It’s déja vu all over again

It’s déja vu all over again

Flat

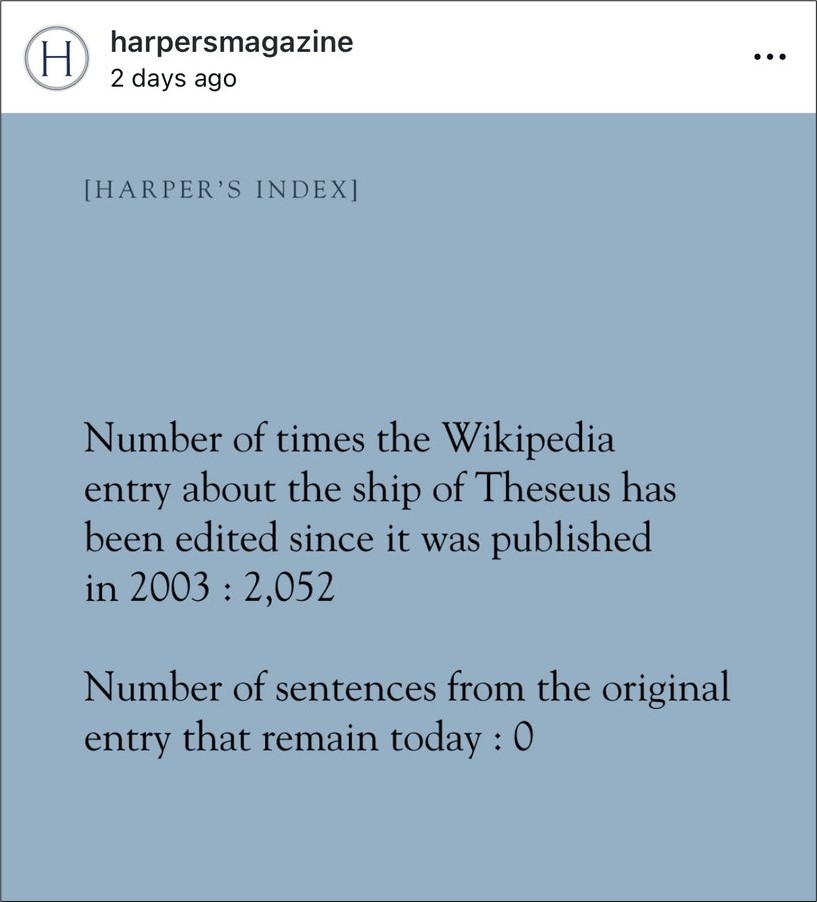

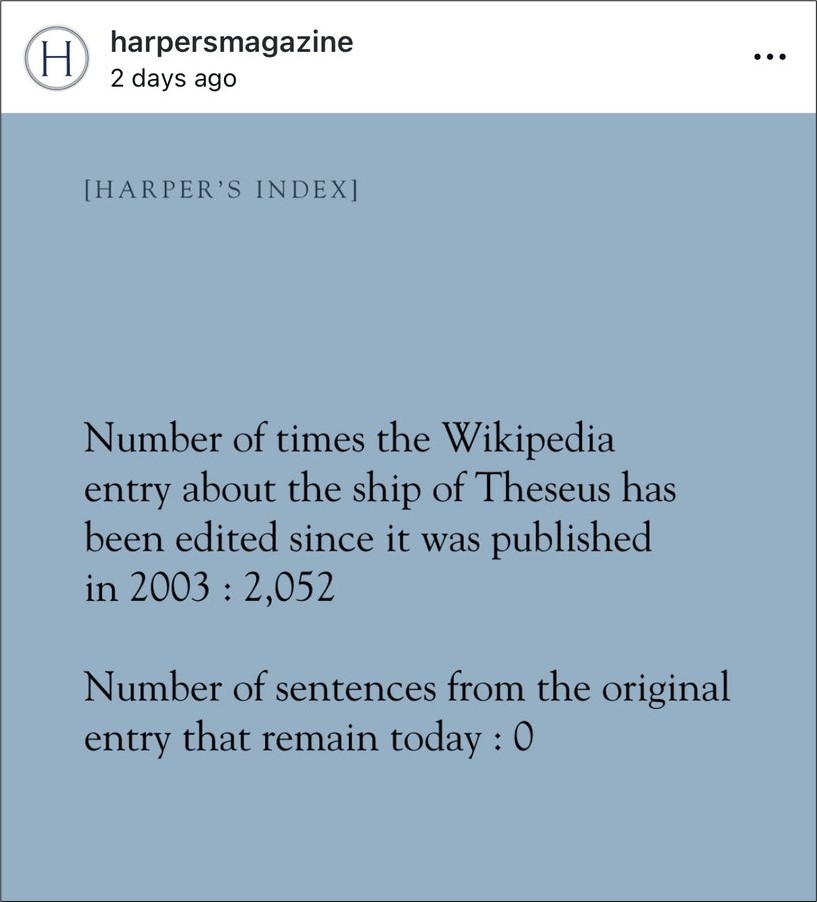

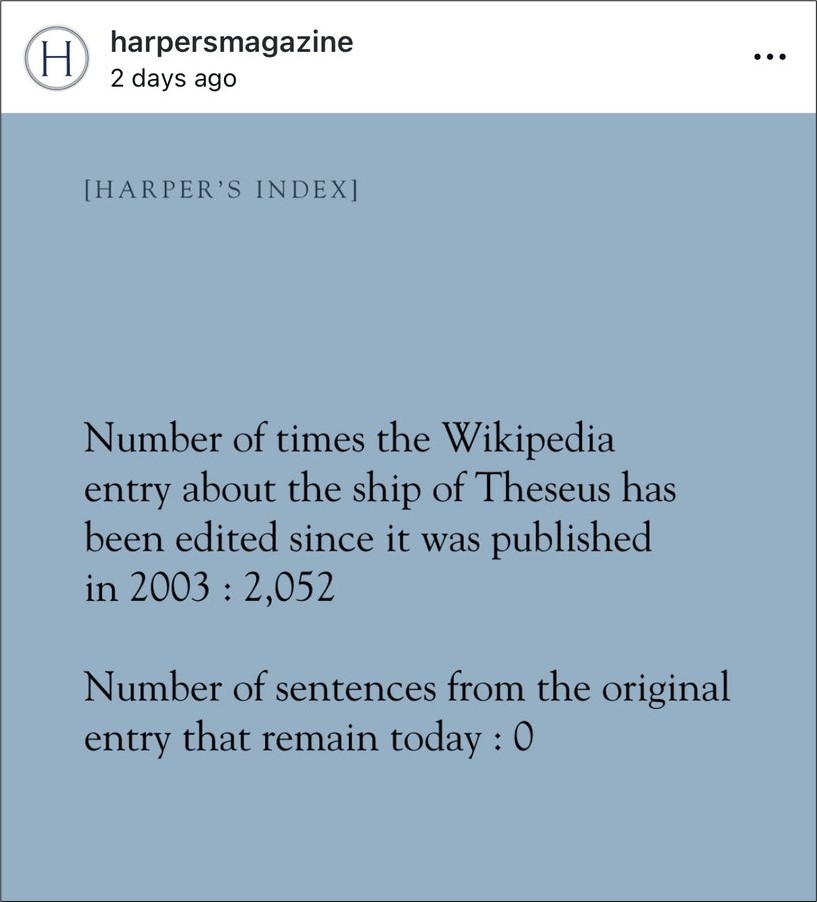

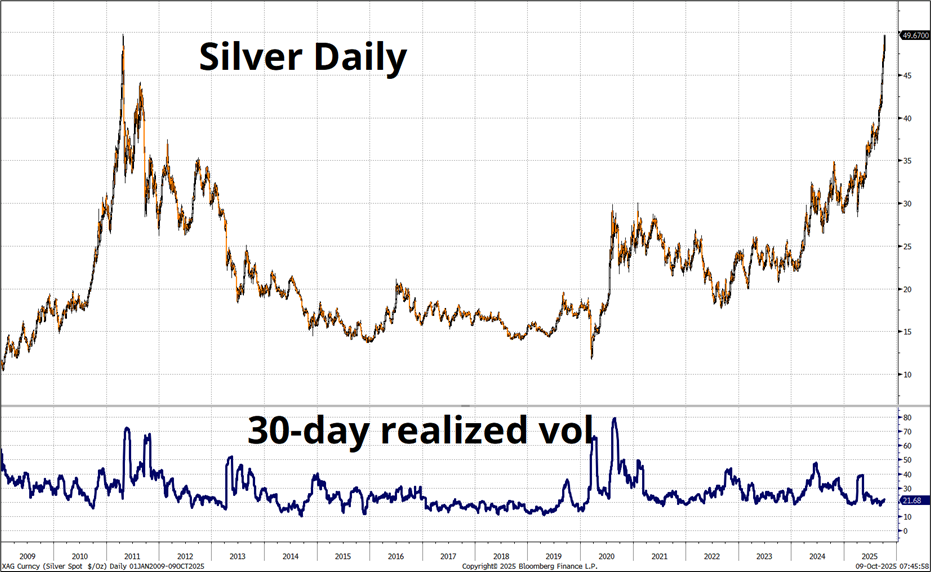

Silver is getting back to $50, the Bunker Hunt level and the peak on April 25, 2011. Everyone knows the story of the Hunt short squeeze, but the narrative around the 2010/2011 rally and collapse is less well-remembered. At the time, the market was in a post-GFC liquidity rampage.

The NASDAQ had more than doubled from 1000 to 2400, and everyone was worried about fiscal madness as the USA and Europe had been “printing money” like crazy with the Fed in year three of QE and no end in sight. Financial repression and too-loose Fed policy were major concerns.

The 2011 debt ceiling crisis was in full swing, as Republicans were demanding that Obama negotiate over deficit reduction (LOL!) in exchange for an increase in the debt ceiling. There was some loose talk of a US default, and people had never been more worried about US government spending and