Stocks looking toppy

Equities showing some weakness, finally, as PLTR delivers a good news/bad price setup, crypto fails to keep pace with equities, and the USD trades weak despite some initial strength in Asia.

Let’s start with PLTR, whose stock fell even after they delivered good results, a stronger outlook, and a flurry of awesomely over-the-top commentary bordering on comedy.

*PALANTIR SEES FY REV. $3.89B TO $3.90B, SAW $3.74B TO $3.76B

*PALANTIR SEES FY ADJ. OPER PROFIT $1.71B TO $1.72B, EST. $1.58B

*Palantir lifts full-year guidance as CEO Karp cites ‘tectonic shift‘ in AI adoption

PLTR CEO Karp touts ‘warrior culture‘ as company boosts annual revenue outlook

Palantir praises DOGE cuts and compares US government to ‘fine-marbled wagyu‘

From the New Testament to Nixon: Takeaways from Alex Karp’s shareholder letter

“Palantir is on fire,” said Palantir CEO Karp.

Palantir is the ultimate retail football stock, trading at 90X earnings and a 300-billion-dollar market cap, making it the most overvalued megacap in history. Still, it’s a dangerous stock to short as retail money flows in daily. But now, as it has rejected $125 a second time with extreme prejudice, it’s a sell rallies again after trading as a buy dips for the runup into earnings. This rejection on good news is interesting as the stock made an impulsive rejection off $125 in February on no particular news.

