Waller’s Bayesian updating of his 70% prior to cut begins at 10 a.m.

Larger version at bottom of page

Waller’s Bayesian updating of his 70% prior to cut begins at 10 a.m.

Larger version at bottom of page

Long USDCHF @ 0.8867

Stop loss 0.8784

Take profit 0.8994

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1216

Close 31DEC

Short EURSEK @ 11.6000

Stop loss 11.8650

Flip long 06DEC

Chris Waller’s speech yesterday sounded like his current probability distribution for a December cut is 70/30 and the market has duly obliged, moving from 61% to 72%.

The most enjoyable part of the Waller speech was this:

Overall, I feel like an MMA fighter who keeps getting inflation in a choke hold, waiting for it to tap out yet it keeps slipping out of my grasp at the last minute. But let me assure you that submission is inevitable—inflation isn’t getting out of the octagon.

While “Submission is inevitable” is the kind of overconfident assertion that can come back to haunt a policymaker, this is still a fun analogy. Waller’s description of the December decision was highly conditional, and he went through a long list of economic data points that might change his mind.

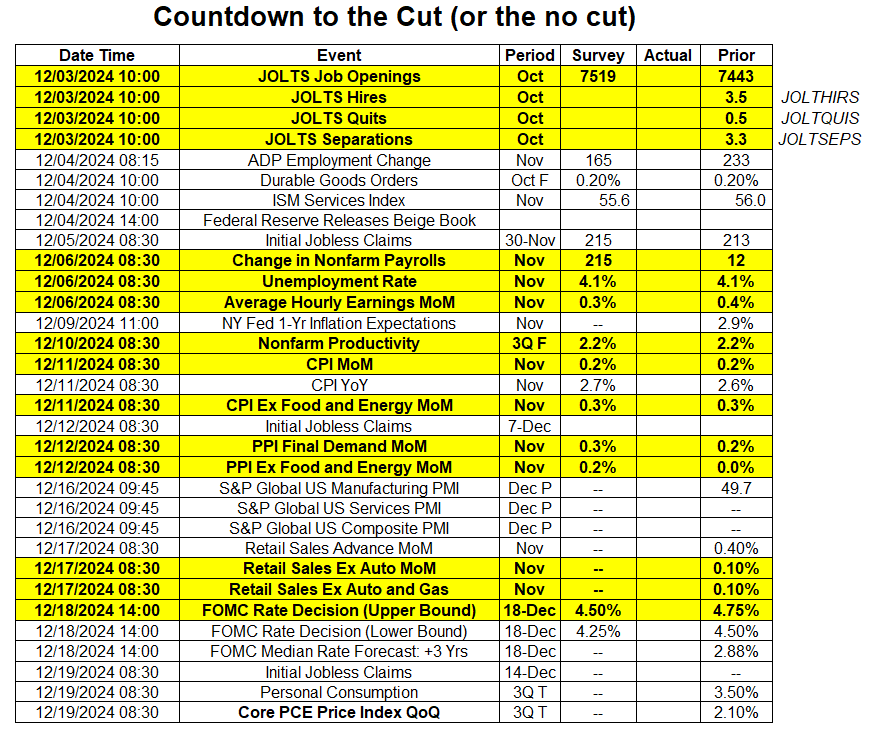

On the next page, I have created a list of all the major economic data points between now and the FOMC meeting, and I used a yellow Hi-Liter® from the 1980s to mark the ones that Waller mentioned in his speech.

Data mentioned in Waller speech is marked in yellow

I will track the evolution of this data as we move forward.

