Equity seasonals, sentiment, and positioning have all flipped from euphoria to panic… But I too am scared

5 years ago, today

Equity seasonals, sentiment, and positioning have all flipped from euphoria to panic… But I too am scared

5 years ago, today

Long 10MAR 104.30 CADJPY put ~64bps

Covered ½ the notional at the strike.

Short gold at 2940

Stop loss was 3011 now 2936

Take profit 2805

The stock market absolutely refuses to bounce. We are now pretty deep in oversold territory, sentiment has flipped from all-time highs and raging post-election euphoria to stagflationary gloom, peak AI capex, and neomercantilismaphobia.

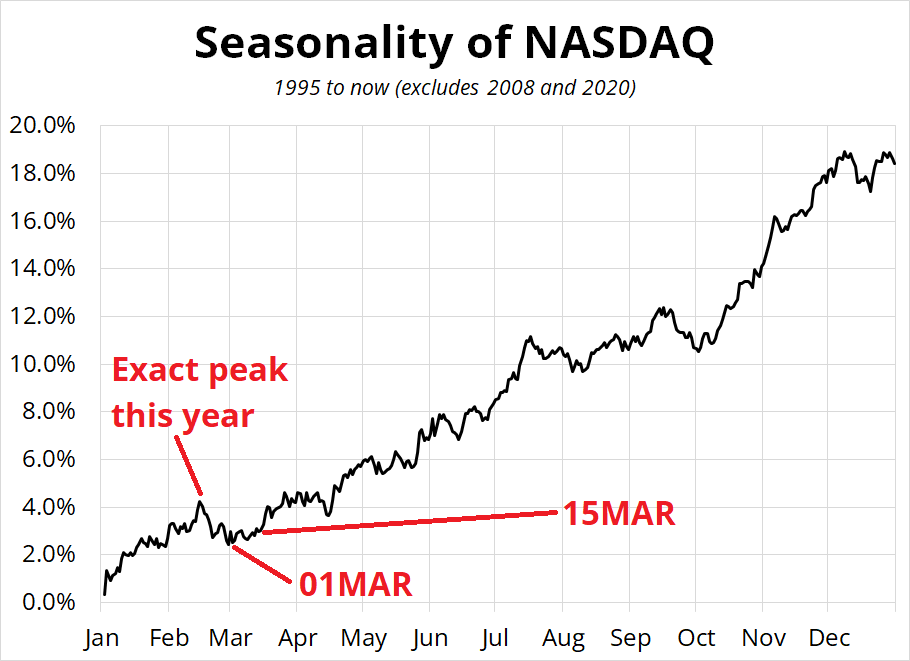

Seasonality worked perfectly this year as the 18FEB high in NASDAQ happened the exact day history would have suggested and all the gleeful new money chasing hot trends petered out around week 6 as it often does.

Now, we get two weeks of flat seasonality before the bull signal kicks in mid-March. So, we have gone from outright euphoria and seasonal strength to seasonal weakness and fear. While seasonals and positioning would normally make me bullish here (and I was wrongly bullish yesterday), it feels reckless to be long into the 04MAR tariff announcement (or punt) for Canada and Mexico.

While April 2 is the date for the broader reciprocal tariffs, the March 4 date is probably more important because if Trump is willing to tariff the closest allies at 25%, there is not much doubt the hammer will drop again April 2. While the rhetoric about a new global trading order has been clear, the enactment of tariffs on March 4th would be a clear and scary sign for markets that we are officially done with the neocon/neoliberal world order and moving to Transactional Neomercantilism. Then again, if the tariffs are just a bluff, the seasonals might nail the rally too.

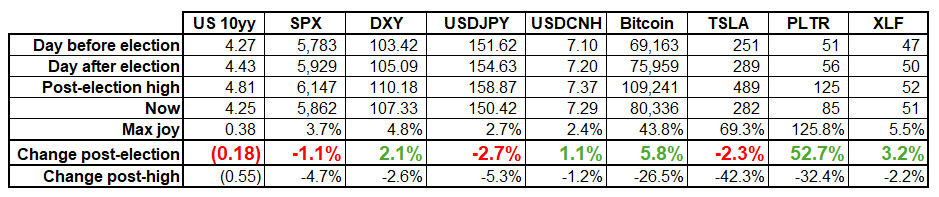

Checking in on the Red Sweep trades after just about four months, the common knowledge was mixed / meh.

My pre-election survey had respondents strongly agreeing that a Red Sweep would mean higher for everything in that table. While there has been much debate post-election about whether the new admin is good or bad for bonds, the unanimous pre-election consensus agreed a Red Sweep 2024 should be similar to Trump 2016. Then, USDJPY and yields skyrocketed on fiscal spending hopes, but now they are slumping on fears of fiscal drag.

