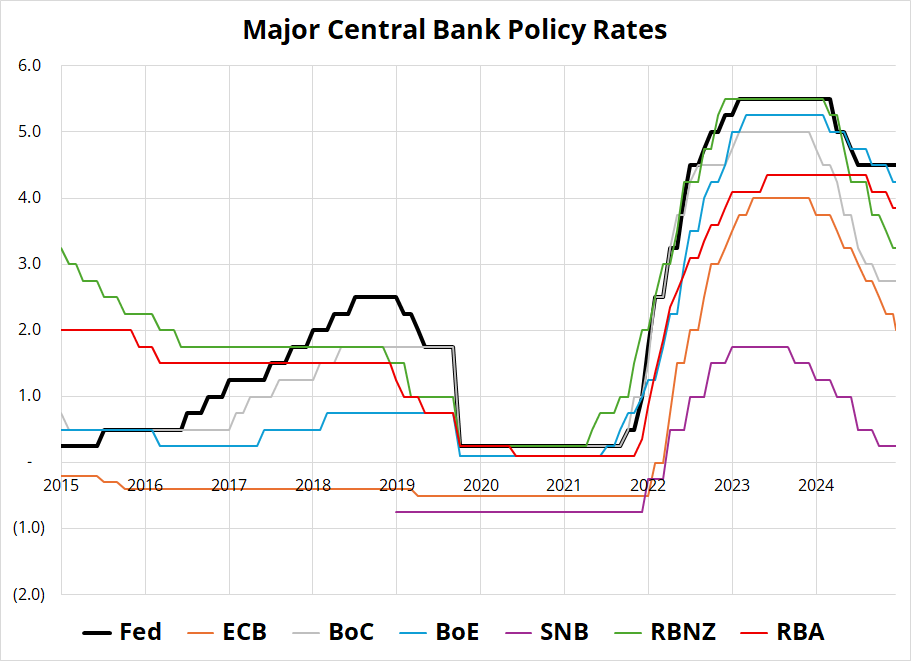

As global central banks cut, the Fed looks more and more like a laggard

What is going on here?

Larger image at bottom of page

As global central banks cut, the Fed looks more and more like a laggard

What is going on here?

Larger image at bottom of page

Flat

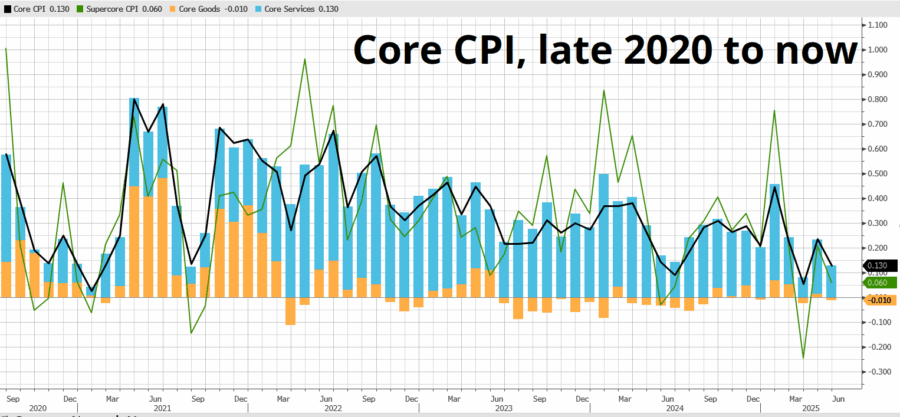

CPI came in low again, confirming evidence from State Street’s PriceStats, and it looks like tariff passthrough is minimal to zero for now. Prices of some things are going up a bit due to tariffs while prices of other things are going down due to softness in demand, cheap oil, and cooling services.

