Momo FOMO losing mojo

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Momo FOMO losing mojo

Hello. It’s Friday. Thanks for signing up. I’m Brent Donnelly.

The About Page for Friday Speedrun is here.

Here’s what you need to know about markets and macro this week

Hello! I am back. I generally pride myself on working hard, even when I don’t feel like it, and so I apologize for the Friday Speedrun hiatus. I have been travelling and/or dealing with personal stuff for the last five Fridays in a row(!!) Now I am back. Thanks for your patience.

Here’s this week’s podcast with Alf.

There is a lot going on in the world of macro, and much of it is barely coherent. Let’s go through some of the major points.

First up, the USA is in a data blackout, and therefore there hasn’t been much economic news. The shutdown is creating some uncertainty, but not a lot of real world damage yet as a few thousand jobs look set to be cut, and a few hundred thousand people are waiting for a paycheck. My default stance on these shutdowns is that they are irrelevant, but that might not be the case here as the political climate is unlike anything we’ve seen in our lifetimes.

Second, there has been a series of crazy momentum trades driving various markets substantially higher, and while people want to bucket it all under one heading and call it “debasement”, that’s not really what it is. It’s more like momentum with narratives backfit ex-post. Gold was rallying because of low real rates, the on central bank buying out of Asia, then on Fed policy turning Turkish, and now on safe haven demand due to credit fears. It just goes up these days, and since the break of 3440, it’s been an absurdly high-Sharpe trade as volatility has not exploded in tandem with price.

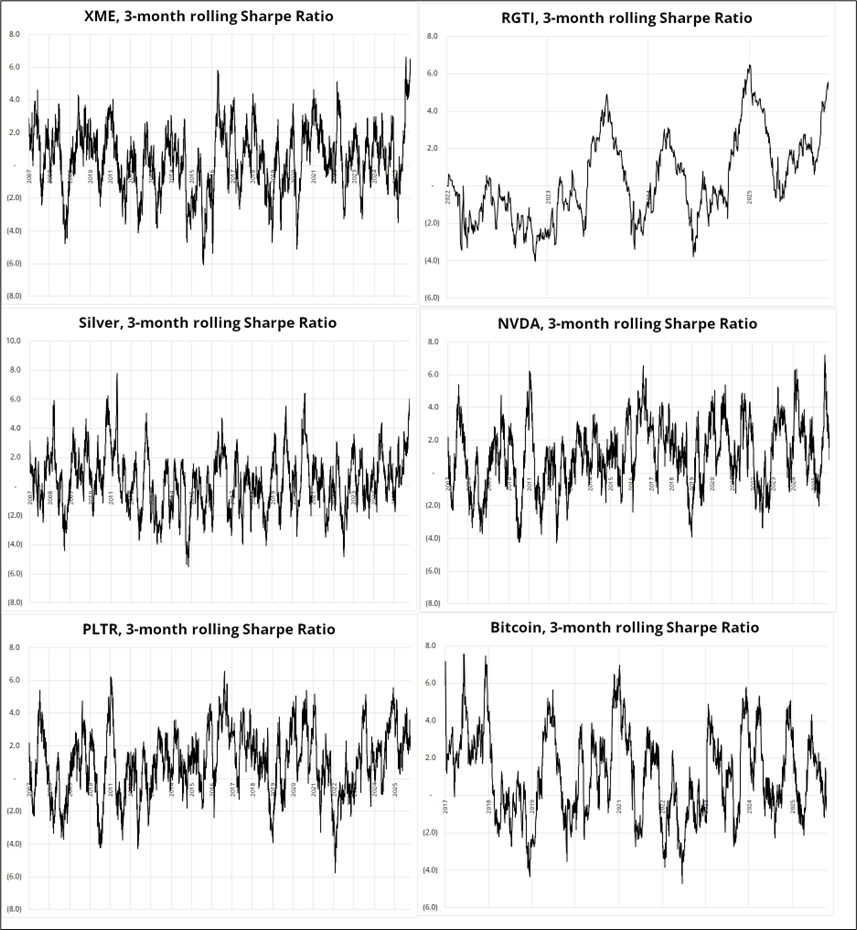

Check out these Sharpe ratios:

Gold and silver and XME and RGTI (and other stuff, but not crypto, NVDA, or PLTR) are trading like we are in some kind of fiat currency crisis or massive positive liquidity shock akin to 2008/2009 or 2020—but without the vol. Silver and XME are realizing less than 30 vols over the last 90 days, and gold is realizing sub-15% as all three fly to Ganymede.

And check out Goldman’s “most short basket”.

