A poetic year for markets.

Hello. It’s Wednesday but up until a few minutes ago I thought it was Friday. So here’s the year end Friday Speedrun, lol.

The About Page for Friday Speedrun is here.

A poetic year for markets.

Hello. It’s Wednesday but up until a few minutes ago I thought it was Friday. So here’s the year end Friday Speedrun, lol.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Global Macro was all over the place this year

Bullish in January ===> World ending by Q2

The Economist nailed the bottom. Covers colored by fear.

Trade wars are good and easy to win. Who knew?

The rare double buy signal issued by The Economist in April 2025

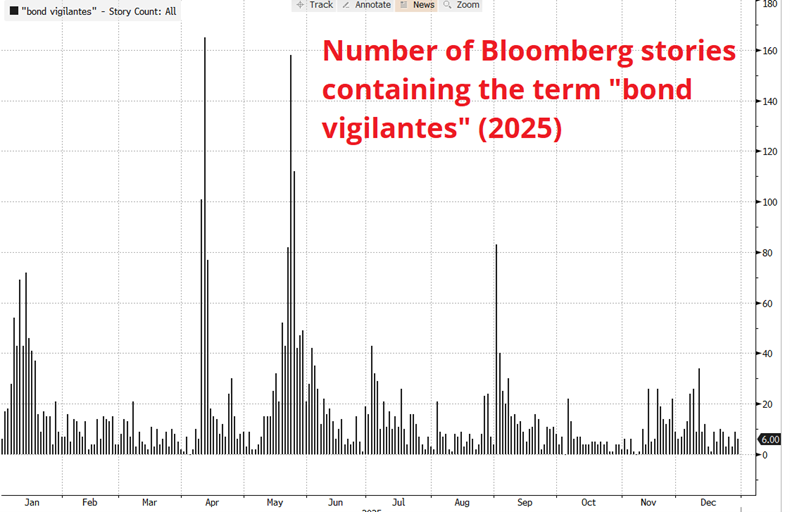

Bond vigilantes appeared for a bit

But they never had control for long

The UK budget was seen as legit

Deficits schmeficits, the global economy’s strong

Mild tick up in the UR and trend GDP

Inflation is sticky but not a concern

It’s year four of the soft landing that was not meant to be

Recessionistas’ hearts and minds churn and burn

Stocks performed well, they did more than okay

January NVDA cratered on the DeepSeek Freak

April, SPX collapsed because of Liberation Day

Then spent the rest of the year climbing to the 7k peak

Stochastic parrots were the primary theme

We need to house billions of them in data centers

They poop out tokens, a technotopian dream

OpenAI and NVDA remain the epicenters

But OpenAI, that guy’s known to lie

The rally in Oracle proved to not be oracular

The MOU took ORCL stock to the sky

Then its fall back to earth was equally spectacular

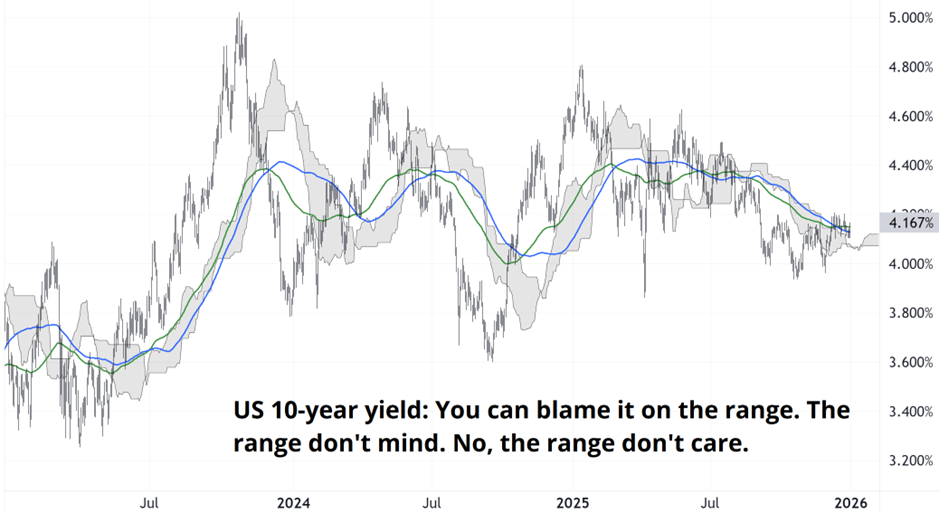

Interest rates traded mostly a range

One that has dominated since two oh two three

10s at 4.15% are sharply unchanged

Can the MOVE index go negative? Tee hee.

The Fed was bullied like a grade school nerd

And fought back by … ermm… cutting rates thrice

The Fed chair pageant drags on, it’s absurd

Yet 2026 has them cutting just twice

Global yields continue their grind up

Japanese bonds are the weakest this year

Who knows where JGB yields will finally wind up

But despite the moves, there’s so little fear.

Fiat currencies had a crazy first half, buddy

Dollar bulls quickly flipped short on capital flight panic

The dollar sold off hard and sentiment got nutty

Every human in the world bearish dollars. ‘Twas manic.

