Some watershed moments on the multi-week horizon

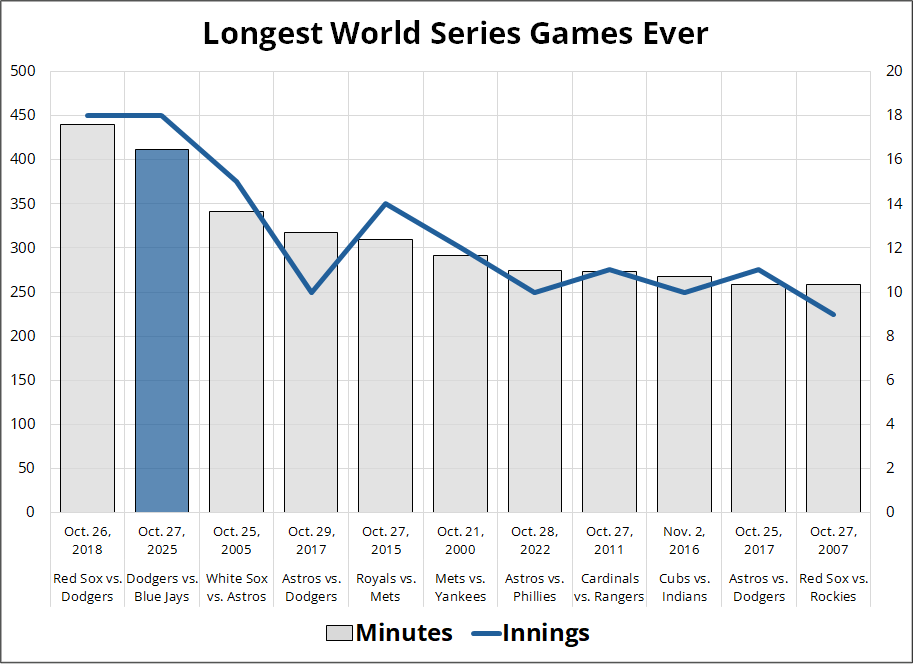

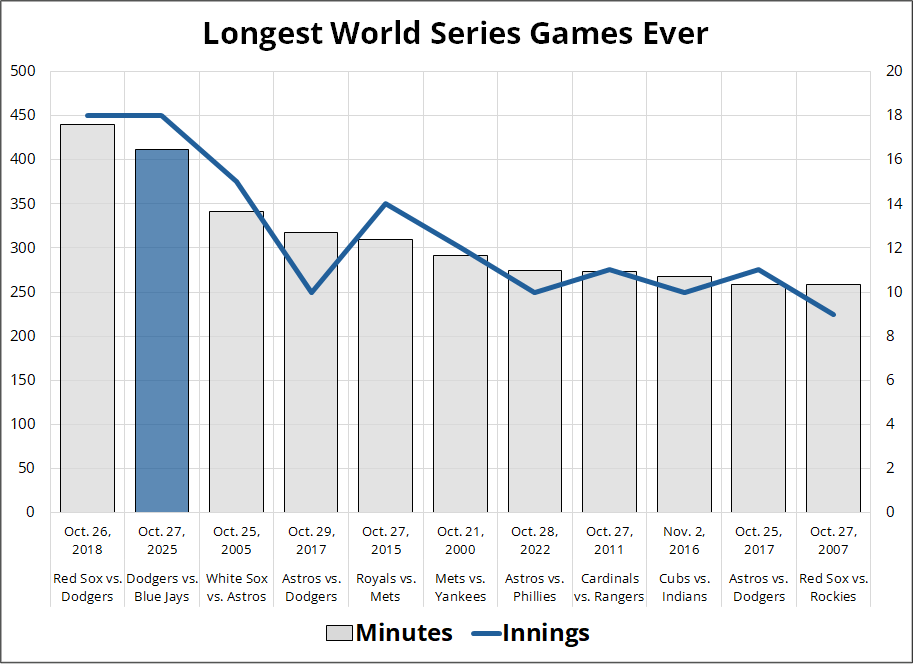

Last night’s game was the second longest World Series game ever.

