Normally CPI comes out first and nobody cares about PPI. But not always.

Jobs are not plentiful

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

Normally CPI comes out first and nobody cares about PPI. But not always.

Zoomed in, the big bubble in my coffee (top three pics) looks like a close-up of a gecko’s eye (bottom pic).

Long a 1-month 1.4600 USDCAD call

for 33bps off 1.44 spot

First: Please take 90 seconds to complete this tariffs survey.

Results in tomorrow’s am/FX.

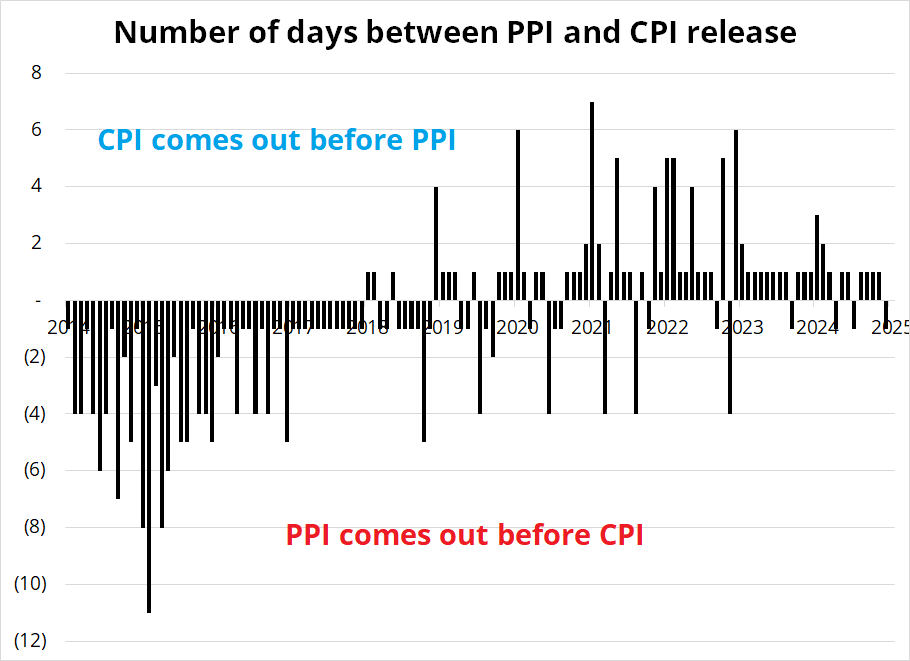

PPI comes out before CPI this month. PPI used to always come out way before CPI, but in 2018 that changed as the BLS altered the release date methodology. Chart here shows you what I mean.

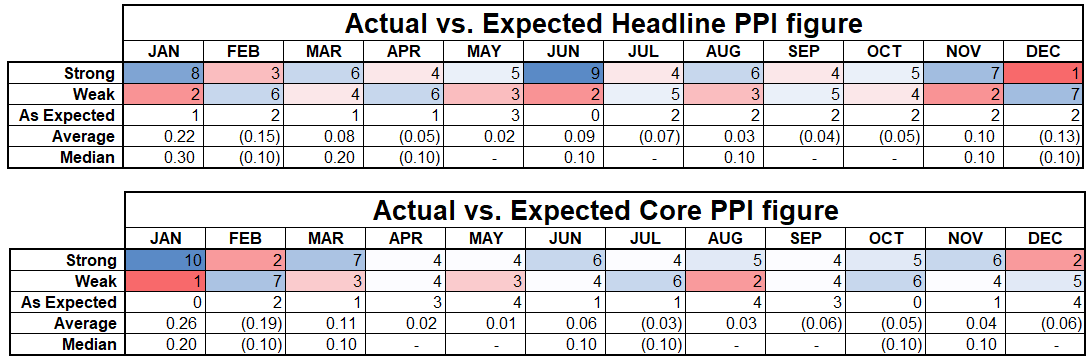

If both Headline and Core PPI are the same way (weak or strong), it’s a pretty decent predictor of both Headline and Core CPI. If they are mixed or as expected, there is no signal. Here are the stats:

Long story short: If both PPIs miss in the same direction today, there is a read through to the miss in CPI. That said, when you look at the Bloomberg PPI data back to 2014 (that’s as far back as it goes when I download it) you see there appears to be a lot of seasonality that is not properly accounted for.

