Even as stocks rebound, the USD does not

It’s all gone k-shaped

As MAG7 eats the world, the real economy becomes a rounding error

Even as stocks rebound, the USD does not

Age of Popes during their papacy, 1404 to now

Larger graphic at bottom of page

Flat

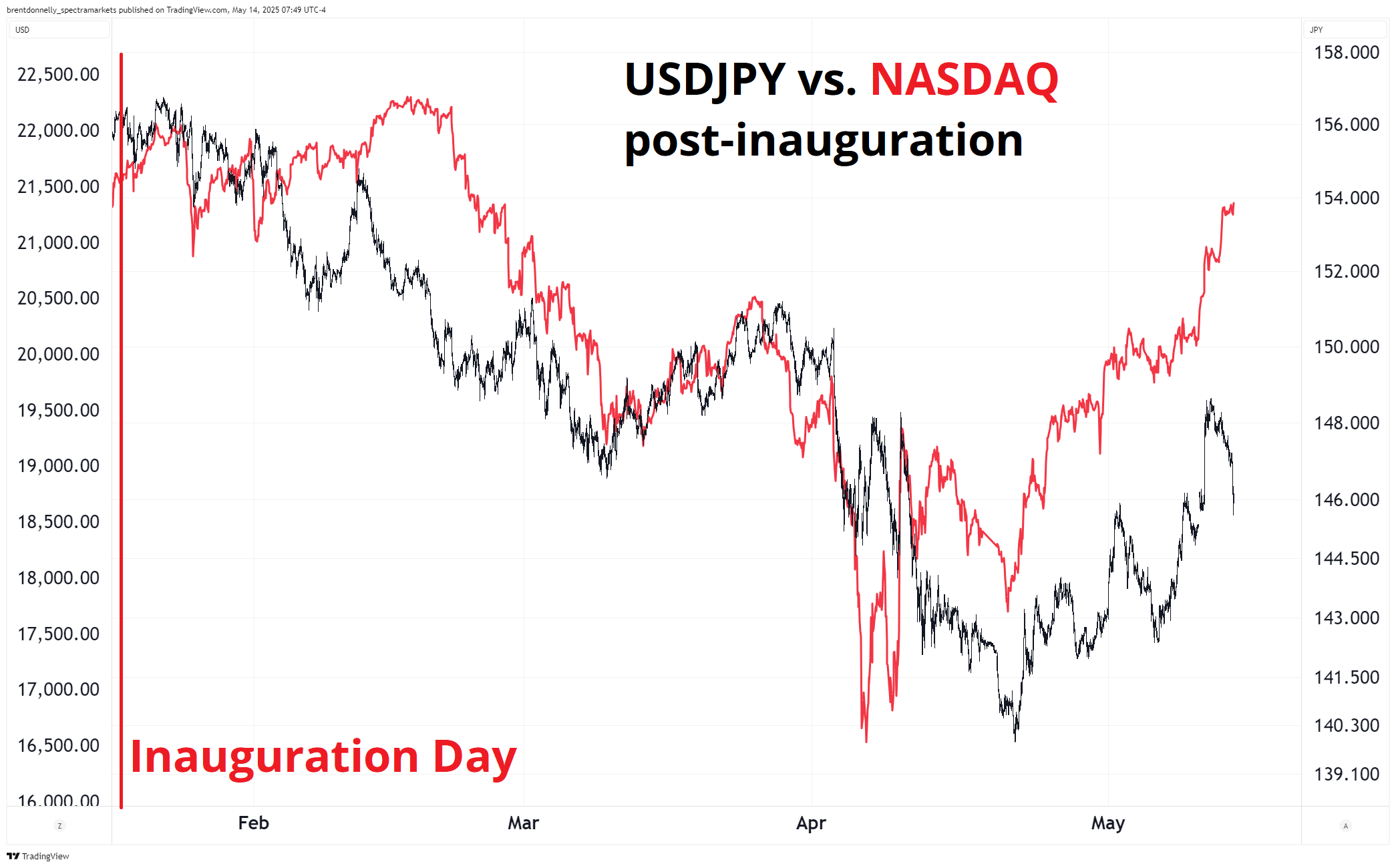

The slowly developing story appears to be the decoupling of the USD from US equity prices. While NASDAQ futures are back to late-February levels (21350), USDJPY is trading 146.25 now vs. 154.50 then. See here:

