The US economy lands softly as Trelon explodes.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

The US economy lands softly as Trelon explodes.

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

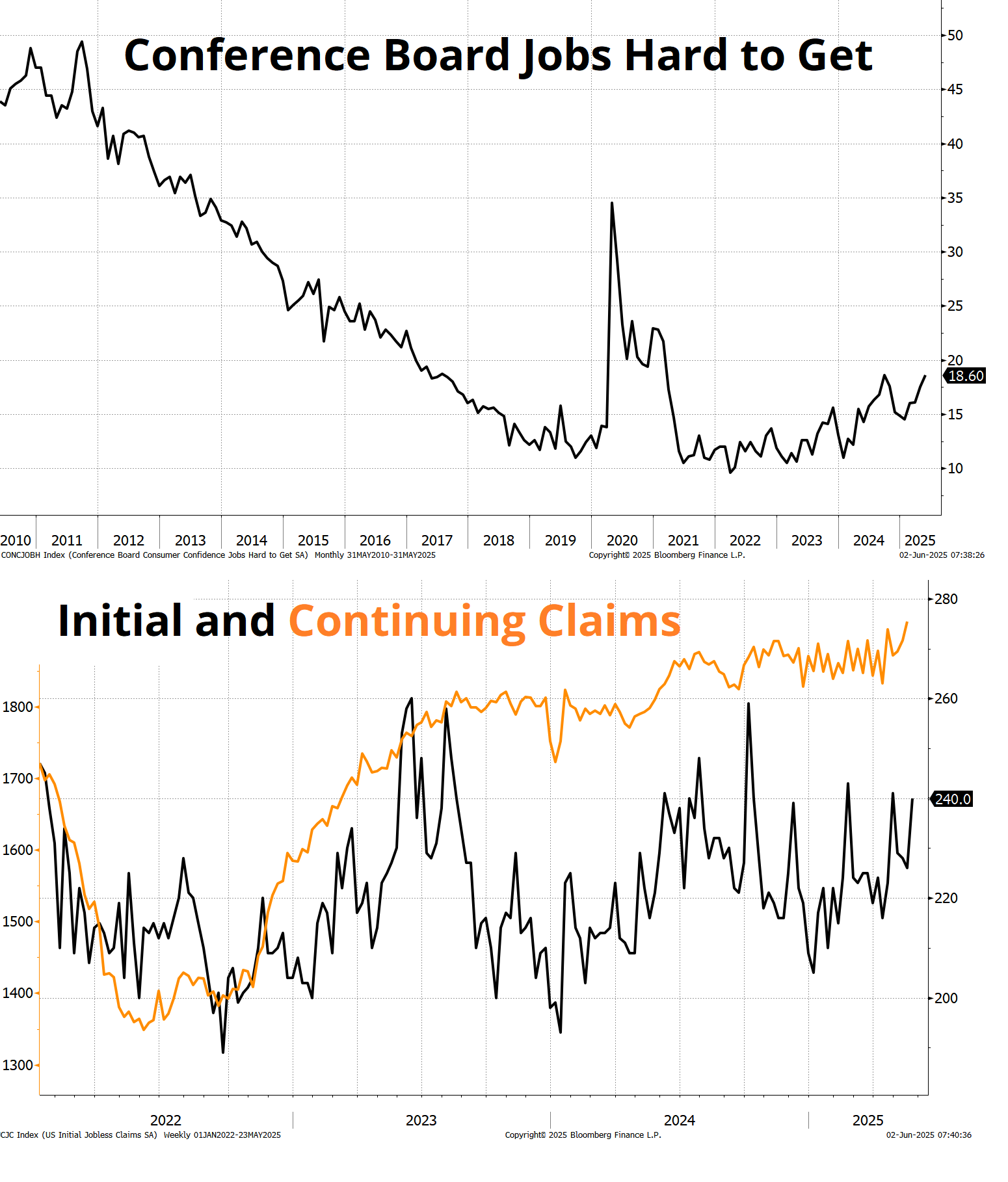

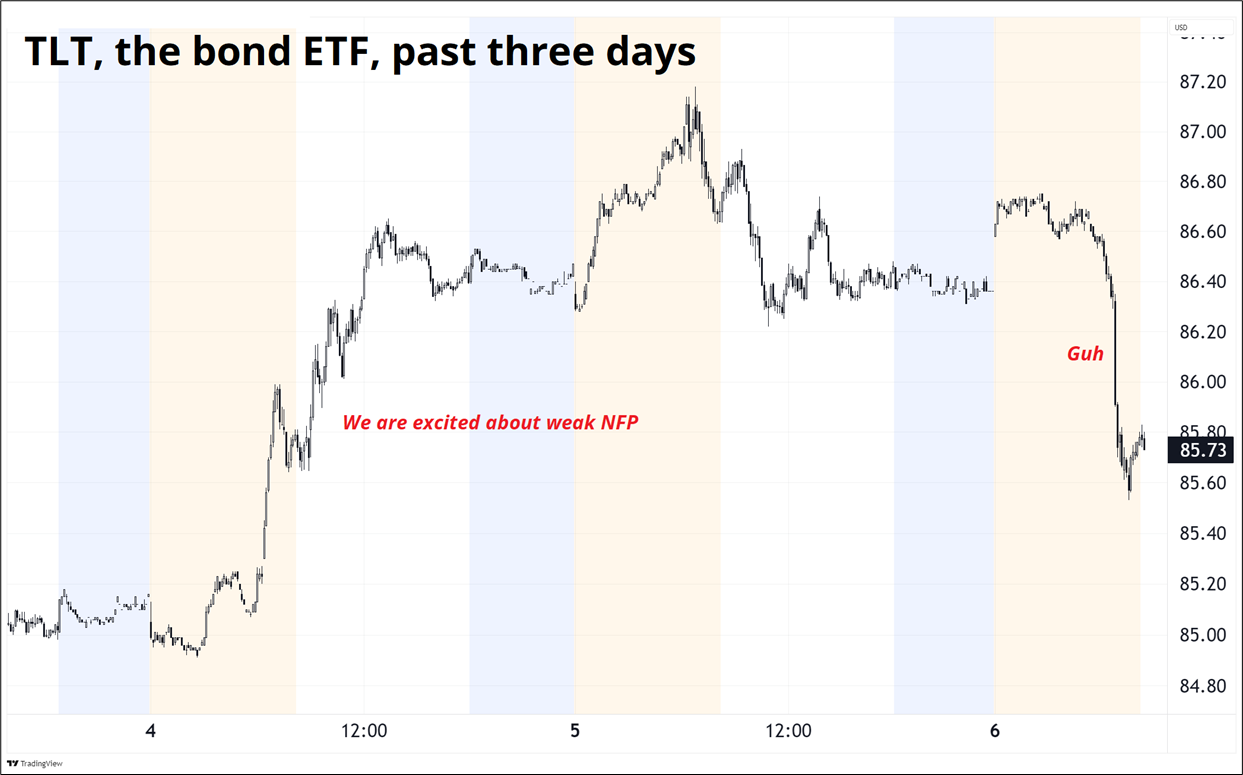

I apologize for the lack of Friday Speedruns over the past few weeks—I have been travelling three of the last three Fridays. Now, I am back. I spent this whole week getting lathered up over a weak nonfarm payrolls release as Conference Board and Initial Claims data point to weak jobs growth…

… But the nonfarm payrolls release itself came in on the screws and I, like others, gave back all my profits in bonds.

So, while the US jobs market shows cracks, it hasn’t cracked. And we wait. The dates on the calendar now are:

The China / US story has devolved into something similar to 2017 where both sides say stuff and nothing really happens and strike/counterstrike and hot air and nobody cares after a while. The trade deals they sign are not credible, China does not buy the prescribed soybeans, everyone tweets and gets mad, and the world moves on. The question is simply whether the higher tariffs on China matter, or we skate through like we did in 2018/2019. The long, slow decoupling continues.

And while it’s fun to try to time the rollover in the US labor market and/or oncoming recession, it’s always worth remembering that this is a perennial sport and we really have not had a true recession since 2008. Yet every year there is good reason to be skeptical of the permanently-growing US economy. For example, here are the concerns looking back. All of them seemed reasonable, as does the current fear of trade wars and max policy uncertainty.

