Easy vs. hard

The reality check continues on policy as we await the slow drip of news between now and the second coming of Donald Trump. No post-election tweets yet from the president-elect, as advisers work feverishly to figure out how to prioritize the four pillars of policy that will most impact the economy:

Taxes, tariffs, government restructuring, and deportation.

Many of Trump’s 2016 promises were kept, but many were not. The logistics of mass deportation are particularly challenging, while the logistics of threatening and increasing tariffs, and cutting taxes are not. Here is a brief recap of the key promises made at the start of the last Trump presidency.

| Tax cuts |

Delivered in late 2017 |

| Trade deals and tariffs |

Delivered in 2018 and 2020 |

| Border Wall Paid for by Mexico |

Partial modest progress |

| Repeal and Replace Obamacare |

Not delivered |

| Cut regulations |

Delivered |

| Leave NATO |

Not delivered |

| Deport all illegal immigrants |

Not delivered |

| Rebuild infrastructure |

Not delivered |

| National debt |

Said he would eliminate the entire US debt over 8 years. Debt increased by 7.8T, (much due to COVID) |

Some things are easier to do than others. It makes sense to take a breath here and wait for some actual information on key proposals, priorities, and nominations. If Lighthizer is nominated to Treasury, for example, that’s a completely different story than Scott Bessent. Also, I would expect some tweets and press conferences and crazy stuff to emerge in the next week or two and perhaps there will be some clues in there, too. Whatever it is, it’s coming in two weeks.

Possible new narrative dropping?

Yields are coming back off, Asian stock markets are weak, and money is flowing back into the yen. See this story:

https://www.japantimes.co.jp/business/2024/11/08/companies/yokohama-bank-japan-bonds/

