The Himino speech Monday could be big.

The Himino speech Monday could be big.

Long a 1-month 1.4600 USDCAD call

for 33bps off 1.44 spot

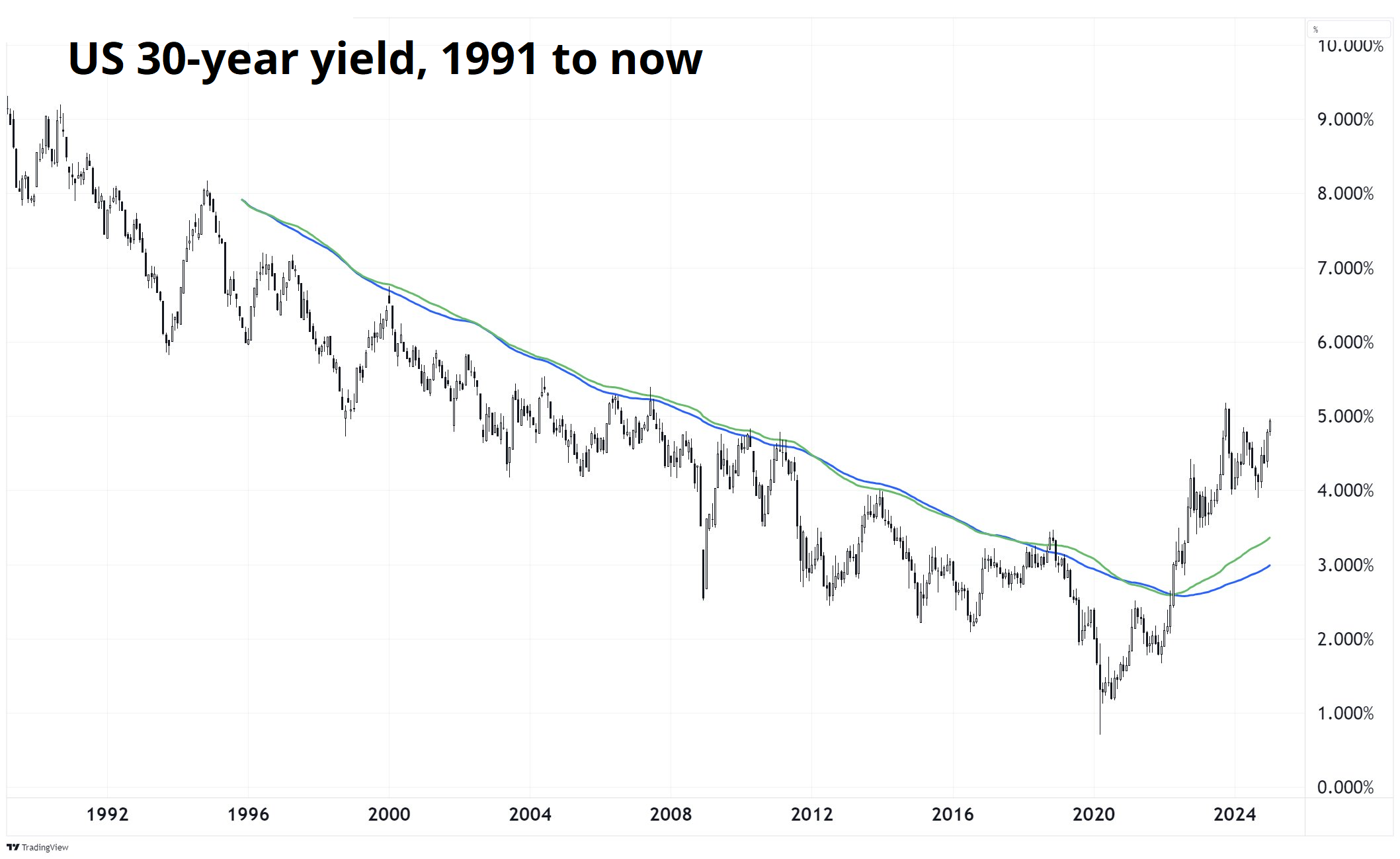

First of all, let me zoom, way, way out. This is one heck of a chart. Currently 5.0%.

What a toxic combination of risk premium, sticky inflation, and stronger-than-expected jobs for the bond market. It creates a challenging setup for risky assets as we start to look back to 2022 as a comparison. Stock/bond correlation looks ready to inflict pain on 60/40 much as it did that year as high inflation required a massive jam of the brakes from the Fed.

This time, the persistently high and now higher yields risk allowing the long and variable lags to kick in at some point. The velocity of the move is not staggering (outside the UK) but the persistence is going to be a problem at some point.

