New Year momentum trades often lose their mojo around mid-February.

Six Weeks

Current Views

Short gold at 2945

Stop loss 3011

Take profit 2805

Momentum Risk

There is a phenomenon I have seen year after year and backtested multiple times where the most popular new year trades tend to run out of gas around week 6. This happens because new money floods into the market on January 1 and that money is logically deployed in the trades that look most attractive. And huge passive flows at the start of the year boost liquidity and all asset prices. Then, around mid-February, the liquidity surge dries up, stocks and gold underperform for a few weeks, and the most popular momo trades reverse.

We are starting to see that with PLTR and WMT in the last 24 hours and I suspect you can go down the list of what’s hot and wonder if those trades are next. Gold, European equities, and long rest of world / underweight USA come to mind. Gold is particularly interesting as Bessent quashed the Gillian Tett gold revaluation meme with a clear statement today:

*BESSENT: REVALUING GOLD RESERVES ‘NOT WHAT I HAD IN MIND’

A big part of the bullish gold thesis was out of control government spending and it’s hard to argue that is still a valid theme in the US. Even if the G and the E in DOGE probably stand for “Gross Exaggeration,” Hegseth’s comments on defense show that even the sacred cows like Defense, Medicare, and Social Security could be on the table for cuts. Short gold with a stop at 3011 and take profit at 2805 makes sense to me as momentum trades reverse, the reval story looks midwit, and US deficits are less obviously going to balloon going forward.

JPY

Some are speculating that the zippy JPY move has been accelerated by final purging of Mexican and other foreign bonds by Norinchukin after they fired their CEO.

