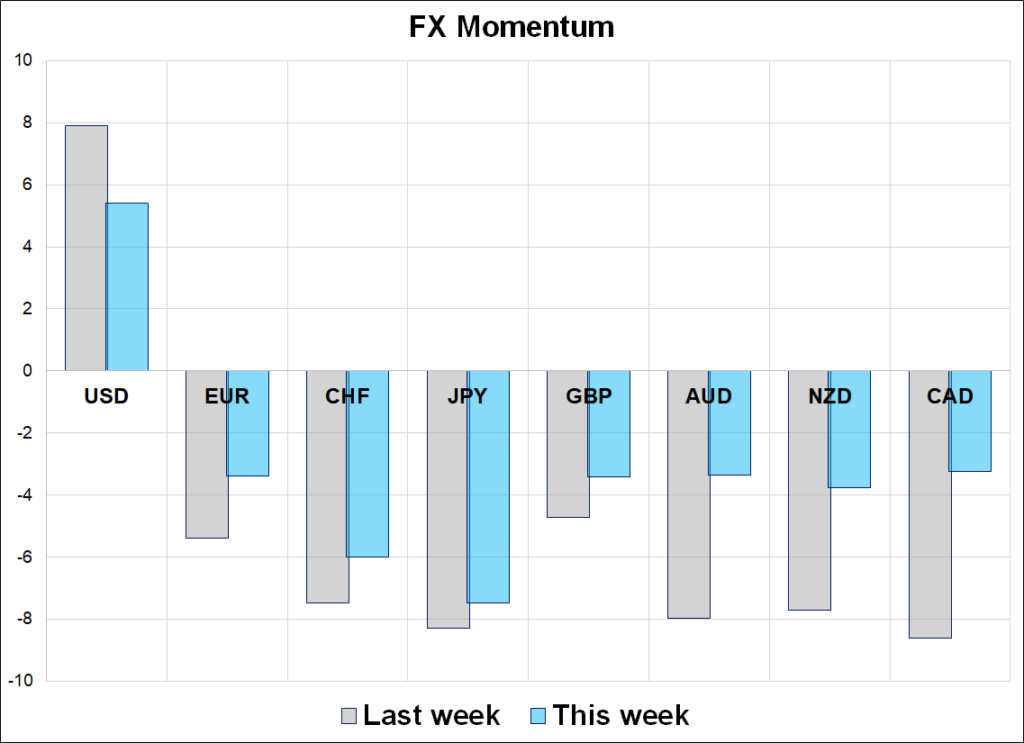

It will be temping to go short USD on weak data given positioning, but any trade on US data has to be a short-term tactical in-and-out burger because you can’t be short USD into January 20th unless you have extremely high conviction on no (or targeted) tariffs.

Is it just me, or is the self-driving and robotaxi revolution going to be led by the legacy automakers, UBER and NVDA, not TSLA? Spicy stuff out of CES last night.

https://finance.yahoo.com/news/top-3-takeaways-from-nvidias-ces-2025-keynote-044257032.html

Hope your day is not too gassy.

FX on tenterhooks ahead of trinary outcome

Hi. Welcome to this week’s report. It remains a long USD world, even as momentum has significantly turned after a brief rip-roaring start to the year. Positioning remains elevated in FX and FX vol as punters view the dollar as the clearest play for tariffs.

