We are back to the “it’s coming in two weeks” nonsense of 2017/2018

This is the first ever photo (by humans) of the dark side of the moon (taken in 1959)

We are back to the “it’s coming in two weeks” nonsense of 2017/2018

This is the first ever photo (by humans) of the dark side of the moon (taken in 1959)

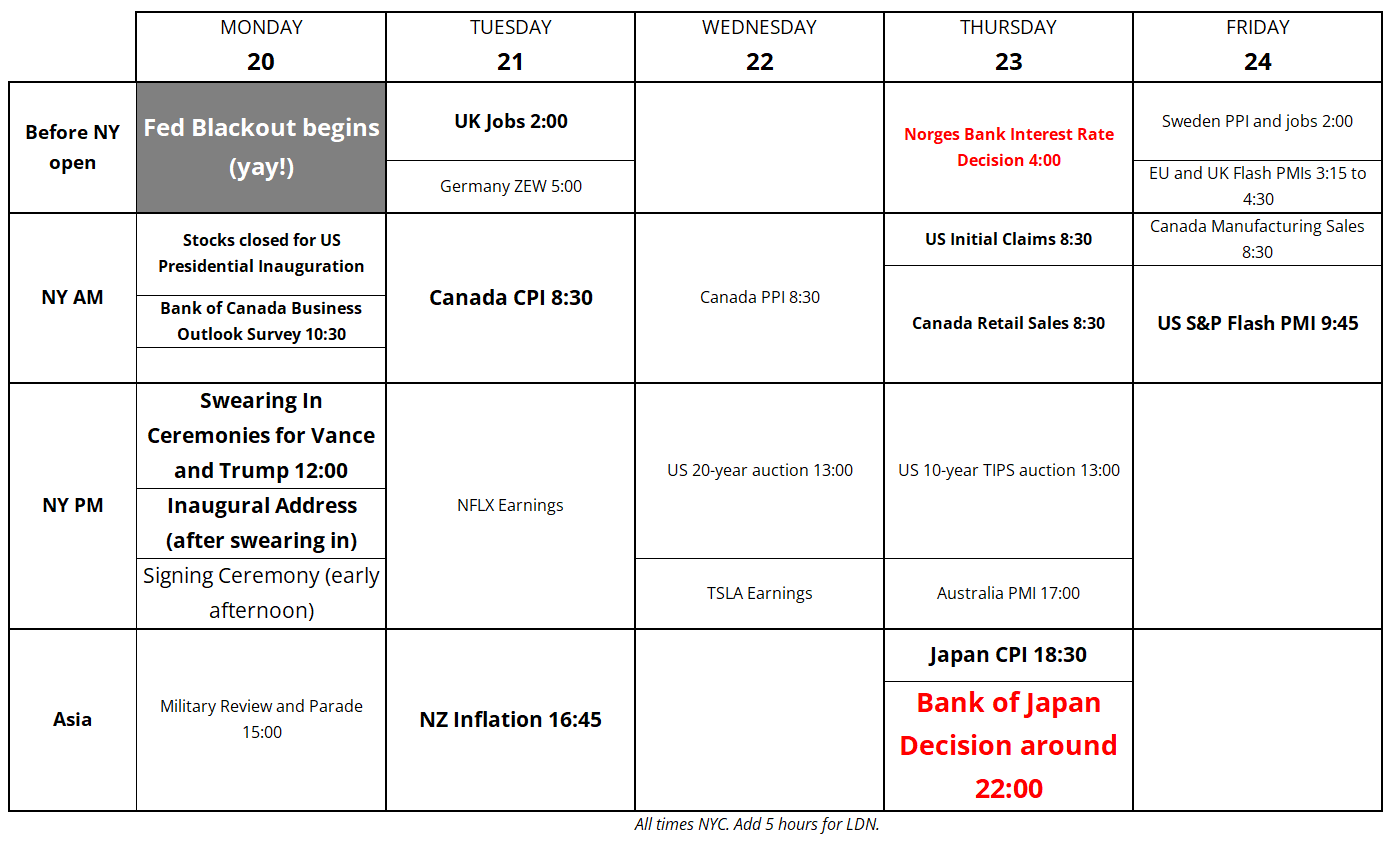

24JAN 158 EURJPY put

31bps off 160.30 spot

24JAN 21.10 USDMXN call

55bps off 20.80 spot

In hindsight, I am a bit embarrassed that I fell for the same shenanigans as 2017/2018 where all sorts of wild stuff was promised on Day One and nothing happened for more than a year other than a battle over Obamacare and some flight bans from Sudan. Trump now says a 25% tariff on Canada and Mexico is coming in two weeks, and anyone around in 2017/2018 will recognize this as the standard line in an ongoing comedy show. See this Bloomberg article, for a summary:

In Trump’s White House, Everything is Coming in Two Weeks

Excerpt:

President Donald Trump has a plan. It’ll be ready in two weeks. From overhauling the tax code to releasing an infrastructure package to making decisions on Nafta and the Paris climate agreement, Trump has a common refrain: A big announcement is coming in just “two weeks.” It rarely does.

Taxes (on Feb. 9): “We’re going to be announcing something I would say over the next two or three weeks.“

Wiretapping (March 4): “I think you’re going to find some very interesting items coming to the forefront over the next two weeks.”

Infrastructure (April 5): “We’re going to make an announcement in two weeks. It’s gonna be good.”

Infrastructure (April 29): “We’ve got the plan largely completed and we’ll be filing over the next two or three weeks — maybe sooner.”

Paris accord (April 29): “And I’ll be making a big decision on the Paris accord over the next two weeks.”

ISIS (May 21): “We’re going to be having a news conference in about two weeks to let everybody know how well we’re doing.”

The full article explains how not one of these initiatives came to pass in 2 weeks, and many never happened at all. So, fool me once but not twice, I suppose. I will exit the 1-month 1.4600 USDCAD call around flat P&L and leave the other two options to fester. Perhaps I get lucky with the BOJ and the EURJPY option, but the hike is fully priced now so it’s actually possible we get a dovish hike at this point.

While the looming threat of tariffs is still bad for Canada and will freeze investment for a bit, I’m not going to sit around waiting for actual tariffs at this point. A quote from GS:

By contrast, Trump’s comment that he might impose a 25% tariff on imports from Canada and Mexico starting Feb. 1 were more hawkish than expected. However, we note that in 2019 he also stated that he would impose a tariff of up to 25% on Mexico within 10 days but the tariff was never implemented. More recently, in November 2024 he pledged to “sign all necessary paperwork” to implement the tariff on Canada and Mexico on Inauguration Day, but did not do so.

It’s always a tough call whether to sell stubs in options, and often the best play is to simply hit a bid and move on. Not as much for financial reasons, but just to free up the mental capital so you’re not anchored on some stale position that might keep you from going the other way.

So, a more rational person might just sell the two 24JAN options and take the loss here, but there are enough Lazarus possibilities here with so much headline bingo. If USDMXN gets up towards 21.00 for some random reason, I will consider cutting the option.

