Talking to Clark Read about crypto, TradFi, gumption, and the Battle for the Ring

Clark Read, VP of Trading at Gemini

Listen to this as a podcast on the web here

Listen to this as a podcast on Spotify here

Listen to this as a podcast on Apple here

Welcome to MacroTactical Crypto #16. Today, for your listening and/or reading pleasure, I interview Clark Read, Vice President of Trading at Gemini and former Head of Trading and Portfolio risk at ShapeShift. Clark also spent twelve years in TradFi, trading G10 FX. But first, a quick update:

Market update

In my last crypto note on April 4 (MTC #15: A Taxing Month Ahead) I went short BTC at 46000 because I expected a four-week move into 35000/38000 as tax day and Fed jitters dominated. I had good accuracy on both the size and timing of the move. Sweet! Once again, BTC trades like a risky asset and follows the script.

Now, tax day is done and the FOMC meets tomorrow. My feeling is that this Fed meeting will be more dovish than the last few FOMCs and this will offer some relief for risky assets and crypto. I fully explain my reasoning in today’s am/FX.

am/FX is the daily macro note I have been writing since 2004. It is my best product. If you would like to check it out, please click here.

At this point, my view is that we get a weak relief rally in crypto which takes BTC back to the 41,000 area. Then you reassess. No trade recommendation today as 3k is a pretty small move and I would rather be short USD than long crypto on a dovish Fed. The next wave of risk aversion won’t be more than a few weeks away, even if I’m correct on the dovish Fed result.

Finally, a heads up: I plan to make MacroTactical Crypto a paid product soon. It won’t be expensive. Here’s my logic for why I’m going to go paid:

It will be a better product. I will be more motivated to write about crypto if people make a financial commitment to me.

I think it’s a good product and it has value. I hope you agree!

Update complete. Now, my interview with Clark Read.

Talking to Clark Read about crypto, TradFi, gumption, and the Battle for the Ring

Clark’s a good friend of mine. He knows a ton about music. He played basketball against Barack Obama. He has partied with Tony Hawk and Axl Rose. He’s the classic cool guy / smart guy mix. He also knows a ton about TradFi and crypto. So without further ado, here’s the interview. BD is me. CR is Clark.

BD

First, tell us a bit about your career to date, and how you got into crypto.

CR

I started my career as an FX trader back in 2005 at Lehman Brothers. After Lehman went under, I worked for Credit Suisse and Nomura in New York and Singapore until 2017. Then, the first significant crypto speculative bubble happened, and things go to a pretty macro scale. And so, my attention was piqued. My interest was piqued.

I spent a long time on two fronts, one was networking around the space to figure out who, and which projects were real. I did a ton of vetting there and then also hand-in-hand with that came a lot of education, just educating myself on the space. And so those two things collided and the more I learned about the opportunity, the more that I realized that I really just couldn’t afford to ignore it from a financial perspective, from a career perspective, etcetera.

BD

Then you left traditional finance and that was 2017. So that was early. How did your peers and your family react? I know 2017 was still kind of a dicey time; crypto was still viewed very much as a criminal facilitation enterprise by some more conservative people.

CR

It’s a good question. And it’s still an ongoing question. Going to an FX conference or telling people I worked in crypto in 2017, it was like, who’s the weird money laundering guy in the corner? Now at an FX conference, it’s like me and others in crypto are the Belles of the ball.

BD

Traditional finance sure feels increasingly outdated, and dinosaur compared to crypto, where all this exciting stuff is going on. It’s interesting that you went into crypto at a time when it was the hard thing to do. Now going to crypto is the easy thing to do.

CR

From a career perspective or social perspective, I’m still kind of hesitant to talk too much about it. I’d say if I go to a party and I’m with a group that doesn’t know about who I am or what I do, I’m reluctant to mention crypto because one of two things will happen. One, people will laugh it off and think that the career isn’t serious… They’ll mention money laundering, crime, etcetera. But the other option is that it ends up eating the conversation. I don’t want to be the person who is always talking about bitcoin at a party.

That’s just not who I am. There are enough of those people out there.