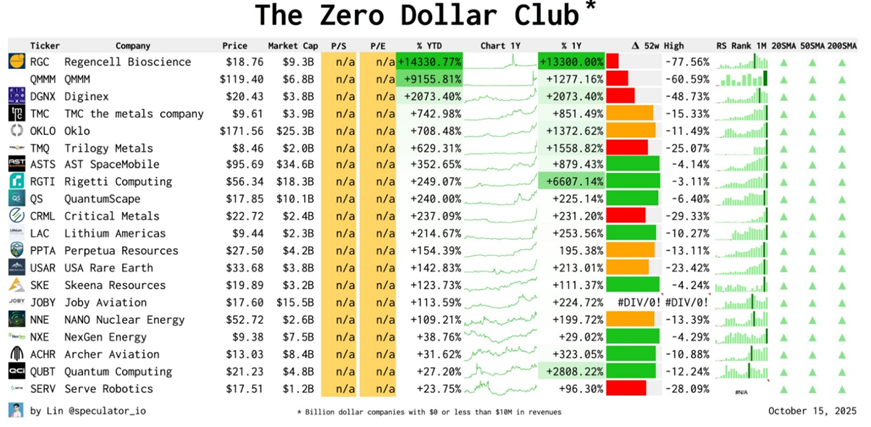

You may have noticed in the six-panel Sharpe Ratio chart that NVDA, PLTR, and bitcoin are delivering flat returns over the past few months, while Sh*tcos like RGTI have exploded higher. There has been a handoff from the AI Capex behemoths to the most-shorted, least profitable, zero revenue names.

Professor Mike Green shared this lovely table with the class:

If you have not seen the clip from Silicon Valley, here you go. It’s a classic:

https://www.youtube.com/watch?v=BzAdXyPYKQo

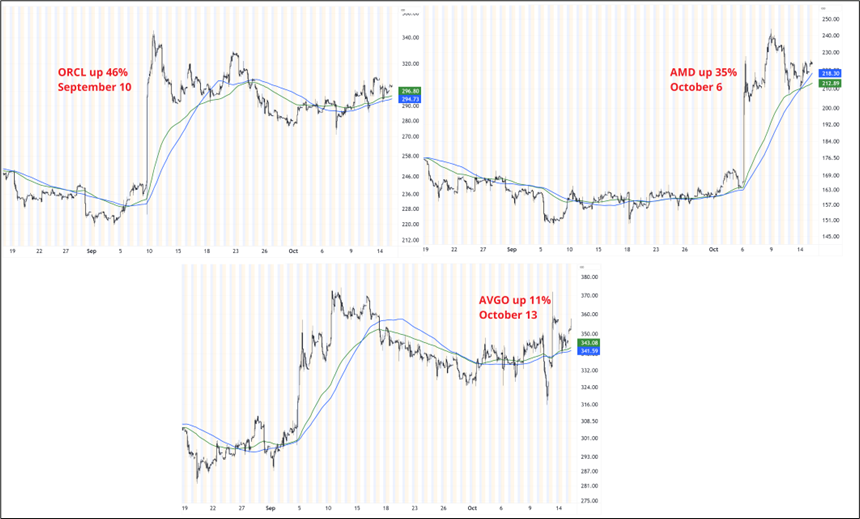

It’s funny because it’s true. Meanwhile, there is a healthy level of skepticism around the OpenAI deals and “I signed an MOU with OpenAI” has become the 2025 equivalent of 1999’s: “I added .com to my company name.” The market has hit diminishing returns on this narrative as you can see in these three charts that show price action after the three MOUs.

The first time you tell a good joke, it’s hilarious. The second time, it’s chuckle-worthy. The third time, it falls flat. I have no edge on predicting whether or not OpenAI will ever make enough money to pay for all its pledges, but it’s notable that NVDA has stopped rallying and the OpenAI headlines are getting less and less juice.

Oh, I forgot this one. Not the Onion. It’s a real headline.

Meanwhile, in the real world, an idiosyncratic fraud here (Tricolor) and another one there (First Brands), and all the sudden Jamie Dimon is forecasting cockroach season. And yesterday ZION reported a write-down on another unrelated (alleged) fraud by California Bank & Trust.

There is a possibility that rising rates didn’t matter until companies operating on the razor’s edge finally need to refinance or are found out to be frauds, and we are at the point where the tide is going out and we are seeing some naked swimmers.

