Micro USDJPY buying, macro watching France, traders watching NVDA

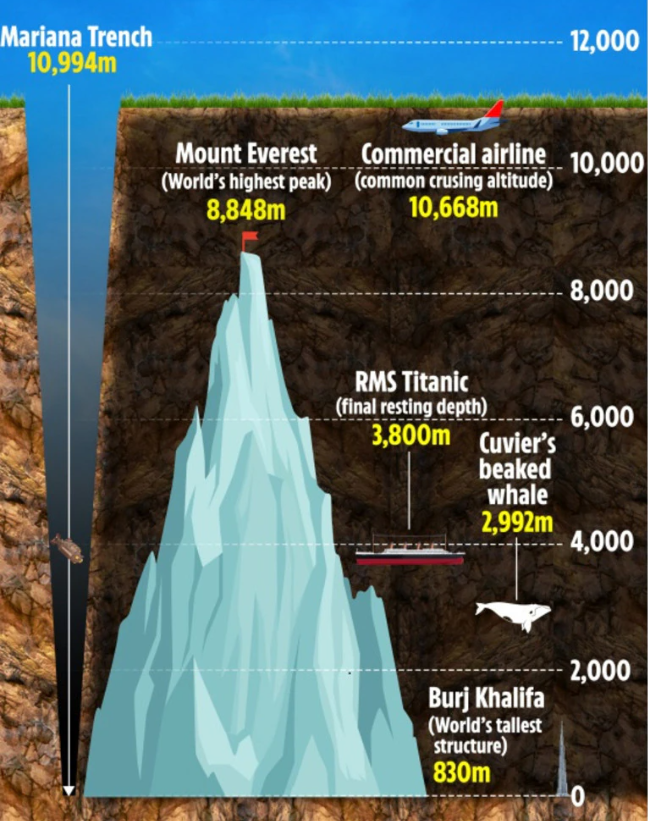

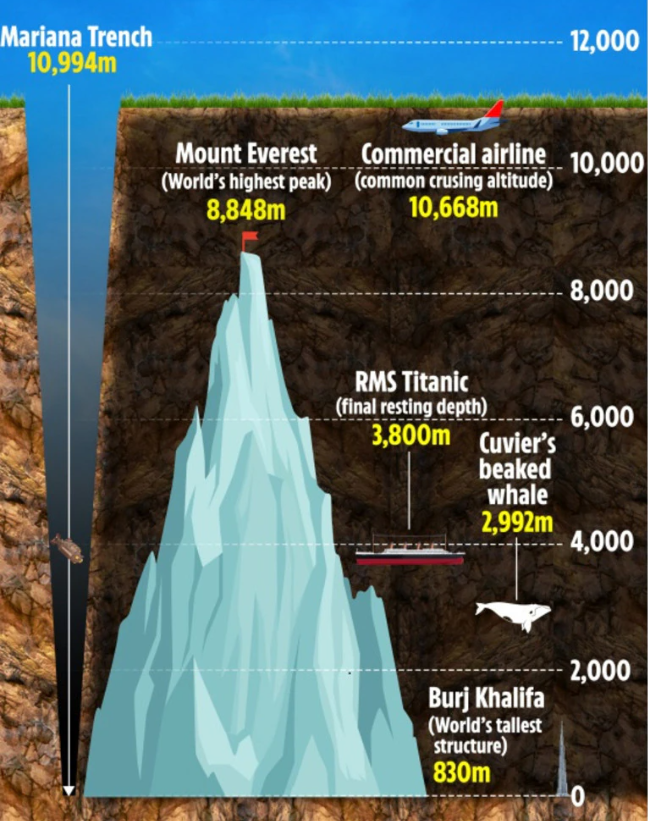

Perhaps the most interesting part of this image shows the Cuvier’s Beaked Whale dives up to two miles deep

Micro USDJPY buying, macro watching France, traders watching NVDA

Perhaps the most interesting part of this image shows the Cuvier’s Beaked Whale dives up to two miles deep