BD

With bitcoin, there is this feeling that the stakes are incredibly high. Depending on who you ask, the entire future of the world rests in the balance. I understand that monetary systems are important, and they influence societal dynamics and so on. But still. As someone who goes to a party and doesn’t want to talk about bitcoin all the time, you probably also have to navigate those people that do. Because there must be many people in your radius that do.

CR

It’s a tough tight rope to walk because I am passionate about the technology. But at the same time, above all else, I like to consider myself a pragmatic person. And this crypto world and even the world at large today in 2022 is not really built for pragmatism.

BD

Right. I also try to be pragmatic and probabilistic when it comes to markets. I never think that I’m 100% right. I’ve been wrong so many times! But in crypto, there’s a good 30% of people that are just ALL or NOTHING. They’re not probabilistic at all. It ends up being a really strange barbell of deterministic people with not all that many Bayesian or probabilistic pragmatists in the middle.

OK, let’s get to a few questions. I’ve heard people like Rob Bogucki say the crypto options market now looks kind of like the Brazil FX options market in 2005 or something like that. How do you compare the spot market in crypto to the spot market in FX? How is it similar? How is it different? How does stuff go down?

CR

One thing is that liquidity is very fragmented. Whether you’re talking about spot or derivatives, I think it is similar to a time from a decade or two ago before things were kind of more consolidated and automated across the board in fiat currency markets.

There is still a very robust voice OTC market in crypto. Most of it’s happening in different electronic chat venues like Telegram or Slack or Bloomberg. In the same way that we used to have callouts in FX. There’s that kind of thing happening where if you need a price in a hundred million dollars worth of bitcoin, you can ask five people in telegram.

So, it’s very similar to the old-school FX market. That’s one piece of it. Now things are starting to get more automated and move from voice to RFQ (Request for Quote), to request for stream to electronic streaming… It’s the same playbook we saw in FX and various other asset classes. The biggest pain point, having sat on both sides of the fence and in more of a buy-side kind of role first at my previous company (ShapeShift), is the credit and settlement layer.

If you’re on an FX spot desk, you can hit “BUY 100 EURUSD” and press ENTER. And as the front office trader, you don’t have to think about it after that. If you’re sitting on a forwards desk, you’re thinking a little bit more about credit. If you’re sitting in the back office or on a funding desk; you think a lot more about it.

I wish I’d paid a little bit more attention to the full stack of how the plumbing works in the FX world. Because a lot of my job now is rebuilding that and repurposing some of the old tools in this new crypto context. And below the top layer, the other layers are completely different from FX because you don’t have ISDAs and SWIFT and all that.

BD

Right. So, stuff like bitcoin and Ethereum are closer to FX, but then some random coin you would have all these weird custody things going on?

CR

Yes. It’s hard from a number of different perspectives. It’s hard from a technology perspective because so many different people have built systems in different ways based on what they’re familiar with. You’ve got venture-backed Silicon Valley style companies popping up that have built systems that look like a Google ad auction, for example. But then you’ve got other people who are building things that look like a commodity space clearing house, and still, other people who are building things that look like an FX ECN (an ECN is an electronic communications network, the electronic brokerage systems where FX trades).

BD

Got it. One conversation that you and I have had quite a few times is: as a long-term believer in crypto, you want to be fully invested. You want to maintain your commitment because you don’t want to make the mistake people made in 2018 and 2020.

How do you manage the psychology or how do you advise other people to manage the psychology of staying fully invested in such a high-volatility instrument? Cause you’ve done it well. You have not panicked now through two cycles.

CR

I read Alpha Trader cover to cover. That’s the answer key, right?

But seriously. I can think of a few things. One thing that constantly comes to mind is a point that I think you were the first one to make to me when I was trying to articulate how I was thinking about this stuff. You distilled it down to something really straightforward, which is, there’s a huge, fundamental difference between a trade and an investment.

Understanding that difference is so important. Many people, me and you included, can get into a habit of overtrading, or confusing trading and investing. Time horizon is everything. There’s just a huge amount of behavioral economics around risk management and investing.

I think crypto is a particularly weird and interesting and scary one because it shares a lot of the same characteristics with other asset classes that are very immature or early-stage like angel or seed investing because of its volatility and all that kind of stuff. But at the same time, there’s this layer of transparency and immediate liquidity that’s strapped on top of it. That’s very dissimilar: the option of hitting a bid, anytime you want. Whereas if you’re a general partner at a VC, you can spread out a thousand different investments. Wait a couple of years… Spray and pray… And you’re not forced to look at a real-time P&L.