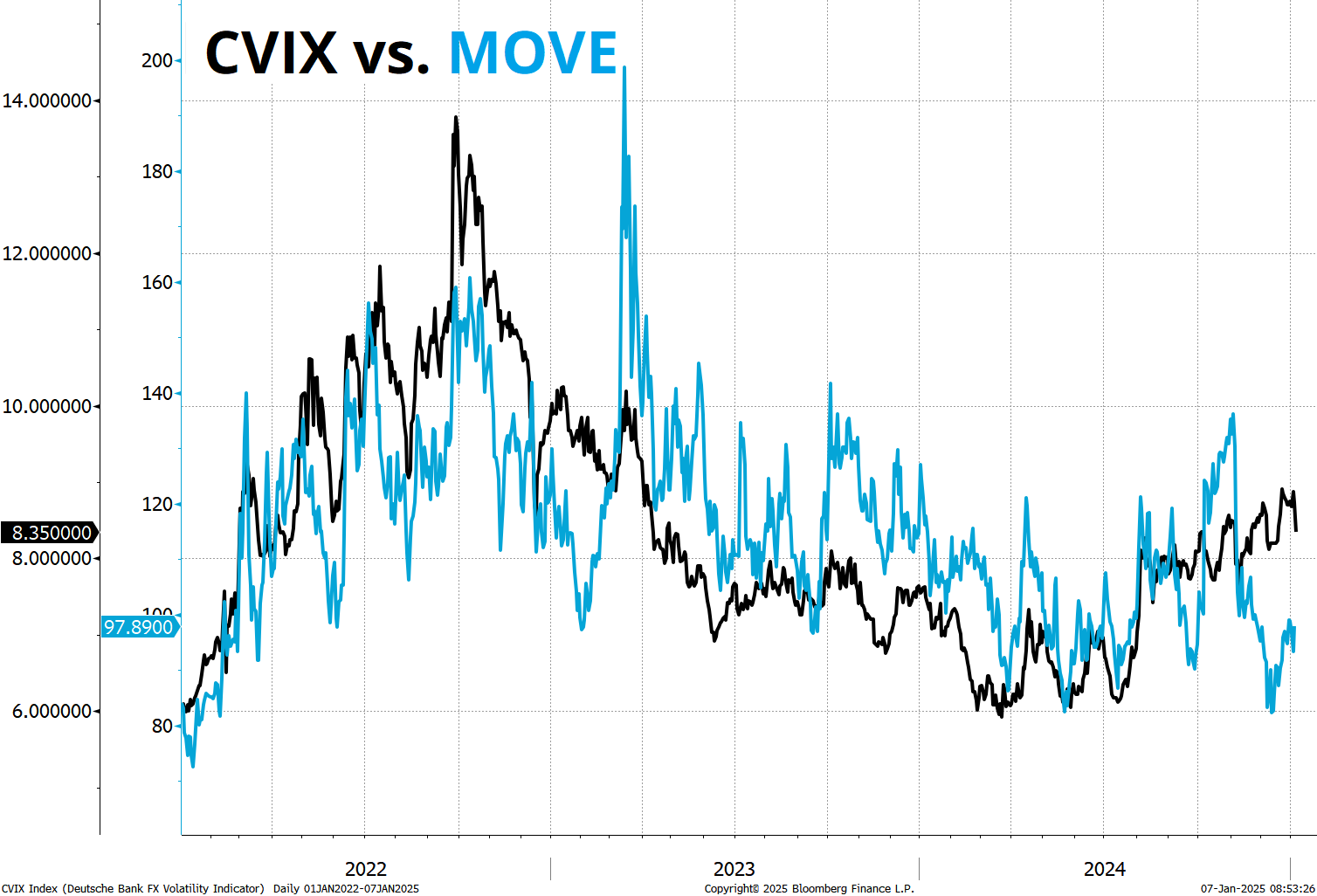

The preference for FX exposure over fixed income going into inauguration is most clearly seen in vol markets as the CVIX (1-month FX vol) remains pinned nearish the highs, while MOVE (1-month bond market vol) is sagging. This is in contrast to March 2023, when the SIVB and other bank failures were viewed as a rates trade, not an FX trade.

While that CVIX looks perky at 8.35%, it’s worth noting that the average CVIX reading from 2000 to 2024 was 9.2% and there were plenty of zippy moves to 12/14 over the years. So yes, FX vol is rich relative to stock and bond vol, but no it’s not crazy expensive relative to history.

If we get shock and awe in the next few weeks, FX vol can still go up significantly, but if we get ultra-targeted milquetoast tariffs, CVIX could plop back down to 6 in a heartbeat. I realize there are lot of if/then statements in my work lately, but we’re approaching a watershed trinary event.

Negativity bias is everywhere but nowhere is it more prevalent than cable “news” networks. They are always negative and never adjust for the falling real price of gasoline.

https://www.briefingbook.info/p/bad-news-bias-in-gasoline-price-coverage