Long EURGBP @ 0.8674

Stop loss 0.8589

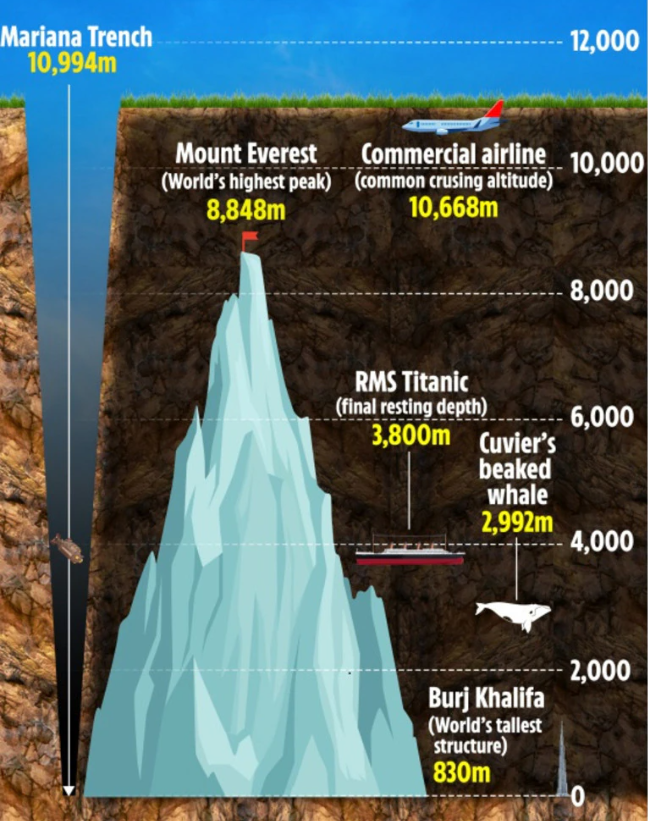

We are seeing significant corporate demand for USD as August tends to be a big month for hedgers. You can see the persistence here.

Also you have this today:

*Sompo Holdings to Buy Aspen Insurance Holdings for $3.5 Billion >AHL

Which could be contributing to USD demand. While 2-year yields continue to fall, the inflationary risks of a too-dovish, captured Fed are keeping the back end heavy. Here’s USDJPY vs. 2s 10s and 30s (yield).

People sometimes debate which part of the curve to watch for USDJPY, or whether real rates matter more or 1y1y or what. To me, the average of all the yield variables tends to make more sense because different actors respond to different parts of the curve. That is, you can’t just watch 2s because while some hedgers and investors care about 2s, some care more about 10s. You have to watch all of them. You could argue USDJPY right now is about right as it responds to a blended average of yields.

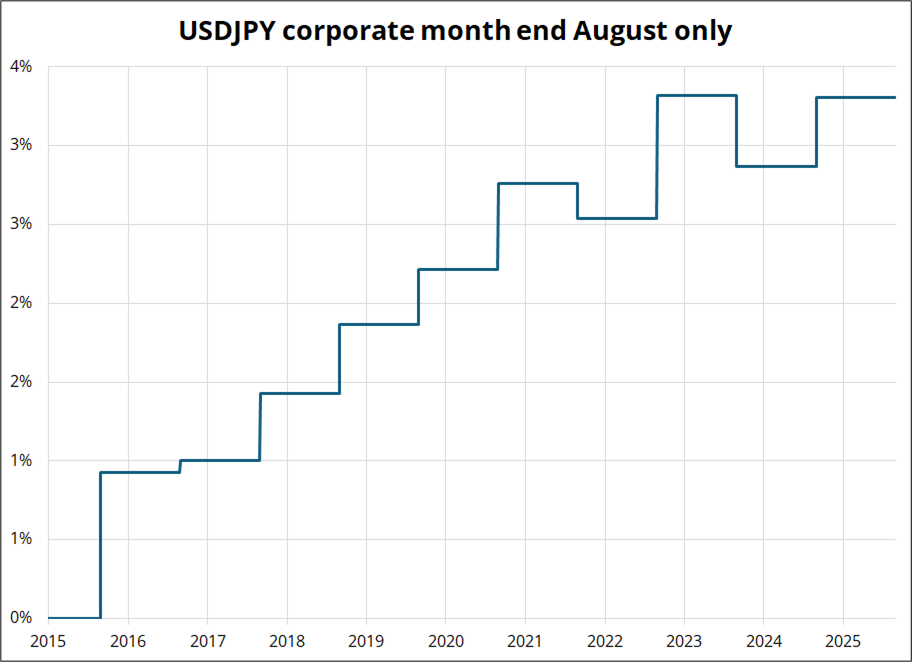

Meanwhile, widening OAT spreads are also bolstering the USD a bit. I had said yesterday that forward returns in EURUSD are not negative after a prior widening, but in real-time EURUSD does track the spread. It’s just that the spread tends to be mean reverting as French politics is too boring to create any meaningful macro story. Watch 90 bps as the line in the sand, because if we go through there, things might get zippy.

NVDA is in play tonight as they report earnings, with a focus on the forward outlook for hyperscalers and chip exports to China. There isn’t a real read through to FX on the day of, as I looked back at the last 10 NVDA earnings releases and can see no unusual volatility in FX on those days. Currency market beta to stocks has been minimal even as there remains a correlation between US equity outperformance and USD strength.