So ultimately I think, whether I was talking to a client back in the FX trading days, or now thinking about my own crypto exposure or some of the exposure of our clients, the way that I like to think about it is to strip away all the vernacular around it and just say, tell me a simple story of what you think is going to happen, what you think the bull case looks like, what the bear case looks like.

And based on that narrative, you can define your risk using simple tools with stop losses and take profits, or more complex tools like derivatives, etcetera, and use that narrative to construct the appropriate strategy.

BD

So, you just mentioned best case and worst case. I think the best case is pretty clear. We’re going to get to another round of Fed easing at some point and bitcoin goes to a hundred thousand, et cetera, as fiat heads toward zero and its printed quantity approaches infinity. But what do you see as the worst case for crypto? In a manageable timeframe, say in the next few years?

CR

I think the most interesting thing here is to zoom out and think about things from a more existential perspective. Crypto at its core, whether you’re talking about bitcoin as money and a store of value, or whether you’re talking about the crypto landscape at large… Crypto can be viewed as an existential threat to the legacy model, the traditional Western frameworks based on centralized control. I’m taking a strong view there. I think that’s the ultimate battle for the ring. The jokes and memes about crypto bros and people getting rich are beside the point. Really the idea is that this technology is fundamentally democratizing and empowering from the bottom up. That’s scary for the status quo and corporate establishment.

It’s setting the stage for a battle, ultimately. There are a number of different risks to that. I’m happy to dive in, but I think, generally speaking, that’s what I think the biggest existential risk is for the crypto ecosystem in the next few years.

BD

Okay. So regulatory risk of some shape or form. One thing that’s kind of blown my mind is that the regulators have not really done all that much, to be honest. As each year passes, I feel more and more like the regulatory ship might have sailed. But maybe bureaucracies are just very slow moving and slow to recognize the crypto threat.

CR

Crypto bulls will argue that the regulatory ship has sailed. But it remains to be seen. I think there are also some other realistic challenges to the “crypto eating the world” view. One is what we discussed: a coordinated action on the part of consolidated first-world powers. The second one though is more insidious. The adoption of this technology and its repurposing in a way that further advances global corporatism and surveillance. Crypto elements co-opted by corporations like banks and governments, for example. It comes down to what Ben Hunt calls: Bitcoin!™. It becomes co-opted to the point where it ends up being a tool of the legacy state in ways that no one really fully understands until it’s too late.

BD

Right, that makes sense. How do you think about bitcoin versus Ethereum versus altcoins in terms of investment and do they have the same time horizon for you?

CR

I believe the bitcoin and Ethereum ecosystems are going to continue to grow aggressively over the long term. So, I have holdings in both of those. That is my core worldview and those are in the back book. I’ll look at it again in a decade or something.

