Hawkish RBNZ hasn’t unlocked much upside for NZJDPY yet. US bonds trade well.

Man naps as container ship runs aground on his lawn.

https://www.insurancejournal.com/news/international/2025/05/27/825052.htm

Hawkish RBNZ hasn’t unlocked much upside for NZJDPY yet. US bonds trade well.

Man naps as container ship runs aground on his lawn.

https://www.insurancejournal.com/news/international/2025/05/27/825052.htm

Buy 86.10 NZDJPY call

29MAY25 expiry

~37.1bps off 85.87 spot

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

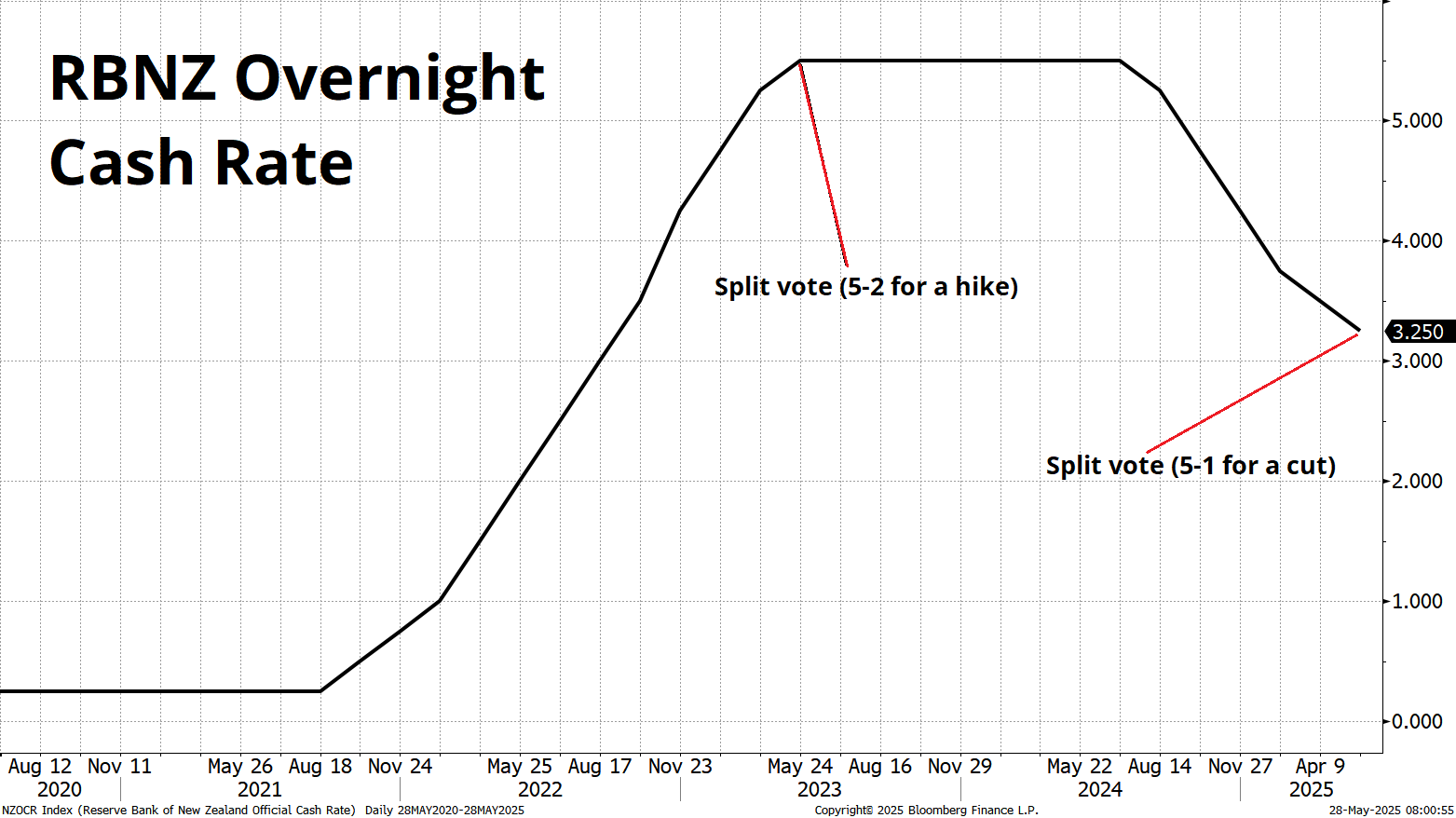

Pretty hawkish outcome from the RBNZ last night as we went in with a few outliers talking about the possibility of a 50bp cut and the reality was a 5-1 vote for 25bps with the dissenter calling for unchanged. It is perhaps notable that the last split vote (May 2023) came at the end of the cycle. It is logical that dissent would increase as the cycle ends because it becomes less obvious whether more adjustment is needed as you move further away from, or towards neutral.