deficits as far as the eye could see. Silver topped at $50 just before the debt ceiling, collapsed to $32 in three weeks, then rallied back to $44.20 in mid-August 2011 after S&P downgraded the US. By the end of August, silver had collapsed again, this time down to $28, as the speculative mania unwound. It then began a slow grind down to $12 pre-COVID.

While the parallels to 2011 are obvious, it’s interesting to note that things just kept getting more and more stupid with regard to government spending and deficits, and yet it took silver 14 years to get back to its peak and obviously silver is much lower now than it was in 2011 if you adjust for the risk-free rate.

Silver in 2011 was a speculative mania, not a hedge for further debasement or US government largesse. Things got much, much worse on the debt side, and silver collapsed. So the question here is: Will it be a good hedge this time? Or is this another spec bubble in silver? I hate to be that guy, but it’s probably a bit of a spec bubble at this point?

The intriguing thing about that second chart there is how low silver volatility has been on this runup. Realized volatility was up in the 70%s in 2011, and it’s in the low 20’s right now. I don’t know enough about silver options to tell you whether skew is cheap or expensive, but the impossibly-high Sharpe on the way up probably means that volatility is going to explode on the way down as sizing is almost certainly too large if people are vol-adjusting with some kind of one-year lookback.

We are trading at $49.98 as I type this. I suppose something to watch would be a false break of $50 and return below that level (i.e., slingshot reversal).

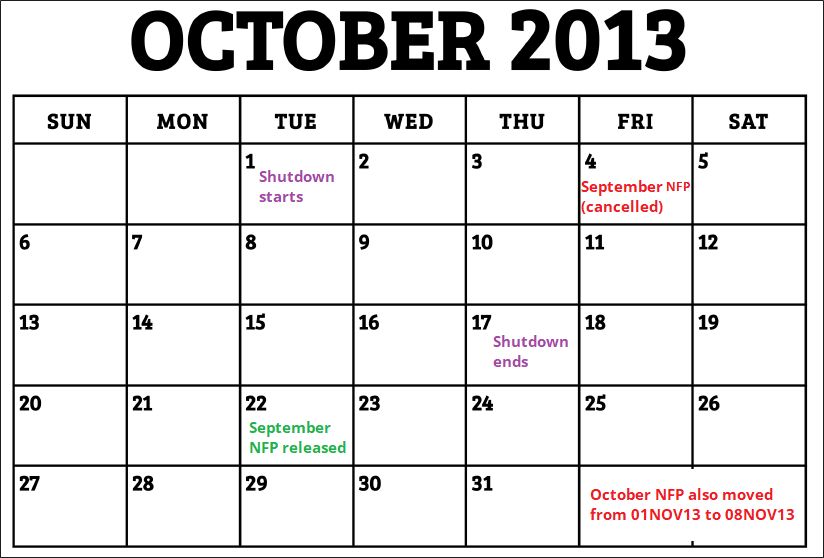

Speaking of US debt crises and government shutdowns, there was another one in 2013. I was wondering what the timing was of the economic data after the shutdown ended. Here’s how it played out:

Here’s a fun line from a 2013 article covering delays to the jobs report due to the shutdown that took place from October 1 to October 17:

Economists had expected the BLS report to show 180,000 new jobs, with the unemployment rate holding steady at 7.3 percent.

