Initial Claims don’t mean revert. Technicals vs. seasonals battle in stocks

If there is warmth, should there also be coolth?

There is! It’s a word.

Example sentence:

The penguin bathed in the coolth of the Arctic water.

Initial Claims don’t mean revert. Technicals vs. seasonals battle in stocks

If there is warmth, should there also be coolth?

There is! It’s a word.

Example sentence:

The penguin bathed in the coolth of the Arctic water.

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

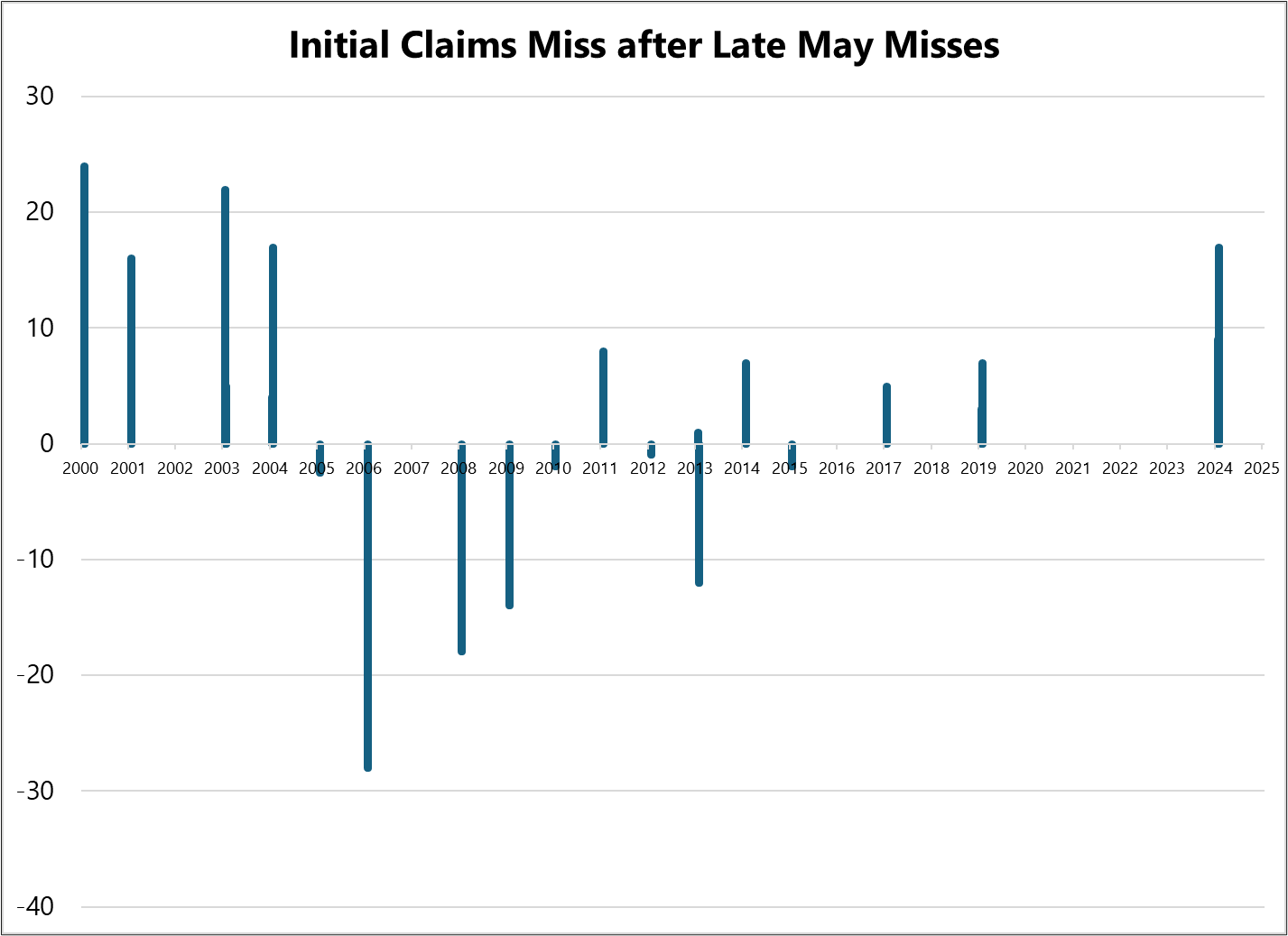

First off, there is some question whether yesterday’s Initial Claims reading is simply an artifact of Memorial Day distortions. That doesn’t seem to be a consistent thing. I looked at weeks in the back half of May when Initial Claims came in higher than expected and here’s what happened in the week after:

No real consistent mean reversion or reversal. If anything, the aftermath is we see another higher-than-expected release. 64% of following weeks are higher and if you look at the two weeks after a high Claims report in late May, the 2-week sum of the misses is positive 86% of the time (19 out of 22 occurrences). So next week’s Initial Claims is worth monitoring and is more likely to be another bond bullish release.

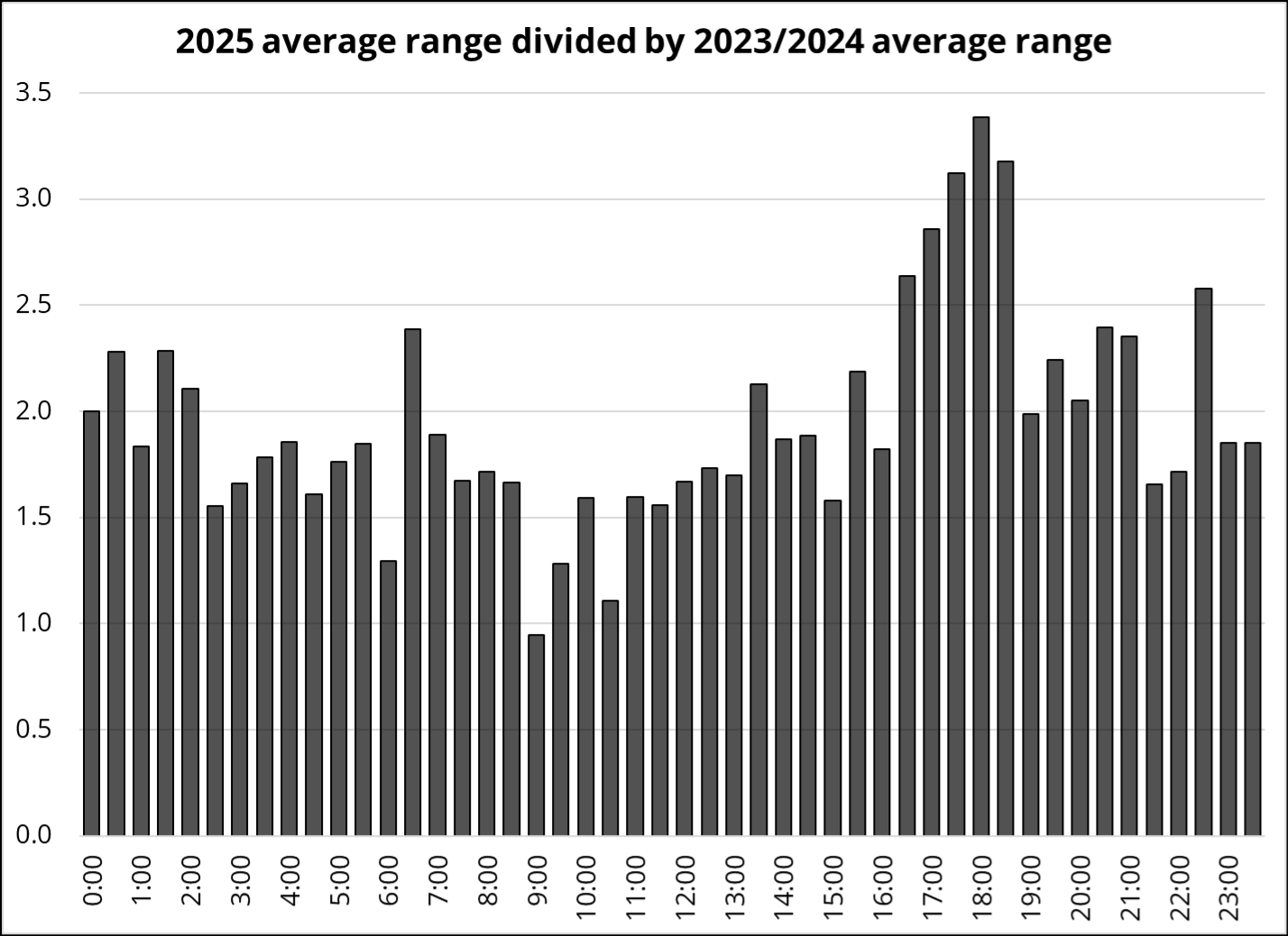

A client asked us to compare the movement of EURUSD in Asia this year with the movements in 2023/2024 to see if Asia is more volatile than it used to be. The question arises because the USD lower theme is somewhat to mostly predicated on a combination of Asian real money (central banks and SWFs) selling USD and Asia central banks stepping away from the bid in their pairs (which leads to USD weakness in G10 FX).