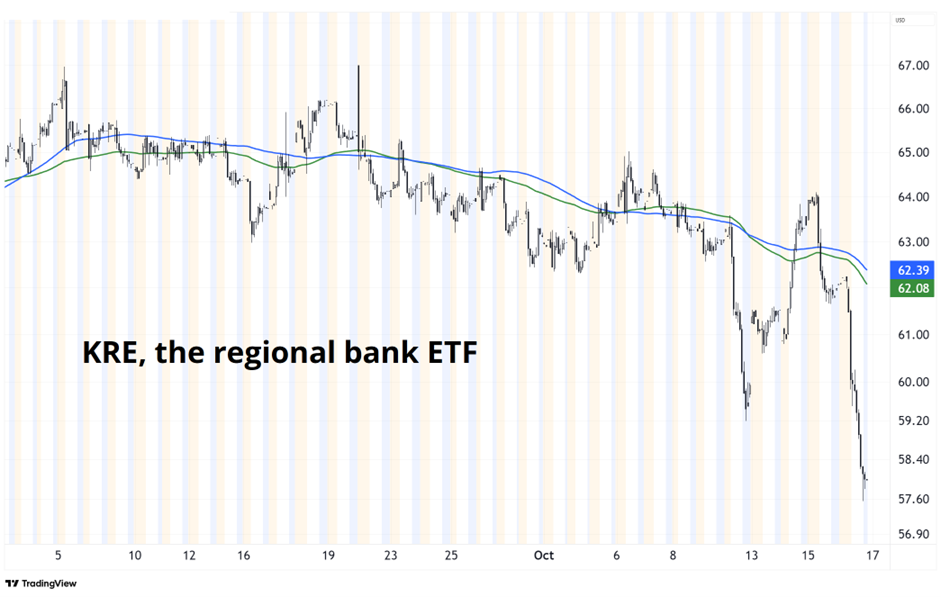

In response, KRE (the regional bank ETF, where most credit skeletons are thought to hide) did this:

The move in KRE happened to be the same day that SOFR ripped 10bps as the deadline for California tax payments was Wednesday. Because of the California wildfires (starting January 7, 2025) and a federal disaster declaration, the IRS granted relief to affected taxpayers in parts of California (notably Los Angeles County). Deadlines for federal tax filings and payments that would otherwise fall between January 7 and October 15, 2025, were postponed until October 15, 2025.

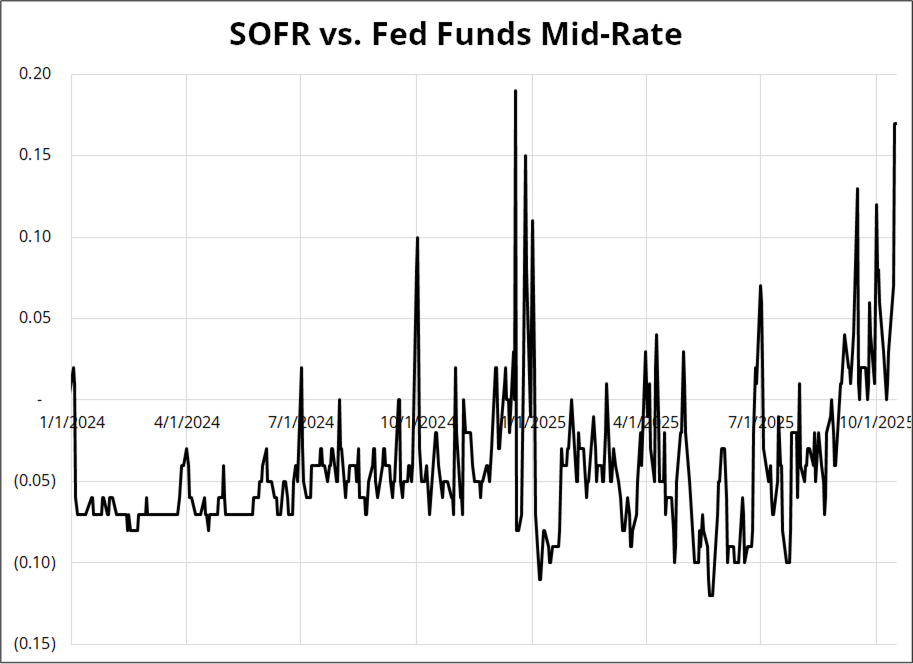

You can see in the next chart that the rise in SOFR is comparable to year-end funding stress at the turn of 2024/2025. Probably nothing to be concerned about, but worth watching over the next few days, especially after the wipeout of crypto leverage over the weekend. Perhaps the altcoin flash crashes are symptomatic of leverage in other trending asset classes.

Click on the ad to subscribe. If you’re not happy, just email me and I’ll refund you. Risk free. Unlimited upside.

