The USDCNH fix last night was interesting.

A Hip Hop playlist that lasts the cooking time of your spaghetti.

The USDCNH fix last night was interesting.

A Hip Hop playlist that lasts the cooking time of your spaghetti.

Buy 2-month 7.40/7.60 call spread

for ~30bps off 7.31 spot

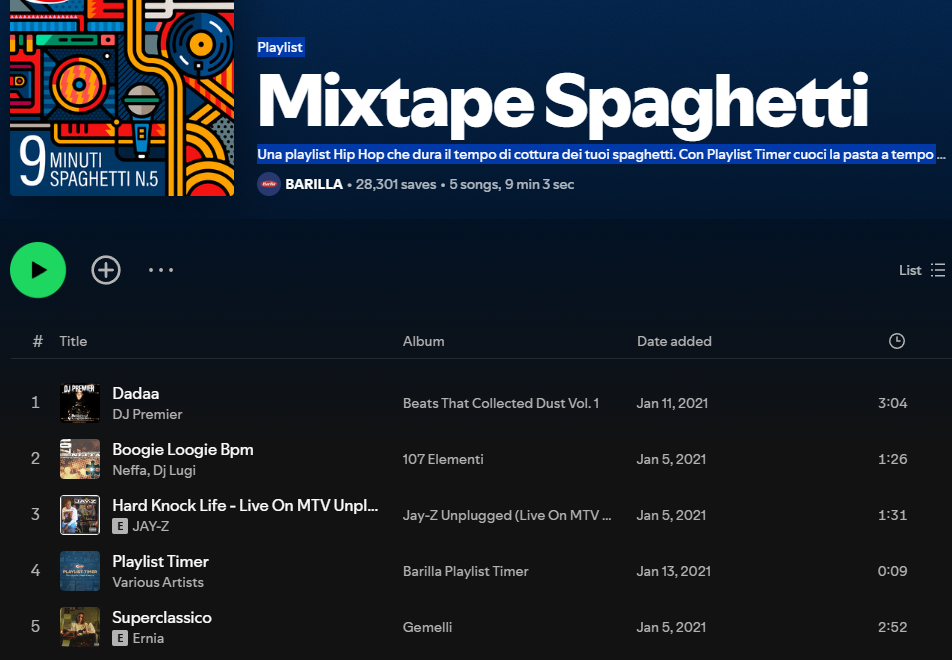

The methodology for determining the tariff rates has been much discussed and ridiculed over the past 12 hours, but in case you missed it: While the administration claimed to be incorporating foreign tariff rates, VAT, and non-tariff barriers, what they did instead was essentially use the formula:

(Imports – Exports / Imports) / 2

And then if that number showed a trade surplus, they just used 10%. This back-of-the-napkin methodology leads to some strange results, as you can see.

There was an idea going into all this that Scott Bessent would be a strong voice of reason advocating for more market-friendly policies. This clip makes it seem like he was not even in the room when the tariff decisions were made.

https://x.com/MeidasTouch/status/1907590196352418279

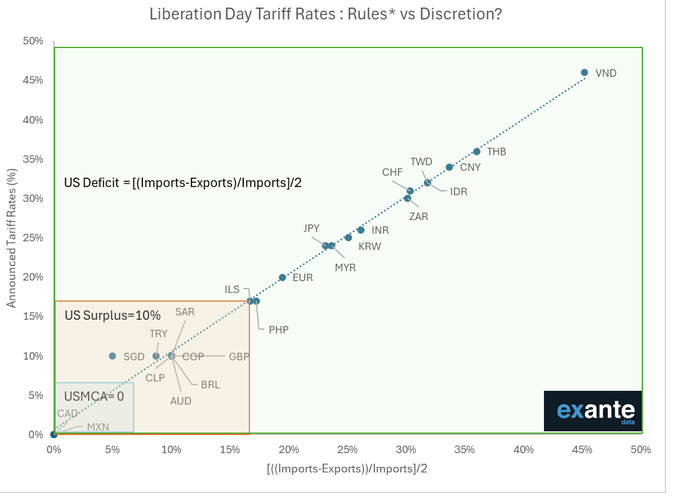

The US is about to experience a massive real growth shock as inflation will rise on the back of tariffs, USD weakness, and the second supply chain shock in 4 years, and GDP is already falling on collapsing investment and hiring confidence. Coming from a starting point of MAG7 supremacy, TINA, and post-election euphoria, it’s easy to get excited about further downside for the dollar and US equities. That said, it’s worth thinking about how much things have moved. For example, USDJPY is now in line with rate differentials. In fact, JGBs moved just as much as UST last night.

