Back in the USA

I am back from two weeks in Brazil and Canada and there is too much to share in one piece. I will cover G10 today and then discuss everything about Brazil in a separate piece tomorrow. I learned a ton about the domestic story in Brazil, and I think much of it is important, but none of it is time sensitive.

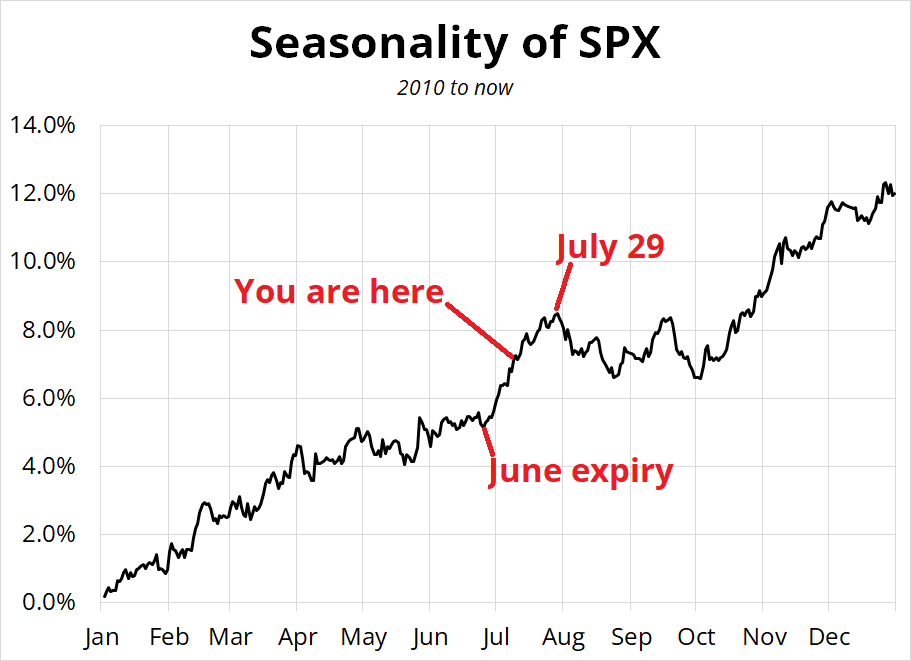

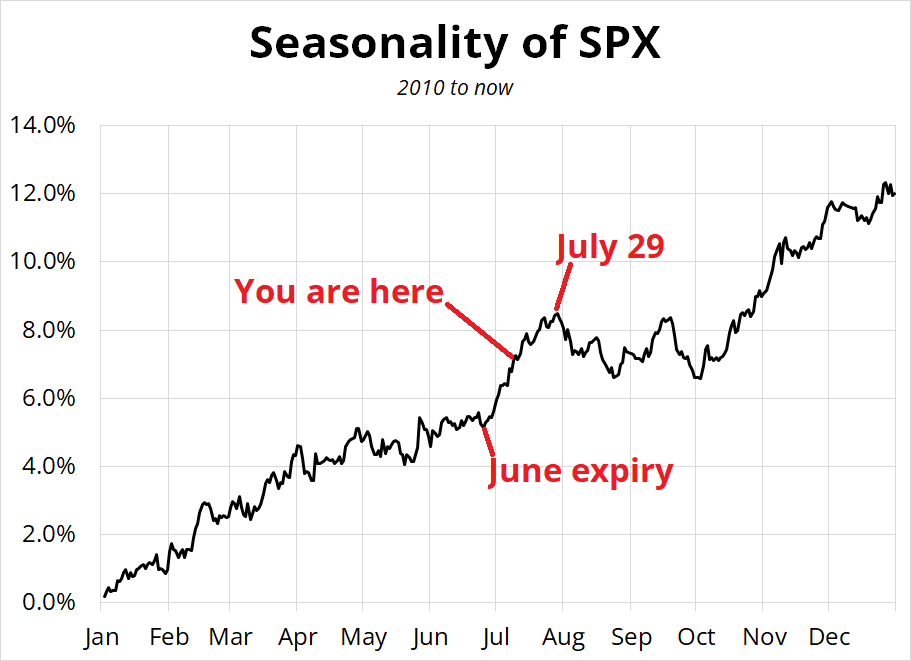

Stocks have done their usual seasonal move post-June expiry, extending higher on a splattering of policy and economic news that looks mixed and continues to argue for the transition from “3/3/3 and DOGE cuts” to Lyn Alden’s “Nothing stops this train.” The oft-disproven but always popular idea that tax cuts will pay for themselves and the economy will grow out of huge deficits is the justification for moar stimulus in year four of the US economic expansion.