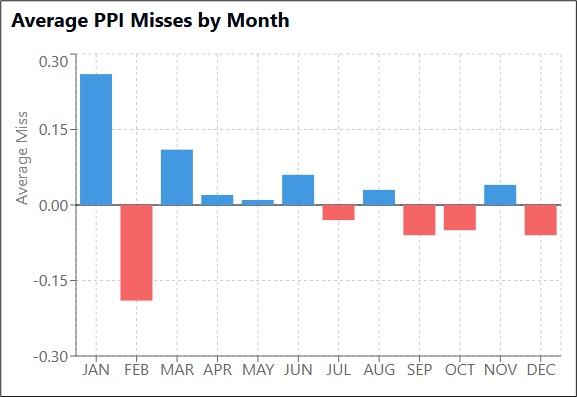

Misses and beats should be evenly distributed across the year, but are not.

The December PPI released in January leans weak. It is possible that economists have finally factored this uncaptured seasonality into their models at this point, and it’s also possible that the sample size is too small to matter. Given the effect is at the turn of the year, which is the noisiest time for inflation due to price resets, my guess is that it is more likely to be persistent and so I would bet more on a weak number today (say, 60/40 odds of weak, IMO). Tables below show the history. To be clear, these are the reporting months, where today we get PPI for December. These are not the months of when it is released.

Chart of Core PPI misses, by month 2014 to now (reference month, not release date)