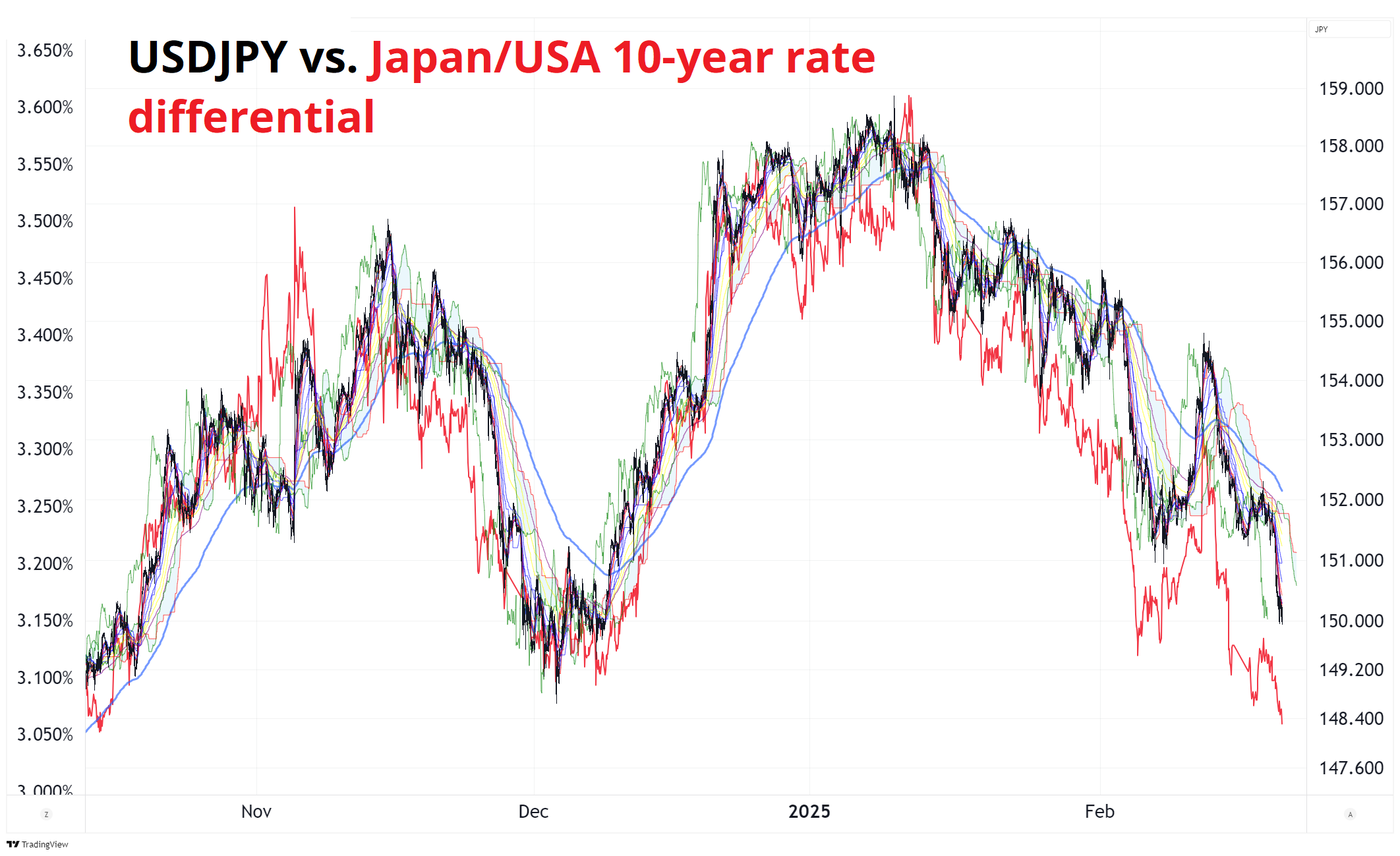

Those flows may be an accelerant, but USDJPY isn’t doing anything all that strange; it’s closely following interest rate differentials. JGB yields continue to fly, up 13 of the last 16 days, even as US yields flatline.

US yields are hemmed in by a combination of simmering inflation issues as non-oil commodity prices rip higher and worries about US-centric slowing triggered by rapid axing of government jobs. When will the decimation of DC show up in the economic data?

Linguistic note: I am using “decimate” here to mean the culling of one out of ten (the old school usage) but it’s fine to use “decimate” to simply mean “destroy or devastate.” Here’s a great writeup on why and how the usage of decimate has evolved and why that’s OK: Merriam-Webster: Regarding the Incorrect Use of Decimate.

According to this AP article, at least 220,000 probationary employees are at risk and one would presume that all DC contractors, companies reliant on government spending, and US defense companies have implemented hiring freezes. The destruction of PLTR stock yesterday was partly attributed to Hegseth’s 8% defense cuts comment and the collateral damage is widening.

