The market fully understands the NASDAQ add/delete process.

“Horizons” is a steel sculpture in New Zealand that is meant to look like a windblown piece of paper. Neat.

The market fully understands the NASDAQ add/delete process.

“Horizons” is a steel sculpture in New Zealand that is meant to look like a windblown piece of paper. Neat.

Short AUDNZD @ 1.1100

Stop loss was 1.1361 now 1.1111

Close 31DEC

Long EURSEK @ 11.54

Stop loss 11.3390

Flip short Friday at 11 a.m.

James Seyffart of Bloomberg wrote an outstanding piece predicting MSTR will be added to the NASDAQ 100 this week. The announcement of the NASDAQ 100 add/delete plan comes out this Friday after the close, and the effective date will be December 23, which means the indexers need to complete their buying by the close on December 20. Check out the article here, there is so much detail—it’s an incredibly professional and expert writeup.

Index inclusion is an interesting, controlled experiment for the efficient markets hypothesis because everybody knows about the adds/deletes beforehand now, whereas in say, 2000, it was kind of niche knowledge. See this crazy trading story from the year 2000, for example, when you have 8 free minutes.

Anyway, the idea that stocks benefit from inclusion in indexes as passive buyers are forced to purchase yards of stock at any price doesn’t work anymore. It has been arbitraged away over the years as the market front runs the add/delete and then when it actually happens, market maker and speculative positioning is equal to or sometimes larger than the required buys from the indexers.

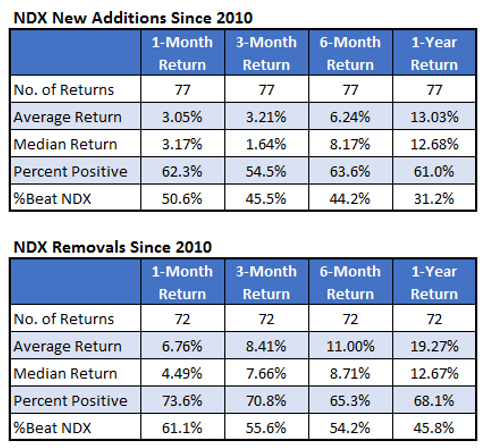

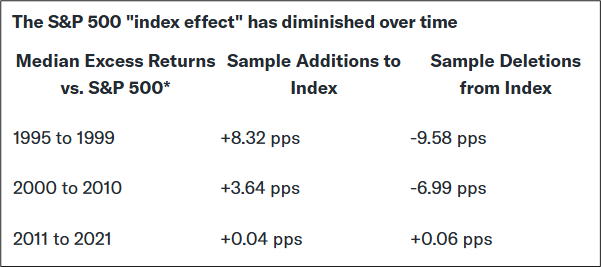

This excellent writeup (Removed NDX Stocks Likely to Outperform Those Added) features a table which is consistent with studies I have seen of S&P add/deletes.

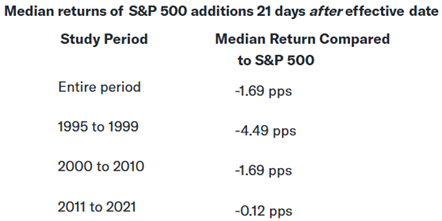

While that study covers the period from 2010 to now, another study done by S&P Global looked at the evolution of returns for S&P 500 additions and deletions over the decades. The output shows the returns during the period from the announcement date to the actual addition (around two weeks).

So the old pattern was that the stocks rallied into the addition. But that doesn’t happen anymore because analysts are pretty good at predicting which stocks are going to be added to various indexes (e.g., that article about MSTR I linked at the start). And everyone gets ahead of the flow. Anyone that gets long on the announcement knows that by the time addition day hits, the whole thing is priced in… So they get out early. On the flipside, there used to be a selloff after the additions, because the stock would get ramped on add day (e.g., my article about trading JDSU in the year 2000).

Again, the effect disappears over time. This is a classic example of high Sharpe trades slowly decaying towards a terminal Sharpe of zero. When there are French fries scattered in the Walmart parking lot, a few birds will notice them at first and those birds will fly down and get fat and be happy. Then, quickly, many other birds will swoop in to peck at the minimal salty remains until there is nothing left to peck at.