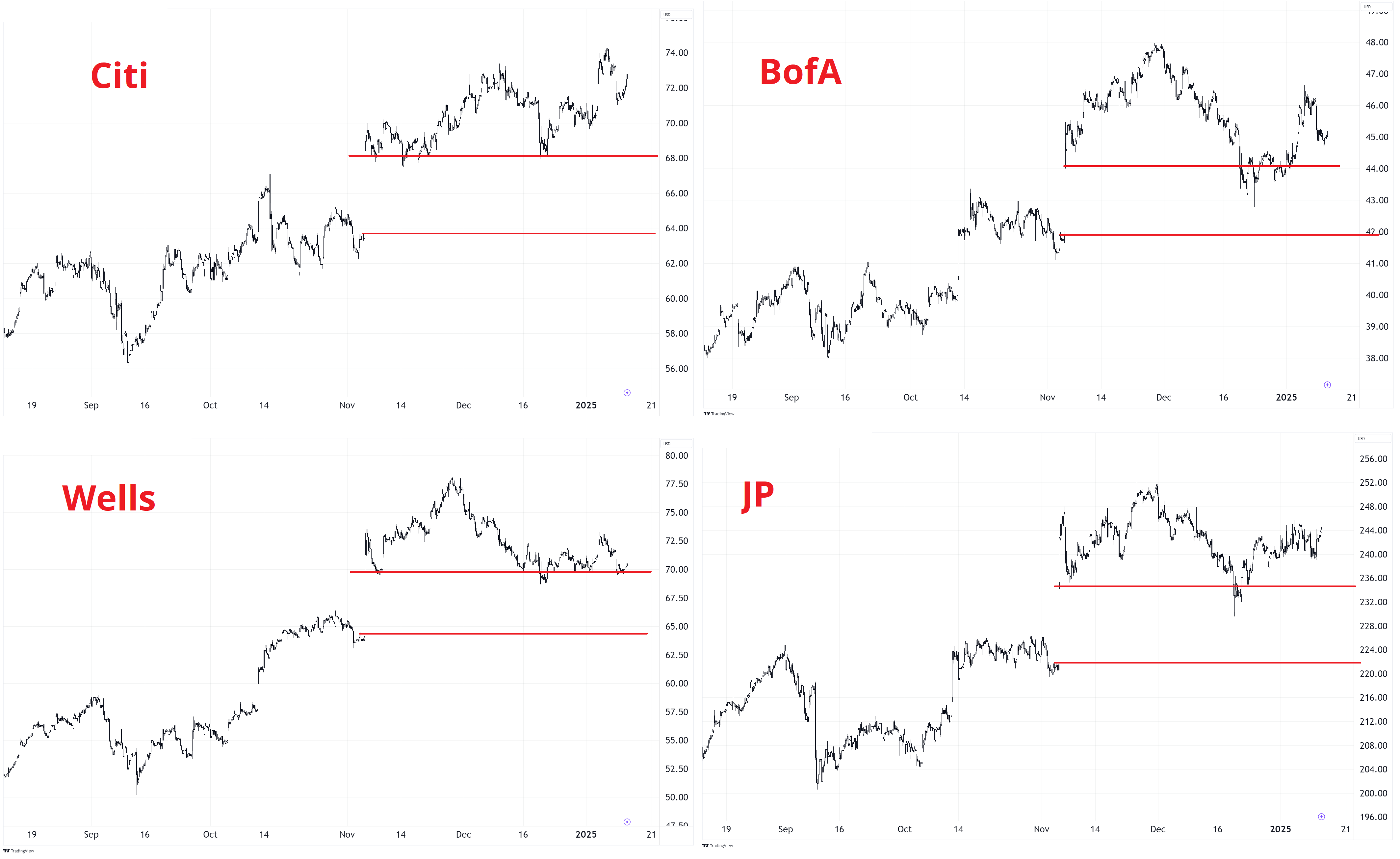

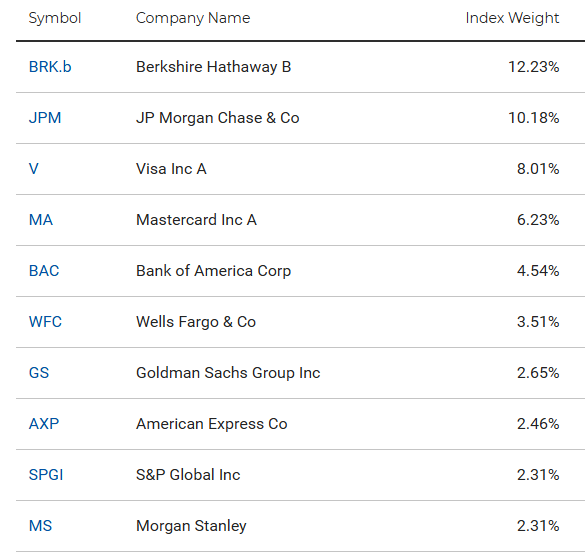

A wise reader pointed out (regarding my comment on XLF yesterday) that to use XLF as a proxy for financials doesn’t necessarily work that well when there is a massive shock to the insurance sector. That is a good point! While XLF filled the post-election gap perfectly, and so did the regional bank ETF (KRE), stocks like WFC and the Mighty C both held the gap zone quite nicely and never went in there for a look. BofA and JP stock took a peek into the gap and then rallied. It will be interesting to see if bank earnings will usher in a new push higher in stocks.

Here, in case you are curious, are the big weights in XLF. Berkshire stands out, obviously, given their insurance liability exposure.

Scott Bessent’s confirmation hearing takes place Thursday. I don’t see that as a market mover. He is trading 96%/98% on Polymarket and that seems like a good bet risking 98 to make 2. :]

And finally, speaking of insurance, nearly 80% of Mercury General’s policies are in California. This is a chart of the stock.

May your day be colorful and chameleon-like.

Long dollars, waiting for news.

