USDJPY is on the edge of a precipice but needs a macro push from the data

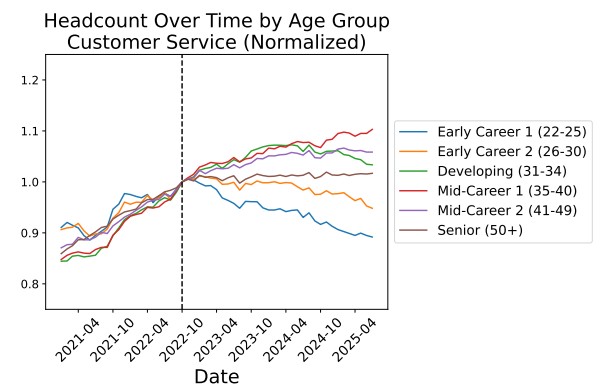

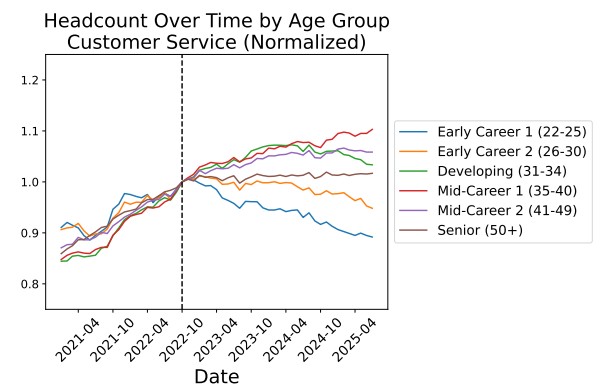

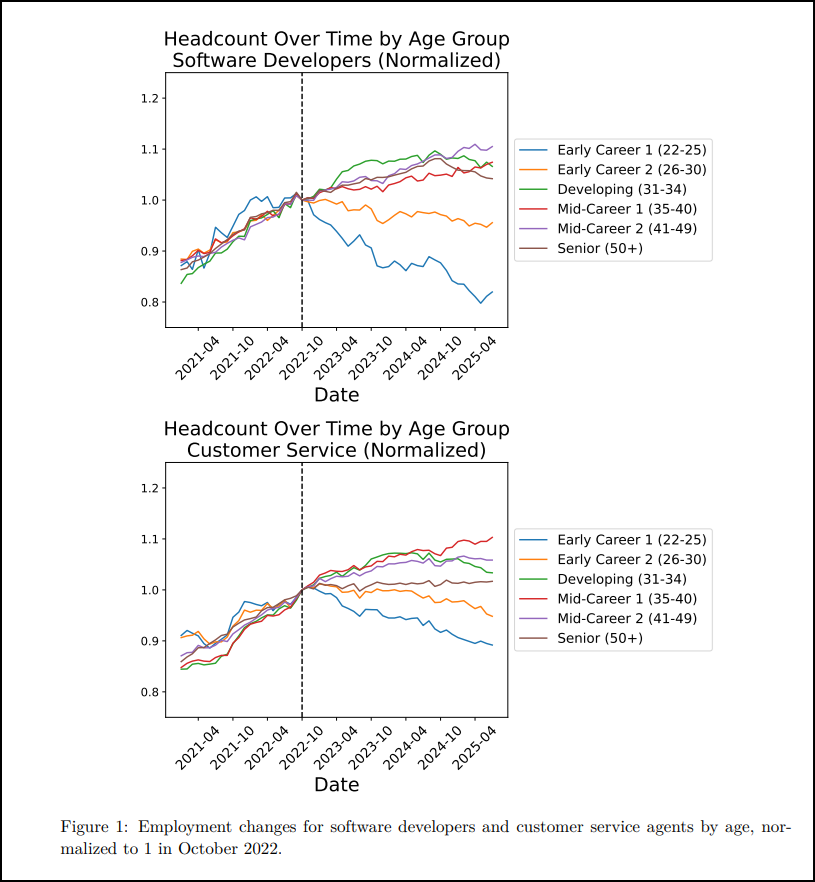

Young people employed in service and software jobs are most easily replaced by AI, according to this (interesting, if not surprising) paper

Via Neb Tnuh

USDJPY is on the edge of a precipice but needs a macro push from the data

Young people employed in service and software jobs are most easily replaced by AI, according to this (interesting, if not surprising) paper

