Survey results and some things to think about.

The most commonly spoken language in each state

Survey results and some things to think about.

The most commonly spoken language in each state

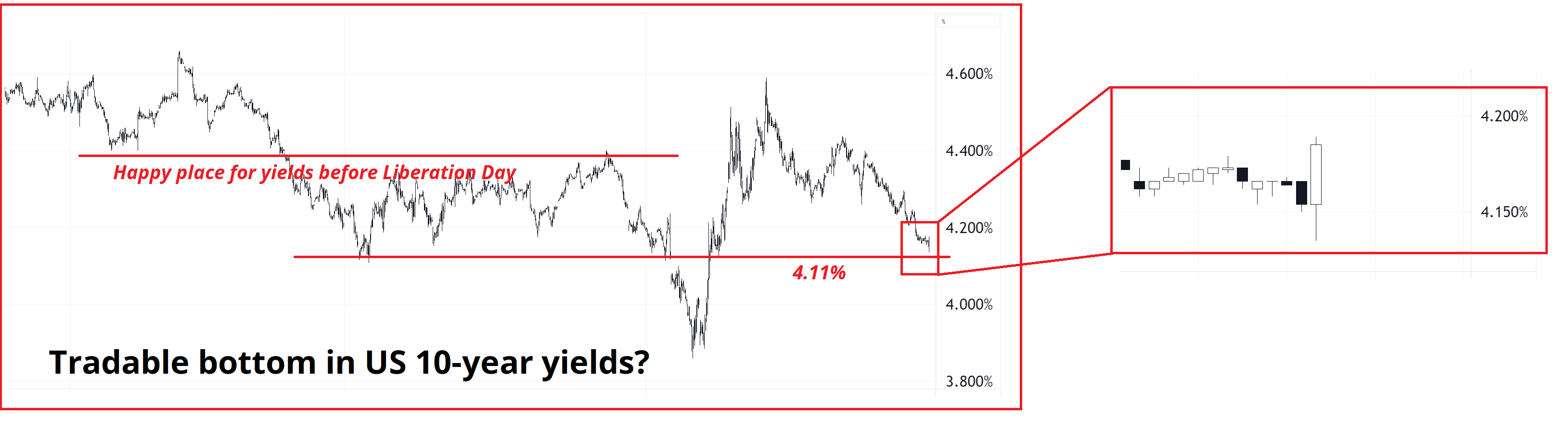

Long 12MAY 168/163 put spread in CHFJPY

~31bps off 175.25

Welcome to Rabbit Hole #13. The Rabbit Hole series offers deep dives into random macro topics that fascinate me. Today: Looking at the difference between positive-EV trading and negative-EV gambling.

10-minute read – feel free to forward this piece

I conducted a survey last week in support of my new book, which I hope will come out around Christmas 2025, barring any planning fallacy. It’s a follow up to Alpha Trader and is aimed at more experienced / advanced traders. The working title is: Alpha Trader: Outside the Box

“Thinking outside the box” is a cliché, but I like the way the title sounds a bit like a movie sequel, like Mad Max: Fury Road or something. If you have an opinion on the title, I will listen; it’s not too late for me to change it.

The quick pitch for the book is that everyone knows about the four pillars of trading: Fundamentals, Technicals, Behavioral Finance, and Quantitative Research… So if those are four sides of the box that all members of the financial herd use to look at markets, what are some different mental models and approaches to that might yield unique ideas, tactics, and strategies.