2010

Premature withdrawal of stimulus measures.

2011

European debt crisis.

2012

US Fiscal cliff, Eurozone Crisis, EU recession.

2013

Fed tapering of QE. Taper tantrum.

2014

Geopolitical tensions, Russia takes Crimea, China slowdown, slowing global growth.

2015

China deval, Strong dollar, weak global demand.

2016

Oil collapse and global economic uncertainty.

2017

Ageing economic expansion and potential asset bubbles.

2018

Trump Trade War 1.0, rising interest rates, restrictive Fed.

2019

Inverted yield curve and global manufacturing slowdown.

2020

COVID-19 pandemic. We did have a hyperquick recession, depending on how you measure things.

2021

Supply chain disruptions and inflation. As economies reopened, supply chain bottlenecks and rising prices led to concerns about sustained inflation potentially triggering a recession.

2022

Aggressive monetary tightening to combat inflation. Global central banks raised interest rates to address high inflation, sparking fears of a policy-induced recession. Disruptoooors blowing up.

2023

High interest rates, Silvergate banking “crisis”, and inverted yield curve. Maturity walls.

2024

Sahm Rule triggered in July, persistent inflation, and geopolitical uncertainties.

2025

Trade war, DeepSeek = Peak Capex, geopolitics, high rates, and record policy uncertainty.

Looking forward, you can argue that the deficit story could come back to the fore if the Big Beautiful Bill passes, but legislative momentum there is not strong and the optimistic date for that is July 4.

You can argue that trade deals are coming before July 9, but they are mostly going to be thin on details and big on hype and so the market will probably not react much to those.