One of the best baseball games I have ever seen.

Congratulations, Dodgers.

(I hate you).

Some watershed moments on the multi-week horizon

Last night’s game was the second longest World Series game ever.

One of the best baseball games I have ever seen.

Congratulations, Dodgers.

(I hate you).

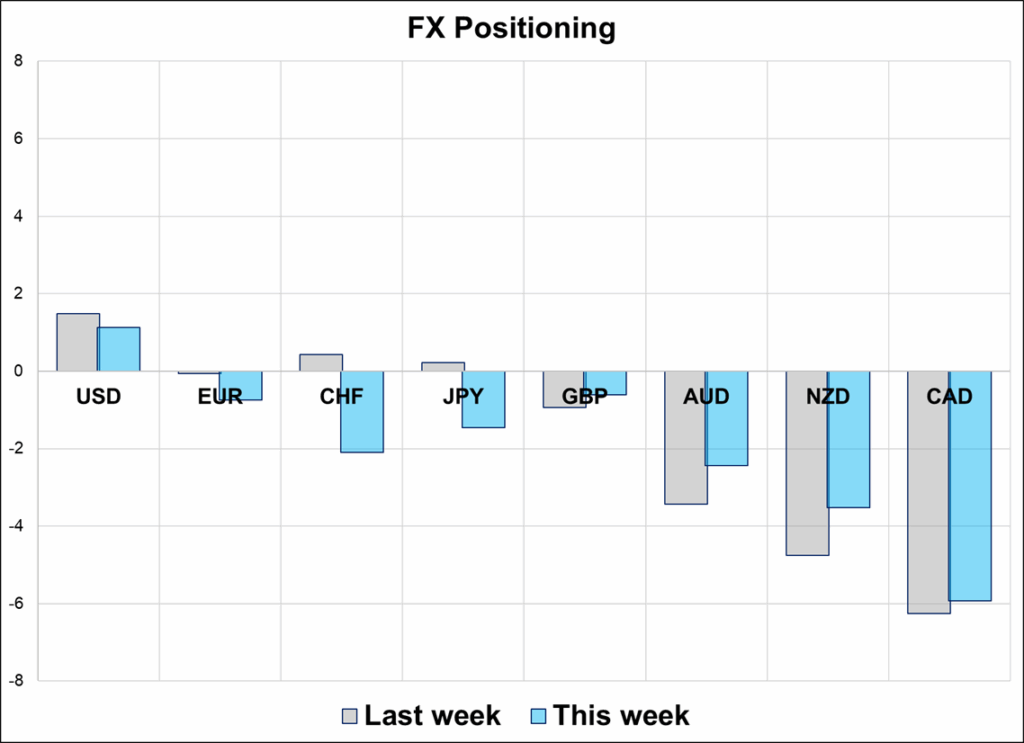

Square up 10am to 11am tomorrow

Long USDJPY @ 151.80

Stop 149.84. Target 154.84.

Short AUDUSD @ 0.6486

Stop 0.6576. Target 0.6357.

Short EURUSD @ 1.1585

Stop 1.1711. Target 1.1409.

Short EURCHF @ 0.9228

Stop 0.9285 Target 0.9111.

It’s that time of year again. The fourth annual handbook has arrived…

The 2026 Spectra Markets Trader Handbook and Almanac live on Amazon!

Use The Spectra Markets Trader Handbook and Almanac as a trading journal/day timer, and as your guide to seasonal patterns and key economic events throughout the year. It will anchor your process on proper journaling and planning—and help you thoughtfully assess your performance at the end of each month. Goals and plans written down are much more likely to come true than a flurry of ideas and thoughts and hopes swirling around in your head.