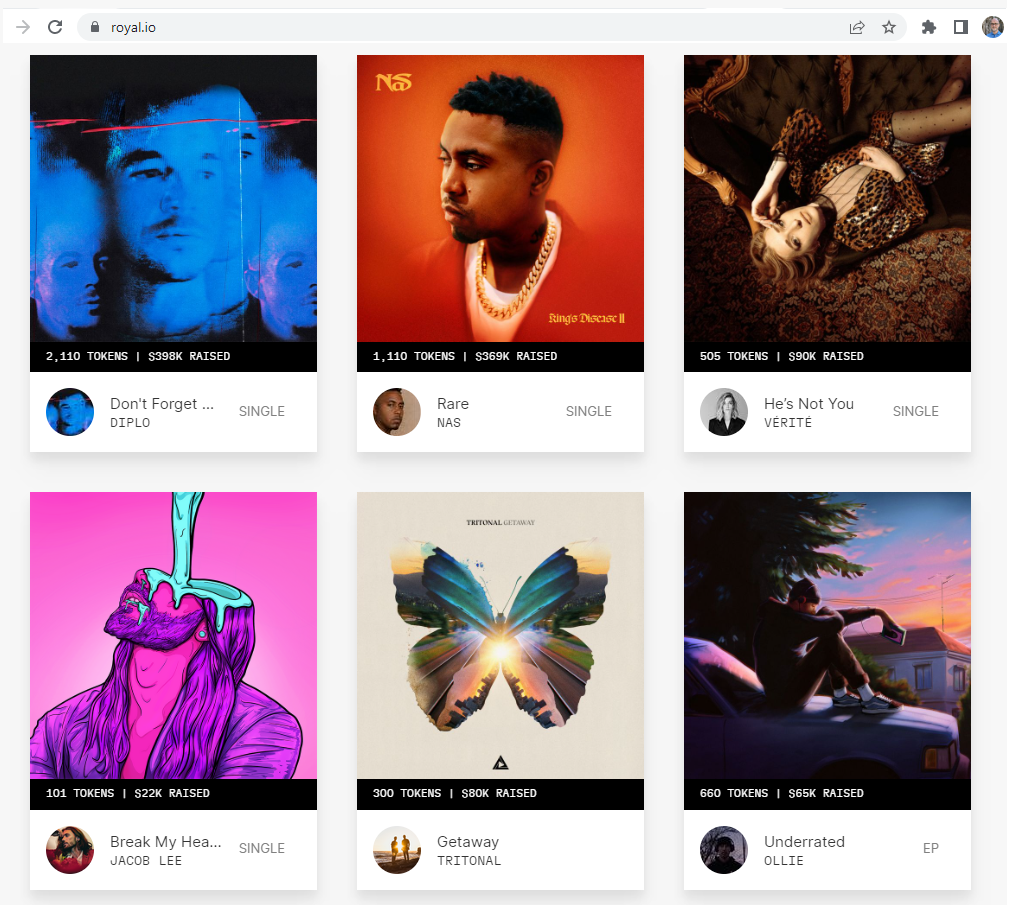

There are many other projects across the crypto landscape that I find interesting. I try to have a practitioner’s or operator’s mindset first. I go in and I use things as a consumer. If there’s a new music NFT project, or a DeFi lending project, I’ll go explore it from a user’s perspective. It’s the best way for me to get a sense of what the opportunity set looks like from a product/market fit and a total addressable market perspective.

My overall theme is that we have agnostic technology layers taking things from analog to digital. We’ve seen that with transportation with Uber and Lyft. We’ve seen it happen with music. From the cassette to the CD to Napster to Spotify. I think it’s a similar kind of thesis that’s playing out in many industries, including finance: disrupting rent seekers and middlemen, greater and faster innovation, infinite scalability, and so on. I focus on a few key leaders in each vertical and try form a longer-term thesis around that.

Royal.io, a project Clark is excited about

BD

Now, one thing I’ve always wondered about crypto but was afraid to ask is if you take something like Solana to the max and it becomes a super, super-efficient, transactional layer, then wouldn’t there be a point where the value of that token is actually zero because it’s so efficient, you just don’t really need to own very many.

I feel like there’s some kind of weird circularity for those tokens. It’s not obvious why the most efficient token should be worth anything because you wouldn’t need thousands of them in your wallet. If you only need 0.00001 Solana to do the thing you’re doing, ‘cause it’s crazy efficient, why does that token need to be highly valued?

Sorry, this might be a noob question.

CR

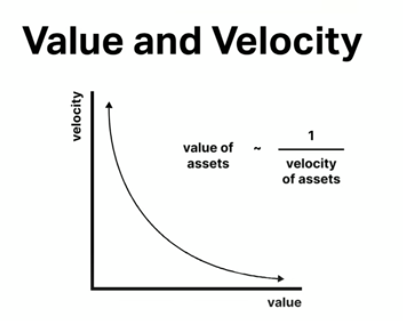

That is a huge question. It’s a multidisciplinary question that draws from aspects of monetary theory around like MV equals PQ and the velocity of money increasing and maybe the value isn’t there.

There’s an important element of defensibility and moats and captivity where (using your example), if Solana wins, then they’re able to potentially extract rent, because they become the default ecosystem and you need to be in it in order to participate.

There’s a lot of focus on this idea of finding a panacea solution in crypto. You think about the trilemma of scalability, security, and decentralization. I don’t think that you necessarily need to solve to max out all three of those for all use cases.