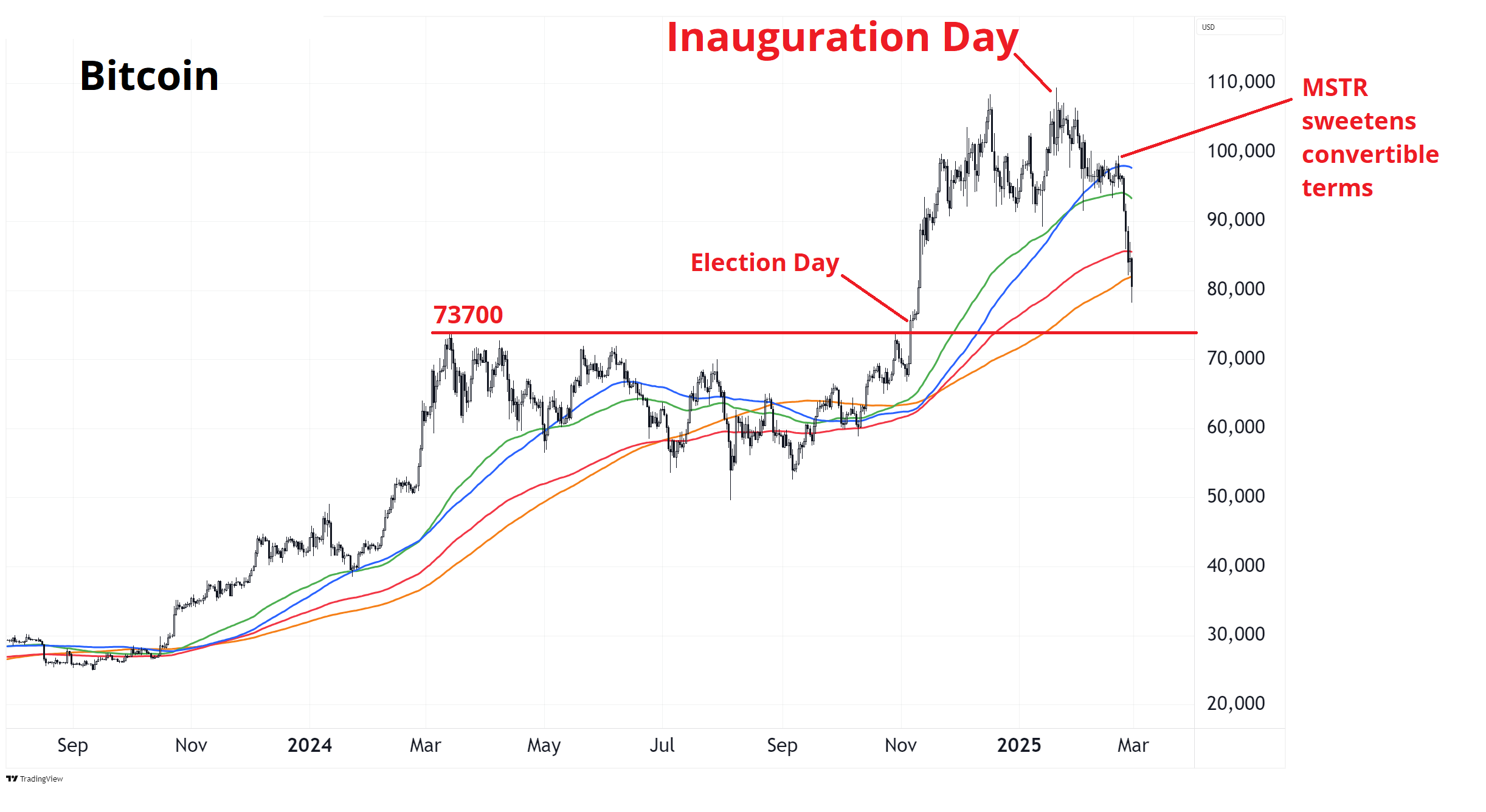

Crypto was a perfect buy the rumor sell the fact, as it often is, as the massive post-election rally peaked exactly on inauguration day.

73700 is the old all-time high resistance (now support). Bitcoin was 69k the day before the election and 76k the day after. So those are your supports. 69100 / 73700 / 76000. That’s a pretty wide band of support, and then below that you have Michael Saylor’s average price of 66350.

