Investment bank outlooks may suffer from extrapolation bias. Tails are the base case.

Satisfying

Investment bank outlooks may suffer from extrapolation bias. Tails are the base case.

Satisfying

12DEC 109 / 107.50 CADJPY put spread

risking 48bps off 109.70 spot

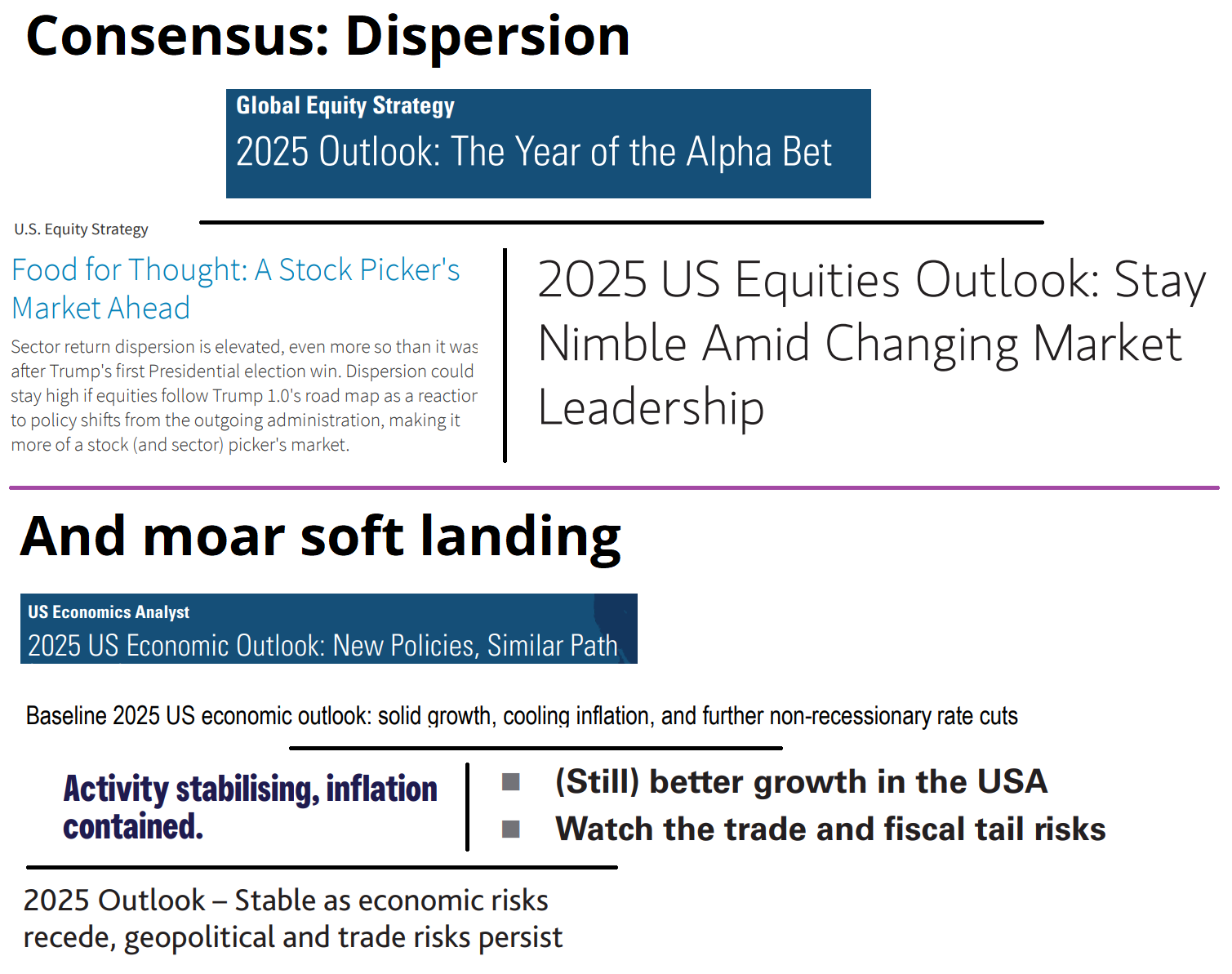

The 2025 Outlooks are coming in fast and furious. Most everything I have seen so far from the marquee names points to extrapolation of current conditions with only a nod to tail risks. I have not seen any bold, off-consensus outlooks yet, but I will let you know! Here is a pictorial summary.