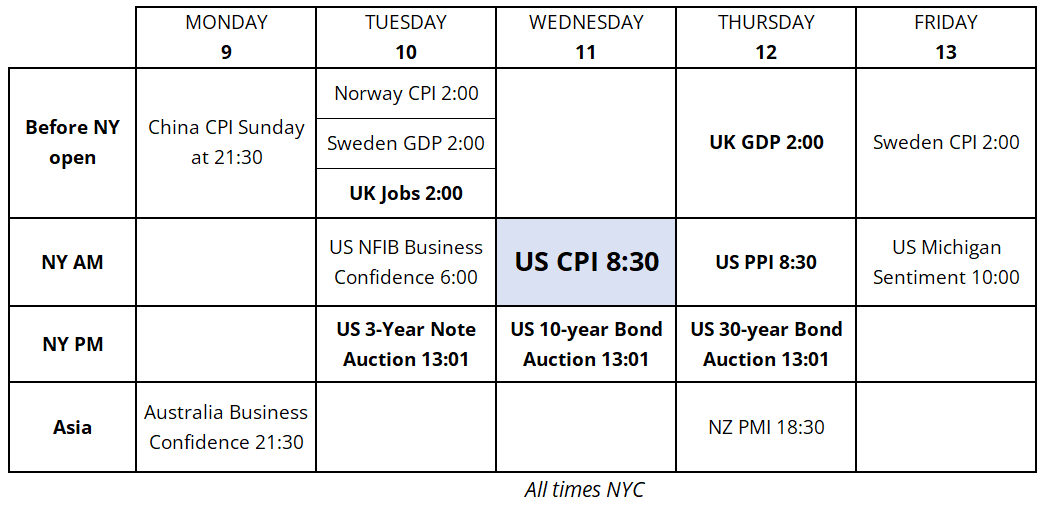

You can wonder if the US economy will slow down as the policy uncertainty starts to bite, but you won’t get any evidence of that next week. And CPI isn’t a huge focus because even if it ticks up, we won’t have a good handle on whether this is a one-time bump or a meaningful uptick in inflationary psychology for many, many months.

So next week could be a summer snoozer.

Here’s the calendar:

If you want to be in the know on macro on a daily basis, click on this rectangle and input your credit card details.

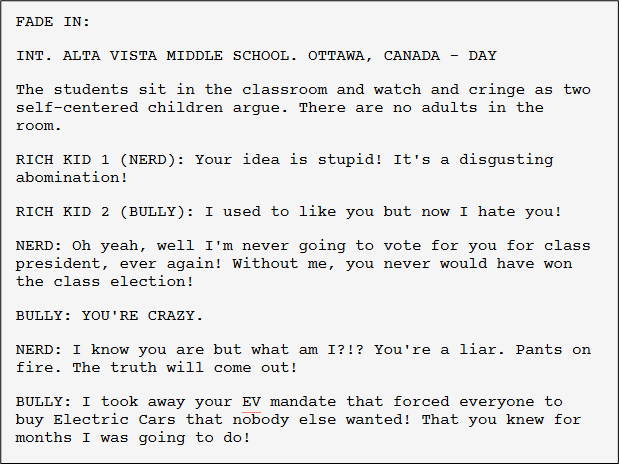

Yesterday, for some odd reason, I had a flashback to a memory from middle school:

Wait, maybe I am confusing two memories here. Anyway, unrelated… TSLA stock is moving a lot.

