It is an exciting time; the new year is right around the corner.

Thanks for everything in 2023 and may 2024 exceed your expectations by at least 215%.

It is an exciting time; the new year is right around the corner.

Thanks for everything in 2023 and may 2024 exceed your expectations by at least 215%.

On October 4, 1982, Jean-Michel Basquiat first met Andy Warhol. Enthused by the encounter, Basquiat left immediately and, according to Warhol, “within two hours” his assistant, Stephen Torton, appeared with a double portrait of the two artists, Dos Cabezas (1982).

Buy 05JAN USDJPY call 142.50

for ~27bps off 141.55 spot

Long EURCHF

9am to 11am TWAP today

Stop loss 11am level minus 70 pips

Take Profit 11am level +130 pips

December 29, 2023

First up, two 1-week time horizon trade ideas as we sneak up on 2024.

Trade 1: Long EURCHF

EURCHF has gone wild to the downside as a huge flow has been going through over the past few days. My observation from price action, data, and from trading flows as a market maker for 20 years is that many large flows are timed to coincide with the end of a period.

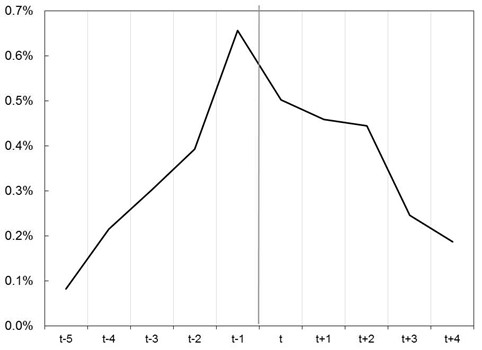

This means that there is a natural mean reversion aspect at the turn of the day, week, month, and year. If you are fading a flow, the best timing for entry is as a period ends. For example, this is how GBPUSD traded around the turn of the month when the month-end models used to work (excerpted from Alpha Trader):

Often you will notice that trends exhaust themselves and turn around at the end of the day, week or month. For example, in months where the US stock market is up 3% or more, GBPUSD frequently rallies into month end and then sells off in the first week of the new month. Here is a chart of how GBPUSD trades around the turn of the month, at the end of months where US stocks rallied 3% or more:

Average performance of GBPUSD in the 10 days around the turn of the month

Only months where SPX was up 3% or more (2010 to 2020)

t = the first business day of the month. Sample size is 37 months.

GBPUSD on the last five days of the month and first five days of next month

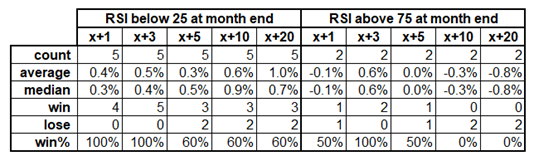

I took a look at how EURCHF performs around the turn of the month when the RSI is extremely low (as it is now) or high. Here are the results:

EURCHF performance when RSI is <25 or >75 on last day of the month (2000 to now)

Small sample size, but nice results. There is a non-zero chance the SNB will get involved at some point too, as they may want to smooth things out as this CHF appreciation is large enough to be disinflationary and contrary to their policy goals.

The strategy (see sidebar) is to TWAP a long from 9am to 11am NY time today as there could be another chunk of the flow to do into 11am, but there might not be. If the flow does not appear, value hunters will be chasing EURCHF higher all morning. If there is a flow, you want to fade it close to 11am. The TWAP is a compromise between a) the risk there is no flow and EURCHF grinds higher, and b) the risk there is a flow and it tanks. My guess is that spec flows will offset much of any LHS flow and as such I want to start on the early side.

Trade 2: Buy 1-week USDJPY calls

As I have been writing for a few days, I think we are in overshoot territory for bonds, and in fact, yields have already bounced off the lows. We had a nice reversal formation on the failed collapse attempt yesterday in USDJPY and I think early January will bring new sellers of bonds and buyers of USDJPY as the market becomes wary of a 6 cut theme that could be shattered by a few strong data points. Obviously, the data is king, but I think the market will run bonds lower and USDJPY higher into ISM and NFP as the bar for further cuts is high and the bar to reprice to, say, 4 cuts is pretty low.

Then, trade the data orthodox when it comes. ISM and NFP are both captured by a 1-week option.

I like 1-week 142.50 for about 26bps off 141.55 spot.

2023 had ~23 themes

Each briefly in our brain like 23 dreams

Each narrative not as good as it seems

Bonds down / bonds up / convexity extreme

Everybody buy high / sell low / revert to the mean

Higher for longer gave the bond shorts thrills

Then they all got crushed cuz Yellen ♥ bills

Yellen likes bills and the dots like cuts

Fed playing poker

Flip the cards

Got the nuts

China reopened but China stocks red

Xi’s got no stimmies China housing still dead

Demographics short Pampers© and long Depends™

Balance sheet recession like this never ends

Regional banks die / VCs panic on twitter

Oil down, USD mixed, gold’s got the glitter

Every single month we got a new surprise

Every single month we gonna dedollarize

Dollar’s always dead but it never did die

SPX, megatech all time high

AI, AGI, GPT3, boom

MAG7 to the moon just like p(doom)

SBF is guilty / crypto’s dead

Crypto falling down like the economist said

Oh whoops winter’s over now it’s summer instead

Solana too sexy for Milan again Right Said Fred

60/40’s back like Lazarus woke from the dead

FCI on the fly risk parity spoke in class (hey)

and the shorts bleed red

Nvidia hysteria

30X sales ain’t scarin’ ya

YC inverted, but nobody caring yea

Carry trade pumping loud like stereos blaring yea

Number one carry is short dollar / long Mexico

Peso been like fire pour on gasoline from Texaco

Housing en fuego too / XHB moonshot

The Economist said housing was doomed too but ermmm… it’s not

Logic said sell / magazine cover capital bought

Get rich or die trying cuz you gotta have fun

Write / trade / laugh / pray/ I’m too old to die young

I rap like Kendrick, I mean Anna, not the other one

So that’s me, MBD, driving across the border of ‘23

in a blacked out M3

blasting Prodigy

Sometimes I’m wrong / Sometimes I’m right

But I always write feverishly

I write like I’m running out of time that’s just me

I talk FX spot and Fed dot plots and take my shots and

sometimes thoughts

arrive like butterflies

Win or lose, tomorrow the sun will rise

“The End of ‘22” by Max Capitulation

We’re all bulls now / smells like extrapolation

Maybe just cynical I’m bullish at the highs desperation?

Anyway, that’s it, thanks for everything

I’m out the door

Lucky ‘24

The Basquiat x Warhol exhibit at the Brant Foundation space in the village runs until January 7. I checked it out yesterday, it’s worth the trip. It’s 20 dollars and takes an hour, so… Small investment both time and money-wise.

https://www.brantfoundation.org/exhibitions/basquiat-x-warhol/

It’s not so much the “WHY?” as the “WHAT?” that matters most in markets. Keep your eyes peeled for good news / bad price setups.

Taking profit on the USDJPY and looking for a way to get short GBPUSD for corporate month end.