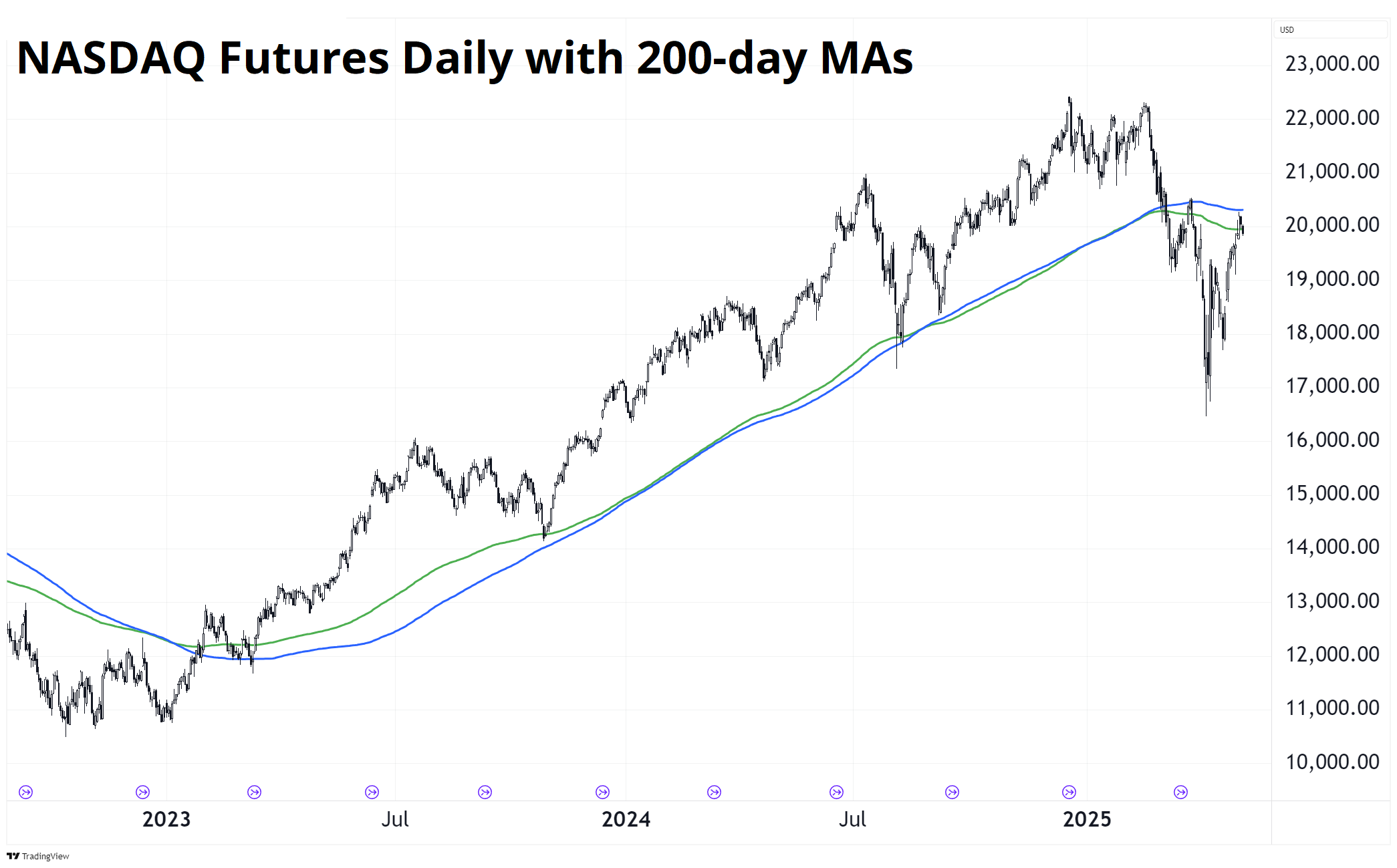

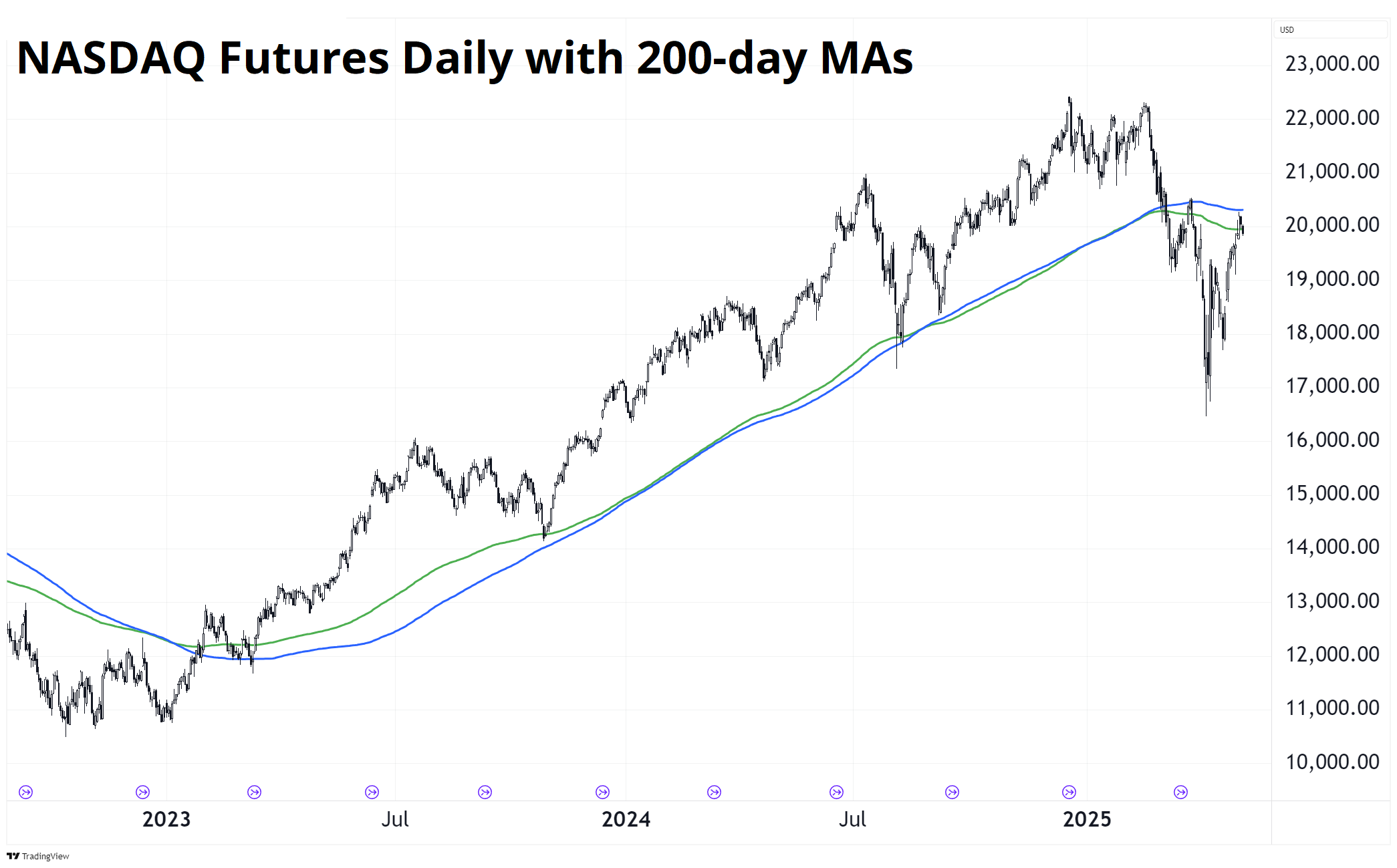

Meanwhile, the NASDAQ daily chart looks like this:

Which Citrini Research has pointed out sure looks a lot like 2022:

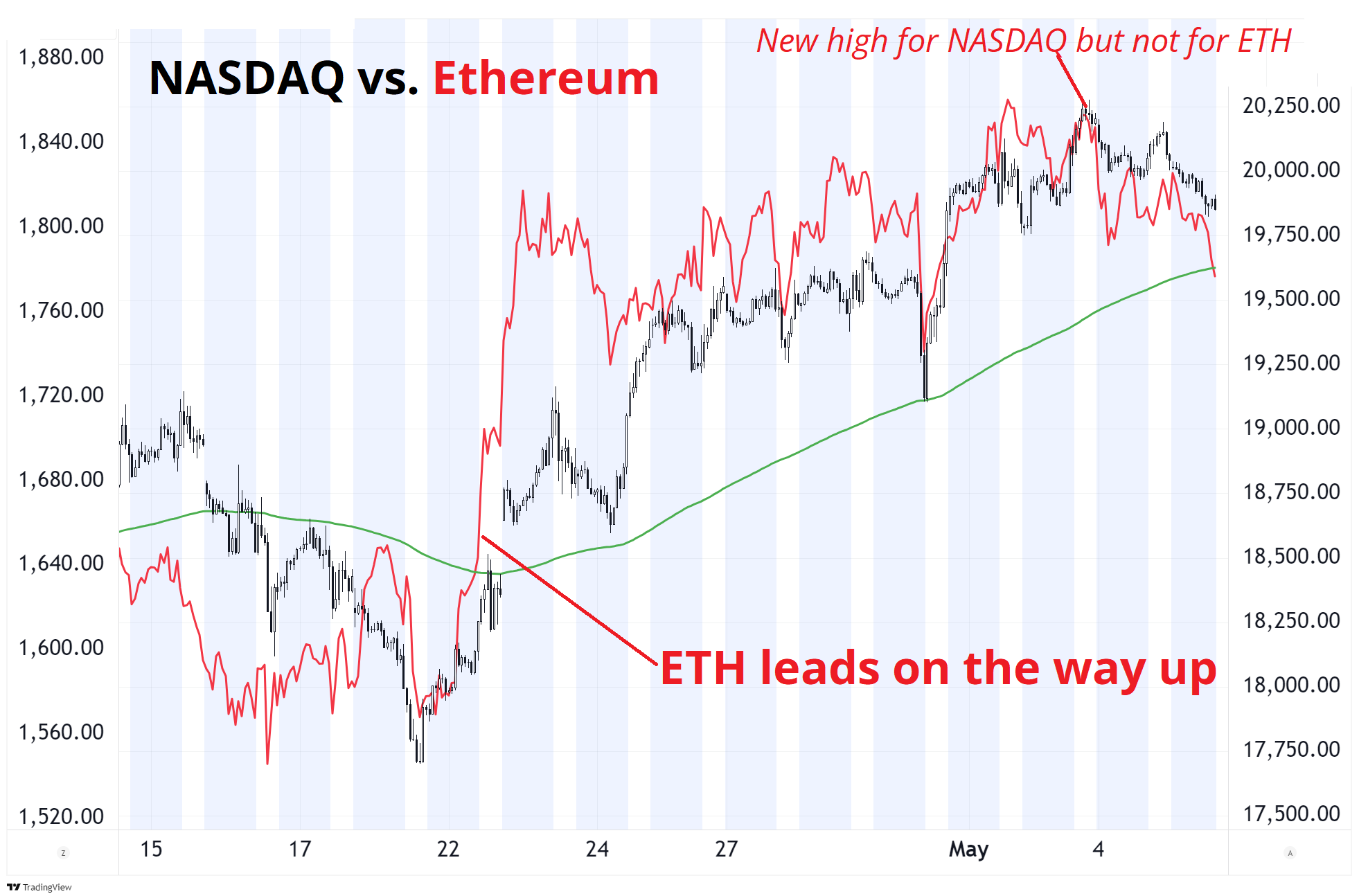

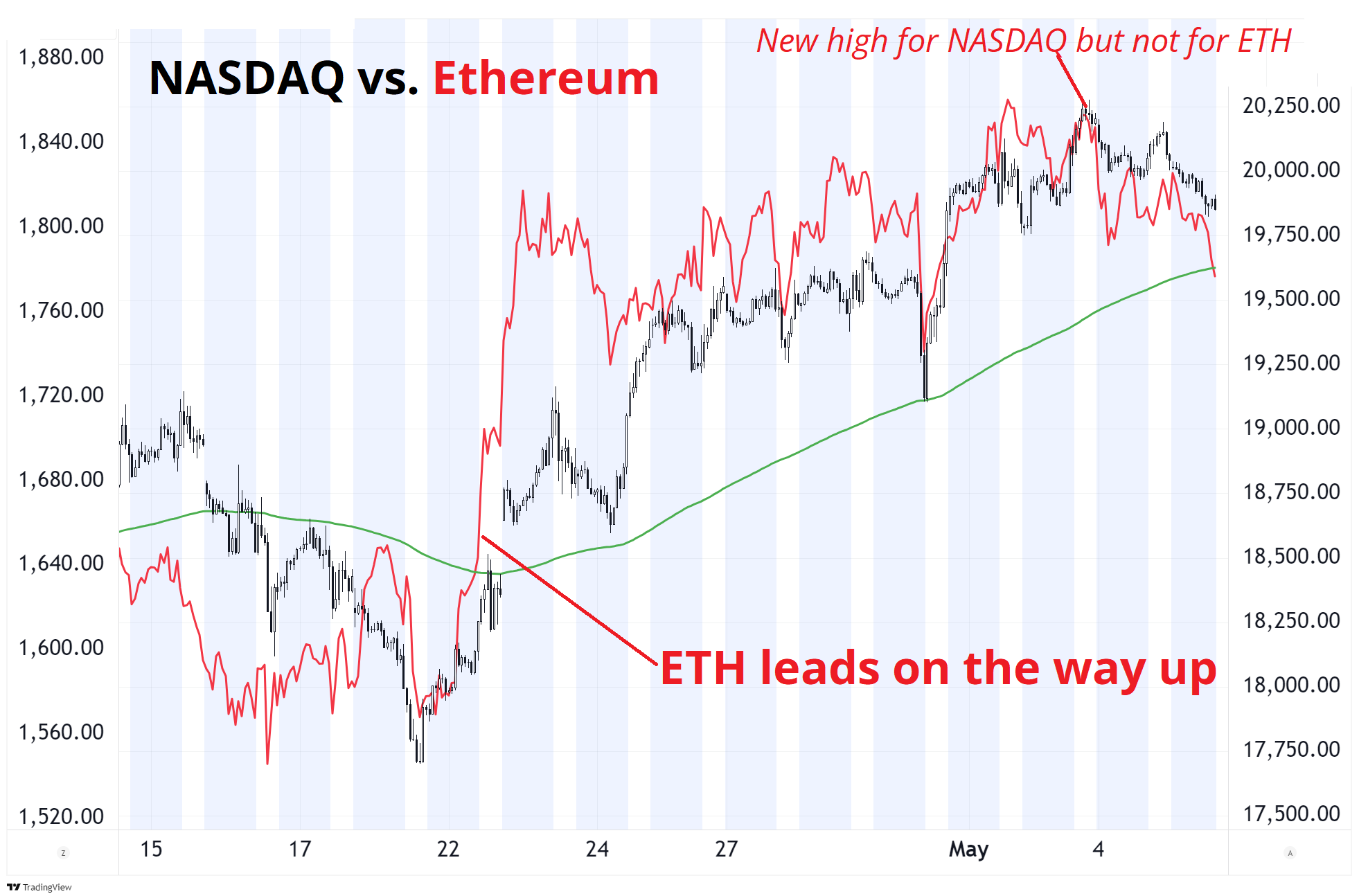

Hmmm. This all supports the sell USD theme and should keep USD/Asia heavy. Also worth noting that crypto, which was the leader on the way up, is looking super soggy.

