US equities are outperforming. This doesn’t mean USD can’t go down but tactics are key.

I like the spirit!

But… New graphic designer needed.

US equities are outperforming. This doesn’t mean USD can’t go down but tactics are key.

I like the spirit!

But… New graphic designer needed.

Long PLN5 @ 1071

Stop loss 964

Take profit 1264

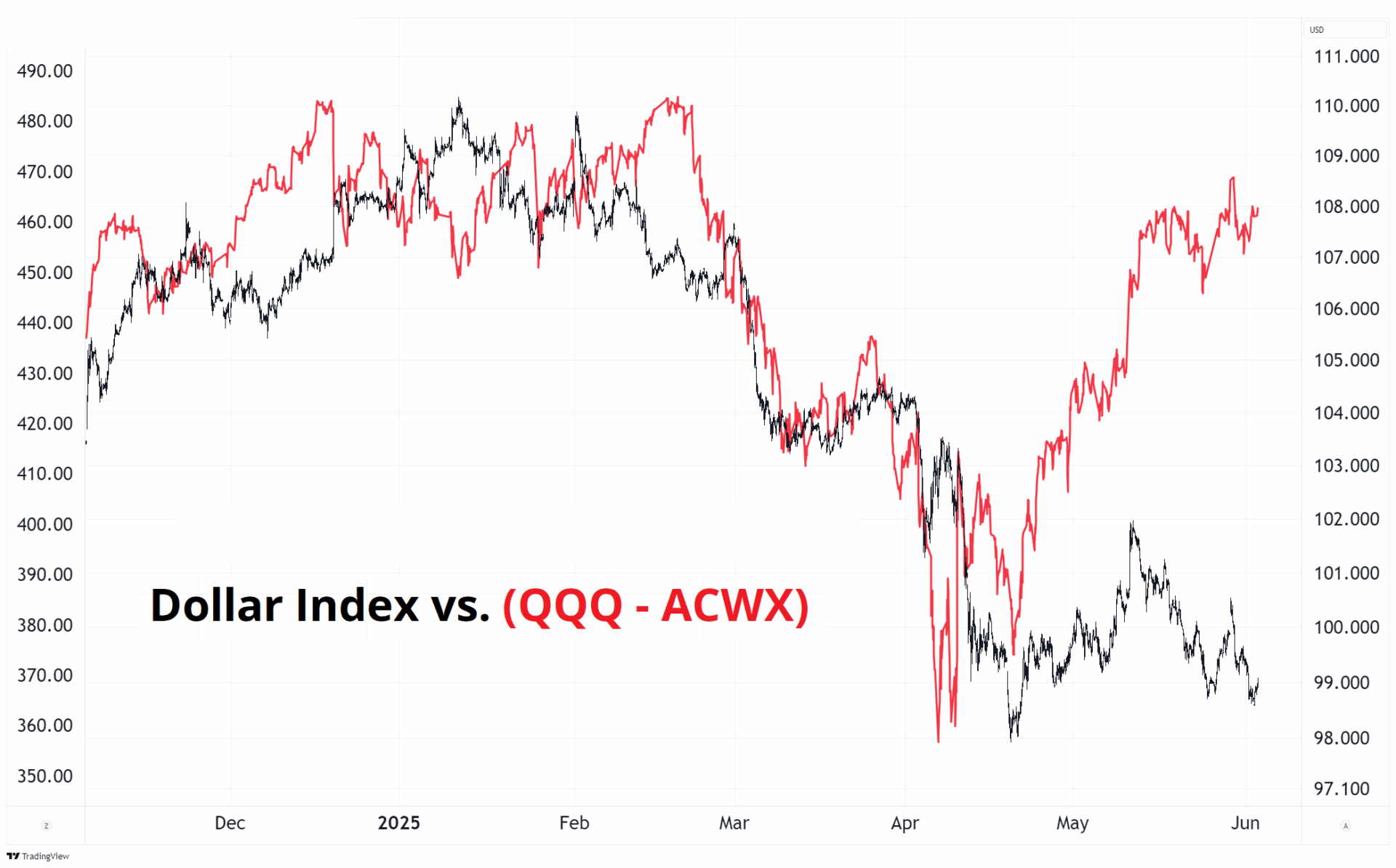

The USD has stalled again at the bottom of the range as US exceptionalism in equities has returned on the back of a MAG7 resurgence. This chart tells the story of the rebound in US stocks. QQQ is the NASDAQ ETF while ACWX is the MSCI All-World Index (ex-USA). With the cost of carrying USD shorts and the cost of USD puts both near multi-year highs, the short USD trade is still tough sledding.

