… Entry point and timing for short USD looks bad.

USD rally looks done, but…

Current Views

Long 26AUG 1.8050 EURAUD call

Cost ~36bps Spot ref. 1.7790

Long 26AUG 0.8760 EURGBP call

Cost ~33bps Spot ref. 0.8680

Long 1-week 149.50 USDJPY call

Cost ~30bps expires 05AUG

Spot ref. 148.75

Fully hedged, trade is over

The dollar

The one-two news punch of the president tinning the head of the BLS on the same day as a Fed hawk resigns early should have lit a fire under gold, silver, and EURUSD, but it has not. I find this surprising and would say it’s modestly bullish USD as it’s a mild case of good news / bad price for those three assets. Definitely not a reason to go long USD, but I think the post-payrolls price action is disappointing for USD bears.

That said, it could simply be a matter of the dollar already trading into short-term oversold territory after the payrolls revisions excitement. So I will not assign too much importance to the boring price action in Asia. Still, EURUSD and gold had a great excuse for an impulsive move in Asia time, and they languished.

US 10-year yields also failed to follow through after Friday’s mild carnage, and they continue to trace out a gigantic narrowing triangle. This lack of movement in US yields has been a frustrating feature of macro since at least mid-2023. We have had multiple recession scares, a growth scare, and an attack or two by the bond vigilantes, and yet bond yields have gone nowhere. 2-year yields are also drifting towards the range bottom, but are unchanged vs. September 2022. It would take a break of 4.0% in 10s to get me excited.

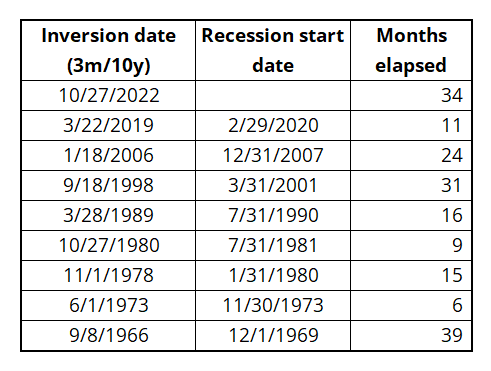

Speaking of recession scares, the yield curve has now been inverted for 34 months (almost as long as inflation has been above target!) This is the longest inversion without a recession since 1966 and is a nice reminder that yield curve inversion works very well in hindsight but is not a useful tool in real life. In fact, the “inverted yield curve predicts recession” meme has been one of the costliest truths in finance in three of the last four cycles. The only one where it nailed the recession was COVID and we have to put an asterisk by that one.