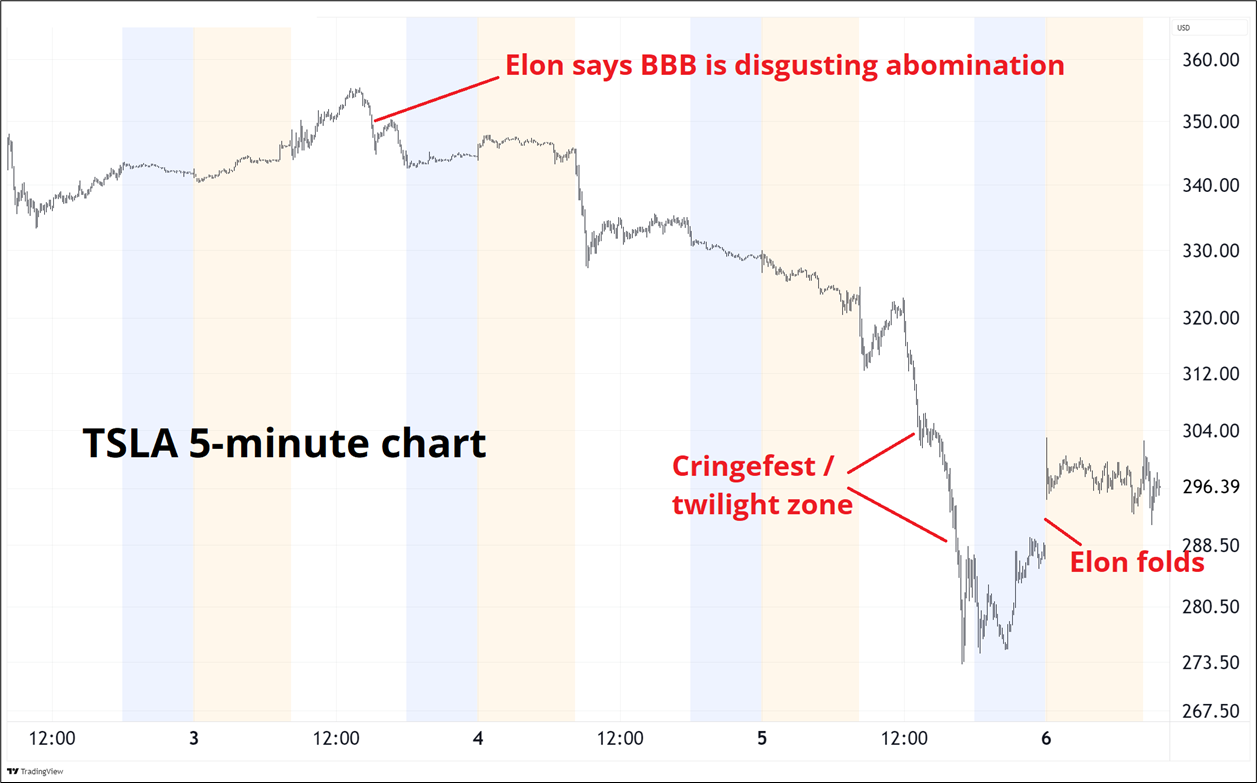

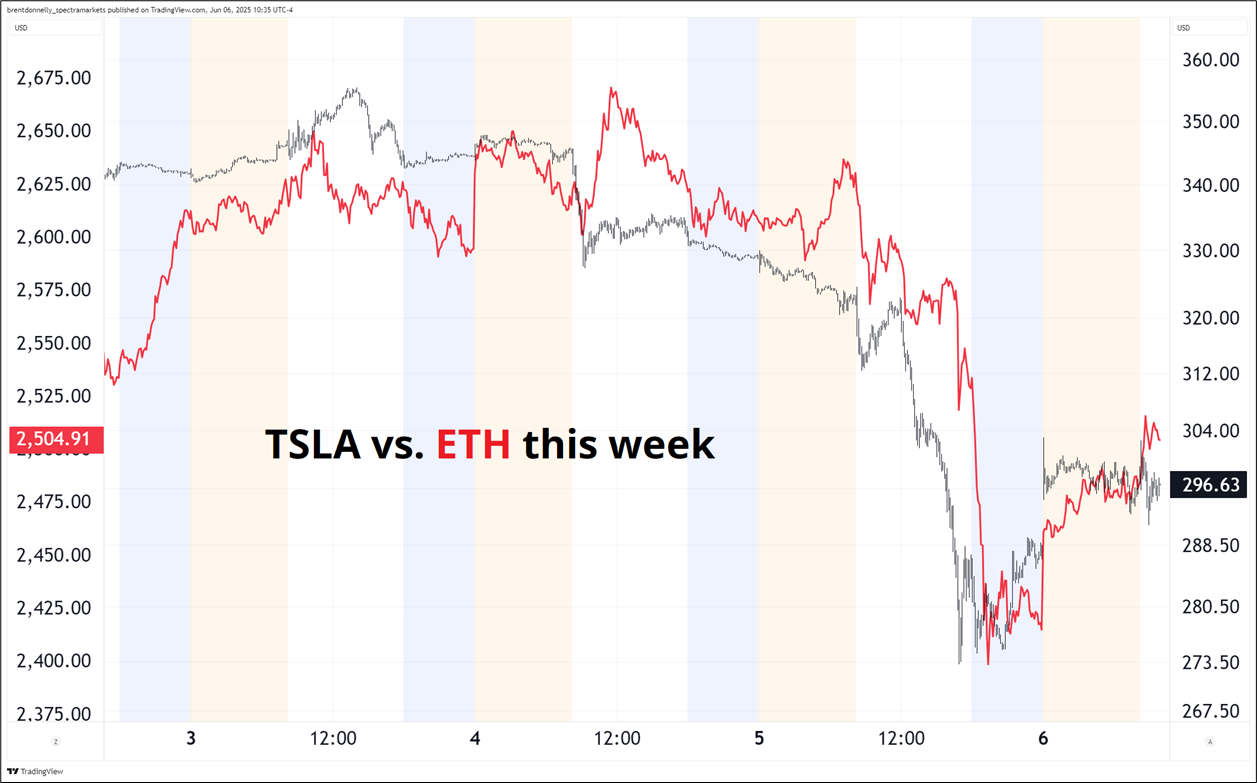

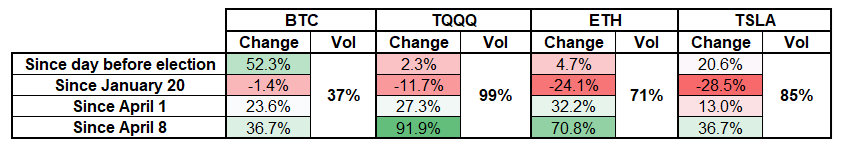

This whole episode was a reminder that it’s memes all the way down when you’re trading TSLA, GME, or ETH… They’re all just barometers of retail sentiment. ETH and TSLA are most closely related in my mind, because they are both high-beta memecoins.

I left BTC out of that list because it has shown over the years that it has some unique properties, unlike the other infinite cryptonuggets and memestocks that all compete for the same finite retail YOLObucks every day. I would throw PLTR in the list of memestocks, too.

The rapid, unscheduled disassembly of the Musk/Trump romance triggered a one-off whoosh in risky assets as people briefly wondered what national security secrets Musk might leak or what new, unserious thing one of the protagonists might say… But when they saw it was just the well-known Epstein angle on Trump, and then Elon folded and stuck out his hand for the President to slap, things stabilized. The VIX is 2 points off the 2025 lows.

With the Liberation Day bear market rejected, deficits ballooning, DOGE flopping, fiscal prudence gone, and AI back in vogue, the NASDAQ is coiling towards the apex of a mega triangle. I usually look at TQQQ when I am thinking about tech stocks, so here’s that humongous triangle:

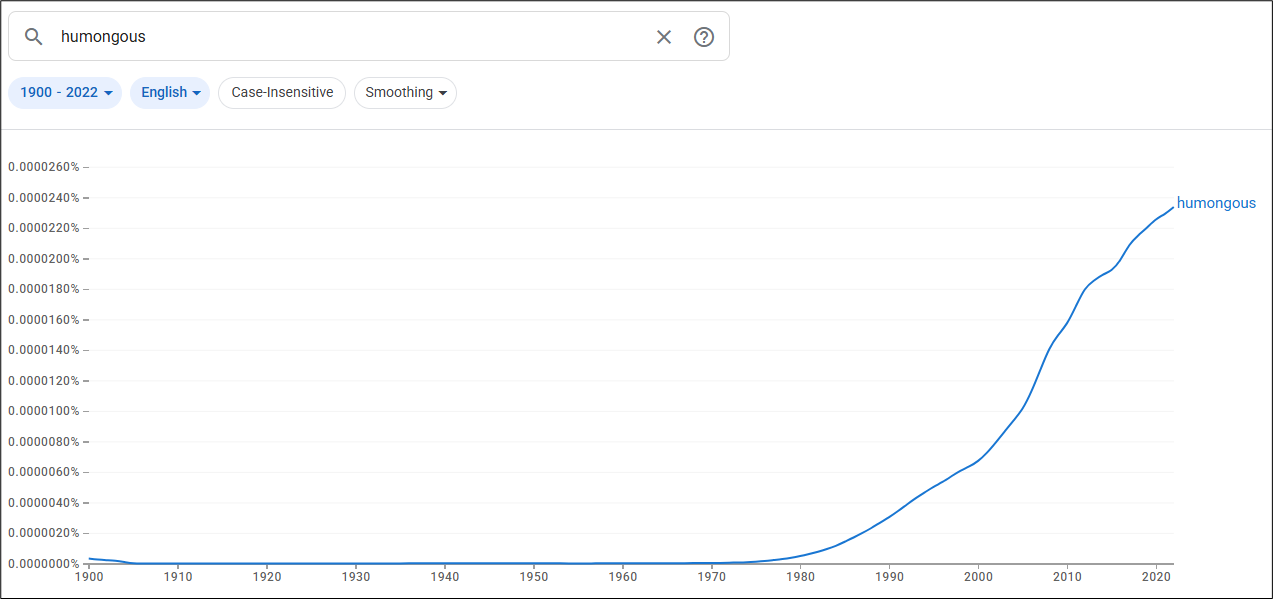

Fun fact I just learned about the word humongous. It was a humorous mash-up of huge and monstrous used by college kids in the 1970s, but it eventually came into regular usage and is now a real word. Here’s the frequency of the word humongous in books over time.

So the humongous NASDAQ triangle is coiling. These narrowing triangles can often resolve in a direction that then defines the primary trend for weeks thereafter, so I’m keeping a close eye on this bad boy. A daily close above $77 or below $69 are the levels that I believe would indicate a clear definition of the trend.

How to lie with statistics:

Arbitrary starting points are one way people lie with statistics.

The last time I wrote Friday Speedrun was 02MAY, and interestingly, I am able to reuse that week’s 14-word stock market summary.

This week’s 14-word stock market summary:

America: Not dead.

AI capex: Not dead.

Bears in pain waiting for the recession.

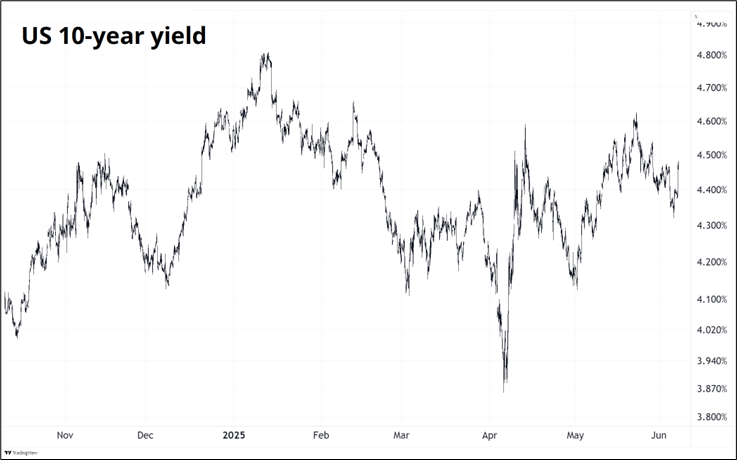

The next chart kind of says it all for US yields. We tried the bond vigilante trade and yields peaked the day the Big Bill passed the Senate (buy the rumor / sell the fact). Then we bottomed on Wednesday’s weak data (ADP and ISM) before yields ripped higher Thursday, well before the Goldilocks NFP. The market is desperately seeking a narrative and finding little that is worth chewing on for more than a few days.

Japanese 30-year yields, which were part of the bond vigilante fear trade, have also come off the boil and are back below 3%.

I like the expression “come off the boil” because it’s not some cryptic thing where you have to Google the etymology from 1608 Norse or whatever. It’s just like … It was boiling. And then it wasn’t.

Speaking of boiling… You know the boiling frog metaphor is false, right? We should stop using it. It’s scientifically incorrect and blatantly froggist. Quoting an Aussie article here:

Dr Victor Hutchison, emeritus research professor from the Department of Zoology at the University of Oklahoma, is a herpetologist and has dealt with frogs all his professional life.

Indeed, one of his current research interests is “the physiological ecology of thermal relations of amphibians and reptiles to include determinations of the factors which influence lethal temperatures, critical thermal maxima and minima, thermal selection, and thermoregulatory behavior”. Now ‘critical thermal maxima’ means the maximum temperature that the animal can bear.