The nature of a sell bonds / sell USD trade is that it will be expensive and hard to hold and therefore you need a constant stream of bad news to keep things chugging. Right now, the Big Beautiful Bill is in limbo until at least July 4th, and tariff news is boring until the July 9th deadline.

What dollar shorts could really use is a flurry of bad US data that brings the Fed into play. Maybe we get it this week. As discussed yesterday, I lean strongly towards weak labor market data this week, with JOLTS a possible exception, and therefore I like long US bonds. I would rather wait until closer to Friday’s release, then get short dollars. I plan to get short USD Wednesday or Thursday.

I am not suggesting that the USD needs to mean revert all the way back to levels suggested by relative equity performance. The USD hedging flows are real. But my point is that when the flows stop, or the SELL AMERICA / Peak AI newsflow stalls, you get uncomfortable mean reversion. The USD is responding asymmetrically to newsflow because of persistent USD hedging flows, but it still needs more bad news to keep going lower now that it’s dropped 10%. Tactics and timing are key.

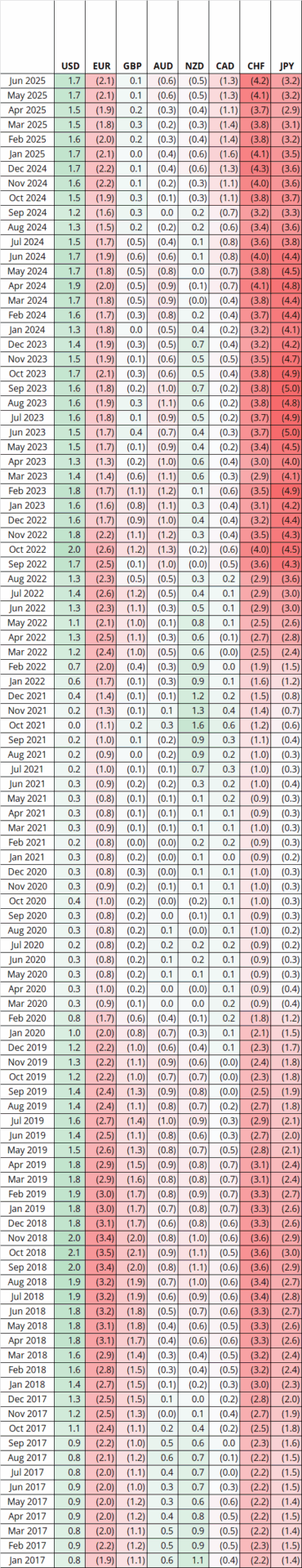

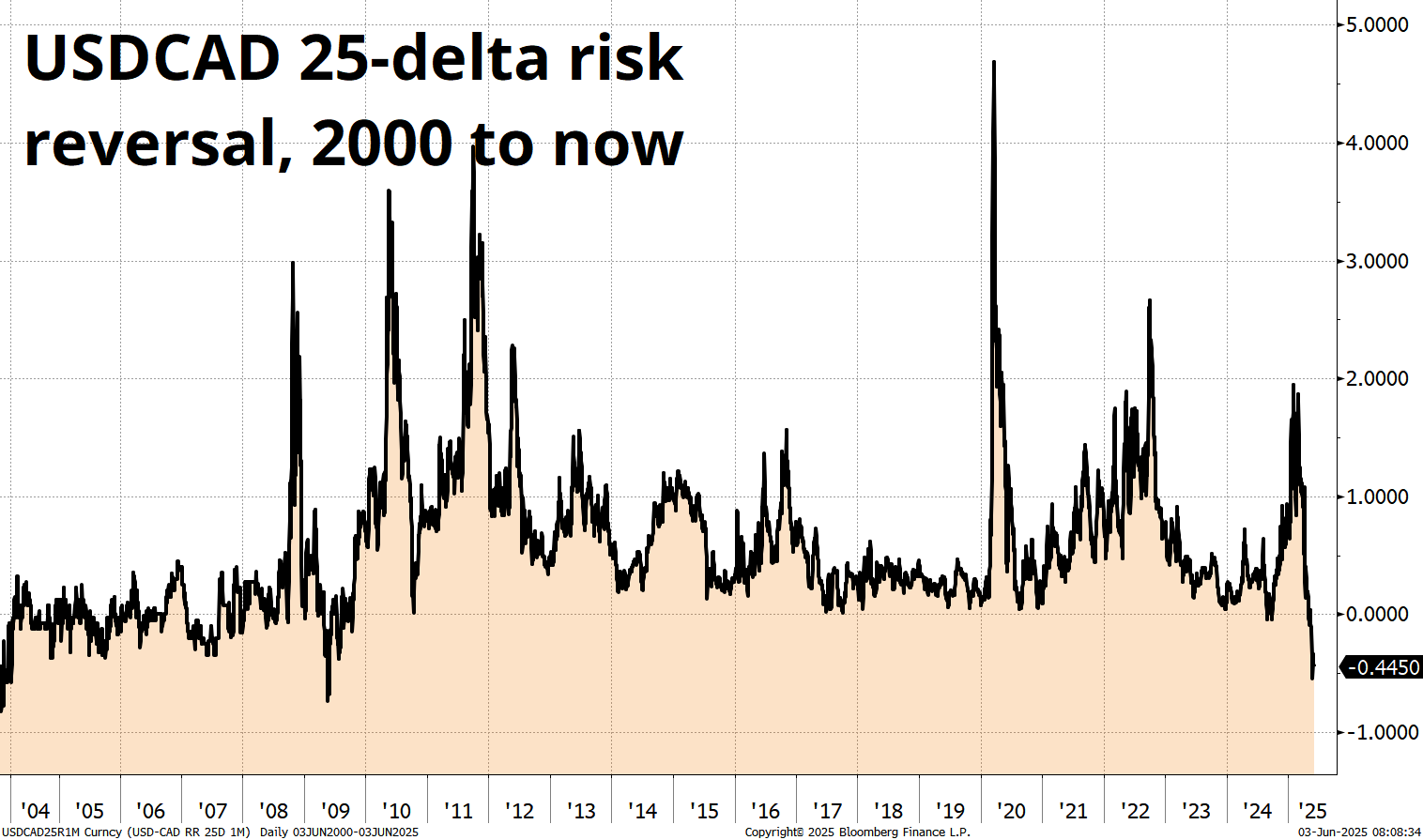

For perspective, here is the evolution of USD carry vs. peers and a chart of options skew to give you a sense of just how costly this trade is for anyone structurally short dollars. Adding dollar hedges is one thing. Sitting short USD is another.

The table shows the 2-year interest rate differential by country vs. the USD. The “USD” column shows the US 2-year yield minus the average of the 2-year yields in the other countries. A few things:

And while the carry is expensive, USD puts trade at a premium too.

None of this means you can’t be short USD. It just means that your timing and tactics need to be excellent. It is worth noting that the last time the risky was here in USDCAD (May 2009), USDCAD subsequently trended lower from 1.1700 to 0.9400. The market is often correct.

So, I am stuck in a stalemate here as I feel that the return of the US exceptionalism and AI fever trades in equities, along with the prohibitive cost of USD puts and USD shorts is in conflict with my view that we see weak jobs in the US this week. Therefore, I will look to do a tactical short USD trade into NFP and continue to play bonds from the long side as has been my bias for the past 8 days or so.

