Neither 0.2 nor 0.3 would be a surprise.

A collapsed hill on Mars.

Looks bearish.

Photographed by NASA’s Mars Reconnaissance Orbiter

Neither 0.2 nor 0.3 would be a surprise.

A collapsed hill on Mars.

Looks bearish.

Photographed by NASA’s Mars Reconnaissance Orbiter

Long 18JUL 1.3410 GBP put

for ~25bps off 1.3470 spot

While a cursory read of the ECO US page on Bloomberg might lead you to believe that the consensus for today’s headline CPI release is 0.3%, a closer look shows that is not really the case. Economists are almost perfectly split and thus the Bloomberg median estimate is settled by a single vote (36 to 35). So, you could say the consensus is for core to be either 0.2 or 0.3. This is relevant because if you see 0.2 on core, be ready for a spike in bonds and quick reversal given that 0.2 is not really a surprise at all.

On headline CPI, the skew leans more standard, clearly towards 0.3.

Next, look at the average estimate for each series in blue to the left of the graphs. It makes sense to observe the average because there are no outliers. You see both CPIs have an average estimate of 0.25%/0.26%.

And Polymarket is skewed the other way on headline, with 52% of the money on 0.2 and just 36% on 0.3.

My conclusion is that neither 0.2 or 0.3 on either or both figures should be considered a surprise and I would expect mean reversion in bonds, FX, and stocks on either one.

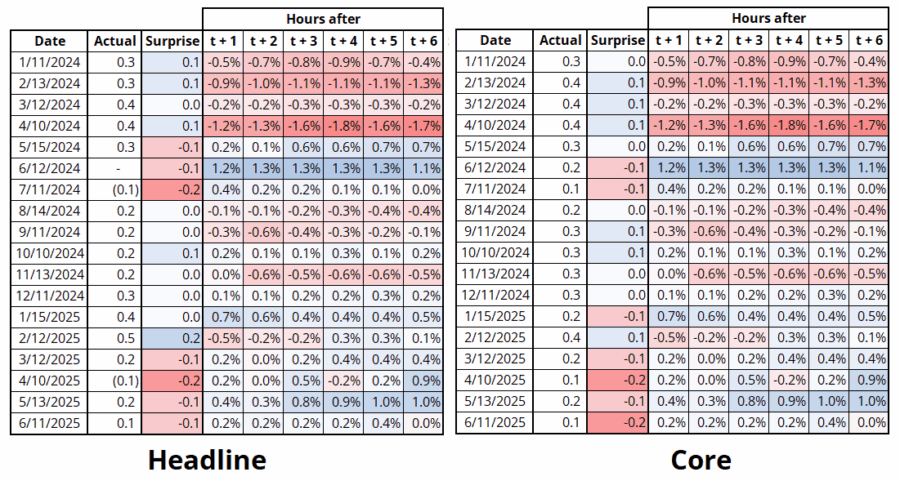

For example, if we get headline/core of 0.2/0.3 or 0.3/0.2, expect a very short-lived pop in bonds. If we get 0.3/0.3 or 0.2/0.2, perhaps there’s a slightly better chance of continuation, but I will not be reacting to anything other than 0.1 or 0.4 unless I’m fading the kneejerk. For reference, here are the 1-to-6-hour reactions of USDJPY and AUDUSD to CPI releases 2024 to now. You can see that when both Core and Headline surprise in the same direction, you get larger USD reactions (naturally!) These grids will give you a sense of min/max moves possible today.