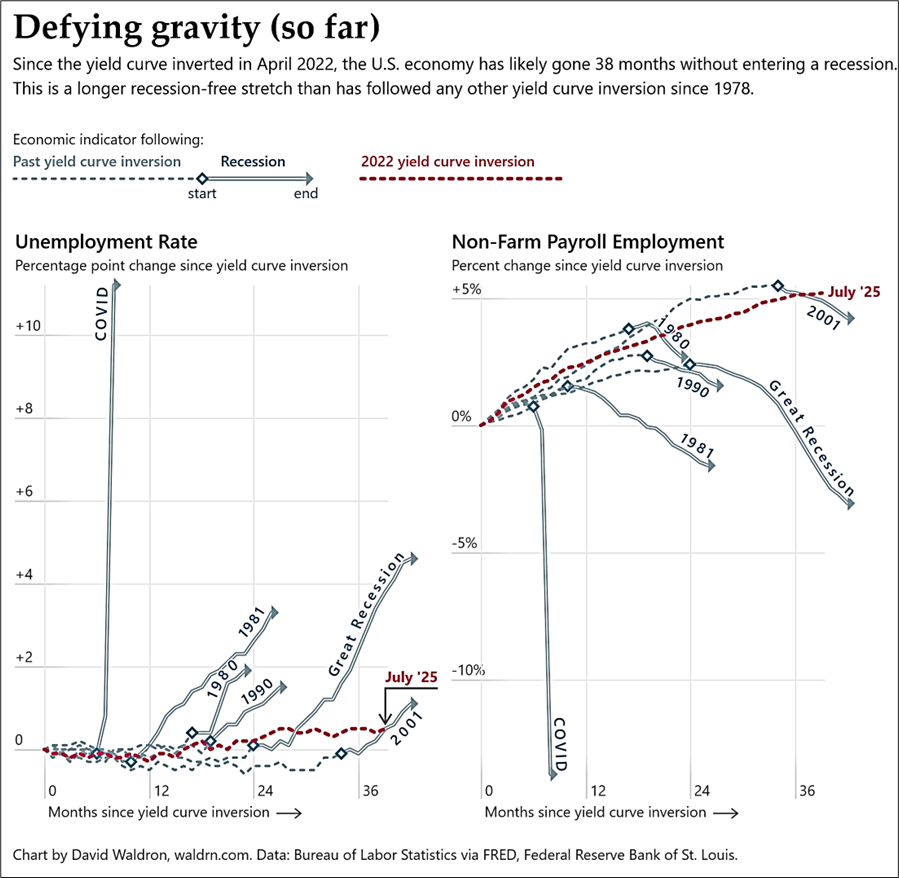

I saw an interesting graph on the progression of the jobs market after a yield curve inversion and the reason it’s interesting is that it shows 2001 is the best remaining analog for this cycle. Much has been written about the similarities between the 2000 dotcom bubble and the current AI maybebubble. Late cycle capex in 2000 kept things aloft while the late cycle capex in 2025 is pretty much the entirety of the economic growth story this time around. Here’s a nice chart from David Waldron’s Substack. I don’t know David, but he made a nice chart!

https://blog.waldrn.com/p/is-the-yield-curve-still-useful-for

After so many false dawns, I am more than happy to consider the possibility that US economic weakness has finally arrived, but my base case has to be that we’re still in the years-long soft landing that started in late 2022 or early 2023.

The long USDJPY / long gamma trade es finito

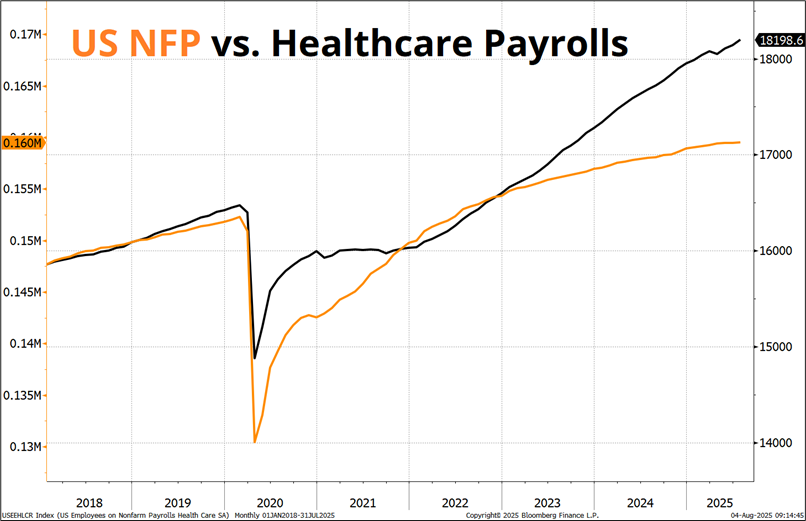

I misread the jobs report a tad and covered the short USDJPY hedge at 149.44 on Friday. My initial reaction was that we have seen negative revisions over and over again since 2022 and thus these revisions are nothing special. Upon further review, I better understand and agree with the market reaction. In the heat of the moment, I was too dismissive. Large downward revisions are now coming off a very low base whereas the revisions in 2022, 2023, and 2024 came off a high base. The revisions now leave Actual NFP looking like this:

y-axis truncated to reduce craziness

This puts the current 3-month pace of job creation at its lowest level since 2010 (ex-COVID).

While Initial Claims and the Unemployment Rate don’t support the idea of tremendous job market weakness, we are seeing a collision of falling demand and falling supply of labor, leaving the jobs market in balance but fragile.

The wild and crazy rally from 148 to 151 now leaves an incredibly bearish-looking USDJPY chart as the major resistance flagged at 151.00/20 held perfectly and now we have crashed back down while yields race lower even faster. Here’s the chart:

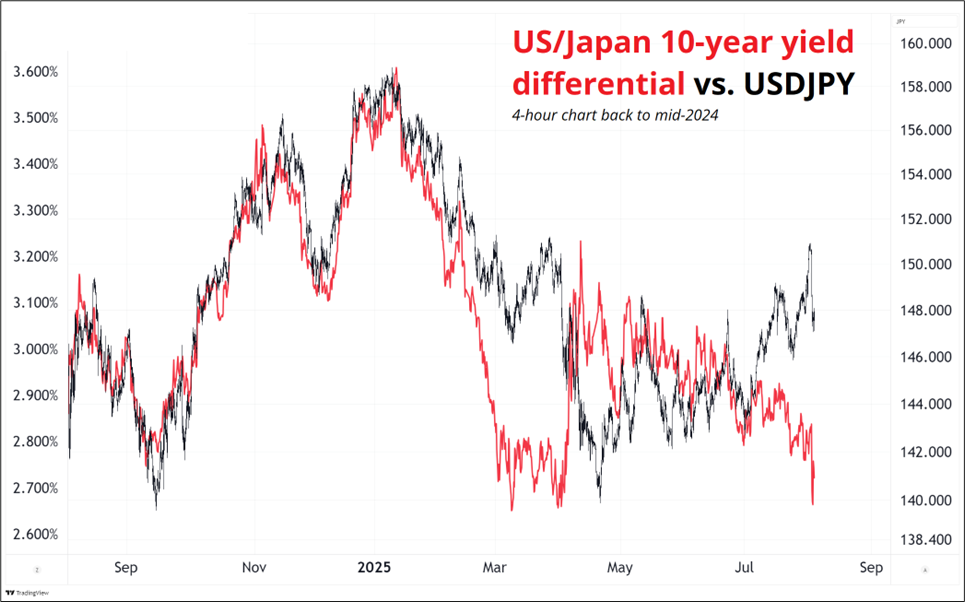

You can see that once the February 2025 support at 151.00/20 broke, it became resistance and USDJPY made a double top there in March and April before cratering to 140.00. Now we have an impulsive rejection of the same level (150.93 was the high pre-NFP). Rate differentials have been a complete mess vs. USDJPY this year because of the bond vigilantes, but you can argue lower USDJPY because of rate diffs if you are so inclined. I am honestly not a huge fan of this next chart, because I think the correlation break in April 2025 makes it a weird overlay, but I present it as food for thought anyway.

Summing it all up, the BLS and Kugler stuff is clearly bearish USD to me, and the huge rejection of 151 in USDJPY is also bearish. I do believe the weakening US labor market data might matter, though I am not close to 100% convinced. I have been bullish USD since returning from Brazil in late June and I am now moving back towards a USD-bearish view. I am not doing any trades for now because the price action in Asia was so disappointing and there’s nothing on the data docket and thus I am worried about entering USD shorts at bad levels with no catalyst. Selling USD at the lows in NY time after an Asia session that saw no USD selling feels highly suspect to me. Let’s see how the week progresses but definitely a buy dips market in EURUSD from here and sell rallies in USDJPY.

Final Thoughts

- Volumes are too low to make this useful yet, but keep an eye on this as the story develops:

https://polymarket.com/event/who-will-trump-announce-to-replace-kugler?tid=1754311744928 - Does Warsh running the Fed even change anything? I am not sure.

- While the US government announced Friday that it does not trust its own jobs data, I still think this chart is interesting.

Left y-axis is total jobs, right y-axis is health care jobs

Have a street smart week.

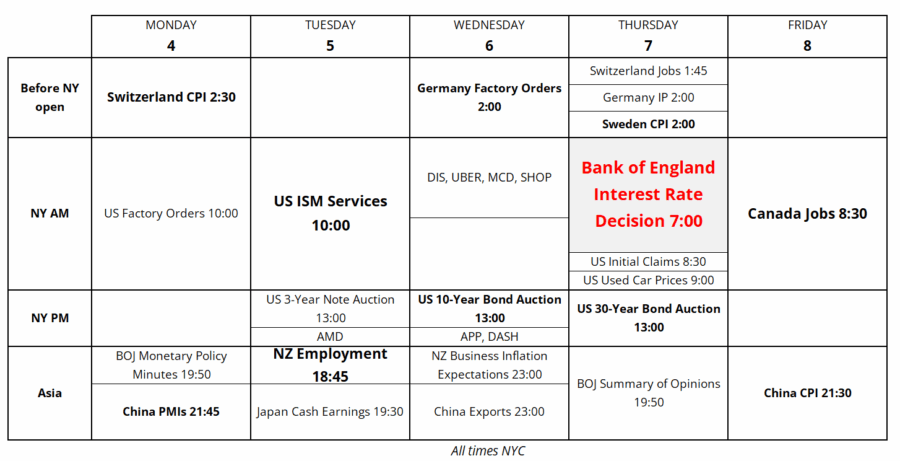

Trading Calendar for the Week of August 4, 2025