Saylor’s DCA price is irrelevant to the company until the convertibles come due in a few years but could serve as a psychological point where people say “eek!”. We may soon need to come up with the correct term for negative bitcoin yield. While it’s hard to separate bitcoin-specific news from global risk appetite (because bitcoin is a tech stock proxy), it’s interesting that the day MSTR could not find buyers for their convert at the initial proposed offering price was the day bitcoin finally peaked for real (see chart). Saylor has slowed his buying—the buyer of last resort disappeared. Obviously, though, you can also just say that all the stuff that drove the NASDAQ lower drove crypto lower and the clattering MSTR flywheel had nothing to do with anything. Or, you could say that perpetual motion machines are not real, as LUNA proved so dramatically a few years ago. The latecomers that tried to copy Saylor’s genius by trumpeting big treasury BTC buys at 100k look bad.

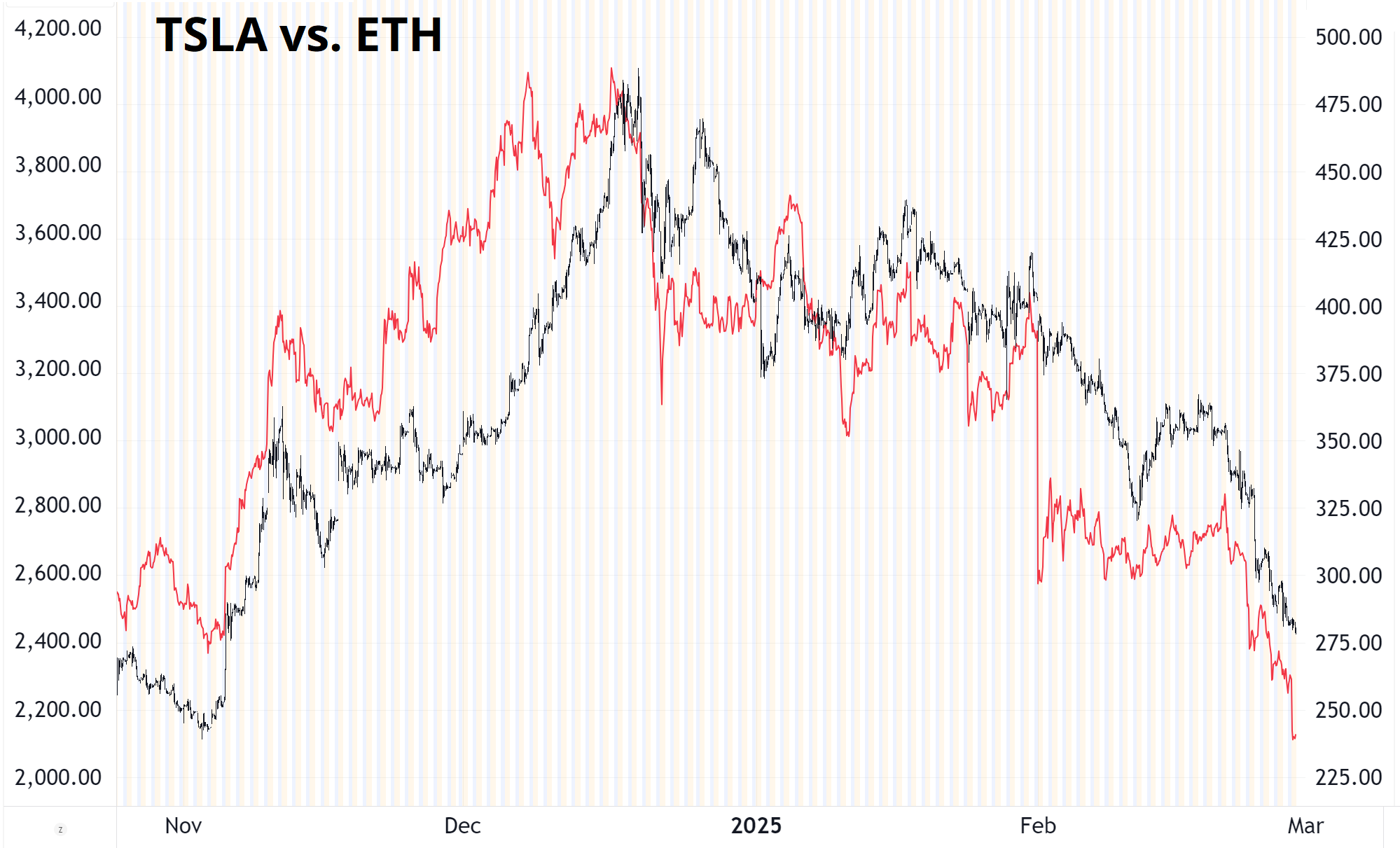

In that table above, you can see that PLTR and XLF worked, and basically nothing else did unless you took profit on 01JAN or on inauguration day. TSLA has had a crazy round trip as it trades more akin to a memecoin than a publicly-traded car company.