Via Neb Tnuh

Long EURGBP @ 0.8674

Stop loss 0.8589

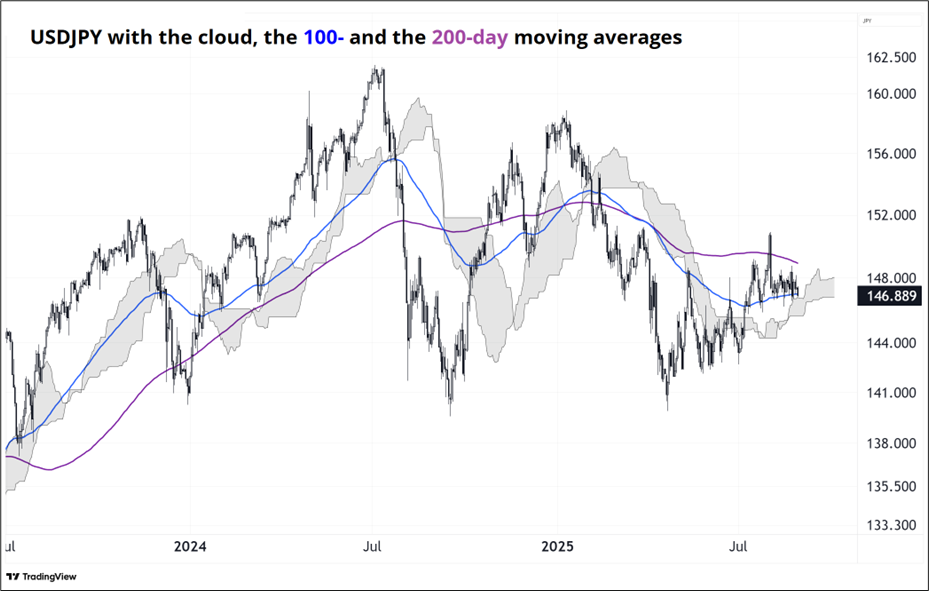

The big flow in USDJPY yesterday hit a brick wall into 148.00/148.20 and so that becomes an interesting level to watch now. US Inflation swaps are creeping higher and Japanese nominal rates are making new all-time highs and USDJPY is bouncing around in a range. You can see in the first chart today that yields and USDJPY have been diverging since Liberation Day as the market priced lower USD and higher yields in April and has spent the past four months going the other way.

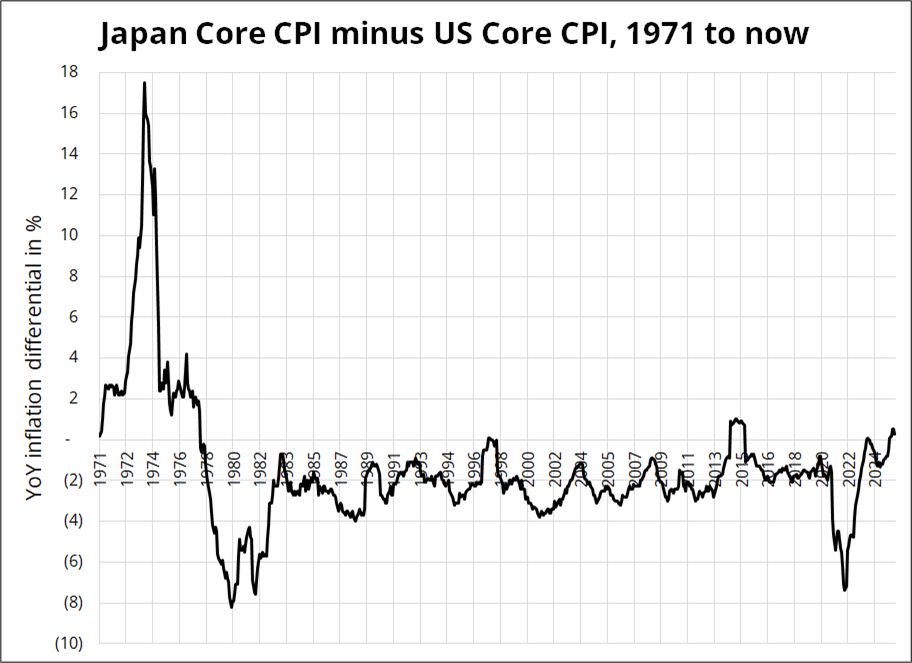

A striking feature of the world today that is a complete regime shift from the past is how Japanese core inflation is now above US core inflation. This hasn’t been a reality since the 1970s (with the exception of a temporary blip caused by the Japanese consumption tax hike in 2014). If you’re wondering about that spike in the 1970s, core inflation in Japan was 20%/24%% while US inflation was around 5%/10%.