Much as the market became convinced that the size of the Fed’s balance sheet was the only thing that mattered for stocks after QE, the market is now convinced that the size of the budget deficit is the only thing that matters for the economy and for US stocks. The Fed’s Balance sheet peaked in early 2022, and the market eventually shrugged off that univariate explanation as stocks powered onward and upward. As we approach the peak of the bullish equity seasonal, I guess we’ll see how long the deficits are bullish for stocks and gold and bitcoin train can keep choo chooing. Single variable explanations for financial market direction are inherently sus and one should be skeptical of any framework that reduces such a complex system down to one indicator. If only it were that easy.

Six big themes emerged from my trip:

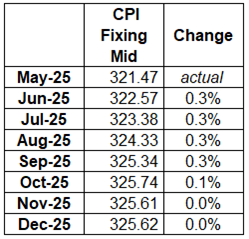

- Show me the data. Nobody cares about policy headlines anymore. The transmission from policy to hard data is all that matters. Next week’s CPI is big.

- Will the structural sell USD theme get a lift from the cyclical side? The US cyclical story refuses to play ball. AI spending remains yuge and hard data holds.

- Will Aussie superfunds hedge? AUD hasn’t received the pension fund support seen in EUR and CAD.

- Can Tarcisio be Brazil’s Milei? Finance types love Tarcisio as a sort of pragmatic Milei who is “more normal”. But the election is a long way off.

- The market is universally (but modestly) positioned short USD and long carry. Punters want a new catalyst.

- Oil supply could push crude towards $40.

What does everyone think?

You would be hard pressed to find a time when everyone in the market was more in synch with the same view on FX. We met around 50 PMs at 15 firms in Brazil and pretty much to a man the view and positioning is:

- Bearish USD

- 25% of max risk

- Long a basket of EUR, JPY, AUD, BRL, and ZAR.

This uniformity of views and exposure is a slight exaggeration, but barely. I would say this tracks perfectly with US and UK hedge fund views and positioning, too. People are willing to ask what might cause the USD to rebound, but nobody is willing to bet on its reversal. While I am sympathetic to the USD down view and believe in the structural USD-bearish story, every cell in my body is telling me that the risk is 1.14 in EURUSD before 1.21. The structural view has been known for a while, the USD hedgers have been active for months, and we are in a new month, quarter, and half of the year. Many hedgers target the end of a period to get their hedging windows properly dressed, so it’s not a sure thing the USD selling from hedgers remains robust.

Meanwhile, the cyclical story refuses to help the USD bears much as the AI narrative remains zippy, US jobs growth is meh but not terrible, US bond market vigilantes lack vim, and it’s too early to say that the US has dodged the inflation resurgence bullet. Waller and Bowman have broken from the pack, but the zero-dotters aren’t going to join the two-dotters with the UR at 4.1% and peak inflation still months away.

Going through the currencies one by one:

- EURUSD. Strong structural story with pension funds steadily increasing USD hedges after reducing some equity overweights in April. The ECB, which normally would be pushing back on EUR strength, has endorsed EUR as a substitute for the USD (see Lagarde’s speech, etc.) The cyclical story is okay, with ECB on hold, and the Fed looking to cut (maybe?). Most punters have 1.20 or 1.22 as their target, and we have just gone from 1.05 to 1.18, so it’s extremely difficult to engage in a meaningful way up here.

- USDJPY. Structural story has been a massive disappointment as GPIF and friends refuse to rotate meaningfully out of US bonds and into JGBs. Rate differentials make USDJPY an expensive short and the cyclical story has also been a massive disappointment as the BOJ remains aggressively unorthodox, pinning the real policy rate somewhere around negative 3% while the US real policy rate is closer to +2%. I don’t see any reason to keep long JPY as part of a short USD basket. The trade was tried, and it failed. The structural and cyclical legs both stink.