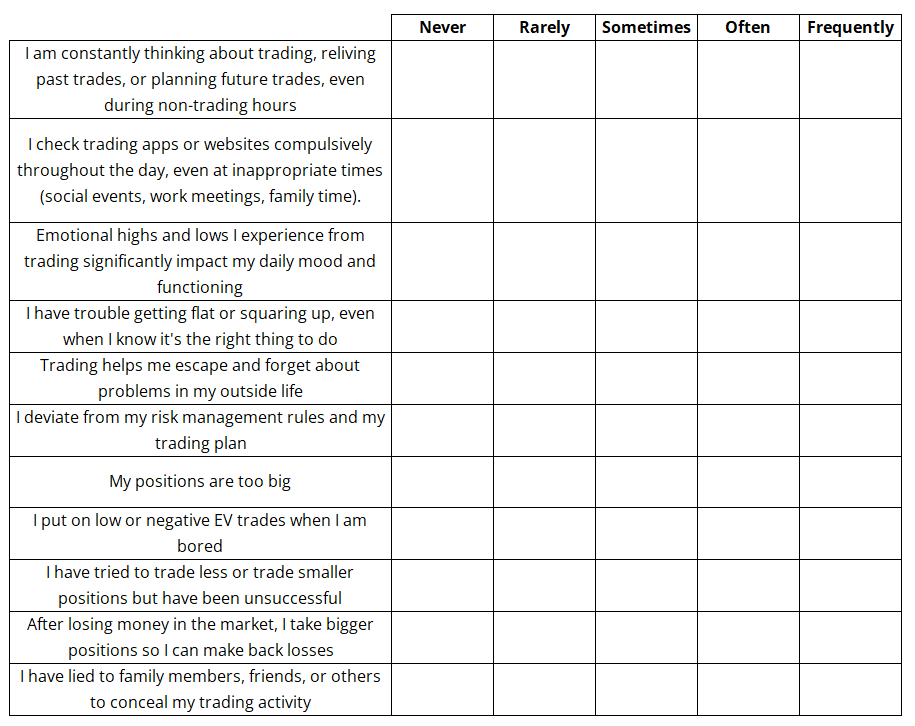

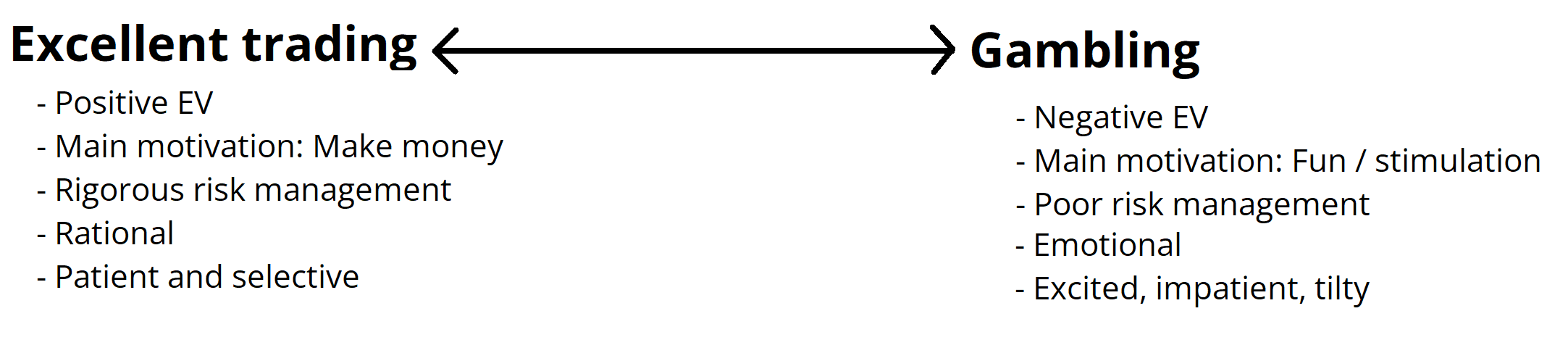

In one part of the book, I contrast excellent trading (positive-EV, good) with gambling (negative-EV, bad). I use the DSM-5 (The Diagnostic and Statistical Manual of Mental Disorders) to help diagnose and find solutions for problematic gambling-adjacent behaviors like overtrading. To establish a baseline for what is “normal”, I conducted a survey. If you did not complete the survey, you may want to do so now, before moving on.

Psychiatrists use the DSM-5 to diagnose mental disorders, and I think it provides some perfect checklists for diagnosing harmful trading behaviors. The 947-page beast organizes mental conditions into logical categories, sets specific criteria for each diagnosis, and distinguishes between normal variation and actual dysfunction.

Academics have studied the differences and similarities between trading and gambling. Here is a summary of a systematic review of the literature conducted in the January 2017 issue of the academic journal: Addictive Behaviors. Their paper is called: “Excessive trading, a gambling disorder in its own right?”