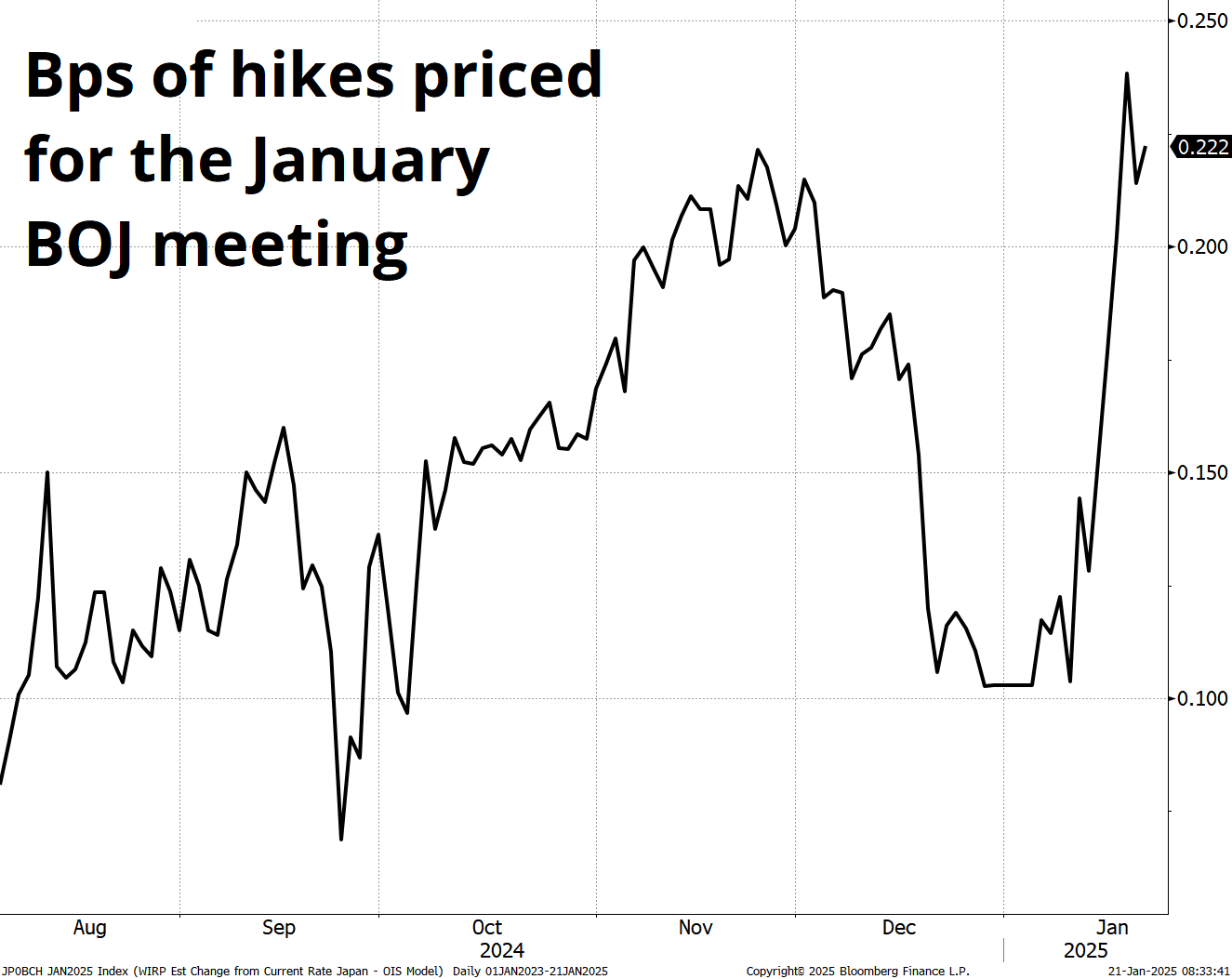

As mentioned earlier, the BOJ hike looks fully priced here with 22bps out of 25bps making this a done deal, pretty much. This creates the risk of a hike and disappointment trade as the BOJ might want to temper any risky asset freak out by implying they are getting closer to neutral. If neutral is around 0.75% or 1%, it would make sense for them to suggest that a jump from 25 to 50 is a big change in policy and further hikes could be smaller or delayed. Also note that the BOJ went 20bps in March 2024 and 15bps in July 2024, so there is no guarantee this hike needs to be 25bps.

They are trying to thread the needle and keep financial conditions loose without destroying the JPY. That’s tricky. It’s tricky to hike on time, to hike that prime rate right on time, it’s tricky. Trick, trick, tricky.

Yesterday came and went with no actual new information, which has pushed the dollar about 1% lower vs. many currencies. MXN, CAD, and JPY, the three most idiosyncratic stories, have suffered while turbo Europe plays like HUF, CZK, and SEK have rallied most. Most of this is mean reversion as the USD ripped against everything European late Friday and Trump has made no mention of Europe so far. Headline bingo will continue.

Positioning report tomorrow. Have a moonshot day.

https://moon.nasa.gov/resources/26/first-photo-of-the-lunar-farside/

This is the first ever photo (by humans) of the dark side of the moon.

In October of 1959, the Luna 3 spacecraft launched from the Baikonur Cosmodrome in Kazakhstan. Luna 3 was the third spacecraft to reach the Moon and the first to send back pictures of the Moon’s far side. The pictures were noisy and indistinct, but because the Moon always presents the same face to the Earth, they offered views of a part of the Moon that had never been seen before.