Overnight we saw a further expansion of decoupling as unnamed sources said South Korea talked FX with the US. There is plenty of FX smoke coming from Asia with the USDTWD move and now this Korea story. From Bloomberg:

The won gained the most against the dollar after the person said South Korea’s deputy finance minister Choi Ji-young and Robert Kaproth, the US Treasury’s assistant secretary for international finance, had talked about currency policies at a May 5 meeting in Milan and will continue to do so. The person asked not to be named as they weren’t authorized to speak publicly. The won jumped more than 1% and neighboring currencies, including the Japanese yen, also rose as investors took news of the talks as further reason to suspect the Trump administration wants the dollar to decline and that foreign governments may accept strength in their exchange rates to smooth the way to trade deals with the US.

The article is a bit clickbaity and sourceless, but it caters nicely to the suspicion that there will be overt or at least tacit agreement between the US and trading partners that a weakening of the USD is A-OK.

With the big washout of USD shorts apparently complete for now, positioning is light, USD bears are confused and underinvested, and a few USD bulls that dipped their toes in the water are finding the water frigid. Our franchise has flipped from USD shorts only! across all clients to a bit more of a mix with some EUR put buying yesterday and unwinds of topside EUR. It’s a tricky regime as the USD isn’t trading off equities or interest rate differentials and is instead getting tossed around by position unwinds and vague, unsourced news out of Asia.

