Crypto appears to have reached an important milestone as it matures into a mainstream but still-contentious asset class.

Running out of narratives

Long 12MAR 177.50 EURJPY put

for ~32bps off 182.30 spot

Rabbit Hole #16

Running out of narratives

Welcome to Rabbit Hole #16. The Rabbit Hole series offers deep dives into random macro topics that fascinate me. Today: Crypto appears to have reached an important milestone as it matures into a mainstream but still-contentious asset class. It has tried on ten or so different narratives in ten years, but none of them seem to stick. Haters gonna hate and maxis gonna max, but the truth is likely somewhere in the middle.

8-minute read – feel free to forward this piece

What does this thing do?

One of the most fascinating, engaging, and annoying aspects of crypto is how just about everyone stakes out a position at one of two mega extremes. Either crypto is rewiring the global financial system and bootstrapping its way towards inevitable mass adoption… Or it’s a scam and it’s all going to zero.

I continue to be awed by how much energy people expend on the crazy outlier scenarios when it seems pretty clear to me that crypto is settling in as an important, but somewhat niche asset class attached, but somewhat adjacent to, the US dollar and tradfi systems.

Ignoring consumer and Web3 use cases for now (I’ll touch on those later), the most important question from a trading and investing point of view is: What does bitcoin do? Haters will say all the narratives stapled to bitcoin across various euphoric NGU episodes show it’s all bullshit. “If the narrative keeps changing, there’s no there there.”

But the ever-changing narrative thing was bullish for a long time, because as people realized bitcoin wasn’t one thing (e.g., useful as money) they could pivot to a new thing (but Wall Street and the U.S. government are going to buy it!). Now this chameleonic nature is becoming a problem because each time a narrative fails, you are one step closer to running out of feasible stories to tell. The chameleon is running out of colors.

Bitcoin is not a viable high-volume payment system. It’s not a safe haven. It’s not a hedge against a weak USD or inflation. It was a risky asset. But then it didn’t rally when every other risky asset in the world exploded higher. It was digital gold. Then gold and silver doubled and tripled and bitcoin stood still, looking on with jealous awe. While the correlation of bitcoin to gold and the US dollar was never particularly high, for years it did track the NASDAQ and SOX closely. For several years, you could make a reasonable case that crypto was the risky asset software kinda layer of the US dollar system. Or something like that.

But recently it’s all gone Pete Tong. Since Election Day, bitcoin is unchanged while gold has doubled and the NASDAQ has rallied around 50%.

The reasons for the poor performance of bitcoin are well-documented, but let me briefly list a few.

- Starting in 2024, investors found a better, shinier object to throw their money at (Artificial Intelligence).

- OG whales, presumably seeing that Satoshi’s dream had morphed into something, ummm, else, sold en masse via the DAT bubble and direct sales of BTC into and after the peak.

- The October 10, 2025 crypto flash crashes disrupted confidence. To say the least.

- Saylor and Tom Lee turned away many serious investors with ridonkulous memes, horrendous averaging, and transparently silly clickbait price predictions.

- Jefferies issued a warning on quantum risk and reduced their bitcoin allocation to zero.

- Deregulation is a double-edged sword as government agents pump-and-dumping crypto is a bad look.

- Crypto DATs and pump.fun fueled the continued perception that crypto is a scam and insiders endlessly abuse retail for exit liquidity.

Then, more recently… Everything lined up for bitcoin. Weak dollar, roaring metals, equities ATH. And crypto just could… Not… Rally. That was the moment of truth. Mid-January 2026. Bulls said “look how cheap crypto is!” and bears said “BTC ain’t rallying, even with silver tripling—is that bad?!”