And while this is a big capital flight / panic story as the US moves hard left on the “uninvestable – TINA” spectrum, these things don’t happen in one day. I am not saying to go long stocks or long USD here, but I think there will be enough volatility to get better levels to sell USD.

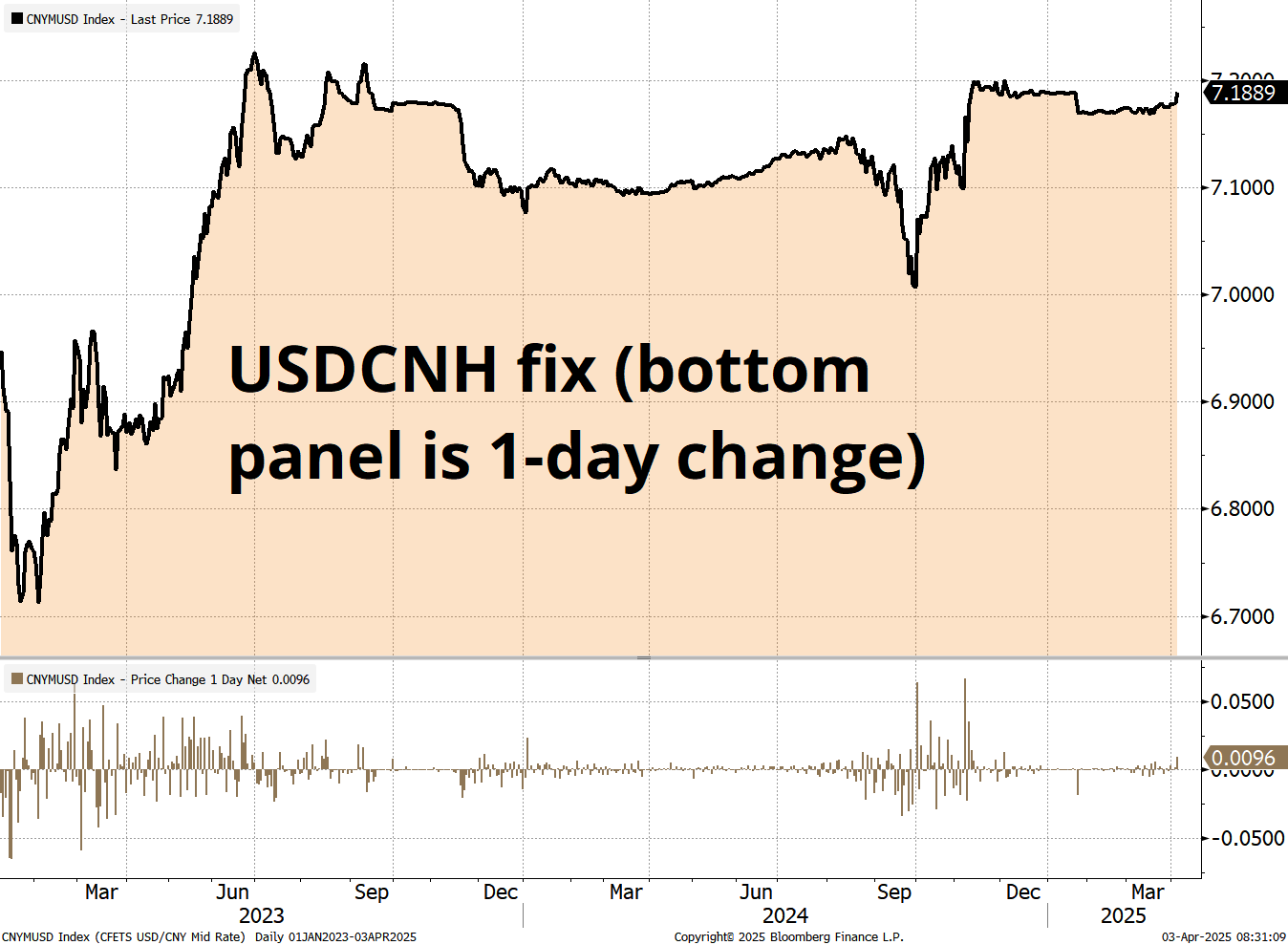

Also, there is something very important that got lost in the madness last night: China has slightly depegged USDCNH. After fixing strong with almost zero vol for ages and ages, they fixed more aggressively weak last night.