Professor Hutchison says: “The legend is entirely incorrect! The ‘critical thermal maxima’ of many species of frogs have been determined by several investigators. In this procedure, the water in which a frog is submerged is heated gradually at about 2°F per minute. As the temperature of the water is gradually increased, the frog will eventually become more and more active in attempts to escape the heated water. If the container size and opening allow the frog to jump out, it will do so.“

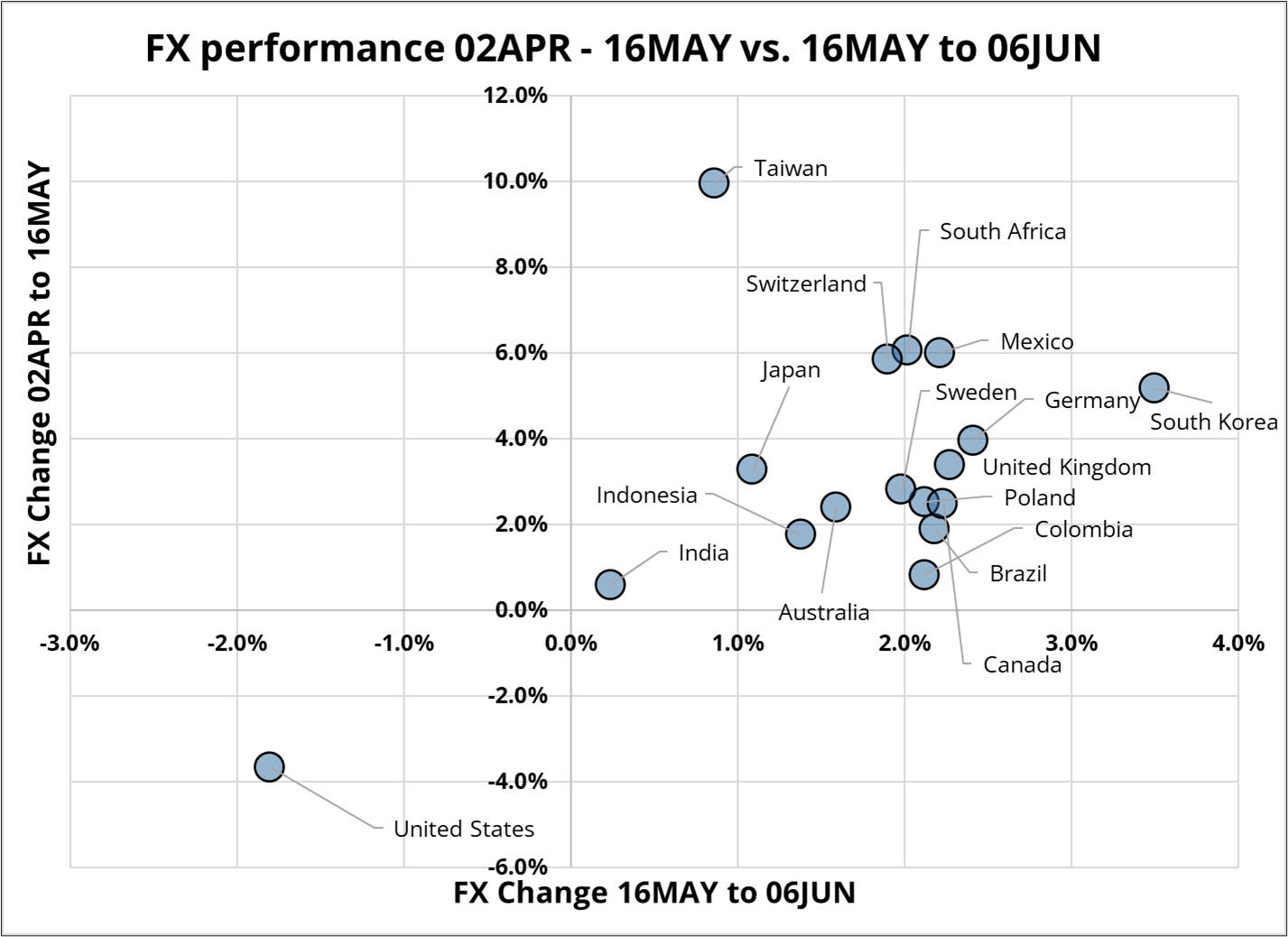

The USD continues to drift lower, with the market first showing a preference for currencies with strong balance of payments after Liberation Day, then transitioning thereafter to a preference for currencies that offer decent carry. The next chart has Liberation Day to mid-May FX performance vs. the USD on the y-axis and FX performance mid-May to now on the x-axis. I think the main story is that dispersion is fairly minimal, Asian currencies are outperforming as intervention by central banks over there slows down, and EM es en fuego.

The SELL AMERICA theme is dying as US bonds are OK, US equities are great, and AI is back. But the dollar remains unloved because foreign pension funds and central banks are using rallies in the USD to add to hedges on already huge US asset holdings. They are in less of a panic to reduce overweights in US assets but are happy to keep adding to USD hedges.

As foreign pension funds increase USD hedges, the specter of Section 899 lurks in the background. This story has been well covered in a few pieces lately, including one by John Authers and another by Alfonso Peccatiello. In case you are not up to speed, I’m going to quote Alf’s piece (with his permission), because I think it’s a good backgrounder. Even though this issue is boring and technical, there are details you need to know in case headlines drop.

Macro Alf’s take on Section 899:

—

excerpt

The One Big Beautiful Bill (OBBB) recently passed the House, and it’s now awaiting Senate scrutiny. Most analyst coverage focused on the bill piling up further government spending on existing deficits, but by far the most important part of the OBBB was deep down in the docs – specifically, in section 899. Section 899 is the first step towards tariffs on capital as a complement to tariffs on goods.

So: what did the Trump administration include in section 899 – the first step towards Tariffs on Money?

