US economy, Chinese yields, and what happens if we get scaled tariffs?

The US $10,000 bill was first issued in 1878 and was discontinued in 1934

US economy, Chinese yields, and what happens if we get scaled tariffs?

The US $10,000 bill was first issued in 1878 and was discontinued in 1934

Flat

As Panama, Greenland, and Canada await their fate under President Trump, FX markets continue to price in Day One tariffs and a zippy / nervous bond market. We get Initial Claims today (probably boring) and then ISM tomorrow as we attempt to handicap the 2025 economic landscape.

Chicago PMI came in near the lows last week, and that created a bit of excitement, but the bond market smartly ignored the figure as it has been completely useless for more than two years. Recall Chicago PMI collapsed below 40 in November 2022, and again in April and May 2024. Needless to say, these 2008-level Chicago PMI readings were not harbingers of anything at all. The economy was fine in 2023 and 2024.

Survey data has lost its mojo post-COVID as politics, inflation, and low response rates have obliterated any predictive power they once possessed. ISM has been less bad than Chicago PMI but note the Chicago figure has been the worst of the worst. An economic figure repeatedly printing at 2008 levels during a 2-year period with GDP above 3%, Unemployment near the all-time lows, and corporate earnings at all-time highs is completely broken.

That said, US economic surprises have rolled over a bit, and we are coming from a starting point that will be tough to top in 2025. And Fed rate cut expectations are limited.