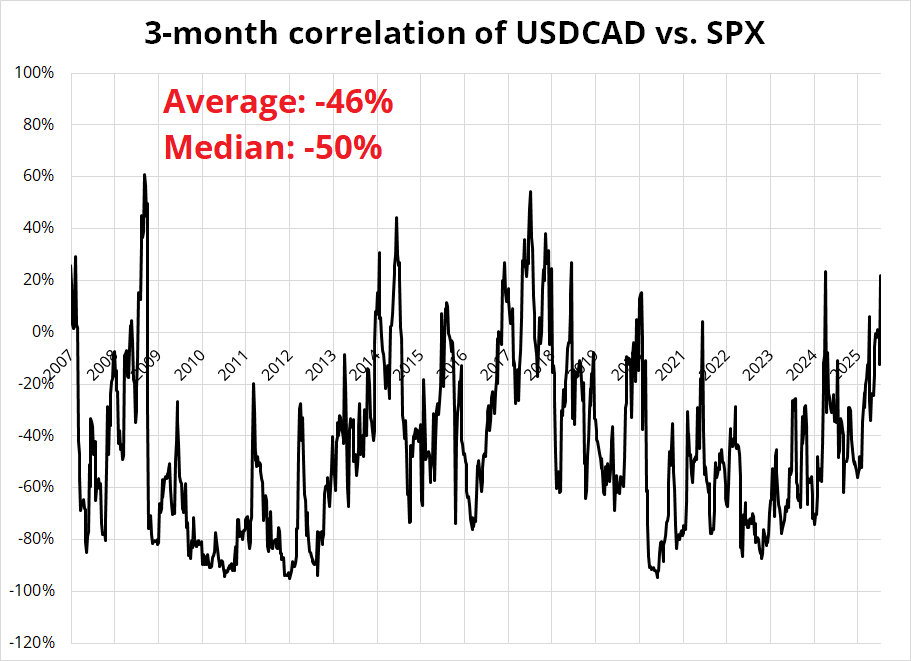

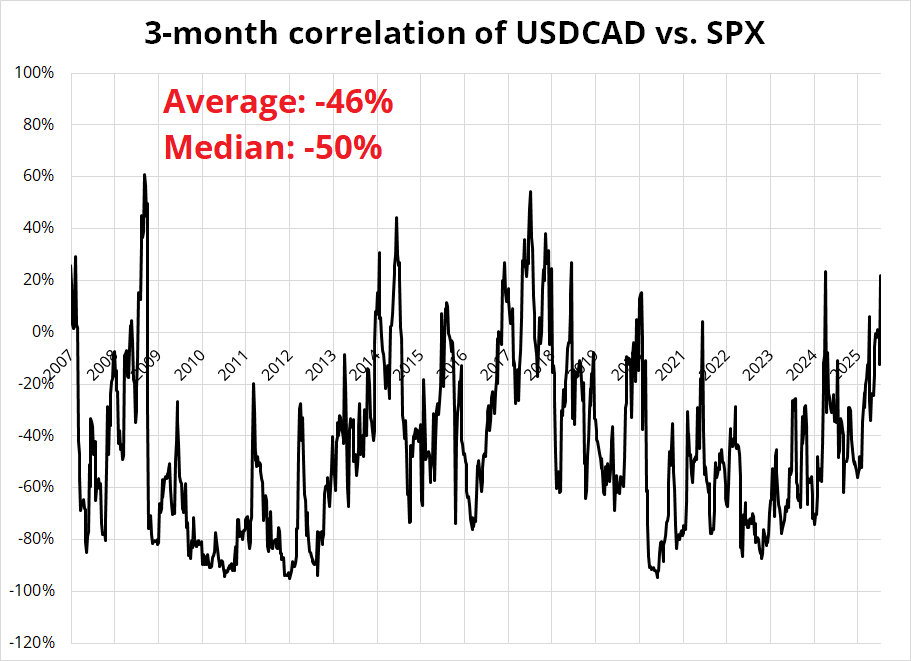

- USDCAD. Good structural story as pension funds rush to get to benchmark weight in US equities and add USD hedges. The cool kids were all unhedged in Canada post-2011 or so as the view was that USDCAD goes up when US equities go down and so correlation offered a natural hedge. That is no longer true. You can see in the chart that the USDCAD vs. SPX correlation was mostly negative over the past 15 years and while there were some temporary spikes above zero, Canadian pension funds are now taking the view that the current move higher will be more of a permanent shift towards positive correlation.