This chart takes the average EURUSD range (absolute value) for each 30-minute period March 1, 2025, to now and divides it by the average EURUSD range for the same time period using all 2023-2024 data. You can see that overall ranges are larger (naturally) and that Asian ranges are much larger at 3X vs. numbers closer to 1X for the NY/LDN overlap. This may have implications for stop loss determination, gamma trading, and expected excitement levels in Asia going forward as I expect this to persist, especially if we maintain a USD lower bias.

As discussed yesterday, a USD lower across the board regime has many implications for how things trade. The example I gave yesterday was how strong the inverse correlation between NZDUSD and USDJPY is (for example) in a USD-down regime, and how cross/JPY tends to disappoint as we get USD moves, not risk on or risk off. The other implication has been that the USD trades very weak in Asia, with greater volatility, and stronger in NY, with normalish volatility. Act accordingly!

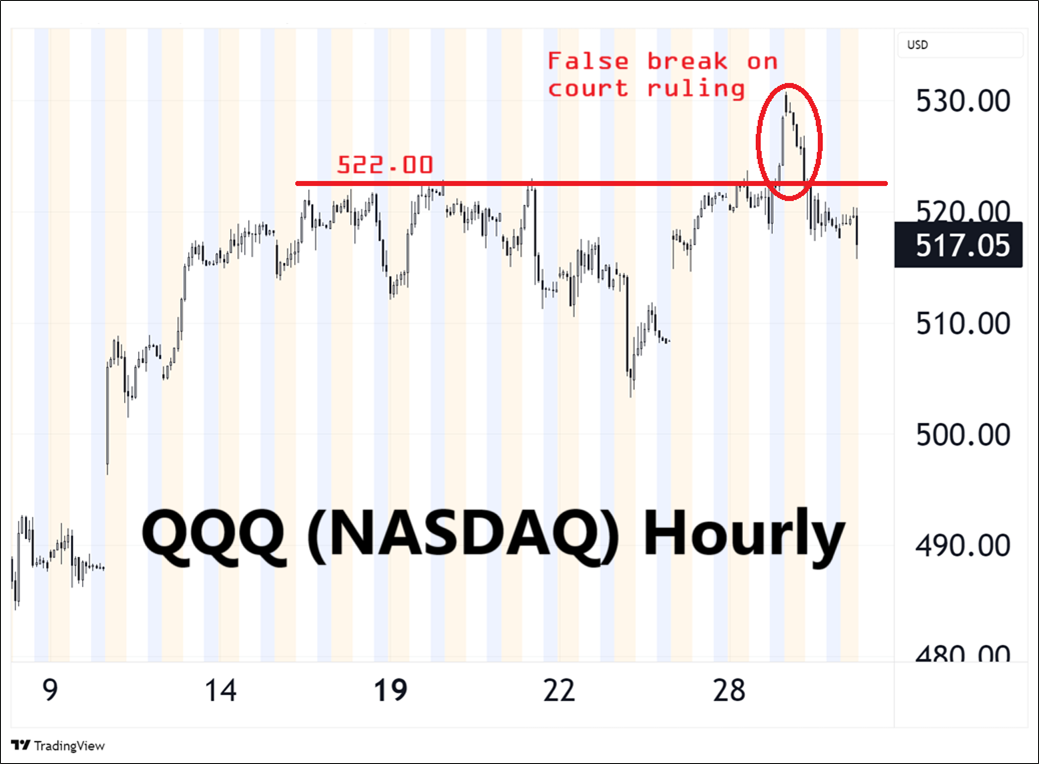

Positive seasonality is slamming into last day of the month jitters and a flurry of continued headline nonsense. There was a clean break higher in NASDAQ as the court blocked the Trump tariffs, but that rally was short-lived as the market soon grasped it just means more uncertainty. And this morning the president is saying that China has already violated its agreement with the USA in a rhyming callback to the 2017 Phase One Deal. That was a complete illusion / distraction and led to zero changes of behavior from China. The chart of the NASDAQ looks mildly troubling as long as we remain below the busted resistance. Here is the chart:

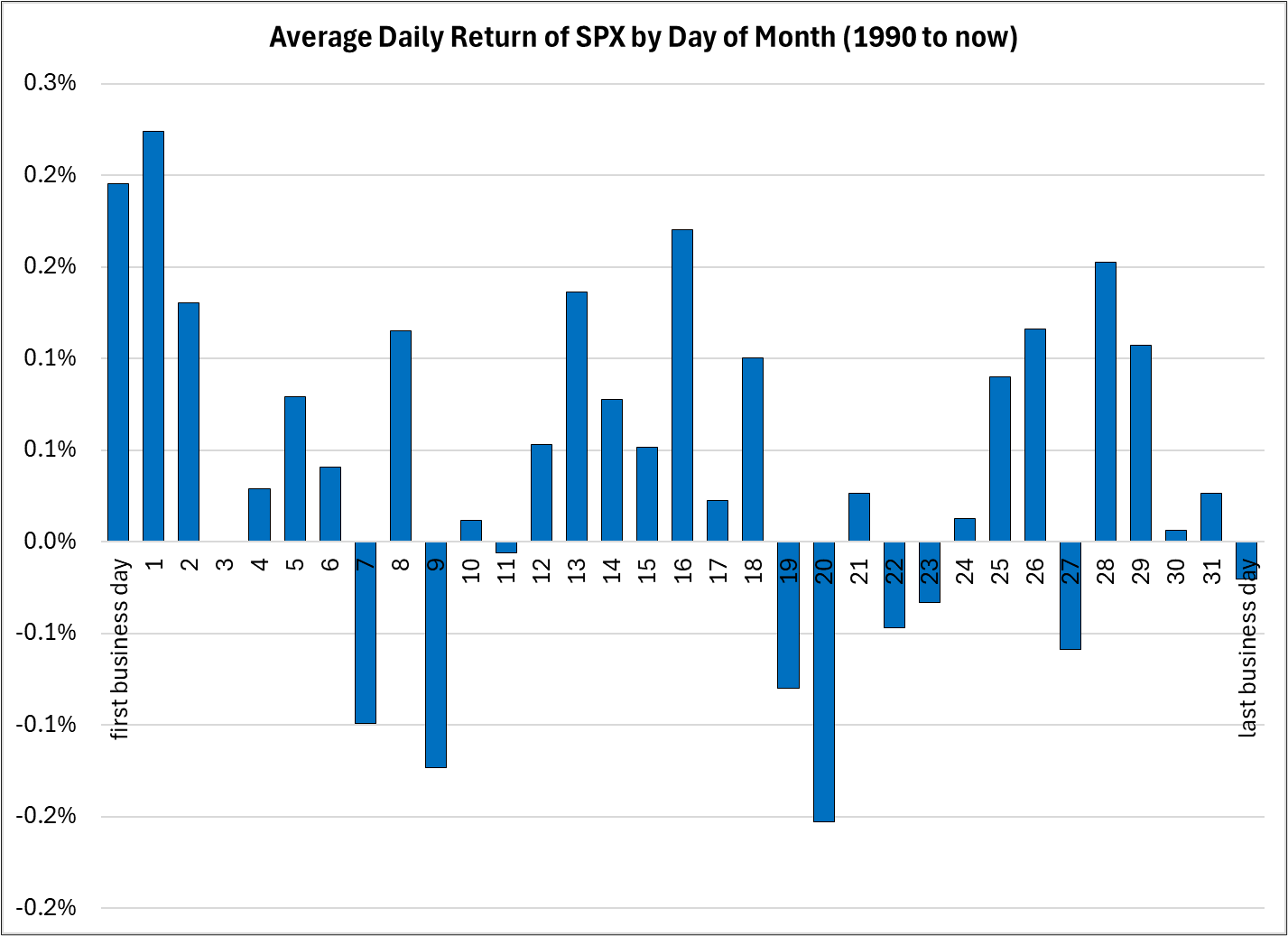

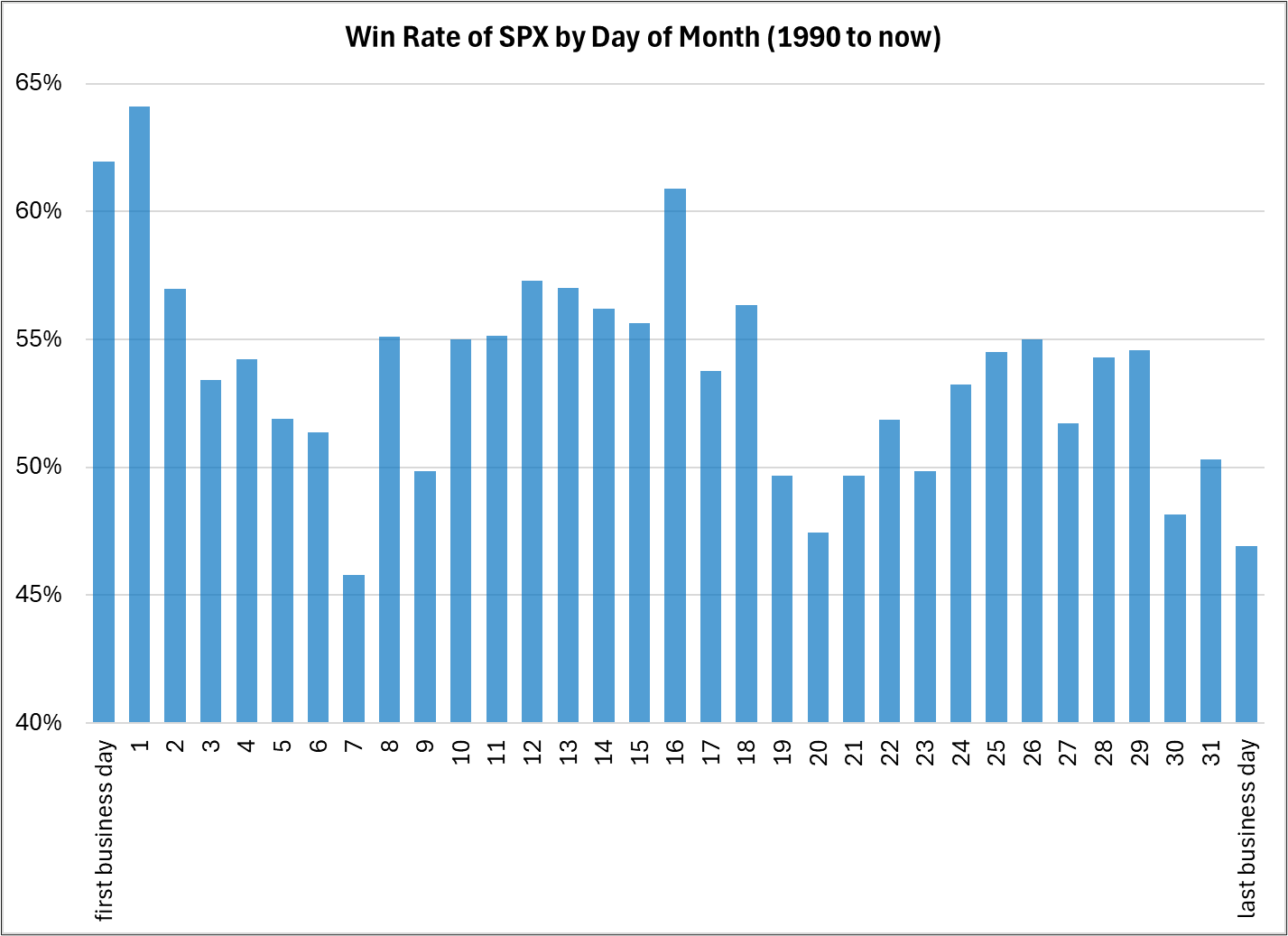

As much as I love this seasonal for equities, this chart is ugly and today is the last day of the month, which as I learned yesterday has an extremely poor hit rate in equities. For fun, here’s the average return of SPX by day of month. Not coincidentally, it follows the payroll cycle. When people get paid, some portion of that money passively flows into their 401k.

Same chart, but with win rates.