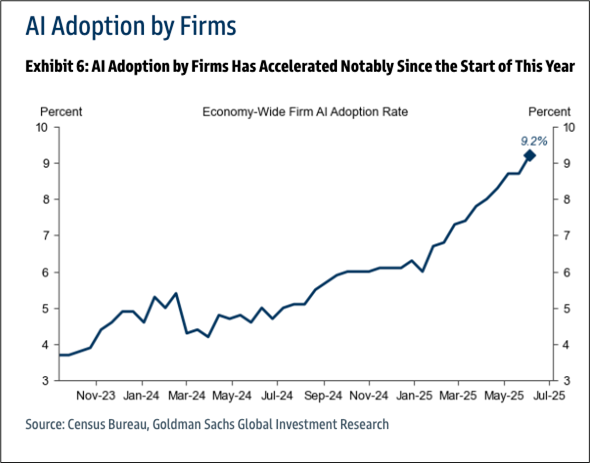

This is happy news for USD bears and carry bulls and now that we are through the bulk of the workhorse US data releases for the month of May, the bears will have to wait another month for the much-anticipated doom and gloom to appear in the real world. The impact of economic uncertainty and tariffs on real economic data has just not been big so far. The only place it’s showing up is in the sentiment data, and since equities are ripping and inflation remains low, I suppose the sentiment data might just catch back up. With the AI and quantum computing themes reborn of late, positive equity seasonality strongly in place until the end of July, and room for the market to price more aggressive Fed cuts, even from here… It’s going to be a long wait for the bears before we get the June data. And it might be fine too.

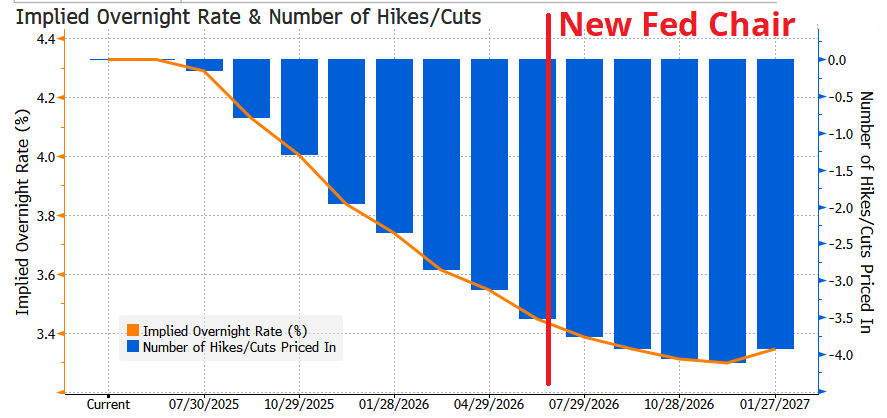

The Fed remains quite tight and if they finally decide it’s time to move, there could be plenty of justification for Fed Funds 100 points lower in 12 months. Current pricing is for three 25bp cuts by this time next year. Separately, the market will soon need to price a kink in interest rate options skew after May 2026 because the new Fed Chair is likely to be an überdove. The distribution of possible outcomes should look nonstandard after that date as some weird outcomes involving rapid, deep cuts become more possible.

Maybe this is just fanciful thinking and the board will keep the new dove in check, but I doubt it. We are moving more and more towards central planning of the economy as rapidly rising debt forces the US government towards wave upon wave of financial repression.

If inflation is rolling over in the US and economists (and the market) have overestimated the inflationary shock from tariffs, Fed Funds are quite high. Neutral is closer to 2.5% or so, depending on how you measure it. The rumors of Scott Bessent as future Fed Chair are also intriguing. Global policy rates tend to move as a pack, and the Fed is behind its peers due to USA-specific uncertainty and higher, stickier inflation. I would attach a higher weight to upcoming Fed speeches—a dovish pivot might be on the horizon soon.

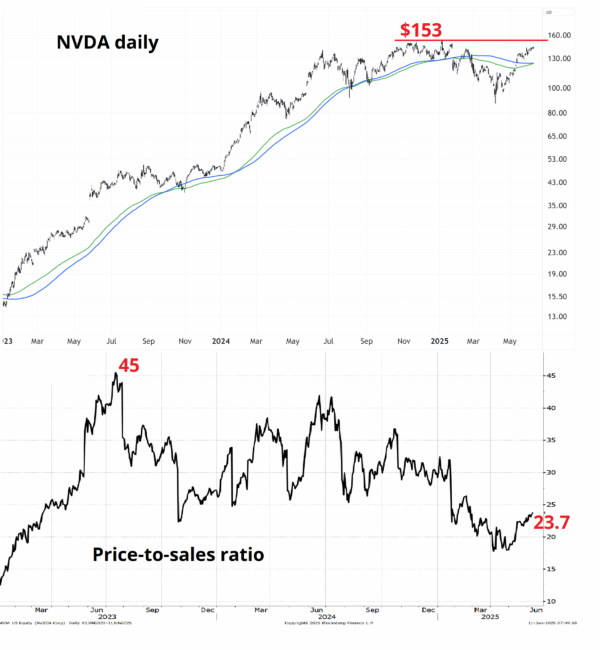

Nvidia has spent that year growing into its valuation as the price-to-sales ratio has come off from 45 to 24.

