Dr. Evil could not have imagined a company worth this much

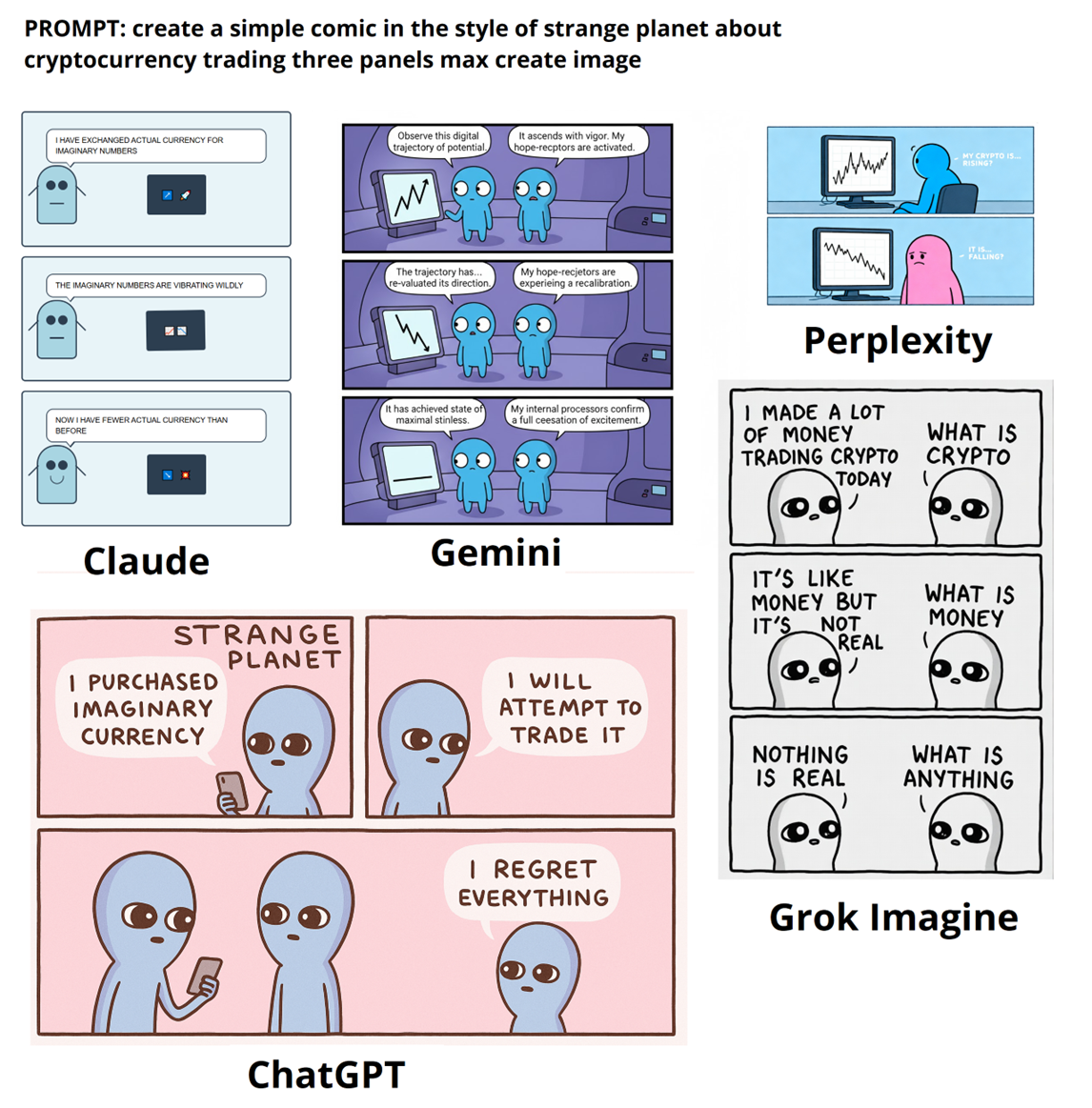

Grok Imagines a Strange Planet style comic about cryptocurrency trading.

See the significantly less excellent output from other platforms at bottom of today’s am/FX.

Dr. Evil could not have imagined a company worth this much

Grok Imagines a Strange Planet style comic about cryptocurrency trading.

See the significantly less excellent output from other platforms at bottom of today’s am/FX.