You might think I cherry-picked these headlines to make it look like everyone is saying the exact same thing—but I didn’t! These are clips from every 2025 preview I read yesterday. Most of it is from the top 3 investment banks in the United States. Three out of three say Alpha and/or dispersion is the forecast.

These are implicitly bullish calls because correlation and volatility are kind of mostly the same thing most of the time. That is, if you are making a call that it’s going to be a stock picker’s market, or that Alpha Bets will reign supreme, you are making an implicit call on lower volatility and higher stock prices, whether you say so or not. You can add this to the litany of indicators pointing to a nearly-unanimously bullish consensus.

Specific trade of the year ideas usually come a bit later than the economic outlooks, so we can be on guard for those next week or just after US Thanksgiving. My general rule is that the “Trades of the Year” tend to work the last week of December and the first few weeks of January because there is significant capital deployed into them throughout that window.

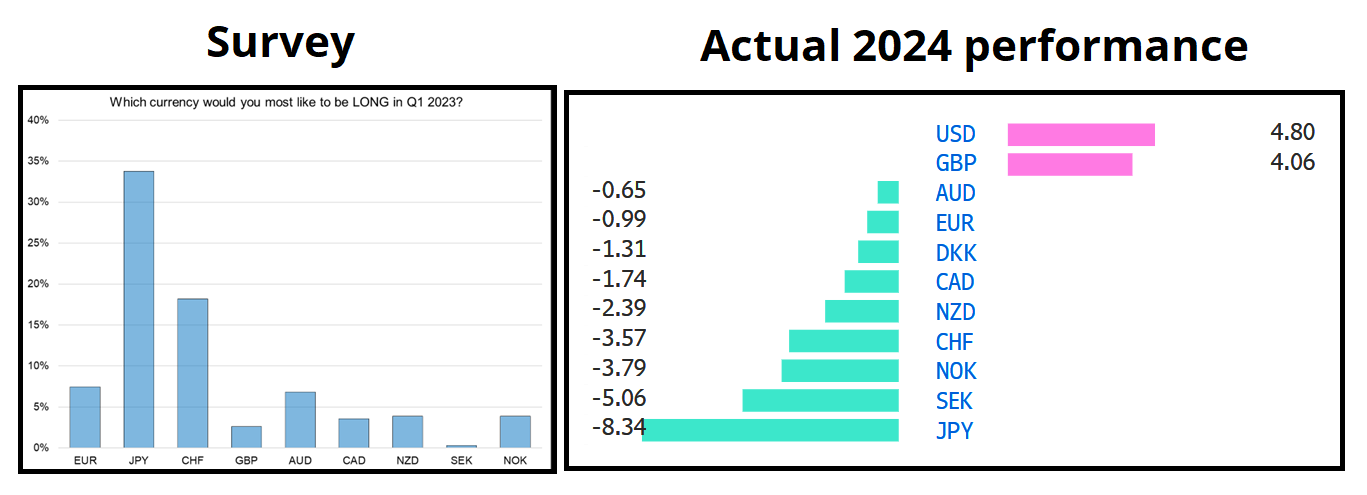

By early-to-mid-February, investors are tired, and new themes emerge that overwhelm the prior forecasts and positions. This year is special with the weeks leading up to inauguration likely to be full of uncertainty (60% China tariffs on day one?) so deployers of capital may be more aggressive than usual over this turn of the calendar. Fun fact: Going into January 2024, the most-loved currency was the JPY and that is the worst-performing currency this year. GBP, which was hated more than any currency other than SEK, performed best. FX is hard!