I feel like the market systematically underappreciates the importance of neutral and simply looks at current conditions and says, “uncertainty bad!” when in fact central banks are obsessed with neutral and the stimulative or restrictive nature of the optimal and current policy settings.

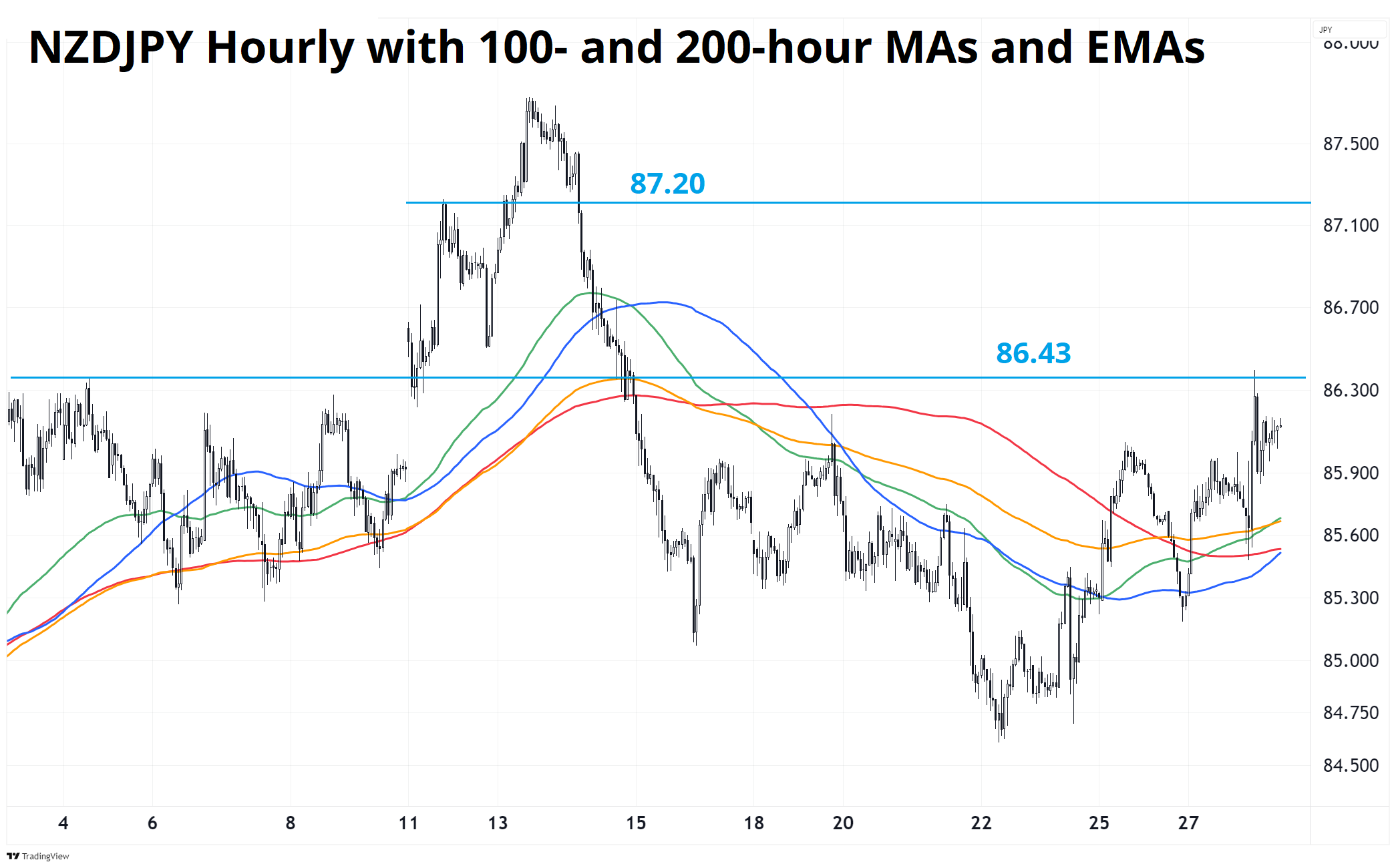

NZDJPY is above my strike, but just barely, so I hope to eke out some money somehow but obviously I would have been better off in spot than options here. I was right and I am (so far) losing money. Trade structuring is just as important as directional accuracy.