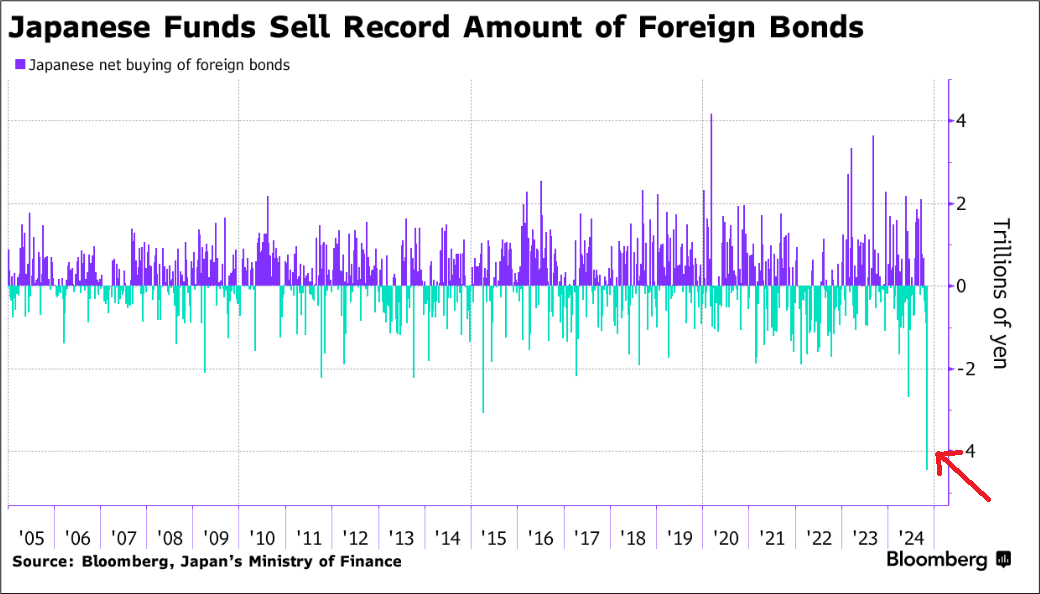

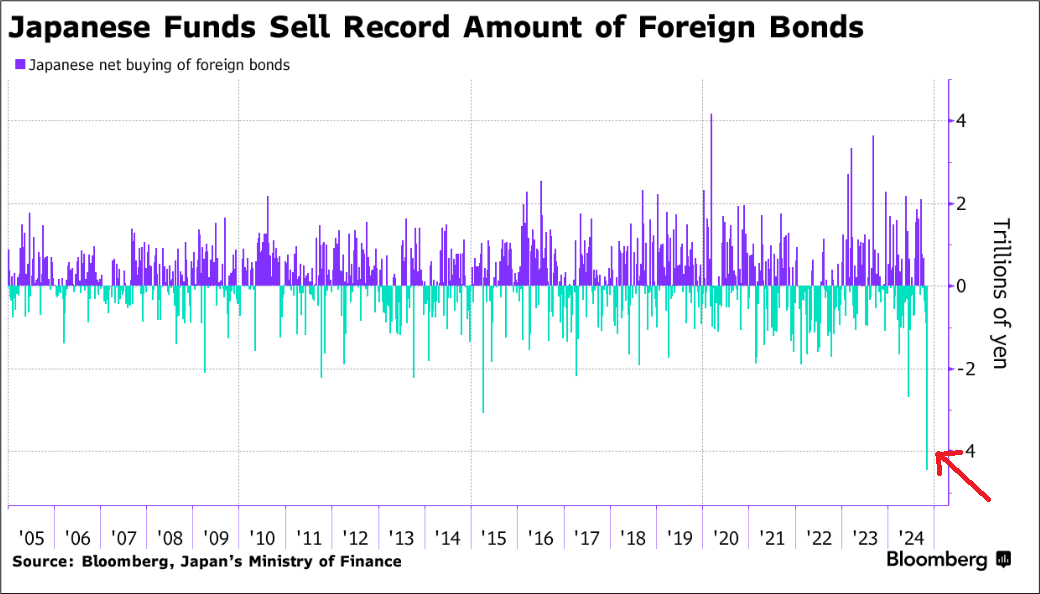

And this data released last night shows heavy Japanese repatriation, out of nowhere (thx Sal).

There is room for the market to price in more for the Bank of Japan as the December 19th meeting is only priced for 44%, and it should probably be closer to 75%. Meanwhile, the Canadian dollar is trading horribly, and Canadian yields have accelerated lower vs. Japan. When AUD and MXN were ripping yesterday, I expected CAD would play catchup, but it struggled mightily.