As foreign pension funds increase USD hedges, the specter of Section 899 lurks in the background. This story has been well covered in a few pieces of late, including one by John Authers and another by Alfonso Peccatiello.

In case you are not up to speed, I’m going to quote Alf’s piece from this morning (with his permission), because I think it’s a good backgrounder. Even though this issue is boring and technical, there are details you need to know in case headlines drop.

Alf’s take on Section 899:

—

excerpt

The One Big Beautiful Bill (OBBB) recently passed the House, and it’s now awaiting Senate scrutiny. Most analyst coverage focused on the bill piling up further government spending on existing deficits, but by far the most important part of the OBBB was deep down in the docs – specifically, in section 899. Section 899 is the first step towards tariffs on capital as a complement to tariffs on goods.

So: what did the Trump administration include in section 899 – the first step towards Tariffs on Money?

1) What is it -> Section 899 also known as the ‘’revenge bill’’ imposes taxes on passive income (e.g. dividends) deriving from foreign ownership of US assets on countries that have enacted ‘’unfair foreign taxes’’ on the US (read: digital service tax or minimum corporate taxes like Canada, Europe and others);

2) Who gets charged -> For a country to be subject to such taxes, it’s enough for the Treasury department to include them in a specific list of DFC – discriminatory foreign countries;

3) The applicable entities -> They include governments, individuals, and corporations – pretty much every investor, including sovereign wealth funds and foreign central banks;

4) How high is the tax rate -> Section 899 generally increases the current U.S. tax rates imposed on applicable entities by 5% in the first year following enactment, increased by an additional 5% for each subsequent year, with the increases capped at 20% above the statutory rate. This is key: for section 899 to apply, there must already be an applicable tax rate (before or after tax treaties) to push up.