USDJPY reactions to CPI, 2024 to now

AUDUSD reactions to CPI, 2024 to now

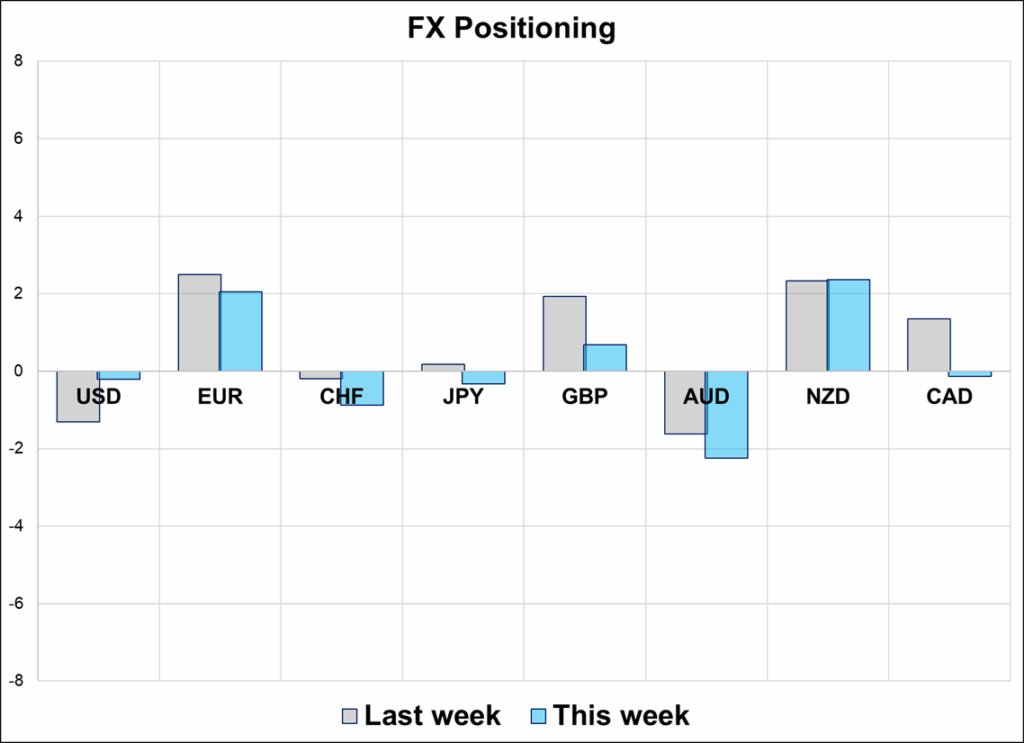

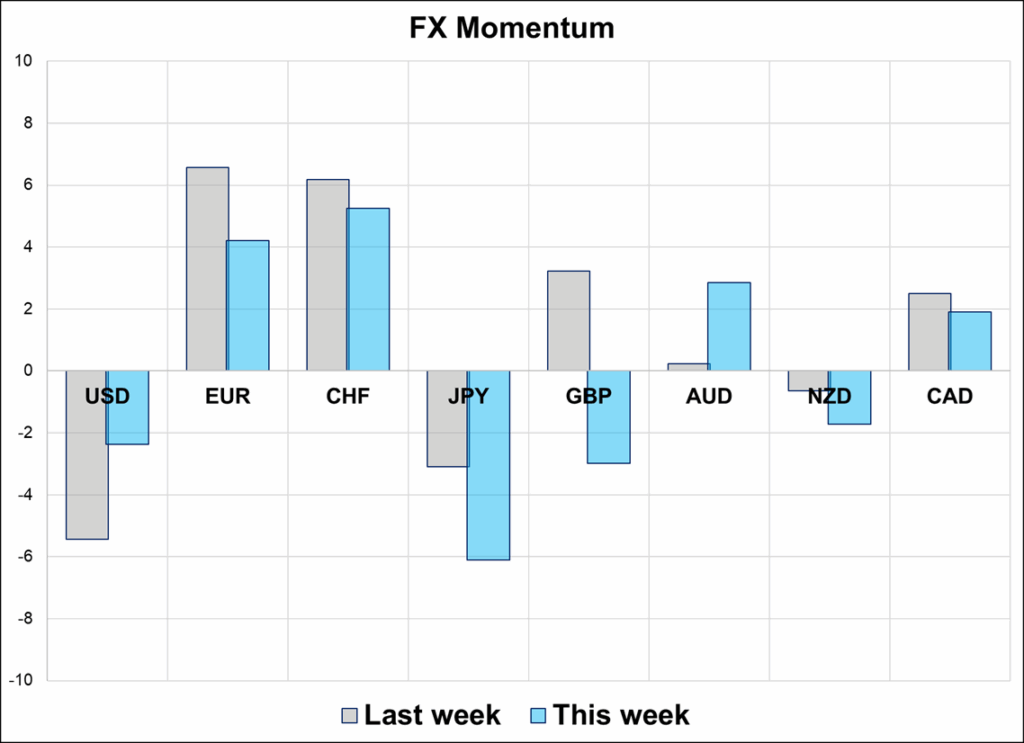

And to close this early-bird special, here is the positioning report for this week. The CFTC remains unbothered by the JPY selloff, as those models are paleolithically slow to react. The overall data shows a market that’s now pretty close to home as the USD has been rallying in a slow straight line for two weeks now and the USD-bearish mojo is gone. Headline-grabbing calls for a 30% or 40% drop in the USD marked the exact low in the greenback. That tends to happen.

What a ride for NVDA. DeepSeek on. DeepSeek off. Export controls on. Export controls off.

Have an ursine day.