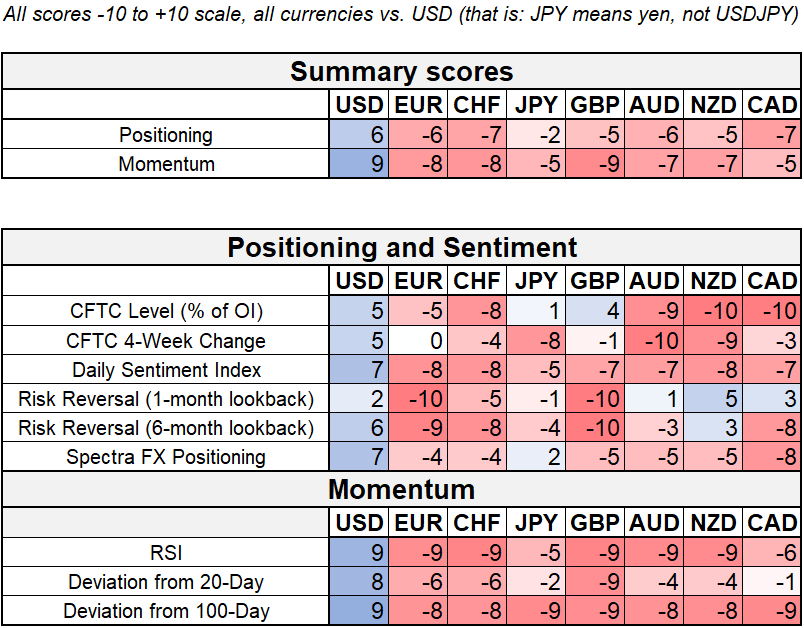

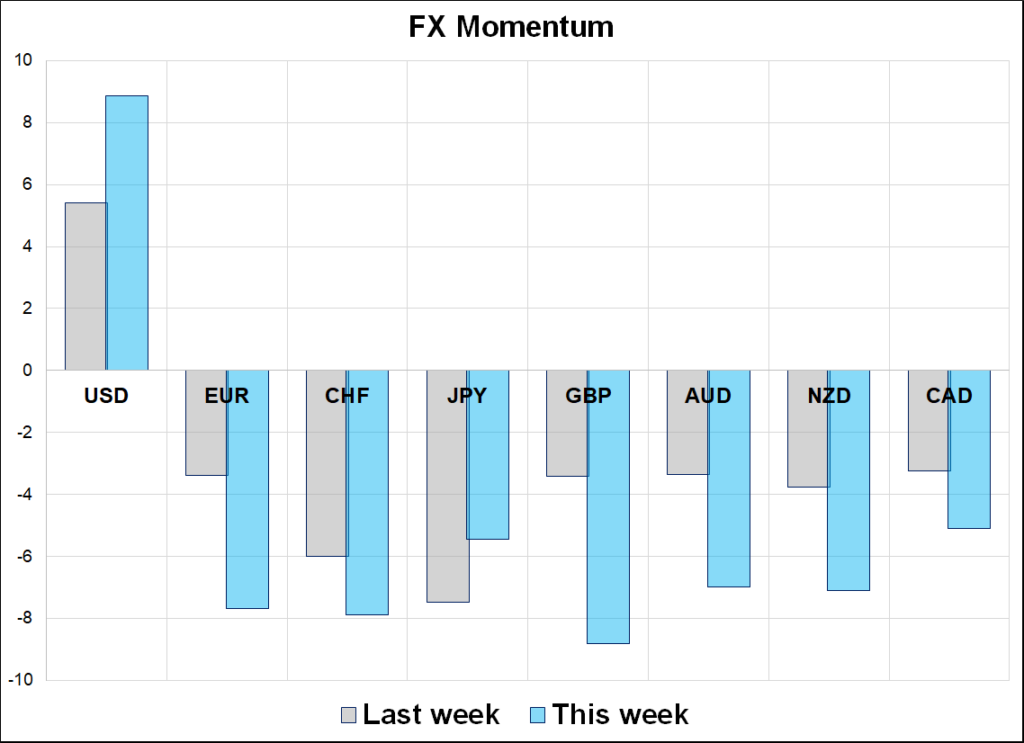

Hi. Welcome to this week’s report. A new all-time high for USD longs in the positioning report this week as dollar bulls add and inauguration creeps closer one slow day at a time. The lack of topside progress in USDCAD is remarkable considering the newsflow looks unambiguously bad with first-hand conversations with Donald Trump suggesting tariffs on Canadian goods are imminent.