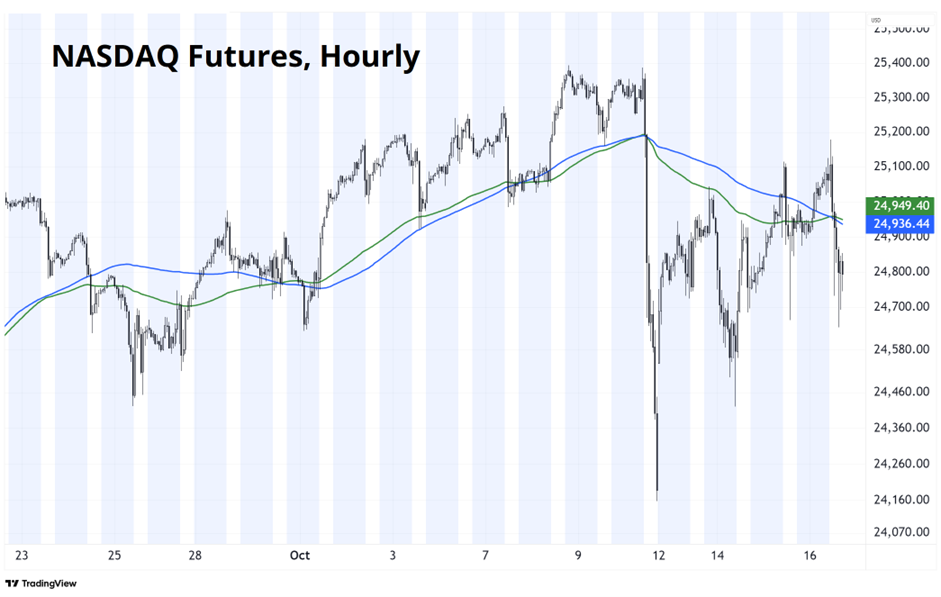

Stocks were at the all-time highs before the latest “Imma 100% tariff you” comments from Trump last week, but when the TACOs were served over the weekend, the NASDAQ punched back up towards 25,000. Now, we are buckling again, under the pressure of some severe MOMO reversals, inability of the big guns to rally (NVDA, PLTR, etc.) and weakness in crypto.

It all looks a tad precarious.

To me, the poster child for the pure momentum trade is RGTI, a company with the following metrics:

15.5B USD market cap

8.2 million USD 2025 sales

Price to sales ratio of 1890 (one thousand eight-hundred and ninety).

Maybe because of the amazing revenue growth rate?

RGTI Revenues:

2022 2023 2024 2025

13.1m 12.0m 10.8m 8.1m

Okie dokie.

I get it. Quantum computing is dope. The point is simply that pure momentum trades work in both directions. RGTI was off 15% yesterday on no news and looks tired, finally.

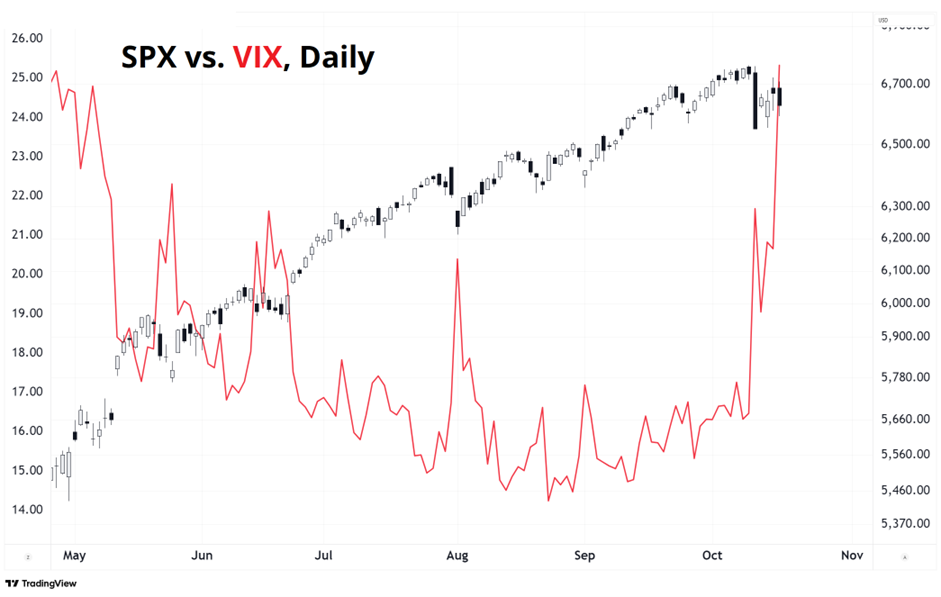

An intriguing feature of the stock market right now is the very high level of VIX relative to stocks’ proximity to the all-time highs. Wednesday’s rally did not lead to a drop in volatility and so you have this:

Higher vol tends to lead to degrossing by systematic funds and (if it’s persistent) can make it harder for stocks to recapture the ATH.

Here is this week’s 14-word stock market summary:

Credit cockcroaches skitter. Not much US data. NVDA and PLTR have now stalled.

Yields have been tumbling as the market fears labor market weakness, cheers Fed rate cuts, and worries about credit standards at regional banks. If they are giving out credit to $12B fraudsters, they might also be handing out cheques to other questionable counterparties. Whether or not there are more cockroaches, this sort of environment can lead to tightening credit standards, restricted lending, and a slower economy. Thus, falling yields.

It’s a bit reminiscent of the Silvergate Crisis of 2023, but different. That flare up led to some major panic on Twitter and in interest rate futures but ended up ricocheting off the antifragile US economy. Now that we are later in the cycle and the jobs market is less robust and immigration is being cracked down, it’s possible the economy can’t handle the credit wobble quite as easily.

Bond yields down and SOFR up is definitely not the dream scenario for economic bulls. The chart of US 10-year yields remains a big, rangebound mess as we have been 3.60%/5.00% for years now.

