Quick thoughts on EUR, VIX, CAD vol, and next week’s spectacular action menu

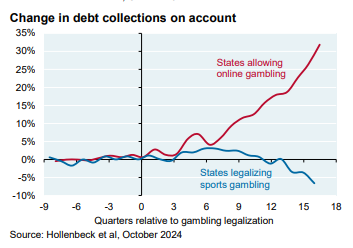

I love gambling, but this seems bad

Quick thoughts on EUR, VIX, CAD vol, and next week’s spectacular action menu

I love gambling, but this seems bad

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC

Long EURSEK @ 11.54

Stop loss 11.3390

Flip short today at 11 a.m.

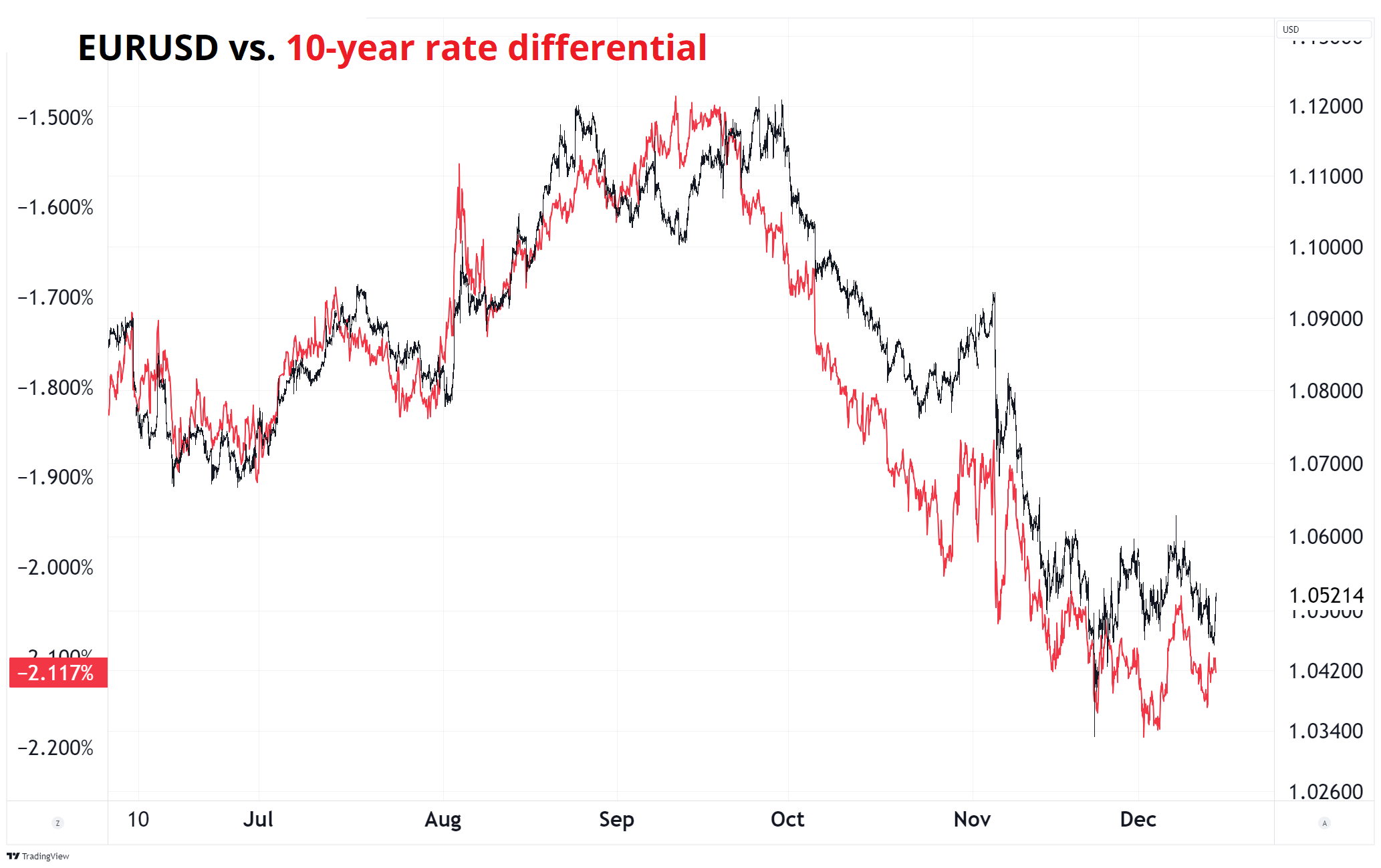

After a pretty epic run lower from its peak in late September to the blowoff bottom at Thanksgiving, EURUSD is stable and choppy again. Rate differentials are not suggesting anything too worrisome for shorts; I think we’re just in a 1.0420/1.0600 consolidation as there is a lack of catalysts and still some positioning risk in the euro crosses (especially EURGBP). After yesterday’s moribund reaction to the 50bp surprise cut from the SNB, EURCHF woke up today kind of out of nowhere.