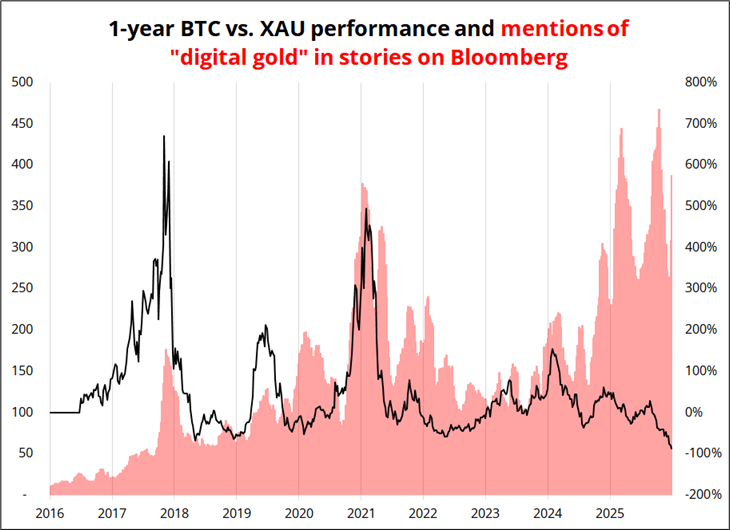

This next chart shows 1-year gold vs. bitcoin performance in black, mapped against the number of mentions of “digital gold” in all Bloomberg articles. It’s a crazy chart. Black line up means bitcoin outperformed.

In the past, the rallies in bitcoin fueled the perception that it was digital gold. There was reflexivity as the narrative fueled the price and the price fueled the narrative. But this year, you got the narrative—and the price didn’t follow. The digital gold narrative went to the moon and price went nowhere… Then silver turned and SaaS cracked, and crypto prices went cliff diving at Casa Bonita. Nasty. The reflexivity between price and narrative that we saw in past cycles completely broke down and now we are left to wonder what’s next.

First of all, it’s useful to remember that bitcoin could, in theory, just snap back up to 125,000 and it would be back in line with its old friends. But I doubt that’s going to happen. Now, you have existential overhang like quantum and Saylor debt rollovers in 2028 and a strong feeling of malaise. These cyclical ups and downs are supposedly a feature, not a bug, but it feels to me like this time is different. It’s getting too repetitive.

Crypto’s been around a long time now. The OG crypto founders are getting into their mid-late 40s (CZ is 49, Winklevii 44, Brian Armstrong 43, Roger Ver 47, Szabo early 60s, etc.) The GenX tradfi buyers are late 50s, early 60s. There is an infinite supply of paper bitcoin and it needs a new narrative or some new buyers. Who will the next wave of buyers be? Saylor is close to tapped out. Wall Street has second thoughts as ETF buyers are mostly underwater now.

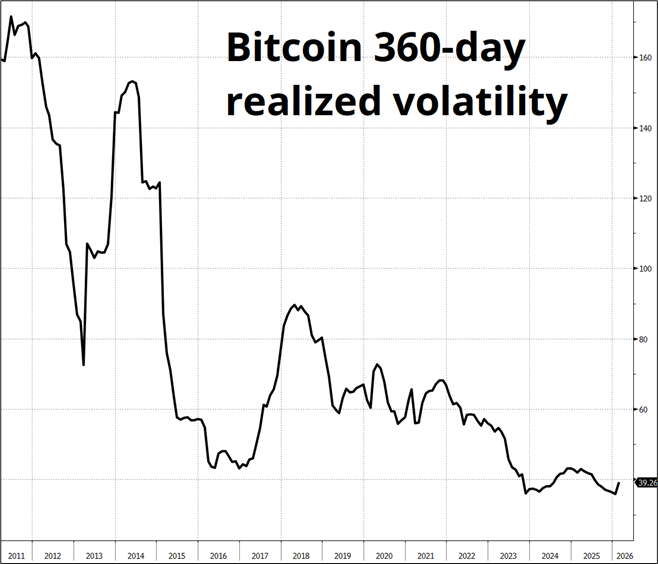

There is no lotto ticket lure to crypto anymore because volatility is too low. Could volatility pick up and reseed the lotto ticket mentality? Sure. Would I bet on that? No. On a medium-term horizon, there is a nearly-perfect correlation between the market cap of an asset and its volatility. A 3-trillion-dollar asset class isn’t going to trade at 100 vols, ever again. Bitcoin only becomes a lotto ticket again if it trades down to 25k-35k. To some extent… With crypto, the volatility was the primary attractive feature. Vol was the product. It’s why MSTR could do bonkers issuance and why it used to be so much fun.

Yes, there are new and exciting applications like tokenization efforts that could change global trade settlement and revolutionize capital markets at the margin. Will they make NGU, though? Not clear.

