Shakespearean tragedies use foreshadowing

Listen to this as a podcast: on the web … on Spotify … on Apple

Takeaways from the LUNA death spiral

If you don’t know the story on LUNA’s death spiral, you can read about it here, here, or here. In this note, I give you my thoughts and takeaways now that LUNA is dead.

Takeaway #1: Yield and risk are always correlated, and it’s nonlinear

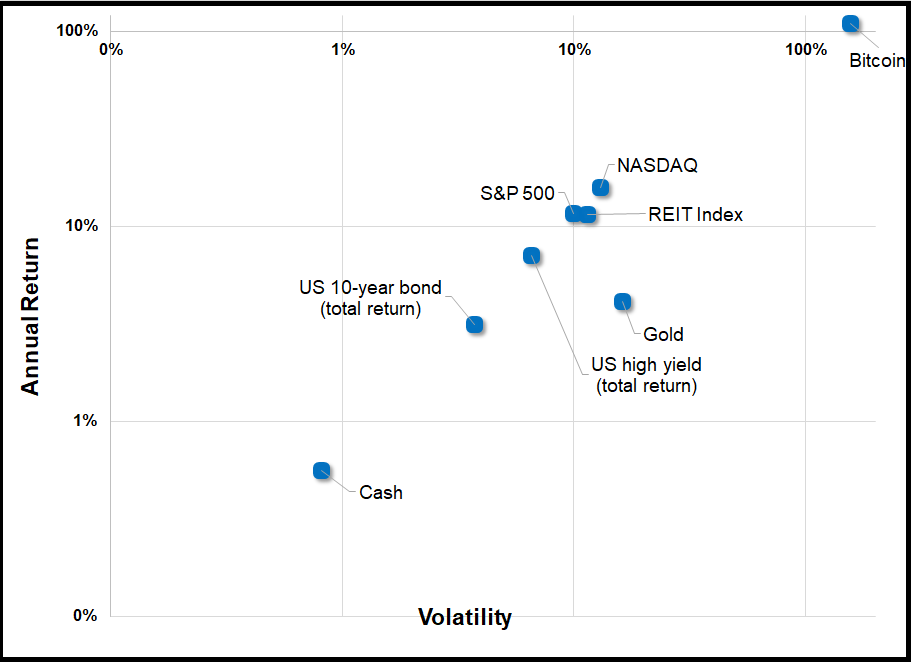

The first chart today shows risk vs. return for the major asset classes and bitcoin since 2010. Note the log scale and how the line of best fit is almost perfect.

Annual return vs. volatility (standard deviation of returns) 2010-2022

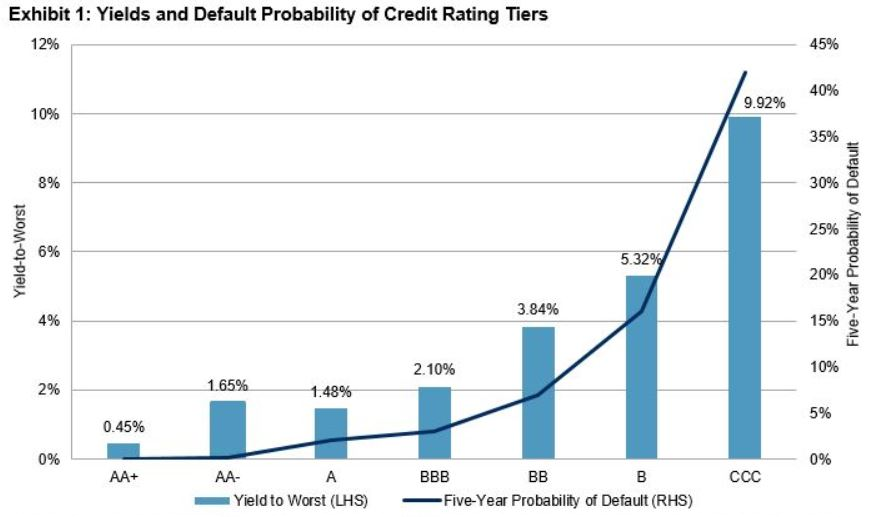

Here is what it looks like in bond land:

High yield means high risk. Super high yield means exponentially higher risk. This is an immutable law of finance. If you want a 20% return in a 0% world, you are taking on massive risk of ruin. You are selling an option where the downside is 100% of your investment.

Any time you size up a financial product with a high yield, unpack the risk factors. When you see a high yield, assume there is an embedded catastrophe risk and then figure out if you have an edge in measuring it. Overcollateralization reduces, but does not eliminate, risk of ruin.

Takeaway #2: Humans are bad at measuring risk, but love to gamble. No amount of regulation can stop us!