The systematic review showed that some traders were comparable to pathological gamblers in terms of clinical personality profiles and the severity of the loss of control. Like many pathological gamblers, they experienced a number of small early wins, chased their losses, lost control over the money they invested and had similar cognitive distortions including selective memory, gambler fallacy or rationalization. However, they seemed to be better socially adapted than pathological gamblers, with less personal and family damage linked to their activity. They had a higher educational level, and were more cooperative.

While my objective with the survey was mostly to establish a baseline so that when a trader rates their own behaviors, they have some context around normal variation, there are some useful takeaways, too. The number one goal with an exercise of this sort is to get people to be honest with themselves about personal suboptimal behaviors. An interesting side effect is that I find when I am writing these books, my trading improves during that period because I am laser-focused on process and significantly more self-aware than average. When I am not writing a book, it’s easier to slip into bad habits and sloppy thinking.

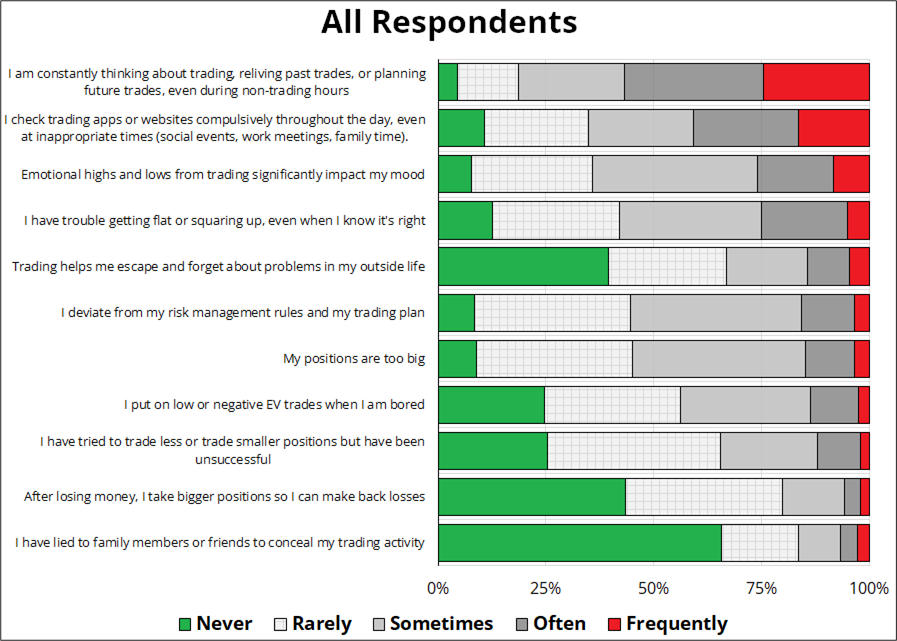

The raw data from the survey isn’t super surprising to me, but the breakdowns by trading experience and retail vs. institutional did kick out some unexpected results. First, let me show you the complete output, for the entire sample of 1,930 people who completed the survey.

Takeaways:

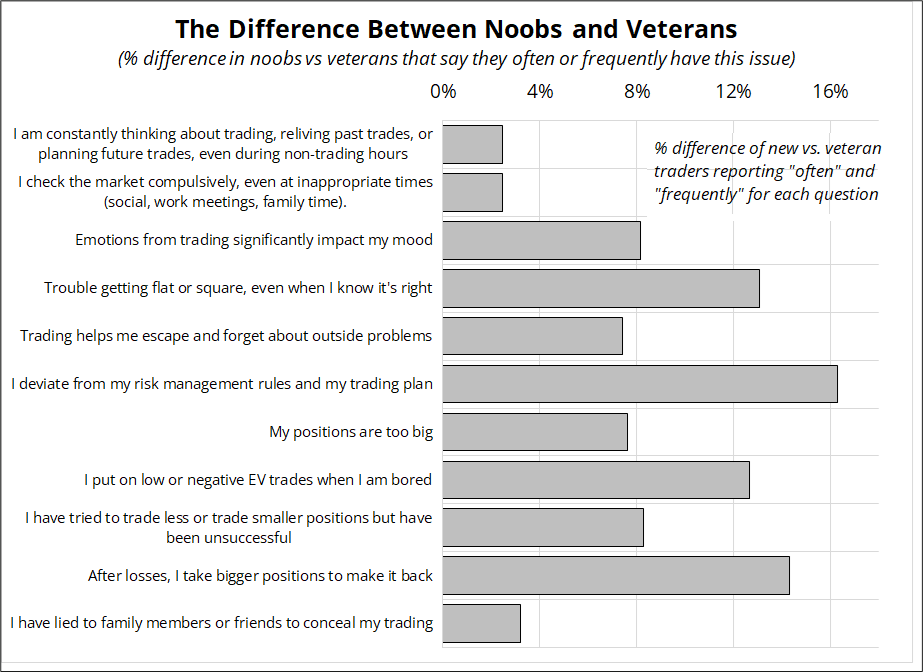

There is a substantial difference between unwanted, gambling adjacent behaviors among new and experienced traders. Here is the differential between how often noobs (1-3 years of experience) reported an issue “often” or “frequently” as compared to veteran traders (10 years + trading experience).

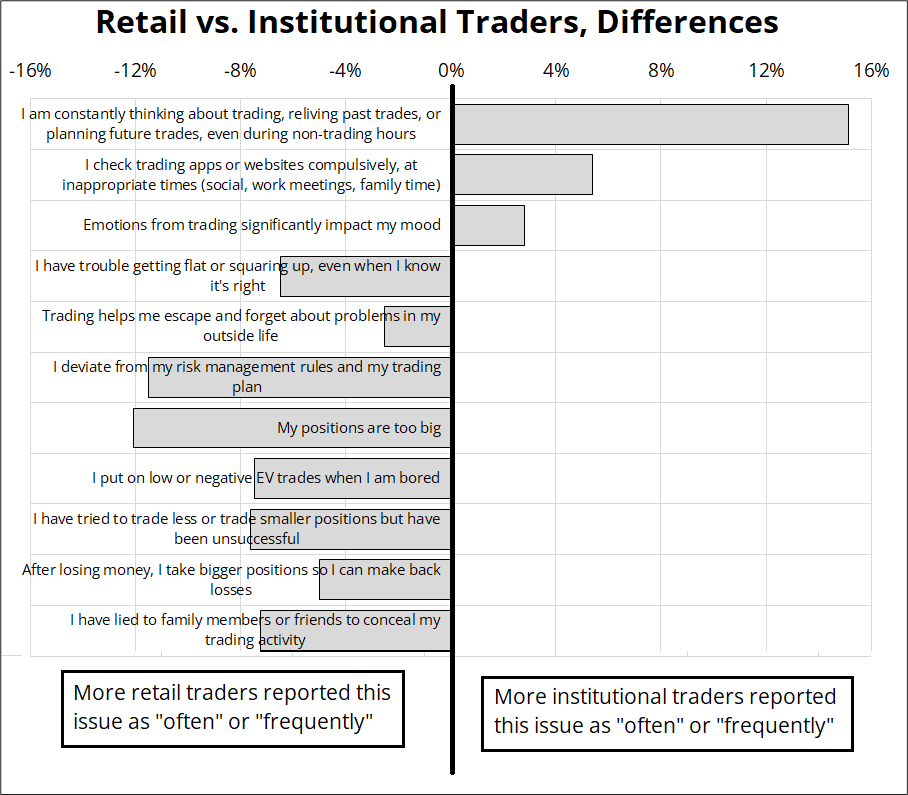

The main difference with experienced traders is that they stick to the plan, they get flat when it’s time to get flat, and they don’t chase losses. I was also wondering whether there is a difference between responses from retail and institutional traders, regardless of experience. I think market makers and institutional traders tend to look down on retail and refer to it as “dumb money” but there is a huge cohort of extremely successful and top-tier elite retail traders out there who are as good as, or better than any HF trader. Here are the results:

I found this understandable, but surprising. Institutional traders are far more obsessed with the market and are constantly thinking about trades and trading.