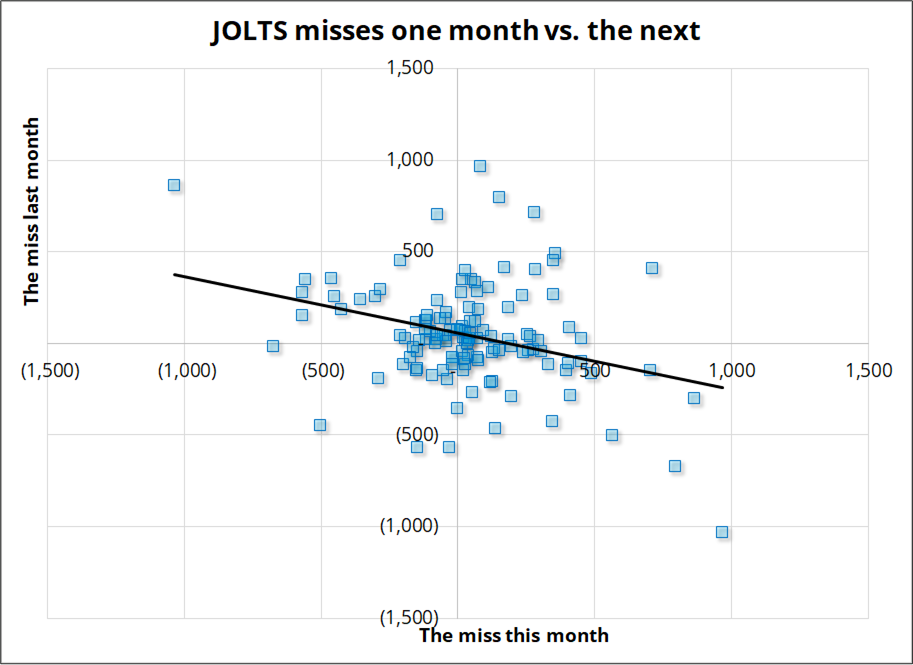

The fun starts at 10:00 a.m. today with JOLTS. That series has a strong tendency towards mean reversion as both the (actual vs. expected) and the number itself tend to flip flop between large ups and large downs. One would think that economists would factor this in, but they don’t do it adequately.

The chart here gives you an idea of the way JOLTS comes in strong and weak in succession, generally.

Looking at the data, you can see there is a bias for JOLTS to be strong because of the huge ramp higher post-COVID, but the general theory holds.

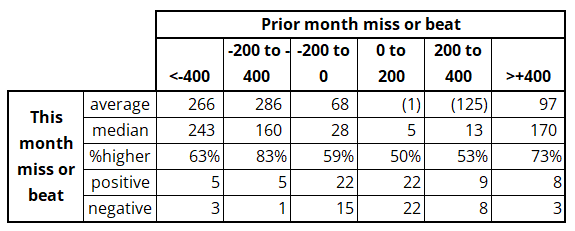

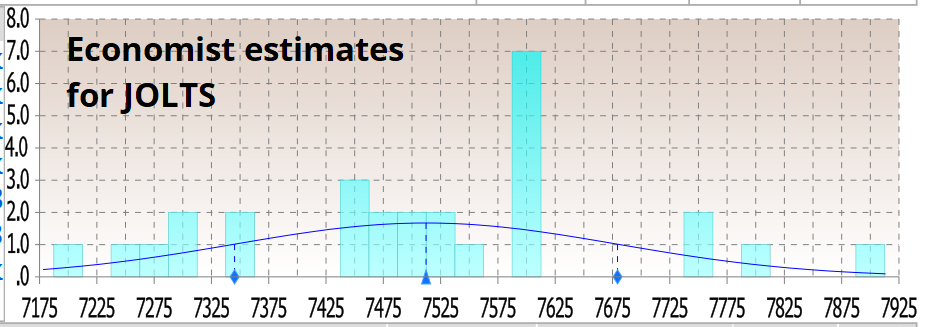

Last month’s JOLTS missed by 557,000, so that would put it in the far left column (< -400k) and would suggest that there is a greater chance of a strong JOLTS number today than a weak one. As is the case with many of these studies, you get something like a 60%/65% hit rate, max. Interestingly, the economist estimates are distributed super unevenly as the mode is 7600 but the average and median are closer to 7520.

Have a festive day.