Finally, the ultimate memestock, TSLA, is either tracing out the top of a $217/$294 range (my preferred view, see red lines) or a bull flag that will resolve with a rally to $365 (cyan lines, not my base base). TSLA through 268 or 298 should help gauge future direction as those are the points where the consolidation has clearly broken out.

It’s incredibly hard to be short stocks with so much random headline risk, so short USD continues to be my preferred play as I dabble short some single names now with fairly tight stops. The third leg of the SELL AMERICA trade, bonds, is also working a bit as corporate supply (Apple, etc.), government supply (auctions this week), and high prices paid despite plummeting oil prices conspire to push yields a bit higher. I can’t come up with a coherent bond view as imminent supply shocks are inflationary and deflationary at the same time.

Canada Update

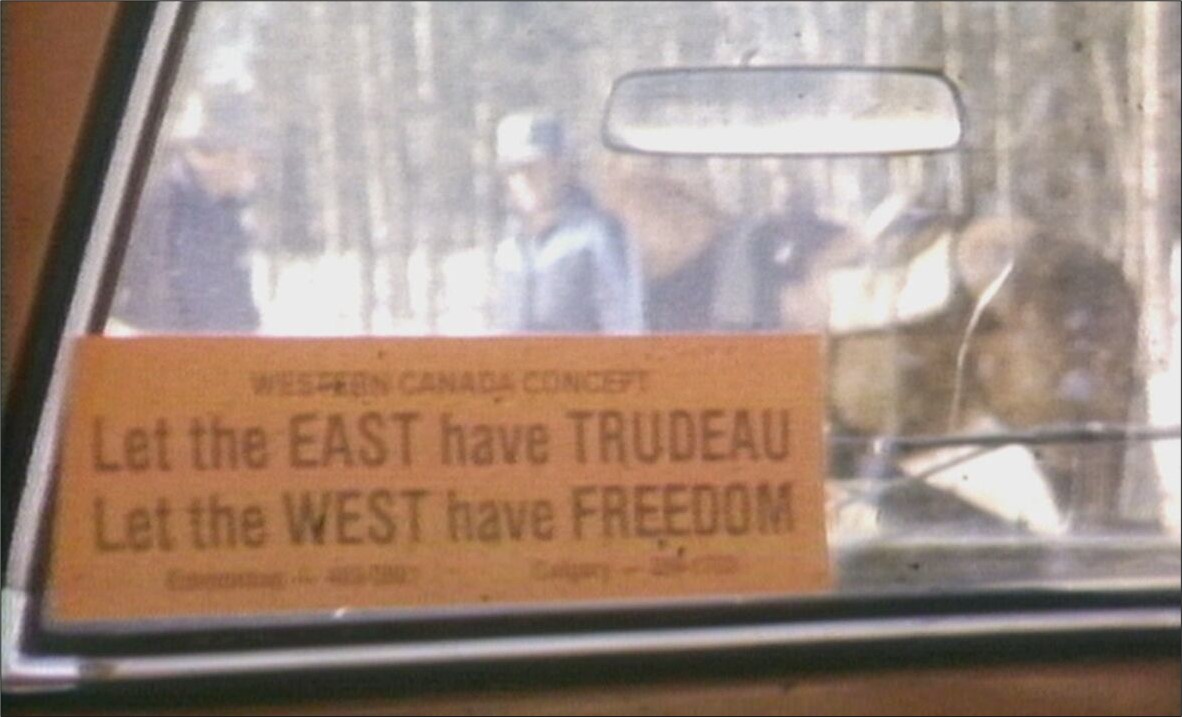

While I hate to say it, I suppose the Alberta referendum on secession from Canada will probably end up as a theme at some point. The Smith government has allowed for the possibility of a referendum next year as recent legislative changes make it easier to drum up referenda there.

Speaking on a livestream address, Danielle Smith said she personally does not support the province leaving Canada and expressed hope of a “path forward” for a strong and sovereign Alberta within a united Canada.

“Should Ottawa, for whatever reason, continue to attack our province as they have done over the last decade, ultimately that will be for Albertans to decide,” she said. “I will accept their judgement.”

Polls currently show 25% of Albertans support separation, but things can change fast in a campaign. Nothing will happen on this until 2026, but I suppose it should be on your radar. Alberta separation is one of those things like California or Texas separation, where it flares up now and then and usually goes away. But the political climate in 2025 is not like anything we have seen in recent decades, so it’s foolish to exclude possibilities that would have been unlikely in the past. There was a loud Alberta separation movement in the early 1980s, but it never amounted to much other than some angry headlines. They railed against Trudeau then and they rail against his son now.

There is no trade here, but it’s something to watch.