5) When could it kick in -> Assuming the OBBB is enacted before October 2025, the Section 899 will take effect as per January 1st 2026.

Tariffs on goods have been estimated to bring in about USD ~200/250 bn/year for the US government. The impact of a moderate Tariffs on Money would be potentially in the USD 100-150 bn/year too. But that requires a key change: the repeal of the Portfolio Interest Exemption (PIE). PIE exempts foreign investors from incurring in any withholding taxes when they buy US Treasuries, and Section 899 only applies a surcharge tax to existing tax rates for foreign investors – which PIE puts at zero for foreign ownership of US Treasuries.

Unless the portfolio interest exemption (PIE) is repealed, Section 899 would only apply to dividends on equities held by foreign institutions – bringing in only a few $ billions/year to the Trump administration. This clause in the Big Beautiful Bill clearly explains that (without a PIE repeal) the Section 899 wouldn’t apply to ‘’portfolio interest’’ – basically coupons on Treasuries held by foreigners:

In its current format, Section 899 would send a worrying signal to foreign investors but its immediate impact would be quite limited. Foreign investors own $13 trillion worth of US stocks, but Section 899 would apply a limited surcharge tax on dividends only and hence cause limited damage.

After all, investors own US stocks for capital appreciation much more than they do to collect dividends. But a repeal of PIE would bring Treasury coupons under the 30% withholding tax regime, and after applying tax treaties but overlaying the Section 899 tax surcharges we’d be looking at a big impact. Coupons deriving from $15+ trillion in US Treasuries owned abroad would incur 20%+ total tax rates, but to get there the Trump administration would have to repeal PIE:

I can’t see any rationale behind including Section 899 in the Big Beautiful Bill to only collect 2-3bn/year by taxing dividends on stocks only. If Tariffs on Money needs to be part of the revenue-raising machine for the Trump administration, they need to go along with a repeal of PIE.

A potential plan could look like this:

1) Pass the Big Beautiful Bill through the Senate possibly in July, but anyway before the August recess;

2) Work in parallel on a repeal of PIE – sending a strong signal to ‘’discriminatory countries’’;

3) To soothe bond market jitters, accelerate the SLR reform to incentivize US banks to buy Treasuries

Bessent has already indicated Q3 as the likely date to accelerate the efforts behind the SLR reform, and such a timeline could be more than a mere coincidence.

From a market impact standpoint, there are two paths ahead of us:

A) Section 899 without PIE repeal: a marginally weaker USD

B) Section 899 + PIE repeal: a large USD down + bond yields up move

Even without PIE repeal, Section 899 raises red flags amongst foreign institutional investors. Using my beloved Canadian pension fund reference, if you were the CIO or the Investment Committee sitting on a 50%+ allocation to US assets and you see Section 899 enacted – what would you do? You’d at least passively reinvest your maturities away from the US and hedge your material USD risk.

And if you were to see concrete talks about a Portfolio Interest Exemption repeal hitting you heavily on your Treasuries coupons – what would you do? This would be akin to ‘’selective Fed cuts’’ only applying to you: a 20% total tax rate on a US Treasury paying a 5% coupon would be akin to a 100 bps reduction in interest rate earned. Add a weakening USD to the picture, and you’d have to rush to hedge your USD exposure alongside considering domestic bonds or other bond markets (Europe?) as an alternative.

There are also second-round effects to Section 899. Sovereign wealth funds and pension funds have large exposures to assets classes such as private equity, hedge funds, and real estate and all these assets tend to be denominated in USD. As the Trump administration is undermining the attractiveness of goods and capital flows in the US, they are directly attempting (and succeeding) at weakening the USD.

To conclude: while investors had already many reasons to be short USD, they are now looking at 899 more reasons. Alfonso Peccatiello Founder & CEO, The Macro Compass – Institutional Macro Research. For inquiries: [email protected]

end of excerpt

—

The takeaway there is that PIE repeal headlines are mega bearish USD.