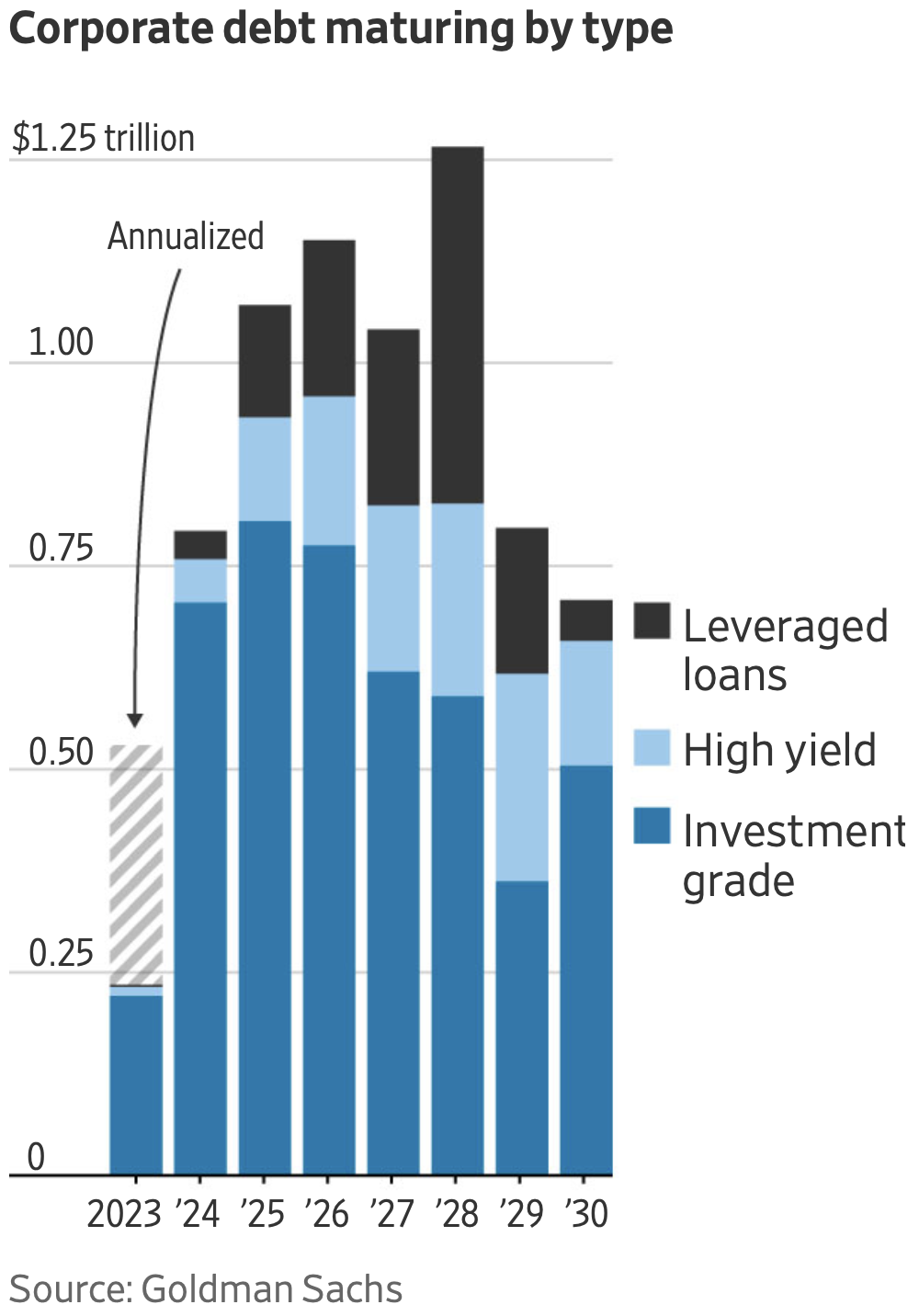

The unusual combination of massive cash balances on the asset side and fixed liabilities in the United States made rate hikes neutral or stimulative in 2023 and 2024, but it’s hard to imagine that remains the case in 2025. Mortgages are going to start to reset a bit, even in the US. Corporates are going to need to roll some debt.

