Quite a lot of weird stuff going on

Silver, inflation, OpenAI.com, +

Current Views

Flat

Silver

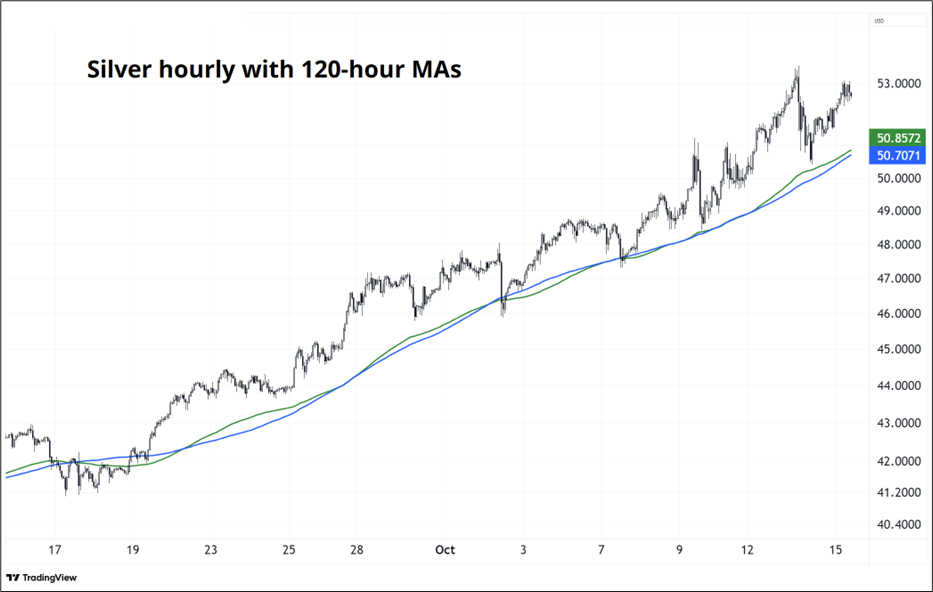

Apologies for the unscheduled off day yesterday; I missed an epic TACO trade as the MOFCOM stuff took a couple of days to get through to the US leadership and they responded Friday, then backtracked somewhat over the weekend. We continue to be in the throes of an epic momentum trade in silver, gold, and RGTI (to name a few), while crypto and AI stocks have lost their upward zip.