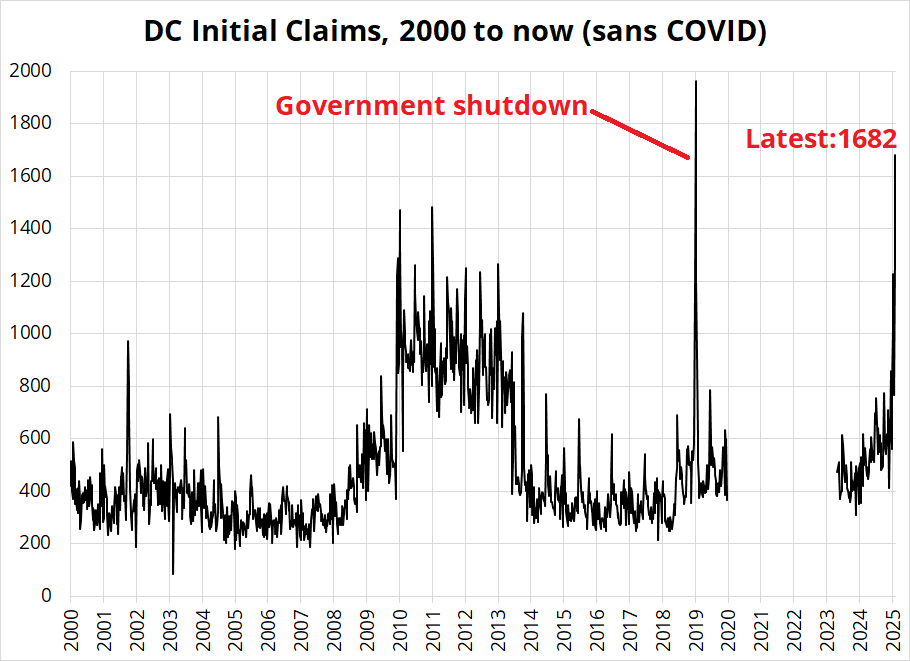

It’s hard to wargame how these cuts will flow through to the economic data because when people get fired, there is often a lag before they show up in the data. Not everyone leaves immediately and not everyone files for Unemployment Insurance right away. Here’s Initial Claims for Washington, DC, with the COVID period (2020 to 2022) cut out to avoid y-axis dilation.

We are already rising fast and this thing has barely started. HT to the Bose Stereos for this idea. His point to me was that the government job cut headlines will only be the tip of the iceberg because there are so many private and public companies and contractors plugged into DC’s Hobbesian Leviathan.

Dispersion of Commodities

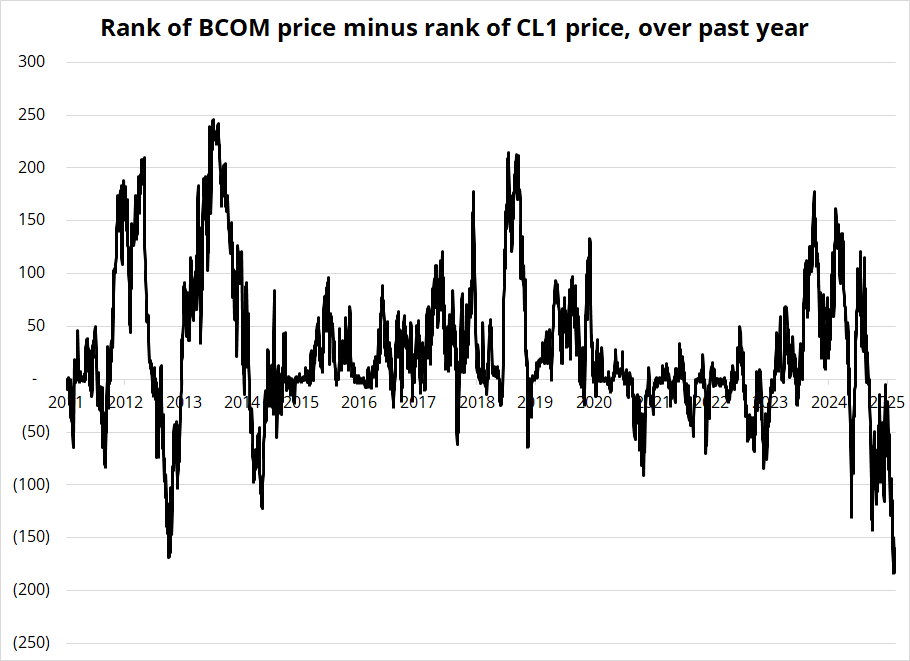

Brad pointed out yesterday that BCOM is ripping without the help of oil, a situation rarely seen. I will write more about this tomorrow, but check this out for now. The chart takes the rank of where BCOM is over the past year and subtracts the rank of where the price of oil is. Right now BCOM is 1 (highest price in the past year) while oil is 161. That is unusual! What are the forward-looking implications? Tune in tomorrow to find out.

Final Thoughts

WMT TWAP cracked.

MSTR struggling a bit to raise. The flywheel is starting to clatter and slow down a bit. Caution on BTC longs.

Have an intergalactic day.