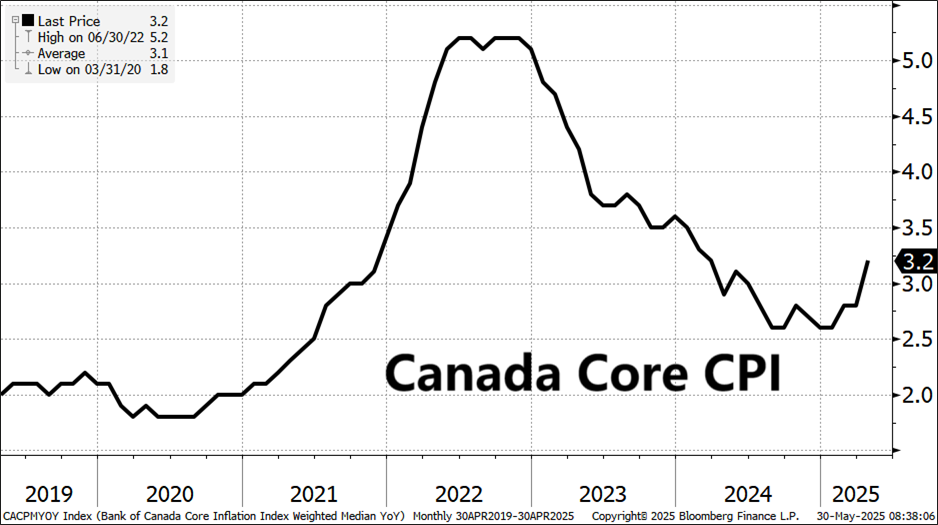

Next week’s Bank of Canada meeting still has 16% chance of a cut (down from 25% a day or two ago). I think that should pretty much be zero. Inflation is stabilizing in Canada at highish levels, and the Bank of Canada is no longer restrictive. Zero reason for them to cut.

Have a not uncoolth weekend.