I will write much more about the 2025 outlook, but for now it seems that forecasters are herding around a base case that looks like an extrapolation of 2024. This seems off base to me given the brand-new shock and awe administration that will kick off with leaks in the first few weeks of January and new policies shortly thereafter.

The base case should be the tails and the tails should be the base case.

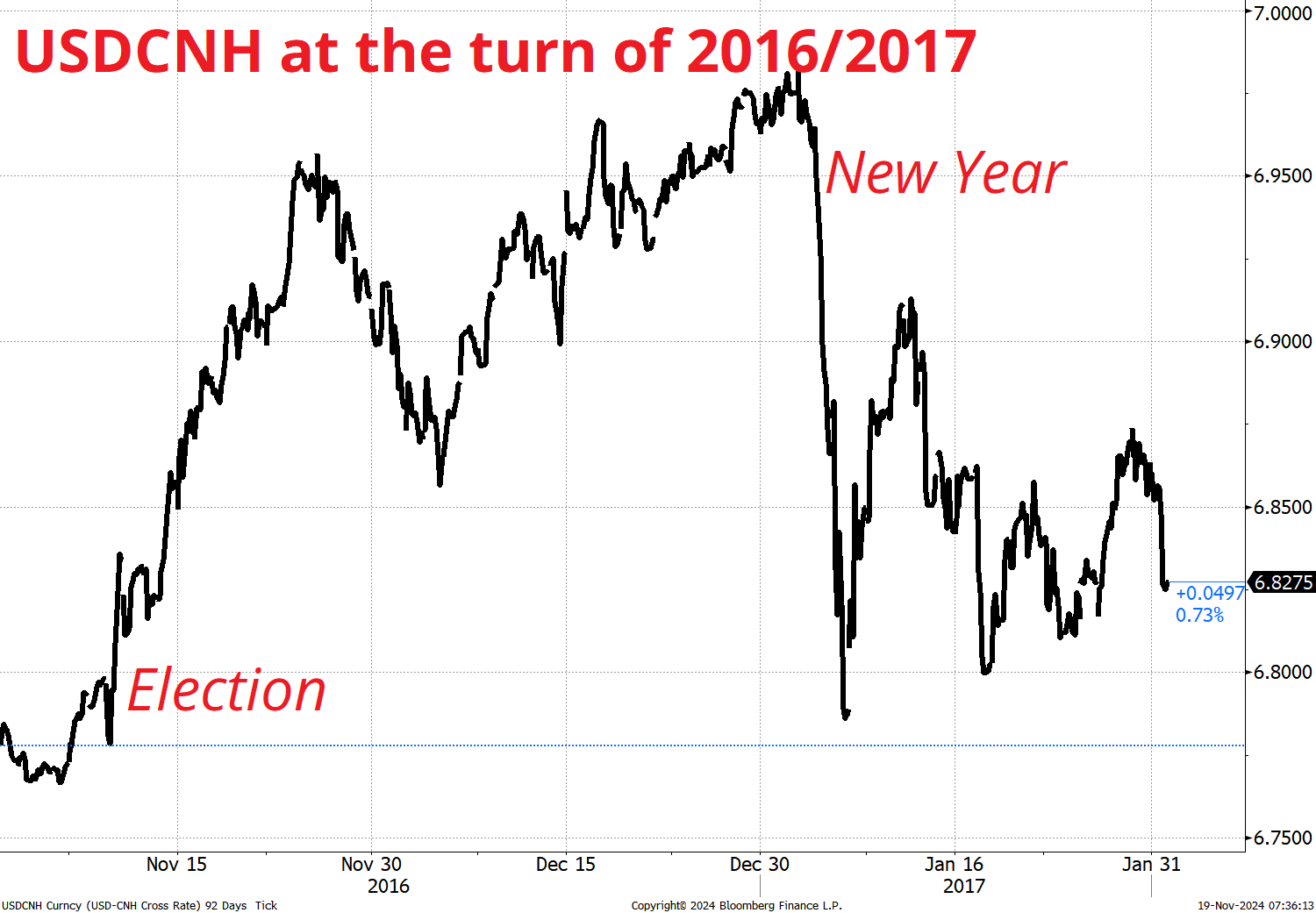

Now obviously the tails being the base case immediately makes you want to buy 3-month USDCNH topside, and that makes sense! Big huge tariffs on Day One is a sensible thing to expect. Unlike tax cuts, mass deportation, and D.O.G.E. government waste elimination, tariffs can be enacted right away. Still, it’s worth keeping in mind that in 2016, this was the narrative too, but the market very quickly lost patience with this thesis and USDCNH absolutely collapsed in the first days of January 2017 as the PBoC engineered a funding squeeze two trading days in and CNH never looked back.

I don’t say this to suggest that tariffs are not coming. I think Day One Tariffs should be the base case. I simply point this out to note that the price action in January looks extremely binary. Either the shock and awe comes, or it doesn’t. There does not look to be a relevant middle ground here. Trades that play for stability into the turn of the year, and then an epic move in January make sense to me. USD puts or calls with window knockouts covering now until 31DEC, for example, depending on your directional USD view.

Speaking of shock and awe, I am trying to keep an open mind on the deportation story. The biggest hurdle is logistics, but if the new administration is willing to enlist military help, maybe it becomes more doable? The labor market implications would be dramatic and disruptive.

Canada CPI ticks higher. 1.3980 was the multi-month breakout level so it will be interesting to see if we can hold that or we cut back down through. A 50bp cut from the Bank of Canada at the December 11 meeting probably off the table now given hawkish Fed, Canada’s weak currency, and this inflation print.

A close below 1.3980 today makes the chart a complete mess.

Have an improbable day.

Max USD long reached (again)