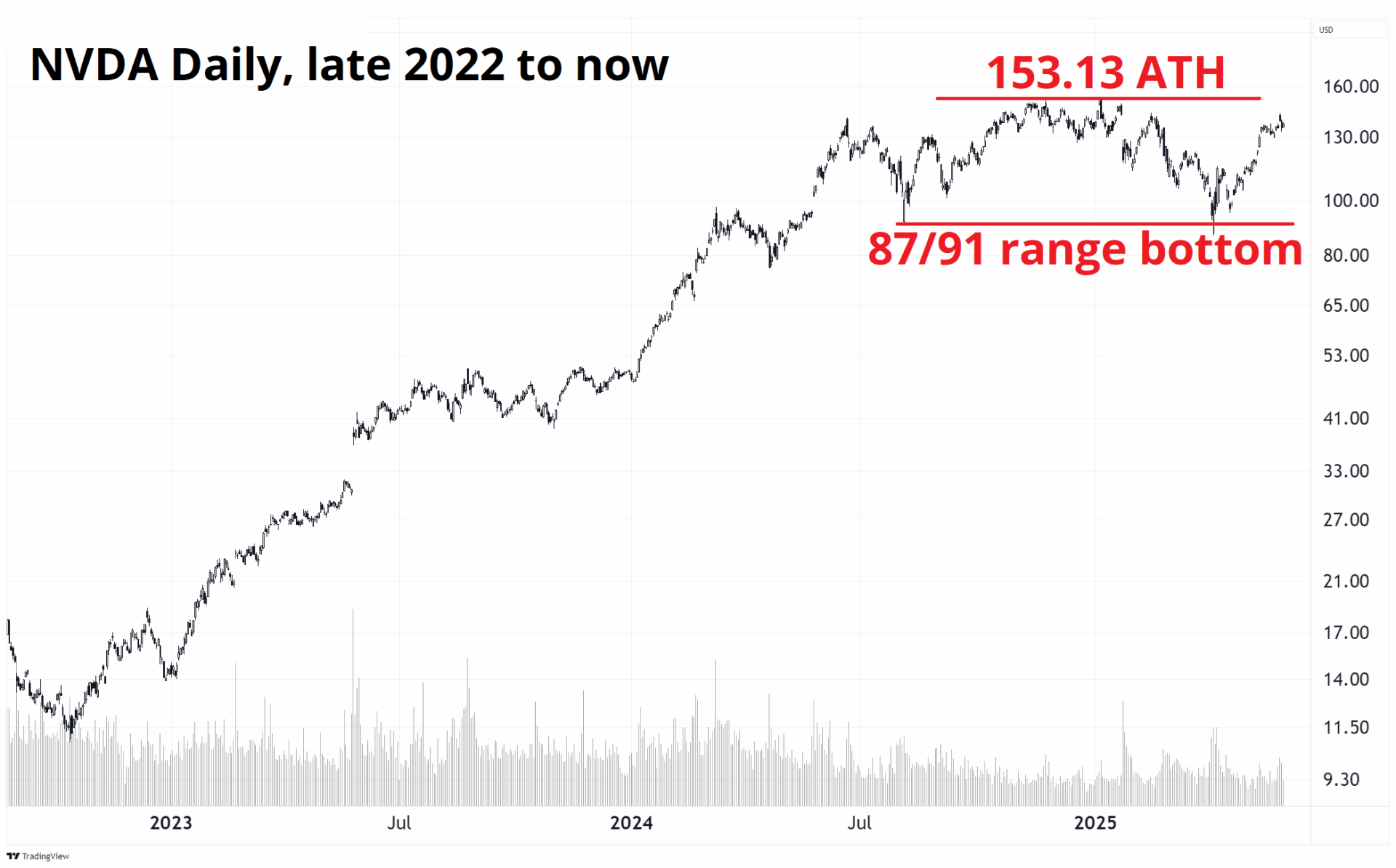

One of the blockers for the USD down trade of late has been the dramatic resurgence of the AI trade as stocks like CoreWeave, which were left for dead a few months ago, are ripping higher. NVDA is still in the range that has defined trading since just about exactly one year ago, with $153.13 the all-time high.

It’s not obvious to me whether a) this is one last gasp before the apex, and DeepSeek was indeed the beginning of the end. Or b), we’ve just been consolidating, and the AI capex cycle has many more months or years to go. I would say a daily close above $154 in NVDA will put an end to any skepticism for the time being.

Have a beautifully-designed day.

I like the spirit! But… New graphic designer needed.