They’re just different levers that you can pull situationally to solve for different applications. You can have less decentralization in some instances, and that might be where the value comes from. And then for other things, say I want my money to be safe from the state, then maybe decentralization is the most important lever for that particular application.

It’s the real world, it’s like a Cambrian explosion. Ultimately, I believe that you’re not going to have one ring to rule them. It’s going to be a messy hybrid. So to answer your question: Transaction throughput is one variable that you can value an asset on. But it’s not the only one that matters.

BD

Got it. OK, let’s change gears. How did moving to Singapore impact your worldview?

CR

That experience shaped my worldview in a way that I never could have anticipated or ultimately replicated any other way. I’ve got amazing friends now, scattered all over the world. I was able to travel across the world.

That had a permanent impact on how I view risk and how I view my career. It gave me the gumption to take a risk like working for a 75-person crypto startup on the bleeding edge of technology and innovation. The experience of picking up my life and moving halfway across the planet for two years kind of shattered my view of what’s risky and what isn’t. On many different levels.

I grew up in Cleveland, Ohio, and I went to college in Vermont, and I went to New York after that. And so, while my experience was certainly different than a lot of other people that I became friends with and worked with, by and large when you zoom out more, my experience is very, very similar to anyone coming from America, living when we live, being a beneficiary of all the systems and so on.

Broadening my experience and perspective and relationships and seeing the myriad different ways that people become successful and happy led to some challenging and thoughtful questions and rewarding experiences that changed how I wanted to live my life going forward.

I try to approach my life with the most open mind possible so that I can continue to grow and learn.

BD

Right. It’s amazing how your whole worldview changes once you get far enough away from home. OK, let’s talk about altcoins. Let’s say there are 15,000 altcoins right now. My guess is that 99% of them end up worthless. What do you think? How many of those will be worth something, five years from now? Can you take a wild stab at that?

CR

My view is if there are 15,000 altcoins right now, I think there will be 150,000 or 1.5 million or 15 million within five years. I think what people miss here, is that if we’re talking about this analog to digital framework; it’s asset class agnostic. I think that over time you’re going to start to see tokenization eat the world really.

You’ll have a token for your identity, for your house, for every song, and so on.

BD note: If you have four hours, this Tim Ferriss podcast with Balaji Srinivasan discusses this tokenization of everything concept. It’s a mind-melting podcast.

Out of the current 15,000, who cares how many are left? The more important point is that there’ll be 150,000 of them, or 1.5 million, or however many, in five years.

This idea that bitcoin is the only thing that can be the denominator for everything. It’s just foolish to me. It’s like arguing that your house title should not exist. And the stock market should not exist. And copyright laws should not exist. They’re all very different things with different attributes that need to be denominated and valued in different ways. Bitcoin’s moat as a digital store of value is definitely significant but you never know.

BD

Would you agree that bitcoin’s moat is bigger than ETH’s if we’re constructing moats in our heads?

CR

I think that’s a reasonable thesis at this point, but it could all change. I think talking about moats and defensibility is important. But it’s tricky because it’s kind of like asking in 1999 what the internet will be used for in 2022.

I was on AOL then. To think about the idea of being able to ask Siri the answer to any question on the planet and get an answer immediately, with no wires attached. You just couldn’t have even dreamed that. So, it’s fun to talk about, but it’s kind of pointless because it’s too complex… The evolution is so complex.

BD

Right. There’s unpredictability to human behavior. Random social and networking aspects are in play. Like doge… Who would have thought that people would actually buy that and think it has value?!

CR

Exactly. Value creation is a fickle thing. Look at GameStop and AMC. They were dead businesses. Now, with a big war chest, maybe they can make something real happen, not just vaporware. There’s weird reflexivity at work. And that’s impossible to forecast.

BD

Right and that goes back to your point about being pragmatic. I like the way you stay humble and open-minded as it’s very easy to be overly dogmatic about this stuff. Ok, well, Clark. That was awesome. Thanks for sharing your thoughts, I really appreciate it and I learned a ton.

Everyone that has crypto to trade… Go trade at Gemini! Clark works there and he’s the best. Good luck with FOMC!

And thanks for reading

bd