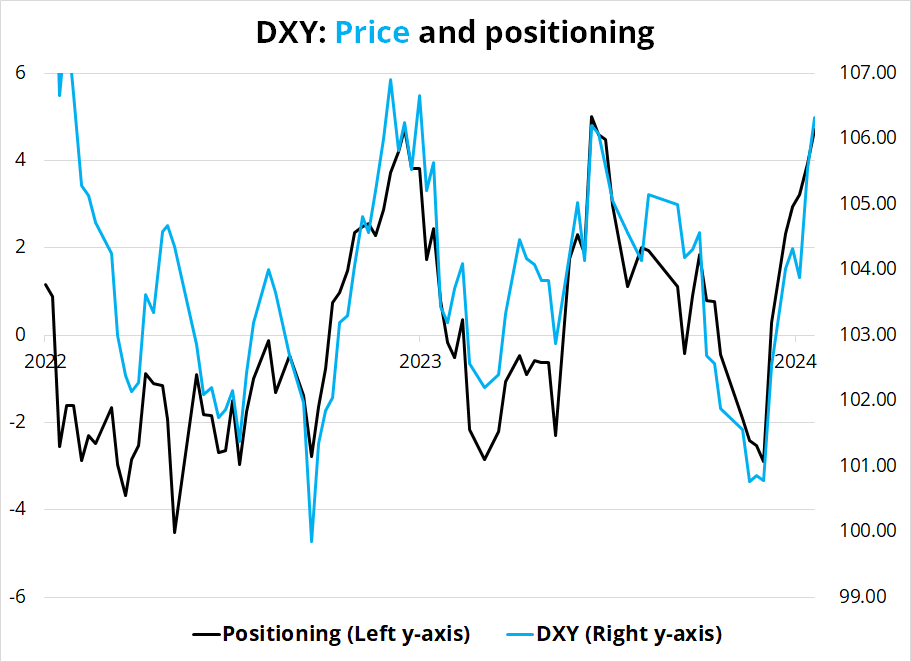

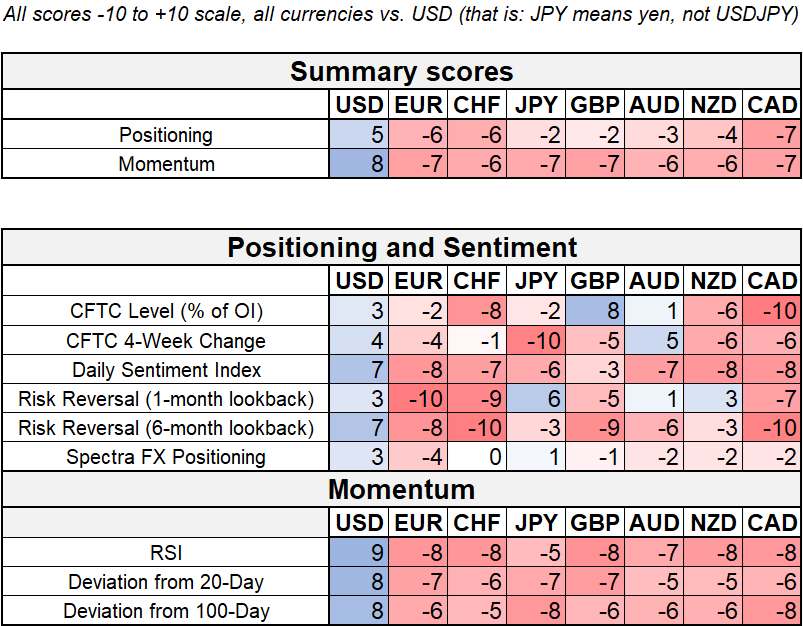

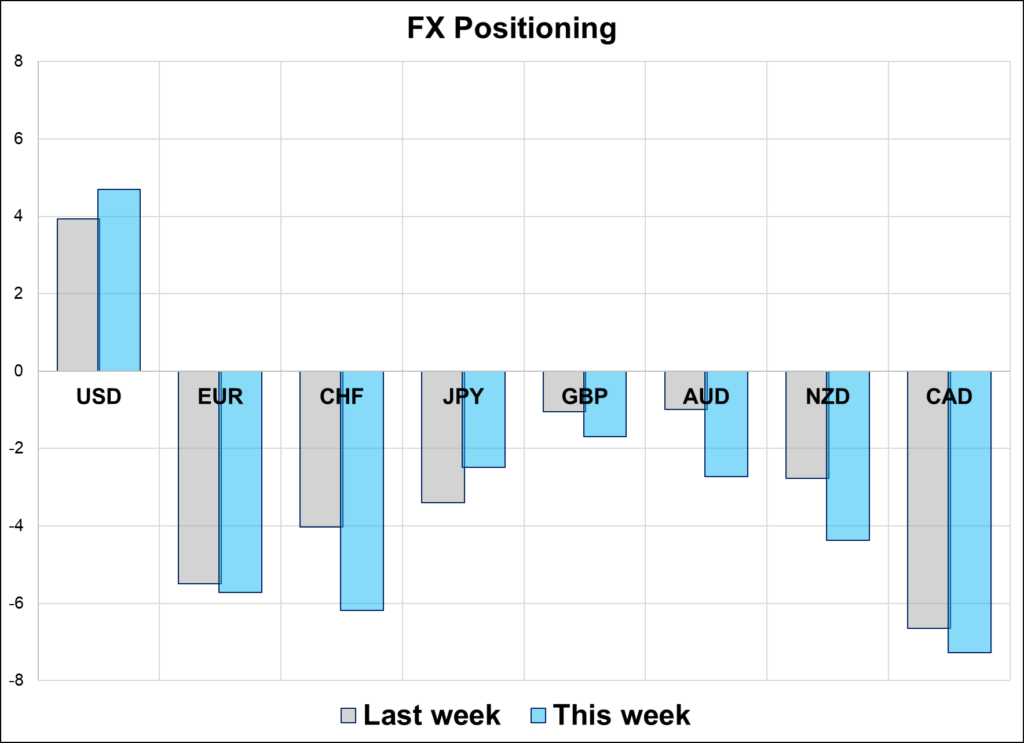

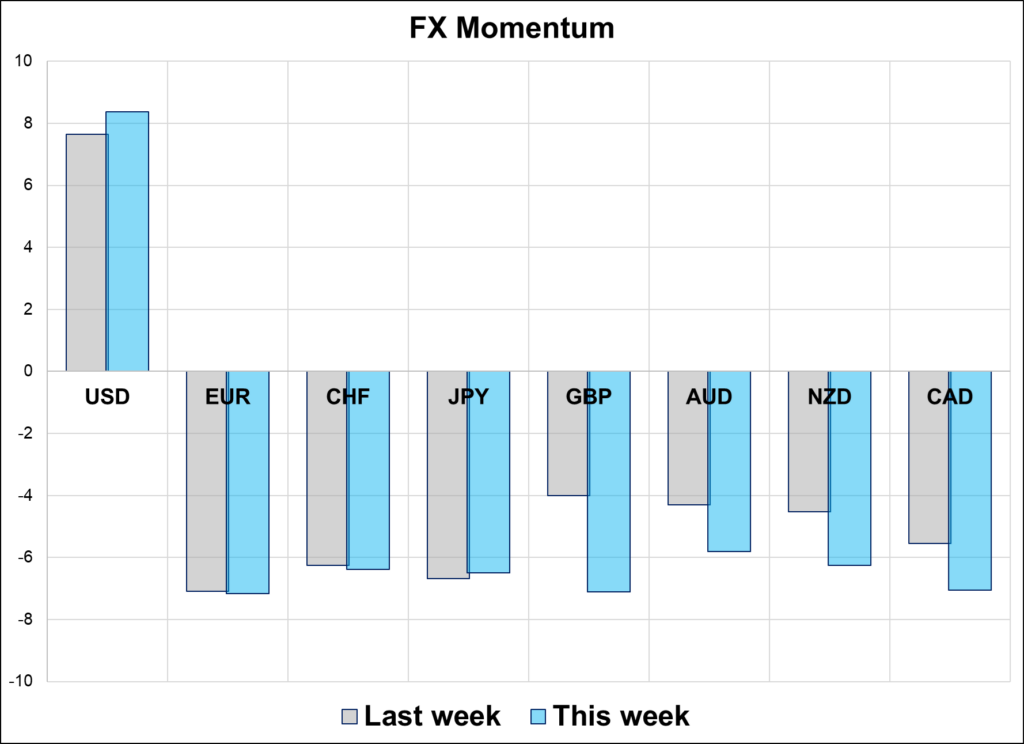

Hi. Welcome to this week’s report. USD positioning took another step higher last week as momentum continues to pull in greater speculative interest. The focus has been on EUR, AUD, CAD, and CNH, with speculators giving up on USDMXN for now as volatility is too high and the price action has been too difficult to process. While the CFTC remains long GBP, every other sector is now short, so GBP finally flips to net short in our metrics this week.

The chart of positioning and price continues to draw a sine wave and we are now at the top of the range for both measures. I want to emphasize that this output is what rangebound markets look like, and in a trending market positioning can remain elevated as price shoots higher and higher. The period from January 2023 to now has been defined by a well-defined range in EURUSD and the DXY, and positioning extremes have coincided with every major low and major high. We are now at a positioning extreme as you can see from the black line.

Note that while the individual sub-components of our positioning metric run from -10 to +10, the nature of the math makes it difficult for the overall reading to go below -6 or above +6 because the overall reading takes an average of the six sub-components. Within our franchise, we’ve seen lightening of EUR shorts, not adding, which runs counter to the overall message from the report. Ranges do not last forever but it will take a major gust of wind to get us through the 107.40 ceiling in DXY and/or the 1.0450 floor in EURUSD, especially as negative USD seasonality begins in earnest at the end of this week.

Of the 131,072 (2^17) possible combinations of letters on and off…

All on or all off would be most likely.

This oddly satisfying combination is highly unlikely.