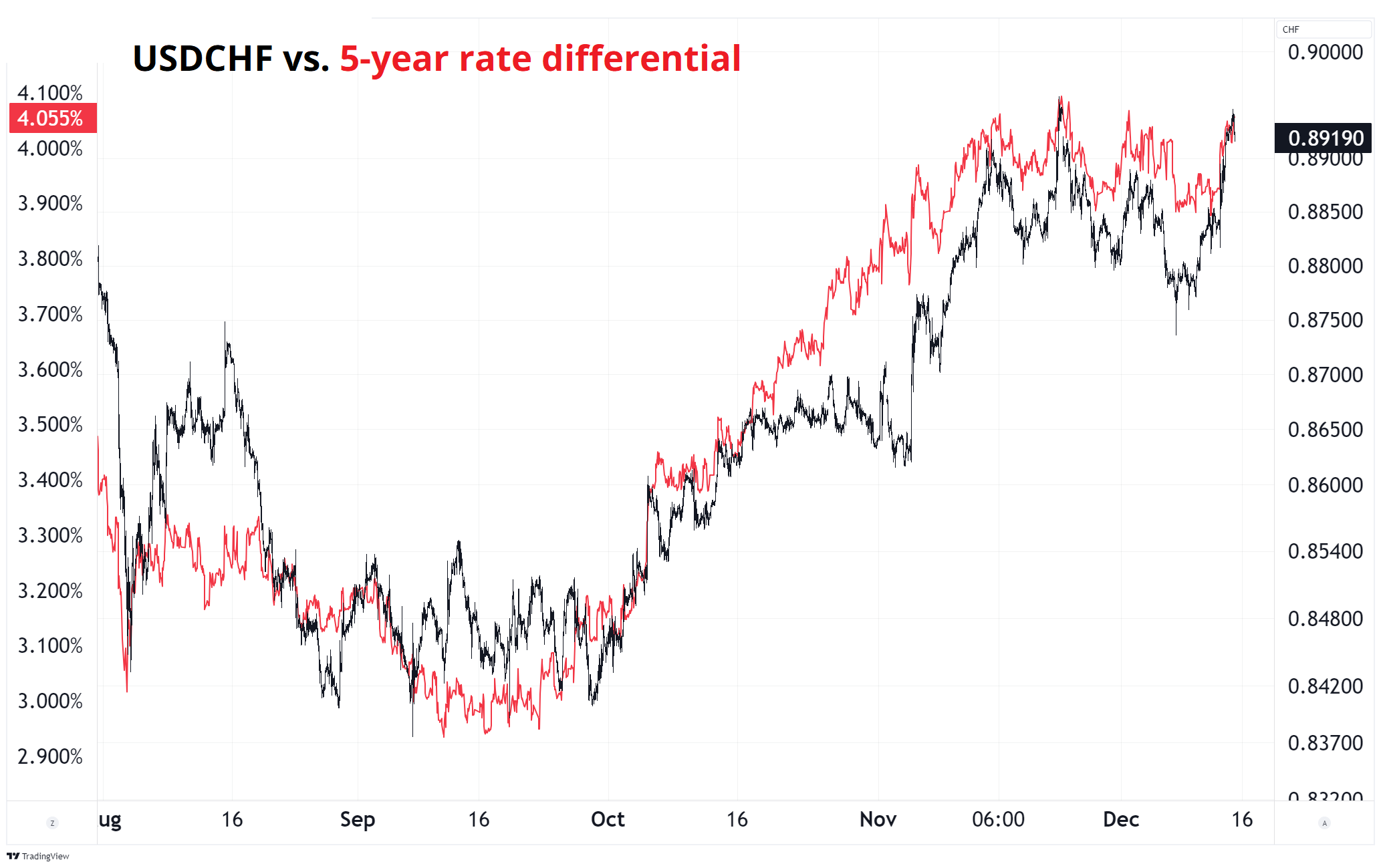

You can see that rate differentials made a new low after the currency, but both have found a fairly stable equilibrium zone here for now. Despite the jumbo cut from Confoederatio Helvetica, USDCHF spreads haven’t made new cycle highs.

In case you’re wondering, the first chart uses 10-year differentials, and the second one uses 5-year simply because that’s how they happened to be set up when I brought up the tab. It very, very, very rarely makes any difference whether you look