1) What is it -> Section 899 also known as the ‘’revenge bill’’ imposes taxes on passive income (e.g. dividends) deriving from foreign ownership of US assets on countries that have enacted ‘’unfair foreign taxes’’ on the US (read: digital service tax or minimum corporate taxes like Canada, Europe and others);

2) Who gets charged -> For a country to be subject to such taxes, it’s enough for the Treasury department to include them in a specific list of DFC – discriminatory foreign countries;

3) The applicable entities -> They include governments, individuals, and corporations – pretty much every investor, including sovereign wealth funds and foreign central banks;

4) How high is the tax rate -> Section 899 generally increases the current U.S. tax rates imposed on applicable entities by 5% in the first year following enactment, increased by an additional 5% for each subsequent year, with the increases capped at 20% above the statutory rate. This is key: for section 899 to apply, there must already be an applicable tax rate (before or after tax treaties) to push up.

5) When could it kick in -> Assuming the OBBB is enacted before October 2025, the Section 899 will take effect as per January 1st 2026.

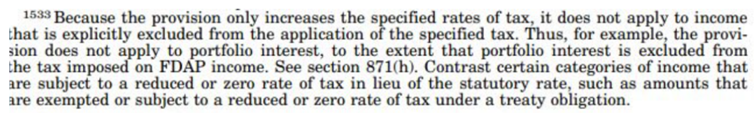

Tariffs on goods have been estimated to bring in about USD ~200/250 bn/year for the US government. The impact of a moderate Tariffs on Money would be potentially in the USD 100-150 bn/year too. But that requires a key change: the repeal of the Portfolio Interest Exemption (PIE). PIE exempts foreign investors from incurring in any withholding taxes when they buy US Treasuries, and Section 899 only applies a surcharge tax to existing tax rates for foreign investors – which PIE puts at zero for foreign ownership of US Treasuries.

Unless the portfolio interest exemption (PIE) is repealed, Section 899 would only apply to dividends on equities held by foreign institutions – bringing in only a few $ billions/year to the Trump administration. This clause in the Big Beautiful Bill clearly explains that (without a PIE repeal) the Section 899 wouldn’t apply to ‘’portfolio interest’’ – basically coupons on Treasuries held by foreigners:

In its current format, Section 899 would send a worrying signal to foreign investors but its immediate impact would be quite limited. Foreign investors own $13 trillion worth of US stocks, but Section 899 would apply a limited surcharge tax on dividends only and hence cause limited damage.

After all, investors own US stocks for capital appreciation much more than they do to collect dividends. But a repeal of PIE would bring Treasury coupons under the 30% withholding tax regime, and after applying tax treaties but overlaying the Section 899 tax surcharges we’d be looking at a big impact. Coupons deriving from $15+ trillion in US Treasuries owned abroad would incur 20%+ total tax rates, but to get there the Trump administration would have to repeal PIE:

I can’t see any rationale behind including Section 899 in the Big Beautiful Bill to only collect 2-3bn/year by taxing dividends on stocks only. If Tariffs on Money needs to be part of the revenue-raising machine for the Trump administration, they need to go along with a repeal of PIE.

A potential plan could look like this:

Bessent has already indicated Q3 as the likely date to accelerate the efforts behind the SLR reform, and such a timeline could be more than a mere coincidence.

From a market impact standpoint, there are two paths ahead of us:

A) Section 899 without PIE repeal: a marginally weaker USD

B) Section 899 + PIE repeal: a large USD down + bond yields up move

Even without PIE repeal, Section 899 raises red flags amongst foreign institutional investors. Using my beloved Canadian pension fund reference, if you were the CIO or the Investment Committee sitting on a 50%+ allocation to US assets and you see Section 899 enacted – what would you do? You’d at least passively reinvest your maturities away from the US and hedge your material USD risk.

And if you were to see concrete talks about a Portfolio Interest Exemption repeal hitting you heavily on your Treasuries coupons – what would you do? This would be akin to ‘’selective Fed cuts’’ only applying to you: a 20% total tax rate on a US Treasury paying a 5% coupon would be akin to a 100 bps reduction in interest rate earned. Add a weakening USD to the picture, and you’d have to rush to hedge your USD exposure alongside considering domestic bonds or other bond markets (Europe?) as an alternative.

There are also second-round effects to Section 899. Sovereign wealth funds and pension funds have large exposures to assets classes such as private equity, hedge funds, and real estate and all these assets tend to be denominated in USD. As the Trump administration is undermining the attractiveness of goods and capital flows in the US, they are directly attempting (and succeeding) at weakening the USD.

To conclude: while investors had already many reasons to be short USD, they are now looking at 899 more reasons.

Alfonso Peccatiello Founder & CEO, The Macro Compass – Institutional Macro Research. For inquiries: [email protected]

end of excerpt

—

The takeaway there is that PIE repeal headlines are mega bearish USD.

I like to look at crypto and compare it to other risky assets and right now it’s awesomely impressive how well bitcoin has traded compared to its peers. This is a theme I have discussed all the way back to the MacroTactical Crypto days in 2022. BTC is unique as first mover. Every other cryptocurrency is not the OG. Second place is the first loser.

But bitcoin has also performed better than TQQQ of late, on substantially lower vol. All that corporate buying is keeping BTC supported. Skeptics would say that as all these companies’ average price converges with the spot price around 100k, downside convexity will pickup because these companies will have debt payments in the future and too little cash flow with which to fund the payments if they can’t roll the debt. So then just like they all buy bitcoin at $105,000 at the same time right now, they will all sell bitcoin at $50,000 at the same time in a few years. My belief is that MSTR did a smart, cool thing and all these copycats will end up roasted as they lure retail into the equivalent of buying bitcoin at $200,000 when it’s trading in the market at $105,000.

