Y’all are hawkish. But short USD?

It’s interesting how some 90s alternative holds up well (e.g., Hole and Alice in Chains) while some sounds whiny and self-absorbed (Smashing Pumpkins)

Y’all are hawkish. But short USD?

It’s interesting how some 90s alternative holds up well (e.g., Hole and Alice in Chains) while some sounds whiny and self-absorbed (Smashing Pumpkins)

Long EURGBP @ 0.8674

Stop loss 0.8589

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Hedged 1.8140/90 (35%)

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

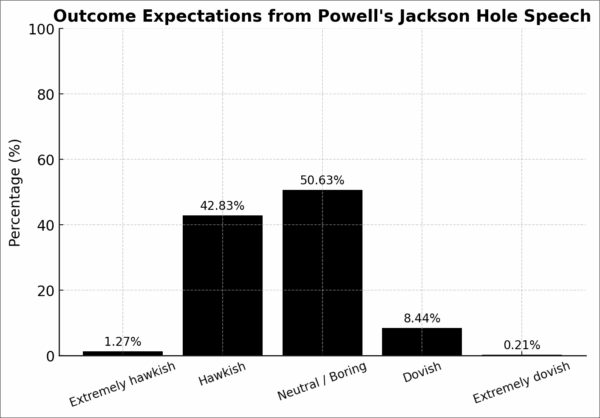

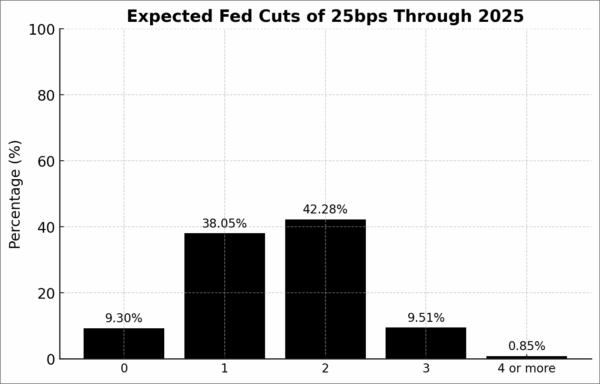

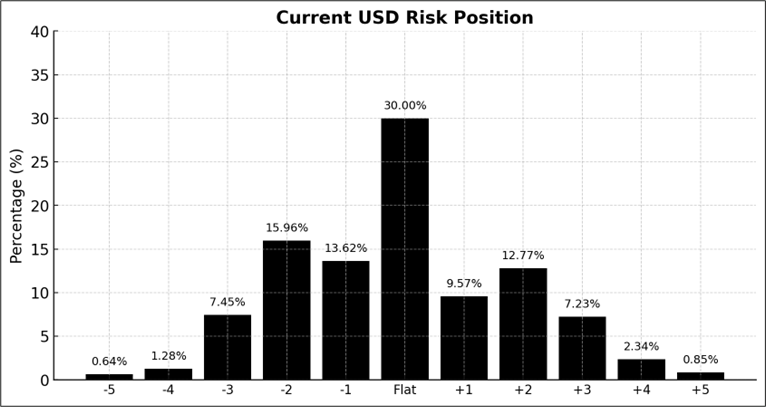

Here are the results from yesterday’s survey. 473 people responded. Thank you for taking the time to contribute.

Wow. Big skew. I suppose the price action going in supports this. USD higher, stocks lower, etc. showing jangly nerves into the confab.

One or two cuts makes sense. Consistent with market pricing.

This is where it gets a bit weird. I suppose traders are core short USD and sitting on it despite believing that Jackson Hole will be hawkish. And many who are short USD are perhaps hoping to ride out a neutral/boring Jackson Hole (which is the modal expectation). Still, kind of an interesting setup that might test the resolve of the USD bears.

“Dammit, I knew it was going to be hawkish. Why didn’t I cut some of my EURUSD calls??” type of thing.