If you want a risky asset: Buy QQQ.

If you want a safe haven or store of value with no counterparty risk: Buy XAU.

If you want to protect against a falling dollar: Short dollars.

If you want a lottery ticket: Bet on sports.

If you want to punt narratives: Trade crypto.

I am sure there will be another bullish bitcoin narrative one day. And I will be long for a trade. But as we put a little red X next to the investment use cases one by one over time, it’s not quite clear what role bitcoin really plays anymore. Mind-blowing historical bitcoin CAGR calculated from a 2015 start point isn’t going to pay the bills in 2026 or 2027 or 2028.

Not every technology is as big as the internet. That’s ok! Crypto is here to stay and it’s big! But it’s mostly a financial asset class built on narratives, self-referential applications, and a side order of niche use cases. The killer use case is stablecoins. That’s pretty boring.

Bitcoin is a narrative sponge that has, for now, run out of narratives. If you buy bitcoin today, what are you cheering for? Bigger deficits? Lower Fed Funds? Strong growth? Weak growth? Higher stocks? Higher gold? Tokenization of assets? More ETF flows? U.S. Strategic Bitcoin Reserve? Hard to say! Each story bitcoin tries on seems to fit for a while, then fall off. For investors, this probably means you just wait until the next bull narrative and ride it. Then disembark when that story gets stale.

What about the broader use cases?

I often find that I can form views sometimes by reading the smartest, most strident bulls and bears and simply watching how I feel about their arguments as I read. Is the person convincing? Or do they seem like they’re dragging their feet through half-baked arguments just because that’s what they do? Is their view spiked with novelty and energy that makes me excited about ripping the offer in the asset they are pumping? Is their bearish view coherent or just angry? Etc. Does it read as a boring list of stale well-known narratives, or a snappy set of bold, new insights?

If you are on FinTwit, you will have noticed that there are many, many long-form posts about crypto in the last two weeks. There seems to be some kind of reckoning where long-time crypto peeps are either throwing in the towel or doubling down. Some are balanced, some are bullish, some are bearish. One post that particularly stood out to me was from Chris Dixon, general partner at a16z. He is a crypto and web3 evangelist, a smart guy, and excellent writer. So I was expecting to be at least mildly convinced of the bull case when reading his post: The long game for crypto. Instead, I came away extremely unconvinced.

His main thesis is that we are in the financial age of blockchains but blockchains will eventually coordinate billions the way the internet has. He explains that financial use cases come first, and the rest comes later. Then, he makes some excellent arguments for why tokenized communities have failed. He argues maybe regulation might fix the trust issue in tokenization, and that the Genius Act launched trust in stablecoins even though stables have been popular for at least 8 years now. He claims the Genius Act legitimized stablecoins “almost overnight”. Meh.

He then transitions quickly to say that “Big things take time.” He says AI started in 1943. The internet dates back to the 1960s. New technological systems take time. The implication, of course, is that crypto is as important of a technology as AI or the internet. But is it? Maybe we have enough evidence at this point to say that people don’t want to tokenize weapons in Fortnite and use them in Halo. People don’t want to turn videogames into pay-for-play work from home drudgery competing against bot farms in the Philippines. People don’t want to get rugpulled in memecoins on pump.fun. People really truly don’t want DAOs, utility tokens, NFTs, play-to-earn, or the metaverse.