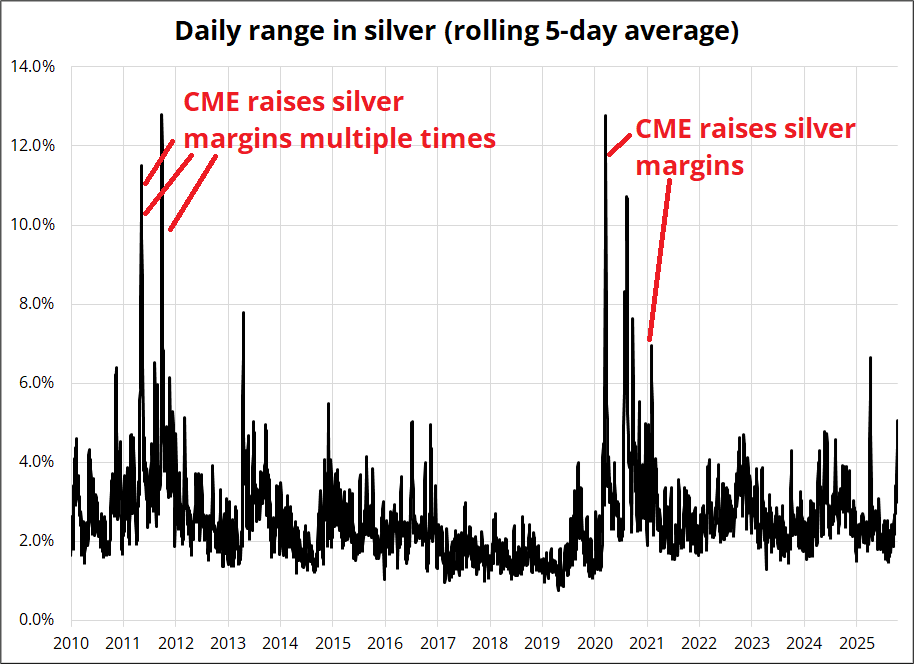

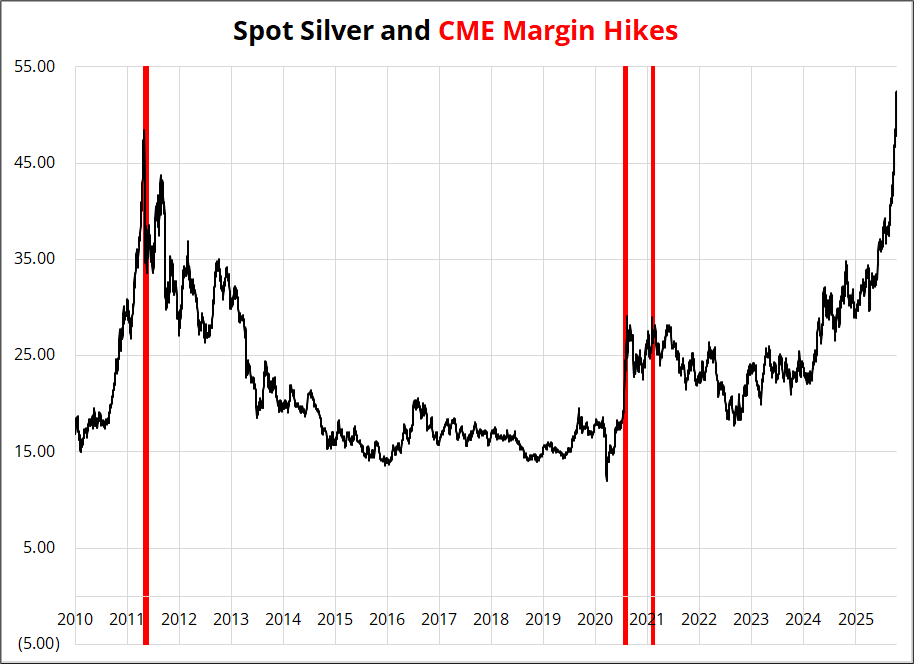

On silver, keep in mind that the CME raising margins was a huge contributor to the collapse in May 2011. CME margins are set based primarily on volatility, and while vol has picked up in recent days, it’s nowhere near levels where past margin hikes kicked in.

In the second chart, see how spot silver traded into and after the margin hikes.

For each contract (future or option), CME defines a set of risk scenarios (price moves + volatility moves) to simulate how the contract’s value would change. While the process is mostly systematic, they might see recent basis moves, vol jumps and physical shortages as problematic and thus forecast potentially higher vol in their stress scenarios.

I am not an expert on CME margins—this is just something to watch for because a hike in margins would probably scare the market, at least initially, given historical price action after margin hikes. It’s fair to say a good piece of this rally is speculative at this point as I don’t think economic or inflation fundamentals are as bad as 1980 or 2011, the prior silver peaks. Then again, maybe I’m wrong.

Speaking of inflation, we remain in the data blackout but can look at State Street’s PriceStats data for a clue. Their data, which correlates nicely with the BLS data overall, shows 42bps for Headline CPI in September and 32bps for Core. That’s consistent with economist estimates for the October 24 release of September CPI, where the median shows 0.4 and 0.3 respectively, with a skew towards weaker rather than stronger data.

Inflation pressure remains meaningful, but not problematic for a Fed that is on autopilot as the doves are in control for at least one or two more cuts. The YoY CPIs will both come in at 3.1% if these MoM forecasts are correct, with the Fed’s reaction function continuing to clearly show that 3% is the new 2% and after 55 straight months above 2%, there is no intent or desire to achieve the old 2% target.