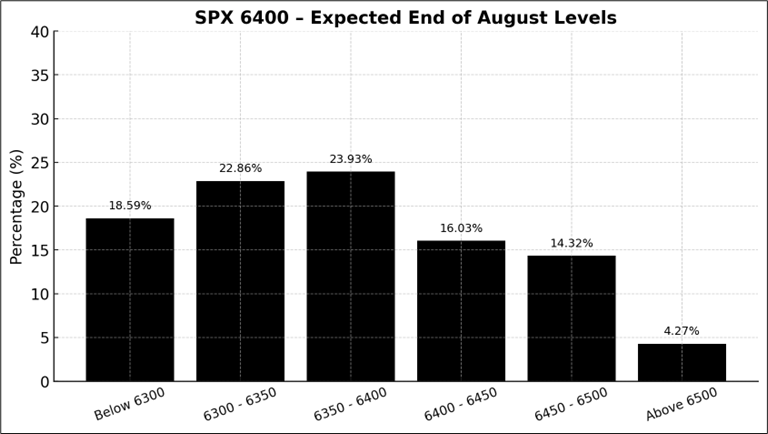

There’s a bearish skew to the short-term equity view as seasonality and hawkish JHole views combine, probably.

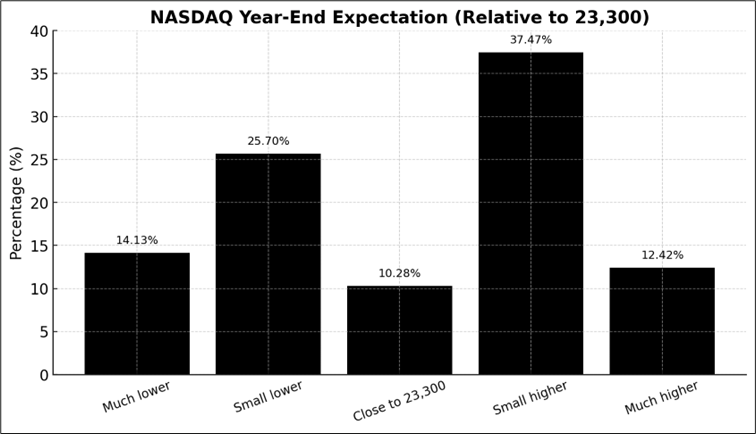

Finally, as you zoom out, readers are more bullish stocks into year end. Overall, the equity views are not particularly hardcore either way but there is definitely a down then up consensus.

I am keeping it short because it’s Friday. Also, I want to send this well before the event or it will be useless. My view is that Powell will sound data dependent and hawkish relative to September pricing, but it looks like that’s what everyone else expects too, so the reaction could be muted or counterintuitive after the kneejerk reaction.

In the end: It’s the data that matters, not the rhetoric. But for today we trade the rhetoric.

https://www.nber.org/system/files/working_papers/w34102/w34102.pdf

“Despite the absence of a positive break in the aggregate index, we find evidence of a broad-based increase in inflation trends beginning in February 2025, when key sectors—such as household furnishings—exhibited renewed price pressures aligned with the timing of the tariff announcements and implementations.”

“They get what they want. And they never want it again.”

– Courtney Love, September 8, 1998

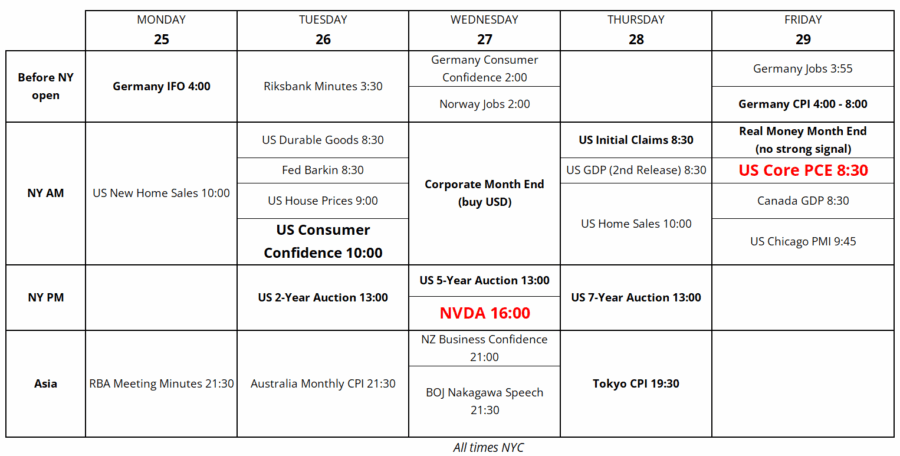

Trading Calendar for the final week of August 2025

Soundtrack for this weekend’s proceedings

Violet (Hole)

Down in a Hole (Alice in Chains)

Head Like a Hole (NIN, Eric Johanson cover)