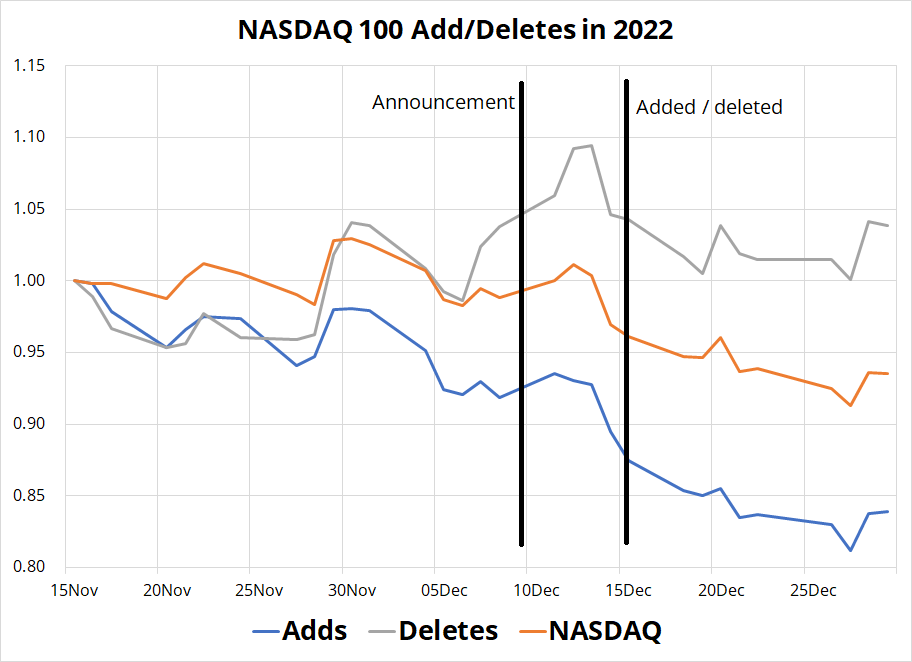

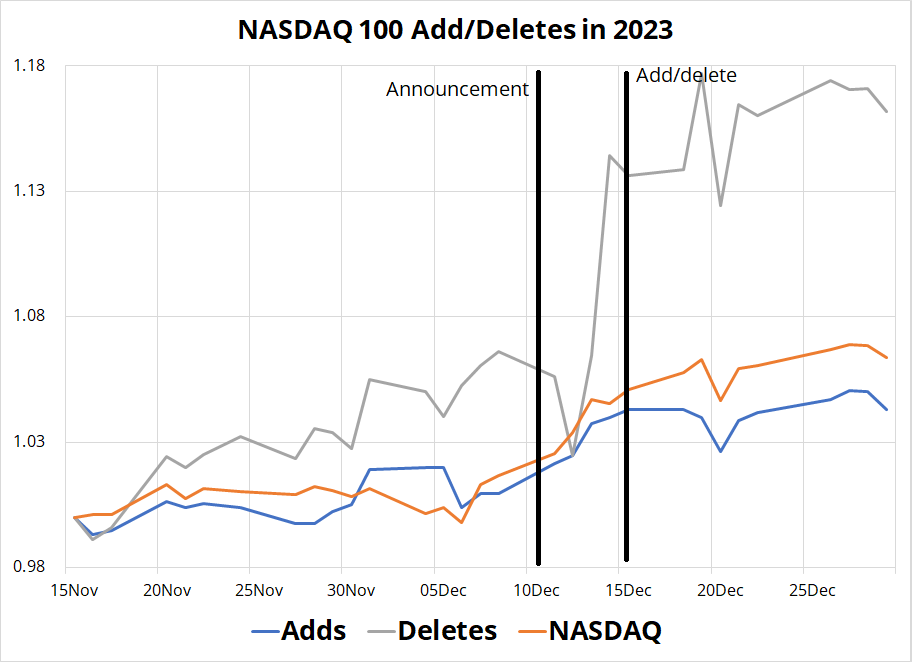

Out of curiosity, I looked at 2022 and 2023 to see what specifically happened each year. Here are the charts.

You can see in both charts that the adds showed negative performance vs. both the NASDAQ itself, and the deleted stocks, in one bear and one bull period. There was a little bump up around the announcement date both years, but not much else to chew on. Selling the adds to buy the deletes is the surprising winner both years.

Perhaps the most interesting scenario this year would be if MSTR does not get added to the NASDAQ because they rule it to be a financial stock not a technology stock (like Coinbase). This would be the correct ruling, in my view, as Saylor’s software business is an unprofitable, de minimis contributor to the stock and company performance. That said, I don’t think the ICB reads am/FX, so my opinion is probably not important.