OpenAI dotcom

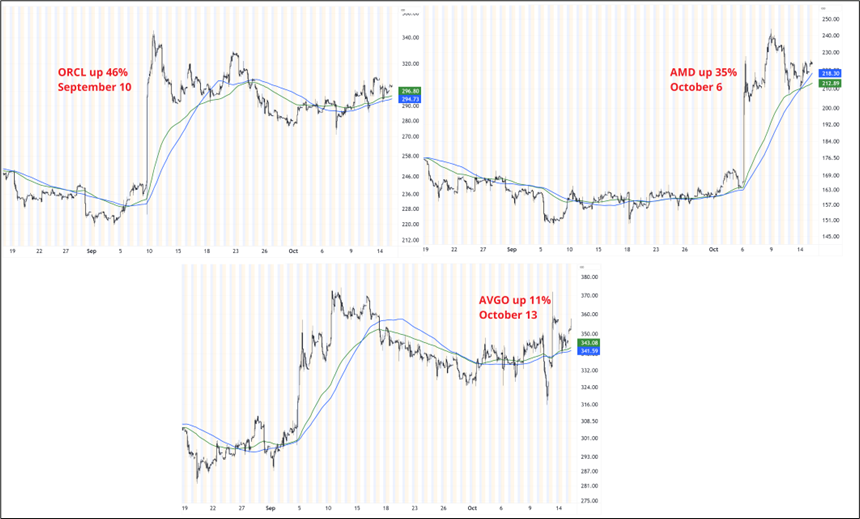

There is a healthy level of skepticism around the OpenAI deals and “I signed an MOU with OpenAI” has become the 2025 equivalent of 1999’s: “I added .com to my company name.” The market has hit diminishing returns on this narrative as you can see in these three charts that show price action after the three MOUs.

You could argue that AVGO ran into the Donald Trump 100% China tariff bluff redux woodchipper, but still.

Currencies

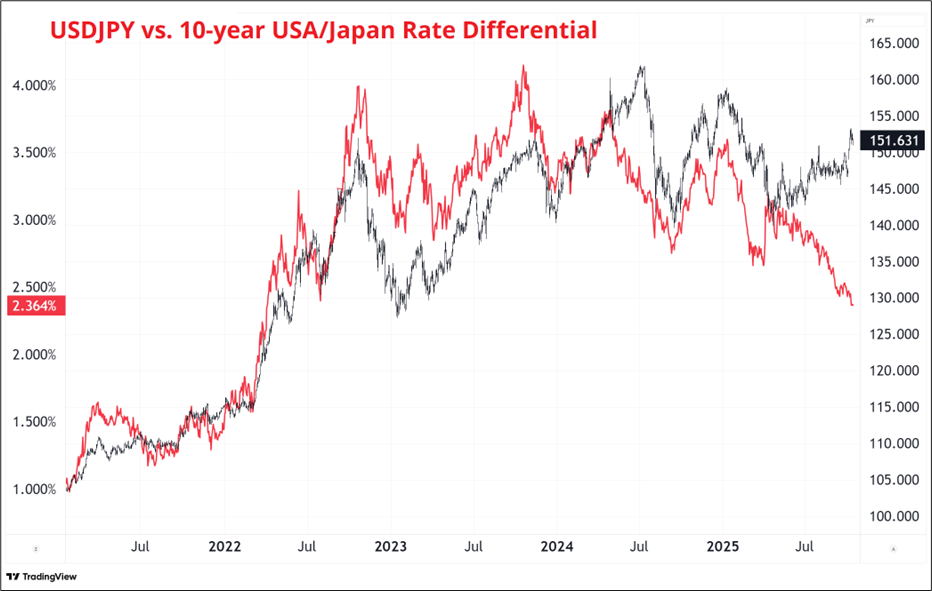

FX has taken a back seat of late as the market slowly unwinds or burns off USD shorts but remains unwilling to commit to USD longs. Price action in USDJPY has been zippy post-Takaichi, but most specs continue to have this chart burnt into their mind’s eye and thus refuse to commit to buying USDJPY. Most divergences like this do close via a sharp move in USDJPY, but these jaws have been widening for so long that it feels futile to play for the recoupling.

