Reloading

I think it is time to reload short USD. Here’s why:

- USDTWD is a canary in the coal mine. Asian demand for USD and Asian CB desire to support the USD is waning.

- China comes back tonight and will probably sell USD and buy gold.

- US economic data has probably peaked. ISM today is a coin flip, but overall I think that the tick higher in Initial Claims is probably more important than the strong NFP. That release was for the week of 12APR and probably does not capture the investment and hiring issues brought on by the trade embargo with China.

- 1.1250 has held nicely in EURUSD. I was expecting a washout of EUR longs, but we never got one. Good trends hold support and take out resistance. EURUSD has held support, and I think it’s ready to take out 1.16 and head towards 1.20 soon.

- The US equity rally has not generated USD demand. This makes me think that the rally is a short squeeze and it’s not foreign pension funds changing their minds. They continue to add to USD hedges and if they start selling US equities again, the impact should be USD-negative. The dollar trades asymmetrically to equities. Stocks up = USD flat. Stocks down = USD down.

- The EU defense spending ramp up theme remains valid and newsflow continues to support it.

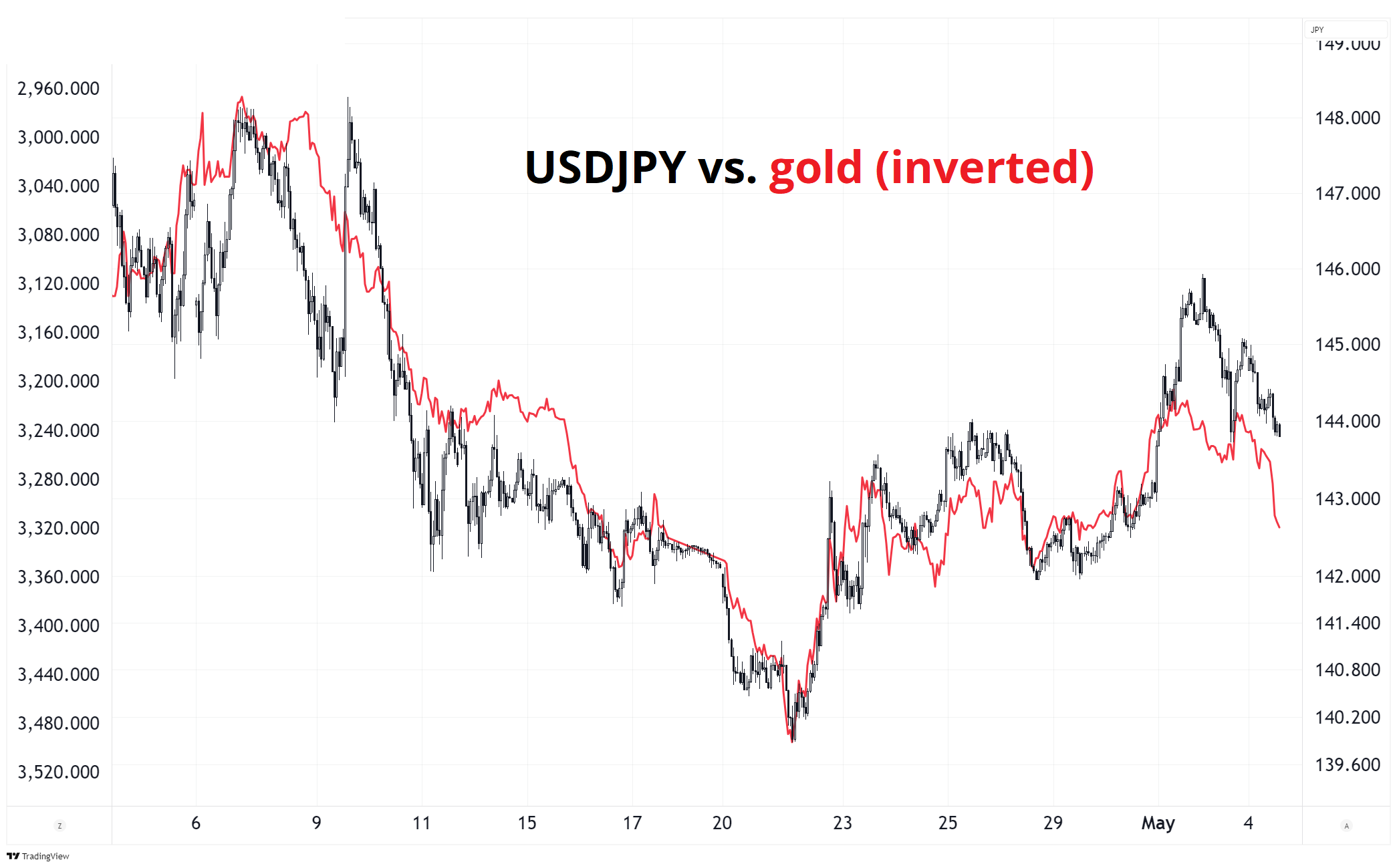

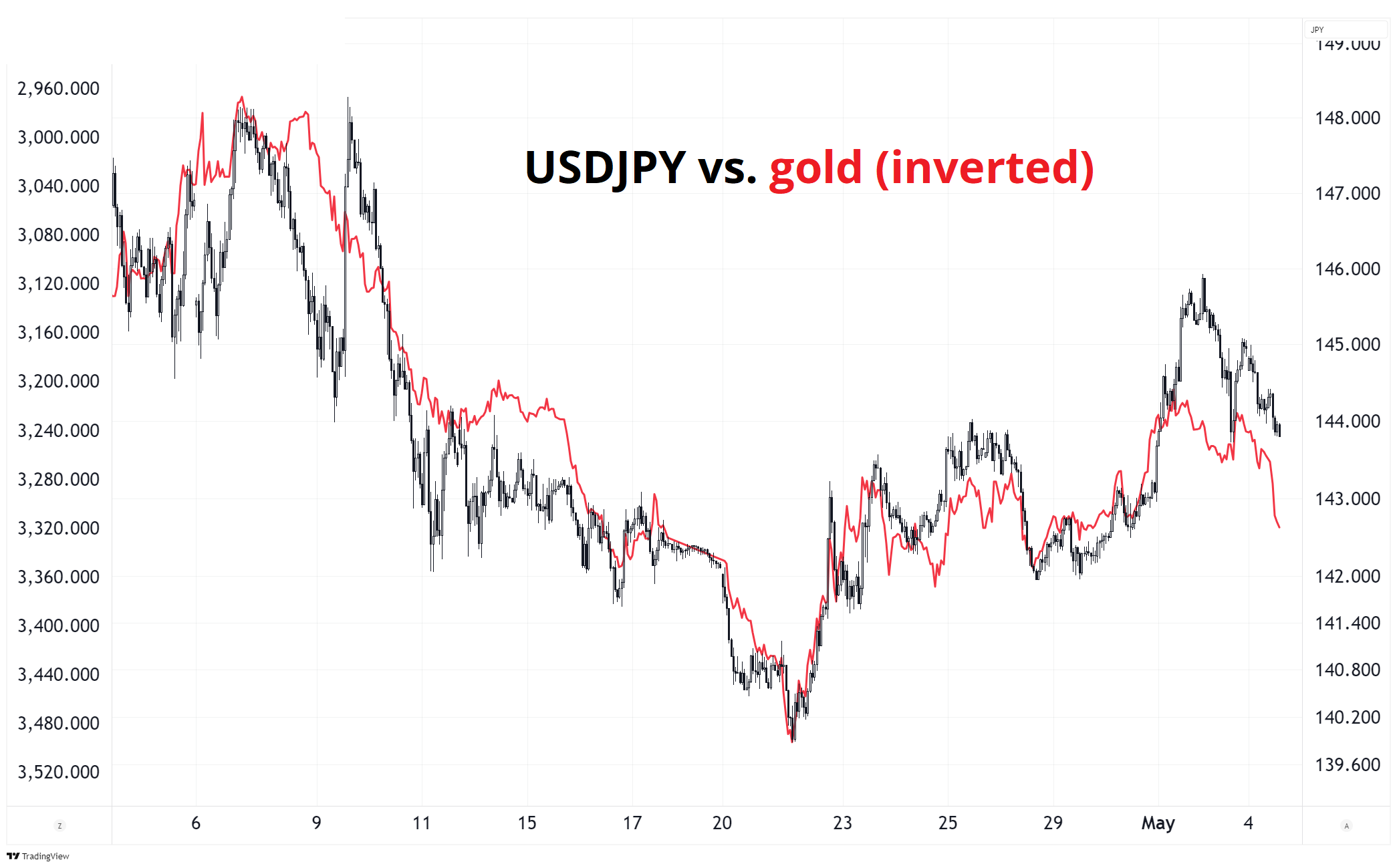

Interest rate differentials have lost explanatory power, and gold is now a better indicator / correlation for the USD. Here’s USDJPY vs. gold back to Liberation Day.