Just crazy to see how high NFP was vs. such a high unemployment rate, even a full five years post-GFC. The UR peaked near 10% in early 2009 and took eight years to get to its current level of 4.3%. In other words, US unemployment was higher than it is now, every month from 2009 to 2017.

Below, what Claims did around the 2013 shutdown. That time, Initial Claims were released in real time, but this time they are delayed.

One final note on the 2011 analog: The NASDAQ peaked the same day as silver and took about a year to make new high as the Eurozone crisis booted off.

No real call to action here, unfortunately, but the takeaways are:

There is a feeling out there that “nothing stops this train” and stocks and silver and AI only go up. That’s not how markets work. That doesn’t mean you need to be short, but I expect an eye-watering correction sooner rather than later. Who knows what the catalyst will be, maybe reopening, or maybe it will be like 2011, where things just keep getting worse, but spec money runs out and we get an endogenous reversal.

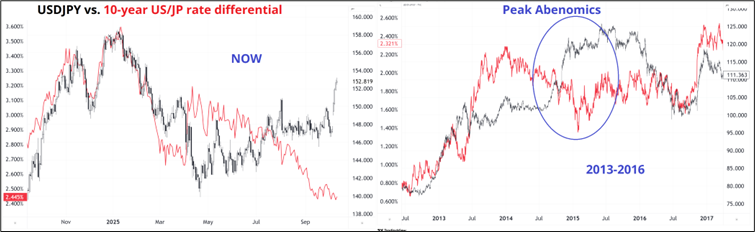

USDJPY is now part of this spec blob as the view is that Takaichi is going to unleash mini-Abenomics and command the BOJ not to hike in October. This is reflected by the increasingly-gigantic divergence between USDJPY and interest rate differentials. Similar to 2015 and peak Abenomics, JPY has completely decoupled (though it had decoupled long before Takaichi took the crown).

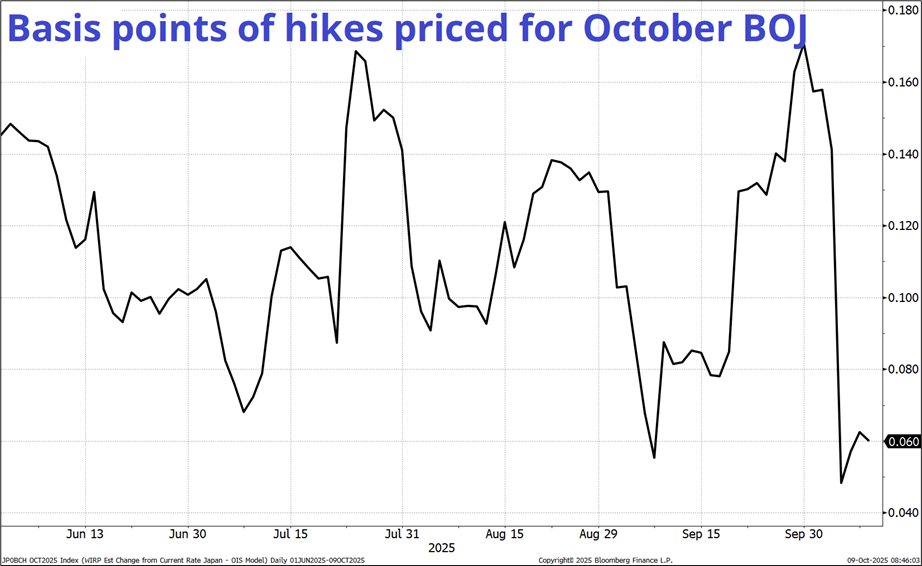

Here’s the evolution of October BOJ pricing. I did not feel the need to label the point where Takaichi won. While I don’t think the market has had much time to put on short yen trades, I suppose the risk now would be that if the BOJ hikes in October, that could put a dent in the spec fever elsewhere because Takaichi’s win put some extra wind in the sails of the debasement trade. XAG/JPY has almost doubled since April. Epic.

RGTI Revenues:

2022 2023 2024 2025

13.1m 12.0m 10.8m 8.1m

Okie dokie.

There is nothing new under the sun.