They are going to do the CPI next week, which should be exciting as we haven’t had much data to chew on.

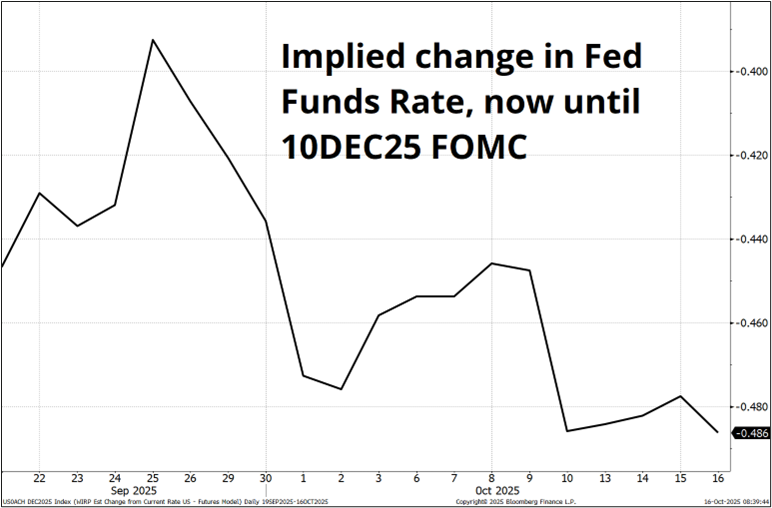

With two full cuts now priced for the Fed (48bps implied, see chart) and questions remaining about whether or not inflation is picking up, CPI should matter. With the regional bank wobbles, you cannot rule out the possibility that the market could start pushing for 50bps instead of 25.

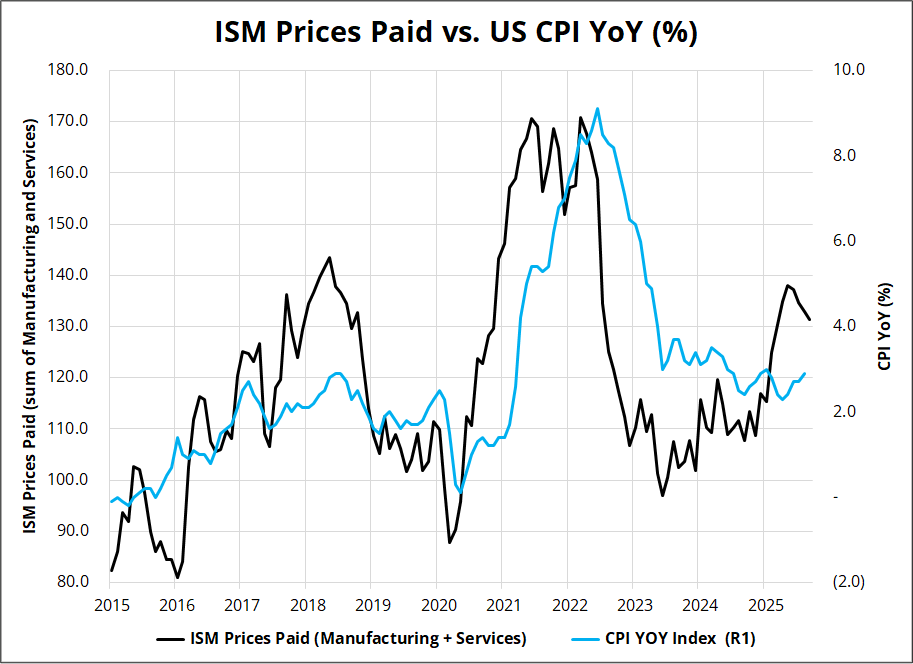

ISM Prices Paid jumped earlier this year, and that tends to foreshadow rises in CPI (see next chart). That said, Prices Paid has come off a bit in recent months, so the signal is a tad ambiguous. Overall, my guess is that there is a higher chance of a high print on CPI next week, not low.

For a longer piece about currencies, check out my notes from Singapore. I was there visiting clients the first week of October.

https://www.spectramarkets.com/amfx/notes-from-singapore/

My only real view in FX in the past few weeks has been bearish CAD (via long USDCAD and/or EURCAD) and those pairs have performed well. The market is getting the idea that the Canadian housing and consumer debt situation (like the story in New Zealand) is not great.