Final Thoughts

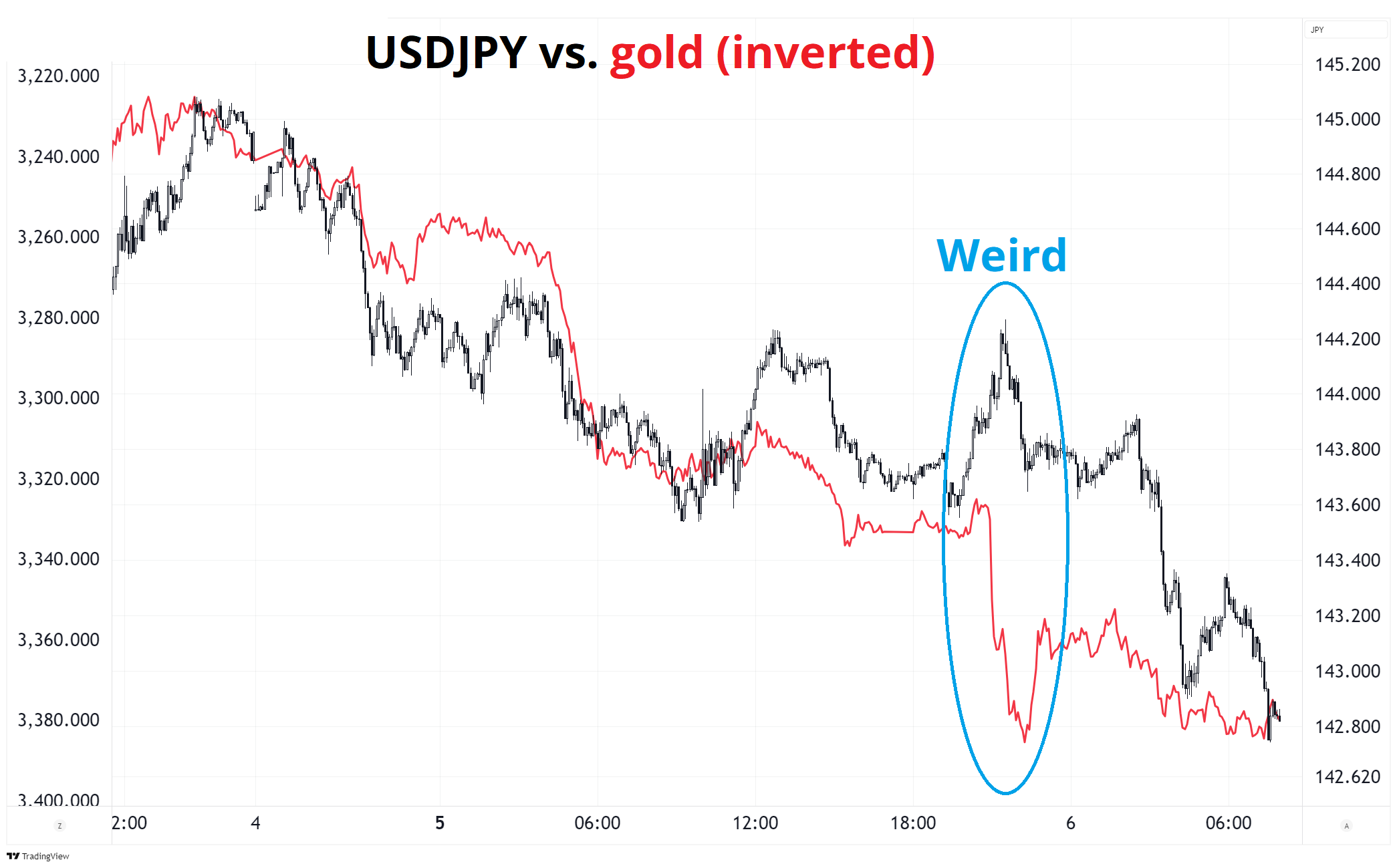

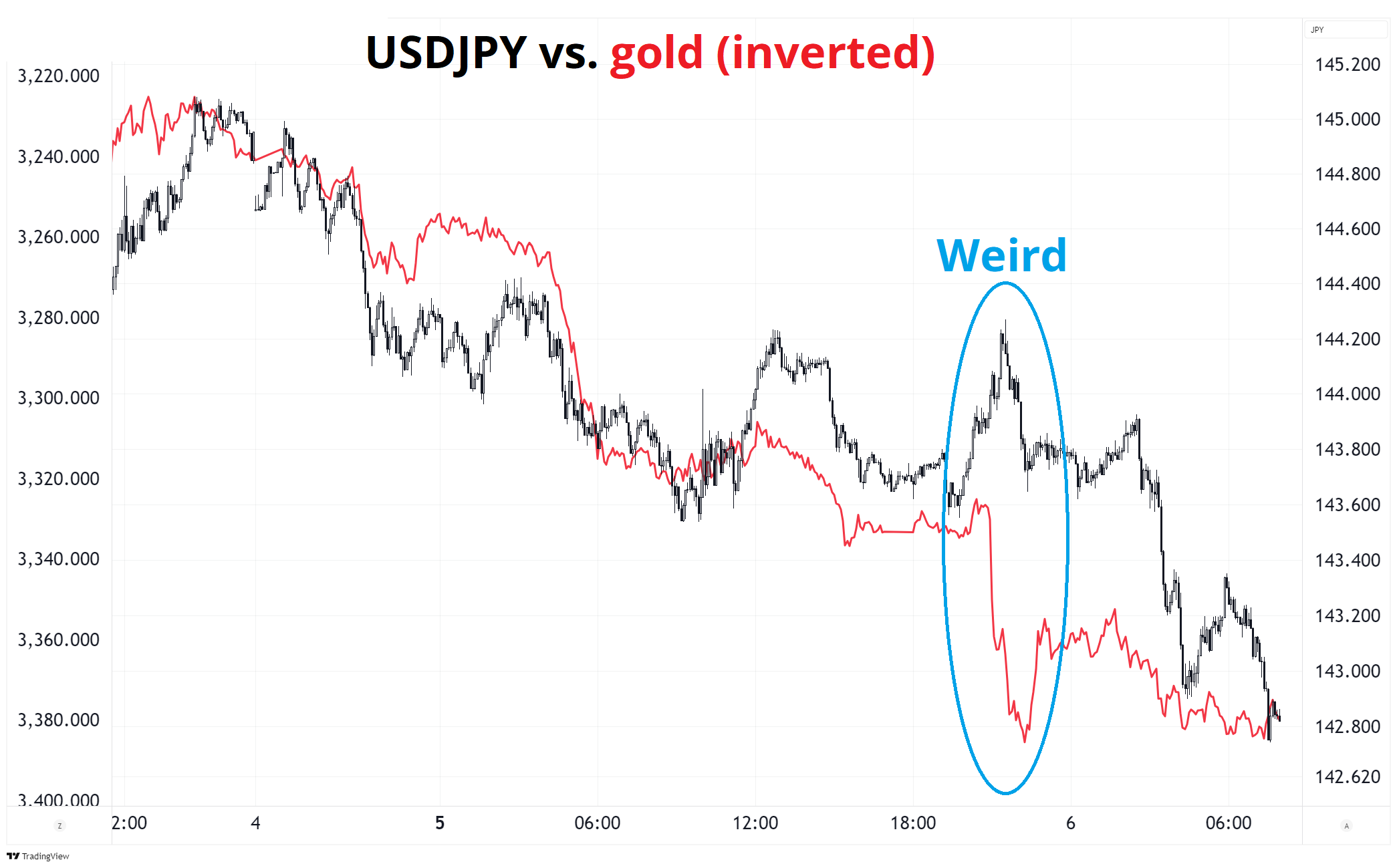

Weird price action last night as the market went into the Asian time zone short USD and got mini-rinsed as apparent USDTWD intervention and a firm USDCNY fixing triggered a stop loss run in the dollar. The strangest part was that gold was in the midst of a $50 rally at the time, and gold is the best real-time correlation for the USD right now. Sanity prevailed eventually, and USDJPY returned to fair value as suggested by gold.

EURUSD isn’t doing much, still, but I think 1.16 is a matter of time. The Merz election stuff is a red herring.