Please do not buy stock in these companies. There are bitcoin ETFs now! And leveraged bitcoin ETFs. These companies are gaslighting you because they have no legitimate business or legitimate chance of generating future cash flows. So they are going all in by making a highly-unoriginal bet on a risky asset. At the highs. Where you pay double market price. Please don’t do that. If there was such thing as a commission that regulated securities and exchanges in the USA, they might even ban this. But there isn’t.

Here’s the performance grid. TQQQ looking pretty shabby vs. BTC on most metrics of late. TQQQ looks zippy off the lows, but that’s mostly because it collapsed the most.

This week was all about the metals that people don’t usually care about: Silver and platinum. After doing nothing for eons, both broke out this week on the back of Chinese demand and a rapidly accelerating narrative about Chinese substitution effects. The story goes that Chinese buyers are finding gold too expensive when it comes to their jewelry and investment needs, and so they are switching to platinum and silver. There is data to back this up as Platinum Guild International disclosed at London Platinum Week that Chinese platinum jewelry demand rose by 50% in Q1.

I have been writing about bullish platinum since I got long on May 21 (see full am/FX issue here) and I took profit today as we are getting up towards major resistance, and the deviation from the 100-day moving average shows platinum at extreme overbought (see bottom panel of next chart).

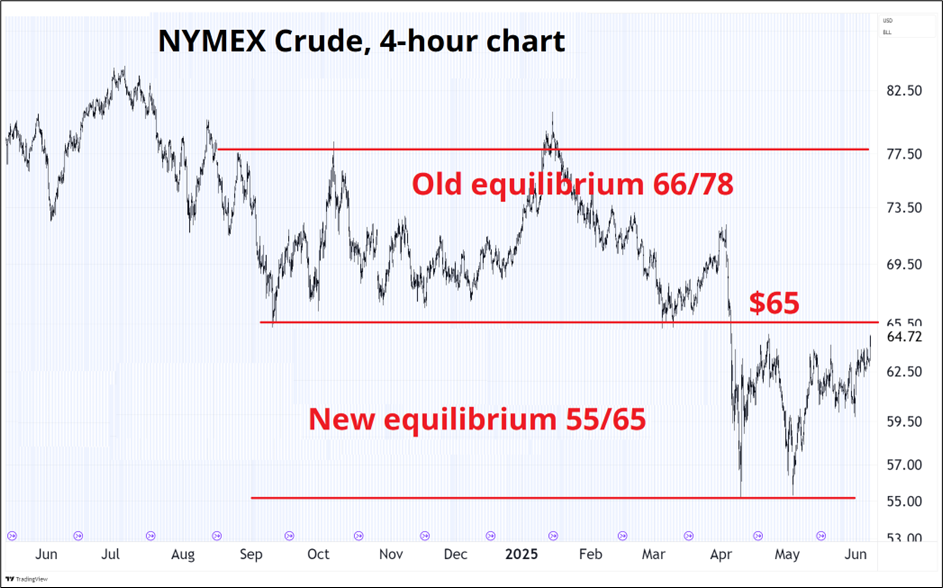

Oil continues to be a call spread sellers’ dream as every rally gets knocked back by some sort of bearish Saudi headline. There is a mini breakout happening right now but as long as NYMEX is below $65/$66, the Saudis are in control, and you can keep selling those call spreads.

The $65 pivot is beautiful and clean.

That’s it for this week.

Get rich or have fun trying.

*************

Be kind, for everyone you meet is fighting a hard battle.

– Socrates

*************

I saw this magazine at the Whole Foods checkout and my System 1 mind immediately called bullshit:

But it’s always important to verify your System 1 thoughts with System 2. So let’s ask ChatGPT, which is a proxy for System 2 thinking:

Axolotl (Ambystoma mexicanum)

Known as the “Mexican walking fish”

Can regrow limbs, parts of the heart, and even parts of the brain

Tardigrade (Water Bear)

Microscopic, extremophile organism

Can survive in space, near absolute zero, or boiling temperatures

Mimic Octopus (Thaumoctopus mimicus)

Can impersonate over 15 different species (lionfish, flatfish, sea snakes)

Incredible shape-shifting camouflage

Platypus

Egg-laying mammal with a duck bill, beaver tail, and webbed feet

Males are venomous; uses electrolocation to hunt

Narwhal

Known as the “unicorn of the sea”

Possesses a spiral tusk (actually an enlarged tooth) up to 10 feet long

Glass Frog

Translucent skin reveals its organs and heartbeat

Excellent camouflage in tropical rainforests

Pistol Shrimp (Alpheidae)

Claws snap shut fast enough to create cavitation bubbles reaching 4,800°C

The bubble’s collapse stuns or kills prey with sound and shock

Saiga Antelope

Distinctive, oversized bulbous nose acts as a natural air filter and cooler

Critically endangered and adapted to harsh steppes of Central Asia

Leafy Sea Dragon

Related to seahorses, but covered in leaf-like appendages

Master of disguise in Australian kelp forests

Mantis Shrimp

Has the most complex eyes in the animal kingdom (16 types of color receptors)

Can punch with the speed of a bullet, breaking glass aquariums

Birds are not even top 25 most remarkable amongst creatures. Can they regrow limbs? No. Can they punch with the speed of a bullet? No. Can they use electrocution to hunt? Again, no.

Barely top 50. Do better, Life Magazine.

*************

Good piece from Claudia Sahm. She was right when she said her own rule won’t trigger recession because the economy has many buffers. Now she is saying the buffers are waning.

https://stayathomemacro.substack.com/p/the-labor-market-wont-offer-the-same

*************

*************

Nice longish read with AI rollout timeline predictions via DH:

https://www.dwarkesh.com/p/timelines-june-2025

*************

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.