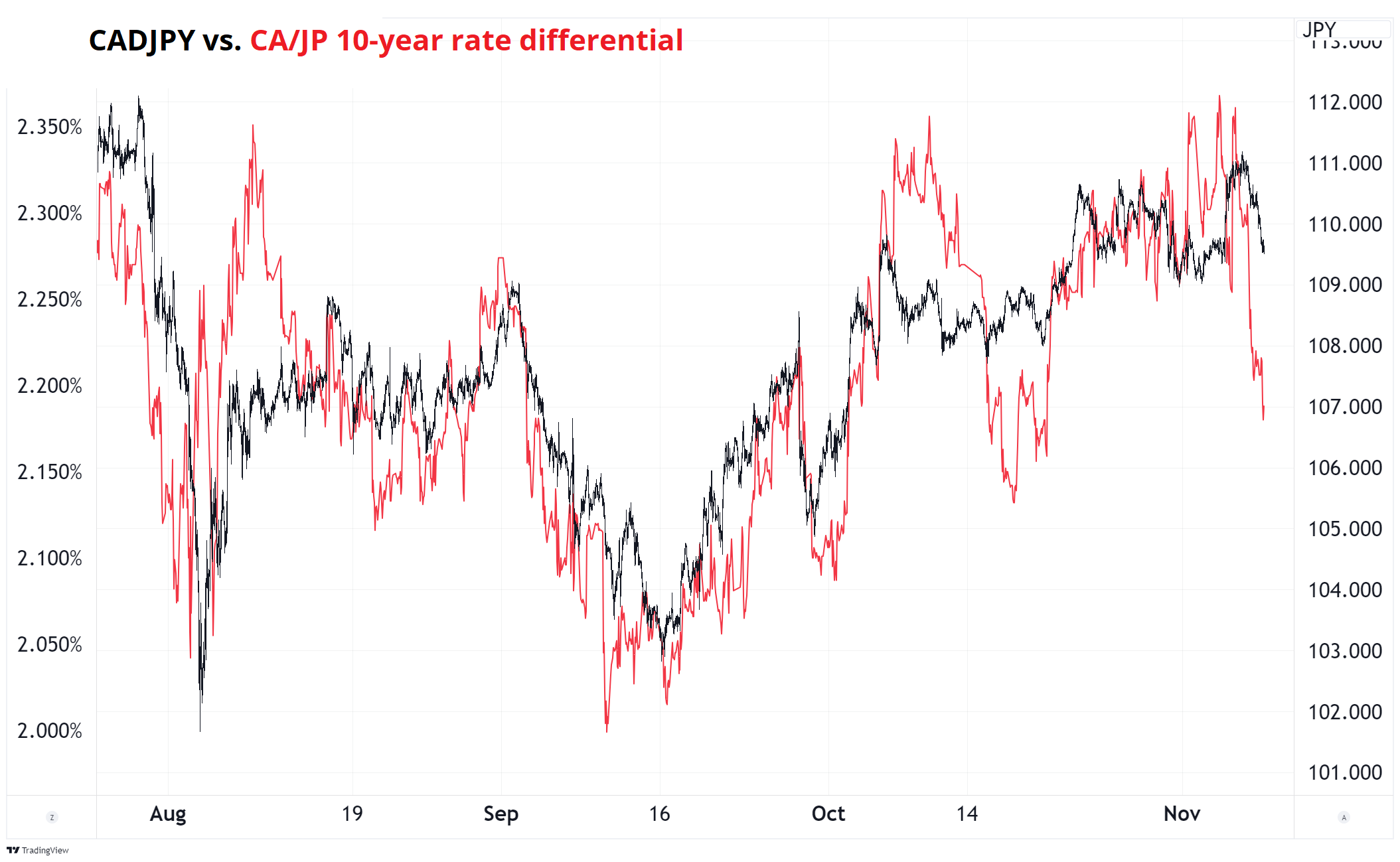

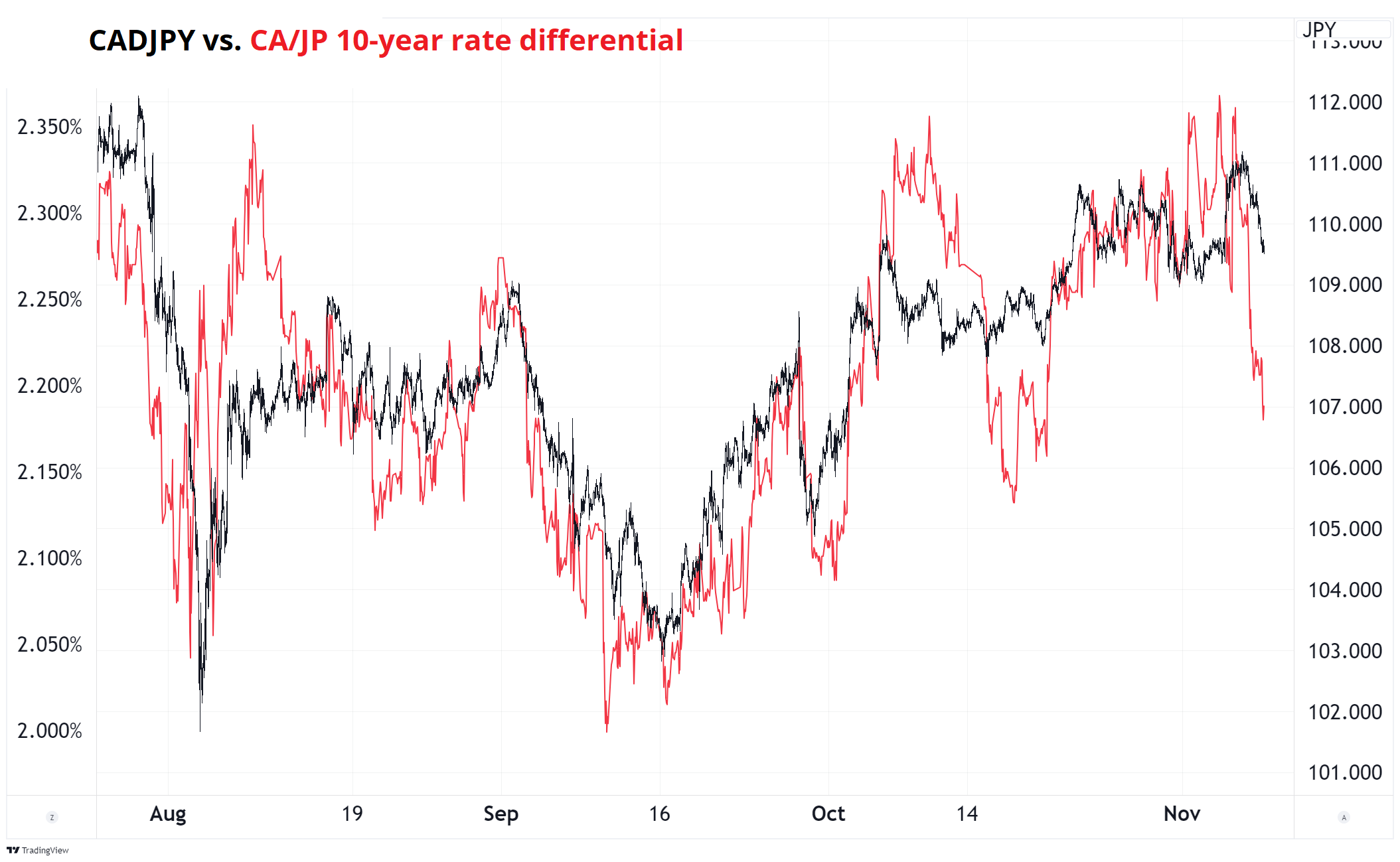

I am taking a view on JPY repatriation picking up, CAD trading poorly, and CADJPY already being too high. If you need a fundamental story on CAD, rents in the big cities are coming off hard. Today’s jobs data is a nothingburger.

Short CADJPY here with a stop at 111.21 looks logical to me, targeting 107.55 or for better leverage, buy a 12DEC 109 / 107.50 CADJPY put spread (risking 48bps to make 140bps off 109.70 spot). I put that in the sidebar. 1-month does not get you BoC, hence the 12DEC (vs. 1-month, which is 10DEC). This won’t get you the Bank of Japan meeting on 19DEC, but it gets you 11DEC BoC, and I think BOJ expectations will have moved enough by then for the trade to work out. Maybe if this idea works, my 148 USD put for a Harris victory will rise up like Lazarus, too :]. With the China stimulus story now a bore once again, you could also consider AUDJPY.

To summarize the logic here:

- USDCAD should have gone down yesterday, and it didn’t.

- CADJPY is 200 points too high vs. rate differentials.

- Japanese selling of foreign bonds (presumably switching to JGBs) looks like a viable new theme.

- China stimulus story is boring again.

My last two JPY trades were duds, but I am not a quitter.