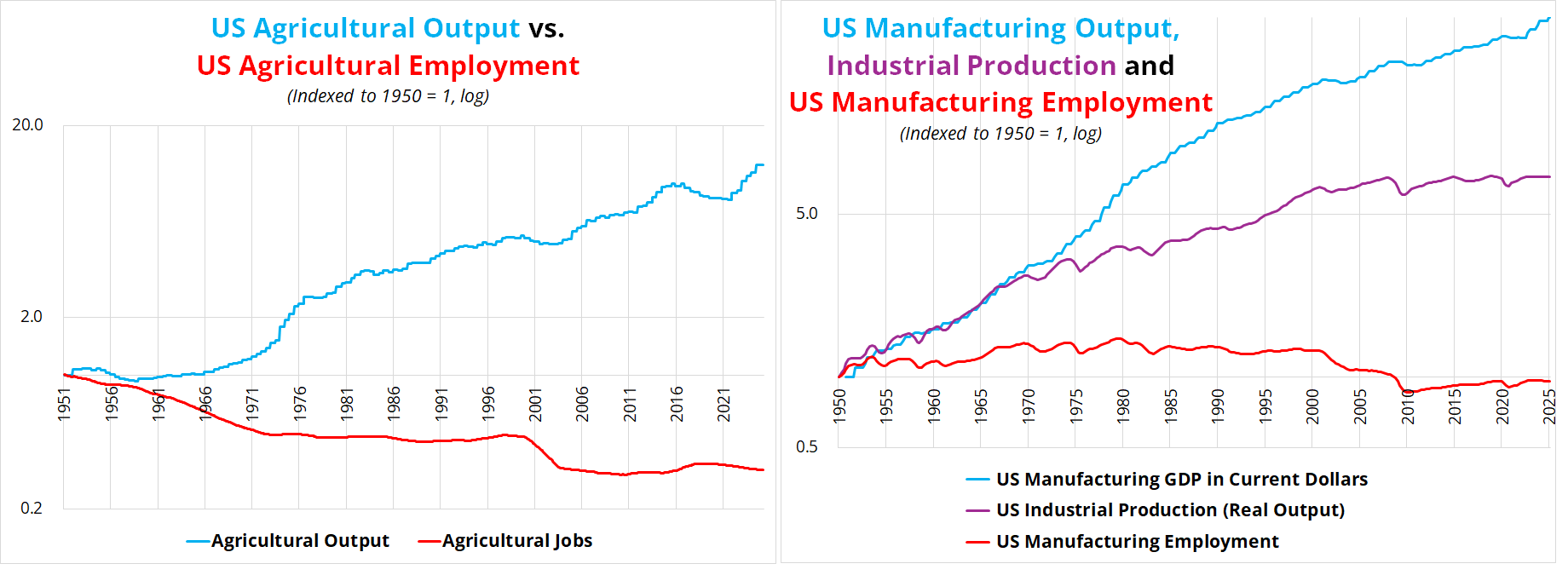

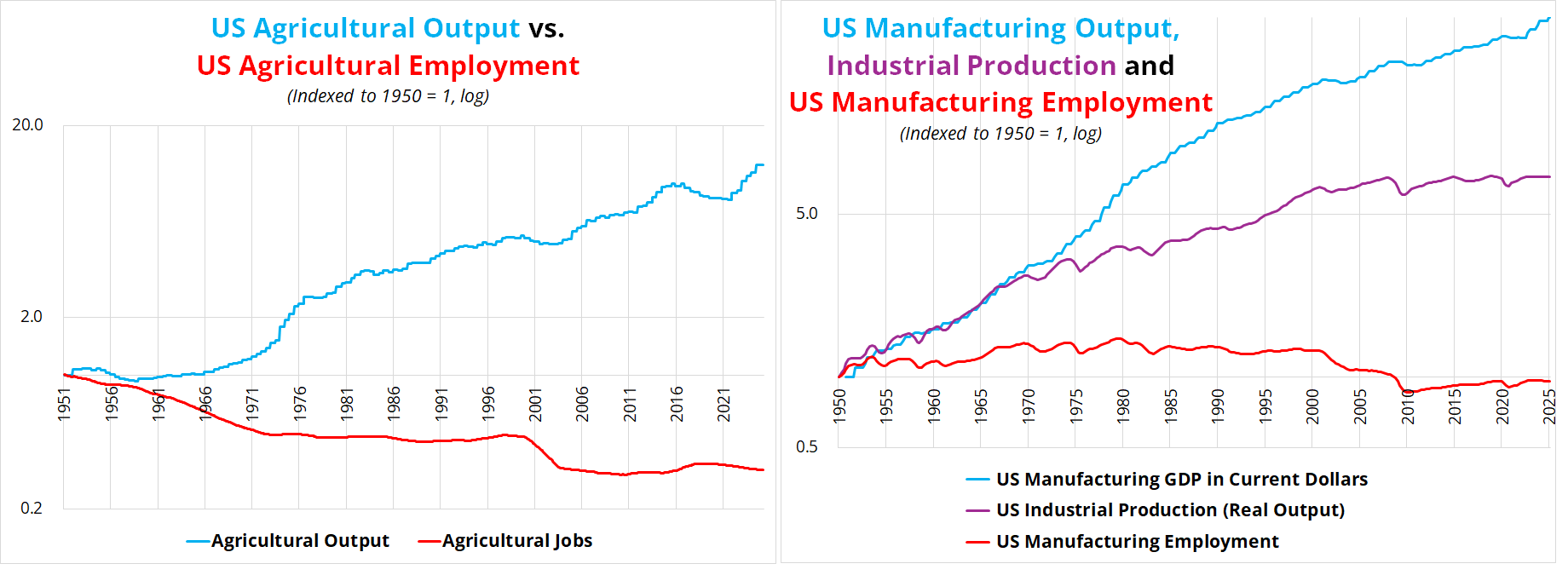

We are led to believe that the US stopped manufacturing, and all the jobs went to China, but that’s not true at all. Some jobs went to China, while many were eliminated by greater efficiency in the US.

Same story in US agriculture.

These things are admittedly sensitive to what price deflator you use because the production figures are real, not nominal. But still.