Every good trader is pre-occupied with the market. The obsession with markets is what makes great traders great. As with most human characteristics, an abundance of a particular trait can be an asset, and an excess can be debilitating. If all you think about is markets, you will find that they never give you what you want or need from life. They will give you money and possibly fun and stimulation, but in the long run it’s family, friends, and community that lead to real happiness.

One way to live a life that is not completely pre-occupied with trading is to go hard when the markets are humming, but give yourself permission to take time off and chill when volatility is low. Sure, volatility isn’t always predictable, but often you can tell in mid-July that it’s probably going to be quiet. Take a week off for no reason. Plan a three-day trip away with just you and your daughter. And when you take time away, stop checking the market.

Finally, take note of how often you are checking your phone. Those futures are going to go up and down whether you are watching or not. Your stop loss in USDJPY is either going to get done, or not get done. Watching the price action in bitcoin on Saturday at 6:14 p.m. probably isn’t going to have any positive impact on your P&L or your mental health. Obsessively checking the market is a bad habit. Be aware of it and if necessary, make some rules. For example, I don’t bring my phone with me if I’m doing something with my wife (watching TV, playing a game, etc.) and I stay off Twitter, Bloomberg, and anything finance-related on Saturday.

Sunday at 1 p.m., I’ll take an hour or two to read emails, get caught up on news, and think about any trades I want to do on the market open. Then I try not to check my phone Sunday night more than four specific times. Once when FX opens (1 p.m. or 3 p.m. NY time), once when futures open (6 p.m. NY), once when single names open (8 p.m. NY), and once before I go to bed.

Sitting there staring at futures for four hours Sunday night is a complete waste of time, but it’s also an easy thing to get sucked into doing if you’re a market junkie like me. Are you obsessively checking the market, even when you’re not at your trading desk? Stop it.

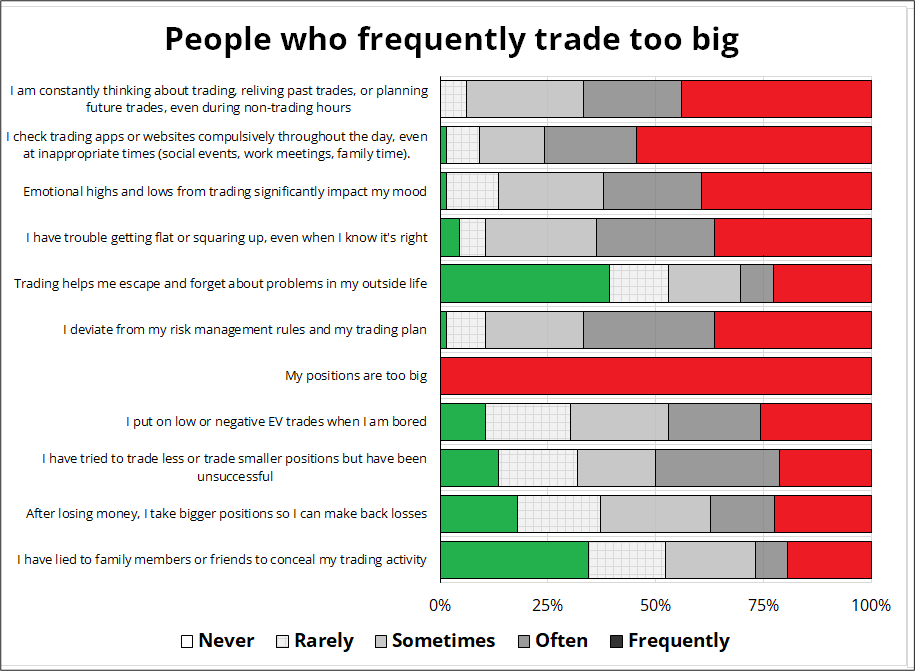

Finally, the trading as gambling issues are highly correlated across respondents. That is, if you’ve got an issue with one of these behaviors, you probably have an issue with many of them. I selected all respondents who answered “frequently” to: My positions are too big, then looked at their responses to the other questions. Here’s what that looks like. For context, compare this to the chart on page 1, which is all respondents.

The main point of this whole exercise is to get thinking about where you are on the trading vs gambling spectrum, and take specific actions to start moving from right to left.

Have a well-mapped out day.