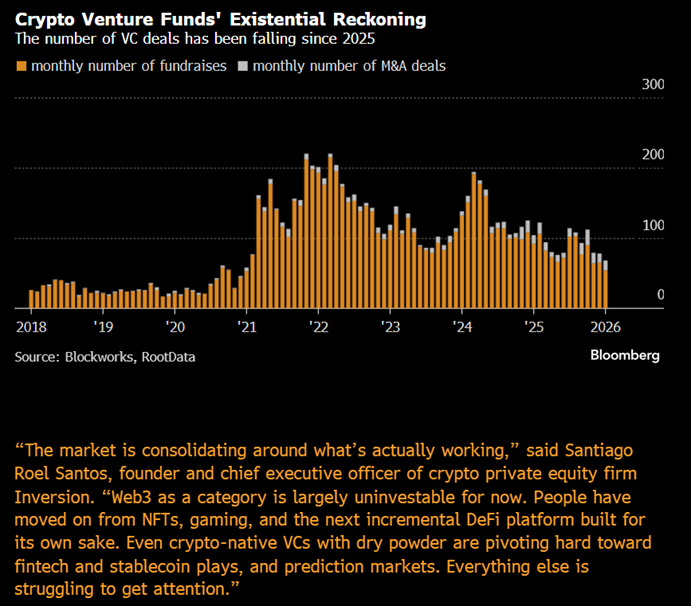

In contrast, people obviously do want smart contracts, DeFi, cold wallets, tokenized assets, and stablecoins. They want to speculate on crypto. People really want all these things. They just don’t want much of the consumer-facing stuff. Yes, Polymarket is consumer-facing, but so is Kalshi. Prediction markets are not a crypto innovation as much as they’re a regulatory change. Broadly, there is no product/market fit.

After 17 years of blockchain and 10 years of megahype and huge investments, crypto has not crossed the chasm, except in finance. Consumer applications, “blockchain for _____” and anything requiring mass mainstream adoption has had billions of dollars and millions of hours thrown at it through two full cycles and we are left with some cool, niche stuff and that’s about it. Sure Polymarket is cool. But Kalshi shows that prediction markets emerged not because of crypto but because of 2020s regulatory indifference.

So my view is that crypto is maturing into a small but meaningful asset class with some important but kinda niche use cases. That’s about it. Like video games, or 3D printing, or VR. Exciting, useful, and important industries. But not the internet. Not railroads. Not AI. There is no coming wave of innovation that will take it to the promised land. Crypto has arrived. It’s maturing. It’s not early. What you see is what you get.

If you would like to read the counterargument to this view, Mo Shaikh’s rebuttal is pretty good. But in the end, I still find his arguments unconvincing. Solutions in search of a problem don’t always find one.

Trading implications:

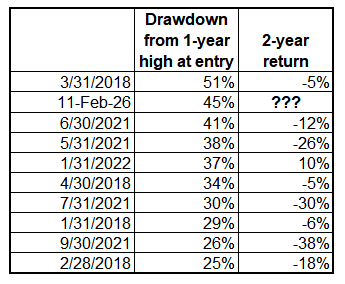

Bitcoin goes nowhere for two years. Dead money. This might seem hard to believe given we’re already 40% off the highs. But it has happened before. If you bought the first pullback in 2018 or 2021, you still lost money or broke even over the following two years. The data, using monthly closes:

Obviously, winter ended both times and you were glad you bought those dips. But you sat on dead money for a few years. This time, the risk is you are dead money even longer.

COIN and HOOD underperform massively. The stocks are already way down, but they could go way downer. Transaction volumes are going to be low when volatility is low and as the original generation of crypto bros ages out, I am not sure there will be fresh meat for a while.

Stay on high alert for the next bull narrative. Bitcoin has been down before, but it’s never out. Gotta be ready for the next wave, in case it comes. But don’t hold your breath.

Buy bitcoin 25k/35k. If bitcoin gets to 35,000, it becomes a bit more of a lotto ticket again and it’s probably worth buying in anticipation of a rebound.

Thanks for reading. Feedback and criticisms welcome.

Kurt Vonnegut:

When I was 15, I spent a month working on an archeological dig. I was talking to one of the archeologists one day during our lunch break and he asked those kinds of “getting to know you” questions you ask young people: Do you play sports? What’s your favorite subject? And I told him, no I don’t play any sports. I do theater, I’m in choir, I play the violin and piano, I used to take art classes.

And he went WOW. That’s amazing! And I said, “Oh no, but I’m not any good at ANY of them.”

And he said something then that I will never forget and which absolutely blew my mind because no one had ever said anything like it to me before: “I don’t think being good at things is the point of doing them. I think you’ve got all these wonderful experiences with different skills, and that all teaches you things and makes you an interesting person, no matter how well you do them.”

And that honestly changed my life. Because I went from a failure, someone who hadn’t been talented enough at anything to excel, to someone who did things because I enjoyed them. I had been raised in such an achievement-oriented environment, so inundated with the myth of Talent, that I thought it was only worth doing things if you could “Win” at them.