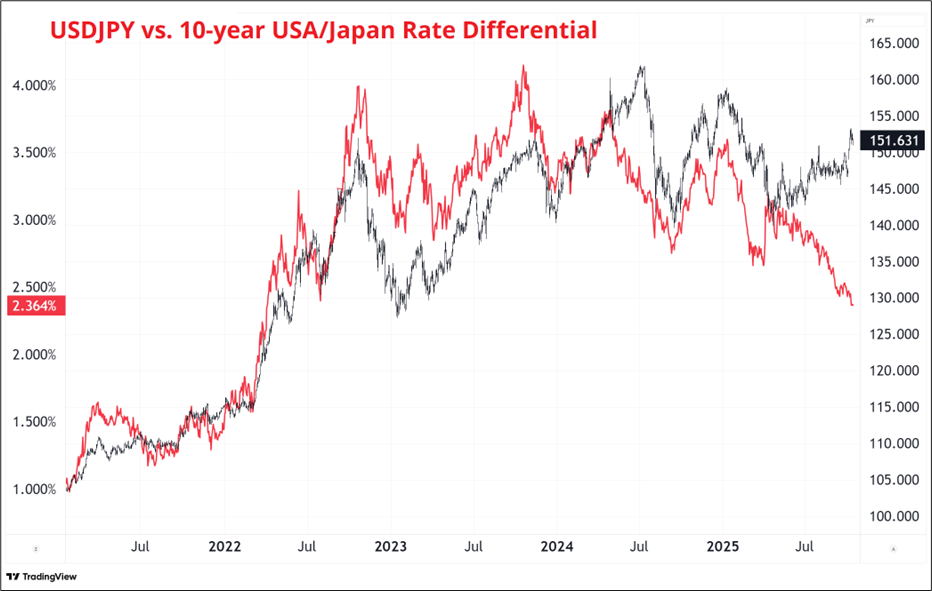

FX has taken a back seat of late as the market slowly unwinds or burns off USD shorts but remains unwilling to commit to USD longs. Price action in USDJPY has been zippy post-Takaichi, but most specs continue to have this next chart burnt into their mind’s eye and thus refuse to commit to buying USDJPY. Most divergences like this do close via a sharp move lower in USDJPY, but these jaws have been widening for so long that it feels futile to play for the recoupling.

The market is still unabashedly bearish USD, but the catalysts have been lacking and the action has been in pairs like AUDNZD and EURCAD, not the DXY.

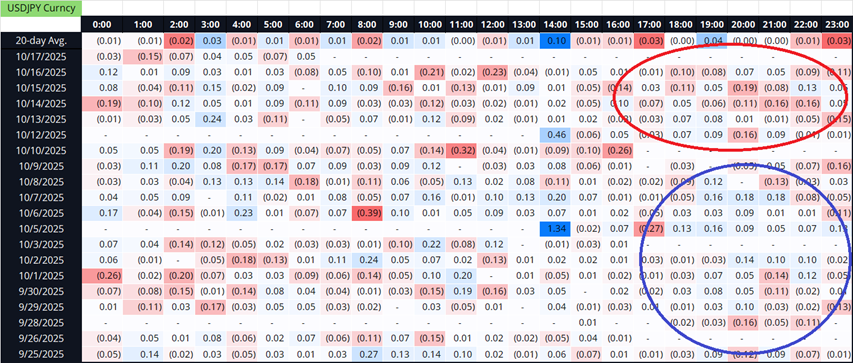

One interesting note: Japan has been buying yen every day since Takaichi won. That’s a reversal of action in recent months as the Asian time zone has mostly been a net buyer of USDJPY until this week. Here’s the hourly heatmap (note how the buying (blue) turned to selling (red)).

I make a lot of bad forecasts and therefore I don’t like calling people out when they make bad calls. If you are taking real risk, you are going to be wrong a lot. That said, I do have a special place in my heart, for clickbait experts like Cathie Wood and Tom Lee simply because they are not serious people making real calls. They are attempting to manipulate people’s emotions with bananaland clickbait. Here’s how things have progressed in recent weeks.

September 30

October 9

October 14

October 16

I don’t know why I let stuff get under my skin. It’s just so transparently manipulative; it bugs me.

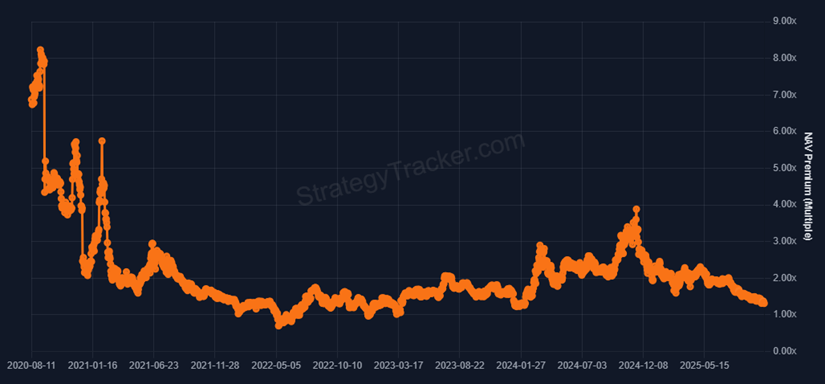

Crypto was the big story last weekend as the flashcrashes in altcoins destroyed quite a lot of paper wealth and left a bearish vibe in their wake. Even when the NASDAQ ripped back up to approach the previous highs, crypto remained waterlogged. In the fracas, Michael Saylor somehow managed to buy a bunch of corn above $123,000. He started amassing at $10,800 in 2020 and his average price is now $74,000. He is not risk averse.