TSLA follows ETH and SOL, not F, GM, or MBG.

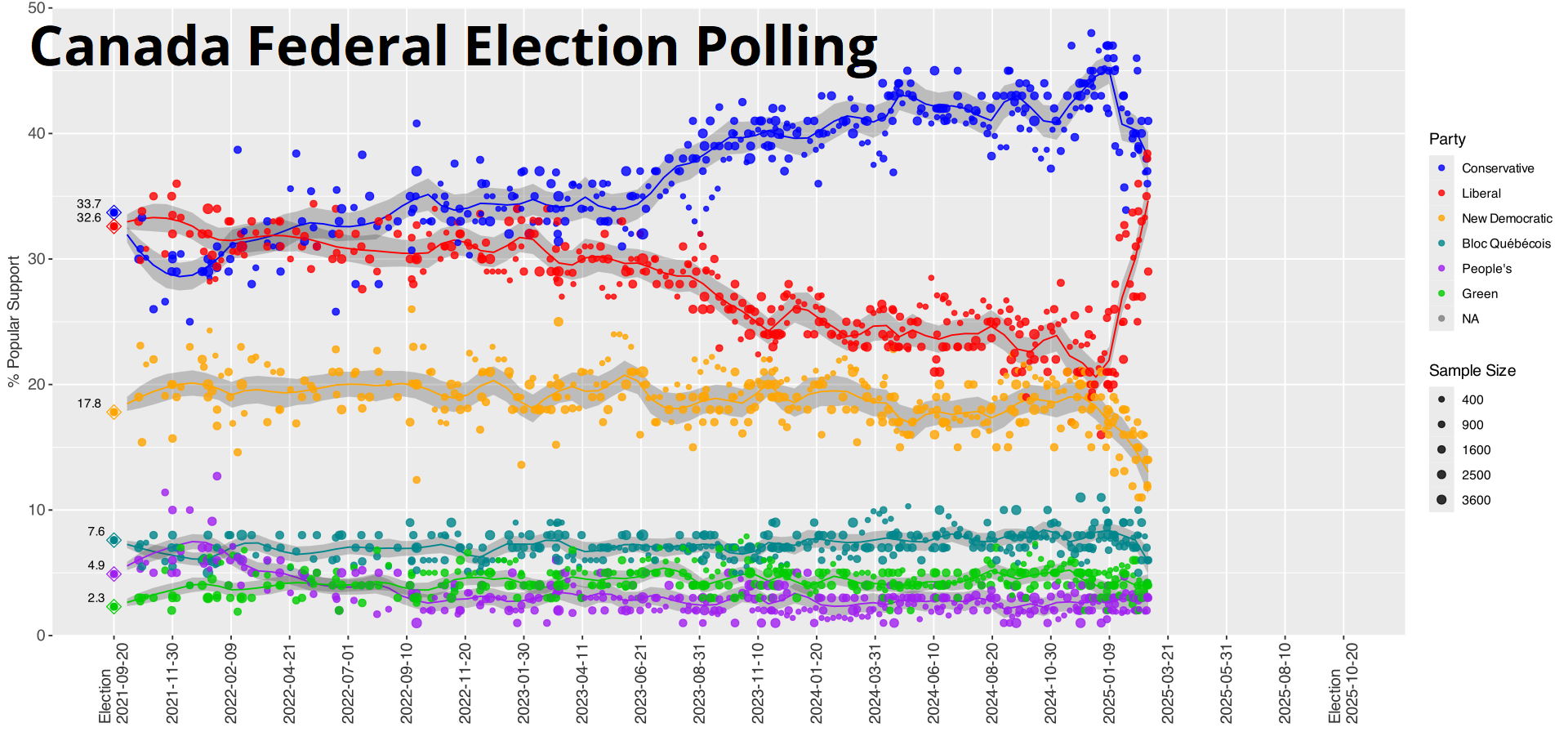

Not really currency-relevant at the moment, but in Canada, the Liberal Party has roared back from 26 points down in the polls and are catching up with Pierre Poilievre’s Conservatives. Mark Carney has become the anti-Trump as Canadians boycott US travel and/or products, and rage against surreal 51st State trolling. Poilievre is perceived more as Trump-lite, which used to be good but is now bad. Voting for the new Liberal leader has started and ends March 9. The election is likely in April or May.