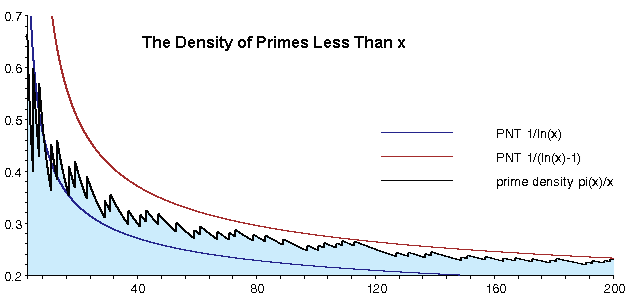

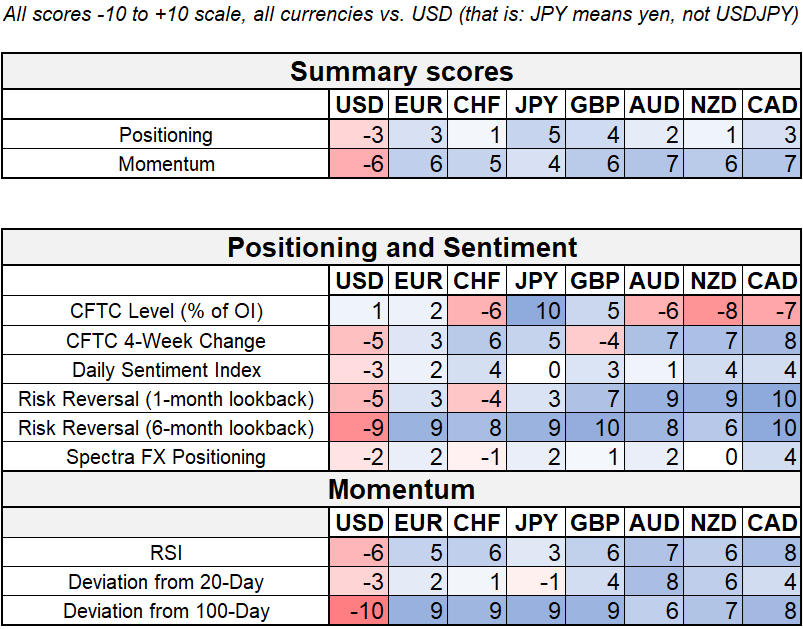

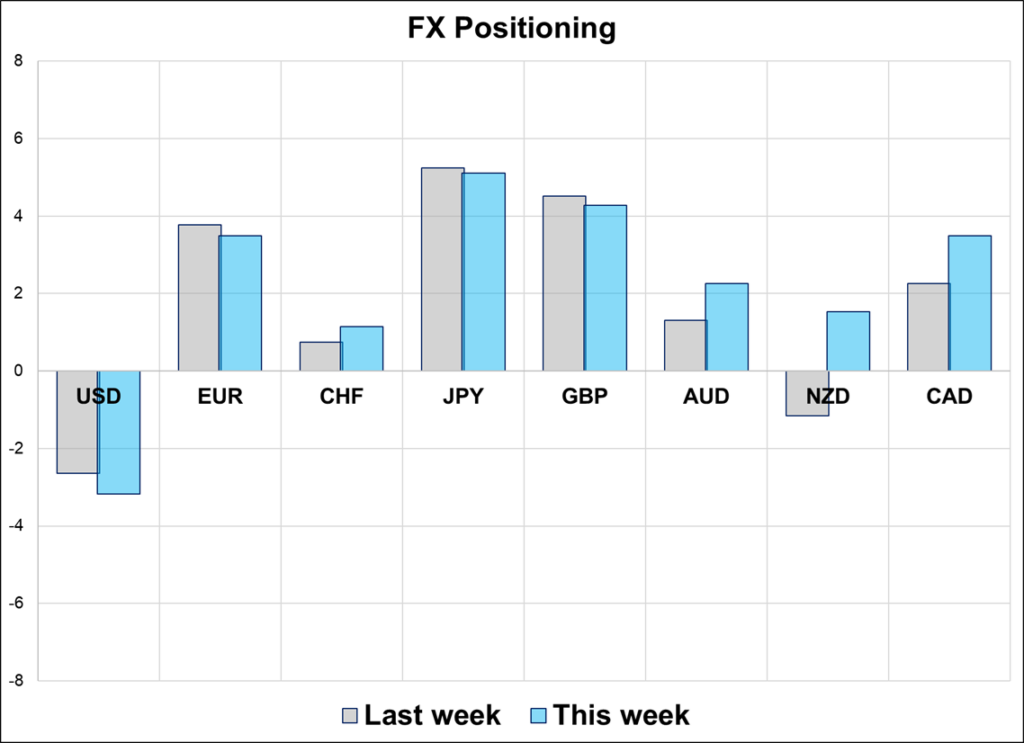

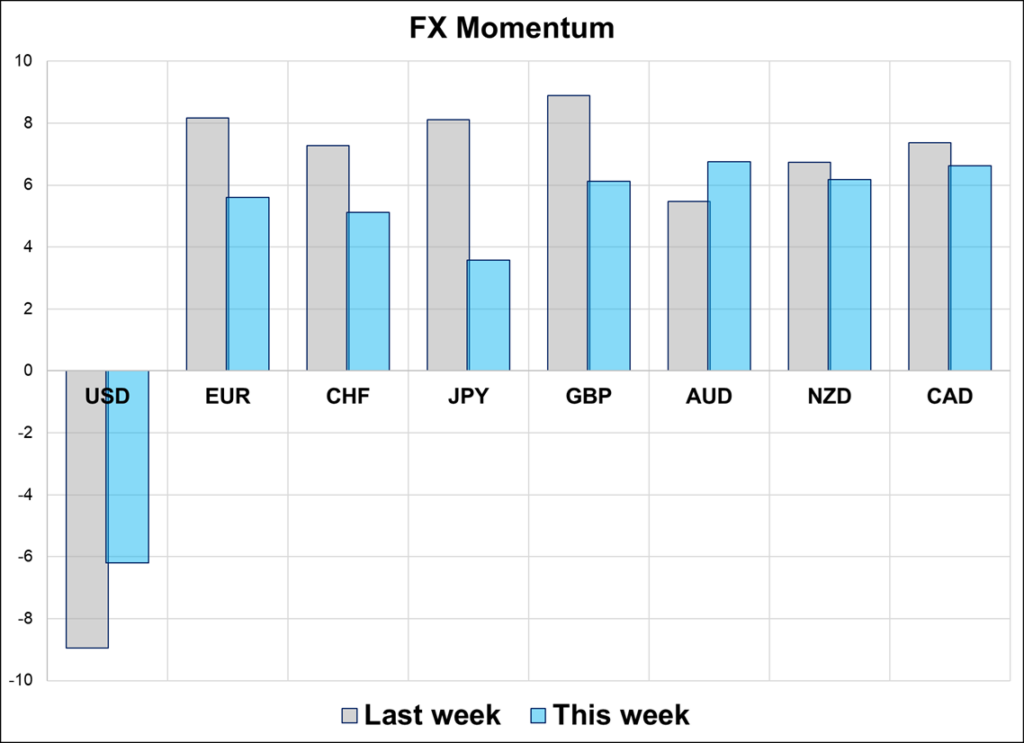

Positioning Report below. Have an asymptotic day.

The Spectra FX Positioning and Momentum Report

Consolidation Continues

Hi. Welcome to this week’s report. Realized volatility has come down significantly as EURUSD remains close to 1.13 over the past 30 days, but implied vols remain high and short USD positioning via options is slowly burning off. New York continues to buy USD while Asia continues to (mostly) sell USD and buy gold.