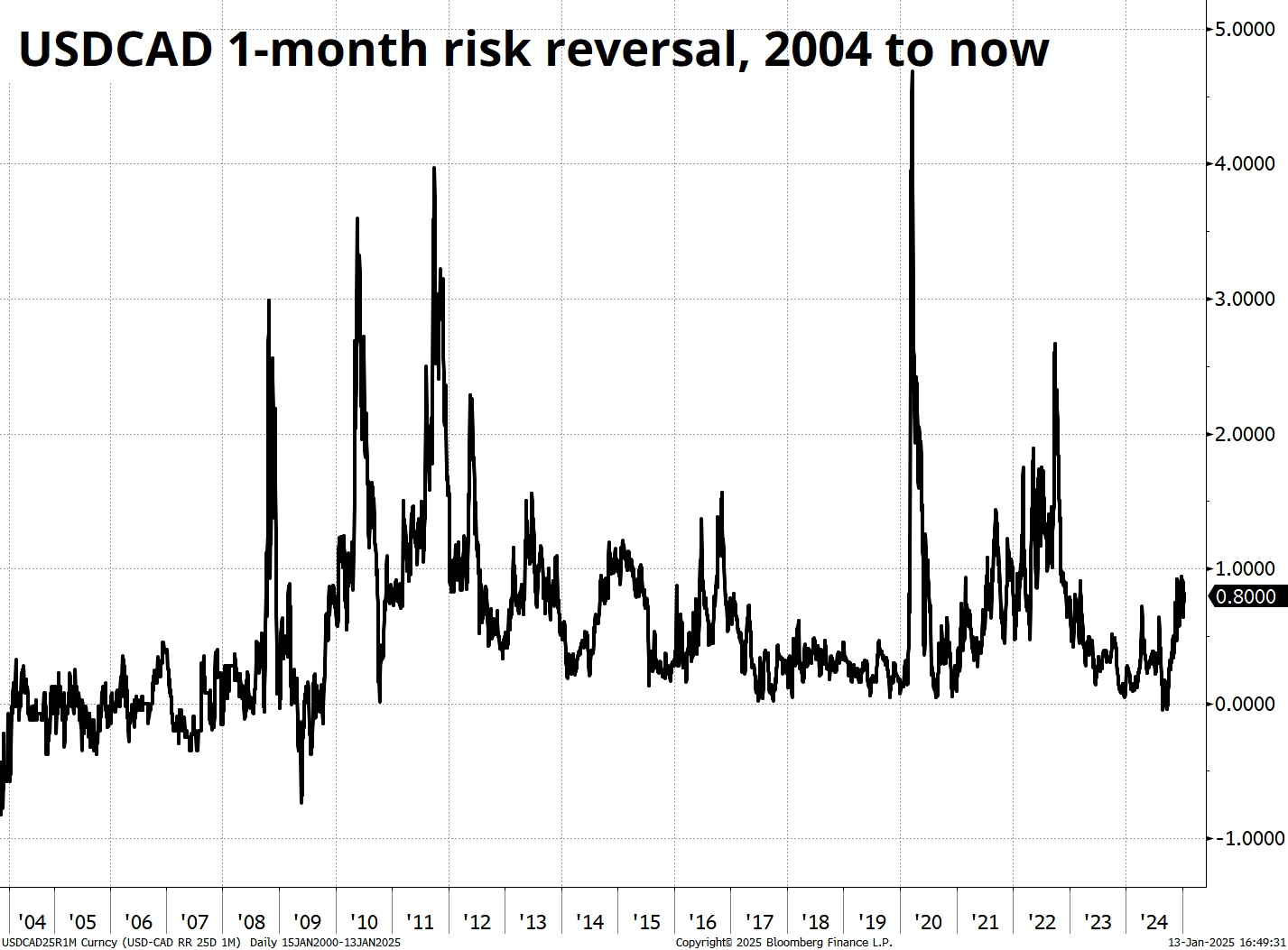

I can’t remember many setups as interesting as the current situation with the USD pinned to the highs, sentiment universally bullish, positioning significant, and massive news coming in a week. The USD has hit a wall in the short term, but a significant tariff announcement on January 20 or January 21 will surely be like the Kool-Aid man, bashing through that wall and triggering a move of 3% to 5% right away. While the 1-month USDCAD risk reversal shows a bit of angst, it’s nothing like we saw in the GFC, Eurozone crisis, or the rate hiking cycle / risk parity collapse of 2022.