Options don’t look particularly attractive to me, with 1-month EURUSD vol still above 9% and EURUSD potentially in consolidation mode for a bit longer. So the trades are simple:

- Long EURUSD. Stop 1.1214, take profit above 1.17 somewhere.

- Short USDJPY. Stop 145.41, take profit 140.11.

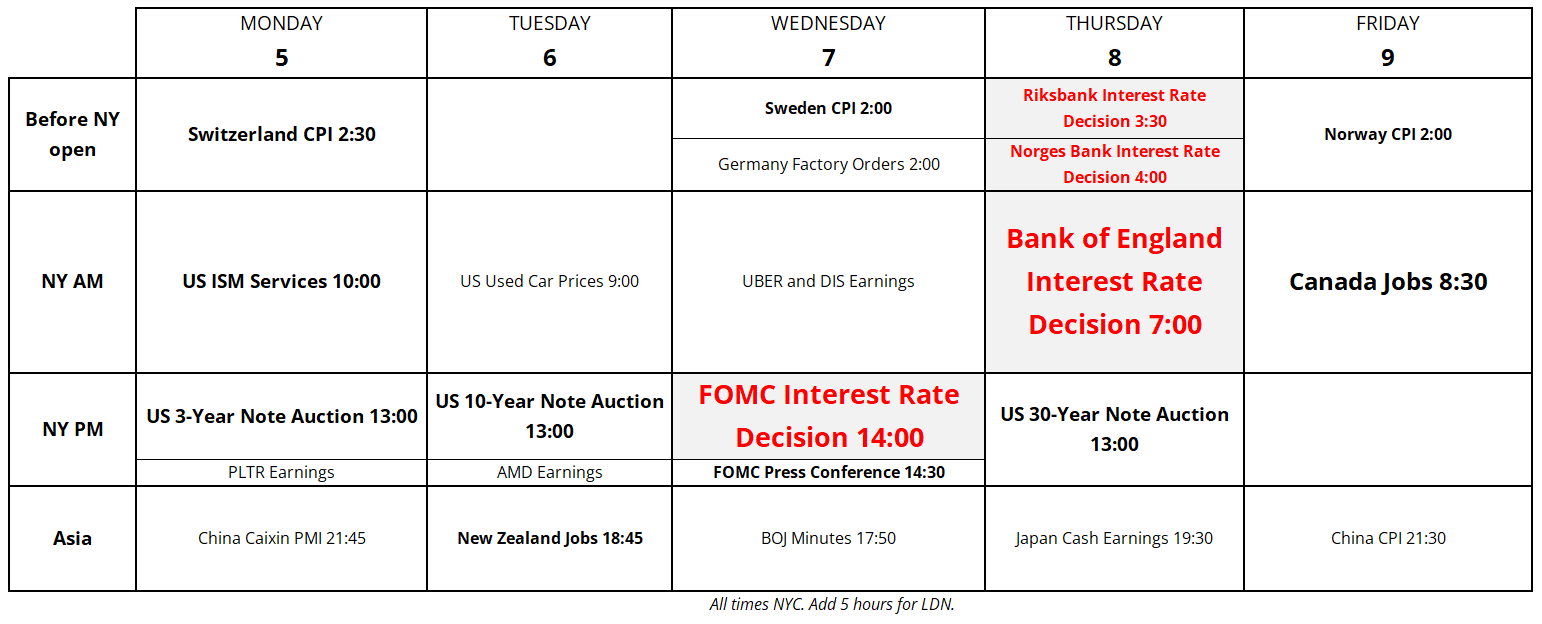

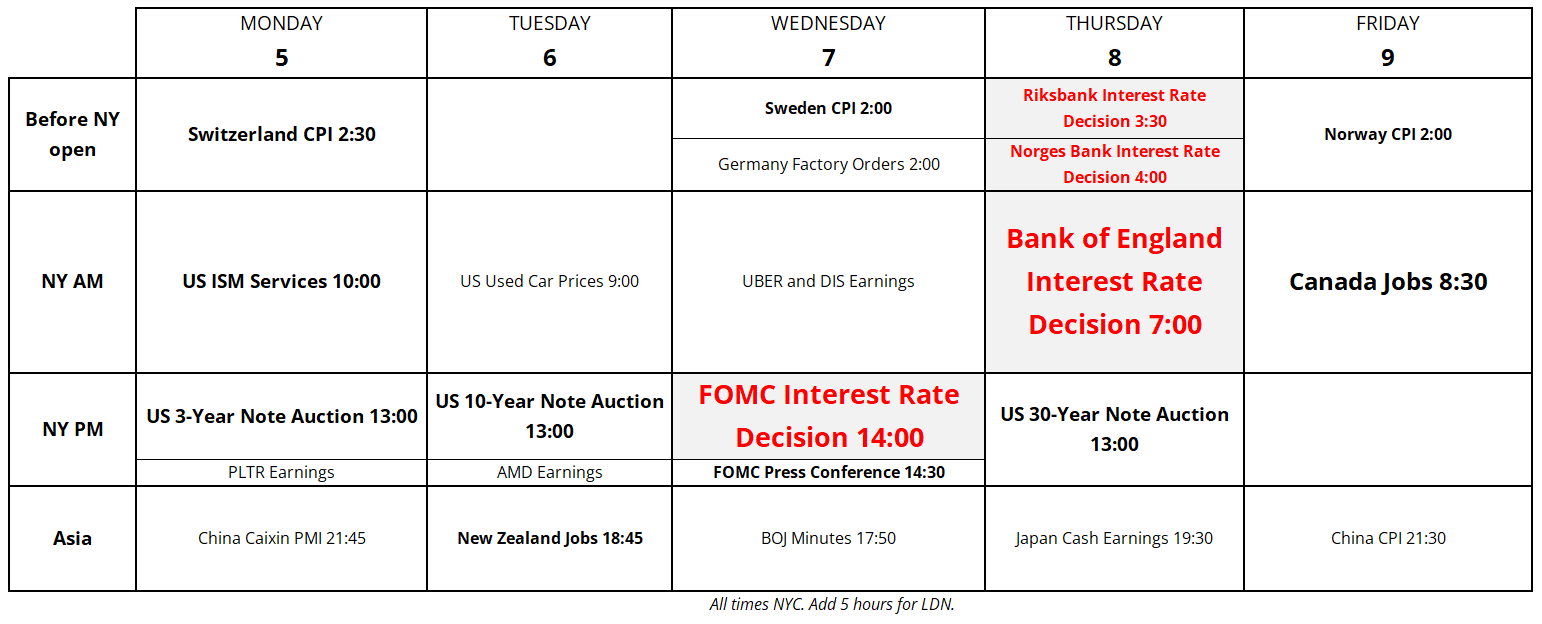

Calendar

Here is the calendar. I don’t normally include Used Car Prices, but that release (9 a.m. Wednesday) might attract a few eyeballs as we look to see any tariff impact. Bill Ackman will be watching for sure because a big part of his thesis on HTZ is that car prices will moon, and their inventory will swell in value. I found the Manheim release date here.

Final Thoughts

- This week’s Fed should be a nothingburger.

- SNB in a tricky spot with zero inflation zero yields and zero good options. Intervention is the last arrow in their quiver, but history has shown this is modestly effective, at best, and they now need to worry about annoying the US government.