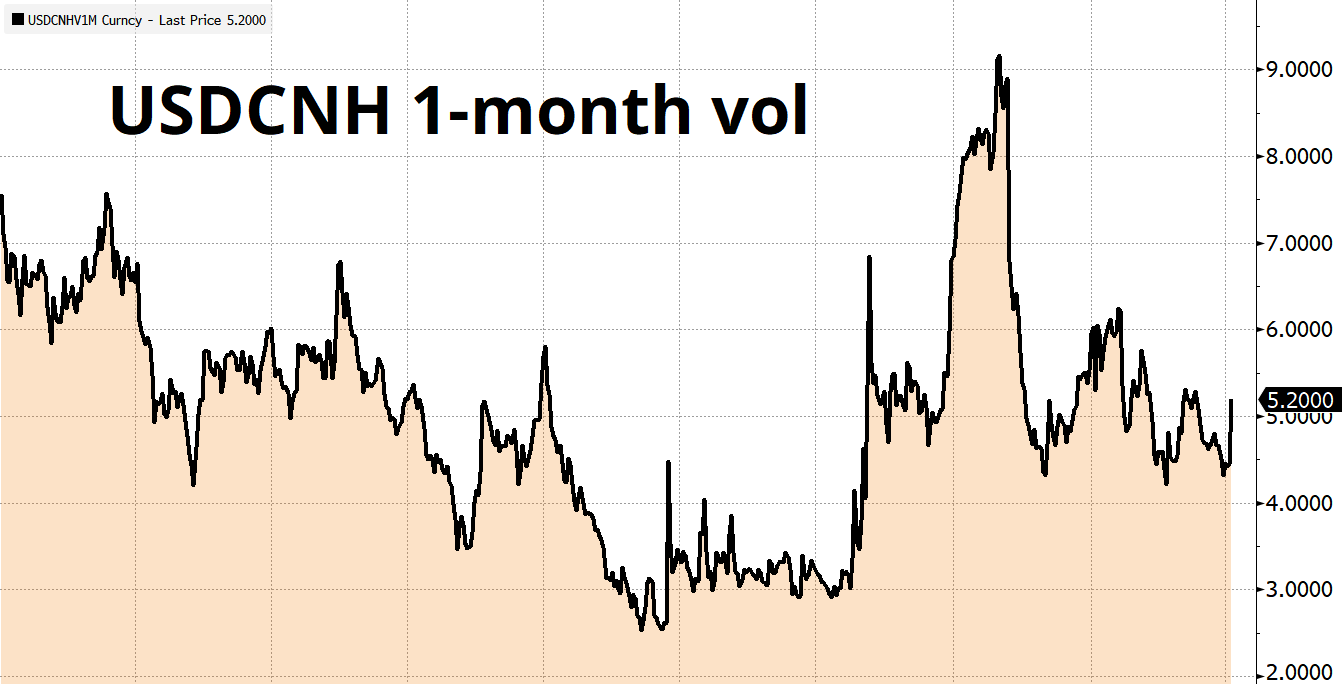

That little blip on the far right of the second panel may seem comically small, but the signaling impact is important to me. One or two more fixes weaker like that and the market is going to pile into topside USDCNH structures. For now, 1-month vol is still pretty low as you can see here.

The market has rightly forgotten about USDCNH because it hasn’t moved in so long, but it’s coiling and 7.37 is a massive level. The PBoC and agents intervened aggressively there in the past and so all eyes will be on authority behavior if we get up there again. Through 7.40 will be zippy for both spot and vol.

I am still raging USD bearish, and usually long USDCNH is a tough trade in a USD down environment but with everything that is going on here, I like USDCNH topside, even as a USD bear. If your book is short dollars, then USDCNH calls are even better as part of that portfolio.

I know retail traders cannot do this, but I am buying 2-month 7.40/7.60 USDCNH call spread here for around 30bps off 7.31 spot. Like I said, I like it in isolation, but I like it even better if your book is short USD.

