This post-CPI GBP bounce is an opportunity to sell.

An evening trade idea

I would normally wait until tomorrow to publish this trade idea, but my guess it that London will probably sell GBP aggressively tomorrow when they walk in as the realization of negative prints on Services inflation, RPI, and PPI and the zero print on CPI trigger CTA unwinds and real money selling.

The trade idea is to buy 8-day 193.00 GBPJPY puts for around 33bps off 194.55 spot. This will be in the Current Trades sidebar (top bar on web page) tomorrow. Alternatively, if you don’t do options, selling spot here with a stop at 196.36 is a similar expression of the idea. I like the option trade (the GBPJPY put) better.

Reasoning for the trade:

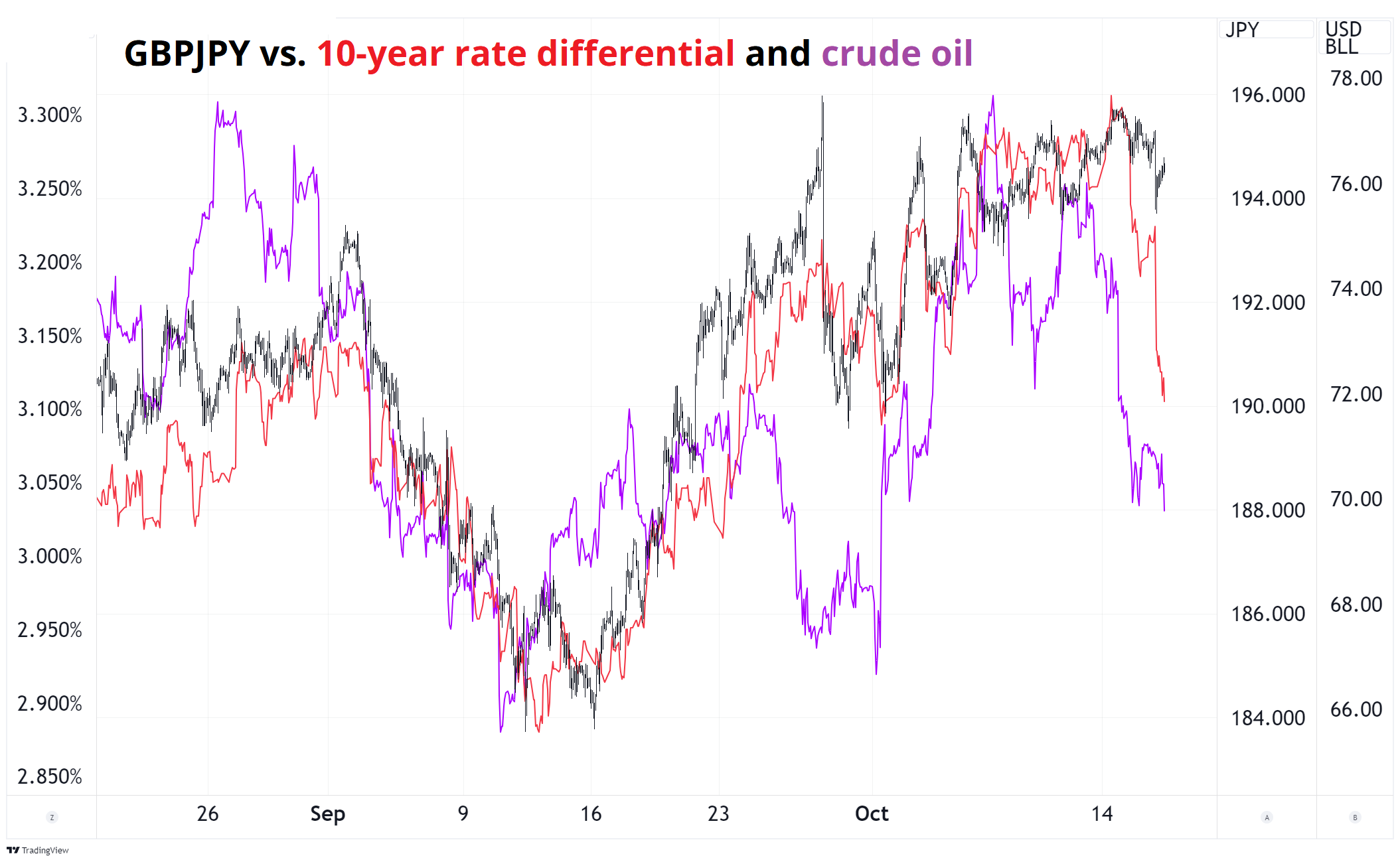

- GBPJPY is high relative to interest rate differentials and oil, two variables it tends to track.

- USDJPY is close to major resistance at 150.00/80. Pre-August payrolls collapse, USDJPY peaked at 150.85 and that 150.85 level was a critical pivot a bunch of times. USDJPY is also quite high relative to rate differentials.

- UK Services inflation was negative MoM. It’s just one figure, but in the context of the Bank of England’s concerns about that figure, it’s a relief. And inflation around the world is falling.

- Peer central banks have been cutting 50bps at a clip, so it’s not outlandish to think that the market can start pricing in 50 for the November BoE meeting. It’s currently priced for a 25bp cut. Will they cut 50bps in November? Who knows. Could it get to 32bps in the next week or so? Yes.

- GBPJPY had a solid selloff on the data but has since squeezed, so the entry point is good. 196.00 has been major resistance for about a month and we’re less than 1% from there.

- Oil is getting smoked, so an October inflation rebound is less of a concern.

- A good bit of the move higher in yields and USDJPY has been on higher Trump odds. I would guess we are near peak momentum and a bit of mean reversion there as the newsflow cools off and Nate Silver and 538 remain closer to 50/50 than the 60/40 in betting markets.

- 8-day captures the Bailey speech on 23OCT.

Thanks have a great afternoon / evening.

bd