The crypto DAT frenzy has cooled substantially and there have been some crazy wipeouts like Strive (ASST), who announced a buyout of Semler Scientific in an effort to gather more BTC. It seems the market didn’t like the huge premium offered.

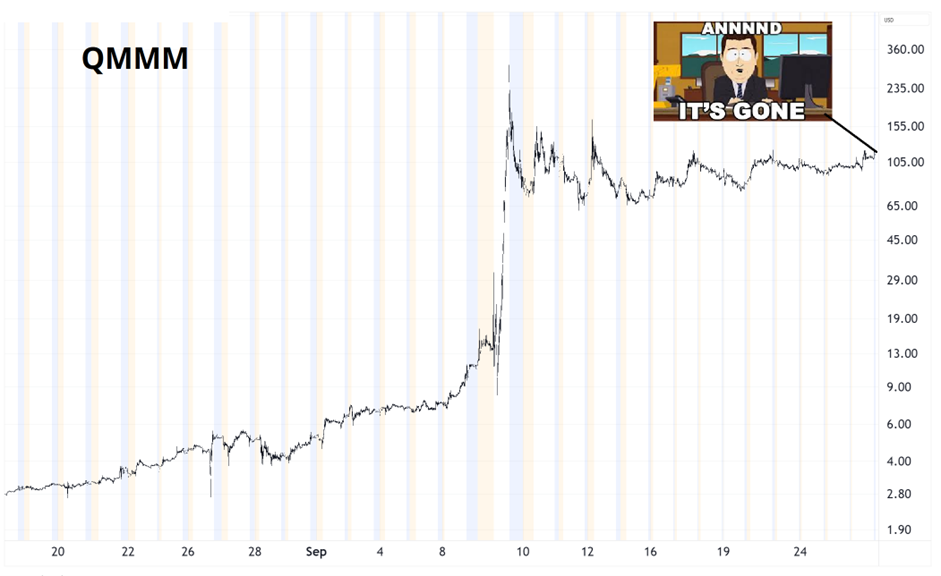

And QMMM managed to just kind of … Disappear?

MSTR is trading down towards its lowest premium since 2022. These things are all procyclical, just like GBTC was procyclical. People will buy at any price on the way up and sell at any price on the way down. And as volatility falls and the premiums evaporate, the non-price-sensitive demand for crypto goes away because there is no vol to harvest via the converts. Everything is procyclical, from AI investment right down to the crypto DATs. It will slowly become evident that if you want leveraged bitcoin, you can just … buy bitcoin using leverage. Same with ETH.

You don’t need the crypto DAT circus at all. Nobody does.

MSTR NAV Premium via SaylorTracker.com

MSTX, one of the worst financial products ever sold, is on its way to zero as fees and vol drag and other factors slowly erode value.

For a nice analysis on why you should never own any levered ETF for more than a day or two, check out this paper.

Gold. Silver. Platinum. They are going up. The break of 3440 was one of the most perfectest chart breakouts I can remember, ever, and here we are at $4337. Wild.