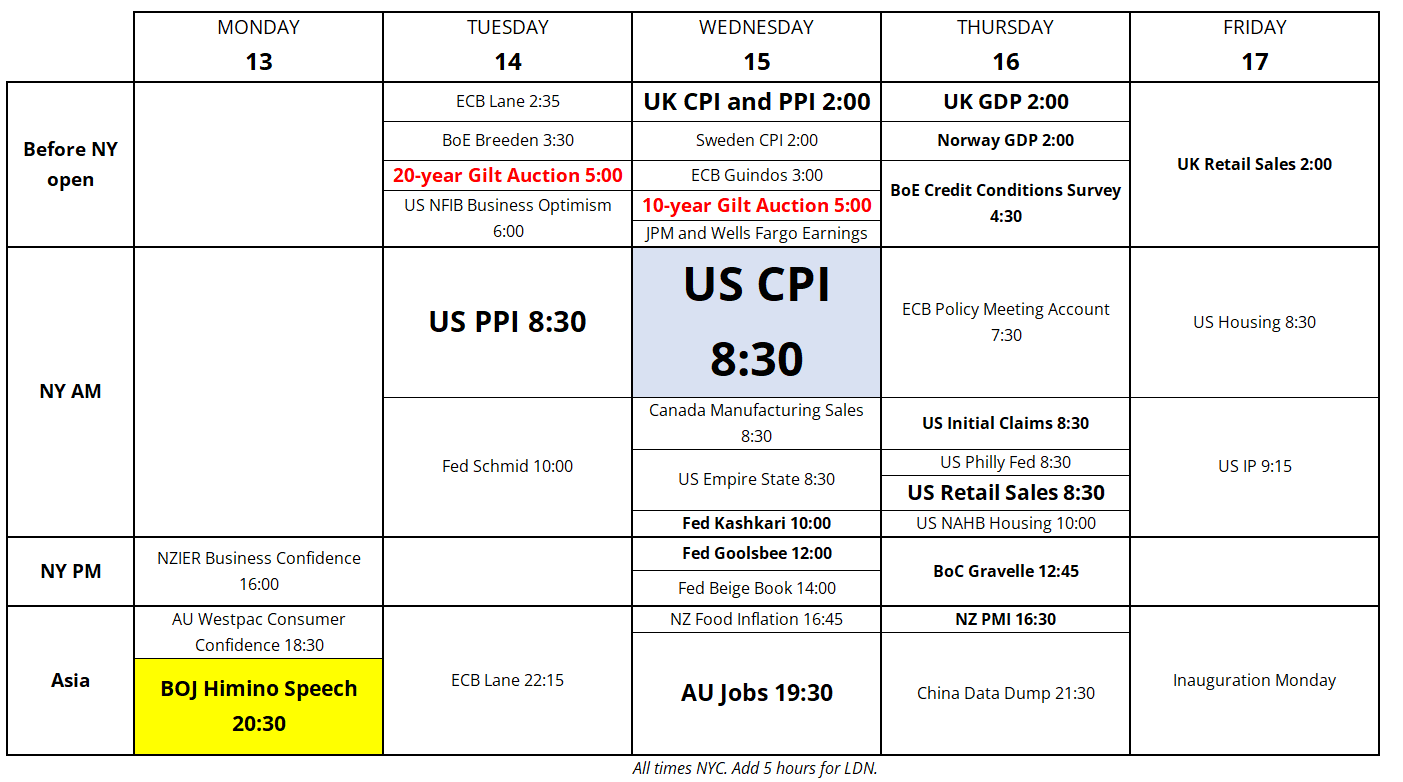

Next week’s calendar is lit. I would like to go over a couple of the big events here.

1. NZ data worth a watch even though nobody cares about it right now. The forward-looking stuff there actually points to a recovery coming.

2. BOJ’s Himino will deliver a speech to business leaders in Kanagawa at 10:30 a.m. local time Tuesday (10:30 p.m. Monday night NY) and hold a news conference from 2:00-2:30 p.m. local time. This could be big and market moving as Himino is a hawk and the wages data that came out this week easily justifies a hawkish stance and a rate hike at the January 23/24 meeting. There is a cohort in the market that believes that this speech was specifically scheduled to telegraph a rate hike and avoid market panic.

You can read a Bloomberg article about that theory right here. This could be a major event for global fixed income and the JPY. While BOJ policy isn’t the primary driver of the JPY (global yields are, in aggregate), the JPY tends to rip higher around BOJ hike talk. So there’s probably a trade there. As people become aware of this, the JPY might catch a bid either today or tomorrow.

I kind of buried the lede here because this is the most important part of am/FX today.

3. Gilt auctions will be in the spotlight next week given the vigilante revival in the UK.

4. CPI obviously big, though coming 5 or so days before the tariff news comes out, maybe not.

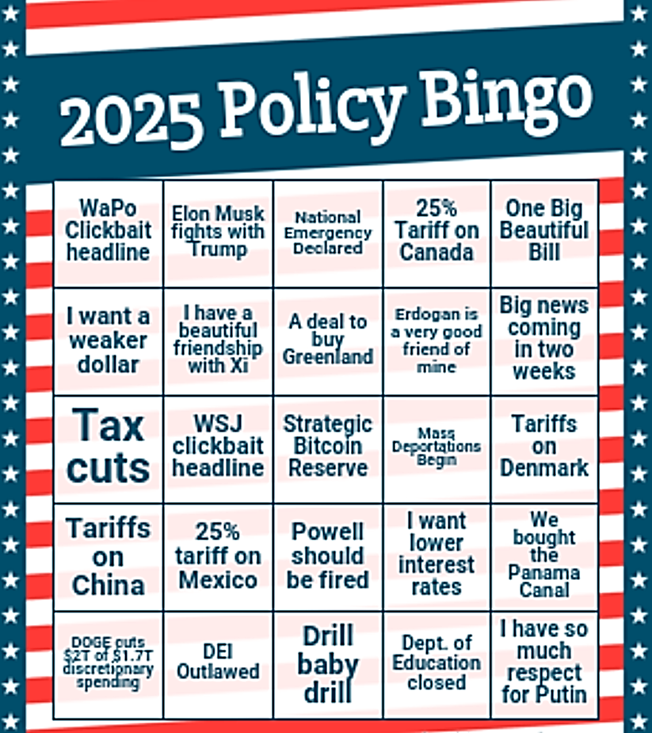

I hope this will help you track policy in 2025.

Have a safe weekend.