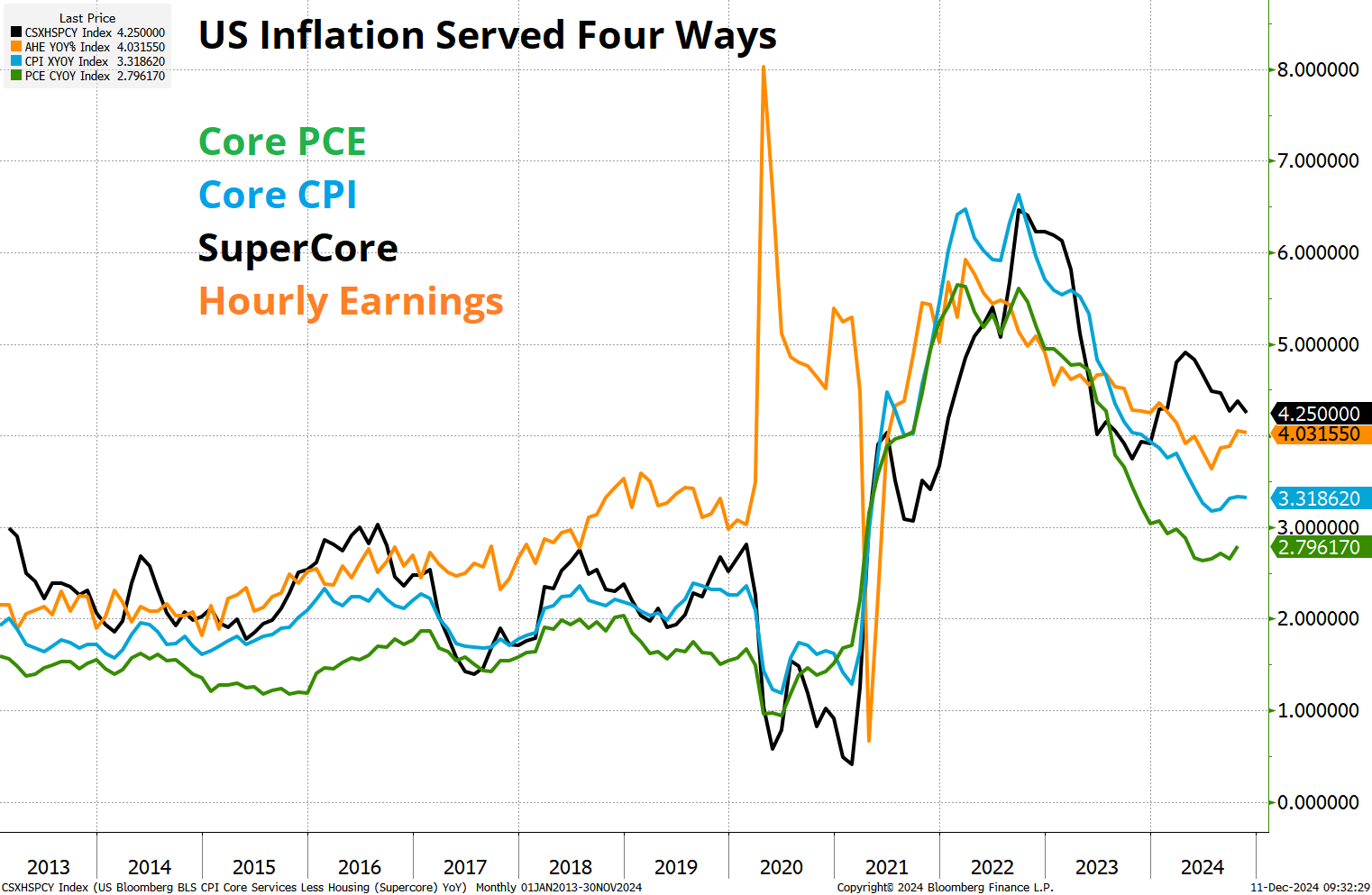

We got a boring result on inflation today and that leaves us with a Fed cut at December FOMC, probably followed by a prolonged pause. Headline, Core, Wages, Supercore, and inflation expectations all suggest that inflation has bottomed here—way above 2%. Core CPI is 3.3% and rising. Supercore and Average Hourly Earnings are above 4%. This is not mission accomplished, at all. This is pretty much the definition of sticky inflation.

There was an article on Bloomberg that triggered a nasty whipsaw in USDJPY as it offered up contradictory red headlines. The crux of the story is that the BOJ might hike in December, but they also might not. There is no new information in the story. The first line captures the ambiguity quite well:

Bank of Japan officials see little cost to waiting before raising interest rates while still being open to a hike next week depending on data and market developments, according to people familiar with the matter.

Unnamed sources saying that the Bank of Japan may or may not hike in either December or January is not news. Face palm emoji.

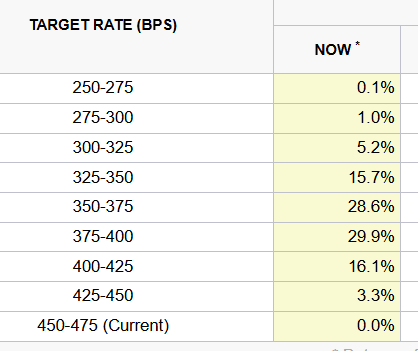

The CME FedWatch tool shows a 0% probability for the Fed to remain on hold for all of 2025 (see table). That seems low. Have a super day.