Stocks and VIX don’t usually matter much for USDJPY. But sometimes they do.

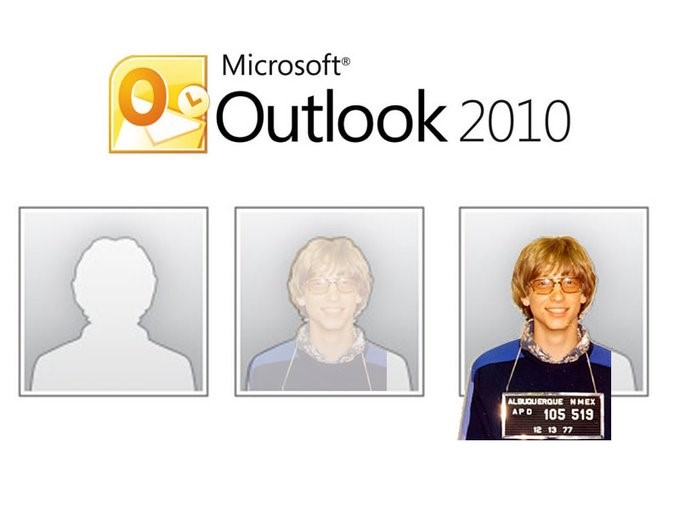

The old placeholder for Microsoft Oulook is a silhouette of Bill Gates’ 1977 speeding mugshot

Stocks and VIX don’t usually matter much for USDJPY. But sometimes they do.

The old placeholder for Microsoft Oulook is a silhouette of Bill Gates’ 1977 speeding mugshot

12DEC 109 / 107.50 CADJPY put spread

risking 48bps off 109.70 spot

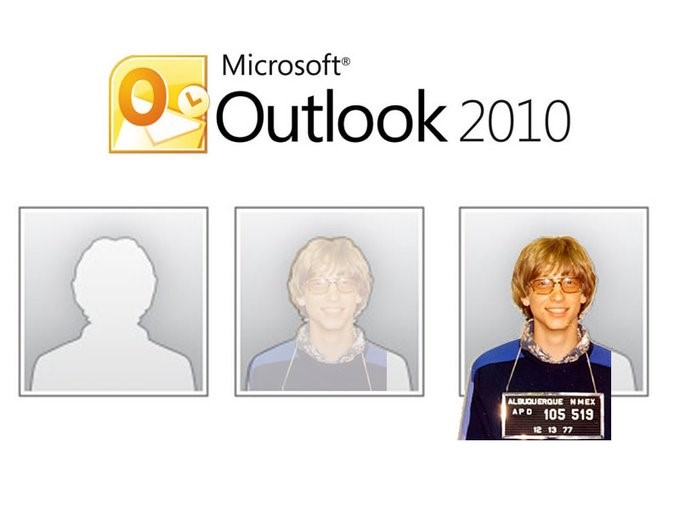

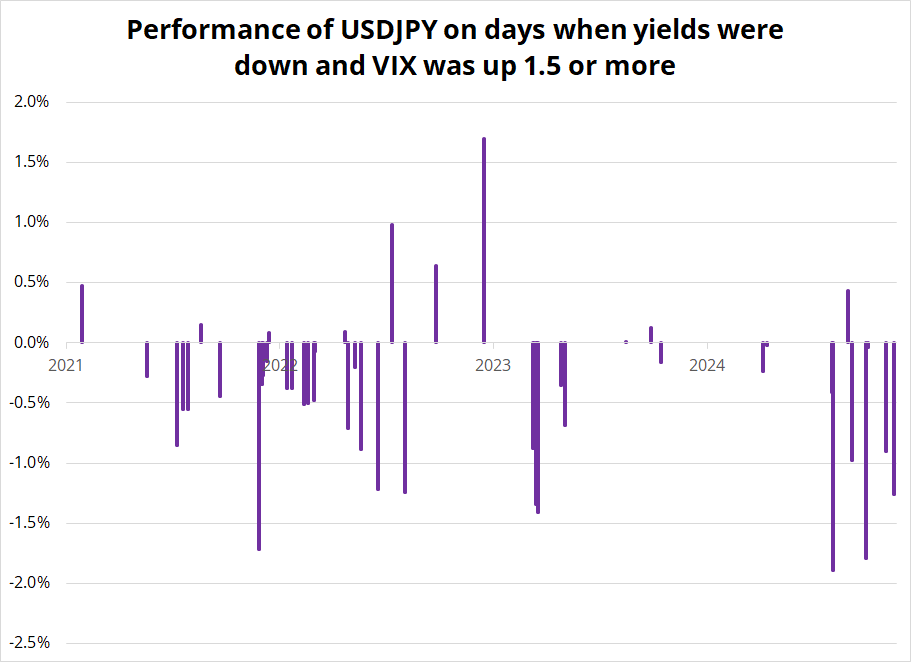

There were many questions about Friday’s move in USDJPY as US yields were only down tiny and yet USDJPY fell 1.3%. This basically comes down to the fact that there is a secondary correlation between USDJPY and equity vol that only kicks in when you get a decent move in VIX. USDJPY is a carry trade and thus financial market volatility matters, whether it’s equity or JPY vol you look at. I use VIX, not JPY vol because there is too much circularity between USDJPY movements and USDJPY vol (spot moves drive vol, vol drives spot, etc.)