at rate differentials using 2s, 5s, or 10s. You can check to make sure that is true now and then, but it’s almost always true because the direction of spreads across the curve is almost always the same, even if the magnitudes vary here and there.

There are 13 cards of each suit in a deck.

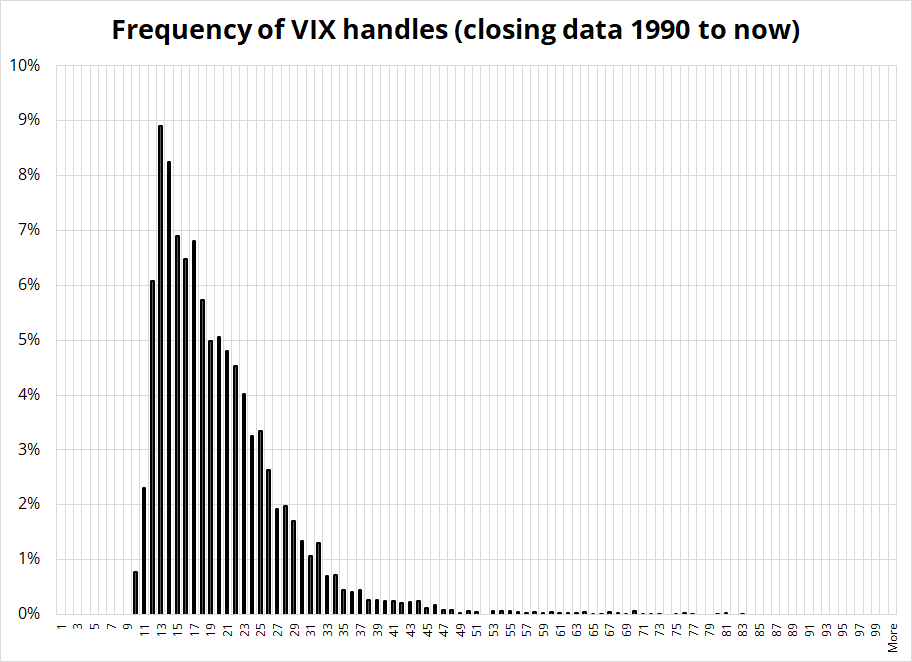

We are on a 13-handle in VIX right now.

13 is the most common VIX handle.

Aluminum’s atomic number is 13.

There are 13 weeks in a season.

Today is Friday the 13th.

13 is a prime number.