Flat

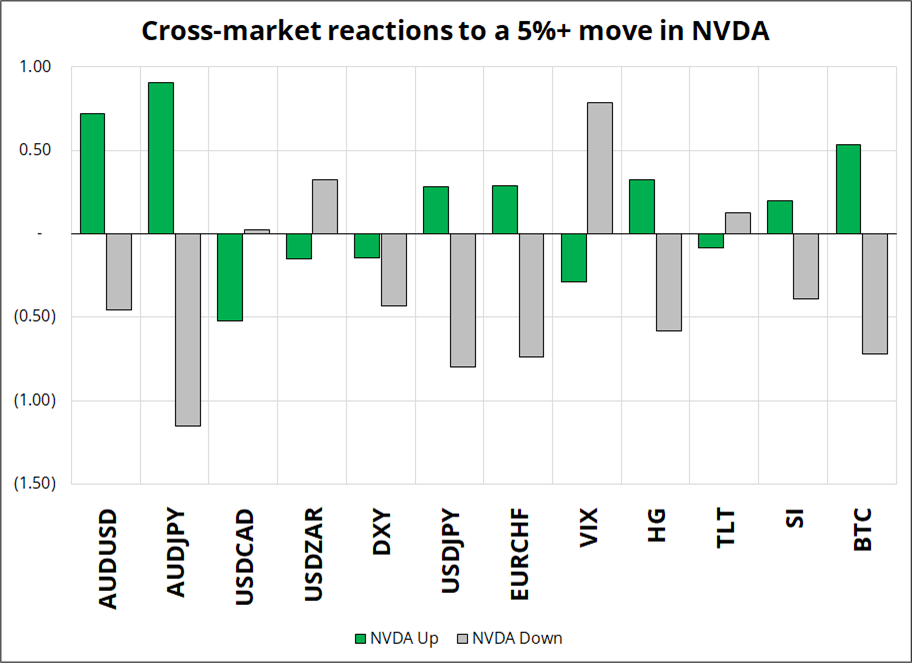

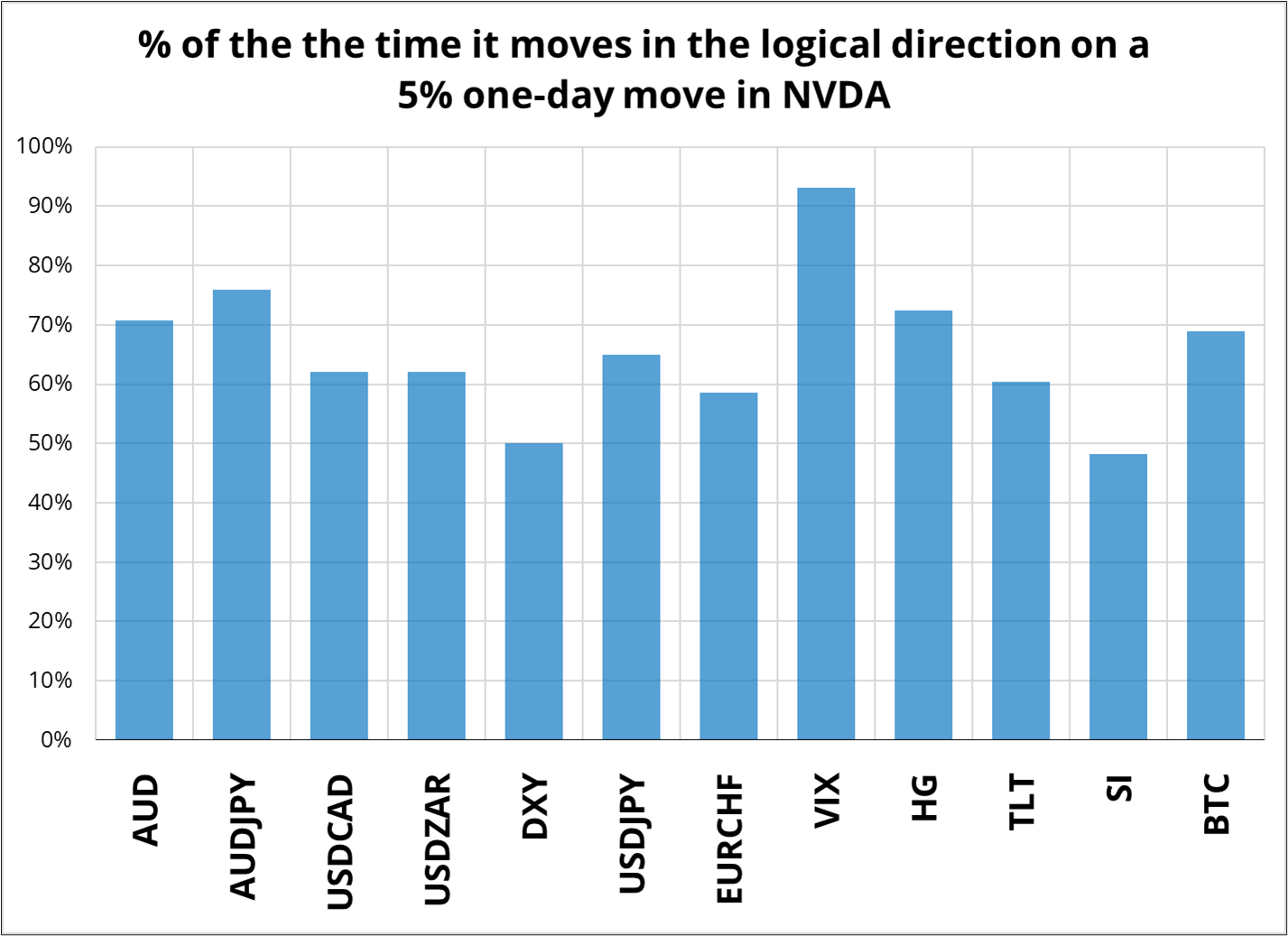

NVDA earnings today. If you’re wondering how that might impact other assets, here are some clues. I looked at NVDA back to 2023 and filtered for 5% moves up or down in the stock. Then, I looked at how many SD various assets moved, and what percent of the time they moved in the logical direction (i.e., NVDA up = AUDJPY up, VIX down, etc. etc.) Here is the output.