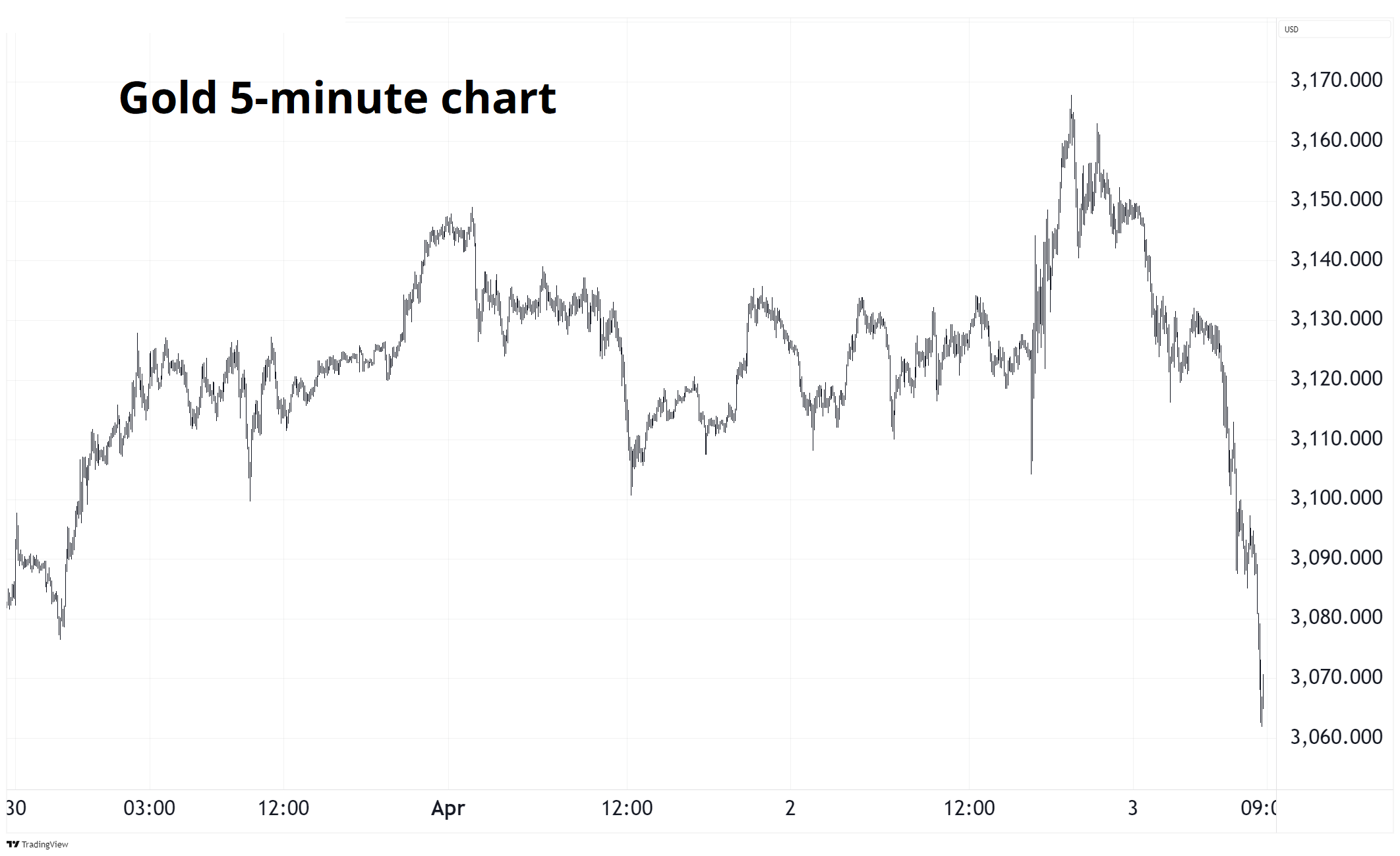

The front running of tariffs in gold and copper is done and they can return to earth for a while. The market tried to take gold higher thinking that tariffs are bad for everything except the yellow metal but that obviously has not worked out. While gold could temporarily correct to $3000 on this, copper could suffer a much deeper and longer correction as global growth isn’t exactly supporting copper at the all-time highs. Inventories of copper are surely plentiful now.

Crypto miner front running of tariffs and supply chain fears.

A summary of MSFT’s pullback from AI capex.

Walmart is trying to answer: Who will pay this massive new US import tax?

More middle grade hilarity: Tariffs on uninhabited Antarctic islands. HT Avi.

A Hip Hop playlist that lasts the cooking time of your spaghetti.

Barilla pasta has a Spotify playlist. Each playlist is the exact length of cook time for the varieties of pasta. Press play, drop the noodles, music stops, el dente noodles.

HT Gittins via @wassup_Cara_Mel