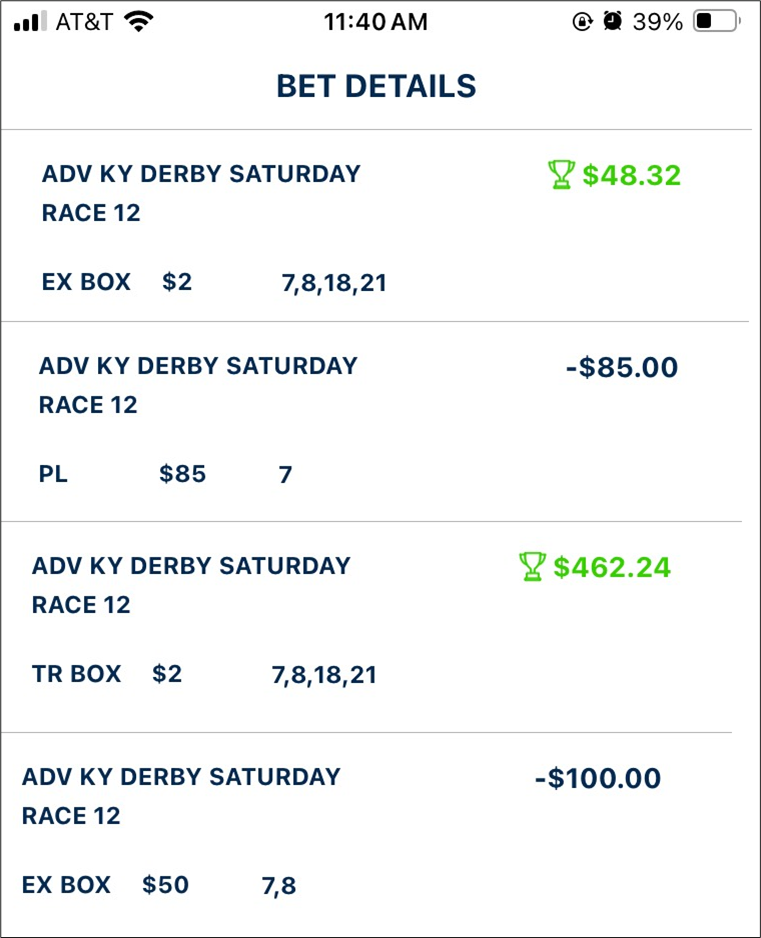

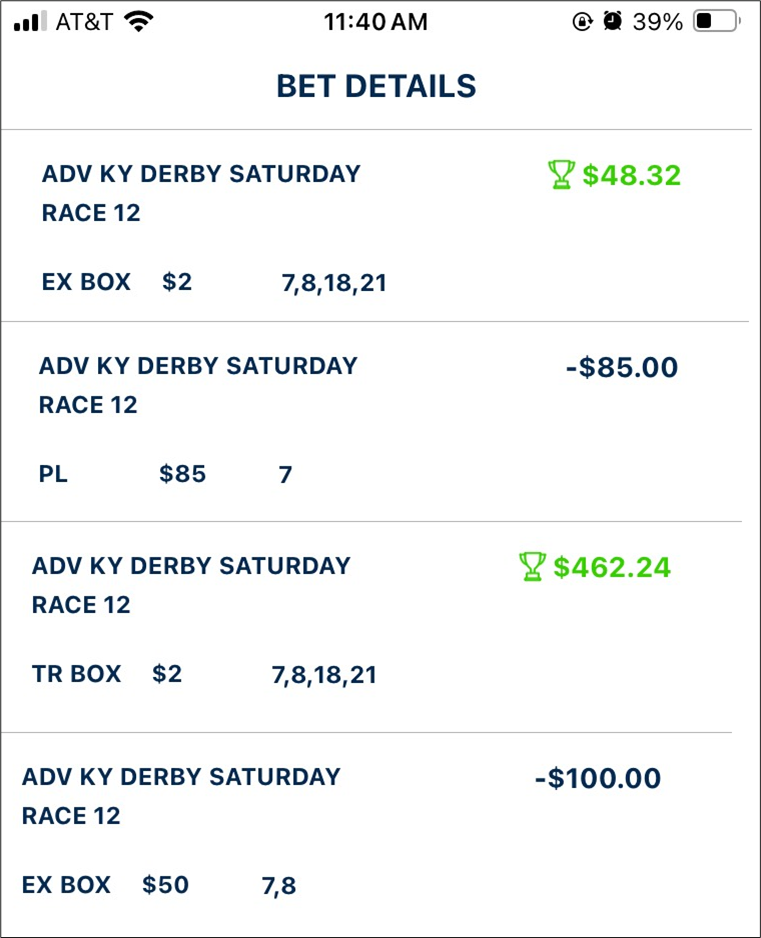

- Kind of a weird turn of events in the Derby as two of my four horses were scratched. As replacements in the exotics, I took Sovereignty (who I had described as my fifth choice in Friday’s piece) and Baeza (he had a Beyer of 100 in his last race, so met my criteria). Luxor Café got a bad trip but despite my main pick losing, I cashed the exacta and trifecta and did OK. Beyer shows the way again this year, like it did in 2024. The Preakness is May 17.

Have a great—really great—like, totally great—week.

https://www.reddit.com/r/dataisbeautiful/comments/1kejuy8/oc_the_em_dash_conspiracy/

Large Language Models — those AI text generators we increasingly rely on — have developed a concerning stylistic tic. They overuse em dashes — inserting them everywhere — as if normal punctuation isn’t dramatic enough. This habit — while creating a sense of urgency — ultimately makes text feel choppy and unnatural. Perhaps LLMs — in their attempt to mimic human writing — have ironically adopted a distinctly non-human punctuation pattern.