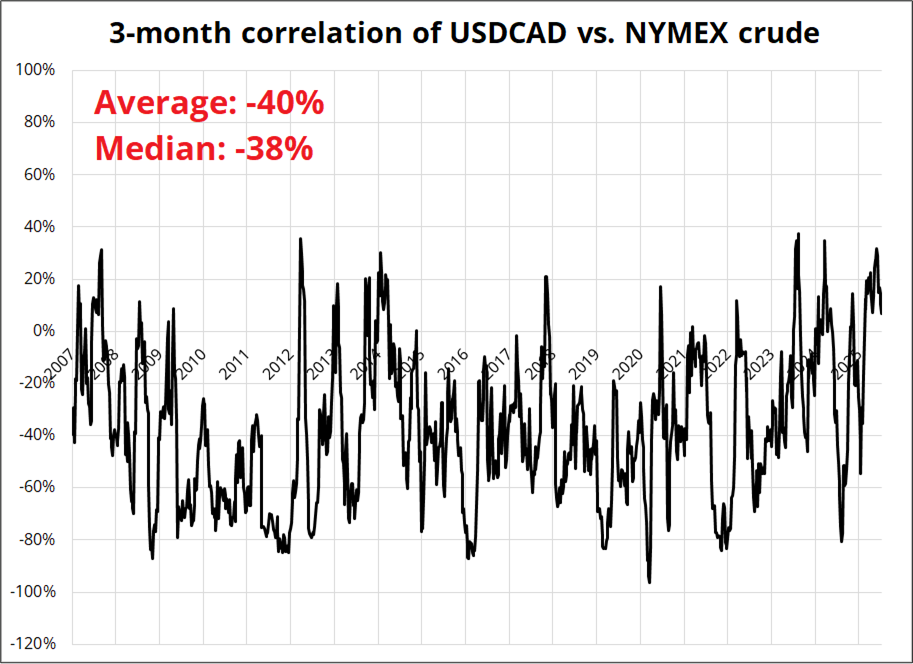

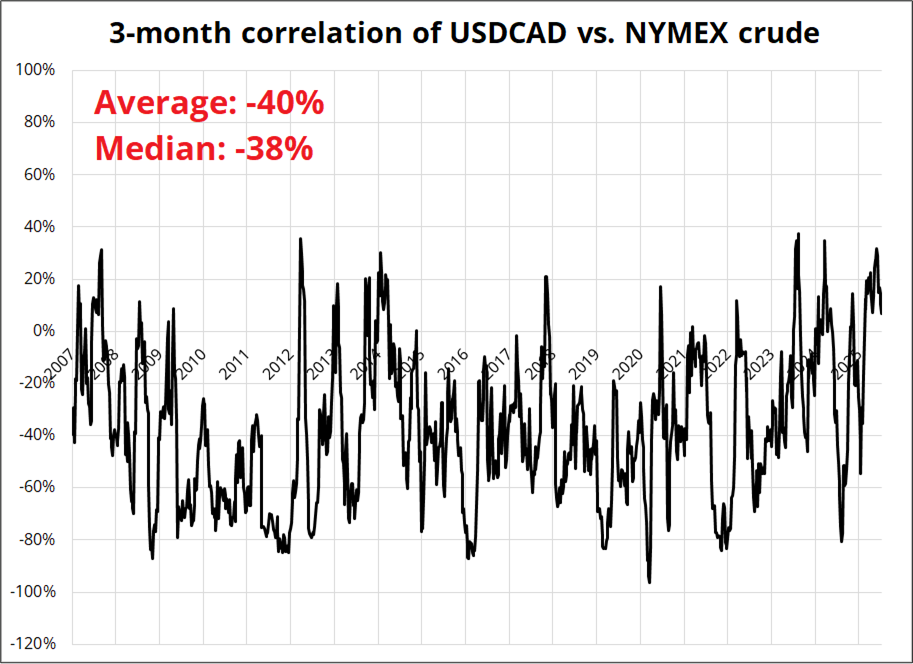

Furthermore, the other reason Canadians used to believe that currency hedging was pointless was the correlation between CAD and commodity prices. Here’s a short bit from Canada Pension Plan’s 2013 Annual Report: “There is no compelling reason to hedge equity-related currency exposure. Hedging would unduly tie Fund returns to the price of oil and other commodities as they drive the foreign exchange value of the Canadian dollar.” Again, this correlation might be gonzo.

