Two or three times per year I like to zoom out and rank the relative yields

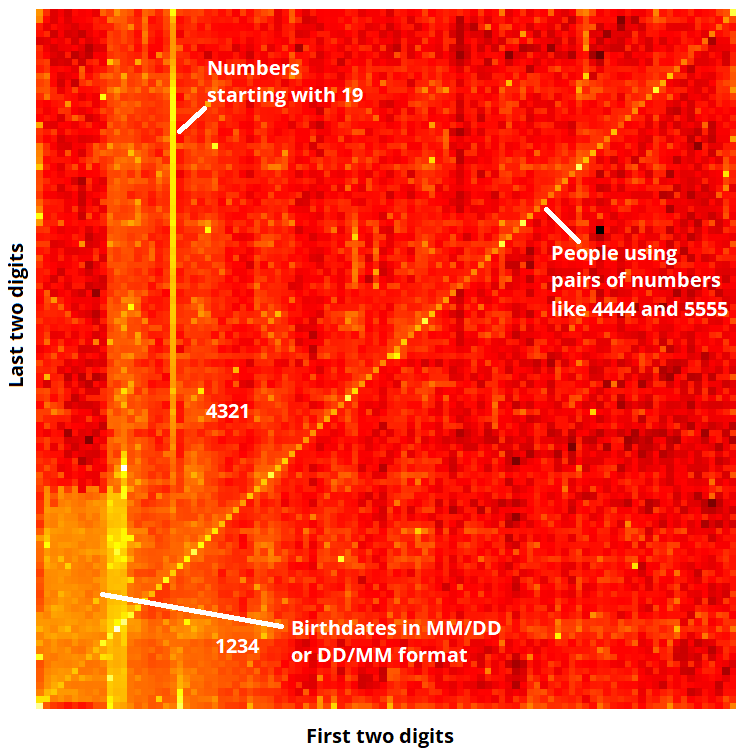

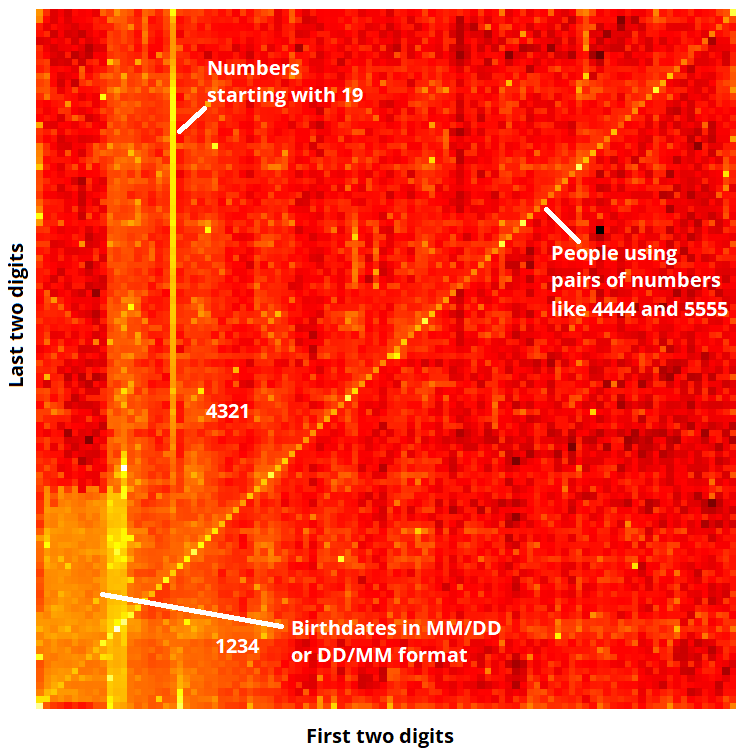

Most common 4-digit PINs and passwords

Two or three times per year I like to zoom out and rank the relative yields

Most common 4-digit PINs and passwords

Long USDCHF @ 0.8867

Stop loss 0.8784

Take profit 0.8994

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1216

Close 31DEC

Short EURSEK @ 11.6000

Stop loss 11.8650

Flip long 06DEC

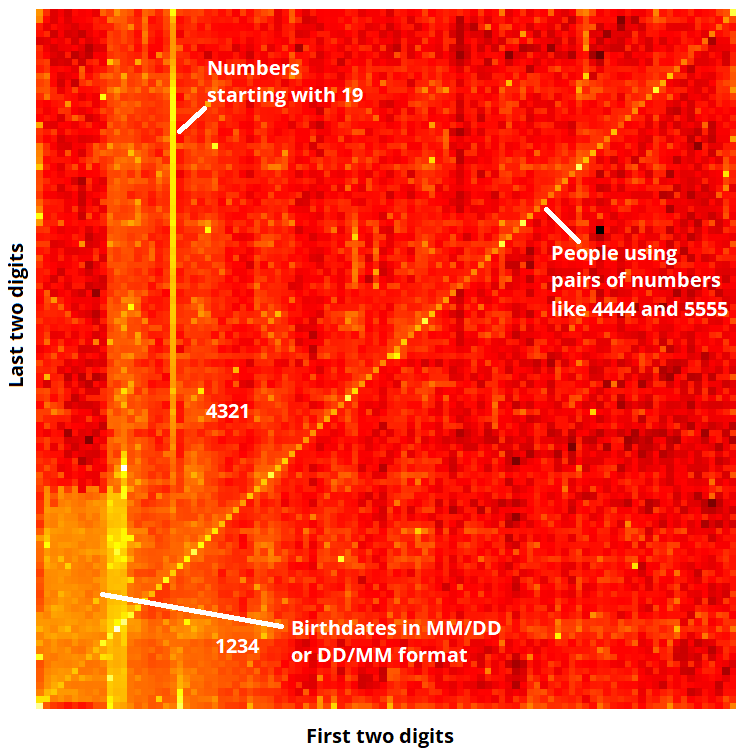

It’s not exactly news, but I just wanted to point out that GBP is now the highest yielder in G10 when you look at 2-year yields. The pound has gone from emerging market currency / laughingstock in 2022 to high-yield stalwart in 2024.

So many different GBP-bearish narratives have appeared over the past two years on both the political and economic side, but none of them have borne much fruit as the BoE hasn’t cut as fast as hoped for, the bond vigilantes packed their bags pretty quick, and the dreaded mortgage reset story has still not yet come home to roost.

The league table for two-year yields now looks like this. Table shows rank of country’s yield, compared to peers. Tariff fears and China wobbles are not impacting the pound the way they impact other currencies like EUR, AUD, and CAD. There are three cuts priced for the BOE over the next year vs. six for the ECB.

You can interpret this as the market is out of line, or the UK is a different economy and more USA-lite, not Europe-lite. Here’s the same table but showing each country’s yield compared to the average of the others.