You sometimes run into misguided proclamations that “low vol is unsustainable!”, or VIX at 13 is “too low” or stability breeds instability because Minsky said, etc.

The reality is closer to the opposite. The default regime for equity volatility is somewhat low. Because volatility clusters (that is, low volatility is more often accompanied by more low vol), you need a reason to expect higher volatility that does not include “it’s low right now so it will be high later.” That said, right now, you do have a pretty good reason to think vol will be higher around January 20th, but markets are about as complacent and unbothered as I can ever remember them being. Hmm.

Nowhere is this clearer than 1-month vs. 2-month USDCAD vol. The 1-month expires a week before inauguration and the 2-month expires February 17th. Sure, there can be tweets and all that in the meantime, but the groundwork for the Canadian tariffs has already been laid, so I would think another tweet is less likely to matter whereas the announcement or non-announcement of tariffs in late January or early February will unlock a binary move in USDCAD as the market either repeats the mistakes of 2017 and watches the USD selloff, or sees a scary round of economy-damaging tariffs unleashed on Canada.

What is the low-vol outcome for January / February? I suppose a temporary hold on tariffs (we might launch them, but we’re going to give you Canucks time to comply—but not much time!) might be hard to price and hard to trade. So there are middle of the road scenarios where the low vol in CAD would happen. But not many?

