The CAD story is so complicated, but that’s what makes it fun!

It’s never too late to do the thing

The CAD story is so complicated, but that’s what makes it fun!

It’s never too late to do the thing

Flat

The will he or won’t he continues on big tariffs for Canada and Mexico. Yesterday, Trump reiterated his plan to enact 25% tariffs on February 1 (the same thing he said two weeks ago) and his continued insistence with the date now so near triggered a sizeable pop in USDCAD and USDMXN.

The question of whether looks increasingly likely to be answer YES, but then we will quickly move to the question of “Are the tariffs real? Or just a bluff?” This question remains relevant even after the announcement of the tariffs because they won’t take force for another two weeks and therefore a heated negotiation phase will begin, and we still won’t actually know if there are going to be tariffs in real life.

I am reminded of May 2019, when this exact thing happened.

On May 30, the Trump White House announced a measure under the IEEPA to impose a 5% tariff on Mexico, effective in two weeks (June 10) with a promise to raise tariffs to 10% on July 1, 2019. Then, on June 7, Trump said:

“I am pleased to inform you that The United States of America has reached a signed agreement with Mexico,” Trump tweeted Friday. “The Tariffs scheduled to be implemented by the U.S. on Monday, against Mexico, are hereby indefinitely suspended.”

Mexico, in turn, has agreed to take strong measures to stem the tide of Migration through Mexico, and to our Southern Border,” Trump tweeted. “This is being done to greatly reduce, or eliminate, Illegal Immigration coming from Mexico and into the United States. Details of the agreement will be released shortly by the State Department. Thank you!”

Seizures at the border did fall significantly after this announcement, though I don’t know enough about it to assess whether this had anything to do with the agreement to rescind tariffs.

The trade at that time was long USDMXN then short USDMXN. :]

Here’s what USDMXN did.

This is not an argument to be short USDCAD at 1.4480!

USDMXN still went up 3.5% in one day. But it might be an argument to sell some USDCAD on the gap open this Sunday if tariffs get announced. Whether we open 1.47 or 1.49, the risk/reward on USDCAD is going to flip very fast if we get up there.

My guess is if the tariffs are announced, we open 1.5% or 2.0% higher in USDCAD, which would be 1.4700/1.4775, so if you could sell there on Sunday night, that might be a home run as the market will continue to price a high probability (50/50?) that the tariff still isn’t going to actually happen.

Note that the 3.5% rally in USDMXN came on a complete surprise and USDMXN is around twice as volatile as USDCAD. Here, we’re talking about a loudly-telegraphed action that was presented two weeks ago, and confirmed yesterday, right down to the specific date. That’s why I think you don’t get much more than 2% higher USDCAD on the announcement. It’s partly priced in, there will be yards of USDCAD to go up there, and there is a good chance the tariffs still never happen, even if they are announced this weekend. And energy will probably be exempted to avoid a gasoline price spike, and that’s 20% of all exports. Yes, a 25% tariff on Canada is cataclysmic for CAD. But we still won’t know what’s real, even if a tariff is announced this weekend.

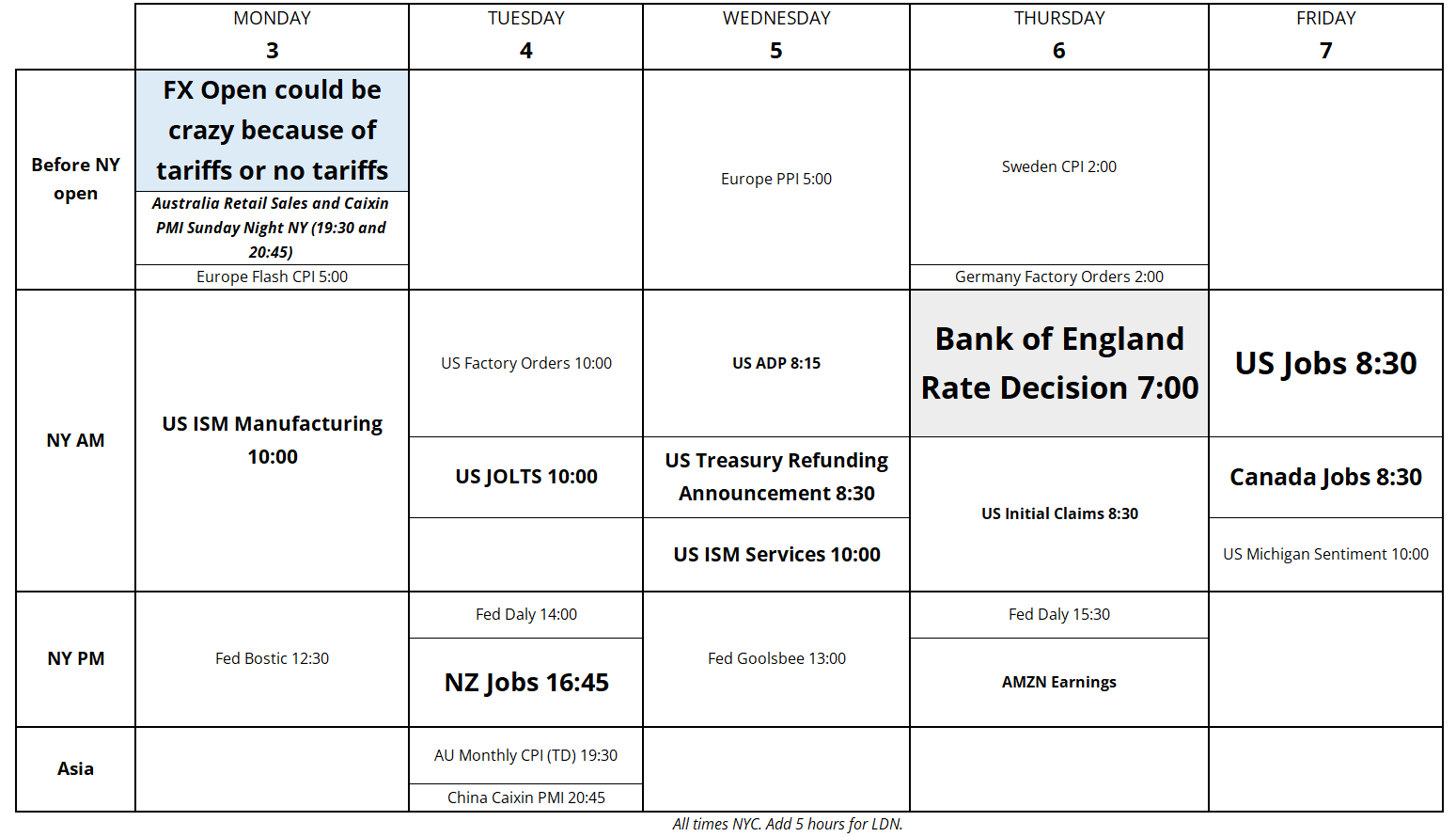

The calendar is kind of sparse next week, though we do get ISMs, and JOLTS, BoE, and NFP.

I am on vacation next week, so am/FX returns February 10. And one last clickbait / guesswork article…

Have a jazzy weekend.