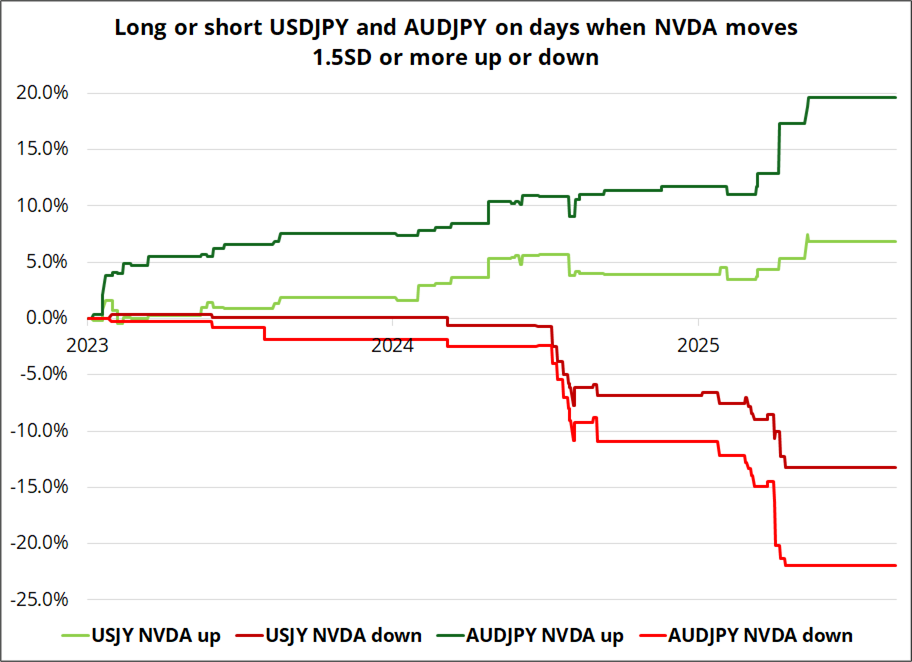

Another way to look at this is to simply filter for huge moves in NVDA and see how USDJPY and AUDJPY moved. This might be more useful than looking at a small sample of earnings releases because NVDA doesn’t always have a large move on earnings day. So, let’s see what USDJPY and AUDJPY do when NVDA has a 1.5-sigma move or more.

You can see there is strong sympathy between NVDA and AUDJPY on the huge days, but most of this is an artifact of the Liberation Day collapse and the “It’s a good time to buy stocks” explosion back higher in the NASDAQ.

Still, I think you could argue that if NVDA moves more than 1.5 SD today (4.8%), AUDJPY will probably end up moving the same direction.

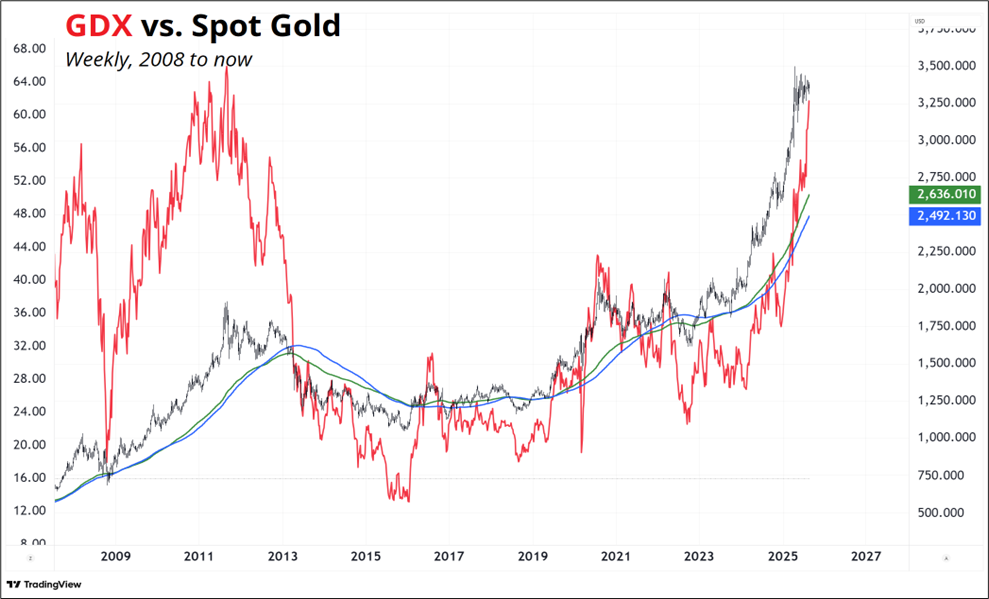

1. After 15 years of torture, GDX (the gold miner ETF) is almost back to 2011 levels. Very strong performance of late, even as spot gold consolidates.

2. Mega triangle forming in gold here. It’s coiling, Corbi!

Have a whale of a day.

Perhaps the most interesting part of this image shows the Cuvier’s Beaked Whale dives up to two miles deep

CBWs be weird