In the second half, there was nobody left to sell

The pension fund thing was a one-off, not persistent

When every strategist called for another 20% down, that was a tell

Q4 themes in FX were almost non-existent

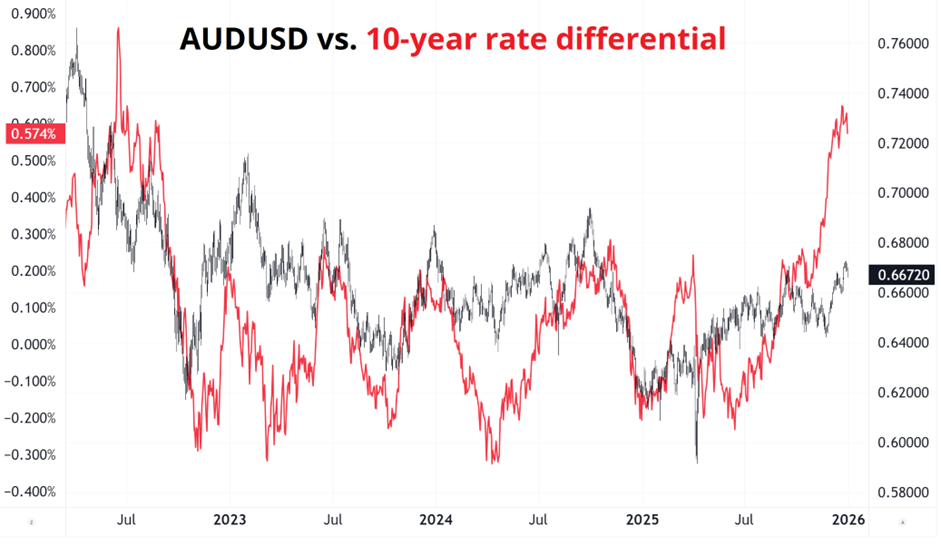

Aussie broke many hearts again this year

Rate differentials just don’t seem to matter

Terms of Trade: irrelevant, that’s been abundantly clear

Look at rates vs. FX; what a mad scatter

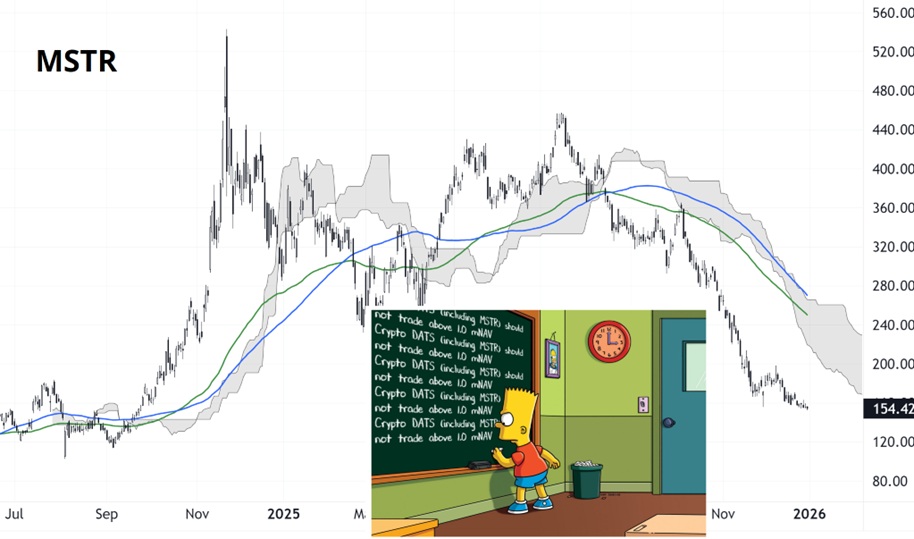

Crypto oh no, altcoins and memecoins are dead, bro

OG whales laid into Saylor’s orange dot flow

DATs pulled the stupidest trick since the SPACs

And the bitcoin vs. gold vs. NASDAQ corr finally cracks

MSTR rinsed by massive dilution

His preferred stock ticker symbols end with F C K E and D (I’m not joking)

“I won’t sell below 2.5 mNAV” Errr… “People are freaking I need a solution.”

“I’ll sell stock to buy fiat!” Sir: Can I ask what you’re smoking?

October 10 liquidity didn’t look like the future of finance

Automatic liquidation more like October 1987, amirite?

Back then we had portfolio insurance, now they have Binance

The FARTCOIN chart is a flatulent triceratops if you squint your eyes tight

The word “poof” is flipped on purpose to mess with your mind

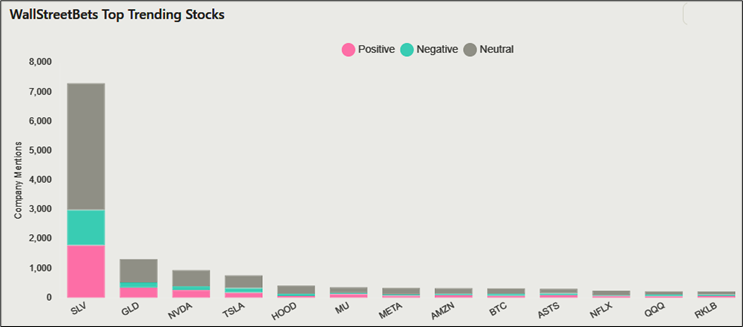

Commodities are hot like wasabi, especially metals

Silver might be a bubble boosted by wallstreetbets

Copper and platinum near the highs as the year settles

But this might be as frothy as it’s going to get

Oil does nothing. Inflation adjusted it’s basically free

One of the primary accomplishments of Trump 2, Year One

The market has been short all year and correct, oh the glee

Though I am not sure oil shorts had all that much fun

How much energy will we need for AI?

Malthus never wins in the long run

Nuclear schemes and lithium dreams: BUY BUY BUY

Be ready for: Energy and rare earths glut, 2031

OK. That’s it!

Thanks for reading my thoughts on markets, and selling, and buying.

Get rich in 2026. Or have fun trying.

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.