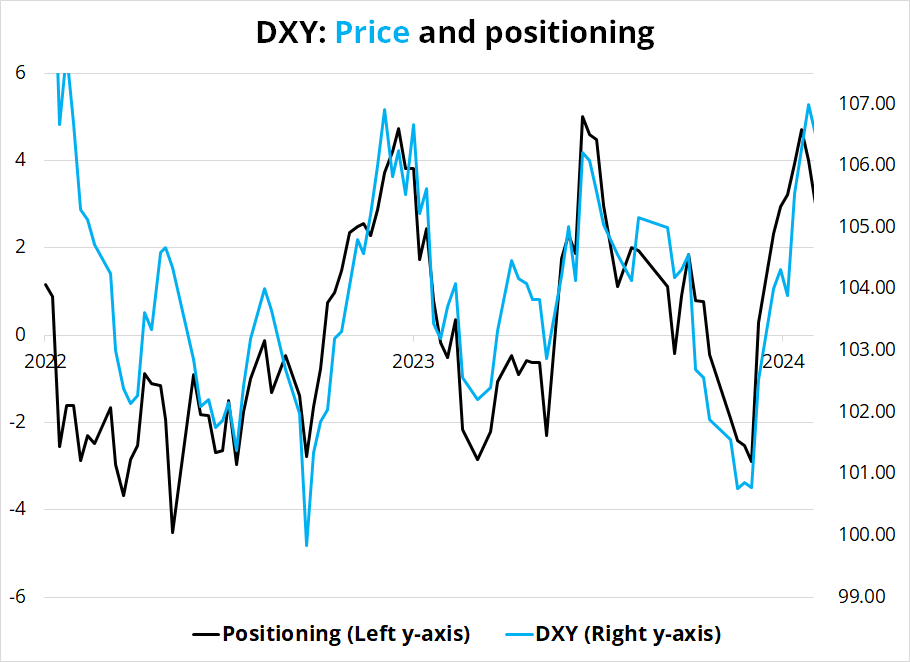

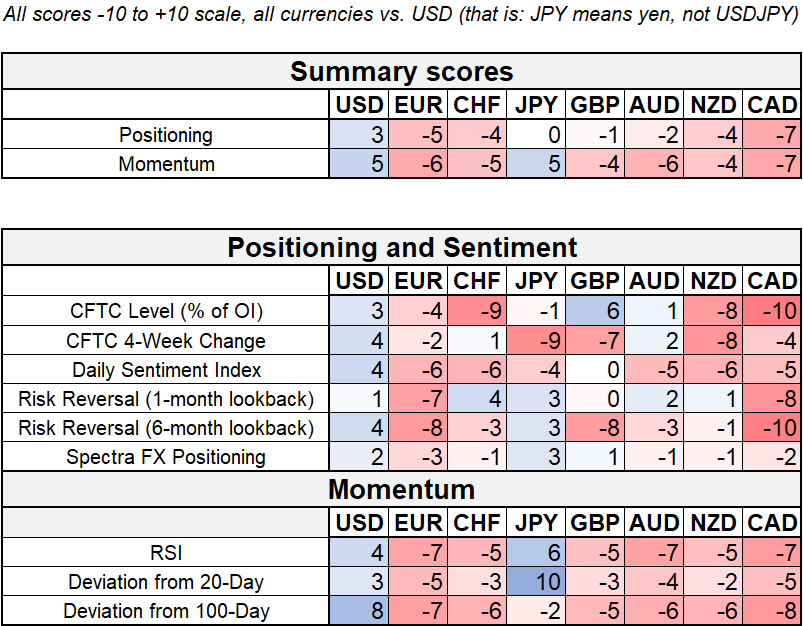

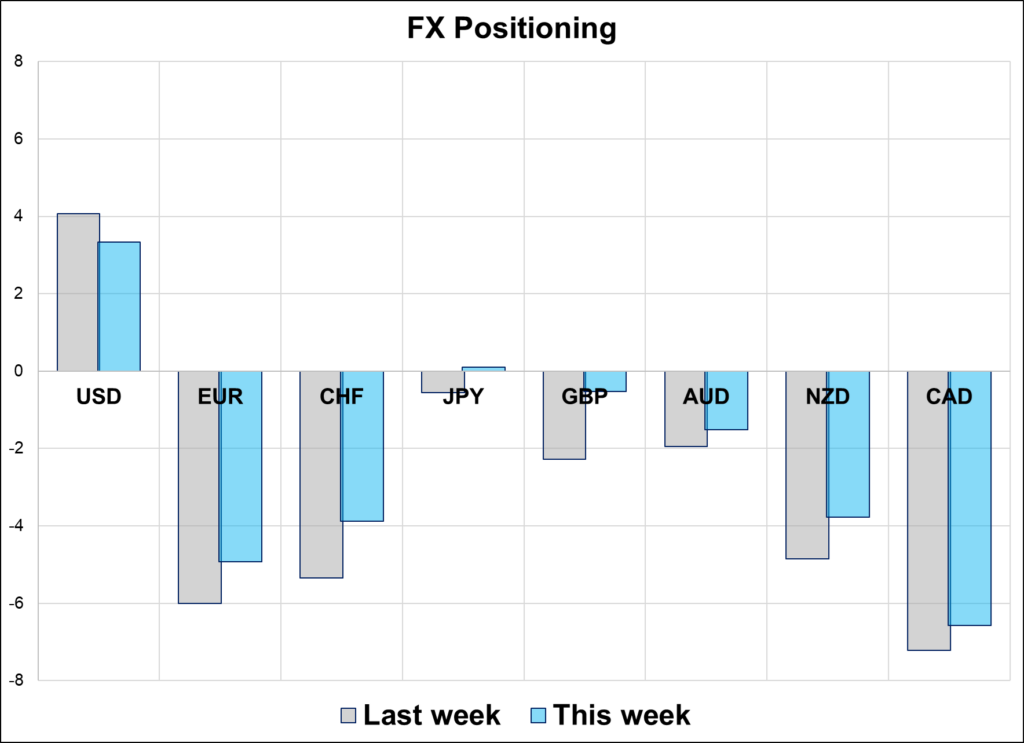

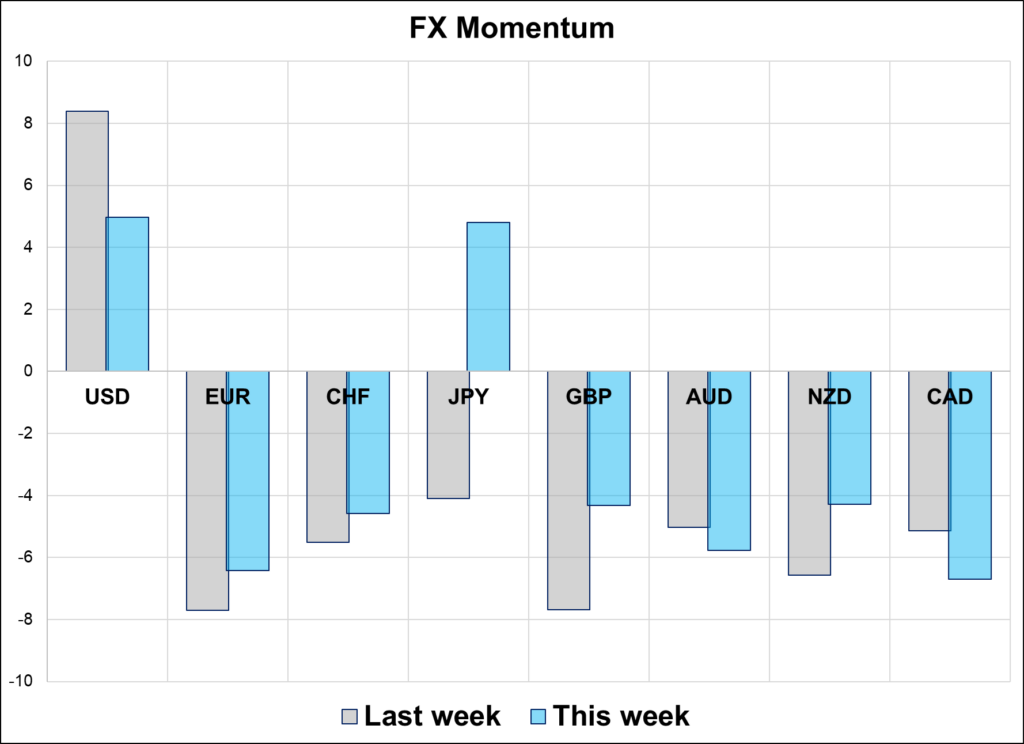

Pullback in USD longs due to seasonality, entry point, and positioning concerns

Hi. Welcome to this week’s report. USD positioning has cooled as the market is worried about lack of downside EURUSD momentum, excessive USD long positioning, and negative USD seasonals into year end. This creates an opportunity for the USD to keep rallying if the macro environment cooperates. That is, the December Fed cut, the December BOJ hike, and the 25bp vs. 50bp December debates at the ECB and SNB could determine the dollar’s fate, along with any more information and/or noise on tariffs from the incoming Trump administration.