To explain it a bit further, here are the scatter plots of USDJPY vs. rate differentials and equities:

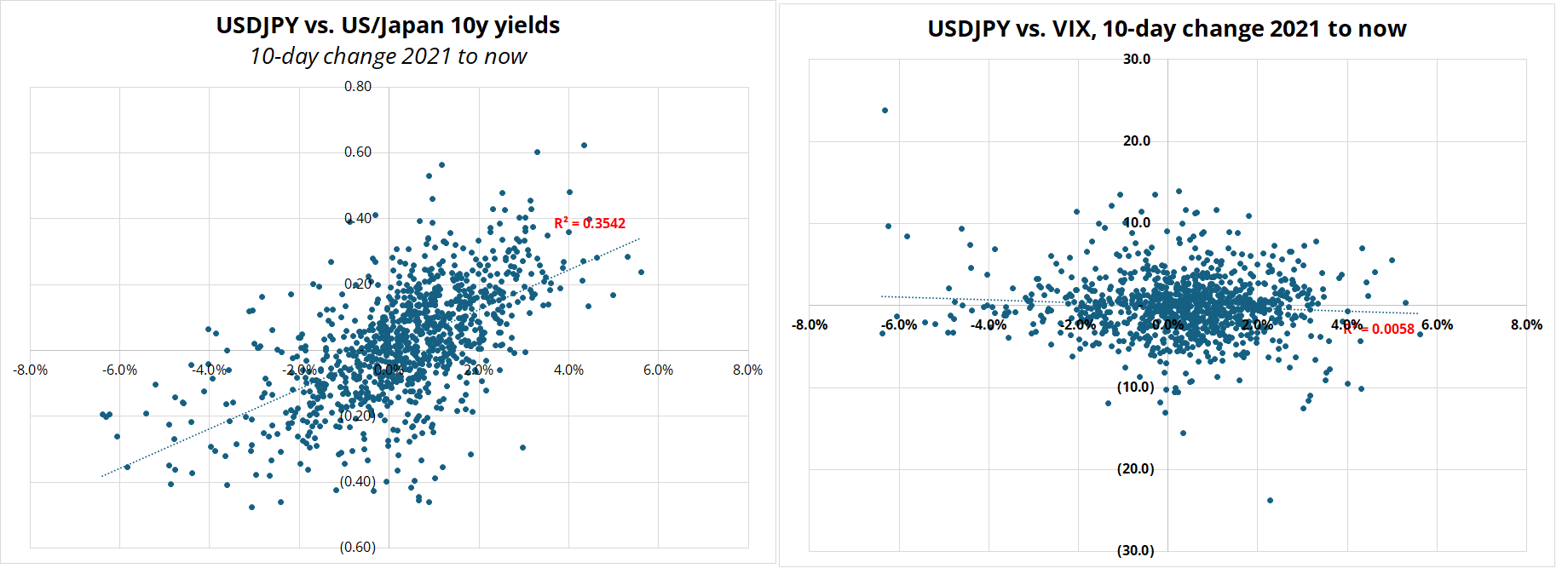

But these plots slightly overstate the importance of yields because if you impose a slightly more granular filter, you can see that regardless of how big the move is in yields, a big move up in VIX triggers a larger move down in USDJPY than one would expect otherwise. Yields down + VIX up > 1.5 sees USDJPY up just 20% of days vs. USDJPY up 38% of the time when yields are down and VIX is down.

Here are all the days when VIX was up > 1.5 and US yields were down:

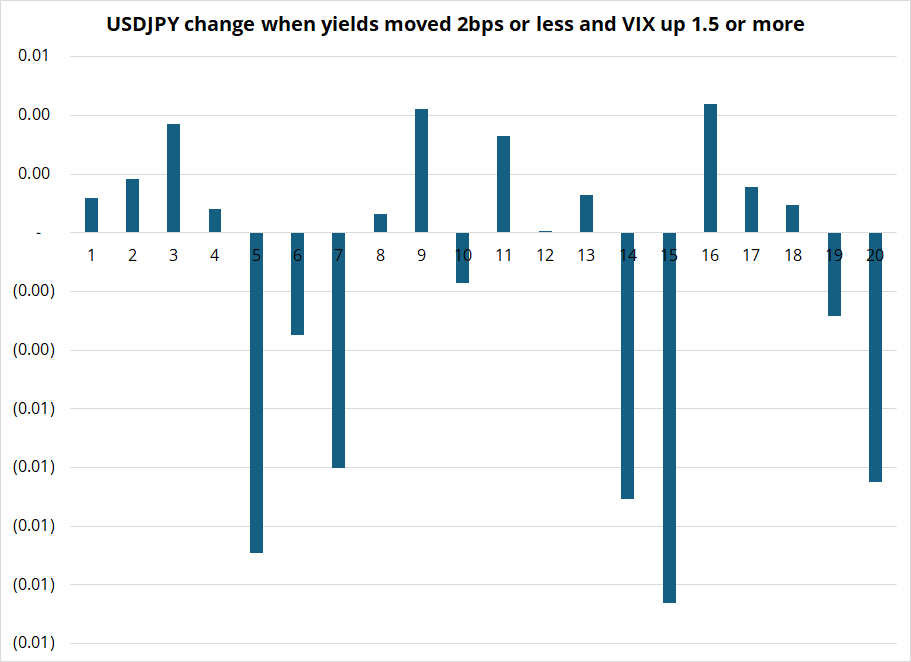

I am usually the guy crowing: “yields are what matters for USDJPY, not stocks!” but it’s good to know that while yields are the primary driver, equity performance does matter on big moves, as long as yields are not pushing the other way. In other words, if yields are up and stocks are down, USDJPY still goes up, but if yields are flat/down and there’s a big move in equities, USDJPY (and cross/JPY) are very likely to respond. Another way to look at this is to see what USDJPY does when yields barely move and VIX goes up a lot.

Again, in the absence of the more dominant pressure from yields, VIX matters as you can see a heavy downside skew to the USDJPY results.

This move lower in stocks has benefited my CADJPY short, which is still not great, but less bad than it was before. The put spread expires 12DEC, so there is plenty of time left. The good news is that the relentless up trend is now busted, and JPY always trades a lot on momentum because it’s the ultimate Veblen currency. See the chart, which shows the up channel in CADJPY has now broken (red lines) and the RSI shows a dramatic loss of momentum (black lines, second panel). RSI was making lower highs and lower lows, even as spot was grinding higher.

The bad news is that there doesn’t yet seem to be any evidence of Japanese repatriation going on, and that was a big part of my bearish cross/JPY thesis.