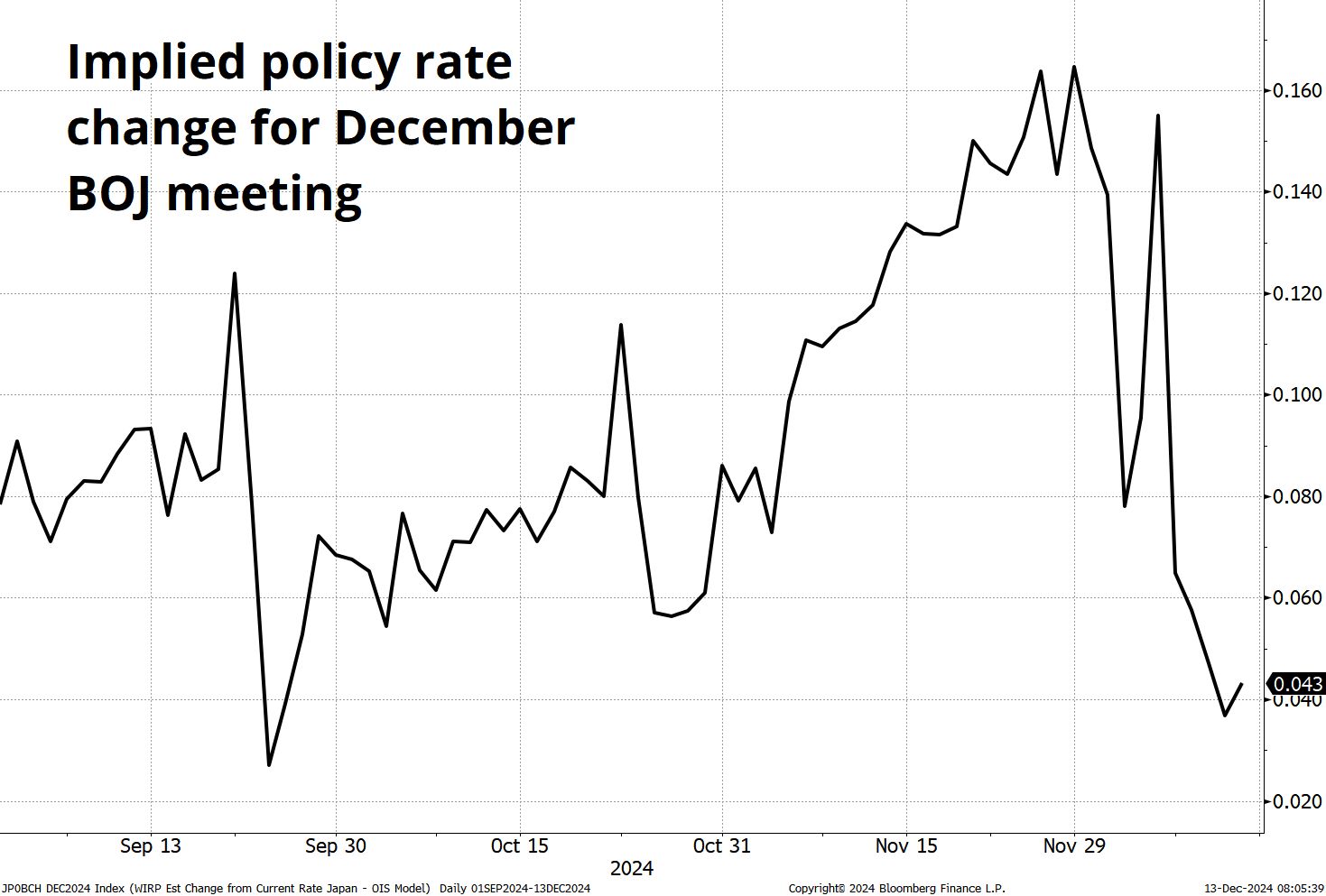

Next week is chock full o’ fun as we get six central banks, five PMIs, three CPIs, and some global GDP and US Retail Sales releases. The BOJ story has gone cold, JPY bulls wondering why they got out of bed at all after Kyodo published yet another story suggesting the BOJ is more likely to be cautious, not pre-emptive at this meeting as too many questions over imminent US policy shocks and Japanese wage and price dynamism remain unanswered. At right you can see we had 15bps priced for ages and now that’s down to 4. They surprised in December 2022 and if USDJPY is at 156 next week they might feel compelled to surprise again. We shall see.

Here is next week’s calendar, in all its glory.

Today is the third and final leg of the EURSEK flipper (see here if you don’t know what this is). Leg1 made money, it looks like leg2 will lose. The AUDNZD seasonal trade has lost its mojo for now as we held 1.0950 twice and AUD finds a floor as copper has been trending slowly higher and USDCNH holds steady around 7.28.

Have a sporting weekend.

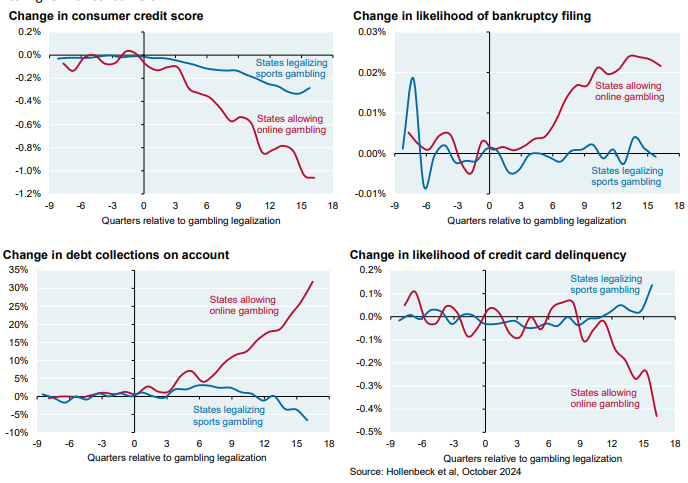

24/7 access, optimized gamification, in-game push notifications, and deliberate exploitation of gambling “whales” (aka, problem gamblers) is what makes smartphone gambling more destructive than real-world onsite gambling.

“How is that any different from 0DTE and Robinhood and Coinbase?”

It’s not. :] I suppose liberty has a price, and there are always tradeoffs, and personal responsibility is a thing, etc. But man, these stats are stark. Then again, most academic research fails replication so maybe these results are false anyway!

Go Commanders!!!!

https://www.slowboring.com/p/the-sports-gambling-industry-needs

The USD is bid, FOMC could surprise hawkish, and crypto proxy supply explodes