Overbought means buy the dip

Male Northern Cardinal

Overbought means buy the dip

Male Northern Cardinal

Long EURUSD 1.0545

Stop 1.0434, Take profit 1.0984

Long AUDUSD 0.6239

Stop 0.6054, Take profit 0.6494

Long 10MAR 104.30 CADJPY put ~64bps

Covered ½ the notional at 104.30 and sold it out at 104.72.

Trade the gamma.

Short gold at 2940

Stop loss was 3011 now 2936

Take profit was 2805 now 2843

A friend of mine, Darren Dempsey, has built a company called Harkster. They offer an app that aggregates, summarizes, and presents inbound research and emails in a useful and succinct way. You set up a separate email there and get your research sent to it, then the app summarizes and extracts trade ideas.

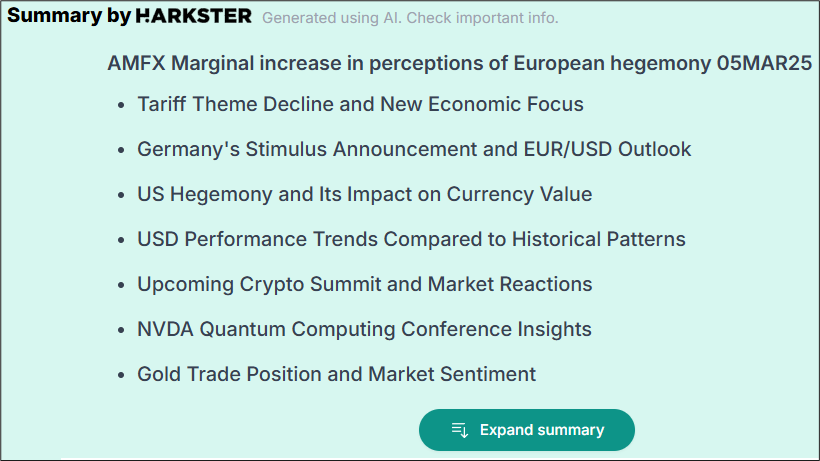

I find the product useful and so I thought I would share with you. When you click on an email it gives you the AI bullets (it does PDFs).

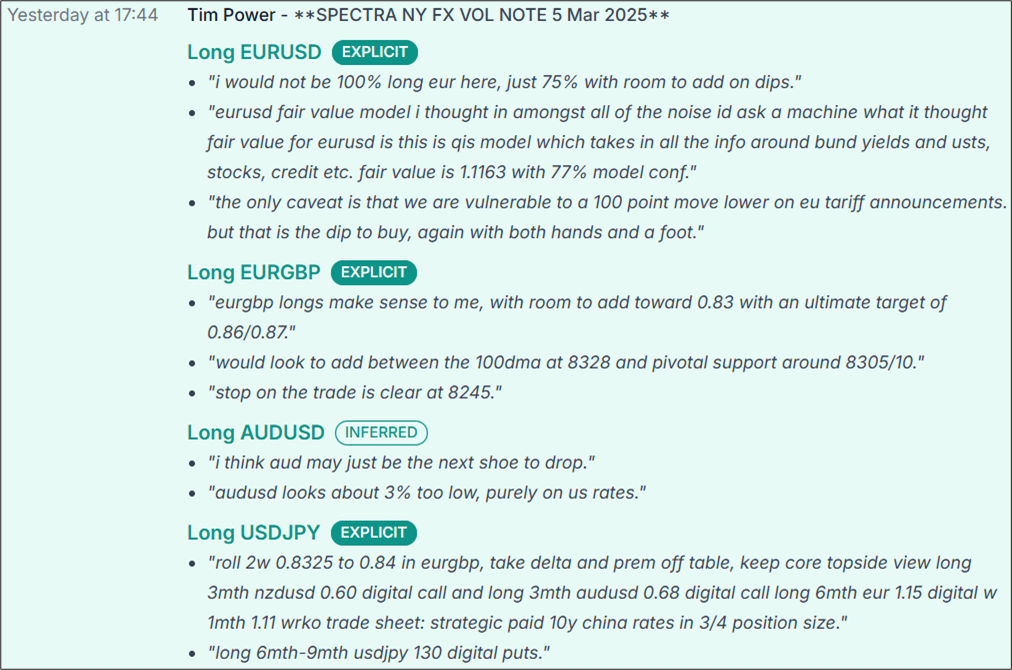

There’s also a place you can go to see only trade ideas, extracted from all your inbound emails.

Finally, the app also has a nice calendar that you can quickly access (see below). I use Harkster every day and figured I’d share with you in case you’re interested. It’s great for quickly aggregating the zeitgeist without having to read 250 emails top to bottom.

Here’s the Harkster calendar:

If you’re interested in checking it out for yourself or your firm, you can email [email protected] or check their website https://harkster.com/. FD: I am an unpaid advisor to Harkster (friends helping friends).