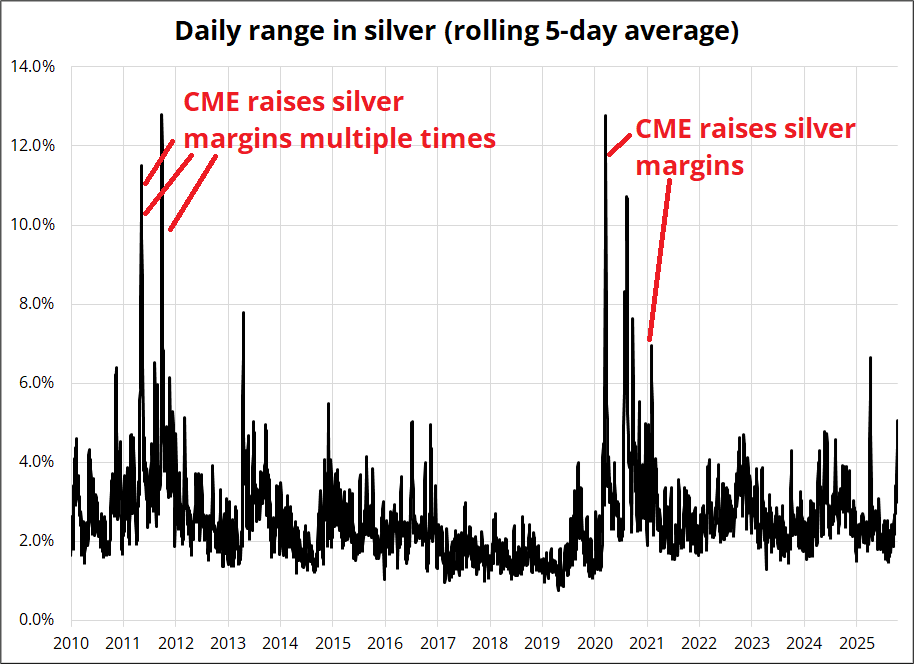

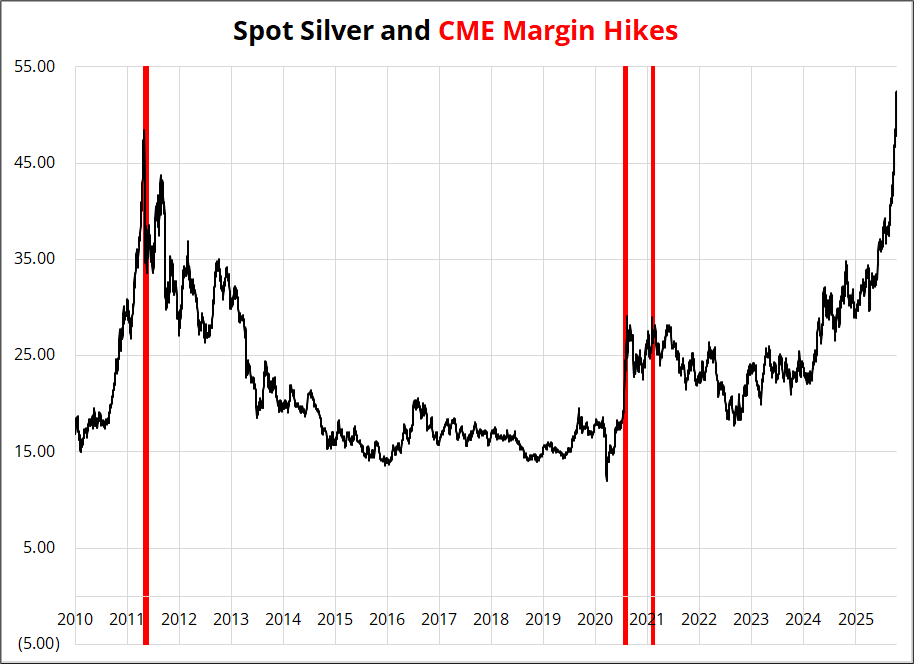

On silver, keep in mind that the CME raising margins was a huge contributor to the collapse in May 2011. CME margins are set based primarily on volatility, and while vol has picked up in recent days, it’s nowhere near levels where past margin hikes kicked in.

Here you can see how spot silver traded into and after the margin hikes.

For each contract (future or option), CME defines a set of risk scenarios (price moves + volatility moves) to simulate how the contract’s value would change. While the process is mostly systematic, they might see recent basis moves, vol jumps and physical shortages as problematic and thus forecast potentially higher vol in their stress scenarios.

I am not an expert on CME margins—this is just something to watch for because a hike in margins would probably scare the market, at least initially, given historical price action after margin hikes. It’s fair to say a good piece of this rally is speculative at this point as I don’t think economic or inflation fundamentals are as bad as 1980 or 2011, the prior silver peaks. Then again, maybe I’m wrong.

And weirdly, everybody’s bearish oil and all it does is go down. Good work, everyone!

That’s it for this week.

Get rich or have fun trying.

The latest trade by Magazine Cover Capital and the stunning YTD results. These are not cherry-picked after the fact. They are announced in real-time on Twitter and in am/FX.

*************

If you like Beck, Radiohead, and Bob Dylan, check out this album:

*************

The Cracker Barrel “outrage” was almost certainly driven by bots.

It never did make sense. Now it does.

*************

Remember: Social media isn’t real people.

*************

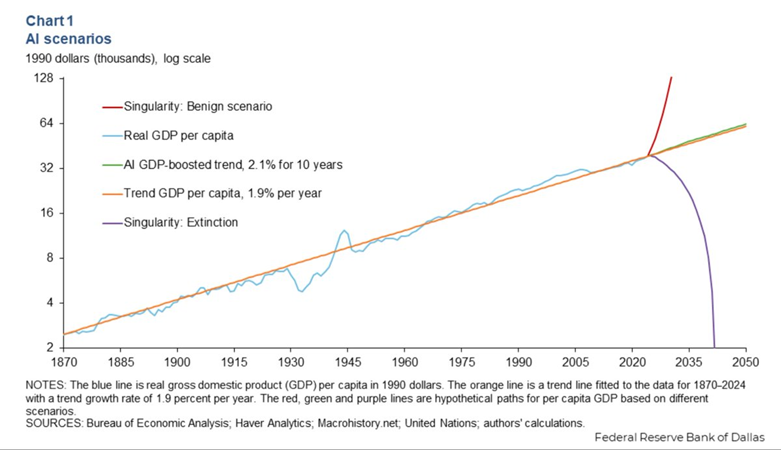

This enjoyably dark chart from the Dallas Fed was published June 2024, but I only saw it this week:

Thanks for reading the Friday Speedrun! Sign up for free to receive our global macro wrap-up every week.