Unfortunately, none of this is necessarily short-term bearish USDJPY for now because the data in the first two weeks of September will decide its fate, not the current setup.

There are signs, however, suggesting USDJPY could be much lower soon.

I would say all signs point to lower USDJPY, other than the performance of US equities and the US economy… And the fact it hasn’t broken yet! From a tactical point of view, there isn’t really any reason to be selling it here, right on support, but if you are a bigger picture macro person who believes in some combination of fiscal dominance and a US labor market slowdown, it could be very expensive to wait for a clear breakdown.

As such, I think 2-month and 3-month downside structures offer good risk/reward as we enter Fall, or simply buy 2-week puts if you think NFP will be weak. For now, I am flat, but I wanted to point out the bigger picture setup as the macro is slowly aligning with the technicals to suggest we finally get a big break lower in USDJPY. I don’t put 2- and 3-month trades in the sidebar here because they reduce intellectual flexibility too much and generally that’s not my time frame, but if I was a PM at a hedge fund with a soft US worldview, I would consider some 2-month 142.50 digitals for around 25% because if NFP is weak, it’s going to be way too late to sell spot—and vols will be substantially higher as spot/vol correlation should pick up to the downside.

Right now, 2-month vol is low and skew is minimal and if USDJPY dumps to 144 on payrolls next week, neither will be true. I suppose it’s the old: Hedge when you can, not when you have to, but it’s “buy USDJPY puts when they’re reasonably priced, not when they’re bid like a T-Swift engagement ring.”

Part of the reason I hesitate on short USDJPY (other than the fact that it’s at the bottom of the range) is that I am not as convinced that the US data is rolling over. Inflation, in fact, is more likely to pick up, and I am not bearish on the labor market because I think that the low breakeven rate for NFP is creating this impression that the labor market is weak whereas I see it as in balance as both supply and demand for labor fall in synch.

Inflation swaps, much like inflation itself in the US, are basing and moving higher as the bottom of the range now is the old top of the range pre-COVID. A chart of core inflation looks similar to this chart of 5-year inflation swaps, though obviously CPI is more volatile. This chart does not look like something I would want to be short as services inflation is not under control and the Fed is about to turn dovish by government decree despite many reasons not to do so.

I realize the first part of am/FX today sounds kind of bearish USDJPY and the second part is bearish US bonds. That’s why I am not doing the USDJPY trade right now. To be medium-term bearish USDJPY, you need to believe that the US economy is rolling over, and I don’t believe that.

The neutering of the Fed seems like a given at this point, which is inflationary but also bearish USD at the margin, and so you can also have the view that USDJPY goes down and yields go up—the bond vigilante trade. That is another way to express what’s going on here: Short USDJPY and short TY in a ratio of 50 million USDJPY per 600 TY (approx.) Using data from 2022 to now, 50 million USDJPY and 600 TY have similar P&L volatility in terms of average, median, and standard deviation. This is a simple vol-equivalence methodology, but one that I have found to be approximately good enough over the years.

Brazil: Tarcisio’s odds are creeping higher. He was 35/37 ish a few weeks ago, now 38/42. Here are the onshore odds via Yuval Polushko.

*ELEIÇÕES 2026*

TARCISIO 38/42

LULA 26,5/30,5

RATINHO 5/8

FLAVIO 2/5

BOLSO 1,5/4

MICHELLE 2/5

HADDAD 3,5/6,5

ALCKMIN 2/5

Lula was supposed to get a boost, Carney-style, from Trump’s Bolsonaro-related bullying, but the bump was short-lived. The seasonal August runup in FX volatility and USDBRL never happened, and Brazil continues to shine bright.

Like a diamond.

Have a brilliant day.

Interesting paper here

https://digitaleconomy.stanford.edu/wp-content/uploads/2025/08/Canaries_BrynjolfssonChandarChen.pdf

Thanks Ben!