We are nearing the moment when the Supreme Court will decide whether or not the Trump tariffs are legal. While a ruling against the tariffs will probably lead to some other random justification for the tariffs under a different section of a different act, a Supreme Court ruling will still take the edge off the tariff story. The idea that the president can ratchet tariffs because he is insulted by a TV advertisement (Canada) or disagrees with a foreign court decision (Brazil) seems pretty obviously contrary to US law, and most experts are therefore leaning towards a Supreme Court ruling against the tariffs.

This is reflected in the gambling odds. Kalshi is trading at 41% chance of Supreme Court supporting the tariffs, with Kalshi at 37%. It is not completely obvious to me what the market reaction will be to a strike down of the tariffs, other than bullish sectoral and company specific reactions. I suppose it’s bullish earnings, bullish stocks, and thus kind of bullish USDJPY, perhaps, but it’s also bad for US deficits. Then again, does anyone care about deficits anymore? The bond vigilantes took their ball and went home. Net it’s stimulative as the potential for refunds rises, so small bearish bonds and bullish USD, I think. A strikedown might also be viewed as a win for institutional checks and balances. Again, mild USD positive?

The other story lurking in the background is the weirdly-drawn-out-in-public process to select a new Fed Chair. Recall that way back in June, the media was running shortlist stories featuring the same names as the stories feature today. The final choice could still be months away, but the media latches onto it now and then. We did this same thing in June, then August and now again in October.

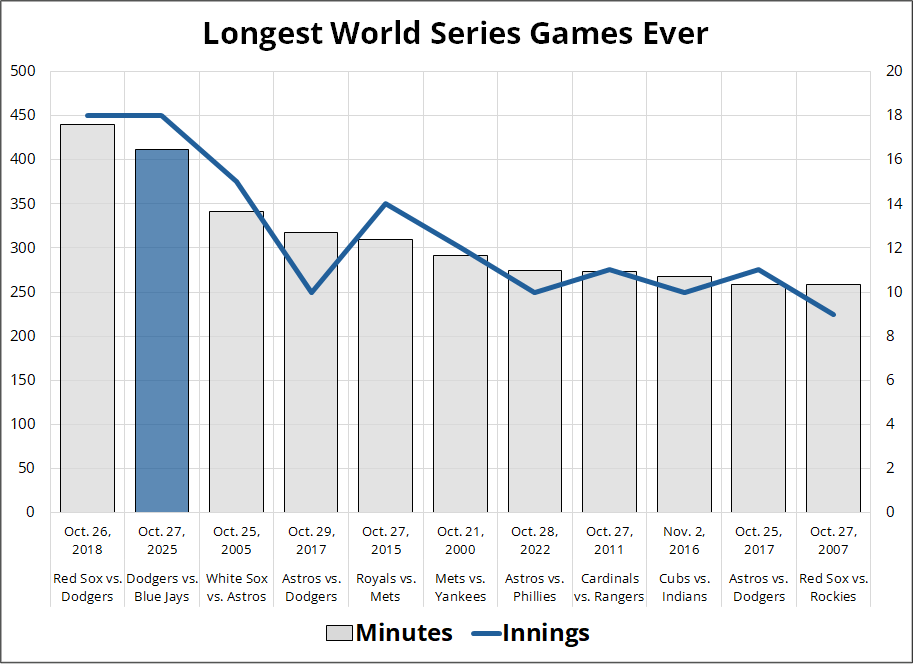

The market has converged on a spectrum through which to view the candidates, from least to most orthodox. Here’s the rough market view, I think:

Note that while I agree with the consensus, I am trying to map what I think the market thinks here.

Bowman seems low at 3%? I suppose you could say the EV of this grid is bearish USD, but the problem is the timing on the announcement is way too random. The fact the “Final 5!” is in the headlines means absolutely nothing. The Final 5 was in the headlines in June, July, and August too. Nothing is necessarily imminent.