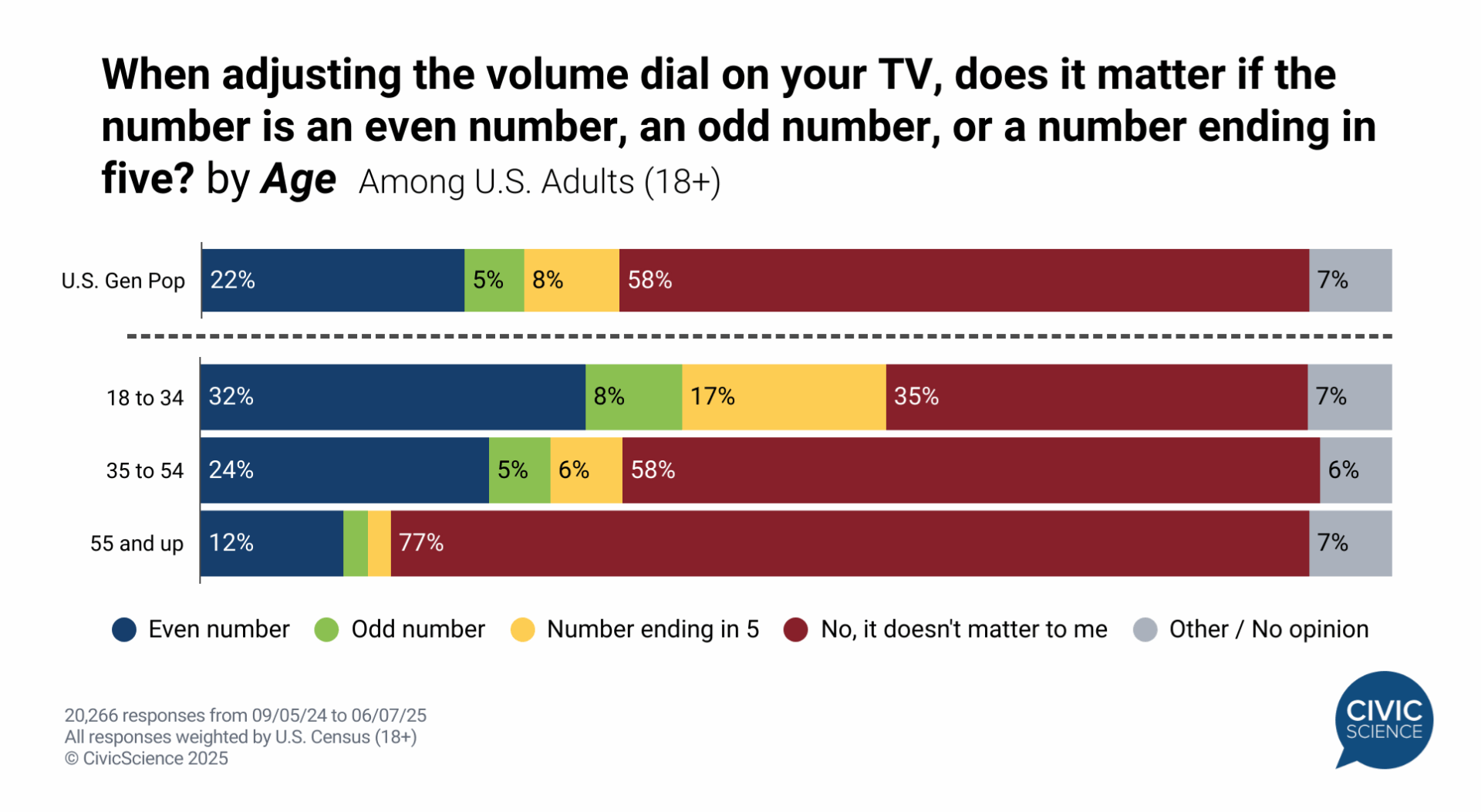