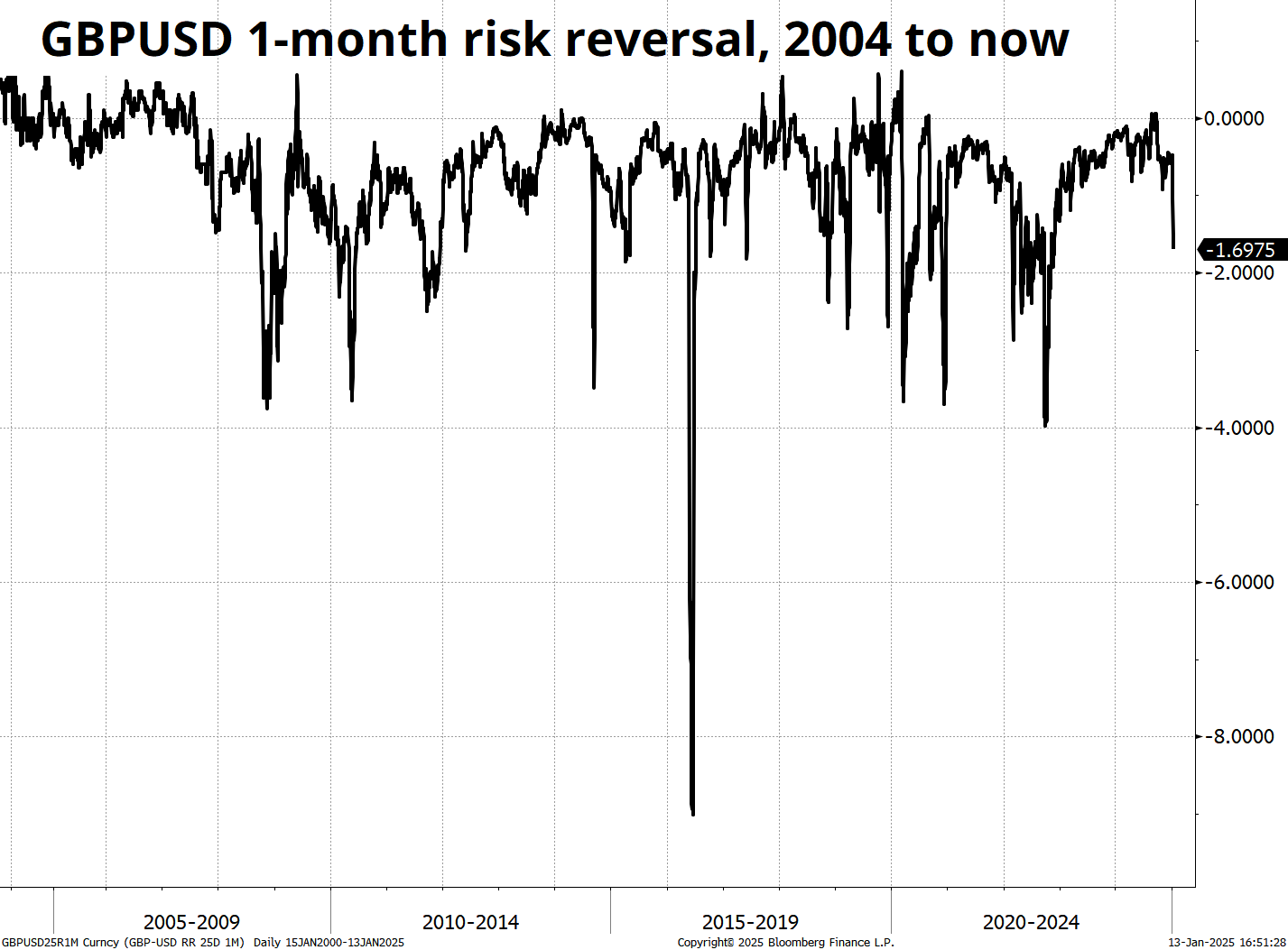

Same goes for the GBPUSD risk reversal. Despite fears of a debt crisis and post-budget economic meltdown in the UK, the risk reversal is not at all unhinged. Directionally, it’s going the right way, but the fear factor is low.

It’s difficult to gauge whether this is complacency, or a simple reflection of the huge positioning that has been put on over the course of the past month as the hawkish Fed triggered mass capitulation of all remaining USD shorts and now everyone is either long USD or flat. When everyone is long USD, bullish USD newsflow is less scary and requires less of a response from the options market, I suppose.

Coffee bubble looks like gecko’s eye

My son said it reminds him of a truffle from Stardew Valley

Hmm. Last week, I tried reacceleration on like a hat, but it didn’t fit very well.

There is too much bad news for the market to keep ignoring Canada

Comments relevant to backtesters and confusion over an early UK meme