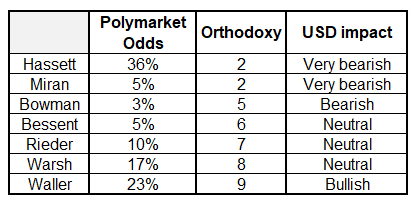

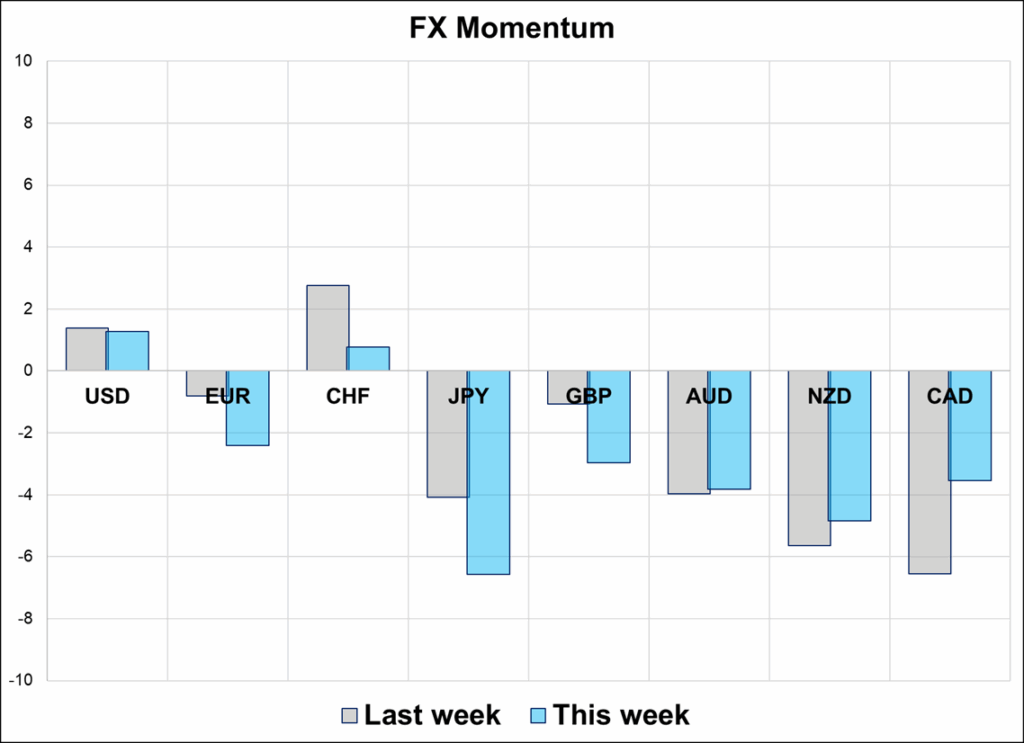

The dollar doesn’t trade particularly well as the market decided to reprice the BOJ last night and maybe add a small JPY-positive flair from the friendly readout of the Takaichi-Trump meeting. October’s BOJ pricing has gone from a low of zero bps to 4bps currently, and this was accentuated by lower US 10-year yields as the meltup in stocks did not feed through to bonds for more than a couple of hours. I am getting a tad concerned about my USD long positions but will keep my hopes intact because tomorrow is corporate month end.

You can see the USDJPY chart is not looking particularly bullish anymore as we have a double top at 153.00/20 and a break below the hourly cloud. I am going to cut all USD longs between 10 a.m. and 11 a.m. tomorrow (NY time). The huge rally in stocks isn’t feeding through to the USD or to yields, and that’s making me nervous. Hopefully the corporate flows will allow for better exit levels around this time tomorrow.

a. Currencies.

b. Currencies? Or…

c. CURRENCIES!

We’ve got a shirt for you. And some of the colors are quite hideous! Jokes aside, the What Time is BOJ Hoodie is incredibly high quality; the one I bought a year and a half ago still looks and feels pretty nice!

Have a 406-foot day.

Last night’s game was the second longest World Series game ever.

Kershaw throwing ball four to Lukes in the 12th with the bases loaded (and him slapping into a ground out) was hard on my soul.