Given the ongoing flip flops in US policy and the fact that Trump 2 is looking more and more like Trump 1, I would not be surprised if the RBNZ just hit the bottom of this rate cut cycle. First resistance in NZDJPY is 86.40/50 and the next layer comes in just above 87.00. If you’re long spot you can move the stop loss to 85.34 as the moving averages have crossed over bullish now and the overnight low was 85.40.

I guess it was a rates trade not an FX trade.

It is moderately interesting that we had a bad JGB auction and a hawkish RBNZ and yet US 10-year yields are tiny lower on the day. Bad news / good price for bonds. I had that NZDJPY chart with all the MAs and brought up US 10-year yield in the same format and man, it looks bearish (bullish bonds). You can see the perfect crossover of all the MAs as yields broke through them all in early May. Now we have the MAs rolling over as yields break below them. It’s a pretty simple technical setup that is invalidated if we touch 4.55%.

I am long bonds for now, but it’s pretty tactical so not in the sidebar. I acknowledge that I completely abandoned the sell bonds / sell USD trade as of last Friday. The Big Beautiful Bill isn’t a big driver anymore. The House passing the thing was the peak in yields and the bond vigilantes sold the rumor and bought the fact. With the BBB unlikely to stimulate much deficit fear again until early July, short bonds could be tough sledding.

The buzz right now is that US corporates are presumably buying USD because it’s corporate month end today (last business day minus 2 days) and that real money will aggressively sell USD the moment the corporates finish up around 11 a.m. NY today. Makes sense to me!

If you are bearish USD, you could do worse than buying EURUSD, GBPUSD, and NZDUSD sometime between 10 a.m. and 11 a.m. today. I am more of the view that we are consolidating and while it’s tempting to just get short USD again, I don’t really know why I would be doing that when both US stocks and US bonds trade very well. Then again, long USD makes no sense to me either because real money is likely to either stay on benchmark (by selling USD) or even add to hedges (buy selling even more USD) between 11 a.m. today and 11 a.m. Friday. It all leaves me neutral on the USD. Through 1.1250 in EURUSD will unleash screams of agony.

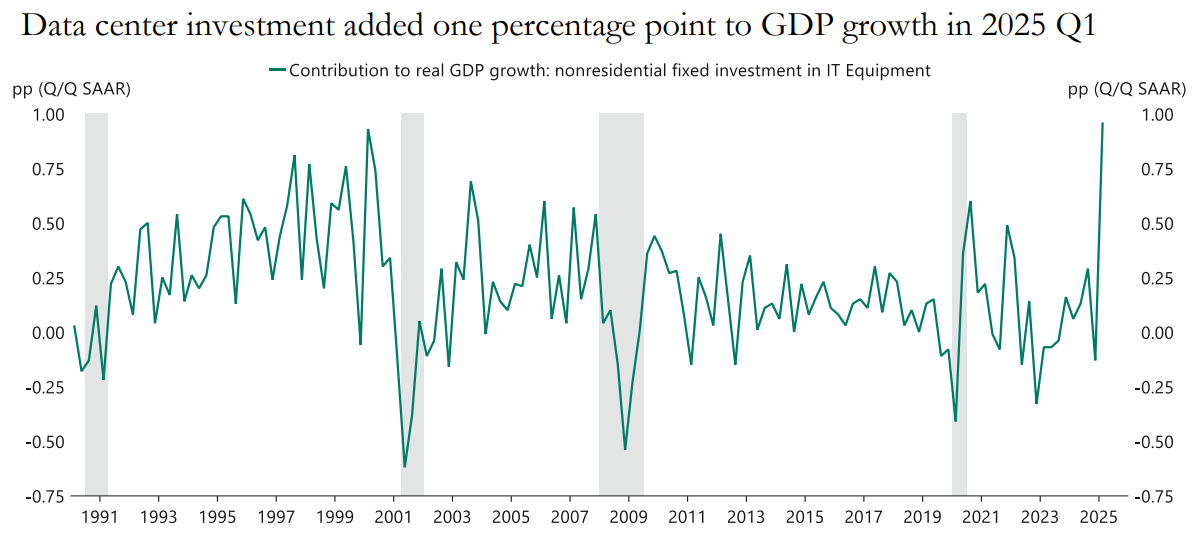

Nice chart from Torsten Slok of Appollo to celebrate NVDA Day.

New M2 CS with lots of carbon fiber and a ducktail spoiler. After the fiasco involving more and more ridiculously large grilles, BMW is back. Thanks Ryan.

Good luck with NVDA today. I think CRWV and NVTS will be good sympathy plays, whichever way Nvidia goes.

Have a sleepy day.

Good morning.