The change in Canadians’ views of USDCAD correlation necessitate a change in hedging behavior and they move as a pack. If USDCAD is positively correlated to US equities and commodity prices, and you’re a Canadian pension fund, you might want to hedge some of your foreign equity holdings. Hedging decisions take time and the hedges are huge. So, this theme can continue for a long time, especially if central banks are also selling USDCAD, buying EURUSD, etc. Higher inflation in Canada has kept the market from pricing more cuts from the BoC and that has also helped CAD at the margin.

- In contrast to CAD, nothing has gone right for AUDUSD. The superfund hedging has not yet started, the RBA has been dovish, and the long-awaited rebound in China just never materializes. As such, AUD has been a disappointment month after month after month. Running huge US equity longs with sub-30% hedge ratios has been a dream trade for Australia superfunds for the better part of 15 years, but they might start to reconsider this going forward. A 10% increase in hedges could yield more than 100 billion of AUDUSD buying, but it remains to be seen whether Aussie supers will hedge. Keep an eye on flows, superfund manager commentary, and price action around 11 a.m. to see if hedge ratios change.

- Finally, the story for EM carry has been goldilocks as volatility falls, the US remains in a soft landing, global yields have stabilized, and carry remains juicy, particularly in BRL and ZAR. The view on CNH is that it’s pegged and the PBOC, which has vocally been targeting stability, won the war.

The bottom line is that the market is universally (but not heavily) positioned short dollars. The entry points at 1.1740 EURUSD and 1.3640 USDCAD are challenging. The structural flows have helped the EUR and CAD longs, while leaving the AUD and JPY longs in the lurch. Going forward, the question is whether a significant portion of the equity hedging and reserve diversification is done, or maybe there is much more to come. It would be reasonable to guess that Australian supers will show up at some point, while European and Canadian hedgers will continue to sell USD rallies and Japanese rotations and hedging might never happen.

USDJPY is a recession trade only, not a soft-landing trade, as the BOJ remains wildly dovish relative to peers and the JPY still has some relationship to interest rate differentials, equities and VIX. JPY positioning also makes the long JPY trade unattractive. EM remains appealing, but moderately crowded.