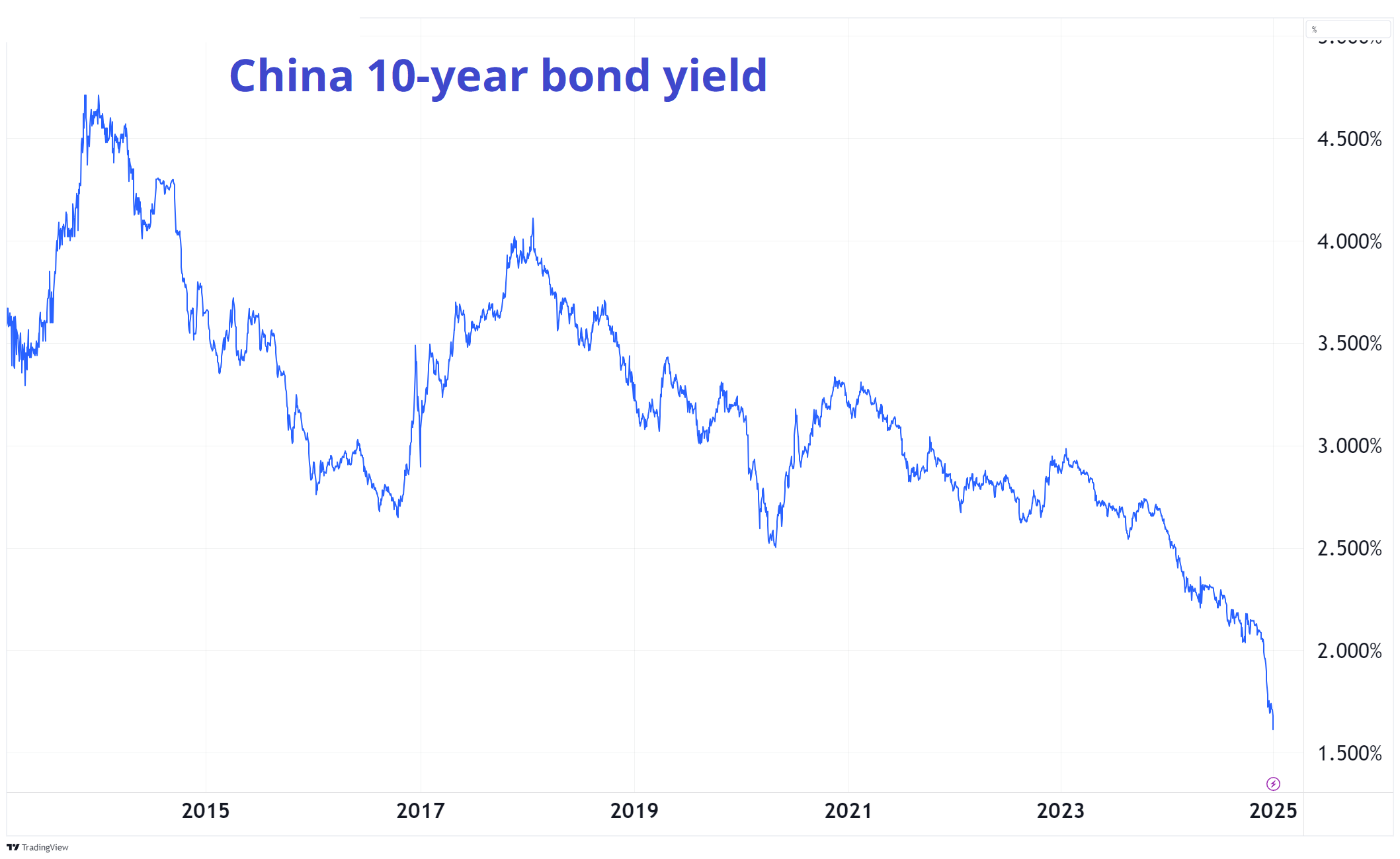

Meanwhile, China keeps ratcheting lower and while Chinese bond yields have offered the best macro read, even Chinese equities are reversing now.

This is interesting given the fact that the equity market was the most obvious target of the big announcements in September and October. The National Team will need to come back in and buy soon. The nearly-unbelievable drop in Chinese bond yields continues:

China exporting deflation has to be a risk to the rest of the world at some point soon if Xi et al remain unable or unwilling to stem the malaise. Despite my skepticism on the usefulness of the Chicago PMI, I do believe there are many more paths where US yields go lower this quarter as economic data cools, views on the US policy mix turn less inflationary, China exports some deflation, extremely difficult 2024 comps come into play, and stock and bond market positioning set the stage for a zippy reversal. Long bonds, long USD is an interesting play if you believe that shock and awe tariffs are coming on or shortly after January 20.

Speaking of tariffs, I believe the idea of scaled tariffs is probably a bit underpriced as the market views the whole thing as binary, when it’s really not. The binary view (which I was as fan of for a while, but no longer) is they either do the tariffs or not (25% on Canada and Mexico, 10% on the world, 10% to 60% on China, etc.) But the alternative approach, one I think will be favored by Bessent and Musk, is to put some kind of small tariff on Day One and legislate steps. For example, you put a 5% tariff on Canada and then make some demands and tell them if they don’t meet the demands then the tariff will increase by 5% every three months. How does that sort of thing impact vol?

I would guess it’s bearish volatility as it reduces uncertainty and opens the door for negotiations and a conciliatory outcome where Trump can declare himself the victor, and everyone else can crawl back home having avoided the total destruction of their economies. And no matter what China does, they can just say “it wasn’t enough” and keep ratcheting up the tariffs there.