Y-axis is standard deviations (average)

Takeaways:

NVDA earnings day has mostly been a big, exciting, optimistic day in recent years, and the stock has performed poorly on the day of because expectations were always sky high. This time the mood is something more like trepidation bordering on fear. My bias remains long equities, and the major 24300/24400 level has held nicely so far in NQ. We have made multiple attempts on high volume as you can see here if you look at the purple bars. Note yesterday’s volume at the lows was the second largest volume bar in the past three months. If NVDA is crushed tonight, we will presumably take out that 24300/24400 gap from mid-September and all bets are off.

For what it’s worth, MSTR shows a similar pattern with massive volume on every attempt to take out the lows 190/192.

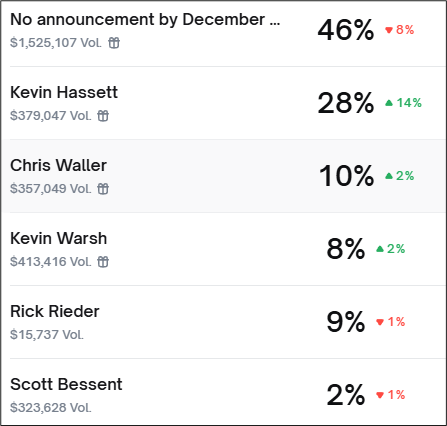

Reporters will never starve in 2025 as they can always write a story about an imminent deal on Russia/Ukraine, or a bit about how Trump is close to picking the new Fed Chair. These are evergreen stories and as long as you use words like “Trump mulls” or “Sources close to the president say” or similar, you can parade out all the old talking points and people like Brent Donnelly will link to your story. Like this:

In there, Bessent suggests “hopefully have an answer before Christmas.” As mentioned, these stories are evergreen. There are dozens of them like this one from mid-August.

Here is what bettors think. Note the daily changes in red and green. Hassett has spiked, at the expense of the “No announcement by end of 2025” bucket…

It feels stupid chasing these narratives, but at some point, the administration will need to name a Fed chair and that choice is important. And hey, it felt stupid to buy stocks on April 10 when Trump tweeted “it’s a good time to buy stocks” and yet it was a good time to buy stocks!

Greg Marks, of HSBC and Citibank fame, wrote a good piece about Warsh. To me, Warsh looks underpriced as his vision of a less interventionist Fed and more domestic focus on bank deregulation fits nicely with the admin’s way of thinking. Here’s Greg’s piece:

https://gregoryalexandermarks.substack.com/p/wsj-warsh-signaling

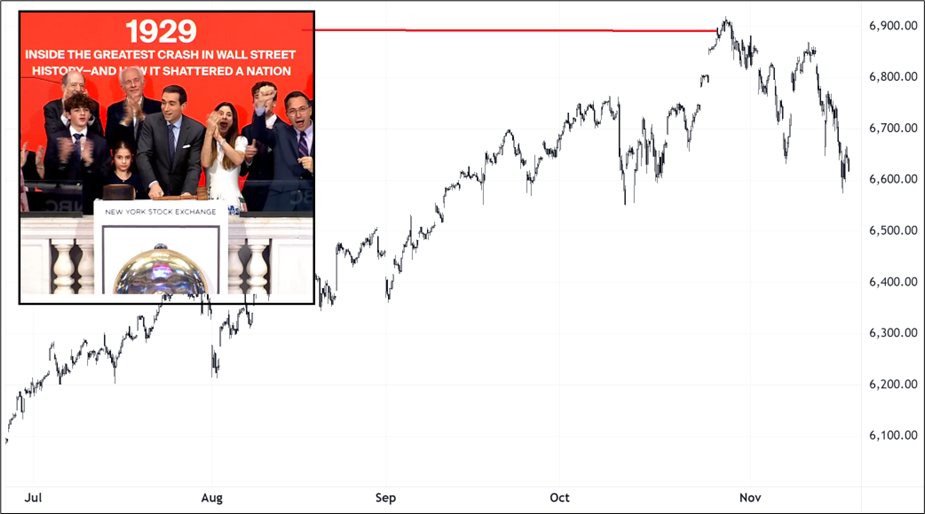

Advice to the NYSE Public Relations Department: When deciding who to pick to ring the bell… Maybe don’t pick a guy who wrote a book about a Wall Street Crash triggered by commercial banker greed, retail excess, Fed capture, and stock market manipulation? That might be… Bad karma? They literally rang a bell at the top.

The latest Russia/Ukraine story. If it’s on Axios, is it still a secret? I hope your day is money.

For image creation, Grok Imagine is light years ahead of every other platform.

I cancelled my Midjourney subscription because the free Grok Imagine is so SOOOO much better. Samples above.