Calendar

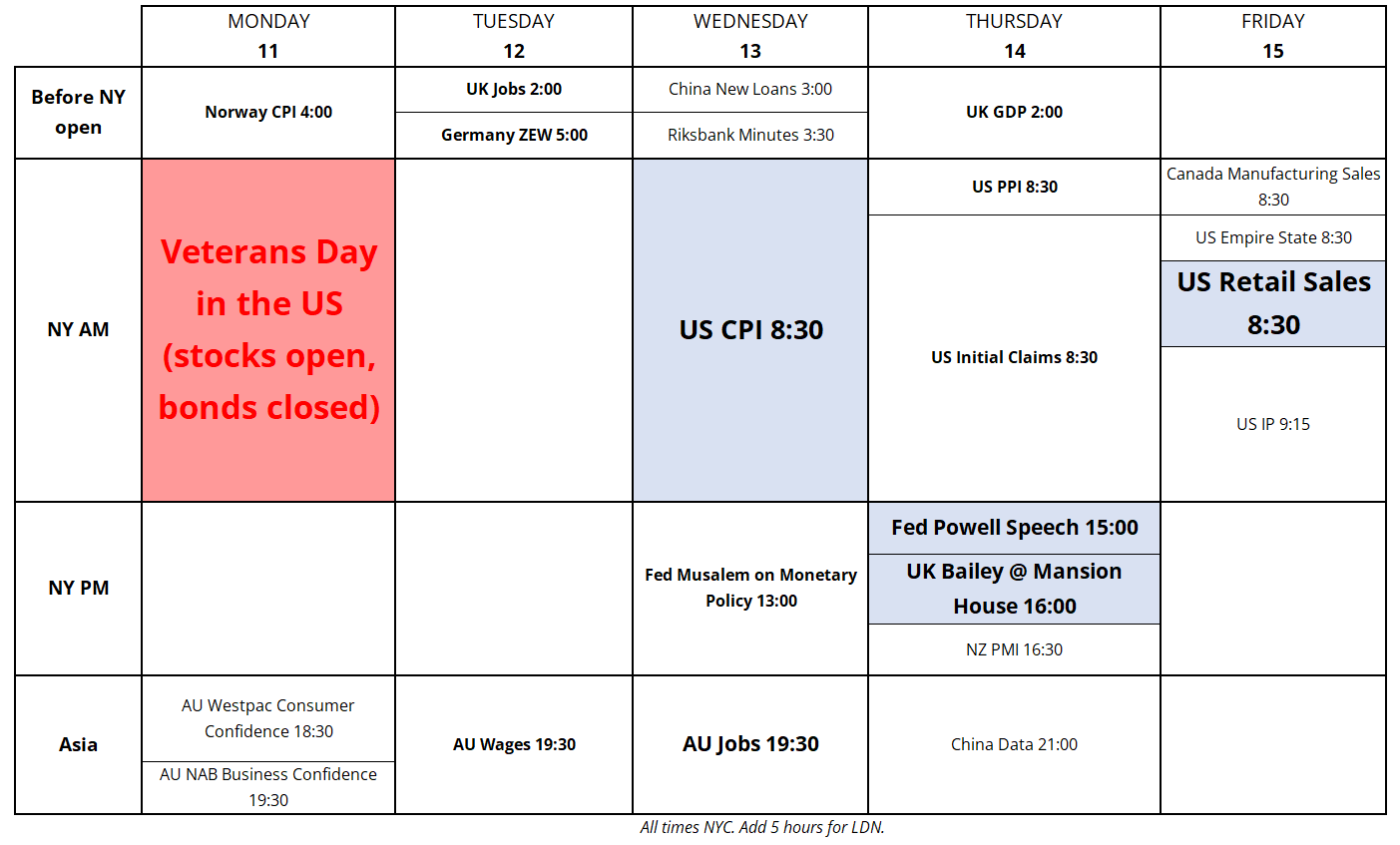

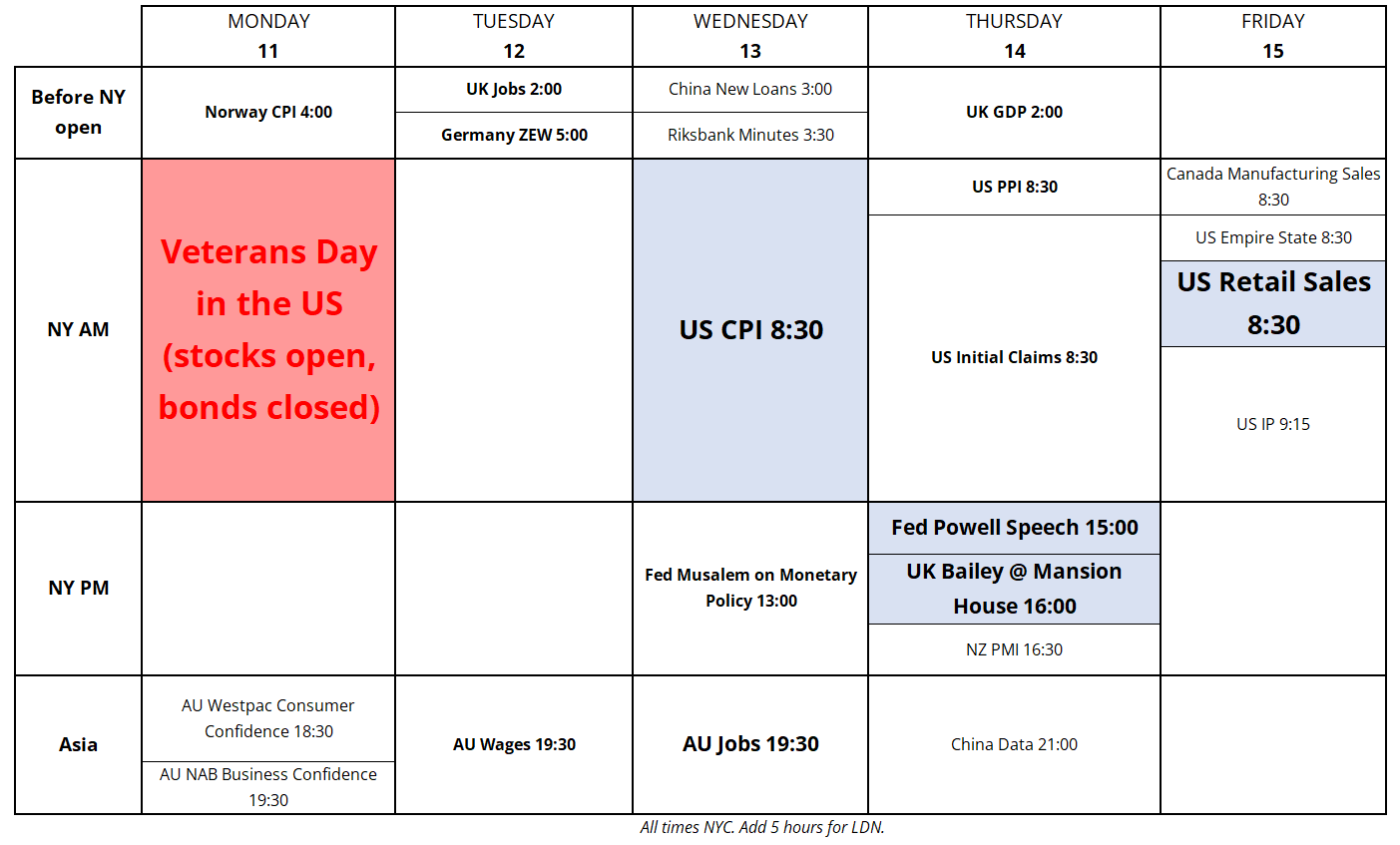

Next week’s calendar is light with just CPI and Retail Sales of major interest in the USA and very little else to chew on. The week after that you get NVDA earnings (20NOV).

Final Thoughts

https://www.nbim.no/en/publications/podcast/stan-druckenmiller-inside-the-mind-of-a-legendary-investor/

Have a superb weekend.