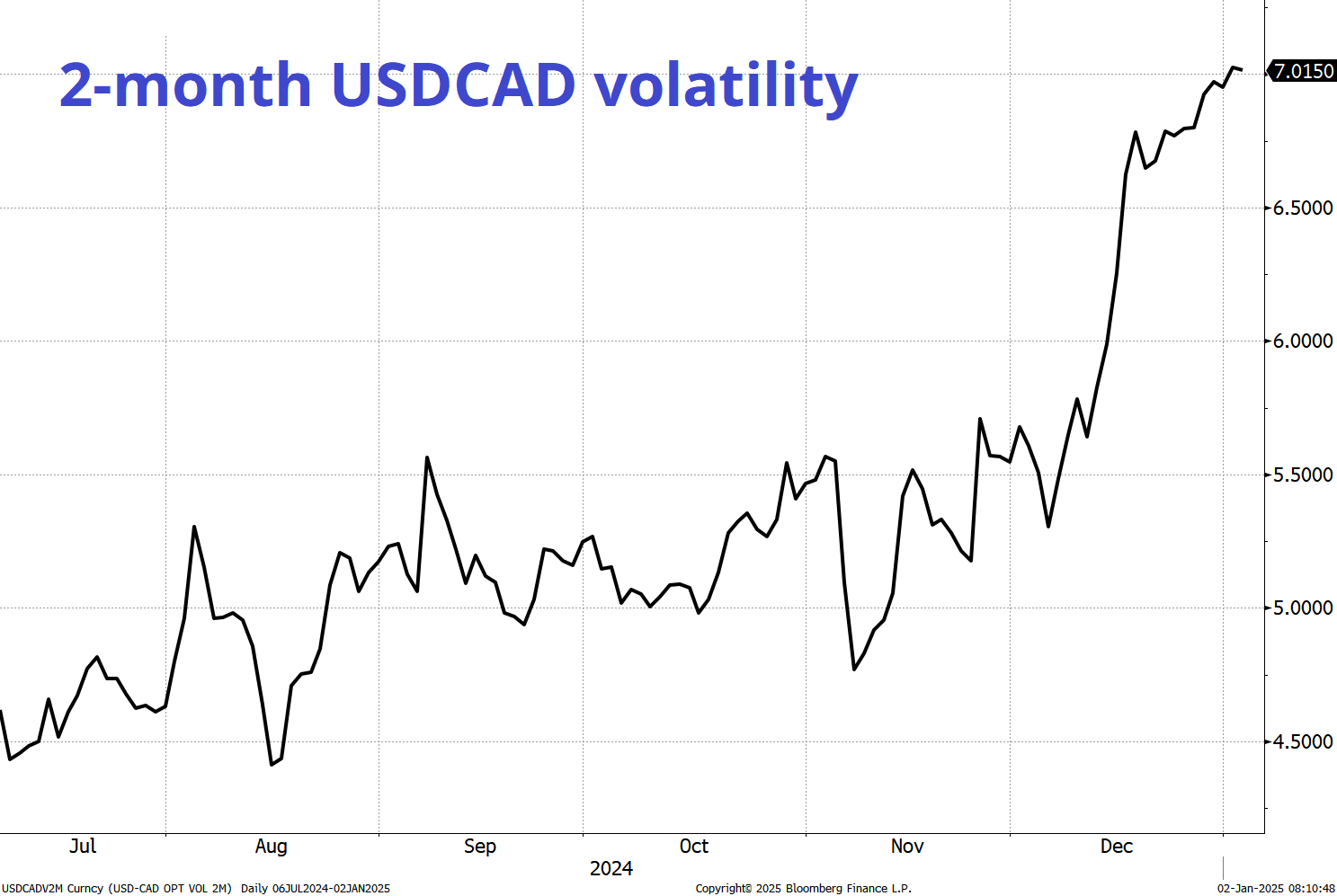

All this speculation is a useful way to prepare for the eventual outcome, but I don’t see any reason to front run the result here. I wrote on December 12 how CAD vol looked mispriced, but it has now repriced significantly and no longer looks cheap.

With the USD and FX vol both at the highs, a large premium in FX vol, USD long positioning near an extreme, Fed cuts mostly priced out, and some global and even US economic risks on the horizon, risk/reward on long USD isn’t obviously attractive anymore. But fading the USD this early makes no sense.

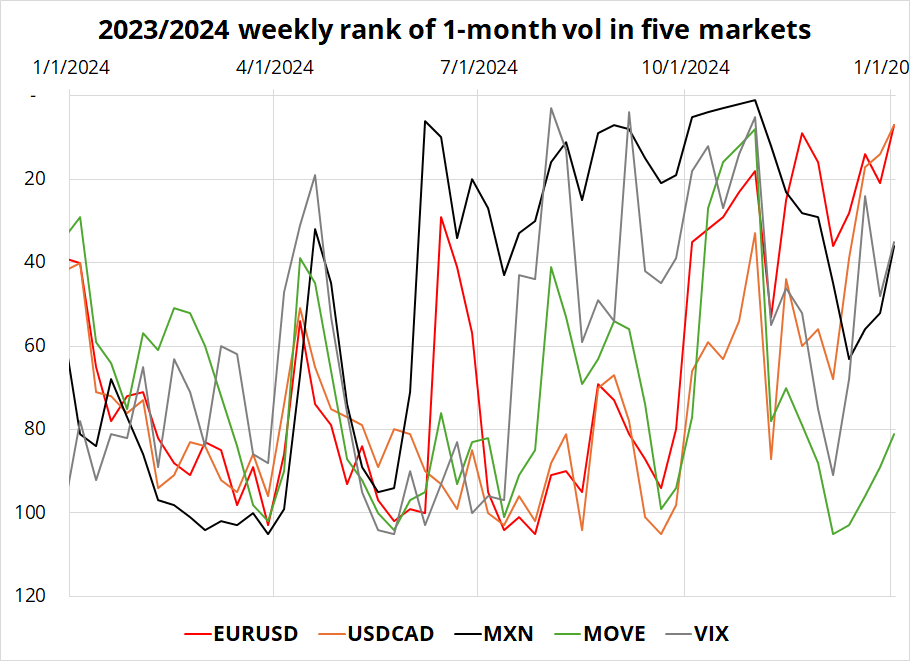

To give you a sense of the premium in FX vol now, here is a comparison of volatility in the three main asset classes. The line shows the ranking of weekly volatility readings compared to all of 2023 and 2024. You can see that EURUSD and USDCAD are basically as high as they’ve been, while MOVE is super low and VIX and USDMXN are in between. This premium in FX vol relates to the tariff threat, because tariffs are most clearly traded in FX. Their impact on yields and equities is less certain. If we get scaled tariffs, expect a rapid fall in FX volatility, even if the USD rallies.

Have a $100k day.

This thing sold for $480,000 in 2023.

Benny Binion had a collection of one hundred $10,000 bills in his casino. The collection was sold in 1999 for just under $10,000,000.