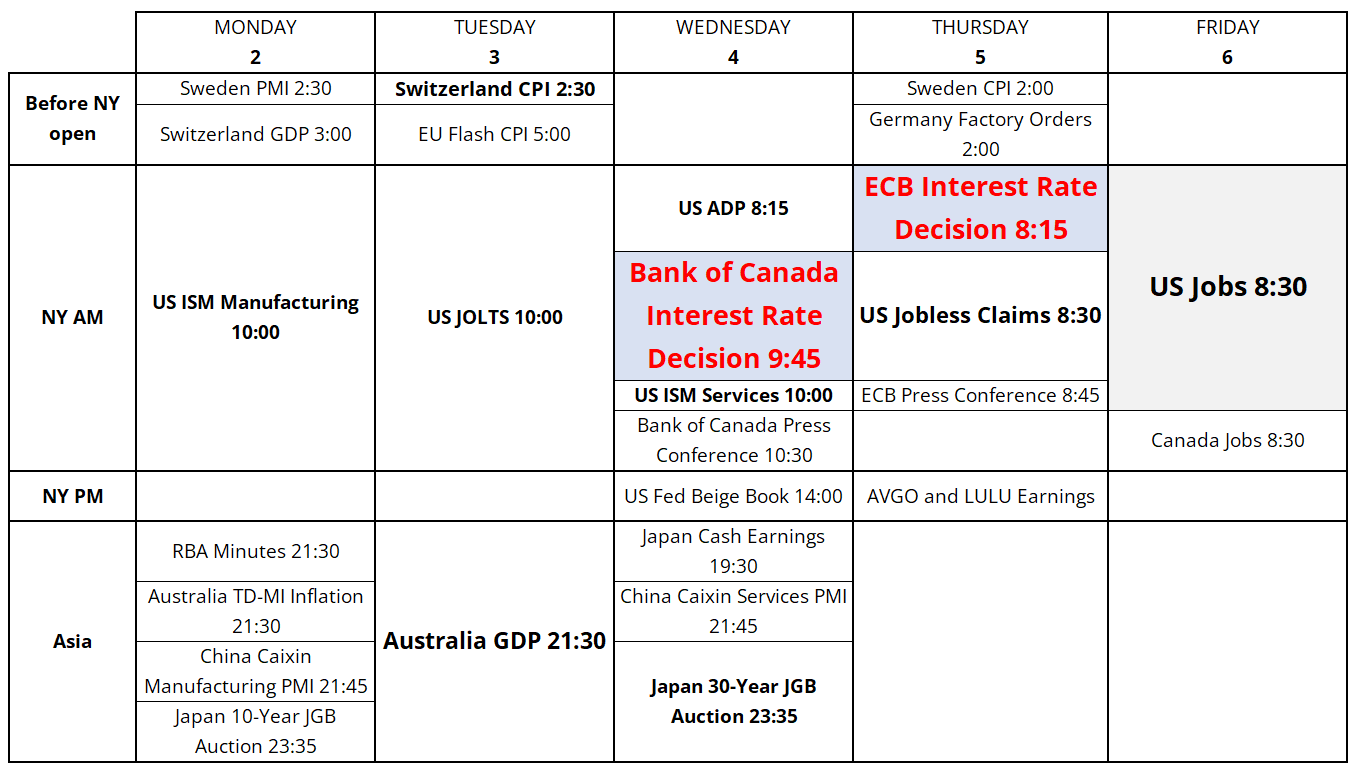

Trading Calendar for the Week of June 2, 2025

Notes (I will elaborate on these in am/FX throughout the week):

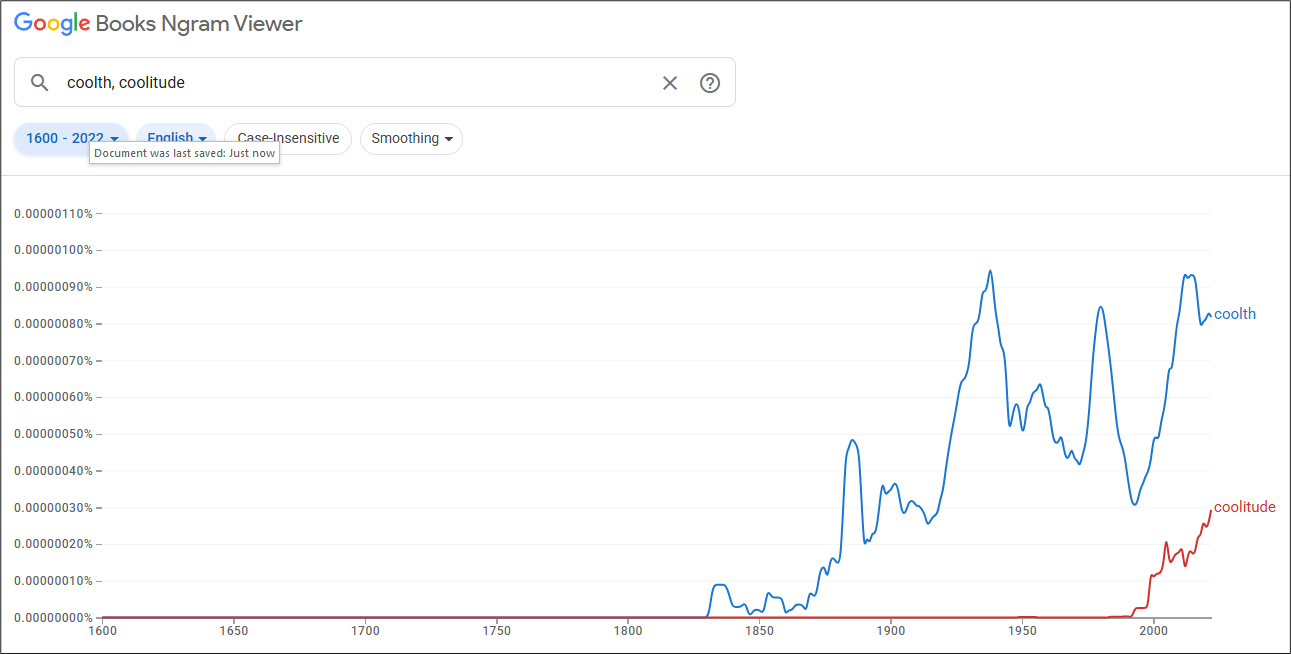

Coolth is more commonly used than coolitude.

Coolitude is something else entirely. It’s not a synonym for coolness.

The concept of “coolitude” provides a creative and discursive framework for remembering and comprehending the dislocation and transformation expressed in the literature, art, music, and other creative work of descendants of indentured workers enmeshed in a global scheme of contract labor. Source

HT SkD