One fundamental and unfixable problem is that current markets are characterized by youthful risk-taking, winner-take-all / lotto-ticket capitalism, and low financial literacy. Low financial literacy does not mean people are stupid. Not everyone can be good at all things! I am tone-deaf, I can’t read music, I don’t know how to fix or build things, I have no sense of direction, etc.

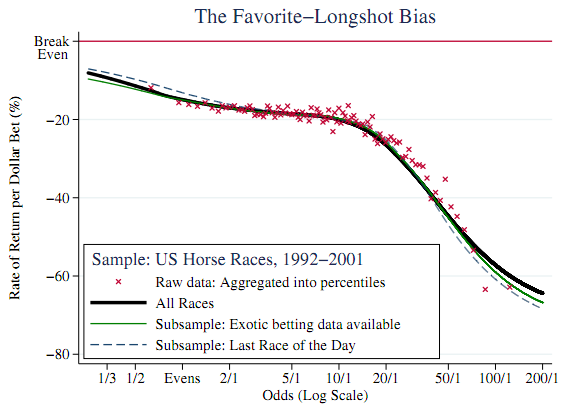

Add the fact that humans are generally bad at games that involve risk assessment. We are overconfident, we overvalue current holdings, we are poor estimators of probability (especially at the extremes), we anchor on meaningless price levels (like entry points), we favor longshots over favorites (even though favorites are usually the much better bet), and so on.

I have written chapters on these behavioral biases (particularly in my latest book: Alpha Trader) and don’t want to fill this whole piece with behavioral finance but let me show you one chart as an example of favorite/longshot bias because it explains crypto pretty well. In the top left, that’s favorites averaging tiny losses, on average. The bottom right shows longshots generate large losses, on average.

People love to buy lottery tickets! If you lose, ok but if you win… Such fun! Negative expected value trades with asymmetric payouts are always popular, even though they should not be.

Where are the regulators?

There are some pretty obvious steps regulators should have taken years ago that would have stopped LUNA and other forms of crypto grift. For example:

- Regulate stablecoins as money market funds with full transparency and mandatory audits. Any stablecoin that doesn’t meet this standard should be illegal to own, trade, or offer for trading on an exchange.

- Prohibit and prosecute those who lie about the assets underlying stablecoins.

- Prohibit the deceptive misnomer “stablecoin” and require a less misleading name like “crypto onramp security” or “asset-backed coin”.

Instead… US regulators just recently announced they are “looking into stablecoins” and “proposing regulation of stablecoins”. Amazing! What is taking so long?

In theory, the primary purpose of regulation is to limit fraud and protect investors, especially investors with low financial literacy. To stop the grifters. But there is no law against being a charlatan or against making bad, clickbaity predictions. There are no laws against herding or hype.

Here are a few random samples of the firehose of LUNA-positive noise that flooded the internet until the volte-face this week. I could literally post 100 of these, but I will post three and you’ll get the point. From a crypto website:

From a different crypto website:

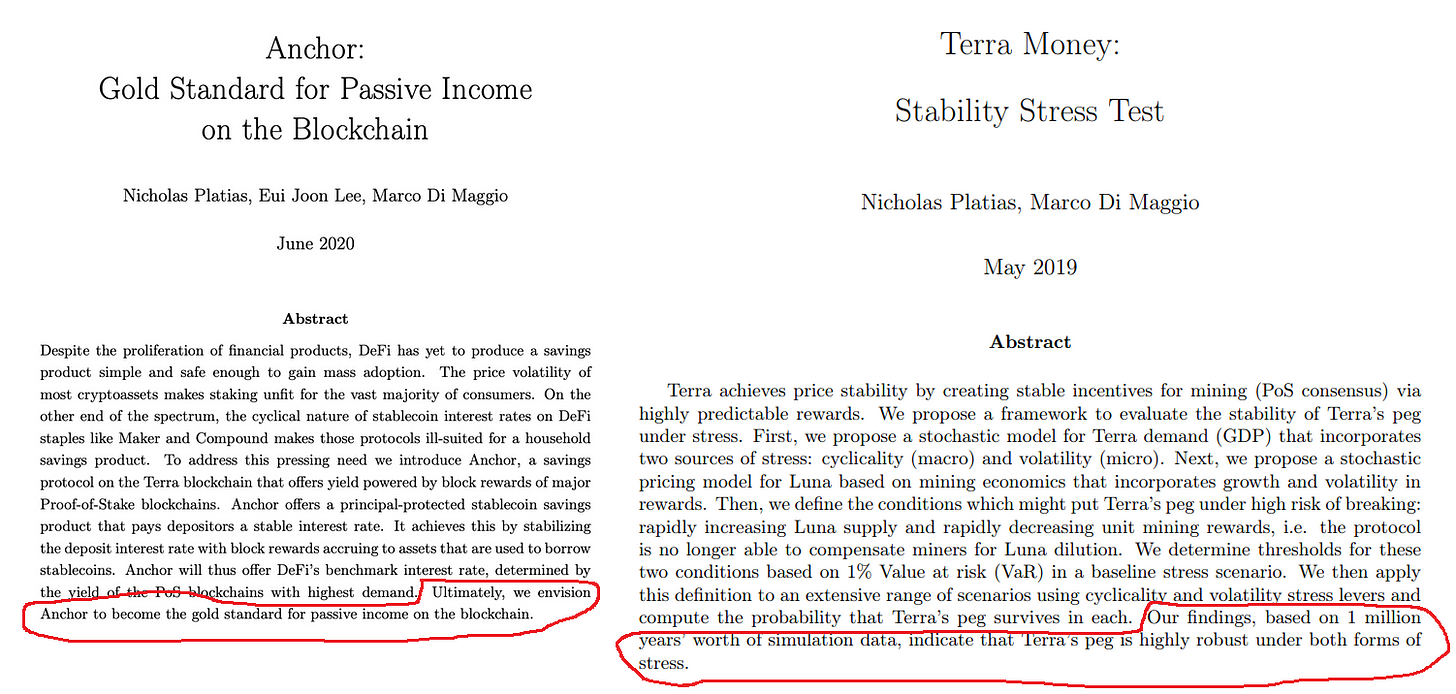

From two studies from a Harvard professor.

I believe people are responsible for their actions. Those who gambled on the LUNA experiment now understand the cliché: “If it seems too good to be true, it probably is.” Shills that coax financially illiterate people into gambling should be prosecuted if they lie or break any laws. But they probably won’t be. And they might not have.

I wish that regulators could have stopped the LUNA collapse, and they could have with some basic/obvious stablecoin regulation… But cries for regulation mostly miss the point. LUNA is a symptom of society’s desire to get rich quick, without hard work. There are symptoms of the Gambling Society everywhere, in crypto, sports gambling, YOLO call buying, WSB, and so on. LUNA was just one of the hundreds of ways to set fire to money in the last 12 months.

Is crypto different from what happens every day on Wall Street? Not particularly. Both crypto and TradFi are both full of bad, clickbaity predictions.

I am singling out three easy targets here, but the truth is: evaluating experts and forecasters is a tricky, subjective thing. Wall Street has plenty of honest, smart people doing excellent work, and plenty of shills peddling clickbait or going all-in on a single theme with never-ending confirmation bias and massive moral hazard. Discerning between the two is hard. It is up to regulators to make sure promoters are not lying or deliberately misleading, and it is up to investors to do their own research and due diligence.

You could argue Theranos investors in 2015 and ARKK investors in 2021 suffered a similar rug pull to LUNA investors in 2022. The hype and FOMO won them over. Their fate was not unlike that of NBA TopShot buyers in 2021 or baseball card buyers in 1990. Or TWTR buyers last week who believed Musk’s words then got rug pulled. Or home flippers in 2006, drawn in by pretty faces on HGTV. Or kids buying ZM calls on Robinhood six months ago. And so on, ad infinitum.

There is nothing new under the sun.

Speculation, gambling, and disastrous ruin are all features of both human nature and capitalism. They cannot be regulated out of existence.

Coinbase, Robinhood, DraftKings, and FanDuel all serve the same purpose. I feel bad for people that bet it all and lost but I also feel bad when I bet and lose. That’s gambling! Whether it’s ETYS on the Merrill buy rec, PTON on Motley Fool’s advice, DOGE on the Elon pump, or LUNA for 20% APY. All the same outcome. There are bad products, bad investments, disingenuous investment advice, and generally wrong and bad ideas everywhere. No amount of regulation is going to change that.

To be clear, I’m not arguing for a world of zero regulation. I’m saying even if we had the optimal regulation framework… The best, fairest one you can possibly imagine… I don’t think it would change the outcomes much.

Financial literacy is mostly earned, not learned

If you are presented with the opportunity for a large reward, there is always a large risk attached to it, however invisible that risk might be. For most people, the only way to learn that lesson is the hard way. Sure, there are places where the regulators could do better, and there is a role for better financial literacy training, but I doubt these would make much difference.

I studied finance and economics, and I still learned pretty much every financial literacy lesson the hard way. I ran up credit cards in university. I YOLO’d my entire first bonus into Bre-X and it went to zero. I lost 90% of my account day trading in 2001 and had a net worth of zero at age 30. Those mistakes are my fault, not the regulators’ fault. We wish there were regulators to protect us, but the truth is: we love to gamble and we love to do dumb shit. That’s human nature.