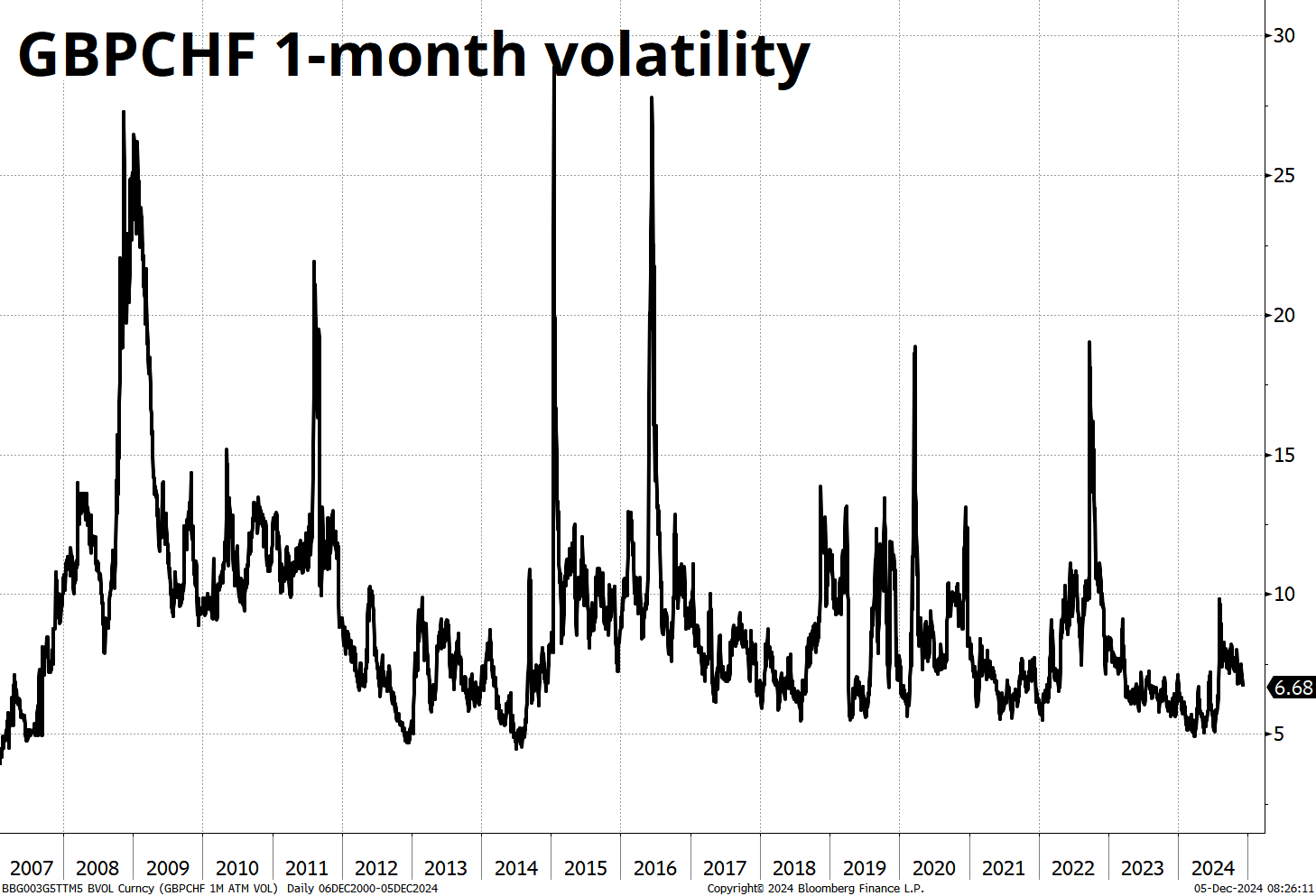

One point that jumps out of those two tables is that CHF is always the lowest yield, and yet it has rallied like mad throughout the entire 2009-2024 period. But it’s also notable that the carry on CHF has widened dramatically even as volatility has not gone up at all. This attractive carry-to-vol profile is probably why the CTAs keep trying to buy GBP vs. EUR, CHF, etc. FWIW, the CFTC has bailed on almost all of its long GBP position at this point.

No call to action on the GBP, I just think it’s interesting to zoom out once in a while and look at what’s happening in relative carry across G10. GBP is moving on up and if the rise in yield is not fiscal risk premium, it makes the pound more attractive than it used to be. It’s odd to see UK rates above NZ—2024 is the first year ever for that.

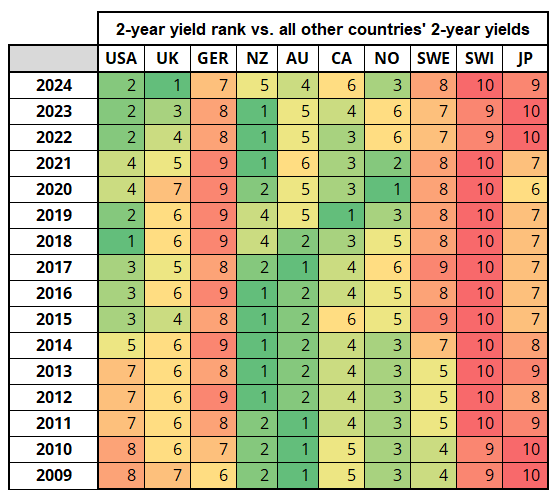

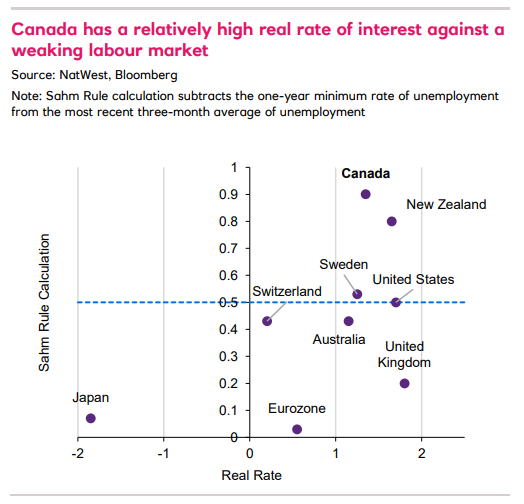

Speaking of yields, this chart from NatWest caught my eye.

Canada and New Zealand stand out, but Canada is more relevant for now given the RBNZ doesn’t meet again until February 2025. I still like the 3-month 1.45s in USDCAD. That’s a bit long-term for the am/FX sidebar but I do sincerely like the trade.

Alf’s back so we will record the podcast today and post tomorrow!

Hope your day is as easy as 1234.

Most common 4-digit PINs.

http://datagenetics.com/blog/september32012/index.html