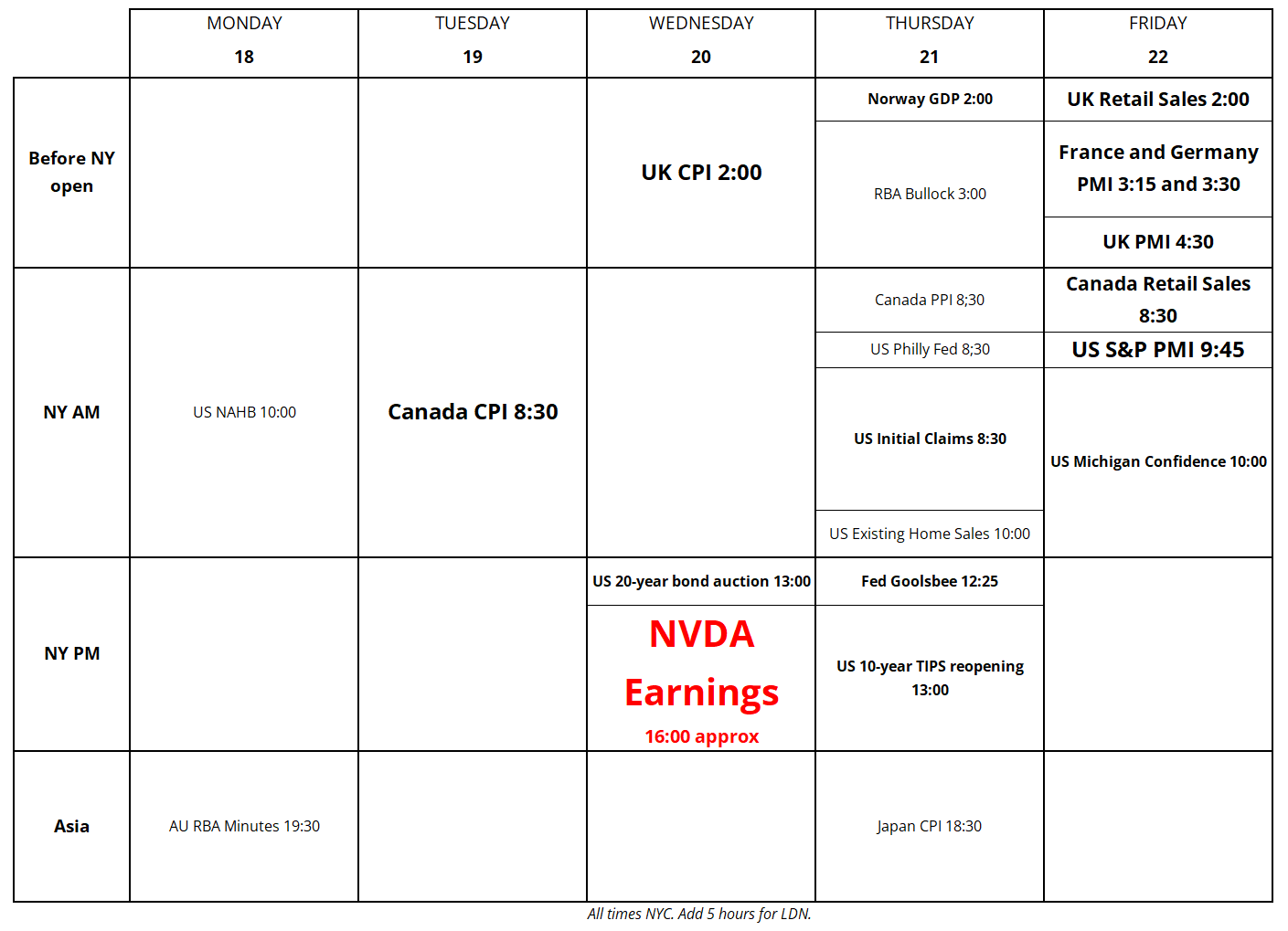

All eyes on NVDA Wednesday. If you see any good research on how it behaves around earnings, I will be writing about that tomorrow and could use any ideas / inspiration. Not so much about the contents of the earnings report itself, which I will leave to the 127 or so analysts poring over the data—I am more interested in patterns or edge on how the stock might react to specific outcomes. NVDA earnings are big enough to matter for G10 FX, I think.

Not too much to chew on until Wednesday, really.

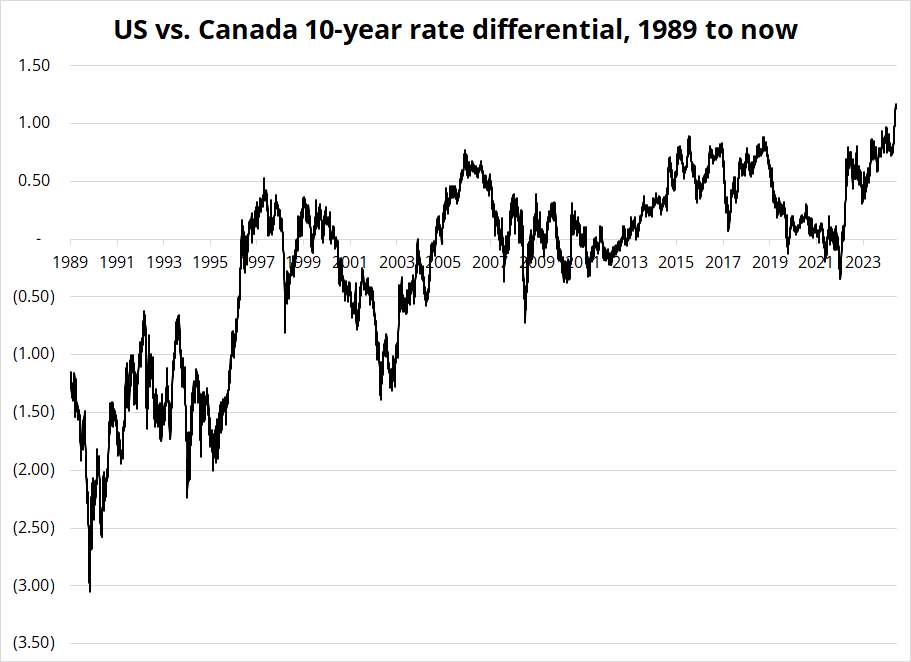

I tend to think of the gap between US and Canadian rates as constrained at the extremes and capped around 1% across the curve. Hmm. Maybe time for me to open my mind as the 10-year spread breaks to an all-time high?

Finally, here’s Scott Sumner in praise of Japan.

Have a speedy week.

That old Microsoft Outlook silhouette is Bill Gates’ mugshot for speeding in his Porsche in 1977.

When Microsoft was based in Albuquerque, New Mexico, 1978, he bought a Porsche 911 and used to race it in the desert; Paul Allen had to bail him out of jail after one midnight escapade. He got three speeding tickets–two from the same cop who was trailing him–just on the drive from Albuquerque the weekend he moved Microsoft to Seattle. HT CnD.