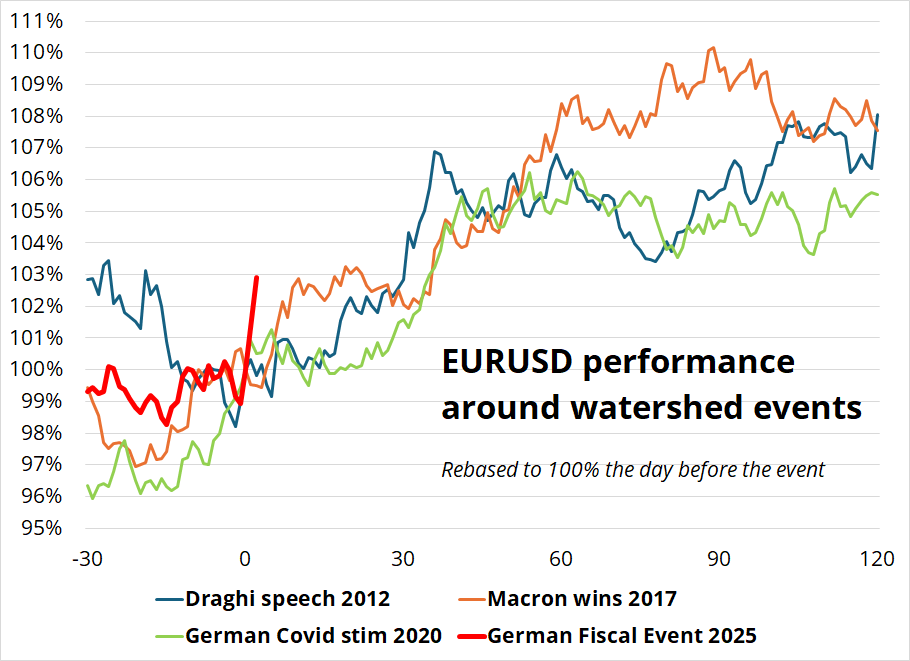

It feels pretty safe to see we are in a regime change here. The US has gone from exceptional to questionable while the EU and China have gone from uninvestable to raging. As you probably heard, yesterday’s move in German yields was the biggest since 1990, and the 2-day move in EURUSD was > four standard deviations. And we have got higher global yields and stronger yen at the same time, which is rather eye-opening!

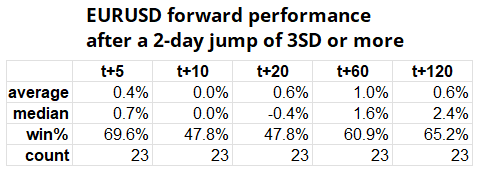

While garden variety overbought is often a good play for mean reversion, impulsive, explosive moves like this are not fades. Here’s the data:

So, you can see that after a mega move, EURUSD keeps going. It’s a tell that the market is the wrong way. This is an important aspect of overbought that people don’t always consider thoughtfully enough. When nothing is going on, and the thing gets overbought, sell it. When there is a regime change and the thing gets overbought, buy dips.

To wit:

As someone with a strong bias towards mean reversion and buy low / sell high strategies, I learned this lesson the hard way. Overbought and oversold are regime sensitive indicators. In a strong trending macro regime, overbought is a signal of a strong trend.

So, where’s the dip in EURUSD? After rip roaring moves like this that leave the market in the dust, Market Profile is useful. The key concept is to look for the single prints or areas where very little value was built. In other words, at what prices did the market never agree? What prices were never an equilibrium? These levels tend to be exceptionally useful pivots, much as gaps in single name stocks are great pivots.

Below, I show the Market Profile for EURUSD going back 6 days. For a full read on Market Profile, check out this 300+ page handbook. It covers all the bases. Or, read “Mind Over Markets” by Dalton, James, and Dalton. That’s the best book on the topic, imo.

Regardless of what ECB does or what NFP looks like, I think the market will be a large buyer of EURUSD 1.0730/40 and again 1.0580/1.0600. The German Defense announcement came out at 1.0541, so that is the final level of support. If somehow we were to go below that level, this entire regime shift idea is cancelled. But I think there is little chance of that happening. 1.11 before 1.05 (equally distant from current 1.08) looks aggressively skewed to me. There are a lot of ways to do this trade other than spot. Sell 1.05s to buy 1.11s, etc. I will leave the structuring to you, but anything that benefits from a move up towards 1.12 over the next month or two is nice.

Dead cat bounce in stocks makes it look to me like we’re going to take out the 200-day MAs in S&P and NASDAQ. This has notes of a 2001/2002 vibe, when US tech unwinds and the USD unwind went in tandem, taking turns lurching lower day by day. Like balls falling down stairs.

Waller with Timiraos today at 3:30pm is going to be lit.

Have a proud and aggressive day.