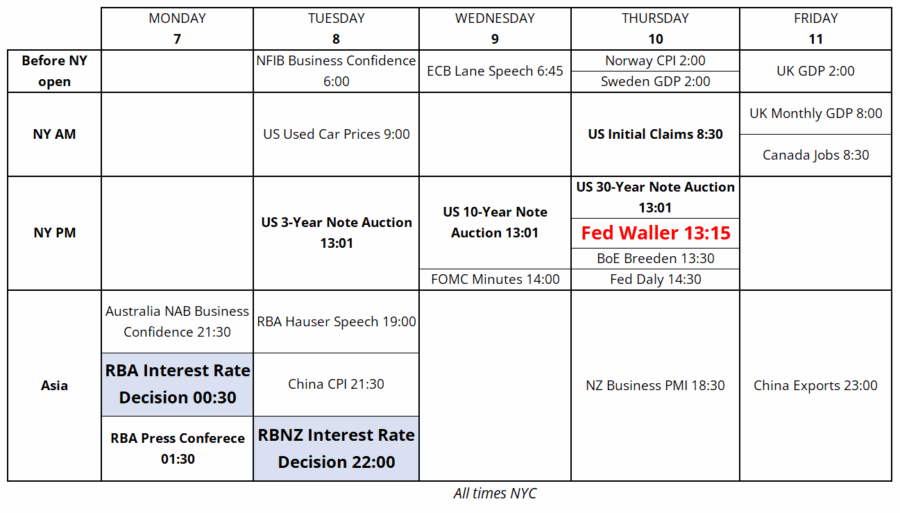

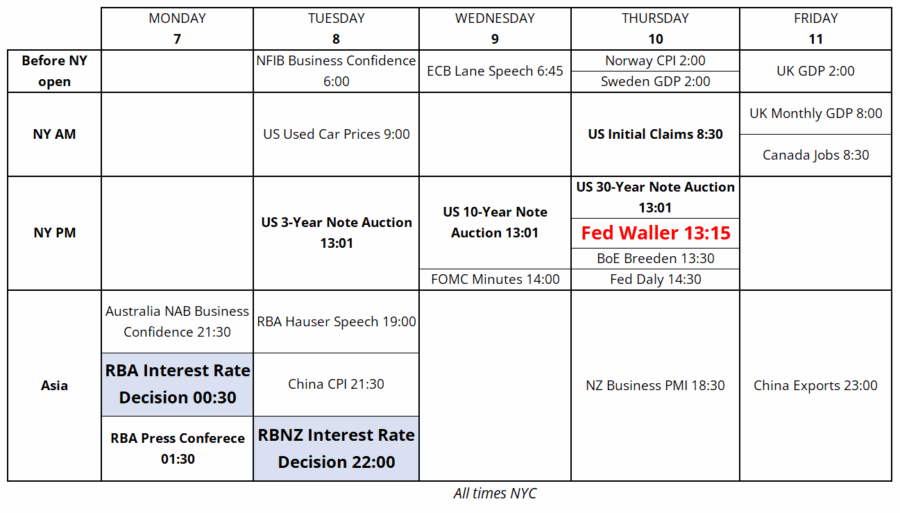

This week has little to offer on the US data front (see calendar further down), so next week’s CPI is the focus. We need to figure out whether the US remains in its years-long soft landing, or whether we are mid-transition towards a) tariff-induced stagflation, b) recession, or c) a reacceleration out of a miniature soft patch. All three look possible/reasonable. It appeared for a moment that a July Fed cut might be a thing, but now it seems not even a September cut is a fully done deal.

Other views out of Brazil

Like I said, I’ll discuss BRL and the domestic view on Brazil tomorrow, but here a few other non-BRL takeaways from the trip.

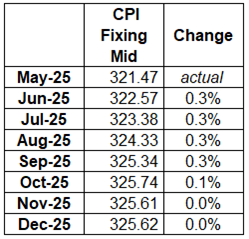

- The market is done trading policy headlines. Beta to policy uncertainty has collapsed as the market no longer takes US policy threats seriously given the TACO narrative and the highly uncertain transmission from nebulous policy to real world economics. Instead of reacting to mercurial policy shifts, the market has decided to wait for the hard data. And the hard data has been fine despite a worrying collapse in soft data during Q2. The idea that we have a clue what tariffs are going to do to the real economy after a month of hard data is silly. We need more data. This is especially true on the inflation front as the combination of higher tariffs and a falling dollar is unusual and potentially rather inflationary. CPI fixings show we are just about to enter the hot zone.

- Short oil, target $40 is popular. The supply/demand dynamic post-summer looks bearish to most of the punters in Brazil and most are short oil.

- Bullish the US AI theme and bullish TSMC were popular trades.

- Not much appetite for MXN. Despite a strong performance, there isn’t much love for MXN given concerns about remittances, the US labor market, dovish Banxico, and lowish real yields.

- Hard to be short equities with US deficits ramping up and no foreseeable peak in AI spending.

Final Thoughts (pop culture)

If you lived in New York City in the 1990s, there is an interesting double play in the book market right now with Keith McNally and Graydon Carter’s books both recently released. McNally started all the cool restaurants in NYC in the 1990s (Balthazar, Pastis, Nell’s, Odeon, etc.) and Graydon Carter was the editor of Vanity Fair. Coincidentally, Carter’s best friend is Brian McNally, Keith’s brother.

I usually read one book on paper and have one audiobook running at the same time and reading these two books at the same time was cool as they both cover some overlapping timelines, topics, and characters. Much of the pleasure came from nostalgia, so I mostly recommend these books if you lived in NYC between 1990 and 2003.

The F1 movie was pretty much exactly as expected, but one standout was the very end, when Brad Pitt goes into the zone as he completes the final lap of his final F1 race. The depiction of the zone was perfect and captured exactly how I feel when I am trading in the zone. Cool.

My hotel room at the Fasano São Paulo was one of the nicest rooms I have ever stayed in. Strong recommend!

Thanks for reading. I am happy to be back. Enjoy your July.

Trading calendar for the week of July 7, 2025