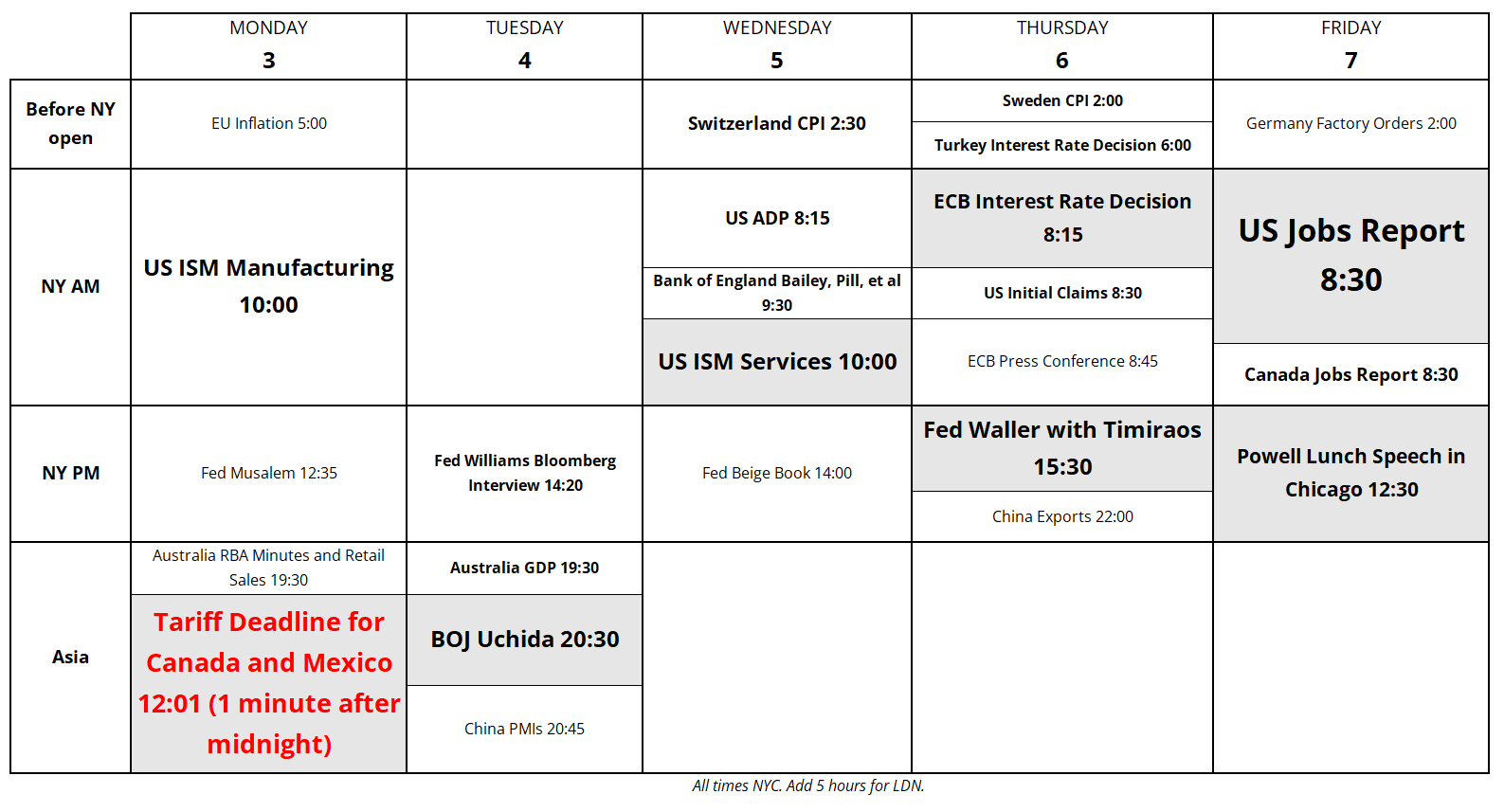

The tariff deadline is the big event on the calendar, but there’s something to chew on every day. That Uchida speech is big, and so are ISM, Waller/Timmy, NFP, and Powell. Got gamma?

Does anyone have any good writeups on what might happen to RUB if there is a UKR peace deal and relaxing of sanctions on Russia? I would like to read about the topic but can’t find anything. Please send! Thanks.

Gold slinking lower. I am moving the stop loss down again. Now at 2936, above all the moving averages and in a location that guarantees nothing worse than flat. Interesting that bonds are not offering any protection as stocks crumple. Stagflationary vibes.

Have an unmasked day.

5 years ago, today