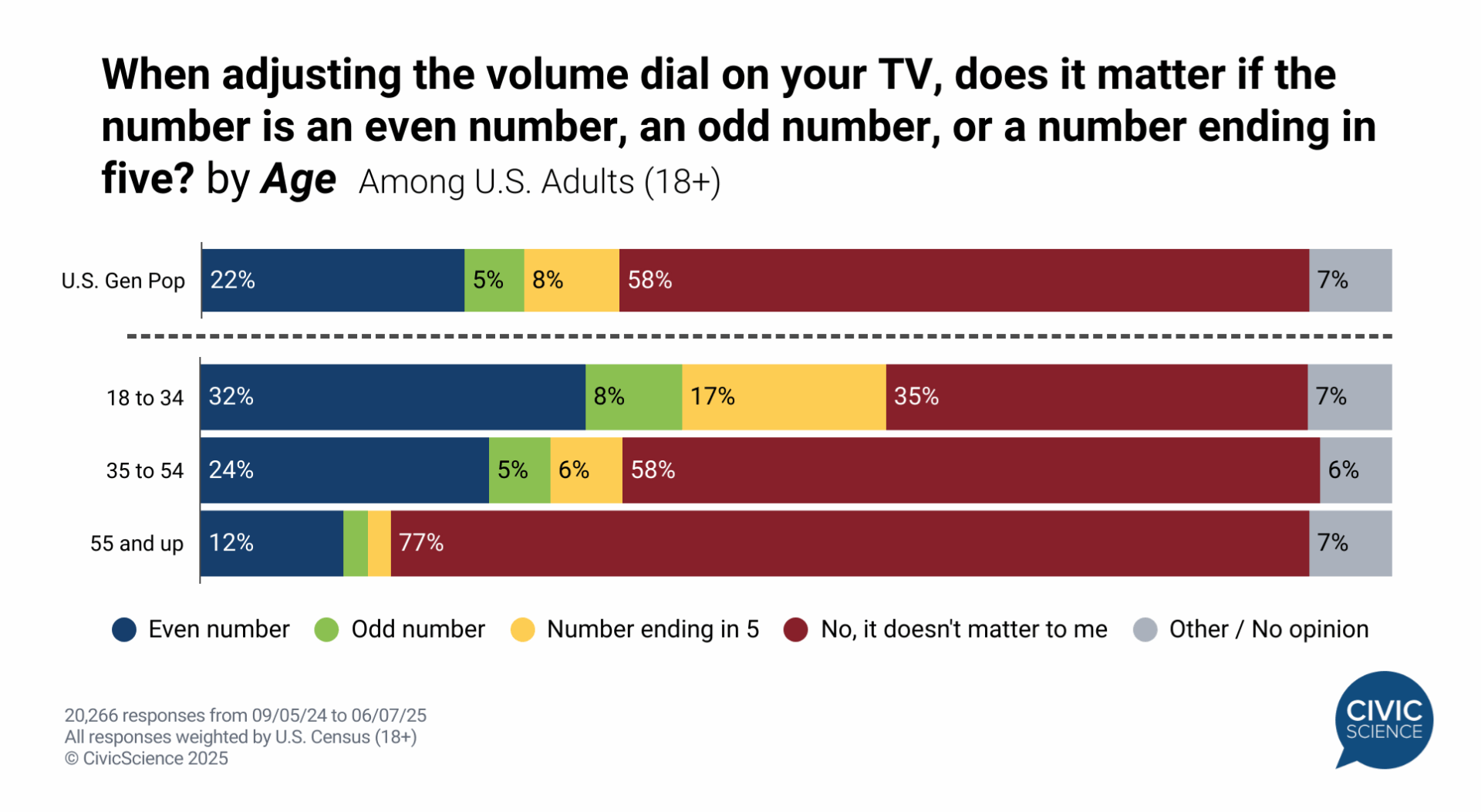

Have a day free of round number bias.