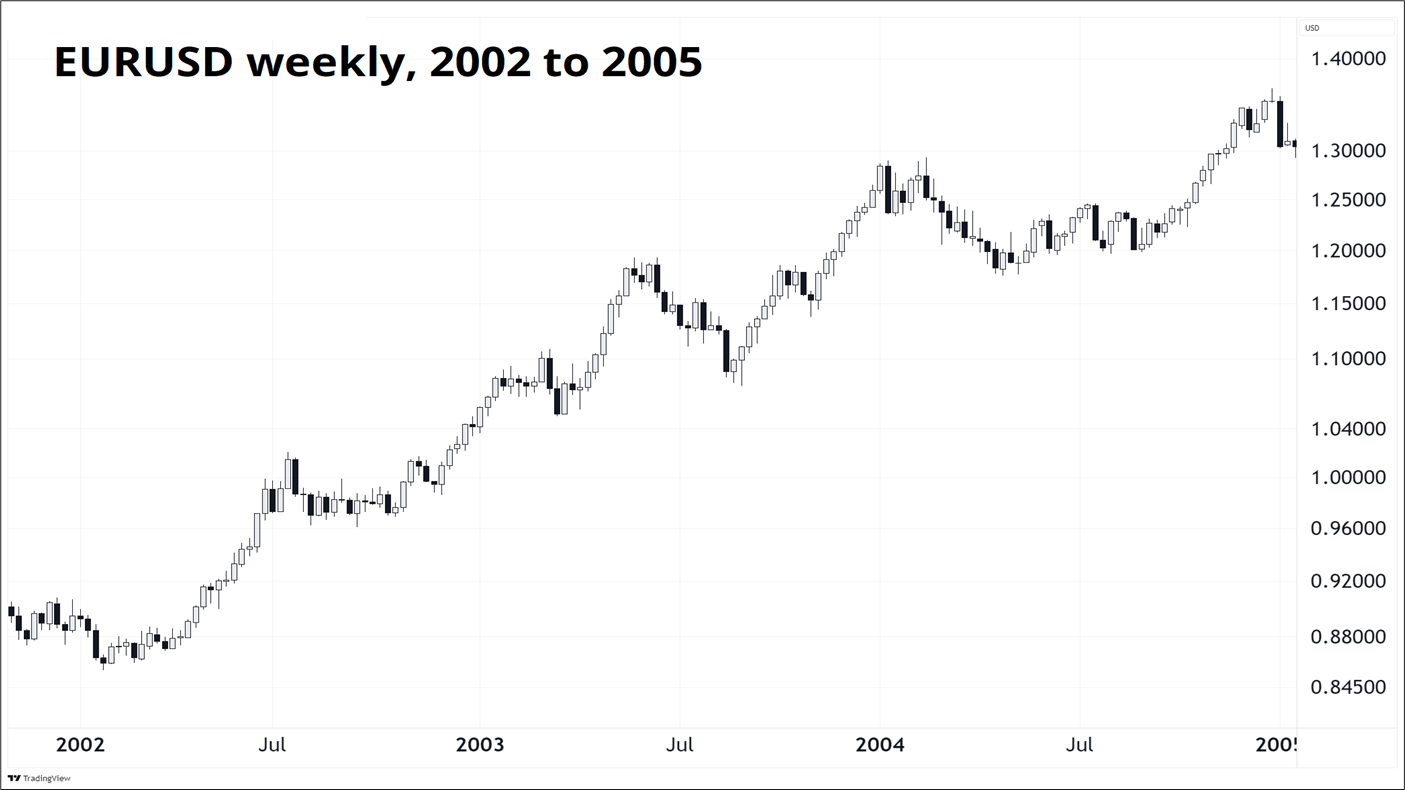

This reminds me a bit of 2002-2004 where the big theme was US Twin Deficits and USD outflows and reserve diversification post-dotcom bubble. We are not seeing US equity outflows right now, obviously, but the similarity is that in those days, nothing really seemed to matter that much other than intermittent but relentless USD-selling, and that selling was not particularly sensitive to changes in the macroeconomic outlook. The flows were rhythmic and continual, not news or macro driven.

Rick was a prop trader and all around super nice guy where I worked in the early 2000s and he was literally long EURUSD for three full years, without a break, from 2002 to 2005. It seemed funny to us because we were whippersnappers getting busy overtrading, and he never changed his view or his position. But he was right!

I was the spot EURUSD trader in those years and every morning, China, Brazil and a few other central banks would come in and buy EUR and sell dollars and they didn’t care what gold or interest rates or NASDAQ futures were doing. They were just methodically reducing USD exposure because the USD was overvalued, the US was running mad deficits, and the US tech boom had reached its zenith.

With markets chopping around and the two 90-day pauses not expiring until July 8 (Liberation Day tariff pause expires, maybe) and August 12 (China tariff pause expires, maybe) the market is starting to dabble in carry trades. These ideas make sense to me because it’s hard to imagine what will meaningfully shake up markets in the short term. The tariff headlines should be less frequent during the pause windows, and economic data remains pretty much meaningless as it’s too easy to just say anything that comes out is backward looking. CPI weak, bonds down yesterday, for example. In an environment where beta to news is low and there is no clear narrative, long carry makes sense.

Our carry trade screener looks similar whether you look at 3-, 6-, or 12-month carry to vol ratios. Here are the top picks based on a simple division of carry/vol.

Interesting to see GBPCHF and USDCHF in there—these carry/vol screeners tend to be dominated by EM. It’s expensive to be short USDCHF! CHFMXN looks sensible as MXN has been bulletproof these days—scary newsflow hasn’t mattered.

Have a holy day.

https://www.reddit.com/r/dataisbeautiful/comments/1kjg4mf/oc_is_the_pope_getting_younger/

Age of Popes during their papacy, 1404 to now

Related (ish):

https://fivethirtyeight.com/features/why-the-oldest-person-in-the-world-keeps-dying/

As MAG7 eats the world, the real economy becomes a rounding error

Good explanations for EURUSD movement are currently hard to come by