You have to run up a few credit cards in your early 20s and get that visceral feeling of how bad it feels to be in so much debt you can barely make the minimum payment… I did that. Now I hate debt.

There is no panacea. The harm created by investment/gambling ruin is sad and real; I am not diminishing it. I am just saying there is no magic regulatory solution. Human nature compels us to take risks, especially in adolescence and early adulthood. This is further manifested by the modern winner-take-all, “I’m fucked anyway so might as well bet it all on black” society. As the once-blurred lines between investing, trading and gambling have now been completely erased by modern society, we need to accept the consequences.

Play stupid games. Win stupid prizes.

Takeaway #3: Bitcoin maximalism makes more sense than ever

LUNA’s collapse shows how centralization can fail and why bitcoin succeeds by solving for security and decentralization. There is no nonsensical death spiral algorithm supporting the price of bitcoin. Bitcoin is worth whatever fickle humanoids will pay for it.

If you believe that humans will prefer a digital store of value to an analog one in the long run, bitcoin is a pretty clean bet on that premise. Any other coin or token is in competition with infinite present and future projects. Bitcoin stands alone.

On page 3 of “MTC #7: These Charts All Look Like Mountains” I posted a graphic that shows how bitcoin maintains its spot atop the Top 15 cryptocurrencies by market cap while other contenders and pretenders continually shuffle in and out. Bitcoin, Ripple, Doge, and Litecoin are the only cryptocurrencies that were in the top 15 by market cap in both 2015 and now. The top 15 cycles in and out. That’s why all the altcoin charts look like mountains. Altcoins are lotto tickets that only pay off if you take profit before they collapse.

The takeaway from that piece (which is still a good read, if you have time) is that BTC has no competition and every other coin and token competes with each other. Even ETH.

In other words: BTC = 21 million coins. Rest of crypto = infinite supply.

BTC’s use case as a digital alternative to gold and its OG status with the Satoshi backstory and actual decentralization means BTC is always number one; I doubt the flippening ever happens. ETH has been mostly steady at #2 in recent years, though it was surpassed twice by Ripple, once in 2017 and once in 2018. It has competition. Bitcoin does not. And never will.

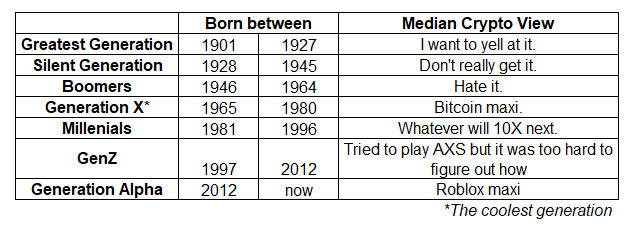

I’m becoming more and more of a Gen-X bitcoin maxi every day. Here’s the generational breakdown as I see it.

If that table is too unscientific for you… Here is actual data for crypto usage by demographic. Naturally, the most risk-seeking group (males 18-29) dominates adoption.

As crypto users age and absorb the lessons of the serial crypto bubbles and bubblettes, they will become less risk-seeking. They are learning that absurd payouts are accompanied by grotesque levels of risk. They will buy fewer lottery tickets and more insurance. That means bitcoin adoption will increase monotonically as interest in shitcoin “investing” fades… At least for 10 or 15 years until all these lessons are forgotten and the next generation does it all again in the Great NuTech Bubble of 2040.

Conclusion

I think the LUNA blow-up is another step in the painful financial literacy lessons learned the hard way by each generation. It will hurt crypto investment at the margins, but it will also push people away from the riskiest projects and towards bitcoin. And while we all wish the regulators could protect us from loss and ruin. They can’t. Sorry. Financial literacy is mostly learned the hard way.

Market update

Long Solana at 62 (averaged 66 down to 58, see MTC #11 for why). Stop loss at 39.

Long BTC at 30300. Add at 22000. Stop loss at 18700. Also explained in MTC#11.

I am nervous about a coming bank run on Tether but I need to stick to my original plan. I have been waiting patiently for this dip since January 26. That said, I’m not going nuts here, risk-wise. Stagflation is replacing the old inflation narrative and that is not going to be great for risky assets. I’m not going all in long crypto here, I’m dabbling.

Keep your risk manageable as LUNA might not be the end of stablecoin deleveraging. Eliminate all Tether exposure as they are almost certainly undercapitalized and there is no way to know if they have $97 of assets for every $100 of liabilities… Or $75. Or $60. Risk/reward holding or using Tether is horrendous. Listen here as George Noble questions Tether CTO Paolo Ardoino in a conversation eerily reminiscent of the Enron / Skilling conference call in April 2001. There is nothing new under the sun.

Thanks for reading.

bd