Long USJDPY is especially unexciting to anyone with more than a short-term outlook because it’s likely to be capped 157/160 as Takaichi continues to attempt a violation of the impossible trinity. Capital is flowing out of Japan via NISA while GPIF refuses to rotate to JGBs, monetary policy remains ultraloose with no hike favored by the new government, and the JPY must not be allowed to weaken dramatically. This is a difficult policy mix, and at some point, she’s going to need to choose. Capital needs to be repatriated, the BOJ needs to hike, or the JPY needs to weaken.

Throw in the back and forth on China (which I refuse to handicap at this point), a US government shutdown, and some concerning (but possibly idiosyncratic) credit events… And USDJPY has no clear direction in my book.

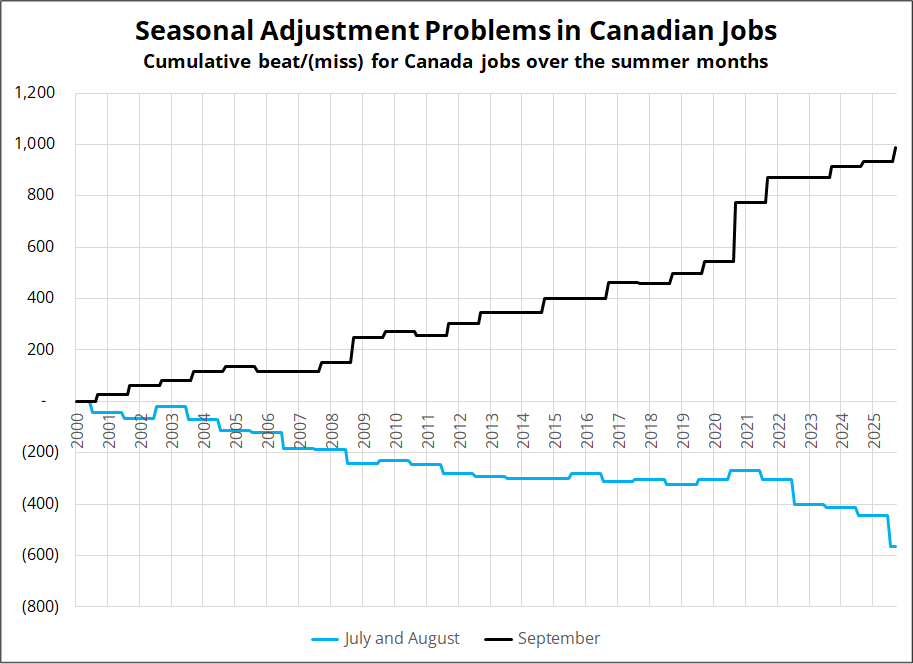

I still like a weaker CAD, despite Friday’s stonking jobs number, as September jobs data in Canada tends to have a ton of seasonal adjustment issues. StatsCan doesn’t adjust properly for the movement of teachers in and out of the workforce. 23 of the past 26 September jobs releases have been strong.

Here’s a chart showing the cumulative miss of July and August vs. September, back to 2000.

Vol-adjusted, I think USDCAD remains the best USD long.

Final Thoughts

- I can’t seem to find a straight answer on Retail Sales and PPI this week, but as far as I understand, they are postponed. This article from September 30th is the best source I could find. If you have a more definitive answer, I would appreciate it. I can’t see why those figures would be released.

- The silver 25-delta risky got back to levels where it topped in the past. At the risk of being annoying, I still think this is a bubblette and we see 46 before 56. The 5-day MAs come in around 50.70/50.85, so that’s the zone to watch if you are assessing its short-term trend.

Have a cracker of a day.

In case you missed it.

The Cracker Barrel “outrage” was almost certainly driven by bots.

It never did make sense. Now it does.

One more reason to stay off social media. It’s not even humans on there much of the time.